3-25 #DOB : Intel has announced that it will spend USD20B to build 2 major factories in Arizona; Qualcomm has announced Snapdragon 780G; Royal Philips has sold Domestic Appliances business to Hillhouse Capital; etc.

Intel has announced that it will spend USD20B to build 2 major factories in Arizona. Called Intel Foundry Services (IFS), Intel’s new chip manufacturing arm will produce the silicon based on the company’s favored x86 architecture, as well as ARM designs like those used in Apple’s A- and M-series SoCs. Intel CEO Pat Gelsinger has revealed that IFS will be run as its own unit and is currently working with Amazon, Cisco, IBM and Microsoft on the initiative. (MacRumors, Yahoo, Apple Insider, CNBC)

Qualcomm has announced Snapdragon 780G (SM7350-AB). It is said to be an octa-core processor with two high-performance Cortex A78 cores clocked at 2.4GHz and six Cortex A55 cores running at 1.8GHz. The production is likely to be done by Samsung Foundry on 5nm process. (My Drivers, CN Beta, GSM Arena, TechRadar, 91Mobiles)

Samsung Display is likely to receive compensation from Apple over a shortfall in OLED panel orders. Samsung Display’s worldwide small OLED shipments in Jan 2021 dropped 9% MoM to 45M units, according to Omdia, which added that the decline is apparently prompted by sluggish sales of Apple’s iPhone 12 mini. Apple has reportedly adjusted target production of the iPhone 12 series to 75M units for 1H21, which is about 20% down from its previous target. Apple reportedly paid an estimated USD684M in 2019 and USD1B in 2020 to Samsung Display for below-par OLED panel orders. (Apple Insider, Korea Herald)

The penetration rate of Samsung Display’s flexible AMOLED panels at the high-end smartphone segment in China in 1Q21 is higher than that seen a year earlier, Digitimes Research has found. Among Chinese vendors, only Huawei and its spun-off Honor and ZTE have opted to adopt flexible AMOLED panels rolled out by local panel makers. Others, including Xiaomi and vivo, are primarily using locally made AMOLED panels to produce mid-tier models. Samsung Display has rcently launched its E4 AMOLED panel, which arrives with a brightness of 1,500 nites over 1,200 nits from the previous generation. (Digitimes, press, Gizmo China)

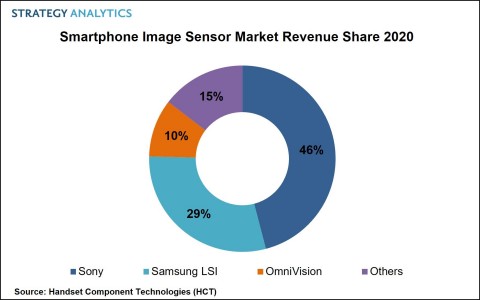

Strategy Analytics finds that the overall smartphone image sensor market experienced a revenue growth of 13% YoY in 2020. Sony managed to take the first position in the smartphone image sensor market with 46% revenue share followed by Samsung System LSI and OmniVision Technologies in 2020. The top-three vendors captured almost 85% revenue share in the global smartphone image sensor market in 2020. (My Drivers, CN Beta, Strategy Analytics)

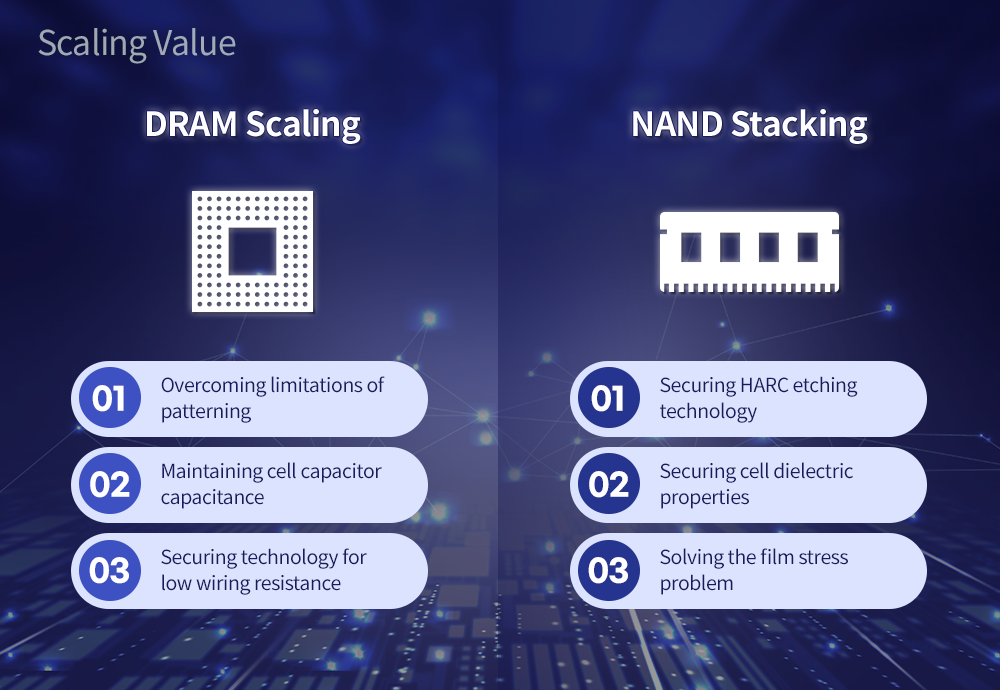

3D NAND has proven to be a very efficient architecture both in terms of performance and scalability, so SK Hynix will continue using it for years to come. Back in Dec 2020, SK Hynix introduced its 176-layer ‘4D’ 3D NAND memory with a 1.60 Gbps interface. The company has already started sampling 512Gb 176-layer chips with makers of SSD controllers, so expect drives based on the new type of 3D NAND memory sometimes in 2022. The company is already among the leaders in atomic layer deposition, so one of its next goals is to implement high aspect ratio (A/R) contact (HARC) etching technology. Also, for 600+ layers it will probably have to learn how to string stack more than one wafers. (My Drivers, CN Beta, Tom’s Hardware, Korea Herald)

Samsung Electronics has announced that it has expanded its DDR5 DRAM memory portfolio with the industry’s first 512GB DDR5 module based on High-K Metal Gate (HKMG) process technology. It can deliver more than twice the performance of DDR4 at up to 7,200 megabits per second (Mbps), yet the power consumption drops 13%. (CN Beta, My Drivers, Samsung)

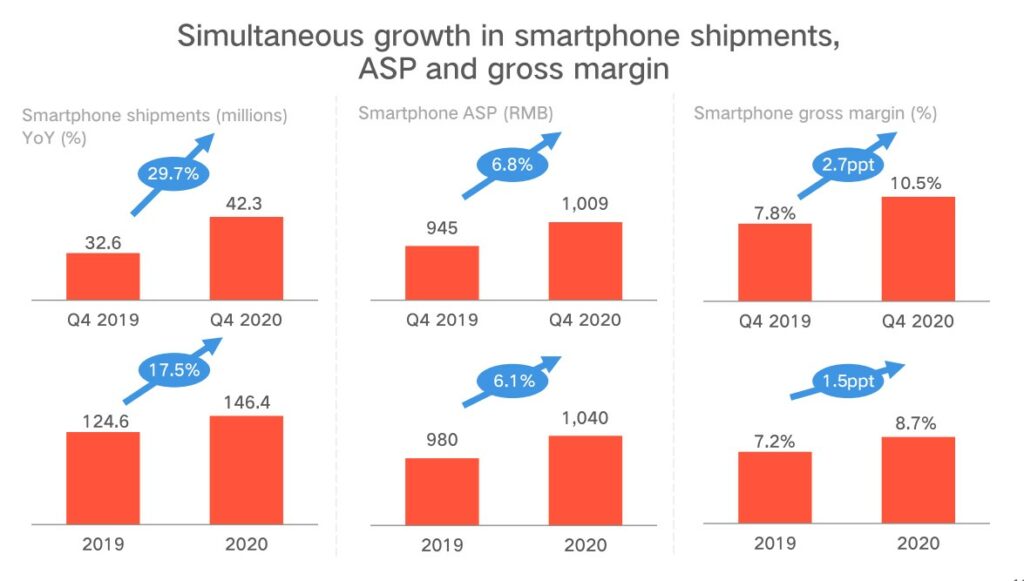

Xiaomi has announced its annual results for 2020. In 2020, Xiaomi reaches CNY245.9B (USD38.3B), a YoY increase of 19.4%; adjusted net profit reached CNY13B (USD1.99B), a YoY increase of 12.8%. Xiaomi’s revenue in 4Q20 is CNY70.46B (USD10.80B). In 4Q20 net profit is CNY3.2B (USD0.49B), a YoY increase of 36.7%. Xiaomi’s global smartphone shipments reaches 146.4M units in 2020, a YoY increase of 17.5%. In 2020, smartphone revenue reached CNY152.2B (USD23.3B), a YoY increase of 24.6%. (CN Beta, GizChina, Mi.com, Xiaomi)

realme 8 series is announced, featuring 6.4” 1080×2400 FHD+ HiD Super AMOLED: 8 Pro – Qualcomm Snapdragon 720G, rear quad 108MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 6+128 / 8+128GB, Android 11.0, fingerprint on display, 4500mAh 50W, INR17,999 (USD248) / INR19,999 (USD275) or GBP279 (USD384). 8 – MediaTek Helio G95, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 4+128 / 6+128 / 8+128GB, Android 11.0, fingerprint on display, 5000mAh 30W, INR14,999 (USD206) / INR15,999 (USD220) / INR16,999 (USD234). (GSM Arena, Android Central, Android Authority)

vivo iQOO Z3 5G is announced in China – 6.58” 1080×2408 FHD+ v-notch 120Hz, Qualcomm Snapdragon 768G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 6+128 / 8+128 / 8+256GB, Android 11.0, 4400mAh 55W, CNY1,699 (USD260) / CNY1,799 (USD275) / CNY1,999 (USD305). (GSM Arena, vivo)

Royal Philips has announced that it has signed an agreement to sell its Domestic Appliances business, a global leader with EUR2.2B sales in 2020 in kitchen, coffee, garment care and home care appliances, to Hillhouse Capital, a global investment firm focused on helping companies achieve long-term sustainable growth through digital innovation and enablement. (CN Beta, Philips, Market Watch)

Samsung Electronics has announced a new partnership with Manna Drone Delivery, a move that will see drone delivery made available to Irish customers when purchasing the latest range of Galaxy devices (including the S21 Ultra, the Galaxy Buds Pro, the Galaxy Tab S7, the Galaxy Watch 3, and Samsung’s recently launched Galaxy A Series) via Samsung.com. (Engadget, Samsung, Neowin, Sina, Sohu)

Geely, the Chinese parent company of Volvo, has announced the launch of a “new electric mobility technology and solutions company” called Zeekr. The company reportedly will invest USD300M into the new venture to start out. It is the latest in a string of deals for Geely that includes satellites, drones, trucking, and partnerships with major firms like Baidu, Tencent, and Foxconn. (The Verge, Reuters, Geely, Nikkei, Sohu, OfWeek)

Tesla CEO Elon Musk has indicated the consumers can buy a Tesla with Bitcoin. He has said that the company is using internal and open-source software to operate Bitcoin nodes and it will not convert the cryptocurrency transactions to fiat currency. (GizChina, TNW, Twitter)