3-13 #Empathy : Apple’s custom-designed 5G cellular modem will likely debut in all 2023 iPhone models; Nokia has struck a deal with Samsung to license patents covering its innovations in video standards; Apple has discontinued its original HomePod; etc.

TSMC says “there are many considerations in choosing the location of the factory, including customer needs. TSMC does not rule out any possibility, but there is no specific plan for setting up a factory in Europe”. (GizChina, IT Home, UDN)

Qualcomm is reportedly working on a new platform for Windows notebooks and 2-in-1 devices, a successor to the second-generation Snapdragon 8cx. The new platform is designed for out-and-out performance and will be available in 2 versions. One version – presumably the upper one – of the new platform seems to have four ‘gold+’ cores clocked at 2.7Ghz and four ‘gold’ cores clocked at 2.43Ghz. All are designed for performance over power efficiency. (Pocket-Lint, Winfuture, XDA-Developers)

Apple’s custom-designed 5G cellular modem will likely debut in all 2023 iPhone models, according to Barclays analysts Blayne Curtis and Thomas O’Malley. The analysts have said chipmakers Qorvo and Broadcom should be among the companies that benefit from the shift to Apple’s in-house solution. (CN Beta, Sina, MacRumors)

Qualcomm is allegedly testing the Snapdragon 888’s successor, the SM8450 (codename Waipio), and that it will be made by Samsung Foundry. However, it is still not clear if the next-generation chipset will continue to use the 5nm LPE process or move to a better one. (Gizmo China, SamMobile)

Qualcomm is struggling to keep up with demand for its processor chips used in smartphones and gadgets, as a chip shortage that first hit the auto industry spreads across the electronics business. Qualcomm chip shortage was hitting production of mid- and low-end Samsung models. Qualcomm’s entire lineup of application processors contain power management chips made with older technology by companies including Semiconductor Manufacturing International Corporation (SMIC) and Taiwan Semiconductor Manufacturing Co (TSMC). (Apple Insider, Reuters, 9to5Google, CN Beta, My Drivers)

The Line S2 fab of Samsung in Austin, Texas sustained a power interruption, which has forced it to suspend operation since mid-Feb 2021, under the impact from the winter storm. TrendForce’s latest investigations indicate that the capacity utilization rate for the entire fab is not expected to climb back to over 90% until the end of Mar 2021. In particular, Samsung manufactures several products that are highly important for the production of smartphones, including the Qualcomm 5G RFIC, Samsung LSI OLED DDIC, and Samsung LSI CIS Logic IC. Supply-wise, the first two products sustained the brunt of the winter storm’s impact, and global smartphone production for 2Q21 is therefore expected to drop by about 5% as a result. (TrendForce, TrendForce, CN Beta)

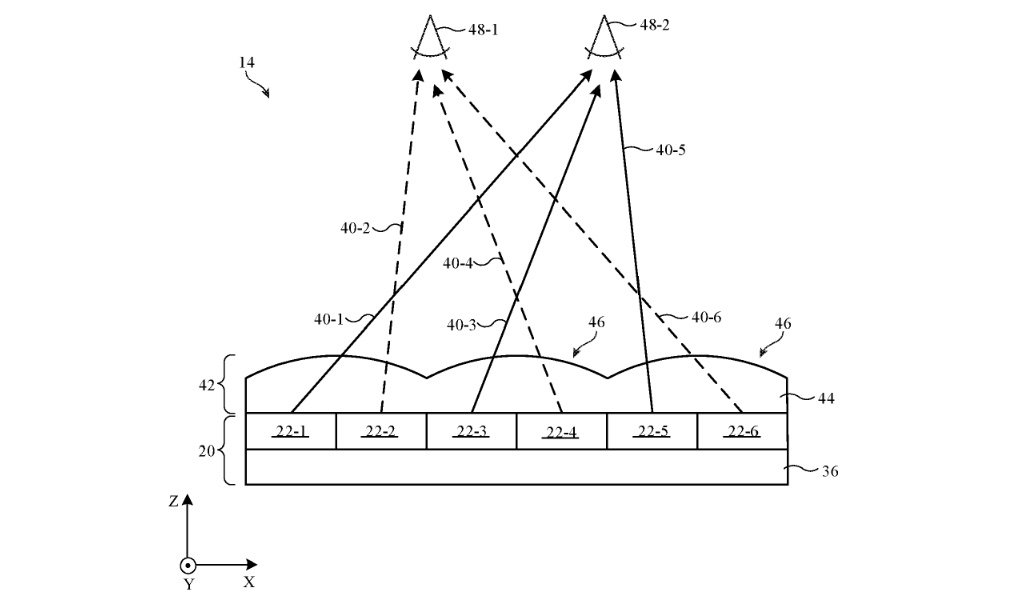

Apple’s patents lay out a way to provide stereoscopic, or three-dimensional, content to viewers of a device using displays equipped with lenticular lenses. These lenses could be formed over an array of pixels, such as those on OLED or LCD displays. Each of the 3 patent applications focus on the same lenticular lens technology, but they all have slightly varying claims. (Apple Insider, USPTO, USPTO, USPTO)

Liao Qian, Senior Vice President of TCL Technology claims that Samsung has more than 20% of the Smart TV market share for the past 5 years. This, in turn, helps TCL as the company provides more than 15% of the large-size display panels, making Samsung the second-largest customer of the company. (Gizmo China, 163)

LG Energy Solution, a division of LG Chem which manufactures batteries, plans to invest more than USD4.5B in its US battery production business over the next 4 years. Denise Gray, president of LG Energy Solution’s Michigan unit has revealed that the company’s investment will result in an additional 70GWh of US battery production capacity to respond to growth in the electric vehicle market. (CN Beta, Business Insider, CNET)

General Motors (GM) says it is planning the next generation of its Ultium batteries with lithium metal anode. To accelerate the commercialisation of lithium metal batteries, GM is now working with SolidEnergy Systems (SES). GM and SES are planning to build a prototype production line for the cells in Woburn in the US state of Massachusetts by 2023. (CN Beta, Electrive, Driving.ca, TechCrunch, General Motor)

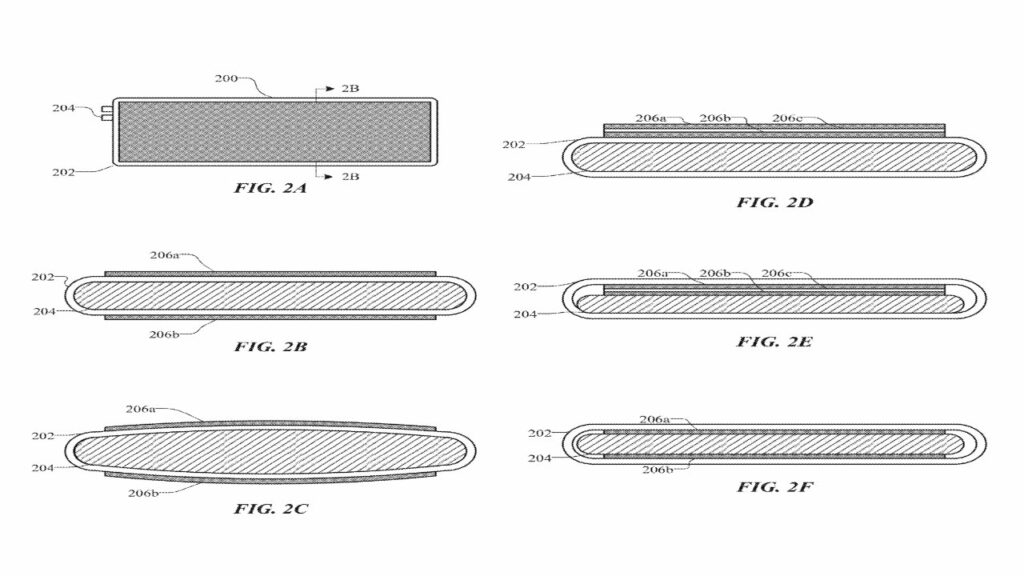

Apple is researching how to use new sensing methods to detect the early signs of a swelling battery. Apple has filed 2 patents pertaining to battery technology that will reduce device size and allow the device to detect battery swelling. These technologies go hand-in-hand for creating ever-smaller devices while keeping them safe for the user. (Gizmo China, Apple Insider, USPTO, USPTO)

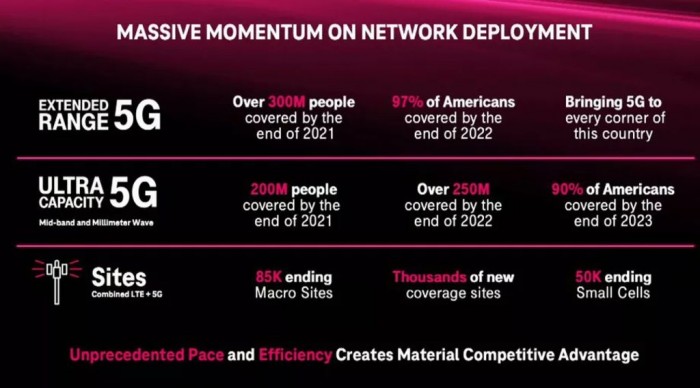

T-Mobile says that by the end of 2023, it will cover 90% of Americans (about 300M) with what it calls Ultra Capacity 5G (its faster mid-band and mmWave service). It also plans to cover 97% of Americans (about 320M) by the end of 2022 with its slower low-band 5G, which it calls Extended Range. Currently, 125M are covered by Ultra Capacity, with Extended Range covering 287M. (CN Beta, Android Central, The Verge, T-Mobile)

Nokia has struck a deal with Samsung to license patents covering its innovations in video standards. Nokia’s patent portfolio is composed of around 20,000 patent families, including over 3,500 declared essential to 5G. (GSM Arena, Nokia, Reuters, CN Beta)

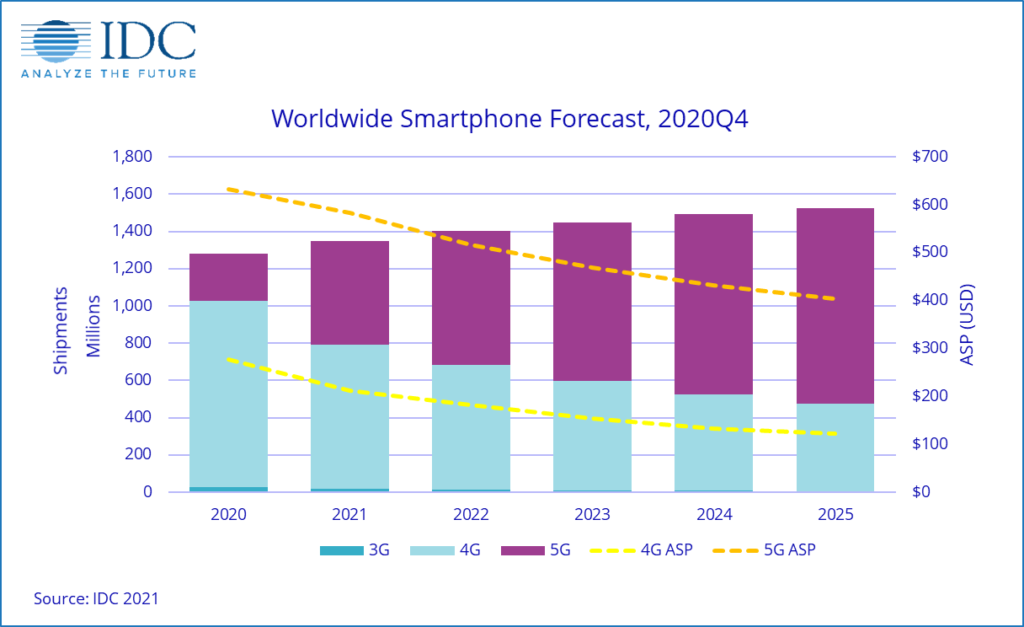

According to IDC, smartphone shipments are forecast to grow 13.9% YoY in 1Q21 and 5.5% for the full year 2021. This growth will be driven by continued recovery in demand and a supply-side push of 5G devices. IDC expects the global smartphone market to deliver a compound annual growth rate (CAGR) of 3.6% over the 2020-2025 forecast period. IDC expects 5G smartphone shipments to account for more than 40% of global volume in 2021 and grow to 69% in 2025. Both factors have helped to increase the overall average selling price (ASP) for smartphones to USD363 in 2021. (Gizmo China, IDC)

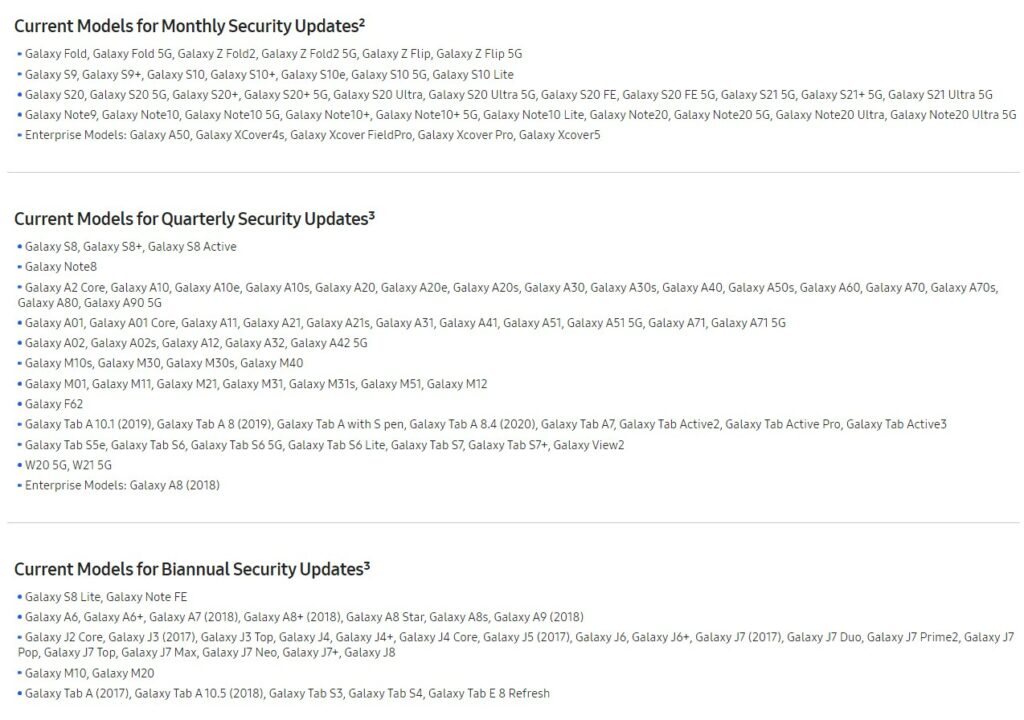

Samsung has recently announced that it would offer 4 years of software support to most of its Galaxy smartphones and tablets. That is 2 / 3 major Android OS updates and security patches for an additional year. Samsung plans to offer monthly security patches to its high-end smartphone and enterprise devices. For mid-range and older flagships, Samsung will offer quarterly updates. (SamMobile, Gizmo China, Samsung)

Samsung Galaxy M12 is launched in India – 6.5” 720×1600 HD+ v-notch 90Hz, Exynos 850, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 8MP, 4+64 / 6+128GB, Android 11.0, side fingerprint, 6000mAh 15W, INR10,999 (USD151) / INR13,499 (USD185). (GSM Arena, Android Authority, Amazon)

OPPO Find X3 series is announced in China featuring 6.7” 1440×3216 QHD+ HiD LTPO AMOLED 120Hz, rear quad 50MP OIS-13MP telephoto 2x optical zoom-50MP ultrawide-2MP macro + front 32MP, Android 11.0, fingerprint on display, 4500mAh 65W, fast wireless charging 30W, reverse wireless charging 10W, IP68 rated: X3 – Qualcomm Snapdragon 870 5G,, 8+128 / 8+256GB, CNY4,499 (USD693) / CNY4,999 (USD770). X3 Pro – Qualcomm Snapdragon 888, 12+256 / 12+256 / 16+512GB, CNY5,499 (USD847) / CNY5,999 (USD924) / CNY6,999 (USD1,078). (GSM Arena, Digital Trends, GSM Arena, GizChina, GizChina)

OPPO Find X3 Neo and Lite are announced in UK: X3 Neo – 6.55” 1080×2400 FHD+ HiD AMOLED 90Hz, Qualcomm Snapdragon 865, rear quad 50MP OIS-13MP telephoto 2x optical zoom-50MP ultrawide-2MP macro + front 32MP, 12+256GB, Android 11.0, fingerprint on display, 4500mAh 65W, reverse charging, GBP699. X3 Lite – 6.43” 1080×2400 FHD+ HiD AMOLED 90Hz, Qualcomm Snapdragon 765G, rear quad 64MP-8MP ultrawide-2MP macro-2MPdepth + front 32MP, 8+128GB, Android 11.0, fingerprint on display, 4300mAh 65W, reverse charging, GBP399. (GSM Arena, Digital Trends, GSM Arena, GizChina, GizChina)

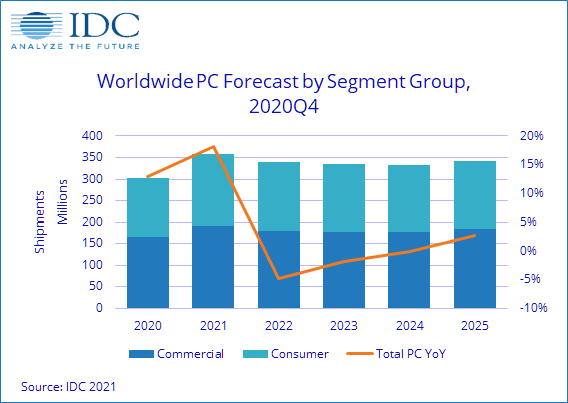

In 2020, PC shipments grew 12.9%; this momentum is expected to carry forward into 2021 as IDC forecasts 18.2% growth for the traditional PC market with shipments reaching 357.4M in 2021. Looking further ahead IDC’s outlook remains stronger than historical levels with a compound annual growth rate (CAGR) of 2.5% for the 2020-2025 forecast period. (CN Beta, IDC)

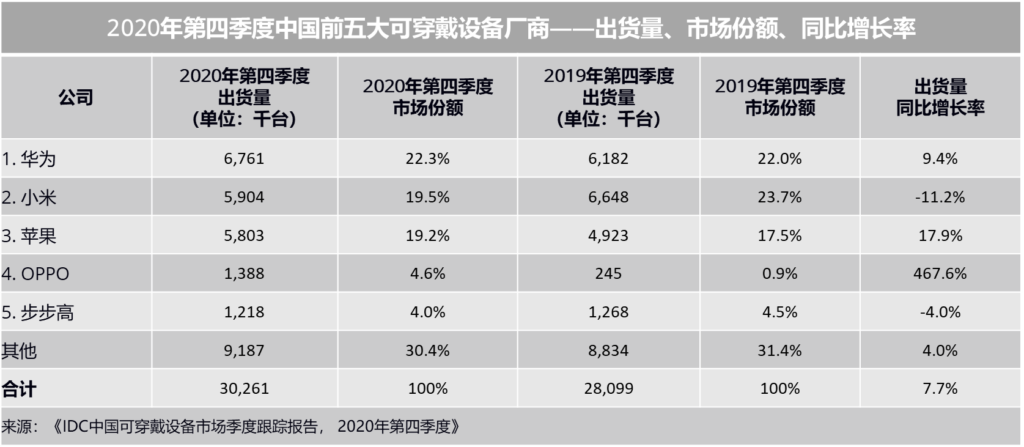

According to IDC, in 4Q20, China’s wearable device market shipped 30.26M units, a YoY increase of 7.7%. The shipment of basic wearable devices (wearable devices that do not support third-party applications) is 25.18M units, an increase of 10.3% YoY, and the shipment of smart wearable devices is 5.08M units, a YoY decrease of 3.6%. Huawei has ranked first with 6.761M units of shipments, with a market share of 22.3%, and shipments increased by 9.4% YoY. (GizChina, IT Home, CN Beta, IDC)

Apple’s patent titled “Computer-generated Reality Recorder” concerns the myriad problems of capturing a 360-degree AR/VR experience. Not only is there a vast amount of data to record from one person wearing a headset, there is also the issue that multiple people can be involved. The patent is about determining which parts a user is interested in, and then capturing those. (Apple Insider, USPTO)

Apple has discontinued its original HomePod, which is launched in 2018. It says that it will continue to produce and focus on the HomePod mini, introduced in 2020. (CN Beta, TechCrunch, The Verge)

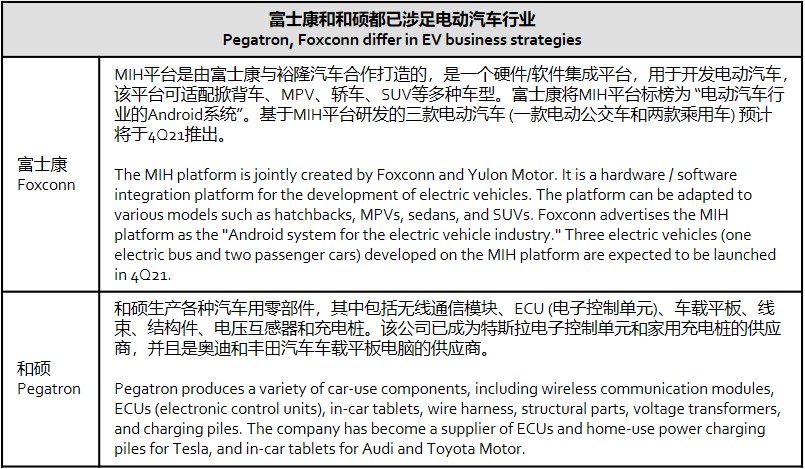

Pegatron embraces a strategy of producing key components on ODM / OEM basis mainly for Tesla, while Foxconn has set up MIH, an open hardware / software-integration platform for developing EVs, accompanied by an ecosystem, the MIH Alliance. (CN Beta, Sina, Focus Taiwan, Digitimes, press)

Lucid Motors has received approval from the Casa Grande City Council to begin the construction of the Phase 2 portion of its new electric vehicle manufacturing facility. The first phase is completed in Dec 2020, and is capable of delivering up to 30,000 vehicles annually. (CN Beta, Teslarati)

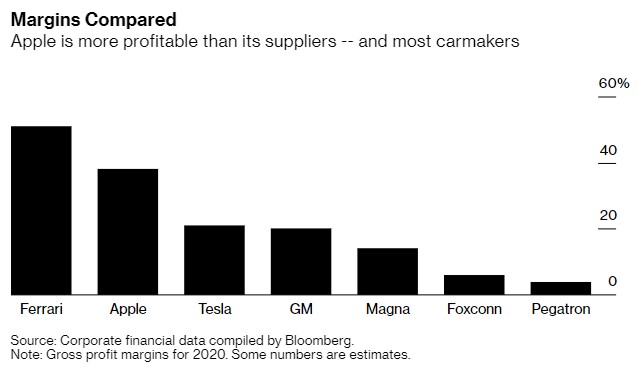

Apple has a tried-and-true approach to launching new products: The company designs in-house, sources its own components, and works with a contract manufacturer to assemble it for sale. To build a vehicle, Apple has 3 primary options: Partner with an existing carmaker; build its own manufacturing facilities; or team up with a contract manufacturer such as Foxconn or Magna International. Eric Noble, president of consulting firm the CarLab, has indicated that Apple is more likely to go with a contract manufacturer because that is the business model they are used to. (CN Beta, Bloomberg)

Uber and Lyft have announced the Industry Sharing Safety Program, a first-of-its-kind effort to share information about the drivers and delivery people deactivated from each company’s platform for the most serious safety incidents including sexual assault and physical assaults resulting in a fatality. (CN Beta, Neowin, Business Wire)

LG Electronics and Luxoft, a DXC Technology Company, have announced the launch of their joint venture aimed at advancing the companies’ shared vision at enabling digital, consumer-grade experiences in automotive. Alluto will drive the commercialization of production-ready digital cockpit, in-vehicle infotainment, passenger-seat entertainment (PSE) and ride-hailing systems based on the webOS Auto platform. (CN Beta, LG, Korea Bizwire)

DeepMind, the U.K. artificial intelligence (AI) lab acquired by Google in 2014, has quietly hired a team of researchers in New York. The company — widely regarded as one of the leading AI firms in the world — hired Facebook AI Research (FAIR) co-founder Rob Fergus to lead its New York team Jun 2020. (CN Beta, CNBC)

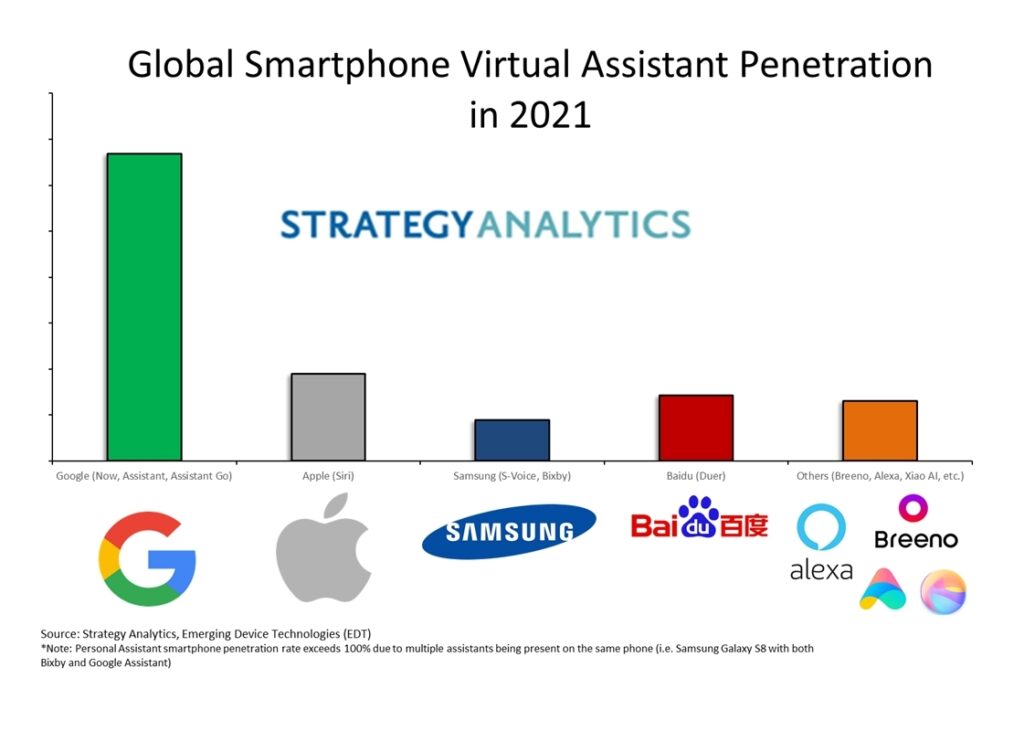

Strategy Analytics (SA) finds that on-device artificial intelligence (AI) is being rapidly implemented by smartphone vendors. SA estimates that 71% of all smartphones sold worldwide in 2021 will have on-device AI. SA also estimates that in 2021 over 80% of smartphones globally will have virtual assistants and the share will grow to 97% by 2025. (CN Beta, Business Wire, Bloomberg)