3-3 #BusinessTrip : TSMC reportedly plans to build a total of 6 5nm plants in Arizona; BOE has unveiled the world’s first 360º flexible display; CXMT plans to raise CNY15.65B funding; etc.

Taiwan Semiconductor Manufacturing Co (TSMC) is reportedly set to sell local currency bonds, as it prepared for a spending blitz amid a global chip shortage. It has planned to price about NTD16B (USD565.25M) of notes in 3 parts in an auction, though the actual issuance size might change. (Apple Insider, Taipei Times, Sina, UDN, Tencent)

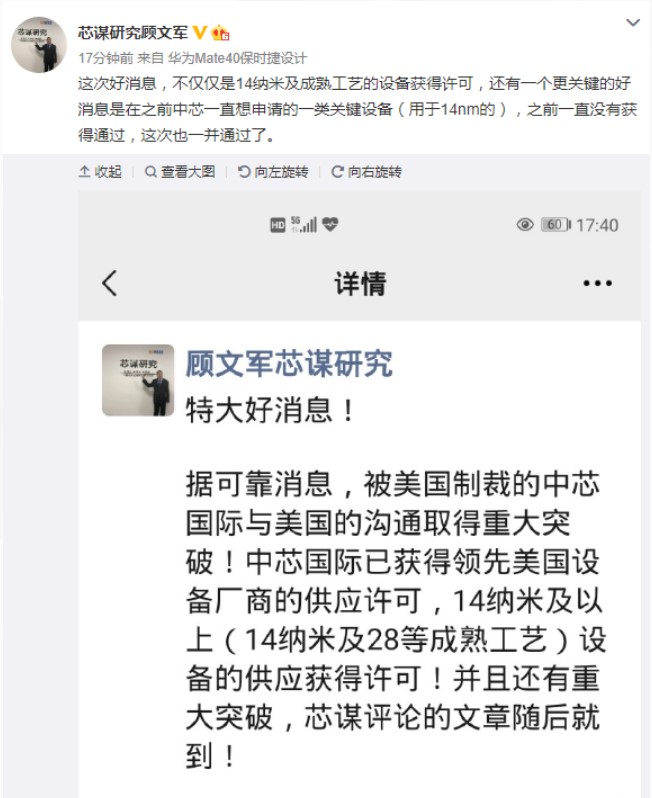

According to the SEMI Insights analyst Gu Wenjun, SMIC has obtained the supply license for some US equipment manufacturers to supply mature process equipment of 14nm and above. The key equipment (for 14nm) has also passed. Morgan Stanley has also pointed out that US equipment suppliers have recently resumed the supply of components and on-site services to SMIC. (My Drivers, Sina, CN Beta)

Qualcomm has launched its own Snapdragon Insider program to create a united community around its products. The program provides exclusive access to contests, events, AMA’s with experts, and more. Snapdragon Insiders will have first access to information on new product launches from Qualcomm. (Android Central, Qualcomm)

Samsung could be working on a new Exynos SoC for mid-range 5G smartphones. the chipset is currently in development with model number S5E5515. Samsung Exynos 980 took nearly ten months to make its commercial debut since it first appeared on the radar. Thus, the S5E5515 will likely arrive in a product towards the end of 2021 or early 2022. (Android Headlines, Galaxy Club)

Samsung Electronics may increase outsourcings some of general-purpose computer chips to Taiwan-based UMC and California-based GlobalFoundaries as it runs out of space at its own foundries due to explosive demand. (CN Beta, Pulse News)

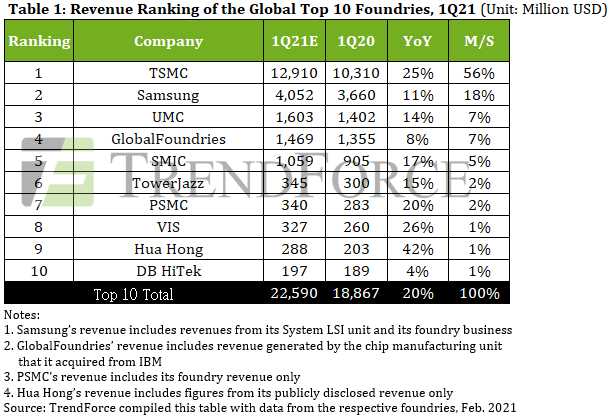

TrendForce expects foundries to continue posting strong financial performances in 1Q21, with a 20% YoY growth in the combined revenues of the top 10 foundries, while TSMC, Samsung, and UMC rank as the top 3 in terms of market share. However, the future reallocation of foundry capacities still remains to be seen, since the industry-wide effort to accelerate the production of automotive chips may indirectly impair the production and lead times of chips for consumer electronics and industrial applications. (TrendForce, TrendForce)

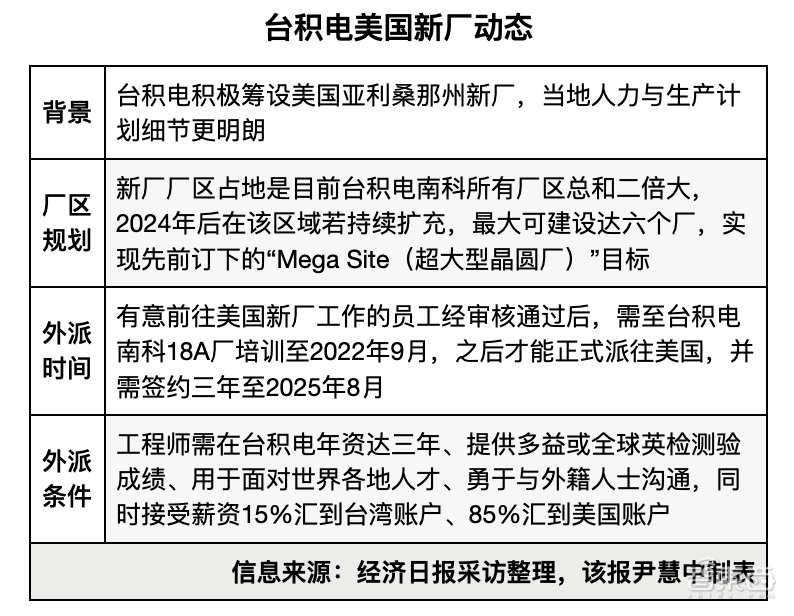

TSMC reportedly plans to build a total of 6 5nm plants in Arizona. These plants’ size is about twice the size of the plant TSMC’s Nanke plant, one of its “base camps”. TSMC’s Arizona wafer fab investment may rise to NTD1T (USD36.2B). Its total monthly production capacity will exceed 100,000 wafers. (GizChina, IT Home, LTN, UDN)

Intel has been ordered to pay USD2.18B to VLSI Technology, after a federal jury found the major chip producer had infringed on a pair of patents. The lawsuit was brought by VLSI, which received the patents from NXP, which owns the company. (Apple Insider, Bloomberg, Waco Tribune-Herald, CN Beta)

MediaTek has announced its new 4K smart TV chip, MT9638, with an integrated high-performance AI processing unit (APU). It supports cutting-edge AI-enhancement technologies such as AI super resolution, AI picture quality and AI voice assistants, plus variable refresh rate (VRR) and MEMC (motion estimation and motion compensation) so graphics appear smoother. (GSM Arena, MediaTek, CN Beta)

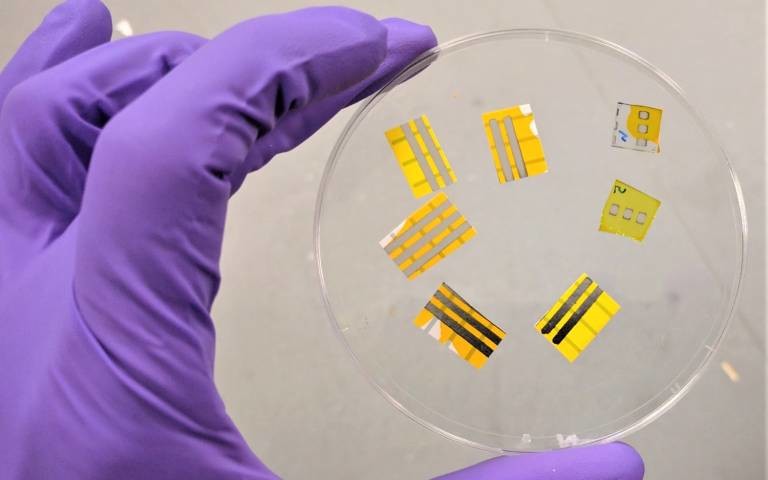

University College London (UCL) and the Istituto Italiano di Tecnologia (IIT, Italian Institute of Technology) have created a temporary tattoo with organic light-emitting technology (OLED), paving the way for a new type of “smart tattoo” with a range of potential uses. (Digital Trends, CN Beta, UCL)

BOE has unveiled the world’s first 360º flexible display. The panel can be folded both inwards and outwards with equal efficiency. The company has reportedly already started the mass production of this next-gen foldable panel. The display can withstand 200,000 folds comfortably. (Android Headlines, Gizmo China, Sina)

Samsung Electro-Mechanics (SEMCO) has revealed on the 1st that it has developed an optical 10x zoom folded camera module and is supplying it to global smartphone companies. SEMCO has developed the dual folded camera module by refracting light two times to increase the focus distance by two times while only increasing the length of the camera module by 25%. (CN Beta, Samsung SEMCO)

The bulk transaction price of CMOS image sensors for smartphones dropped by 3% in 1Q21 relative to 4Q20. For the past 3 consecutive quarters, there has been a drop in the price of CMOS image sensors. At present, among the many products of CMOS image sensor, the representative one is the product with 13MP (sensor size 1/3”), and its low-priced product for the bulk demand side is about USD1.55. Just like other products, the price also represents a 3% drop. (GizChina, IT Home, Nikkei)

Changxin Memory Technologies (CXMT) plans to raise CNY15.65B funding. In 2019, the company has begun mass-produced 19nm process DDR4 and LPDDR4 memory, which are currently used in many domestic memory brands. The company is also the world’s fourth manufacturer of DRAM products using processes below 20nm. The company’s 17nm technology R&D will be completed in 2021, and the R&D of DDR5 DRAM products will be accelerated. (My Drivers, CN Beta, IT Home)

Wide Bandgap Semiconductor Group at the National Institute of Materials Science (NIMS) has developed diamond batteries (or betavoltaic batteries) that can generate electricity as long as they are in radioactive fields where they can receive beta rays from isotopes such as carbon-14 and nickel-63. These batteries have such long lives because the carbon-14 and nickel-63 decay by half in roughly 5,700 and 100 years respectively. NIMS has used electrons, adopted by devices such as electronic microscopes, instead of beta rays for the production of electricity but plans to use nickel-63 from now on. (My Drivers, Sina, Nikkei, BBC)

TF Securities analyst Ming-chi Kuo believes that market and financial benefits will mean Apple skips USB-C for iPhone and will also not move Touch ID to the power button at any time in near future. He indicates that there is no visibility on the current schedule for the iPhone to adopt these 2 new specifications. Specifically, Apple’s Made for iPhone (MFi) programme is a profitable business that would be affected. (Apple Insider, TF Securities, CN Beta)

According to the data released by Ericsson’s official website: As of now, Ericsson has won 131 5G commercial contracts globally, among which Ericsson has reached publicly 5G commercial contracts with 75 operator customers. Currently, 79 of them have officially operated in 40 countries with Ericsson’s 5G network equipment. (CN Beta, Ericsson)

Richard Yu, CEO of Consumer Business at Huawei, has revealed that AppGallery now has more than 530M monthly active users, with an annual growth rate of 83%. At the end of 2020, the AppGallery app store had 384B downloads. He has also added that 2.3M developers are developing mobile apps for AppGallery, up 77% from 2019. (GizChina, IT Home, GSM Arena, Fonearena)

Carbon Mobile launches Carbon 1 MK II, the word’s first smartphone with a carbon fiber monocoque. The Hybrid Radio Enabled Composite Material (HyRECM) combines high quality carbon fibers sourced from Germany with a composite material that allows radio waves to pass through. It features 6” 1080×2160 FHD+ AMOLED, MediaTek Helio P90, rear dual 16MP-16MP + front 20MP, 8+256GB, Android 11.0, side fingerprint, 3000mAh fast charging, EUR799. (CN Beta, GSM Arena, Carbon Mobile)

Meizu 18 and 18 Pro are announced in China, powered by Qualcomm Snapdragon 888: Meizu 18 – 6.2” 1440×3200 Super AMOLED HiD 120Hz, rear tri 64MP OIS-8MP telephoto 3x-16MP ultrawide + front 20MP, 8+128 / 8+256 / 12+256GB, Android 11.0, fingerprint on display, 4000mAh 36W, CNY4,399 / CNY4,699 / CNY4,999. Meizu 18 Pro – 6.7” 1440×3200 Super AMOLED HiD 120Hz, rear quad 50MP OIS-8MP telephoto 3x OIS-32MP ultrawide-0.3MP 3D ToF + front 44MP, 8+128 / 8+256 / 12+256GB, Android 11.0, fingerprint on display, 4500mAh 40W, 40W wireless charging, 10W reverse charging, CNY4,999 / CNY5,499 / CNY5,999. (GSM Arena, CN Beta, Meizu)

Gionee Max Pro is launched in India – 6.517” 720×1560 HD+ v-notch, UNISOC SC9863A, rear dual 13MP-2MP depth + front 8MP, 3+32GB, Android 10.0, 6000mAh, INR6,999 (USD95). (GSM Arena, GizChina, TechAndroid)

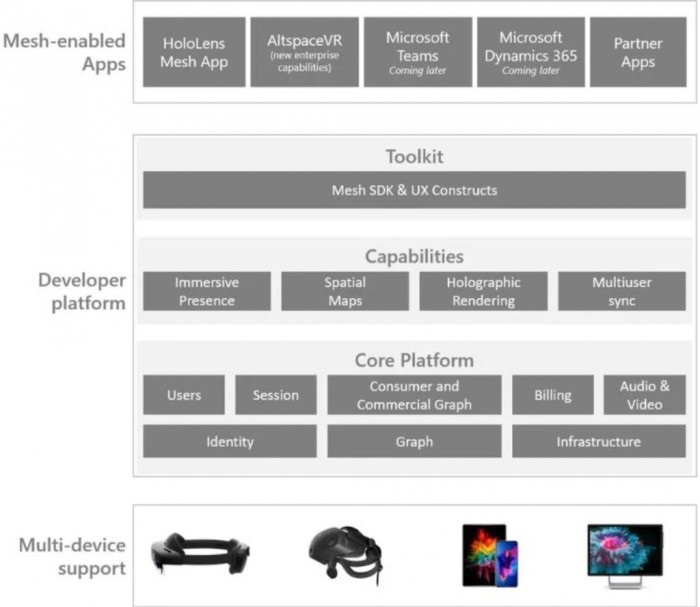

Microsoft is Microsoft Mesh, a new platform built on Microsoft Azure, enabling developers to build immersive, multiuser, cross-platform mixed reality apps. It enables its users to connect with presence, share across space, and collaborate in an immersive way as if they were in person regardless of physical location. (Liliputing, Microsoft, Microsoft, CN Beta)

The Google Play Services for AR app, which unlocks experiences built using the Google’s ARCore SDK, has been updated with “Dual camera stereo depth on supported devices”. Using two cameras will give ARCore better depth perception, which could translate to more realistic placements for its AR objects. (Engadget, Android Police, Sohu, Sina, 163)

Smart-TV maker Vizio, backed by Foxconn Technology Group, has filed again to go public, this time with a growing entertainment platform. Vizio in its filing listed the size of the offering as USD100M. Vizio filed to go public in 2015 but withdrew that plan the following year after reaching an agreement to sell the company for USD2B. Vizio terminated that deal with an affiliate of Leshi Internet Information & Technology in 2017. (CN Beta, Bloomberg)

LG Electronics has announced on that it will release an increased number of OLED TV models with lowered prices in 2021. The company will sequentially launch a total of 18 models in 2021, 6 more than 2020. They will include 11 super-sized models with 70” or bigger screens in the Korean market. Their wholesale prices will be cut by 20% compared to models launched in 2020. (GizChina, Business Korea)

Volvo plans to sell only electric cars by 2030 in the latest move by a legacy carmaker to abandon fossil fuels that contribute to global heating. In coming years Volvo Cars will roll out several additional electric models, with more to follow. Already by 2025, it aims for 50% of its global sales to consist of fully electric cars, with the rest hybrids. By 2030, every car it sells should be fully electric. (CN Beta, BBC, The Guardian, Volvo)