4-27 #Self-improve : Intel has announced plans to spend as much as USD20B to build 2 factories; LG will change its smartphone production line on Haiphong Campus in Vietnam to a production base for household appliances; etc.

Patrick Gelsinger, who returned to Intel as CEO in 2021, has announced plans to spend as much as USD20B to build 2 factories and open its factories to other chip makers and advance chip manufacturing capacity. Atlantic Equities analyst Ianjit Bhatti has indicated that there are significant issues that must be overcome if this is to be a success, with investment ahead of time and profits unlikely until after 2025 if not later. In the near term (2-3 years), they do not believe that Intel has an answer to AMD’s market share gains. (Laoyaoba, Reuters, 163)

Starting with the Snapdragon 855, Qualcomm will mass produce an upgraded version of the Snapdragon 800 series flagship processor in second half year, Snapdragon 855 Plus, and will launch the Snapdragon 865 Plus in 2H20. As usual, the Snapdragon 888 flagship processor is also expected to launch an upgraded version in 2H21, which may be named Snapdragon 888 Pro. It may still be made by Samsung’s 5nm process, the CPU frequency will be improved, and the overall performance will not be too far from the Snapdragon 888. (CN Beta, GizTech Today)

According to CSET, the overall value distribution of the global semiconductor industry chain mainly falls on wafer manufacturing (38.4%), design (29.8%) and wafer manufacturing equipment (14.9%), so Changjiang Securities mainly tracks semiconductors from these links for the overall prosperity of the industry. At the same time, since the semiconductor industry as a whole is similar to many manufacturing, there has been an overall trend of industrial chain transfer for decades. (Changjiang Securities report)

According to VLSI Research, the number one semiconductor equipment manufacturer in 2020 is still AMAT, but from the perspective of future development, it is very likely that ASML will surpass AMAT, especially the leading companies represented by TSMC, Samsung and Intel in the future. In the past few years, it will invest heavily in advanced process chip manufacturing, which will provide ASML with greater development space for EUV equipment. (Changjiang Securities report)

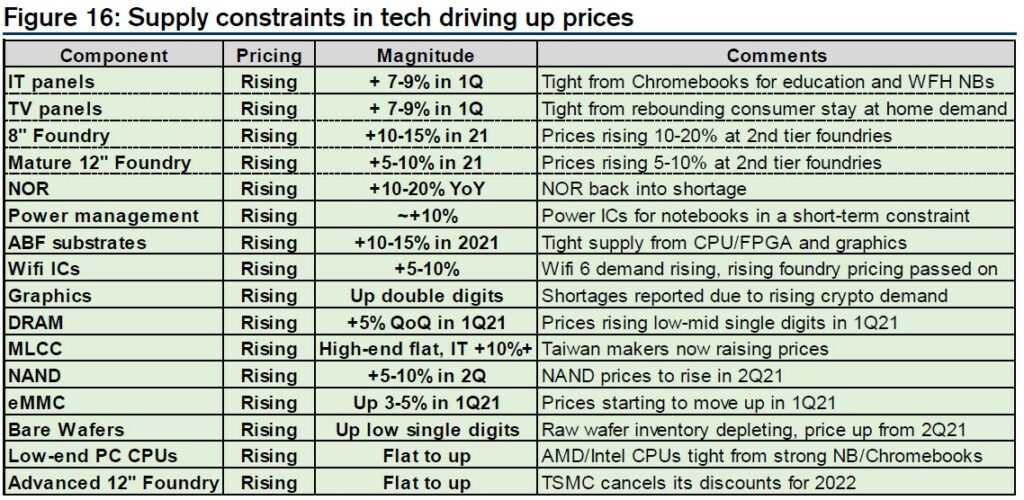

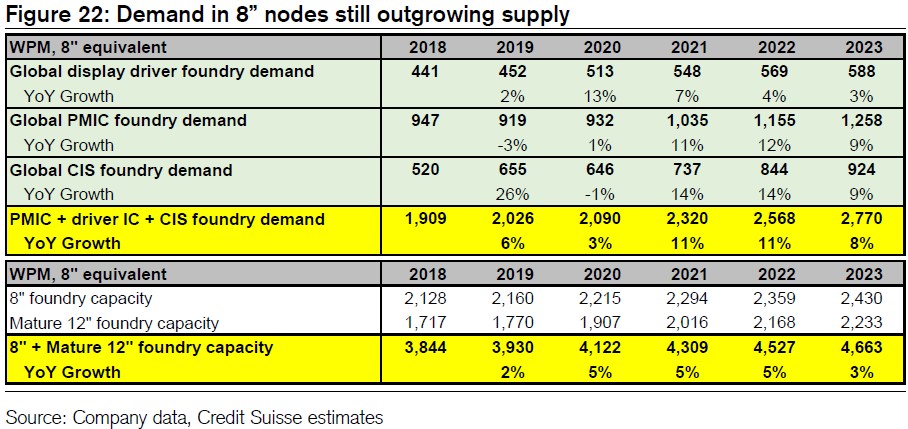

The supply chain is seeing supply constraints across more areas in 1Q21. Prices are now up across all the components in Credit Suisse’s tracker into 2Q21, across foundry, display, PMIC, CPU, advanced substrates, driver ICs, CIS, DRAM, NAND, NOR, IT MLCCs and substrates. (Credit Suisse report)

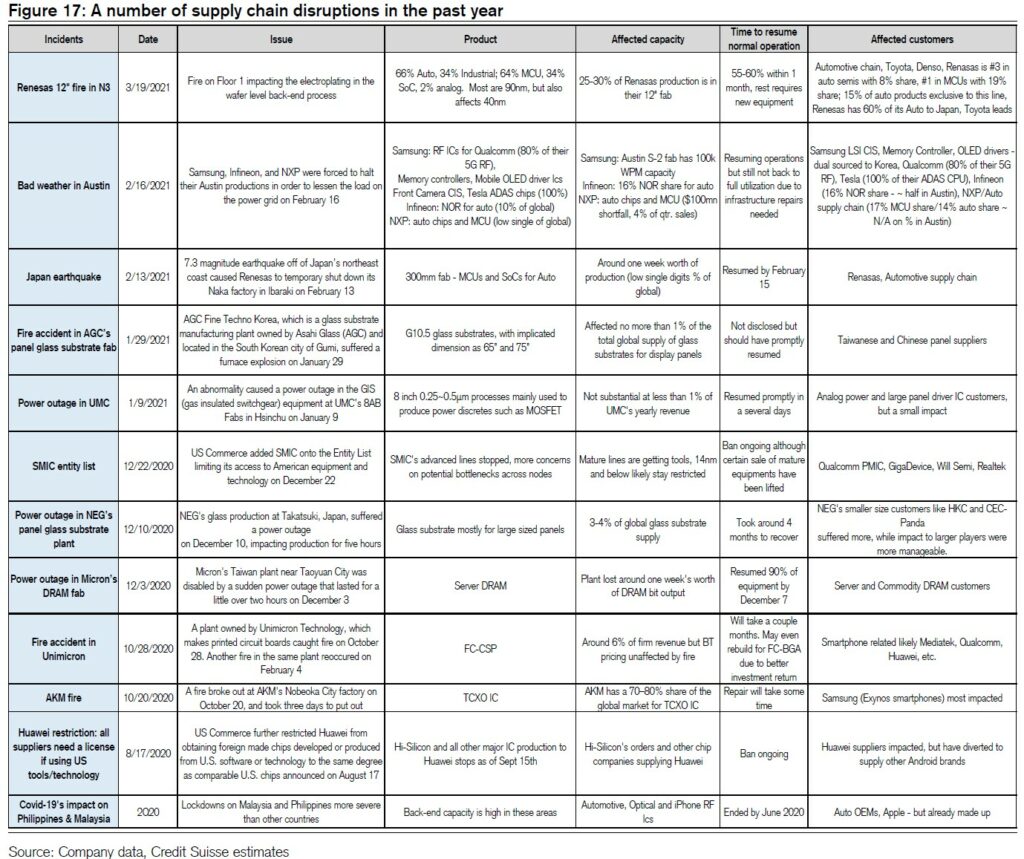

A number of incidents that occurred in the past year have led to further disruptions in the tech supply chain, which was already running at tight capacity. (Credit Suisse report)

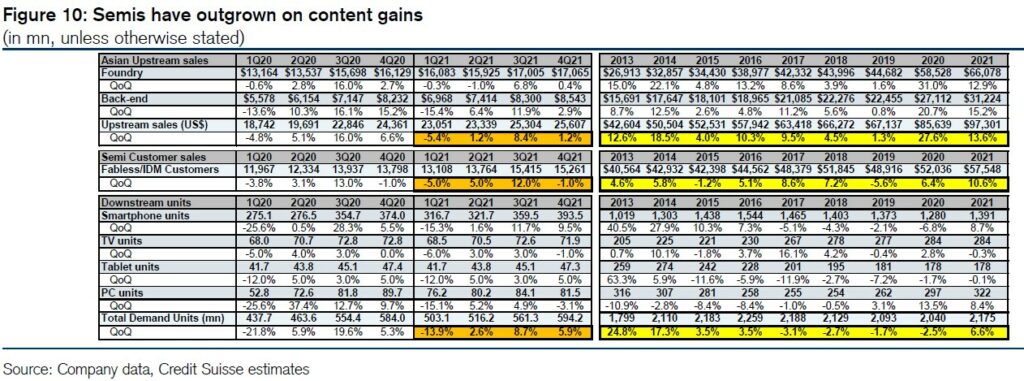

Following an above-seasonal 1Q21, the outlook for the Asia semiconductor industry is still holding strong into 2Q21. The semiconductor supply chain should benefit from content gains on 5G, continued solid stay-at-home demand for PC and consumer devices, data center investment recovery from hyperscalers in 1H21, and tailwind from the supply chain building inventory levels from low levels and amid supply tightness. (Credit Suisse report)

Credit Suisse analyzes the demand growth outlook for major semiconductor demand on the legacy nodes across 8” and mature 12” nodes and expect demand to accelerate from 4% CAGR from 2010-2020 to 9% CAGR from 2021-2023, mainly driven by recovery in power discrete and MCU demand for automotive, and growing EV adoption along with still healthy growth in driver IC, CIS and power management IC on the back of growing content in 5G smartphones and higher unit tech end-market demand. (Credit Suisse report)

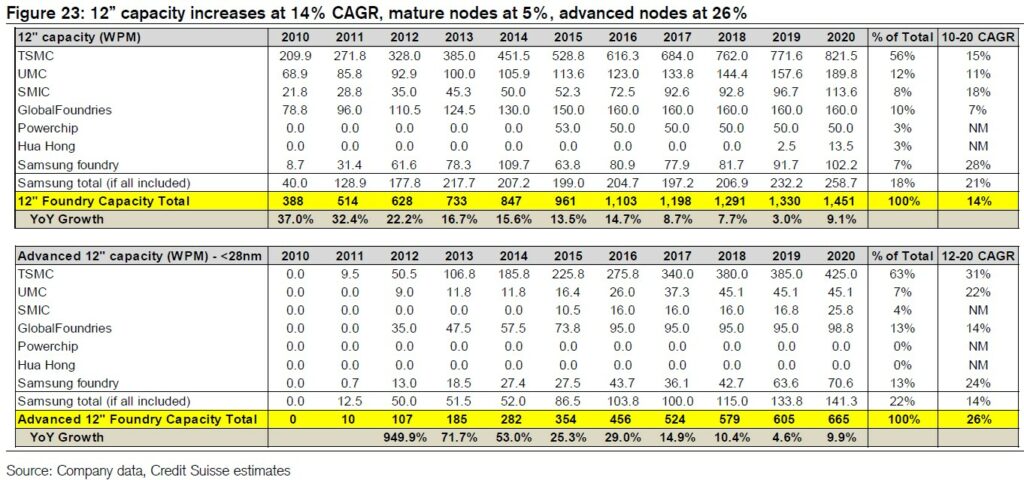

Credit Suisse estimates global 12” foundry capacity has been growing at 14% CAGR in the past decade but the advanced capacity at a faster 26% rate as these nodes attract the industry growth in high performance compute, 5G and some initial demand from ADAS, infotainment and some of the advanced edge computing nodes. (Credit Suisse report)

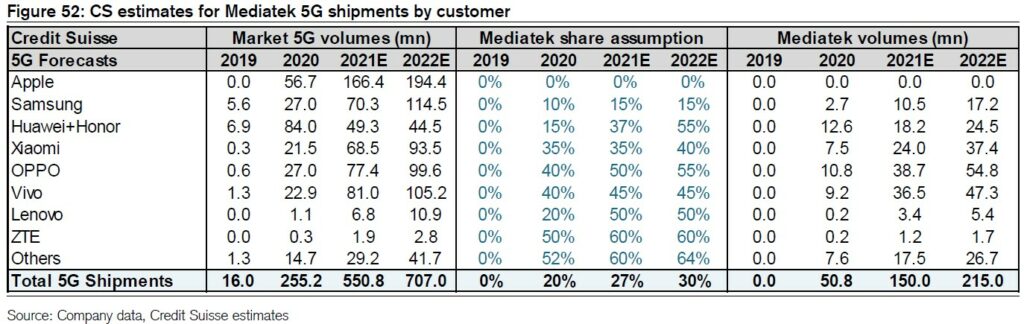

Credit Suisse expect MediaTek to ship 150M / 215M 5G chipsets in 2021 / 2022, up from 51M in 2020. They estimate the company ramps to 45-50% of OPPO / vivo by 2022, 40% at Xiaomi and 60-65% at smaller China brands, and also secures 15% of Samsung’s volumes as it retains a strategy of using ODMs for entry and mainstream models. (Credit Suisse report)

Cisco’s chief executive Chuck Robbins has indicated that the global shortage of computer chips is expected to last for most of 2021. He has further added that will get better and better over the next 12 to 18 months. (CN Beta, Business Insider, BBC)

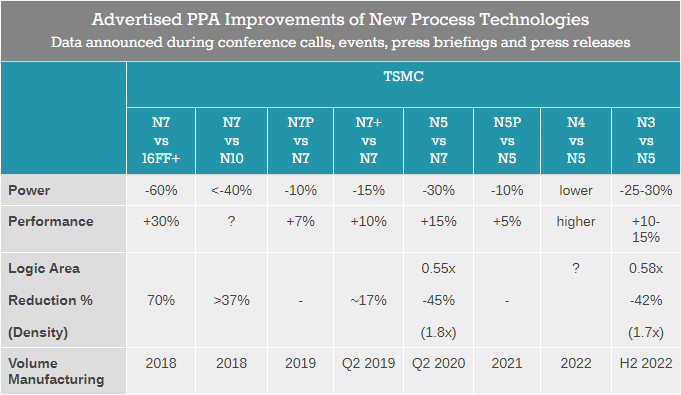

TSMC has recently reiterated that it is confident that its N2, N3, and N4 processes will be available on time and will be more advanced than competing nodes. Early 2021 TSMC significantly boosted its 2021 capex budget to a USD25B-28B range, further increasing it to around USD30B as a part of its 3-year plan to spend USD100B on manufacturing capacities and R&D. About 80% of TSMC’s USD30B capital budget in 2021 will be spent on expanding capacities for advanced technologies, such as 3nm, 4nm/5nm, and 6nm/7nm. (CN Beta, AnandTech)

Han Jong-hee, the president of Samsung’s visual display division has revealed that the company may have trouble manufacturing TVs because of the global shortfall of semiconductors. They might run into a situation where they cannot produce TVs because of the chip shortage. He has said the company has enough of the components to keep making TVs in 2021, but the shortages could become serious in 2022. (CN Beta, Sina, Korea JoongAng Daily)

Apple’s next generation of Mac processors has reportedly entered mass production in Apr 2021. Shipments of the new chipset — tentatively known as the M2, after Apple’s current M1 processor — could begin as early as Jul 2021 for use in MacBooks that are scheduled to go on sale in 2H21. (CN Beta, Apple Insider, Nikkei)

Samsung C&T is considering investing USD673M to build solar power plants with a combined operating capacity of about 700 megawatts in Texas. The planned power plant will be built in Milam County. Samsung Electronics is currently considering building an additional plant in Austin by investing USD17B. (CN Beta, Reuters, Pulse News, Business Korea)

Due to the full display design, the increase in battery capacity, and the increase in functional modules such as wireless charging inside a phone, the thickness of the middle frame of the phone is compressed, which requires higher material strength. Compared with aluminum alloy, stainless steel has significant advantages in hardness, drop resistance and scratch resistance. Due to the production process of the stainless steel middle frame is more complicated, and the PVD coating process is required for the inability to perform anodization, the overall value is greatly increased. In addition, the titanium alloy material used in the Apple Watch case has obvious comprehensive advantages in terms of hardness, weight, and biocompatibility. It is also limited by the high cost and is not currently used in the middle frame of Apple mobile phones. (Changjiang Securities report)

According to Xiaomi, as of the end of 2020, the company had 19,000 patents worldwide. The company further stated that nearly half of these patents are from outside China. In terms of trademarks, as of the end of 2020, Xiaomi had applied for more than 27,000 trademarks worldwide. Its trademark applications cover over 160 countries around the world. (Laoyaoba, Sina, GizChina)

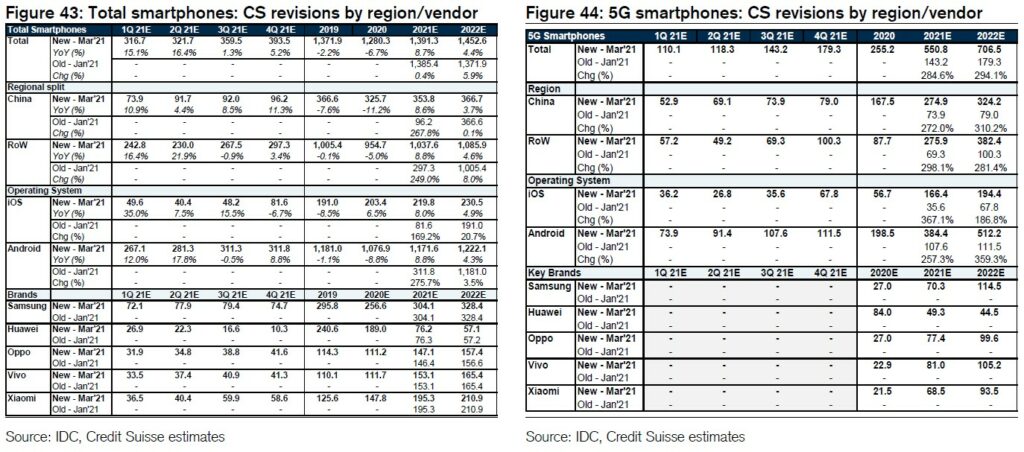

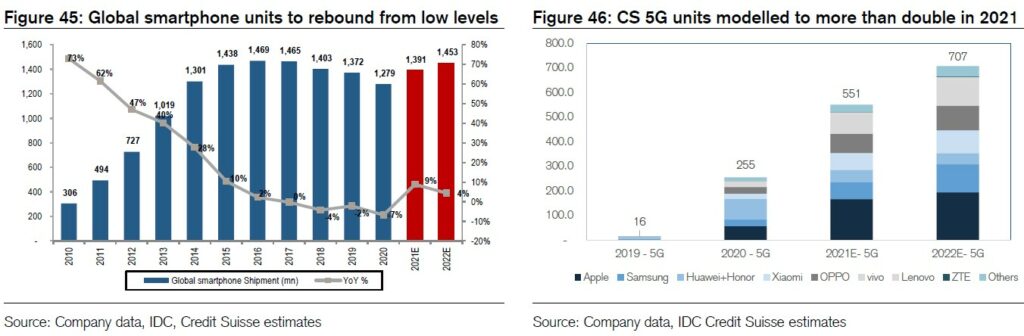

Credit Suisse has recently raised smartphone units for 2021 / 2022 to 1,391M / 1,452M, reflecting +8.7% / +4.4% YoY unit growth. The unit growth reflects a rebound following 4 consecutive down years and 2020 volumes falling 7% YoY to 1.28B due to the pandemic. (Credit Suisse report)

Credit Suisse believes the market shipped 255M 5G smartphones in 2020 led by the ramp in China and forecasts 5G smartphone to reach 550.8M / 706.5M units for 2021 / 2022 on faster penetration into lower price points. The largest gains will be in the USD200-300 doubling to 40% and USD300-400 categories ramping from ~50% to 75% as brands bring out lower priced models. (Credit Suisse report)

Apple has announced an acceleration of its US investments, with plans to make new contributions of more than USD430B and add 20,000 new jobs across the country over the next 5 years. Over the past 3 years, Apple’s contributions in the US have significantly outpaced the company’s original 5-year goal of USD350B set in 2018. (Neowin, Apple)

LG Electronics will change its smartphone production line on Haiphong Campus in Vietnam to a production base for household appliances. The company will carry out the production line conversion and manpower rearrangement within this year and then announce additional investment plans. LG established the LG Haiphong Campus in Haiphong, Vietnam in 2015. The smartphone lines in Haiphong can produce 10M units annually. (CN Beta, LG, Business Korea)

Huawei nova 8 Pro 4G is announced in China – 6.72” 2676×1236 FHD+ 2xHiD OLED 120Hz, HiSilicon Kirin 985, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front dual 16MP-32MP ultrawide, 8+128 / 8+256GB, Android 10.0 (no GMS), fingerprint on display, 4000mAh 60W, reverse charging 5W, CNY3,999 (USD615) / CNY4,399 (USD680). (GSM Arena, Huawei, Myfixguide, GizChina)

Honor Play 20 is announced in China – 6.52” 720×1600 HD+ v-notch IPS LCD, UNISOC T610, rear dual 13MP-2MP depth + front 5MP, 4+128 / 6+128 / 8+128GB, Android 10.0 (no GMS), no fingerprint scanner, 5000mAh 10W, CNY899 (USD138) / CNY1,099 (USD169) / CNY1,399 (USD216). (Gizmo China, GSM Arena)

Moto G20 is launched in Europe – 6.5” 720×1600 HD+ v-notch 90Hz, UNISOC T700, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 13MP, 4+64GB, Android 11.0, rear fingerprint scanner, 5000mAh 10W, EUR149. (Android Authority, GSM Arena, CN Beta)

According to Brand Finance, the total value of the world’s top 50 most valuable apparel brands has declined by 8%, decreasing from USD301.9B in 2020 to USD276.4B in 2021. All brand values have a valuation date of 1 Jan 2021. (Brand Finance report)

According to Brand Finance, the apparel ranking is divided into sub sectors: luxury; sportswear; fast fashion; watches, accessories & jewelry; high street designer; underwear; and footwear. Of these sub sectors footwear is the only one to record an increase in brand value year-on-year, posting a 9% increase in brand value on average. New entrants Timberland and Converse have performed particularly well in 2021, recording a 47% and 8% brand value increase, respectively. (Brand Finance report)