3-17 #Unfair : Samsung has revealed there won’t be Galaxy Note device in 2021; OFilm has revealed that it has received a notification from a “particular overseas client” saying it would cut its business ties; Huawei will negotiate rates and comprehensive cross-licensing agreements with Apple and Samsung; etc.

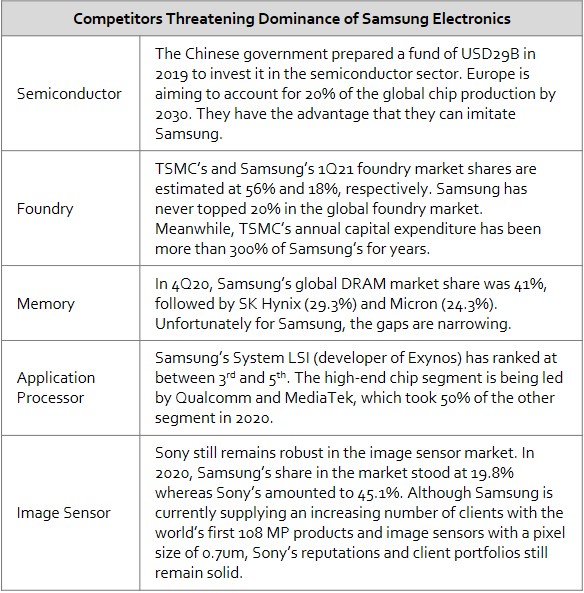

For the first time since 2016, the global smartphone applications processor (AP) market returned to revenue growth in 2020, according to Strategy Analytics. Despite the COVID-19 pandemic, the global smartphone AP market showed resiliency and grew 25% YoY to USD25B in 2020. Qualcomm maintained its lead in the smartphone AP market with a 31% revenue share, followed by Apple with 23% and HiSilicon with 18%. (Strategy Analytics, Laoyaoba)

Baidu has revealed that its artificial intelligence (AI) chip unit Kunlun recently completed a round of fundraising, which values the business at about USD2B. Baidu reported in 2018 that its Kunlun chips were able to achieve 260 tera-operations per second and provide 512-gigabit per second memory bandwidth. (My Drivers, Reuters, CNBC, Silicon Angle)

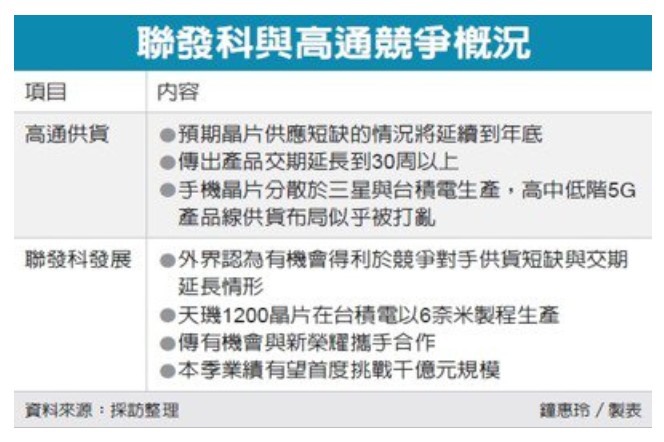

Qualcomm is facing issues as its foundry capacity is tightly packed. Additionally, Samsung faces further delays in production as its Austin plant has yet to resume production due to cold wave in America. Thus, there is a disruption in the supply chain for 5G mobile processors, with delivery times being as along as 30 weeks for Xiaomi, OPPO, etc.. Thus, Xiaomi is turning towards MediaTek for help, as it aims on reducing the proportion of Qualcomm chips from 80% to 55%. (Gizmo China, UDN)

Samsung Electronics has dominated the global memory chip market for as long as 29 years. However, its market dominance is no longer guaranteed with competitors emerging. Besides, Samsung Electronics is failing to catch up with market leaders in the system-on-chip industry. (Gizmo China, Business Korea)

Samsung Electronics has recently won a project for Google parent Alphabet’s autonomous driving unit Waymo to develop chips for next-generation self-driving cars. Samsung will develop a chip that computes data collected from various sensors installed in autonomous vehicles or centrally controls functions by exchanging information with Google data centers in real time. (GizChina, NASDAQ, SamMobile, Sohu, Digitimes)

Rockchip has launched the RV1126 car vision solution. It has fully upgraded five major technical advantages-1) Car recording performance is doubled, supporting 8 channels of 1080p video recording; 2) Built-in 2T independent NPU, AI efficiency is higher; 3 ) Equipped with a security-level ISP to ensure high-definition night shooting; 4) Double the storage space, extend the recording time, and 5) Decompression time is 22 times faster, and the device startup speed is increased. (CN Beta, Sohu)

General Motors (GM) has revealed that due to the global semiconductor chip shortage the U.S. automaker is building certain 2021 light-duty full-size pickup trucks without a fuel management module, hurting those vehicles’ fuel economy performance. The lack of the active fuel management/dynamic fuel management module means affected models, equipped with the 5.3-liter EcoTec3 V8 engine with both six-speed and eight-speed automatic transmission, will have lower fuel economy by one mile per gallon. (The Verge, Reuters, VOA News)

UBI Research CEO Choong Hoon Yi has said Samsung Electronics will unlikely to use Samsung Display’s quantum dot (QD)-OLED for its TVs. Samsung Display is considering building a Gen 6 rigid OLED production line at L7-2 plant at Asan, to produce more notebook OLED panels. L7-2, which will likely be renamed A4-2, will be used to manufacture low temperature polycrystalline oxide (LPTO) thin-film transistor (TFT) rigid OLED. (Gizmo China, The Elec)

LG has filed a new design patent, which reveals a rollable display that expands to offer more screen. It is capable of expanding the display from the right edge to offer more estate. When unfolded, the screen is 40% larger than its compact size. The left side of the rear panel features a vertical bar. (Android Headlines, MySmartPrice)

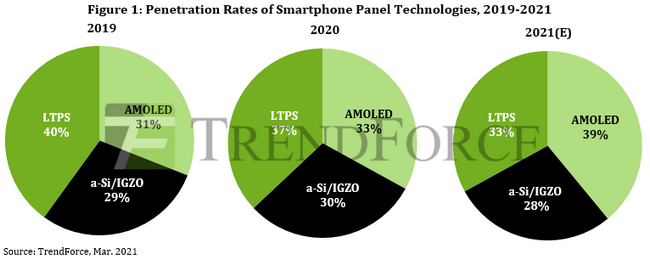

Among the various display technologies used for smartphones in 2021, AMOLED models are expected to account for a 39% penetration, thanks to smartphone brands’ increasing adoption of this technology, according to TrendForce. In the entry-level and mid-range segments, the smartphone demand for a-Si LCD models remains strong, although this technology’s penetration rate is expected to undergo a slight decrease to 28%. On the other hand, LTPS LCD models are continuing to lose market share to competing technologies, resulting in a 33% penetration rate, while LTPS HD LCD models will occupy a growing share of this segment. (TrendForce, TrendForce, CN Beta)

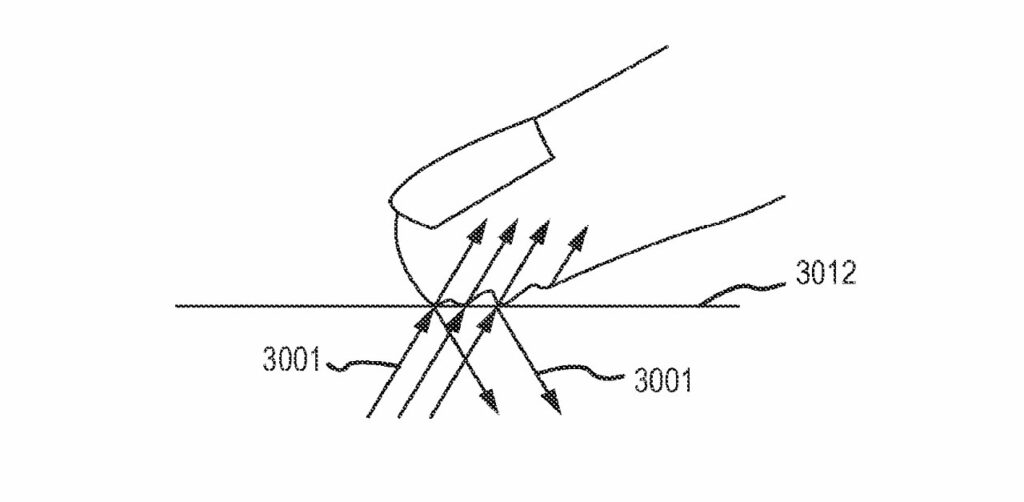

Apple’s patent titled “fingerprint-assisted force estimation” is concerned with how to use pressure to distinguish between accidental and deliberate touches on capacitive screens when wet. If the screen can detect just how damp a person’s finger is, it can recalibrate itself to better determine when a touch is a deliberate press or not. (Apple Insider, USPTO, Sina, IT Home)

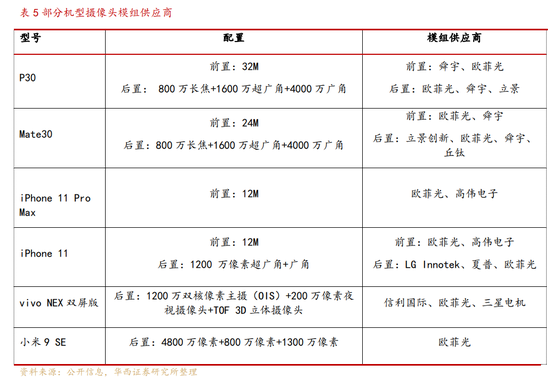

Leading China-based smartphone vendors are likely to adopt entry-level ToF 3D-sensing technology for rear cameras of new models to be launched in 2H21, according to Digitimes. These vendors are expected to finalize their plans in early 2Q21. China-based Wuhan Silicon Integrated and Ningbo RaySea Technology are prepared to provide entry-level ToF 3D sensing modules for Chinese smartphone vendor. (Gizmo China, Digitimes, press, Digitimes)

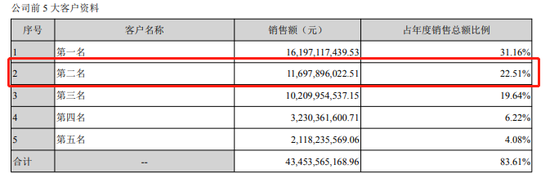

OFilm has revealed that it has received a notification from a “particular overseas client” saying it would cut its business ties. According to OFilm, the customer contributed 22.51% of its operating income in 2019. OFilm is known as a supplier of camera modules for Apple, which uses them in its line of iPhone smartphones. (Apple Insider, Reuters, CN Beta)

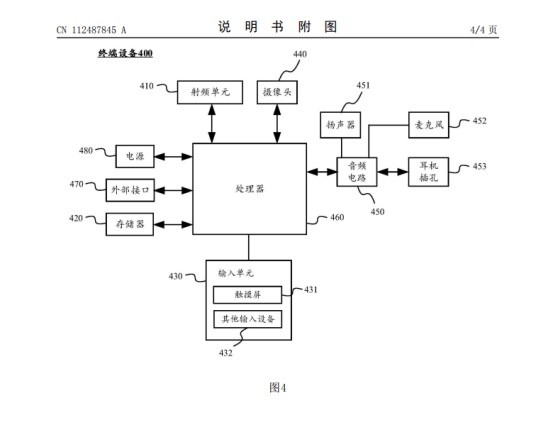

Huawei has published a new patent for under-screen fingerprint technology. The patent synopsis discloses a method for displaying fingerprint prompt patterns and unlocking devices under the screen. This under-screen fingerprint solution is used to display the fingerprint prompt pattern because multiple fingerprint prompt patterns are displayed in turn. Also, the display positions of the multiple fingerprint patterns in the fingerprint prompt area are not completely overlapped. (My Drivers, CN Beta, Huawei Central)

Volkswagen plans to build 6 battery cell plants in Europe by 2030 and expand infrastructure for charging electric vehicles globally. Volkswagen has indicated that the European factories will have a joint production capacity of up to 240 gigawatt hours (GWh) a year, adding the first 40GWh would come from Sweden’s Northvolt, with production starting in 2023. (TechCrunch, CNBC, Reuters, Bloomberg, Auto News)

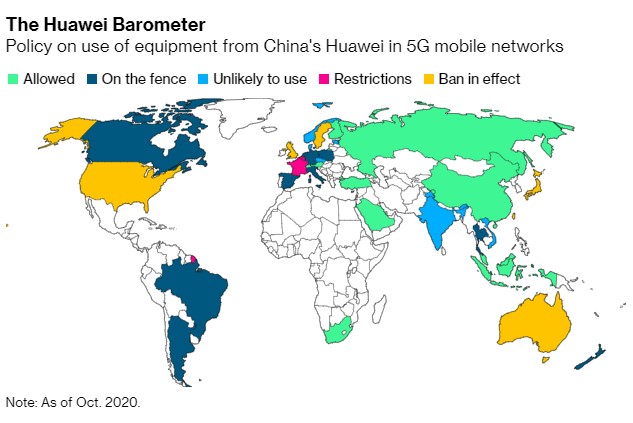

Huawei’s Chief Legal Officer, Song Liuping, has explained that the company will negotiate rates and comprehensive cross-licensing agreements with Apple and Samsung, promising to charge lower rates than competitors such as Qualcomm, Ericsson, and Nokia. Per-phone royalties will be capped at USD2.50, which is markedly less than Qualcomm’s USD7.50 rate that led to a legal battle with Apple over supposedly unfair pricing. (Bloomberg, MacRumors, IT Home)

Finnish telecoms giant Nokia is to cut 5,000-10,000 jobs worldwide in the next 2 years as it cuts costs. This is expected to lower the company’s cost base by approximately EUR600M (USD715.7M) by the end of 2023. (CN Beta, BBC, CNN)

SellCell has conducted a survey of 5,000 American phone users in early Mar 2021 indicating that Apple iPhone loyalty (willingness to buy the same brand again) is at an all-time high of 91.9% while Android faithfulness is dropping. Samsung users’ loyalty fell from 85.7% in 2019 to 74% in 2021. It only got worse for other brands. (Apple Insider, SellCell)

Google plans to reduce the fees it charges to feature Android apps within its Play store. From 1 Jul 2021, it will take a 15% cut from the first USD1M in sales each year of the apps and any digital goods and services sold within them, rather than its current 30% commission. Google has said 99% of global Android developers did not earn over USD1M a year, so would benefit from a 50% reduction in fees. (CN Beta, TechCrunch, BBC, Google)

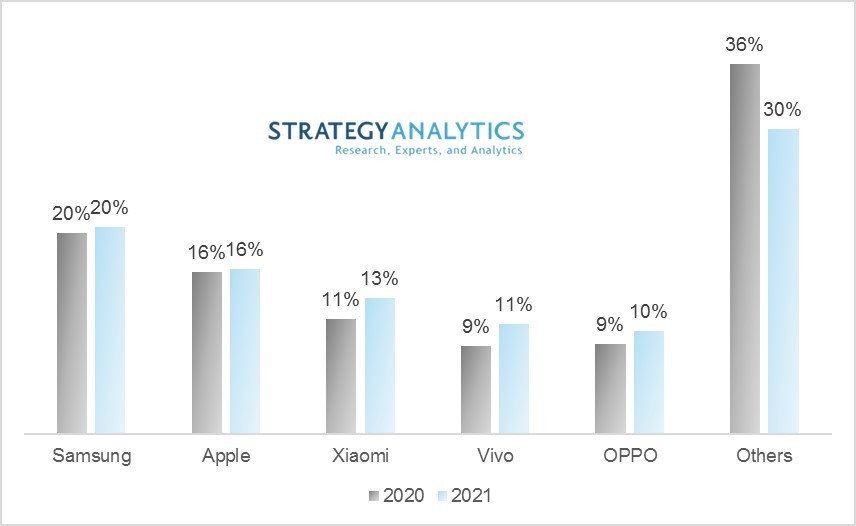

According to Strategy Analytics, Strategy Analytics, the global smartphone shipments will rebound +6.5% YoY to reach 1.38B units in 2021. The growth is driven mostly by the improved economic situation as the COVID-19 pandemic weakens, a growing stock of aging smartphones and the operator/vendor push for migration to 5G. For 2021, they believe Xiaomi will emerge as the third largest global smartphone vendor surpassing Huawei. (CN Beta, Strategy Analytics)

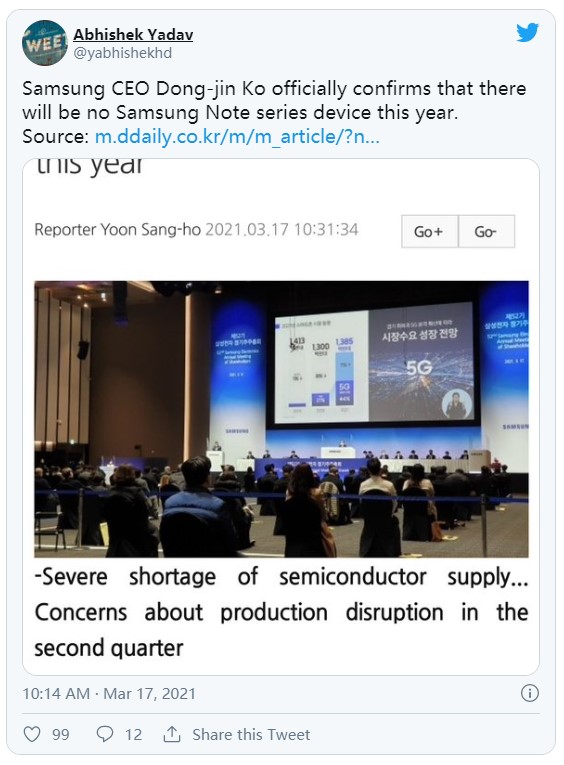

Samsung CEO Dong-jin Ko officially confirms that there will be no Samsung Note series device in 2021. It does not mean that the company is discontinuing the series, news products under the series will launch in 2022, but no fixed time is decided yet. (Android Authority, Digital Daily, MySmartPrice, Sina, IT Home)

OPPO Reno5 F is announced in Kenya – 6.43” 1080×2400 FHD+ HiD OLED, MediaTek Helio P95, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 8+128GB, Android 11.0, fingerprint on display, 4310mAh 30W, KES31,499 (USD287). (Gizmo China, GSM Arena, OPPO)

vivo iQOO Neo5 5G is announced in China – 6.62” 1080×2400 FHD+ HiD AMOLED 120Hz, Qualcomm Snapdragon 870 5G, rear tri 48MP-13MP ultrawide-2MP mono + front 16MP, 8+128 / 12+256GB, fingerprint on display, 4400mAh 66W, CNY2,499 (USD385) / CNY2,999 (USD461). (GSM Arena, vivo)

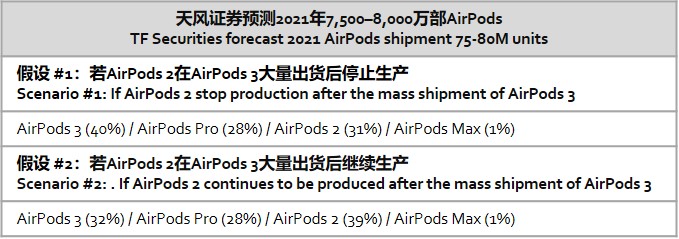

TF Securities analyst Ming-Chi Kuo has lowered Apple AirPods shipment forecast for 2021 by 30–35% to 75–80M units, implying a 10–15% annual decline. AirPods 1Q21–3Q21 shipments will decline by about 25% annually to 55M units, even if the market demand for the new AirPods 3, which is expected to be shipped in 3Q21, is better than expected, the 4Q21 AirPods shipments will be flat to 23M units in 2021. Annual AirPods shipments will also decline to about 78M units (vs. 90M units in 2020). (CN Beta, TF Securities, MacRumors, GSM Arena)

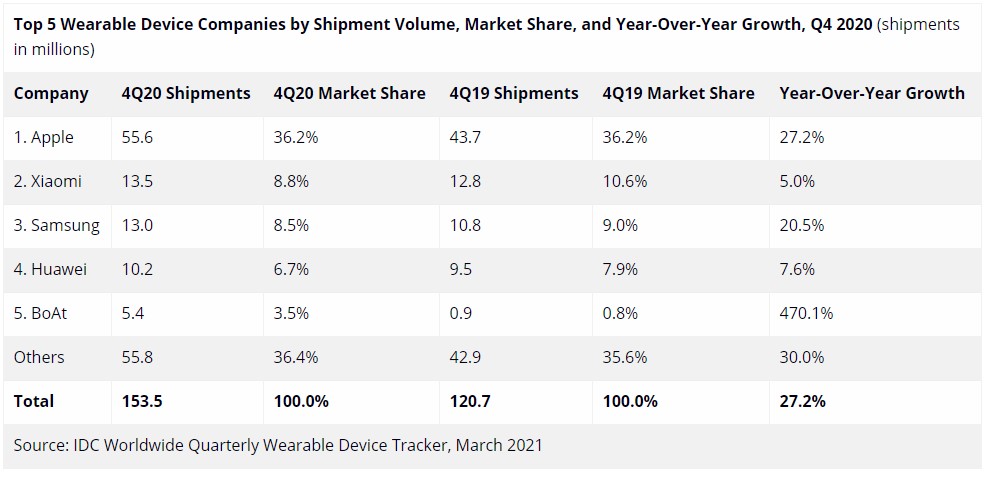

Worldwide shipments of wearable devices reached 153.5M in 4Q20, a YoY increase of 27.2% according to IDC. Shipments for the full year grew 28.4% to 444.7Munits. Apple led the market once again with 36.2% share of 4Q20 shipments. Its Watch shipments rose 45.6% thanks to the appeal of three models with different price points (Series 6, Watch SE, Series 3). Xiaomi ended the quarter in the second position, growing 5% YoY. (Phone Arena, IDC)

As for the whole year of 2020, Huami Technology generated around CNY6.433B in operating income, indicating a YoY increase of 10.7%. The adjusted net profit stands at CNY294M. For the year 2020, the company shipped 45.7M units with a YoY increase of 8%. (Gizmo China, Sohu, IT Home)

Huawei Watch Fit Elegant is announced in UK features 1.64” AMOLED, Kirin A1, Huawei’s Lite OS. It has a built-in GPS sensor, 24-hour heart rate sensor and all-day SpO2 tracker. Features include 12 animated workouts, 96 workout modes, a menstruation tracker, and the Huawei TruSleep 2.0 to track and analyze sleep schedules. It is priced at GBP110. (CN Beta, GSM Arena, Huawei)

Google is announcing its second-generation Nest Hub with 2 key new features: (1) better audio quality, promising the same audio technology with 50% more bass; and (2) sleep tracking called Sleep Sensing, which uses Motion Sense, better known as Soli radar. It is priced at USD100. (GSM Arena, Google, CN Beta)

General Motors’ majority-owned autonomous vehicle subsidiary Cruise has agreed to acquire Voyage, a self-driving car start-up that operated in retirement communities. Cruise is focused on launching a robotaxi business in San Francisco. (VentureBeat, CNBC, TechCrunch, Voyage, Sohu)