3-10 #Felicity : TSMC and Apple are reportedly jointly conducting R&D on the 2nm process; OnePlus has announced that it has entered a 3-year partnership with Hasselblad; SK Hynix has announced that it has started mass-production of 18GB LPDDR5 mobile DRAM; etc.

China will increase its annual research and development spending by more than 7% every year over the next 5 years, the government wrote in its work report from the Fourth Session of the 13th National People’s Congress. The government will increase expenditure on basic research by 10.6% in 2021. China has highlighted 7 key areas related to technology it aims to boost: next-generation artificial intelligence, quantum information, brain science, semiconductors, genetic research and biotechnology, clinical medicine and health, and deep space, deep sea and polar exploration. (Engadget, WSJ, Reuters, Gizmo China, People.com, Yicai)

Microsoft and Intel will be working with the Defense Advanced Research Projects Agency (DARPA) to develop and implement fully homomorphic encryption (FHE) in hardware. A fully homomorphic encryption scheme would be capable of performing all mathematical operations on any encrypted data without the need to decrypt it. (Engadget, Intel, DARPA, Extreme Tech, CN Beta)

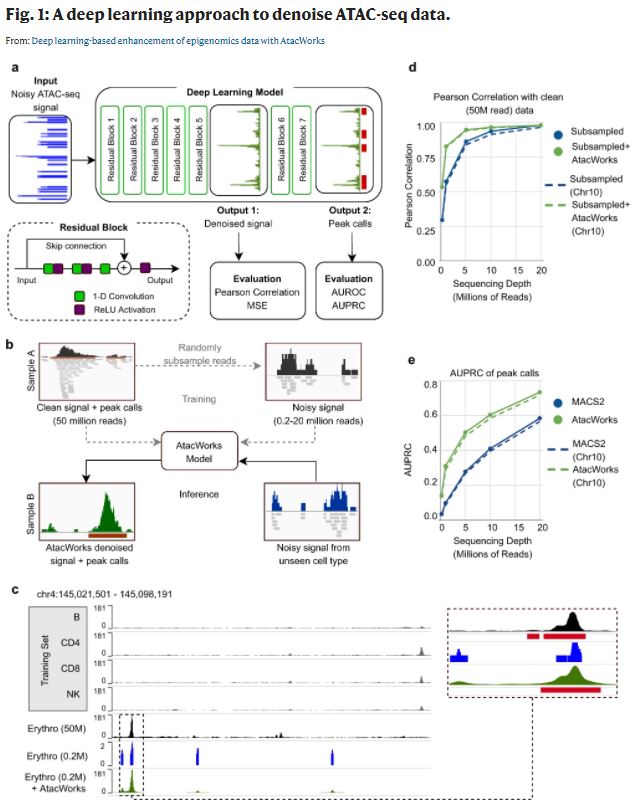

NVIDIA and Harvard have jointly developed a deep-learning toolkit that is able to significantly cut down the time and cost needed to run rare and single-cell experiments. The AtacWorks toolkit can run inference on a whole genome, a process that normally takes a little over two days, in just half an hour. It is able to do so thanks to NVIDIA’s Tensor Core GPUs. (Engadget, Nature)

Qualcomm’s incoming CEO, Cristiano Amon has indicated that the current supply chain crisis that we are having in the semiconductor industry is what keeps him up at night. He has further added that the shortages likely will continue until late 2021. He has explained “V-shaped recovery”, which is a huge dropoff in purchases, followed by a rapid return of demand. He has further elaborated that most chipmakers like Qualcomm do not actually build their own semiconductors. It takes about 12-18 months to build new semiconductor manufacturing capacity. (CN Beta, Sina, CNET)

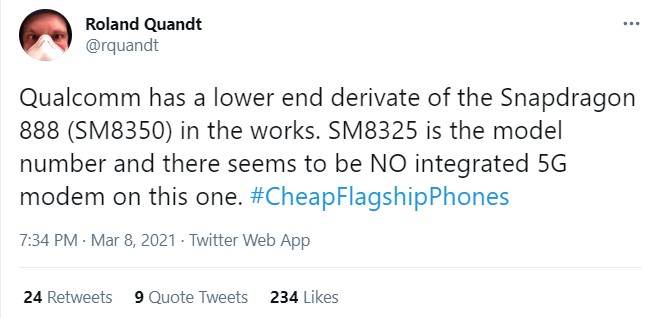

Qualcomm is allegedly developing a new variant of the Snapdragon 888 flagship without an integrated 5G modem. By removing the 5G modem, Qualcomm is seemingly aiming the chipset at flagship 4G phones or “cheap flagship phones”. The new chipset is reportedly identified by the part number SM8325 (Snapdragon 888 has the part number SM8350). (Android Headlines, Twitter, GizChina, GizChina, My Drivers)

Qualcomm has recently introduced the flagship Snapdragon 888, and the company is already working hard on its successor called Waipio with part number SM8450. (GizChina, WinFuture)

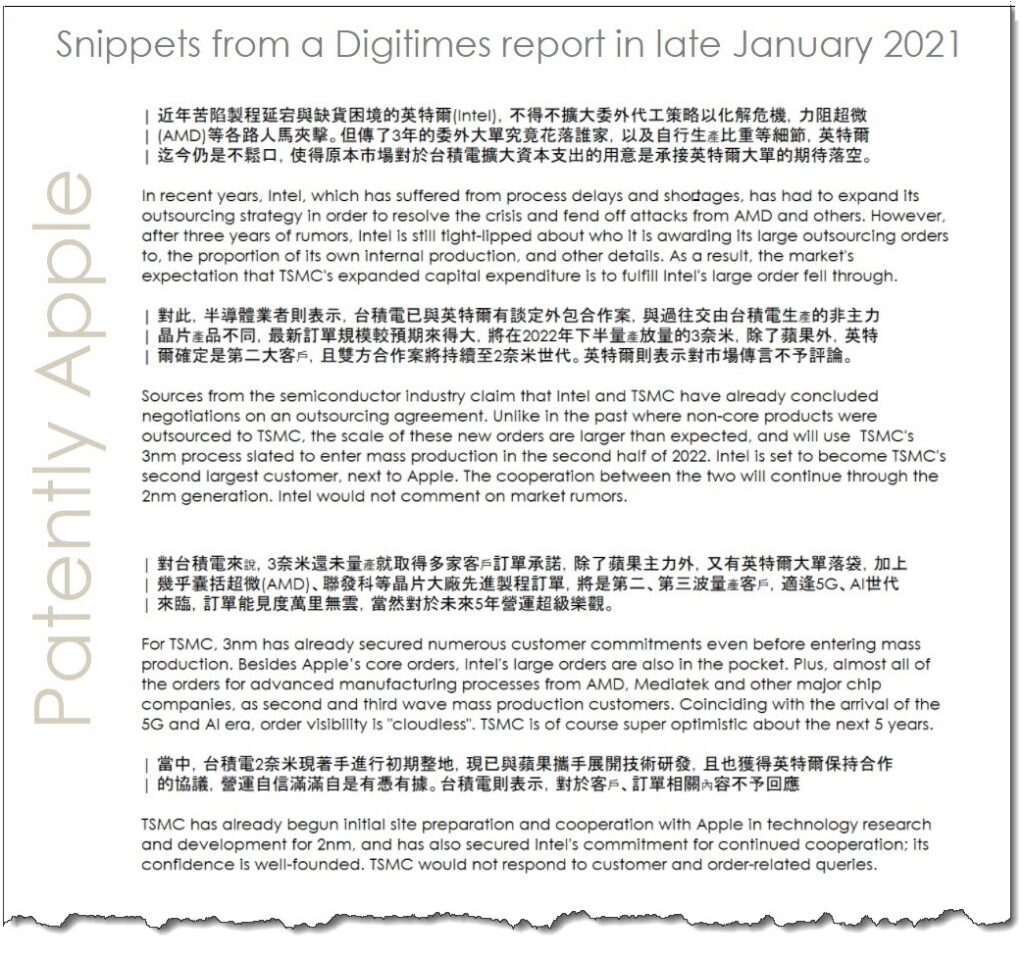

TSMC and Apple are reportedly jointly conducting R&D on the 2nm process. TSMC is currently mass-producing 5nm chips and the 3nm process is still in development. If TSMC can start mass production of 3nm chips in 2022, the 2nm trial production may be carried out in 2023. It is expected that in 2021, TSMC can occupy 80% of the market share with its 5nm production capacity. (GizChina, Patently Apple, CN Beta, CNA, TechNews)

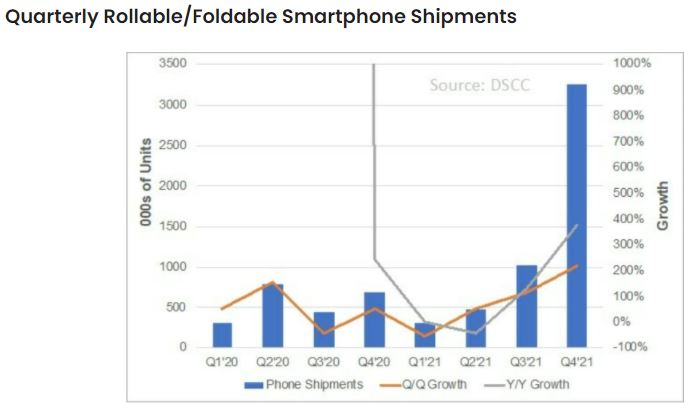

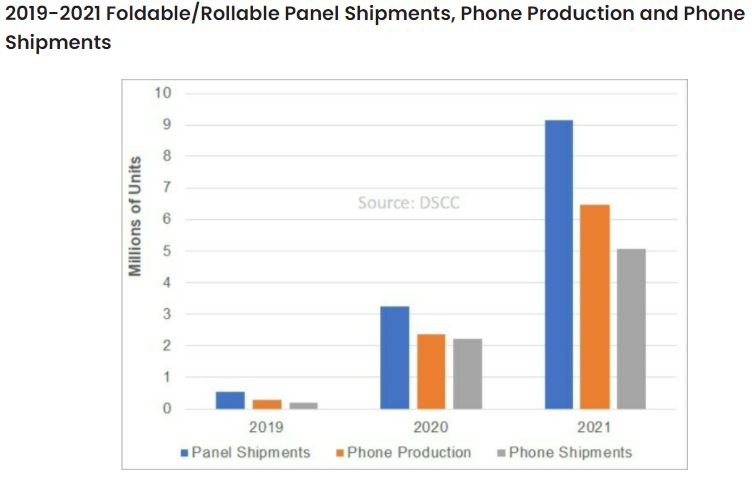

Display Supply Chain (DSCC) expects to see at least 12 different foldable and rollable smartphones on the market from at least 8 brands and shipments of more than 3M units in 4Q21. For 2021, foldable / rollable volumes should reach 5.1M units, up 128%, with revenues up 137% to USD8.6B. In 4Q20, foldable smartphone shipments were up 54% QoQ and 242% YoY. However, in 1Q21, foldable smartphone shipments are expected to rise just 1% YoY with a 40% YoY decline expected in 2Q21 on the lack of new products. However, 3Q21 and 4Q21 should each be up well over 100% YoY. In 2021, DSCC expects Samsung to continue to dominate the foldable / rollable market with an 81% unit share and 76% revenue share. (GizChina, XDA-Developers, DSCC)

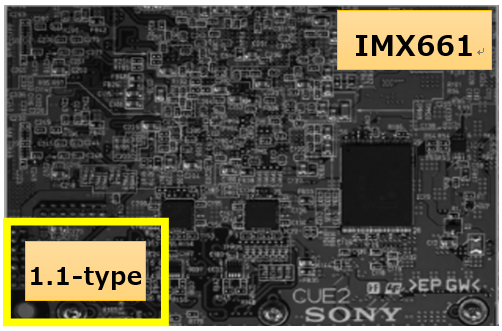

Sony has announced the upcoming release of a large format 56.73mm diagonal CMOS image sensor “IMX661” for industrial equipment with a global shutter function and the industry’s highest effective pixel count of 127.68MP. It also features Sony’s original global shutter pixel technology “Pregius”, which enables capture of motion distortion-free images. (CN Beta, Sony, Sony)

TF Securities analyst Ming-chi Guo predicts that 8P lenses will be widely adopted by smartphone brands starting from 2H22-1H23, and that Apple’s iPhone is expected to adopt periscope telephoto lenses in 2023, which means Largan Precision is still on a positive long-term trend. At present, Largan only produces 8P lenses but the yield rate is less than 50%, although the optical performance of 8P lenses is not about 10-20% higher than that of 7P lenses, the use of phones is limited due to the high cost. He predicts 8P Lens yield increased to 70% in 2H22, and Largan has significant technical advantages and will become a major supplier in terms of using periscope telephoto lenses for the new iPhone to be launched in 2H23. (TF Securities, CN Beta)

TF Securities analyst Ming-chi Kuo has predicted Apple to integrate a total of 15 cameras, supplied mainly by Largan Precision, in an AR / MR headset rumored to launch in 2022. Among them, 8 camera modules, are expected to be placed around the wearable “helmet” to facilitate pass-through VR, a technology that allows users to “see through” the enclosed device by feeding exterior images onto interior screens; 6 to be used for innovative object recognition; and 1 camera module for environment detection. Apple’s product is said to utilize high-resolution Micro-OLED displays. (TF Securities, Apple Insider)

LG Innotek has announced that it collaborates with Microsoft to unblock access to 3D vision technology and unleash innovation across multiple industry verticals such as: fitness, healthcare, logistics and retail with LG Innotek’s ToF (Time of Flight) technology-based 3D camera modules and Microsoft’s Azure Depth Platform. (CN Beta, MS Poweruser, PR Newswire)

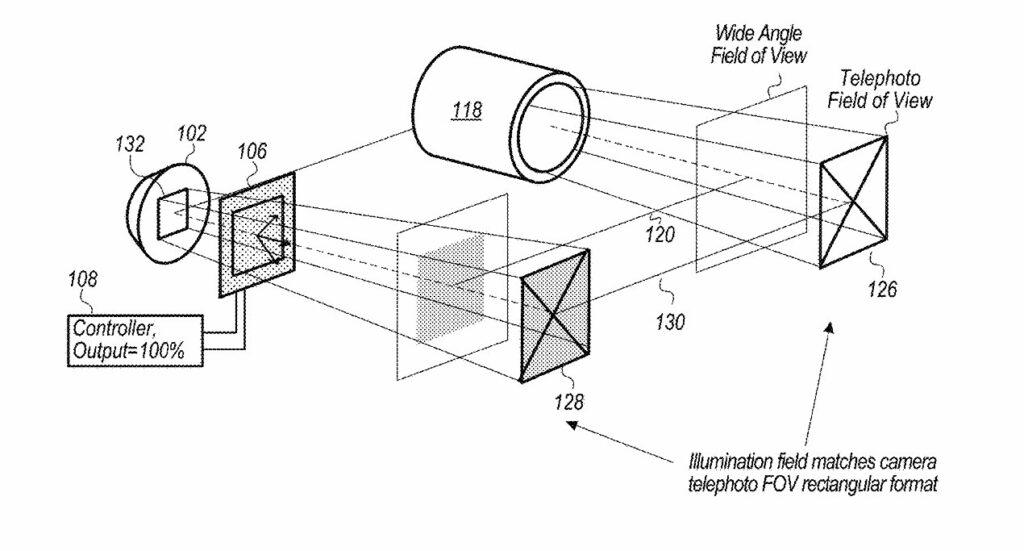

Apple’s newly-granted patent titled “light source module with adjustable focus” suggests that the flash will rely, at least in part, on the iPhone camera calculating distances to different objects within view. The patent’s proposal is to have a flash “light source module includes an illumination element and an adjustable light diffusing material”. The camera controls the flash, but then would also control the diffuser. (Apple Insider, USPTO, Sina, IT Home)

OnePlus has announced that it has entered a 3-year partnership with camera-maker, Hasselblad. OnePlus is committed to investing USD150M in that time to its photography capabilities. (Neowin, Pocket-Lint, Sohu, IT Home)

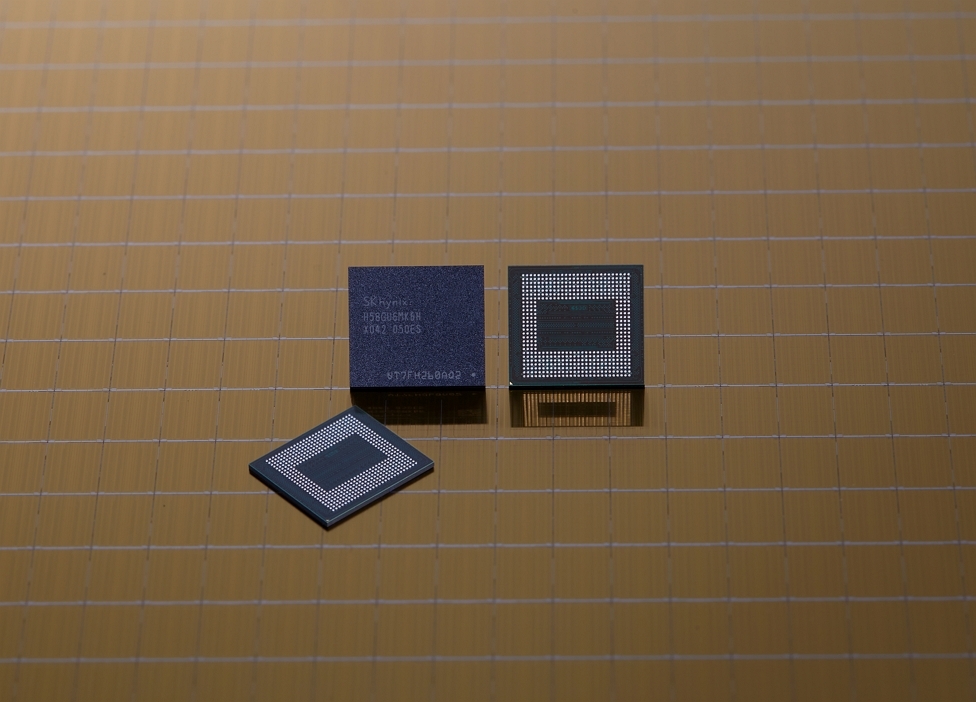

SK Hynix has announced that it has started mass-production of 18GB LPDDR5 mobile DRAM, which offers the largest capacity in the industry. The new product runs at up to 6,400Mbps (megabits-per-second), around 20% faster than the mobile DRAM (LPDDR5 with 5,500Mbps) for existing smartphones, a data rate that is capable of transferring ten 5GB FHD (Full-HD) movies per second. (CN Beta, The Register, SK Hynix)

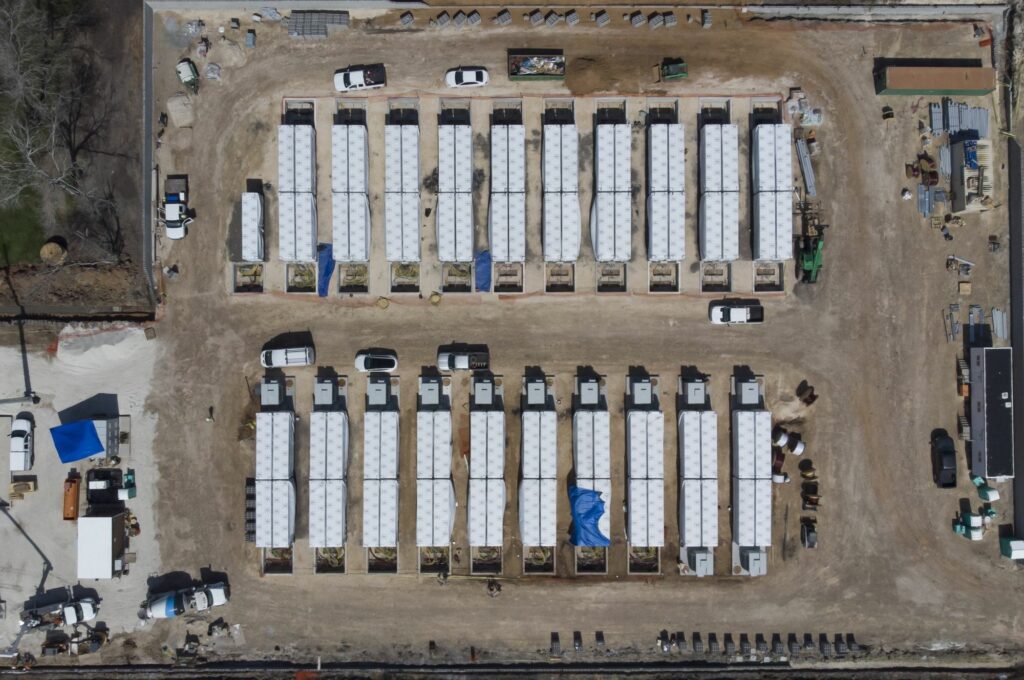

A Tesla subsidiary registered as Gambit Energy Storage LLC is quietly building a more than 100 megawatt energy storage project in Angleton, Texas, a town roughly 40 miles south of Houston. A battery that size could power about 20,000 homes on a hot summer day. (Engadget, Bloomberg, Sina)

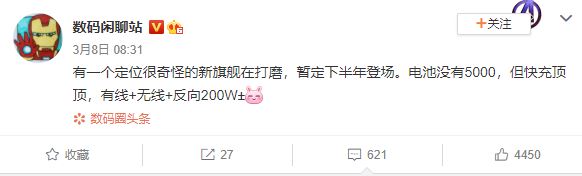

Xiaomi is reportedly working on the first phone in the world with 200W fast charging. The new phone will also feature wireless charging and reverse wireless charging, and will sport a 5,000mAh battery. (Phone Arena, Weibo, PC Home)

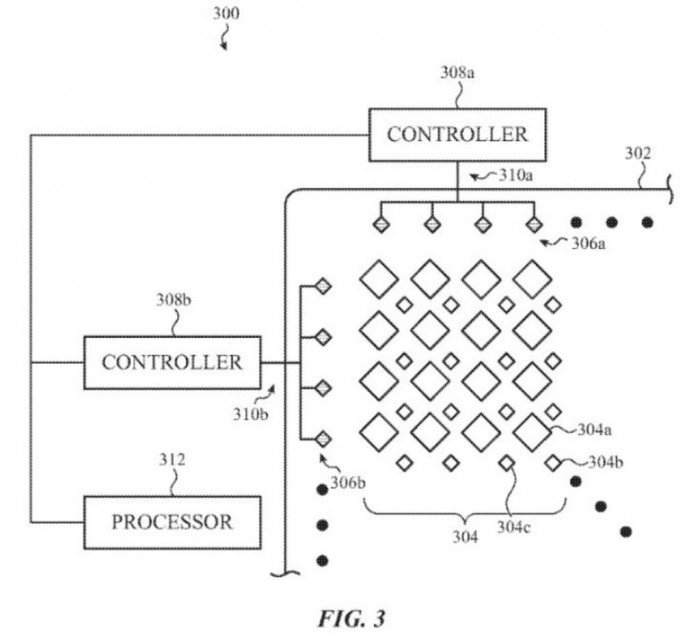

Apple’s patent titled “Sensing System for Detection of Light Incident to a Light Emitting Layer of an Electronic Device Display” lays out a system to embed a light detection layer in the display stack. In particular, light sensors associated with the light sensing system can be distributed around or within an active display area of the display. (CN Beta, Sina, Apple Insider)

According to Dell’Oro Group, the market for Microwave Transmission equipment declined 6% in 2020 but is positioned for growth in 2021. Huawei’s revenue share in the global wireless equipment market outside of China in 2020 will drop by 2 percentage points to about 20%, and it will still be in third place after Ericsson and Nokia. Ericsson’s share increased by 2 percentage points to around 35%, while Nokia’s share increased by 1 percentage point to around 25%. Despite the impact of the pandemic, global spending on cellular equipment reached USD35B in 2020, and spending in many regions exceeded expectations, including antennas and connection components. (CN Beta, Huawei Central, Dell’Oro Group, WSJ, Sina)

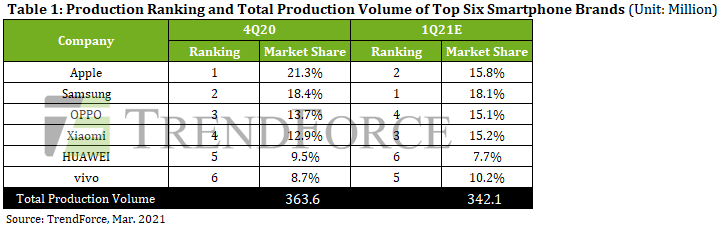

Owing to high sales of the iPhone 12 series as well as an aggressive device production strategy by Chinese smartphone brands in response to sanctions on Huawei, which has lost considerable market share as a result, global smartphone production for 1Q21 is likely to reach 342M units, a YoY increase of 25% and a QoQ decline of just 6%, according to TrendForce. Historically, smartphone production tends to experience a QoQ drop of around 20% for 1Q21 as demand collapses from the peak-season level of 4Q20. Apple produced 77.6M units of iPhones in 4Q20, an 85% increase QoQ, thereby overtaking Samsung and ranking first amongst all smartphone brands. It should also be pointed out that iPhone 12 devices accounted for about 90% of the iPhone production in 4Q20. (GSM Arena, TrendForce, TrendForce)

Apple is allegedly preparing to move 7%-10% of production for the iPhone 12 from China to India with assembly partner Foxconn said to be working on units for sale within the country and for the export market. A facility in Tamil Nadu will allegedly expand its existing production of the other 2 models to include the current-generation models. (GizChina, My Drivers, Apple Insider, Business Standard, India Times)

OPPO F19 Pro series is announced in India featuring 6.43” 1080×2400 FHD+ Super AMOLED HiD, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, Android 11.0, fingerprint on display: F19 Pro – MediaTek Helio P95, 8+128GB, 4310mAh 30W, INR25,990 (USD335). F19 Pro+ 5G – MediaTek Dimensity 800U 5G, 8+128 / 8+256GB, 4310mAh 50W, INR21,490 (USD293) / INR23,490 (USD320). (GSM Arena, Gizmo China)

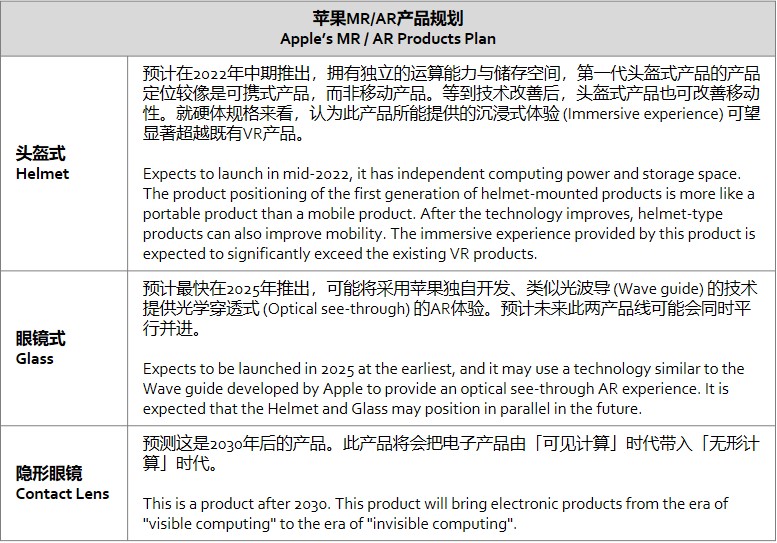

TF Securities analyst Ming-Chi Kuo expects Apple plans to release its mixed reality (MR) headset “in mid-2022”, augmented reality (AR) glasses by 2025, and AR contact lenses in the 2030s. (TF Securities, Mac Rumors, Mac Rumors, The Information)

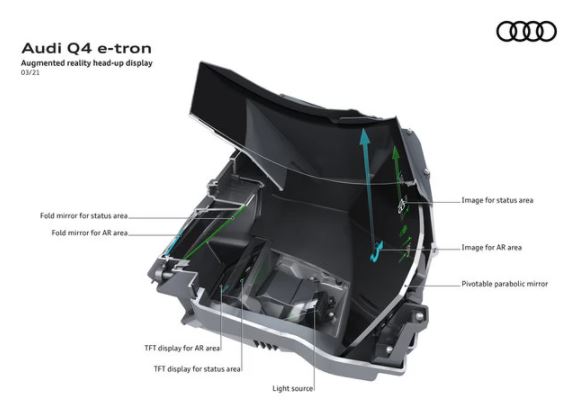

Audi has revealed the interior of its next EV, the Q4 E-Tron, which is a new augmented reality heads-up display in front of the driver, which offers a wider field of view and more accurate and advanced animations. Audi says this new AR system pulls in more than 1,000 “signals” from sensors all over the Q4 E-Tron to figure out exactly where to place these AR elements. (Pocket-Lint, The Verge, CNET, Audi, 163)

Hyundai Motor Group will set up a subsidiary in Washington as early as 1H21 to be responsible for urban air travel (UAM) projects. Hyundai Motor Group will promote the development of urban air travel projects with South Korea and the United States as the center. It plans to launch hybrid air cargo UAV system (UAS) by 2026 and all electric UAM model optimized for urban operation by 2028. (CN Beta, Hyundai, Sina, Equal Ocean)

Aerial passenger drone startup EHang will launch an electric aircraft with a range that will exceed 400 kilometers, ten times that of its current flagship EHang 216. The flight distance has exceeded US-based Joby and German-based Lilium. Both Joby and Lilium plan to go public in the near future under the SPAC model. Joby plans to be listed in 2Q21, with an estimated valuation of USD6.6B. (CN Beta, Seeking Alpha, 163, CN Techpost, Forbes)

Drone maker DJI currently dominates the consumer drone market, controlling about 60% of the market. The US government recently restricted the company’s access to chips and other components by placing it in the same entity. Its North American operations have been hit by internal ructions in recent weeks and months, with a raft of staff cuts and departures. (Gizmo China, Reuters, Reuters, Sina)

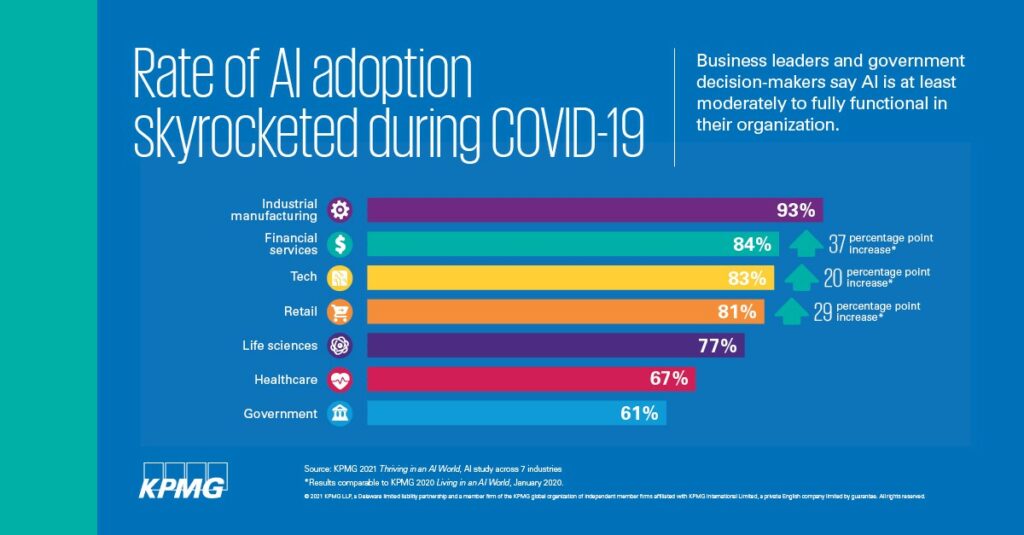

According to KPMG, the COVID-19 pandemic has accelerated the pace of artificial intelligence (AI) adoption, but many say it is moving too fast. High numbers of business leaders from the following industries say AI is at least moderately functional in their organizations, including those in: industrial manufacturing (93%), financial services (84%), tech (83%), retail (81%); life sciences (77 percent), healthcare (67%) and government (61%). (VentureBeat, KPMG)

PayPal has announced that it has agreed to acquire Curv to accelerate and expand its initiatives to support cryptocurrencies and digital assets. Curv is a leading provider of cloud-based infrastructure for digital asset security based in Tel Aviv, Israel. (CN Beta, PR Newswire, TechCrunch)

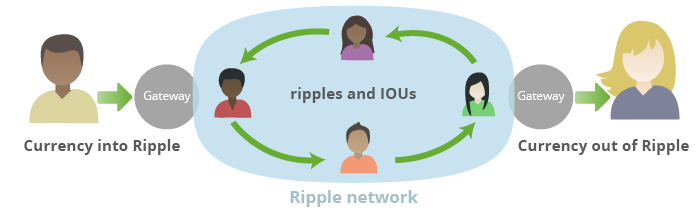

Distributed ledger company Ripple has announced that its partnership with money transfer firm MoneyGram is coming to an end. Ripple CEO Brad Garlinghouse has also noted that both companies are “committed to revisiting our relationship in the future”. Ripple and Moneygram’s partnership dates back to Jun 2019. (CN Beta, The Block, Yahoo, Ripple)