4-18 #Cheese : US and Japan have agreed to jointly invest USD4.5B for the development of next-generation communication 6G; Uber has teamed up with PayPal and Walgreens to create a Vaccine Access Fund; etc.

TSMC’s wafer factory 14A has suffered a power outage due to an accident mid-Apr 2021. This halt in production for many hours is affecting the production of no less than 40,000 wafers. In addition, TSMC’s wafer plant 14A mainly uses 40nm, 45nm, 65nm, and 90nm processes to produce chips for customers. The latest power outage does not have any effect on TSMC’s 5nm or 7nm processes. Thus, the loss is relatively small. Nevertheless, the wafer loss as a result of the sudden power outage could hit USD28M. The loss could be as high as USD35M. (GizChina, CN Beta, IT Home)

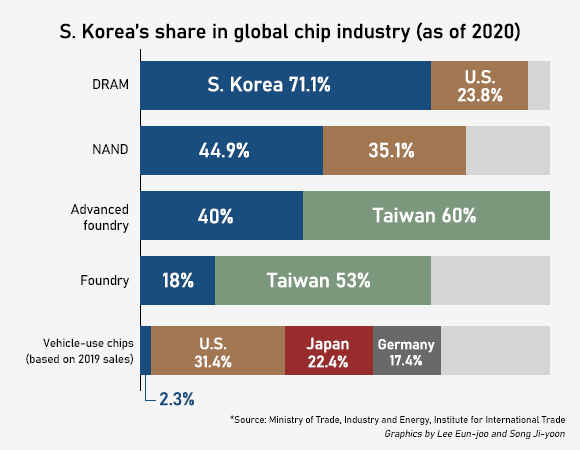

The Ministry of Trade, Industry and Energy has made public the draft of its semiconductor industry growth plan. The plan includes large-scale tax cuts and assistance for infrastructure expansion. In addition, industrial clusters for semiconductor equipment, material and component suppliers will be established in the metropolitan area. In the United States, the CHIPS for America Act has been tabled so that a 40% tax deduction can be provided for every semiconductor facility investment in the United States. South Korean semiconductor companies are currently asking the government to raise the facility investment-related deduction rate to 50% and the government is said to be considering raising it to the level of the United States. (Laoyaoba, Business Korea, Pulse News)

Worldwide sales of semiconductor manufacturing equipment surged 19% from USD59.8B in 2019 to a new all-time high of USD71.2B in 2020, according to SEMI, the industry association representing the global electronics product design and manufacturing supply chain. For the first time, China claimed the largest market for new semiconductor equipment with sales growth of 39% to USD18.72B. (Laoyaoba, CN Beta, Evertiq, SEMI)

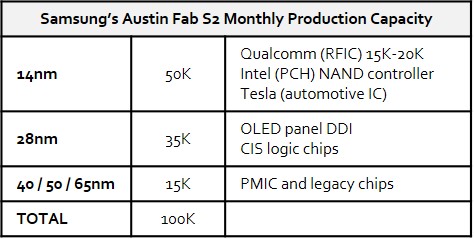

According to Omdia’s analysis, Samsung’s Austin fab power outage due to the snowstorm. Qualcomm is expected to be affected by 43K (per month). The damage for DDI is around 27K (per month). (Omdia report, Omdia report)

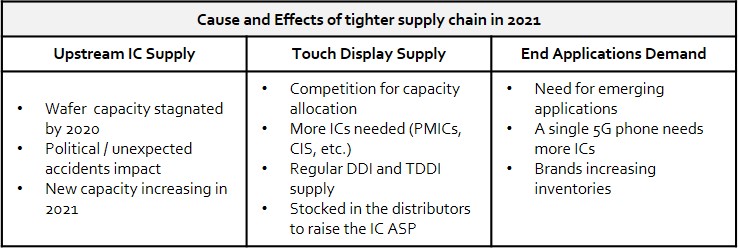

According to Omdia, most end applications suffer from wafer capacity and supply shortage affecting the supply chain. The situation will likely continue through 4Q21. Most wafer foundries did not notably increase investments into capacity, especially 8” wafer. Despite lower capacity through 2020, many emerging applications have been growing, leading to fierce competition for the limited wafer capacity. The competition from other applications makes the regular DDI and TDDI supply tighter. (Omdia report, Omdia report)

According to Changjiang Securities, the demand of 5G mobile phones and base stations has driven high demand of wafer for radio frequency chips. Meanwhile, the large demands of wearable devices, laptops, tablets, PCs and other devices also impact processors, memories, power management ICs, and driver ICs. These chips are mainly produced on 8” wafers, which has led to shortage. (Changjiang Securities report)

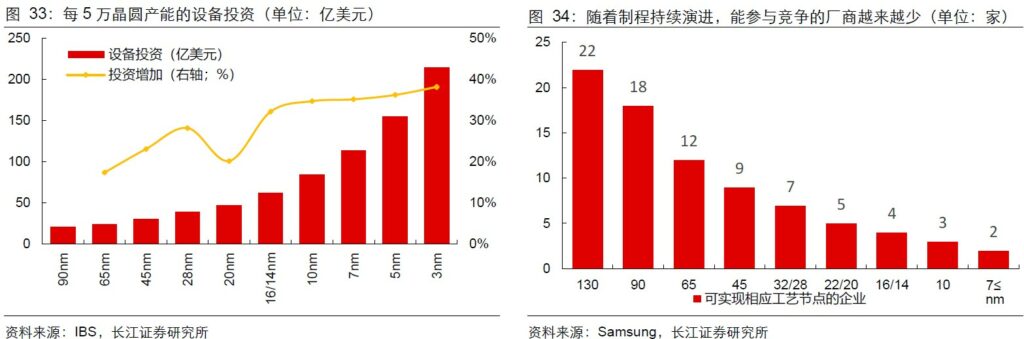

According to IBS, with the continuous shrinking of technology nodes, the equipment investment in integrated circuit manufacturing has shown a significant increase. Take the 5nm technology node as an example, its investment cost exceeds USD15B, which is more than twice that of the 14nm and about four times that of the 28nm process. As the process continues to evolve, fewer manufacturers can participate in the competition. Currently, the only foundries that can provide advanced processes of 7nm and below are TSMC and Samsung. (Changjiang Securities report)

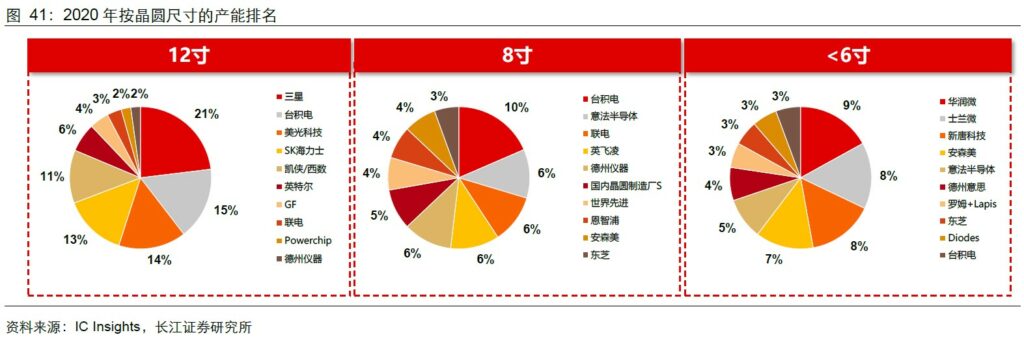

According to Changjiang Securities, the top 10 12” production capacity mainly includes DRAM and NAND flash memory suppliers, such as Samsung, Micron, SK Hynix and Kioxia / Western Digital; the world’s 4 largest pure wafer foundries TSMC, GlobalFoundries, UMC and Powerchip (including Nexchip); and Intel, the largest microprocessor manufacturer in the industry. The types of ICs offered by these companies benefit from the use of the largest size wafers to maximize the amortization of the manufacturing cost of each chip. (Changjiang Securities report)

As the industry shifts IC manufacturing to larger wafers in larger fabs, the number of IC manufacturers continues to decrease. According to IC Insights, as of Dec 2020, a total of 63 companies own and operate an 8” wafer fab. There are 28 companies that own and operate 12” wafer. In addition, among these manufacturers, the distribution of 12” wafer production capacity is the top priority, and the 5 largest manufacturers control 74% of the global 12” IC production capacity. (Changjiang Securities report)

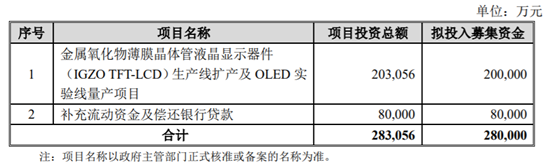

ST CPT plans to raise no more than CNY2.8B to invest in the expansion of the metal oxide thin film transistor liquid crystal display device (IGZO TFT-LCD) production line and the mass production of the OLED experimental line, as well as replenishing working capital and repaying bank loans. CPT, a subsidiary of the company, invested CNY12B in Hanjiang District, Putian City to build the Gen-6 thin film transistor liquid crystal display device (TFT-LCD) production line and OLED experimental line project, mainly producing small and medium-sized displays based on TFT-LCD panel. As of Jun 2018, CPT has achieved a monthly design capacity of 30K LCD panels. (Laoyaoba, NBD, Sohu)

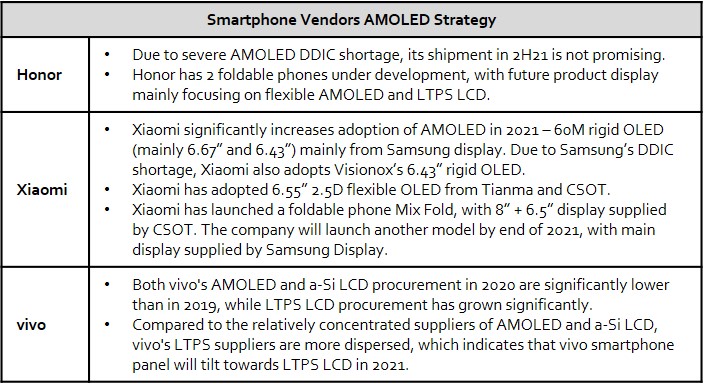

According to Omdia, in Jan-Feb 2021, Samsung Display shipped 82M units AMOLED displays (including flexible and rigid AMOLED), an increase of 90% over the same period last year. In the same period, LG Display and BOE’s flexible AMOLED shipments were 7.8M and 4.5M units, respectively. (Omdia report, Omdia report)

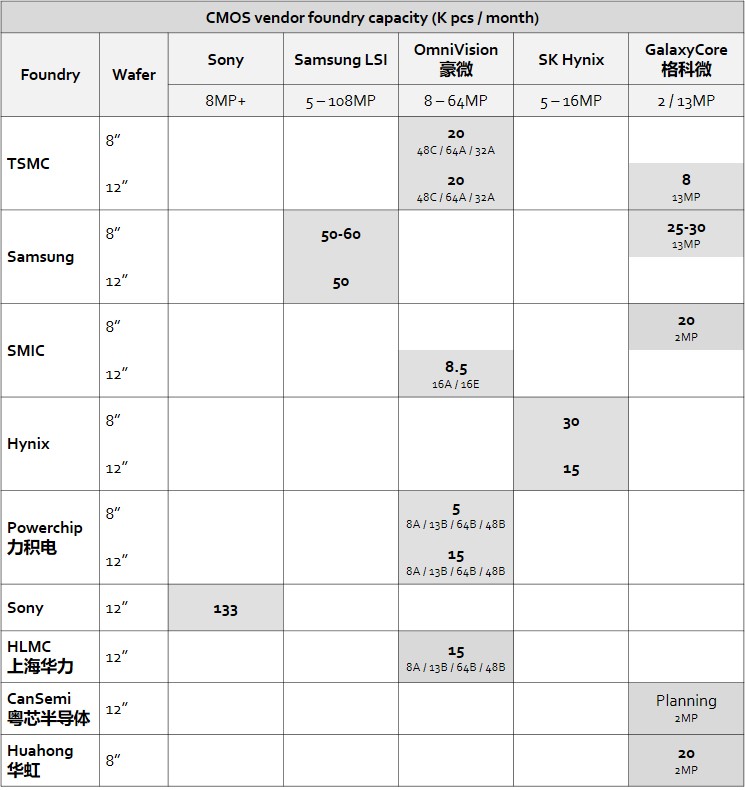

According to Omdia, 8” CMOS chips and display driver IC products are most impacted. It is expected that the prices of GalacyCore, OminiVision and SK Hynix 2MP, 5MP, 8MP and 12MP will continue to rise by 15-20% in 2Q21. Due to the shortage of 8” wafer capacity, Samsung, GalacyCore and OminiVision ‘s 8MP CIS chip production is gradually switched to 12” wafer. (Omdia report, Omdia report)

According to Omdia, motors account for nearly 50% of the cost of periscope camera modules. Currently, Mitsumi, TDK, Semco and Magnetation are all shipped in batches. Due to the gradual maturity of the supply chain, the cost of general 13MP/8MP 5X zoom solution will drop to about USD10 in 1H21, and will be gradually popularized in medium and high-end phones. The overall shipment of periscope cameras is expected to double in 2021. (Omdia report, Omdia report)

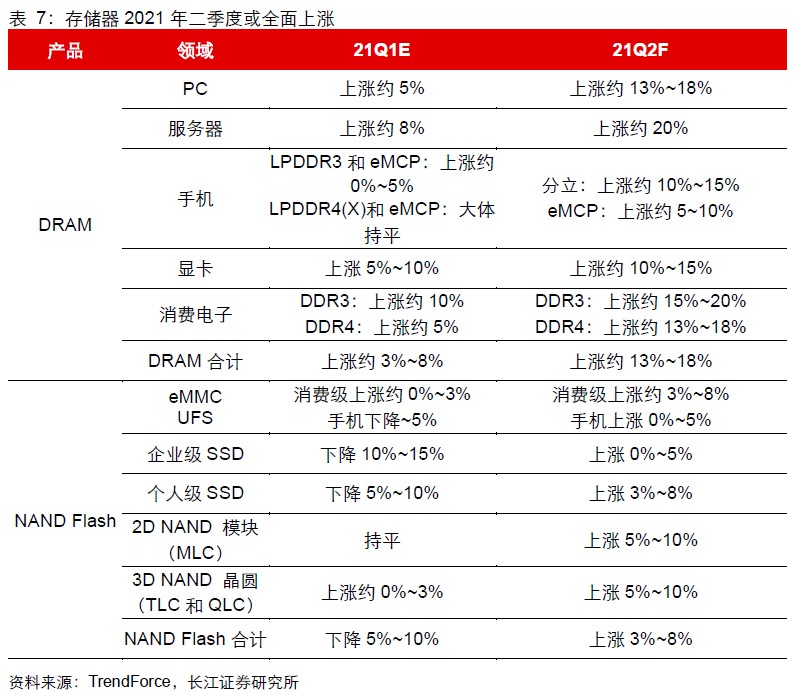

The production capacity of major storage manufacturers such as Samsung and Micron have been affected. The downstream demand for storage continues to be strong, driven by the demand for smart devices and servers, and storage. DRAM prices has continued to rise at the beginning of 2021. Take the average spot price of DRAM: DDR3 4Gb 512Mx8 1600MHz as an example. Its price rose 137.45% from its low price in 2020. Although there have been slight fluctuations, the overall upward trend is still good; NAND Flash is in server construction began to rise gradually. According to TrendForce’s forecast, memory may usher in an overall rise in 2Q21. (Changjiang Securities report)

China’s electric vehicle startup Xpeng uses a combination of radar, cameras, high-precision maps powered by Alibaba, localization systems developed in-house and, most recently, lidar to detect and predict road conditions. Xpeng is adding lidar to its mass-produced EV model P5, which will begin delivery in 2H21. (TechCrunch, IT Home)

Huawei has released a new generation of intelligent components and solutions including 4D imaging radar, AR-HUD, and MDC810. Huawei’s high-resolution 4D imaging radar uses a large 12T24R antenna array (12 transmitting channels, 24 receiving channels). Huawei has said it is 24 times higher than the conventional millimeter wave radar 3T4R antenna configuration, and 50% more receiving channels than the industry’s typical imaging radar. 4D imaging radar inherits the excellent range and speed capability of traditional millimeter wave radar. (CN Beta, Sohu, Sina)

US President Joe Biden and Japanese Prime Minister Yoshihide Suga have agreed to jointly invest USD4.5B for the development of next-generation communication known as 6G, or “beyond 5G”. The United States has committed USD2.5B to this effort, and Japan has committed USD2B. (My Drivers, Sohu, NY Times, Nikkei, Reuters, White House)

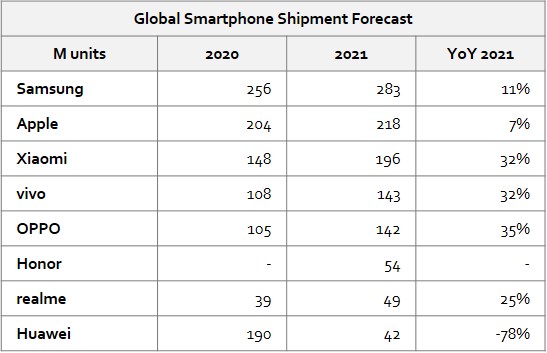

According to Omdia, smartphone demand is expected to continue to recover in 2021 (albeit it is still constrained by the chipset shortage), reaching about 1.3B units, a 6% YoY growth. (Omdia report, Omdia report)

Uber has teamed up with PayPal and Walgreens to create a Vaccine Access Fund with the aim of covering the cost of trips to COVID-19 vaccination sites, especially for people in underserved communities. The 3 companies are getting the fund rolling with a joint USD11M donation. (Engadget, Paypal)

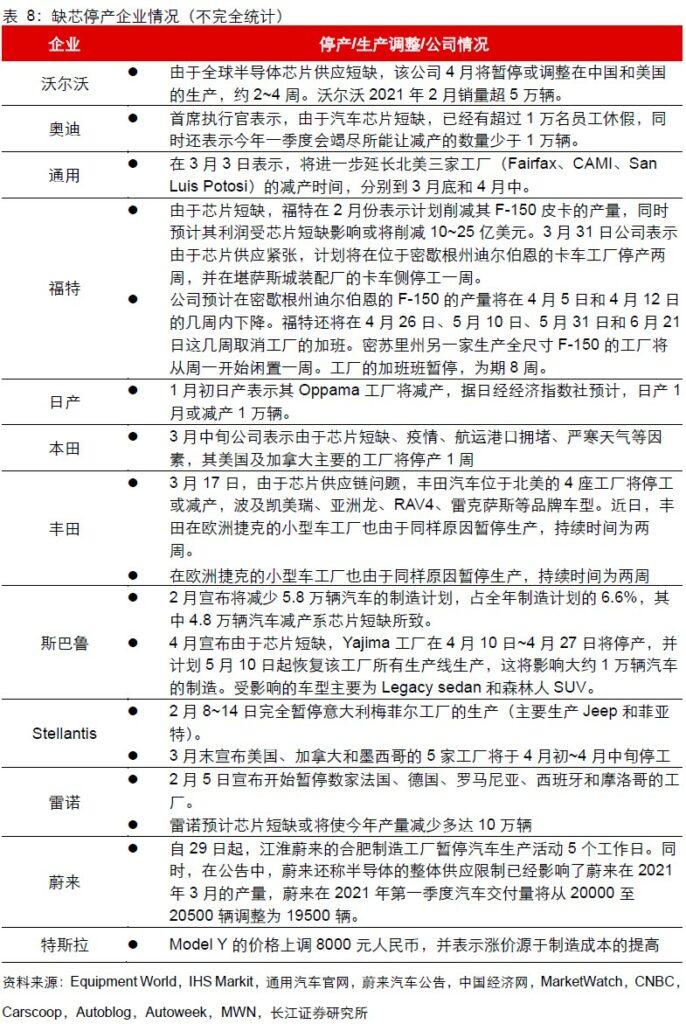

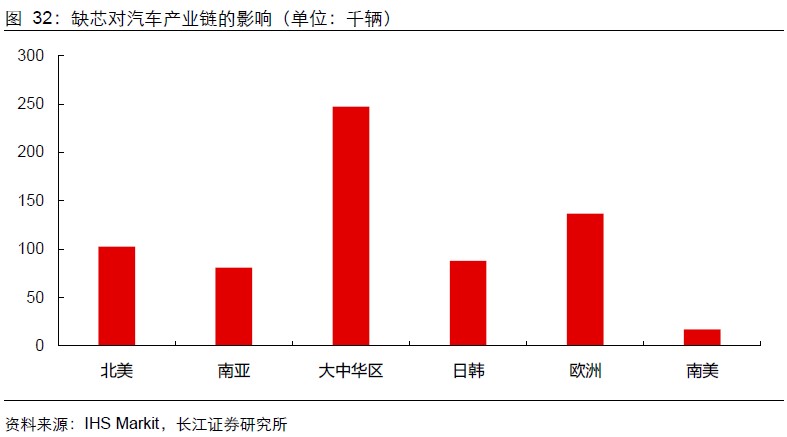

The poor supply of semiconductors has caused the production of Japanese and German cars to slow down in the first 2 months of 2021. According to IHS estimates, 1Q21’s global car manufacturing volume will be reduced by 1M units. According to the American Bernstein Research Company, the global automotive chip shortage in 2021 will cause the loss of up to 4.5M car production, which is equivalent to nearly 5% of the global car production. (Changjiang Securities report)

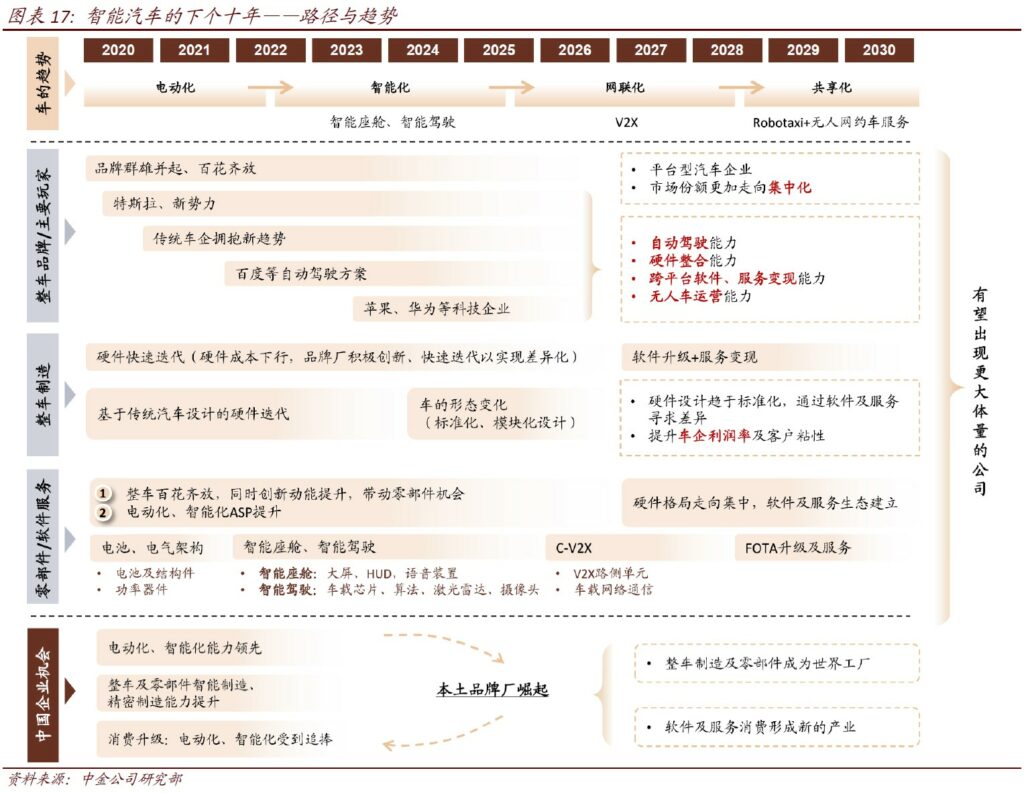

CICC believes that the smart car industry will show the trend of electrification, intelligence, networking and sharing in the next 10 years. Vehicle brands, vehicle manufacturing, parts, and software services are expected to nurture platform-based auto companies, and their market share will become more centralized. The main players will have autonomous driving capabilities, hardware integration capabilities, cross-platform software and service monetization capabilities, and unmanned vehicle operation capabilities. Chinese domestic manufacturers are expected to grow with the differences through software and services, and transform from hardware to software and services, which will increase the profitability of car companies and increase customer stickiness. (CICC report)

CICC proposes 5 major trends of the high-level autonomous driving industry, focusing on the analysis of the commercial feasibility, main players and landing prospects of the five sub-scenarios. They believe that conditional autonomous driving on L3 highways, L4 autonomous valet parking, autonomous driving in mining areas, and unmanned terminal delivery will be mass-produced by 2025, and L4 unmanned Robotruck / Robotaxi is expected to be in commercialization in 2025-2030. (CICC report)