2-20 #VIP : BOE set up Fab B11 in Menyang exclusively for Apple; ZTE will showcase its second-generation mass-produced under-screen camera technology; POCO has announced its new brand logo and company mascot; etc.

Analog Devices CEO Vincent Roche has indicated that the semiconductor shortage hurting automakers around the world is a problem many of them brought on themselves. He has said that from start to finish it takes as long as 15 weeks to manufacture, package and test a chip. That is a mismatch with the way automakers typically manage their supply, holding very little inventory and expecting suppliers to be able to respond to their orders in just-in-time arrangements. (Bloomberg, Barron’s, CN Beta, Reuters)

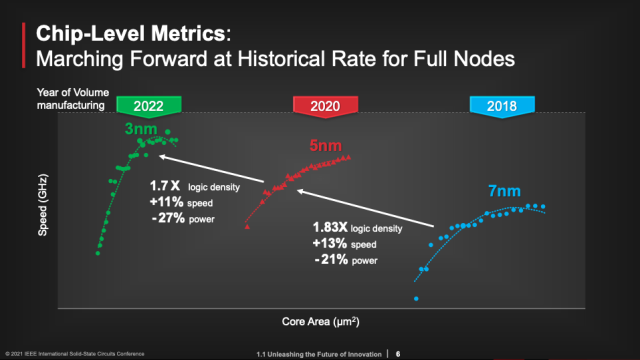

Each successive step in semiconductor integration has taken an increasing amount of effort to achieve, but the next node — 3nm — should still arrive right on schedule, according to TSMC chairman Mark Liu. Liu has reinforced the point that 3nm was tracking with TSMC’s original schedule or slightly better than planned for introduction. Liu did note that EUV is a power hog. In terms of improvement, TSMC is getting high volume throughput at 350W illumination source power for 5nm production with a path to 1nm. (CN Beta, EET Asia, TechNews)

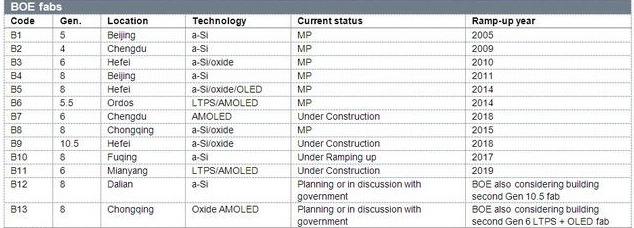

BOE is busy expanding its business areas after entering Apple’s supply chain. BOE’s move will inevitably affect Samsung Display and LG Display. BOE set up Fab B11 in Menyang exclusively for Apple and launched efforts to expand its OLED panel supply to the U.S. client. Fab B11 is currently manufacturing samples of iPhone 13 panels. BOE is also targeting Apple‘s VR / AR devices. (CN Beta, Business Korea, My Drivers)

Samsung Display will not be the supplier of the small-sized, bendable panels intended to feature in Huawei’s next foldable smartphone, dubbed “MateX2”. Huawei has decided to make a change and will obtain its foldable panels from BOE. The Huawei Mate X2 opens and closes like a book. When open, it presents a tablet-sized 8.03” display with a 4.5” external screen. (Laoyaoba, Pocket Now, Phone Arena, Sam Mobile)

According to Ni Fei, President of ZTE’s Terminal Business Unit and President of Nubia, Ltd., ZTE will showcase its second-generation mass-produced under-screen camera technology and will first launch under-screen 3D structured light. (CN Beta, GSM Arena, MyFixGuide, GizChina)

Apple is allegedly in discussions with “a number of potential suppliers” for the laser-based sensors, which could allow an autonomous vehicle to see its surroundings. As with the iPhone supply chain, Apple will tap third-party vendors to supply critical components for the “Apple Car”. (CN Beta, Apple Insider, Bloomberg)

Kioxia and Western Digital (WD) have announced that the companies have developed their sixth-generation, 162-layer 3D flash memory technology. This sixth-generation 3D flash memory features advanced architecture beyond conventional eight-stagger memory hole array and achieves up to 10% greater lateral cell array density compared to the fifth-generation technology. (CN Beta, Kioxia)

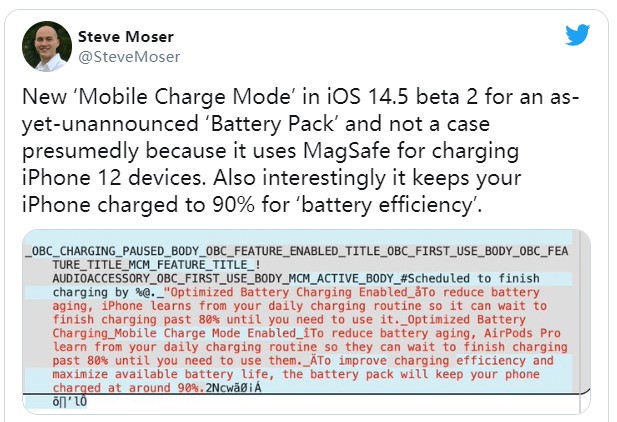

Apple is reportedly working on a magnetically attached battery pack for the newest iPhones. The battery pack would attach to the back of an iPhone 12 using the MagSafe system, which all the new phones use for charging and pairing other accessories like cases and wallets. (GizChina, Bloomberg, Bloomberg, CN Beta)

Apple has “internally discussed a goal of letting many of its mobile devices like Apple Watches, AirPods, and iPhones charge each other”, however, the report notes that it’s unlikely to be launched in “the near future”. (MacRumors, Bloomberg)

China may allegedly ban the export of rare-earths refining technology to countries or companies it deems as a threat on state security concerns. The Asian nation is also exploring a ban on rare earths as part of its sanctions on some individual companies, including Lockheed Martin, which violated China’s core interest over arms sale to Taiwan. China controls most of the world’s mined output of rare earths, a broad group of 17 elements that are used in everything from smartphones to fighter jets, and has a stranglehold over processing. (Laoyaoba, Bloomberg)

Pegatron has disclosed it has spent INR1.028B (USD14.12M) acquiring rights to use a plot of land for building a factory in Channai, India. Pegatron will set up a manufacturing base on the factory site mainly for production of Apple iPhone, with production to begin the earliest in 2H21. Pegatron in Nov 2020 established a wholly-owned subsidiary, Pegatron Technology India, with initial paid-in capital of INR10.989B. (Digitimes, press, Apple Insider, Digitimes)

Huawei Technologies has reportedly notified its suppliers that its smartphone component orders will fall by more than 60% in 2021, as U.S. sanctions continue to bite. Huawei has notified suppliers that it plans to order enough components for 70M-80M smartphones in 2021. The company’s component orders have been limited to those for 4G models as it lacks U.S. government permission to import components for 5G models. Some of the suppliers indicated the figure could be lowered to nearly 50M units. (GizChina, OLT News, Nikkei)

POCO has announced its new brand logo and company mascot. The new visual identity, for now, is exclusive to the Indian division of the brand. The company also revealed a new tagline — Made of Mad. (GSM Arena, Financial Express, First Post, TechRadar, Xiaomi Today)

Geopolitical tensions between India and China are beginning to hurt some of Taiwan’s biggest technology companies, including suppliers to Apple and hindering New Delhi’s much-vaunted incentive program for electronics manufacturing. The wrangling may delay Prime Minister Narendra Modi’s plan to bolster India’s manufacturing capacity and deter overseas investors, who invested USD30B in the 6 months to Sept 2020, with the maximum foreign direct investment flowing in the computer hardware and software sector. The companies are looking to India to diversify their supply chains. (Apple Insider, SCMP)

Moto E7 Power is announced in India – 6.51” 720×1600 HD+ v-notch, MediaTek Helio G25, rear dual 13MP-2MP macro + front 5MP, 2+32 / 4+64GB, Android 10.0, rear fingerprint scanner, 5000mAh 10W, INR7,499 (USD105) / INR8,299 (USD115). (GSM Arena, Gizmo China)

University Health Network has launched a new clinical study, in collaboration with Apple to test if remote monitoring with Apple Watch can help with early identification of worsening heart failure. In this study, data collected using an Apple Watch will be compared to data routinely collected from the rigorous physical tests that patients normally undergo, to see if Apple Watch health sensors and features, including the Blood Oxygen app and mobility metrics, can provide early warning for worsening heart failure. (Apple Insider, News Wire)

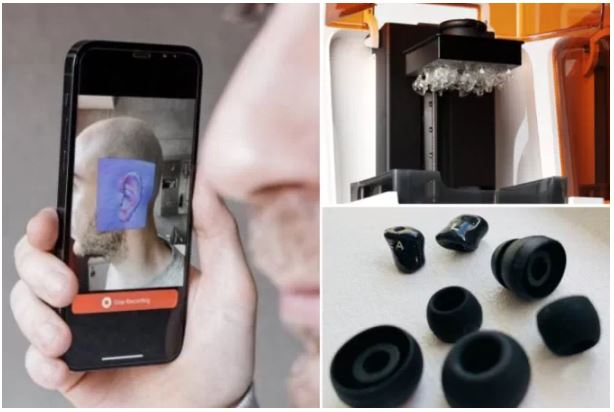

3D-printing company Formlabs is teaming up with audio giants Sennheiser to make custom tips for the latter’s high-end Ambeo earphones. Users can take an image of their ear with a mobile app, which they then upload, generating the design for a custom-fit earbud. Once designed, the plans are directed to a Formlabs’ Form3 printer for creation. (CN Beta, Engadget, Formlabs)

Samsung is reportedly working on new wearables, which run Android instead of Tizen. Samsung is working on two devices with model numbers SM-R86x and SM-R87x. They speculate that they might be part of the Galaxy Watch Active 3 or 4 series. (Pocket-Lint, Galaxy Club, Android Police, CN Beta)

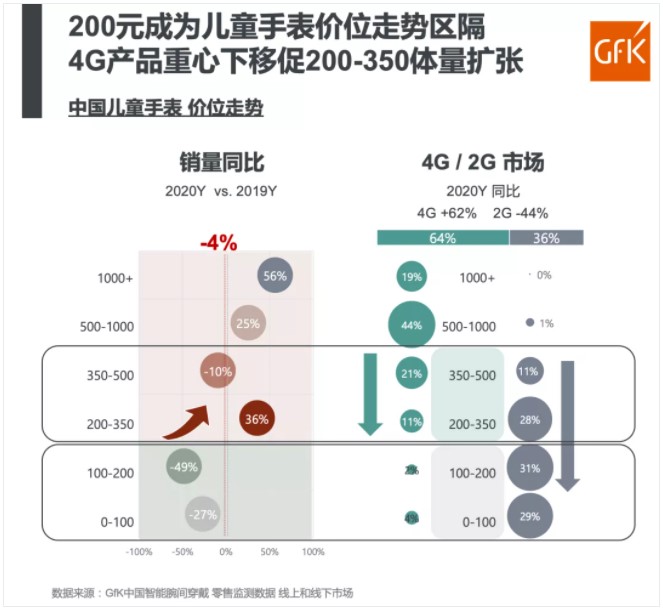

According to GfK retail research data, despite the impact of the pandemic, China’s wearables market in 2020 has a steady and slight decline of 5% YoY, and smart watches have a rapid growth of 48% YoY. Kids’ smartwatches experienced a 21% decline in 1Q20, and 2Q20 demand increased by 16%. Then in 3Q20 and 4Q20 return to stability, the annual sales volume slightly decreased by 4% YoY. GfK has revealed that the network standard switching of kids’ smartwatches is the main driving force for product replacement in the market in 2020 and will affect the increase in average market prices. (GfK, press, Laoyaoba)

Geely reportedly plans to set up a firm to explore new approaches to product planning, marketing and sales of electric vehicles (EV), departing from industry convention whereby EVs are marketed and sold alongside traditional cars. The owner of Volvo Cars and 9.7% of Daimler AG will establish Lingling Technologies in 2021 to manage models based on its open-source EV chassis base, announced in Sept 2020 and dubbed Sustainable Experience Architecture (SEA). (CN Beta, Reuters, Reuters)

Ford has announced a new strategy for the European market that aims the automaker at primarily only selling electric vehicles by 2030. To do so, Ford intends to spend USD1B to revamp a factory in Cologne, Germany, where it will produce EVs using a Volkswagen platform. The first production vehicle from the updated factory is expected by 2023. Ford’s announcement comes after a similar pledge from General Motors where it said it intended to mostly produce EVs by 2035. (CN Beta, BBC, The Verge, TechCrunch, The Guardian)

Ford is vowing to convert its entire passenger vehicle lineup in Europe to electric power by 2030 in just the latest sign of the seismic technological changes sweeping the auto industry. President of Ford of Europe Stuart Rowley has indicated that Ford will spend USD1B to revamp its factory in Cologne, Germany and make it a base for production of battery powered cars using Volkswagen’s mechanical framework. (CN Beta, AP News, Ford)

Xiaomi is allegedly planning on building its own car and is considering it as a strategic decision, but the specific details and path it aims to take has yet to be determined. The project will directly be led by the smartphone maker’s Founder and CEO, Lei Jun. The company has responded stating “wait and see, temporarily no plan”. (Gizmo China, CN Beta, iFeng)

Bitcoin’s volatility needs to ease to prevent the token’s rally from fizzling, according to JPMorgan Chase & Co. Unless swings recede rapidly, the current price of the largest cryptocurrency “looks unsustainable,” according to the strategists led by Nikolaos Panigirtzoglou. Bitcoin has been barreling through records, scaling another peak above USD51,000. (CN Beta, CNBC, Bloomberg)