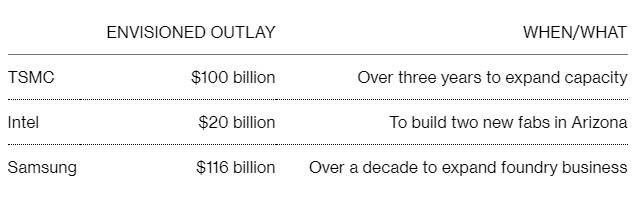

4-1 #Recognition : TSMC plans to spend USD100B over the next 3 years to expand its chip fabrication capacity;

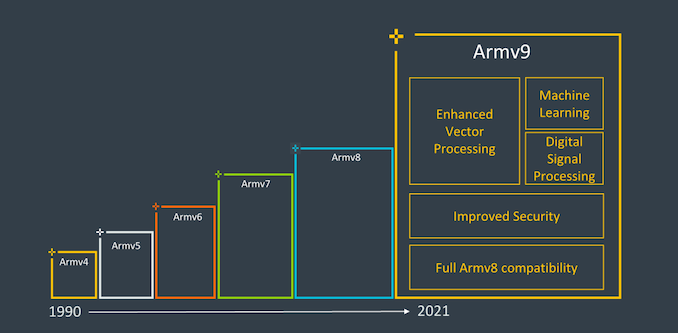

Arm has announced Armv9, which is the first new Arm architecture in a decade and will define the next generation of mobile, server, and other processors over the next 10 years. Armv9 continues the usage of AArch64 as the baseline instruction set. The 3 new main pillars of Armv9 that Arm sees as the main goals of the new architecture are security, AI, and improved vector and DSP capabilities. Arm has developed SVE2 for Armv9 to enable enhanced machine learning (ML) and digital signal processing (DSP) capabilities across a wider range of applications. (Android Authority, Android Headlines, ARM, AnandTech, IT Home)

In response to the recent tight supply and demand of semiconductors, Arm Taiwan President CK Tseng has indicated that basically the shortage problem would be unsolved in the short term. With the gradual mass production of vaccine supply, more people will be vaccinated, and it can be expected in Jul or Sept 2021, more countries and cities will return to normal. When people return to offices and schools, there will be a new wave of IT-related needs. Some manufacturers will expand production, but the shortage situation (CN Beta, UDN)

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s leading contract is rumored to increase its pricing by 15% because of the on-going chip shortage. However, 1Q21 is about the end and the company has not yet raised the pricing. Yet TSMC is rumored again to raise the price of its 12” wafers by USD400. This could result in a 25% price hike, which is an all-time high record. According to IC Insights, In 2020 TSMC’s wafer is average about USD1643 per piece, which is about 2.39% cost up compared to the previous year. (Gizmo China, UDN, CN Beta)

Taiwan Semiconductor Manufacturing Company (TSMC) plans to spend USD100B over the next 3 years to expand its chip fabrication capacity, a staggering financial commitment to address booming demand for new technologies. TSMC already planned a record capital expenditure of as much as USD28B in 2021. TSMC Chief Executive Officer C.C. Wei has revealed that the company’s fabs have been “running at over 100% utilization over the past 12 months”, but demand still outpaced supply. TSMC will suspend wafer price reductions for a year from the start of 2022. (MacRumors, Bloomberg, UDN, 36Kr)

India is offering more than USD1B in cash to each semiconductor company that sets up chip fabrication units in the country as it seeks to build on its smartphone assembly industry and strengthen its electronics supply chain. This is a part of the Prime Minister Narendra Modi’s ‘Make in India’ initiative. Chips made locally will be designated as “trusted sources” and can be used in products ranging from CCTV cameras to 5G equipment. (Gizmo China, Reuters, Reuters)

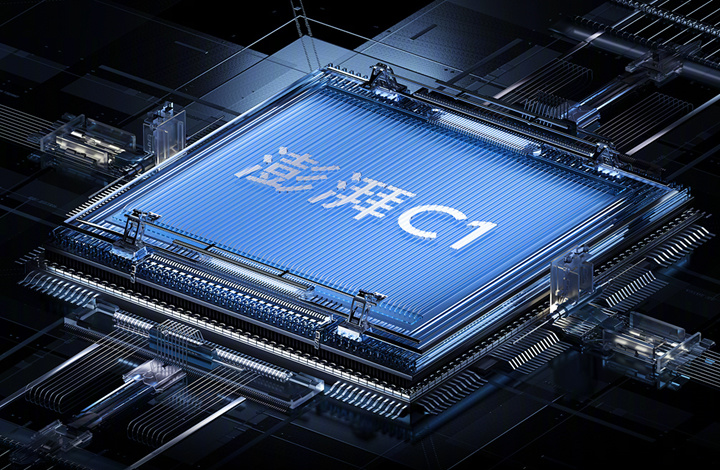

Xiaomi CEO Lei Jun has announced its first self-developed image signal processing (ISP) chip, the Surge C1. Xiaomi says that the Surge C1 has a dual-filter configuration which helps it process both the low and high-frequency signals parallelly. This, when combined with the effective use of the 3A algorithms, is aimed to get 100% signal efficiency. The ISP chip uses the combination of the 3A algorithm as shown below: AF– Auto Focus, AWB– Accurate White Balance and AE– Automatic Exposure. (Laoyaoba, Sohu, IT Home, Gizmo China)

Corning is announcing a moderate increase to its display glass substrate prices in 2Q21. This price adjustment is a result of increased costs in logistics, energy, raw materials and other operational expenses during the current glass shortage. Additionally, the costs of precious metals required for maintaining reliable glass substrate manufacturing have risen significantly since 2020. (CN Beta, Corning, DisplayDaily)

TF Securities analyst Ming-Chi Kuo expects Sunny Optical to successfully pass the quality verification of the 7P wide-angle lens order for Apple’s 2H21 iPhone series (tentatively known as iPhone 13). As iPhone 13 mini, 13, and 13 Pro share the same f1.6 7P wide-angle lens (vs. 13 Pro Max’s f1.5 7P wide-angle lens), so Sunny Optical’s order is the most in-demand. They estimate that Sunny Optical will ship the 7P wide-angle lens of the iPhone 13 to LG Innotek as soon as May 2021. (CN Beta, TF Securities, MacRumors, CN Beta, GSM Arena)

Apple plans to use Telsa’s “Megapack” battery pack at a newly announced energy farm in California to help power Apple Park and further its commitment to renewable energy and being carbon-neutral by 2030. Apple’s newly announced California solar farm will use 85 of Tesla’s 60MV battery packs to help power Apple Park. (MacRumors, The Verge, Apple, IT Home, Sina)

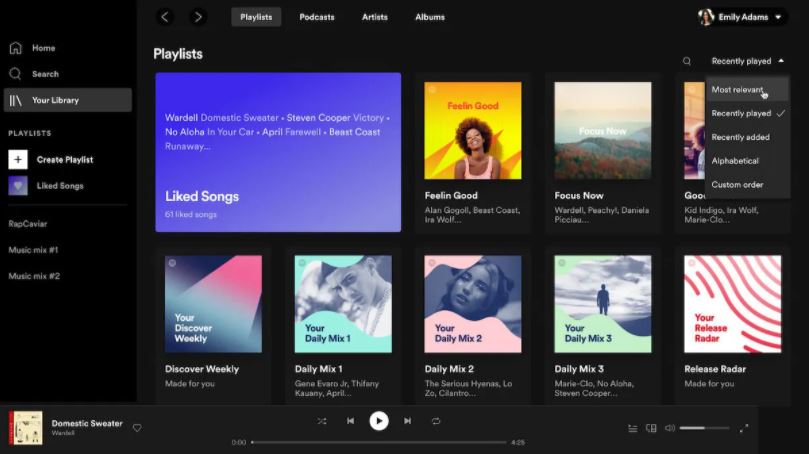

Spotify has acquired Betty Labs, the company behind sports-focused social audio app Locker Room, to accelerate its move into live audio. The music-streaming service has said in the coming months it would “evolve and expand” Locker Room. (CN Beta, CNBC, The Verge, Reuters)

Independent music distribution platform and tool factory UnitedMasters has raised a USD50M series B round led by Apple. UnitedMasters is also entering a strategic partnership with Apple alongside this investment. UnitedMasters is to provide artists with a direct pipeline to data around the way that fans are interacting with their content and community. (Apple Insider, TechCrunch, WSJ)

Apple has announced that more than 110 of its supply chain partners globally will switch to 100% renewable energy, a step toward its goal to become carbon neutral by 2030. The Apple manufacturing partners will move to clean energy for their Apple product. They plan to bring 8 gigawatts of renewable energy online, commitments that will avoid over 15M metric tons of CO2e annually. (Apple Insider, Apple, CN Beta)

Samsung decided more than 2 years ago that it will take extra steps towards a sustainable future and reach a point where it can rely solely on renewable energy in the USA, Europe, and China before the end of 2020. The decision is made in mid-2018, and Samsung has now confirmed that its goals have been met. Samsung has reached 100% reusable energy at its factories located in the USA, Europe, and China. The company reached 92% reusable energy by the end of 2019, and it managed to reach 100% in 2020. (Android Headlines, SamMobile, Samsung)

LG is expected to confirm its exit from the smartphone market in Apr 2021. Remaining employees will apparently be assigned to a home appliance factory in Changwon, South Korea. The manufacturer has also reportedly canceled planned first-half releases of other new handsets. LG might discontinue software support for existing phones. (Phone Arena, Phandroid)

Huawei also revealed that the company has received a deposit of CNY10B (USD1.52B) for the sale of its former smartphone-making subsidiary, Honor. Huawei made a deal with Shenzhen Zhixin New Information Technology, a consortium of over 30 agents and dealers in China in Nov 2020. (My Drivers, Sohu, Huawei Central)

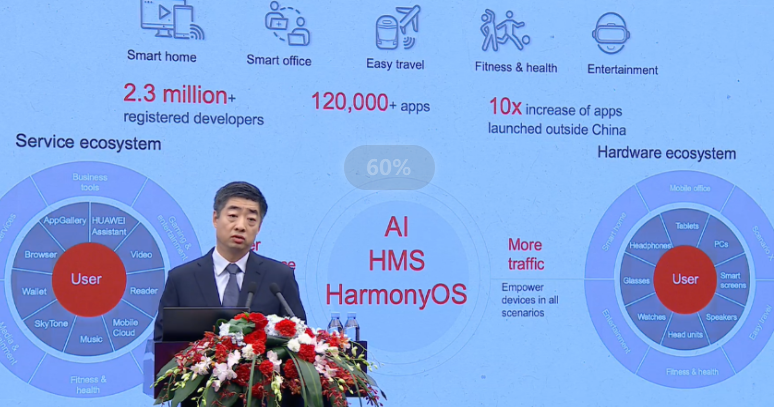

Huawei’s vice chairman and rotating chairman Hu Houkun stated that HarmonyOS has attracted more than 20 hardware vendors and 280 application vendors to participate in ecological construction. In the next step, it is planned to launch the HarmonyOS operating system on mobile phones. (RPRNA, Laoyaoba, IT Home)

Honor CEO George Zhao has revealed 5 major new strategy——(1) Products: Honor Magic series and Honor number series will be regarded as Honor’s flagship and high-end products, respectively; (2) Design: Exceeds the design and usage experience of Huawei Mate and P series; (3) Software: Adhere to the bottom layer of the operating system and Human Factors Design; (4) Usage Experience: Create “1+8” seamless connection between devices and application; and (5) Strategy: Focusing on mobile phones, tablets, notebooks, smart screens, wearables, audio to become number one. (My Drivers, CN Beta)

realme V13 5G is announced in China – 6.5” 1080×2400 FHD+ HiD 90Hz, MediaTek Dimensity 700, rear tri 48MP-2MP macro-2MP B/W + front 8MP, 8+128 / 8+256GB, Android 11.0, side fingerprint, 5000mAh 18W, CNY1,599 (USD245) / CNY1,799 (USD275). (GSM Arena, realme)

realme GT Neo is launched in China – 6.43” 1080×2400 FHD+ HiD Super AMOLED 120Hz, MediaTek Dimensity 1200 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 6+128 / 8+128 / 12+256GB, Android 11.0, fingerprint on display, 4500mAh 50W, CNY1,799 (USD274) / CNY1,899 (USD290) / CNY2,399 (USD366). (CN Beta, GSM Arena, realme)

Samsung Galaxy S20 FE 5G is launched in India – 6.5” 1080×2400 FHD+ HiD Super AMOLED 120Hz, Exynos 990, rear tri 12MP OIS-8MP telephoto 3x optical zoom OIS-12MP ultrawide + front 32MP, 8+128GB, Android 11.0, fingerprint on display, 4500mAh 25W, fast wireless charging 15W, reverse wireless charging 4.5W, INR55,999 (USD765). (GSM Arena, Gizmo China, Samsung)

ZTE S30 series is announced in China: S30 Pro – 6.67” 1080×2400 FHD+ HiD AMOLED 144Hz, Qualcomm Snapdragon 768G, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 44MP, 8+256GB, Android 11.0, fingerprint on display, 4200mAh 55W, CNY2,998 (USD456). S30 – 6.67” 1080×2400 FHD+ HiD 90Hz, Qualcomm Snapdragon 720G, rear quad 64MP-8MP ultrawide-5MP macro-2MP depth + front 16MP, 8+128 / 8+256GB, Android 11.0, side fingerprint, 4000mAh 30W, CNY2,198 (USD334) / CNY2,398 (USD265). S30 SE – 6.67” 1080×2400 FHD+ HiD, MediaTek Dimensity 700 5G, rear tri 48MP-5MP macro-2MP depth + front 8MP, 6+128GB, Android 11.0, side fingerprint, 6000mAh 18W, CNY1,698 (USD258). (GSM Arena, Gizmo China, ZTE, ZTE, ZTE)

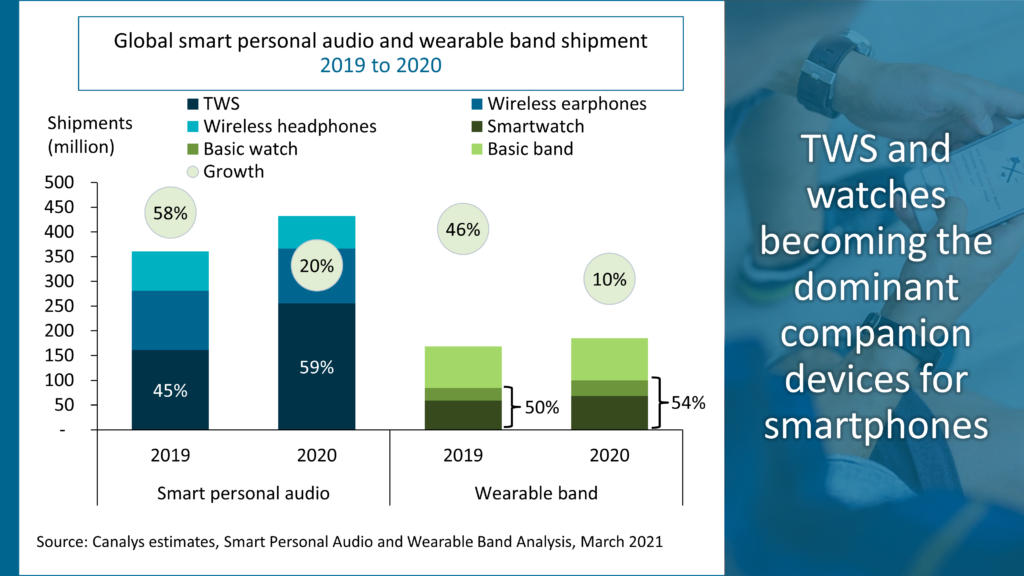

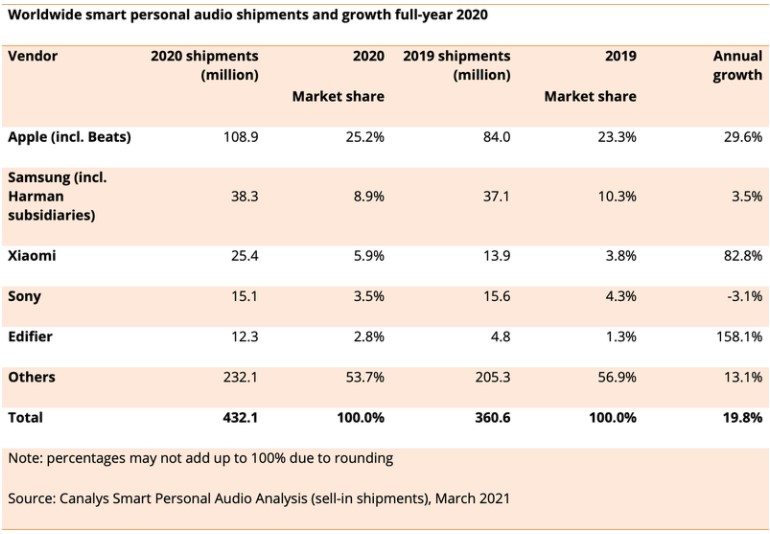

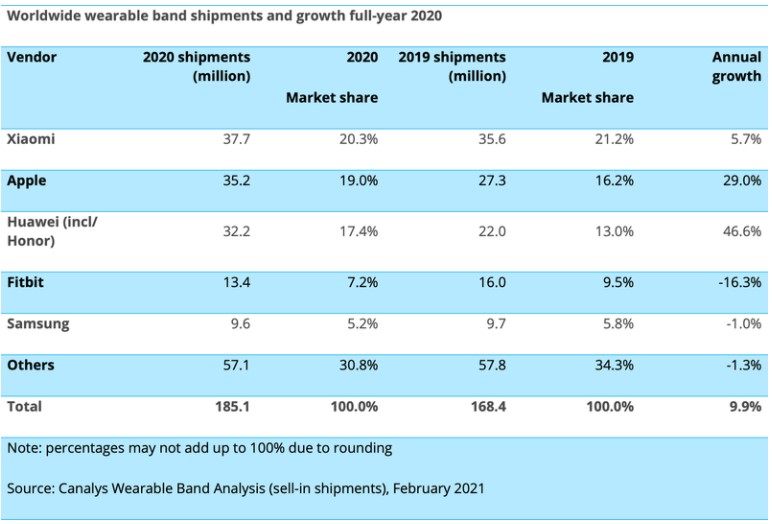

According to Canalys, smart personal audio and wearable band devices were two consumer IoT segments which stood the test of 2020 to reach new heights. Smart personal audio devices grew 20% in 2020 to reach 432M units, while wearable bands grew 10% to reach 185M units. In view of the supply chain constraints due to component shortages, Canalys adjusted its 2021 forecasts and now expects smart personal audio to grow 15.6% to reach 500M units, and wearable bands to grow 10.2% to reach 204M units. (GSM Arena, MacRumors, Canalys)

realme Bud Air2 active noise cancellation earbuds are announced in China, priced at CNY299. It could last for 5 hour with one single charge, and with the charger cases, it could last for 25 hours of whole-day usage. (CN Beta, realme, TechRadar)

ZTE Watch GT is announced in China featuring 1.19” 2.5D curved AMOLED, Blood Oxygen monitoring sensor, supports up to 16 sports modes, comes with a multi-mode GPS positioning system, 5ATM waterproof certified, priced at CNY599 (USD91). (Gizmo China, Sohu, IT Home)

Optimus Ride has announced a partnership with Polaris to manufacture custom-designed GEM vehicles. Under the joint agreement, an exclusive line of Polaris GEM electric low-speed vehicles (LSVs) will be re-engineered to integrate Optimus Ride’s autonomous software and hardware suite direct from the factory. (CN Beta, TechCrunch, The Verge, Electrek)

Self-driving and robotics startup Cartken has partnered with REEF Technology, a startup that operates parking lots and neighborhood hubs, to bring self-driving delivery robots to the streets of downtown Miami. The REEF-branded electric-powered robots are now delivering dinner orders from REEF’s network of delivery-only kitchens to people located within a 3/4-mile radius in downtown Miami. (CN Beta, TechCrunch, Miami Herald)

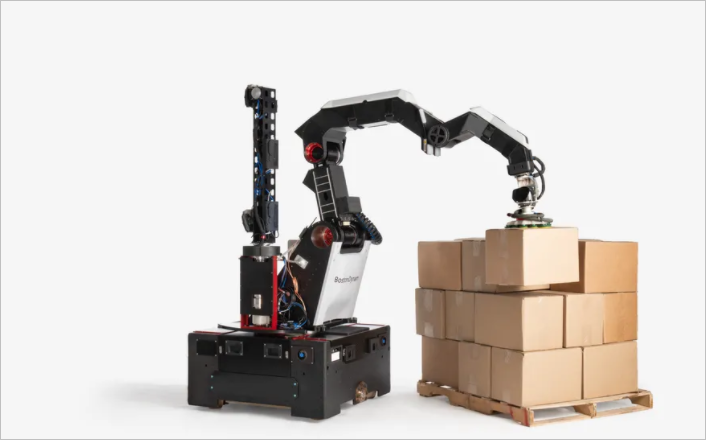

US-based robotics manufacturer Boston Dynamics has released a new robot Stretch to enhance logistics in the warehouse. The company claims the robot is very efficient and versatile, making it possible to deploy it to warehouses without installing additional automation infrastructure. The Stretch robot can move boxes in the warehouse at an estimated throughput rate of 800 packages per hour. (Gizmo China, The Verge, TechCrunch, Sohu)

General Motors (GM) has admitted it would evaluate whether bitcoin payments are of interest for its customers. The company CEO Mary Barra has said GM will monitor customer demand for cryptocurrency as a payment method for vehicles and services. (CN Beta, Motor1, GM Authority, Reuters)

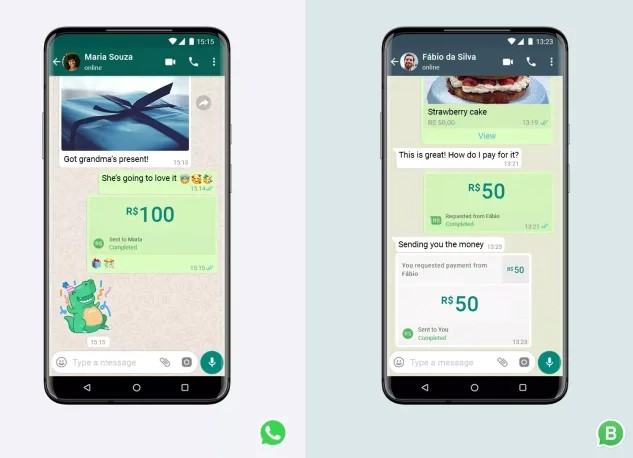

Brazil’s central bank has cleared the way for Facebook’s WhatsApp messaging service to let its users send each other funds using the Visa and Mastercard card networks, months after vetoing WhatsApp’s initial attempt. The regulatory approval comes months after the central bank launched its own instant payments system in Nov 2020, called Pix, which has since been widely adopted. (Engadget, Reuters)