4-28 #SleepDeprive : TSMC has announced will expand its chip fabrication capacity; VIS will spend NTD905M to purchase AUO’s L3B plant and factory facilities; UMC has announced plans to expand capacity at its 300mm Fab 12A Phase 6 (P6); etc.

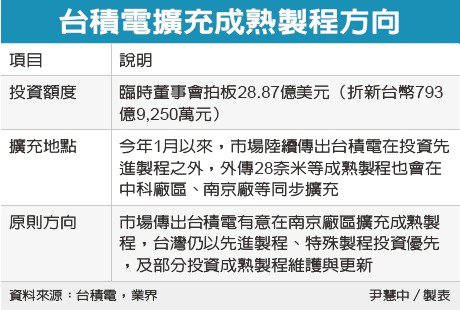

TSMC has announced it will invest USD2.887B in expanding its chip fabrication capacity on mature technologies. The new investment will include expansions of the Nanjing fab to produce 28nm process chips. Volume shipment is slated for 2H22 and is expected to reach monthly 40,000 chip production capacity by mid-2023. (CN Beta, Digitimes, LTN, Buzzorange, Reuters, UDN)

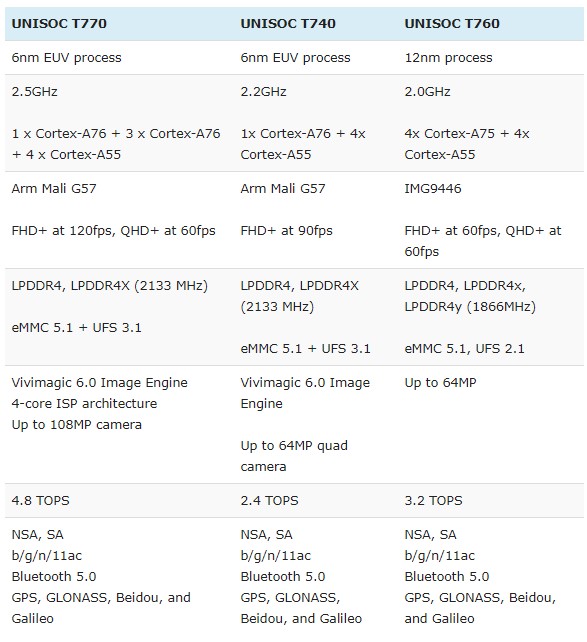

UNISOC has announced Tanggula series of its new 5G chipsets, which are classified into 4 series — 6, 7, 8 and 9. According to UNISOC, the Tanggula 6 series are entry-level chipsets, the Tanggula 7 series brings a user upgrading experience, the Tanggula 8 series brings leading performance, and the Tanggula 9 series brings cutting-edge technology. The Tanggula 7 series includes 3 chipsets – T770 (formerly known as T7520), T740 (formerly known as T7510), and T760. (Gizmo China, GizChina, Sohu, CN Beta, People)

Guoxin Micron’s T9 series, on the basis of compatible with international mainstream algorithms, supports domestic cryptographic algorithms, and uses a rich security algorithm system to ensure user identity authentication and data security; at the same time, this series of chipsets have obtained AEC-Q100, CC EAL6+, ISCCC EAL4+, National Secret Level 2 certification. Currently, this series of chipsts has been recognized by many domestic tier-1 car vendors. (Laoyaoba, CSIA, IT Home, Sohu, Guoxin Micro)

Volkswagen de Mexico has revealed that it will suspend production of Jetta models in Mexico for 2 weeks in May 2021 and will pause assembly of Tiguan SUVs for 11 days due to a global semiconductor shortage. Volkswagen de Mexico said Monday it will suspend production of Jetta models in Mexico for two weeks next month and will pause assembly of Tiguan SUVs for 11 days due to a global semiconductor shortage. The shortage has already forced Ford to build F-150 pickup trucks without some onboard computers. The trucks will be held at factories for “a number of weeks”, then shipped to dealers once computers are available and quality checks are done. (CN Beta, Financial Times, Reuters, ABC News)

Vanguard International Semiconductor (VIS) has announced that it will spend NTD905M to purchase AUO’s L3B plant and factory facilities. The delivery date is 1 Jan 2022. VIS has explained that the newly purchased AUO L3B factory will be the world’s 5th fab of VIS in the future. (Laoyaoba, UDN, CNA, Digitimes)

United Microelectronics Corporation (UMC) has announced plans to expand capacity at its 300mm Fab 12A Phase 6 (P6) in Taiwan’s Tainan Science Park through a collaboration model with several of its leading global customers. The P6 expansion is scheduled for production in 2Q23, with total investment for the project earmarked at NTD100B. In addition to UMC’s previously announced 2021 CAPEX of USD1.5B, the bulk of which is allocated towards equipment for the company’s Fab 12A P5 site adjacent to P6, total UMC investment in the Tainan Science Park will reach approximately NTD150B over next 3 years. (Laoyaoba, UDN, UMC, LTN, Yahoo, UMC)

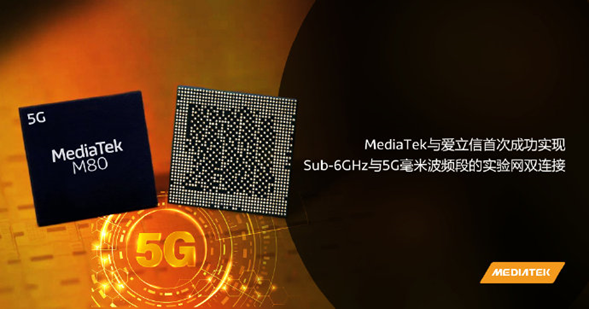

Ericsson and MediaTek have jointly achieved speeds of up to 5.1Gbps on a single device using mmWave in a 5G Standalone (5G SA) mode combined with the mid-band spectrum based on MediaTek’s M80 5G modem. (India Times, Laoyaoba, TechNews)

Luminar Technologies, the global leader in automotive lidar hardware and software technology, is expanding its LiDAR system beyond autonomous vehicles. It has unveiled its partnership with Airbus UpNext, Airbus SE’s subsidiary created to give future flight technologies a development fast-track by building, evaluating, maturing and validating new products and services that encompass radical technological breakthroughs. (Engadget, Business Wire, Sina, CN Beta)

Tesla is reportedly preparing to build a new battery cell and electric motor recycling facility at its Gigafactory Shanghai in China. The new facility will be used to repair and reproduce key components such as electric motors and battery cells. Tesla will add manufacturing capacities for car structures and electric motor controllers. (CN Beta, Electrek, Caixing Global, Reuters)

The U.S. automotive lithium battery market grew from USD1B in 2017 to USD1.39B in 2020. The size is expected to reach USD1.99B in 2023 and USD2.8B in 2025. According to market research firm IBISWorld, Panasonic batteries were the most widely used automotive battery in the United States in 2020. The company supplied batteries for use in the Tesla Model 3, S, X, and accounted for 46% of the U.S. market. LG Energy Solution came in second with 11% and the market shares of EnerSys, A123 and Samsung SDI stood at less than 4%. (Laoyaoba, Business Korea)

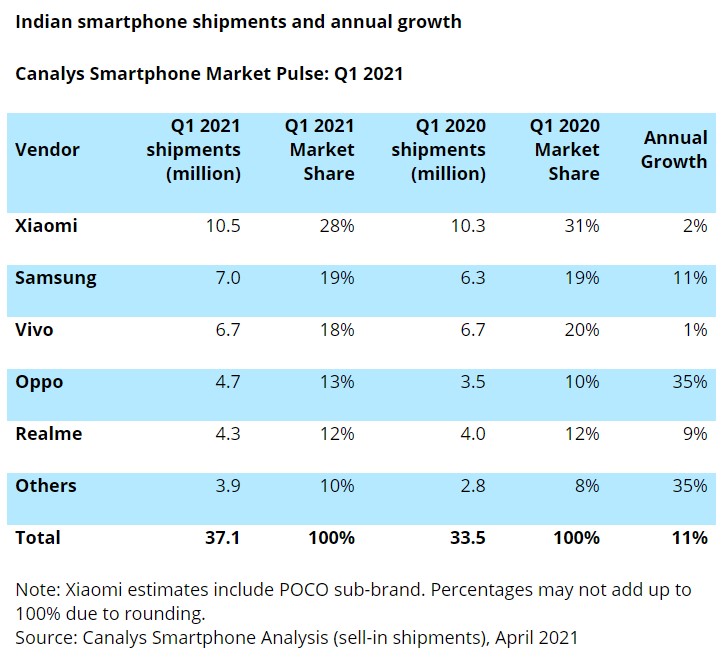

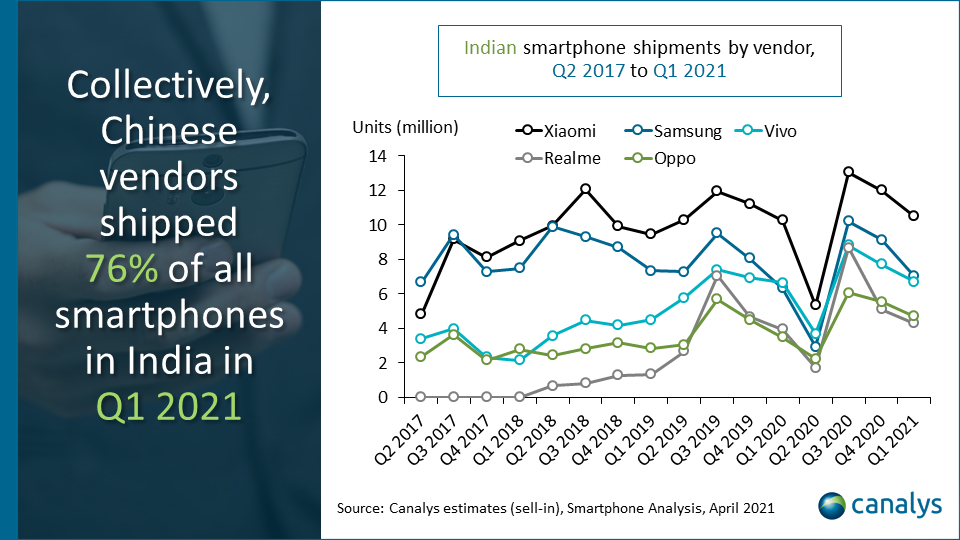

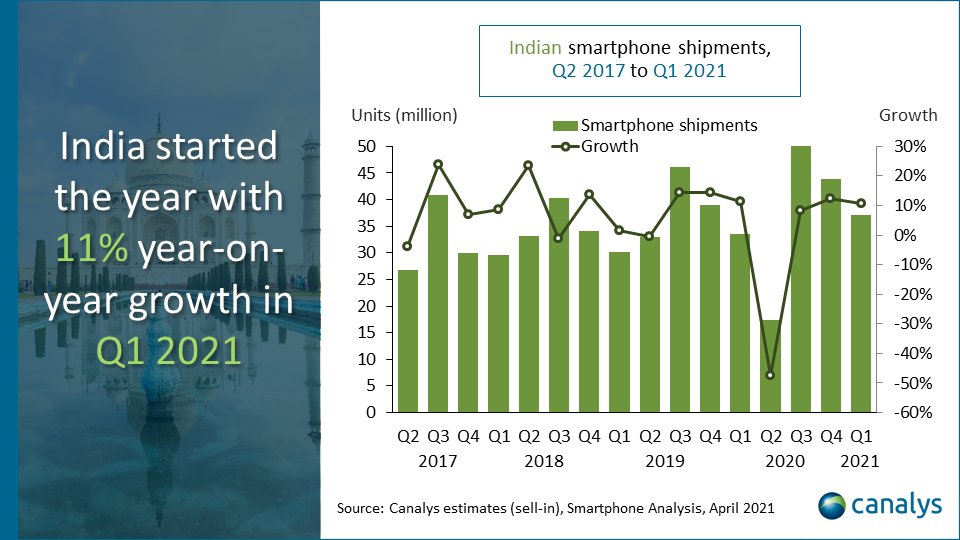

According to Canalys, smartphone shipments in India grew 11% in 1Q21, to 37.1M units, as favorable macroeconomic factors helped smartphone vendors capitalize on the growing importance of smartphones for remote education for Generation Z and for work and leisure for Millennials. Xiaomi retained its position as the market leader, with its 10.5M shipments accounting for a 28% share. (Laoyaoba, Canalys)

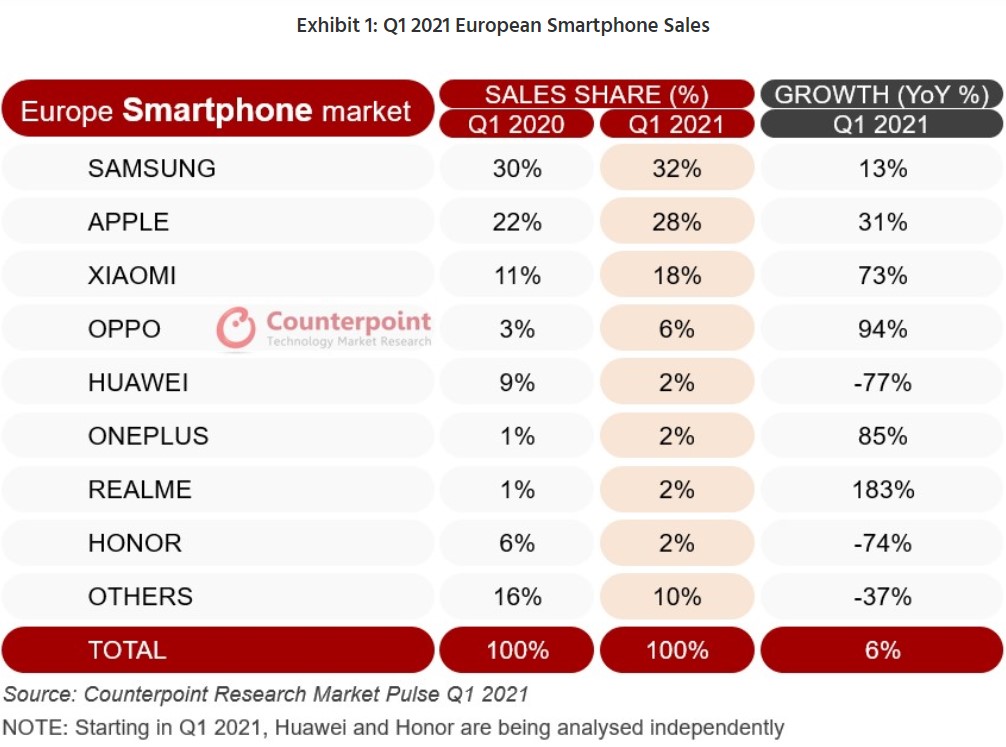

The European smartphone market appears to be on the road to recovery after a difficult 2020. An improving COVID-19 outlook compared to this time in 2020 (the end of 1Q20 marked the beginning of a major downturn for the smartphone market as the pandemic started to take its toll), helped European smartphone sales grow by 6% annually in 1Q21. However, ongoing COVID-19 challenges across the region means the market is still down slightly on 2019 levels. (Laoyaoba, Counterpoint Research)

OPPO A95 5G is announced in China – 6.43” 1080×2400 FHD+ HiD AMOLED, MediaTek Dimensity 800U, rear tri 48MP-8MP ultrawide-2MP macro + front 16MP, 8+128 / 8+256GB, Android 11.0, fingerprint on display, 4310mAh 30W, CNY1,999 (USD310) / CNY2,299 (USD355). (Gizmo China, GSM Arena, OPPO)

OPPO A53s 5G is launched in India – 6.52” 720×1600 HD+ v-notch, MediaTek Dimensity 700 5G, rear tri 13MP-2MP macro-2MP depth + front 8MP, 6+128 / 8+128GB, Android 11.0, side fingerprint scanner, 5000mAh 10W, INR14,990 (USD201) / INR16,990 (USD228). (Gizmo China, NDTV)

vivo V21 series is announced in Malaysia, featuring rear tri 64MP-8MP ultrawide-2MP macro + front 44MP, 8+128GB, Android 11.0, fingerprint on display, 4000mAh 33W: V21 – 6.44” 1080×2400 FHD+ u-notch Super AMOLED 90Hz, MediaTek Dimensity 800U, MYR1,599 (USD390). V21e– 6.44” 1080×2400 FHD+ u-notch Super AMOLED, Qualcomm Snapdragon 720G, MYR1,299 (USD317). (GizChina, GSM Arena, Fonearena)

Redmi K40 Gaming Edition is launched in China – 6.67” 1080×2400 FHD+ HiD OLED 120Hz, MediaTek Dimensity 1200 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 6+128 / 8+128 / 8+256 / 12+128 / 2+256GB, Android 11.0, side fingerprint, physical pop-up gaming triggers, 5065mAh 67W, JBL-tuned stereo speakers, Hi-Res Audio and Dolby Atmos support, CNY1,999 (USD310) / CNY2,199 (USD340) / CNY2,399 (USD370) / CNY2,699 (USD420). (GizChina, GSM Arena, 163, Sohu)

Samsung Galaxy M42 5G is launched in India – 6.6” 720×1600 HD+ u-notch Super AMOLED, Qualcomm Snapdragon 750 5G, rear quad 48MP-8MP ultrawide-5MP macro-5MP depth + front 20MP, 6+128 / 8+128GB, Android 11.0, fingerprint on display, 5000mAh 15W, INR21,999 (USD295) / INR23,999 (USD322). (GSM Arena, Samsung, Gizmo China)

Apple is trimming its planned production of AirPods wireless earphones by 25%-30% in 2021 as intensifying competition dents sales of Apple’s fastest-growing product line. Apple now expects to make 75M-85M units for 2021, compared with a previous production forecast of 110M units. (My Drivers, Gizmo China, Asia Nikkei)

Tesla has revealed that they are currently building Model Y capacity at Gigafactory Berlin and Gigafactory Texas and remain on track to start production and deliveries from each location in 2021. Tesla reports it produced 180,338 vehicles in 1Q21 (+76% YoY) and delivered 184,777 vehicles (+109%). (CN Beta, Business Standard, Benzinga, Seeking Alpha)

Exyn Technologies has announced that it has achieved what it considers the highest level of aerial autonomy reached within the industry. The key to the achievement is that Exyn drones are immune to GPS signal loss, meaning all spatial and mapping computations are done onboard. Under Exyn’s definitions of autonomy, which are based on a similar standard applied to automotive, the company’s drones have achieved Level 4A autonomy. (CN Beta, TechCrunch, IEEE Spectrum)

JD.com, a major Chinese online retailer has revealed that it has started paying some staff in digital yuan since Jan 2021, the virtual version of China’s physical currency. JD.com has cooperated with the PBOC on the digital currency trials. The company has used the DC/EP to make payments to other businesses, too. (TechCrunch, CNBC, Sina, Jiemian, IT Home)

South Korea’s finance minister Hong Nam-ki has announced that the government will start taxing capital gains from trading of cryptocurrencies from 2022 as previously proposed. Any annual gains of more than KRW2.5M (USD2,253) from trading of cryptocurrencies will be subject to a 20% capital gains tax. Starting in 2023, stock and bonds investors should pay taxes on capital gains exceeding KRW50M (USD45,000). (CN Beta, Bitcoin, Korea Herald, Reuters)