5-1 #LaborsDay : SK Hynix has expressed an intention to expand its investment in its 8” foundry business; Intel wants EUR8B in public subsidies towards building a semiconductor factory in Europe; etc.

Samsung Electronics has revealed that a monthlong shutdown at its U.S. semiconductor plant cost it more than KRW300B (USD270M) in losses, although the facility is now fully normalized. Samsung’s Austin plant, also known as Line S2, manufactures products like radio frequency integrated circuits (RFIC), display driver integrated (DDI) circuits, solid state drive controllers, image sensors and other microprocessors using nodes from 14nm to 65nm. (YNA, Android Headlines)

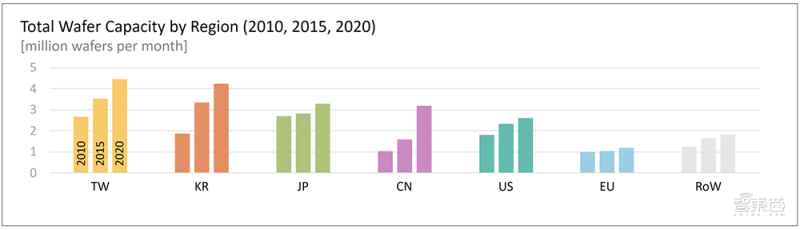

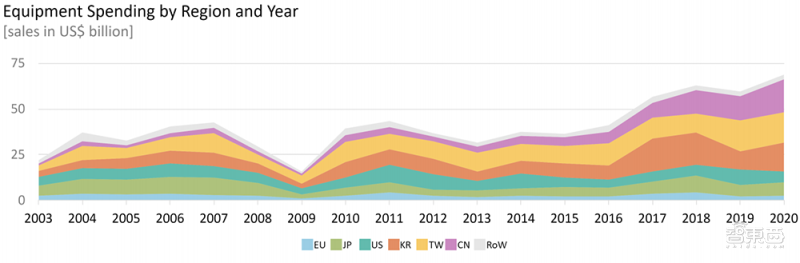

Thierry Breton, European Commissioner for Internal Markets, will hold dialogues with Intel, TSMC and Samsung. The new European plant he plans to negotiate with Intel is several times larger than the largest existing wafer production base in Europe. He also plans to meet with NXP and ASML to discuss the possibility of building a European semiconductor supply chain. As part of the “2030 Digital Compass decadal plan” strategy, the European Commission’s goal is to have Europe’s share of the global semiconductor production market reach 20% by 2030 and have a fab capable of producing advanced 2nm chips. This will require tens of billions of euros of investment. (CN Beta, IT Home, SNV, report)

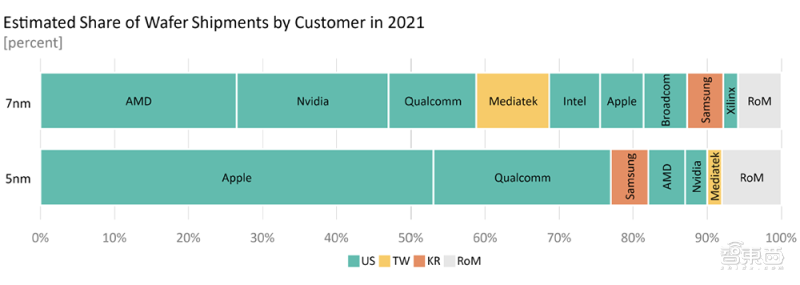

According to Stiftung Neue Verantwortung (SNV), chasing the 2nm fab is a futile endeavour with a very real risk of wasting billions of Euros in public and private money. This idea lacks a business case due to the following factors. First, an EU foundry would predominantly serve European customers, but there are very few semiconductor companies in the EU designing chips on 7nm or 5nm nodes today. Second, it is at best overly optimistic and at worst naïve to hope an EU foundry would attract orders from US chip design companies. Third, it is not by chance that the market for cutting-edge chips manufacturing consolidated substantially over the last 20 years. CN Beta, IT Home, SNV, report)

SK Hynix has expressed an intention to expand its investment in its 8” foundry business. System IC, a foundry affiliate of SK Hynix, has secured price competitiveness by moving its plant from Cheongju to China. However, SK Hynix has said that it has no plan to promote a 12” wafer-based foundry business or an advanced process foundry business that requires large-scale investment. In detail, SK Hynix will supply high-capacity multi chip packages (MCPs) based on 12GB starting from 2Q21. It has decided to increase production of third-generation (1z) 10nm products. It will start mass-producing fourth-generation (1a) products within 2021 by utilizing EUV technology. (CN Beta, The Elec, Business Korea)

Intel CEO Pat Gelsinger has indicated that the company wants EUR8B (USD9.7B) in public subsidies towards building a semiconductor factory in Europe, as the region seeks to reduce its reliance on imports amid a shortage of supplies. (Reuters, Yahoo)

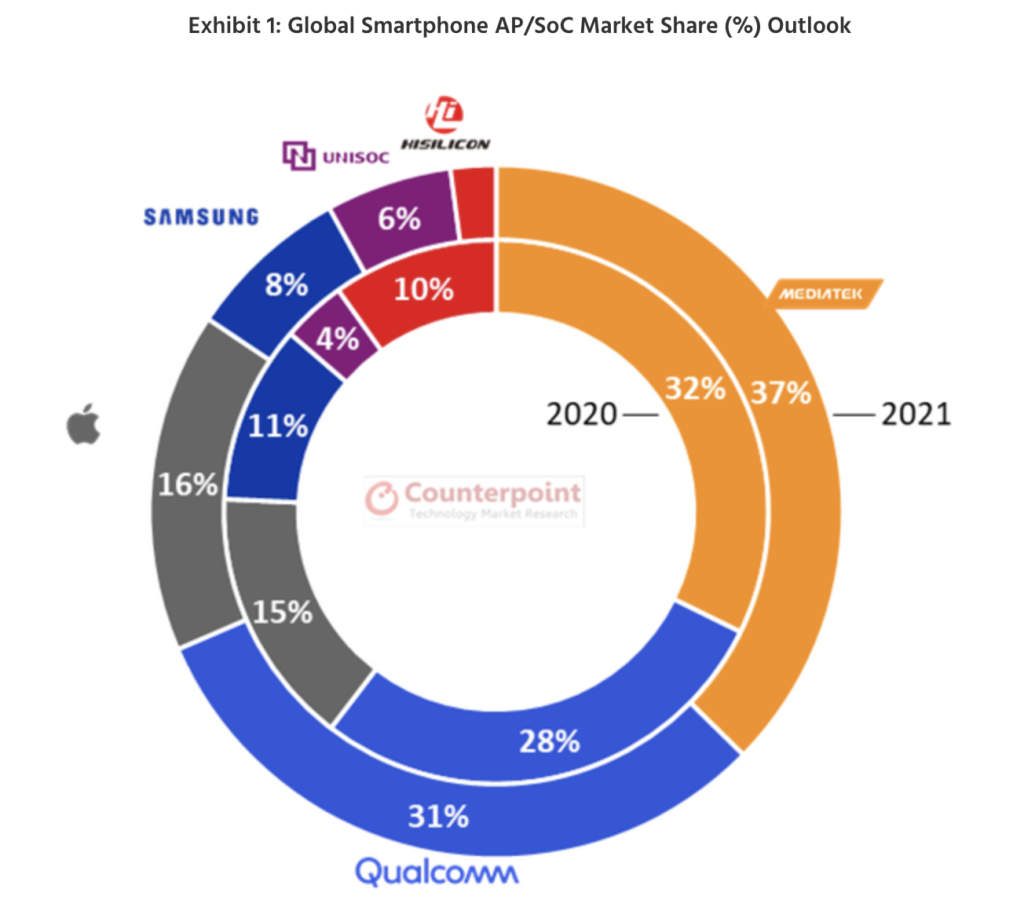

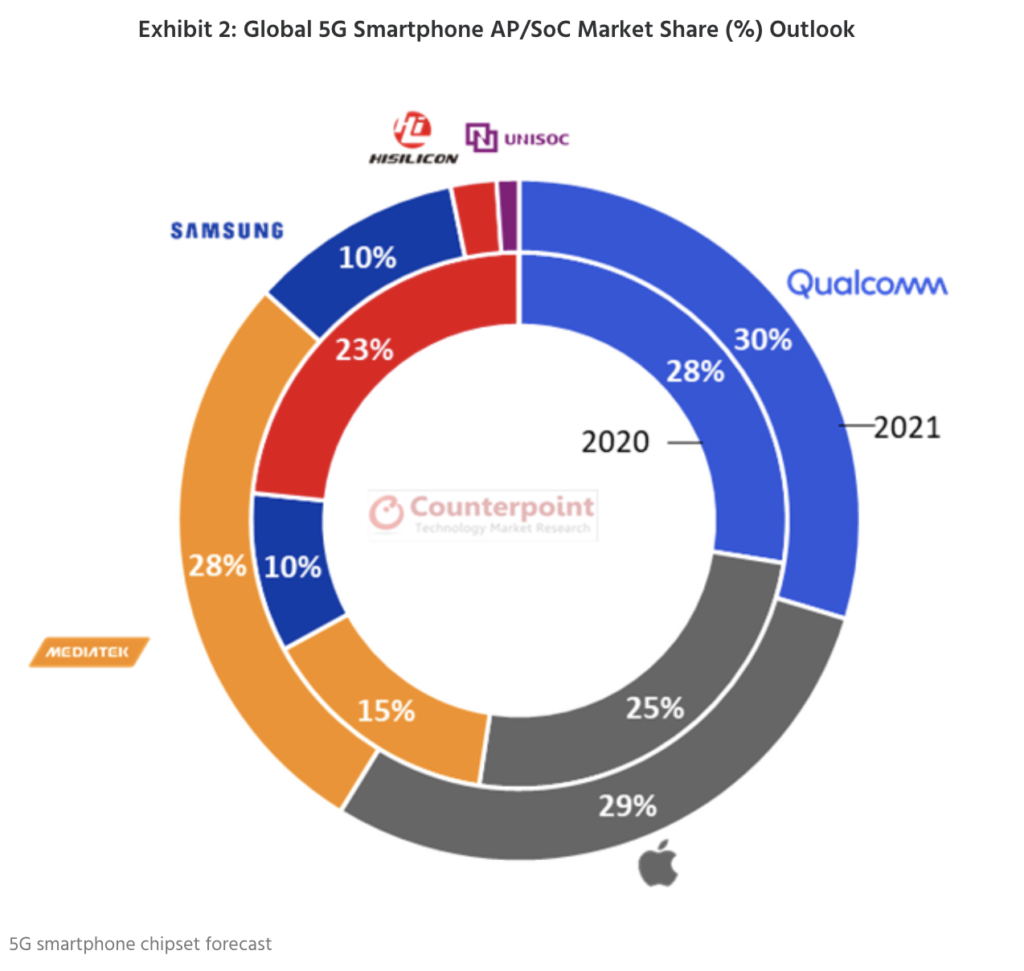

According to Counterpoint Research, global smartphone AP (Application Processor) / SoC (System on Chip) chipset shipments will grow 3% YoY in 2021, factoring in the impact of supply constraint, rapid growth of 5G smartphones and related competitive dynamics. MediaTek is likely to continue its 4Q20 momentum into 2021 and likely to capture 37% unit share of all the smartphone AP / SoC shipped for the full the year. They also estimate Qualcomm to increase its 5G SoC market share to grow to 30% mark in 2021, with 5G solutions across the tiers, from Snapdragon 8-series down to 4-series. (Laoyaoba, Counterpoint Research)

Samsung Display has filed a trademark with the European Union Intellectual Property Office (EUIPO) and the Korean Intellectual Property Office (KIPO) for the name “S-Foldable”. The application is categorized as Class 9 and has the following description, ‘display panels; display for smartphones; LCD large-screen displays; flexible flat panel displays for computers’. (CN Beta, LetsGoDigital, MS Poweruser, WCCFTech)

Samsung’s earlier “Armor Frame” trademark is designed to enhance the frame strength of Samsung’s mobile devices.. Samsung has submitted an application for the “Pro-Shield” trademark to the UK Intellectual Property Office (UK IPO), and the registration category is the 9th category covering smart phones, mobile phone frames, and smart watch frames. (CN Beta, LetsGoDigital, iPhone Wired)

Zhejiang Crystal-Optech has indicated that the market application of the company’s new AR display business in the consumer electronics field is still in its infancy. At present, the company has a research and development layout in a variety of display solutions to meet the needs of industry end customers. The company’s AR-HUD products use the TFT solution. Crystal-Optech has stated that in the future, with the maturity of industry technology and the continuous optimization of product size and price, AR-HUD will surely sink from high-end models to mid-range and low-end models. (Laoyaoba, Sohu, 163, Kaixun)

Daimler Truck AG and Volvo Group have officially outlined their pioneering roadmap for the new fuel-cell joint venture cellcentric, as part of an industry-first commitment to accelerate the use of hydrogen-based fuel cells for long-haul trucks and beyond. (Laoyaoba, Daimler, Volvo, Green Car Congress)

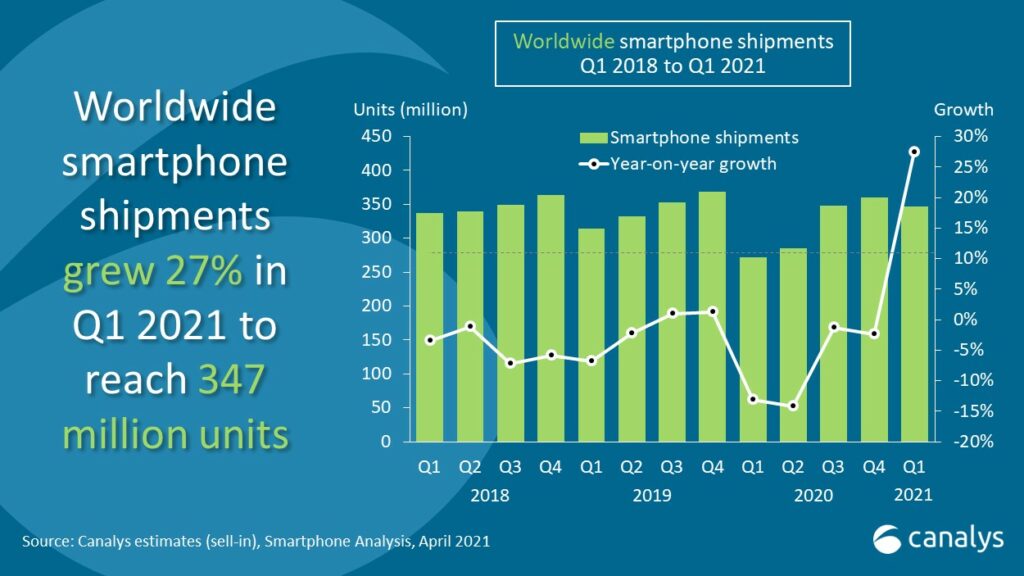

The pace of recovery for the smartphone market accelerated in 1Q21 with 25.5% YoY shipment growth. According to IDC, smartphone vendors shipped nearly 346M smartphones during 1Q21. Samsung regained the top spot in 1Q21 with impressive shipments of 75.3M and 21.8% share. The new S21 series did well for Samsung, mainly thanks to a successful pricing strategy shaving off USD200 from the flagship launch in 2020. (CN Beta, IDC)

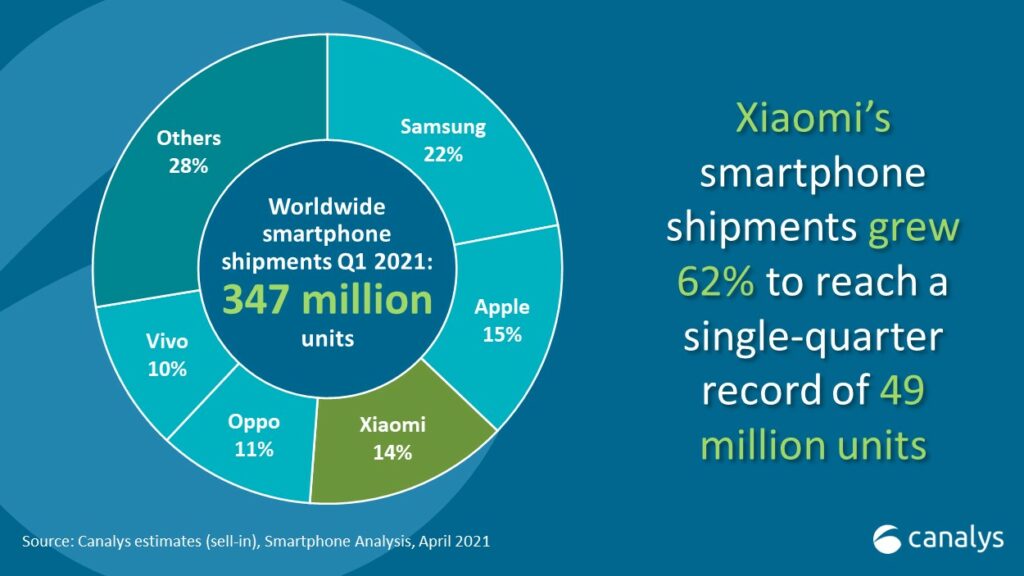

In 1Q21, worldwide smartphone shipments reached 347M units, up 27% YoY. Samsung took first place, shipping 76.5M to take a 22% share. Apple shipped 52.4M iPhones, to take a 15% share. Xiaomi clocked its best single-quarter performance ever, growing 62% and shipping 49.0M units. (Canalys, GSM Arena)

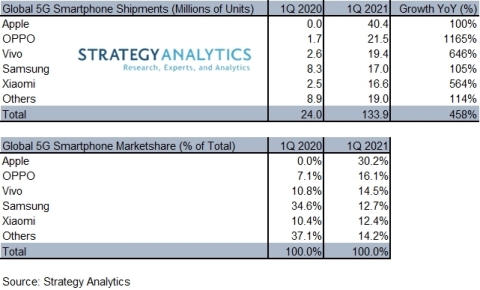

According to Strategy Analytics, China’s rapid adoption of 5G technology is powering demand for 5G smartphones. Apple and the domestic trio of OPPO, vivo and Xiaomi benefitted most as the demand exploded. OPPO, Vivo and Xiaomi closed on Apple capturing 16%, 14% and 12% global market share in 1Q21, respectively. (Android Authority, CN Beta, Strategy Analytics)

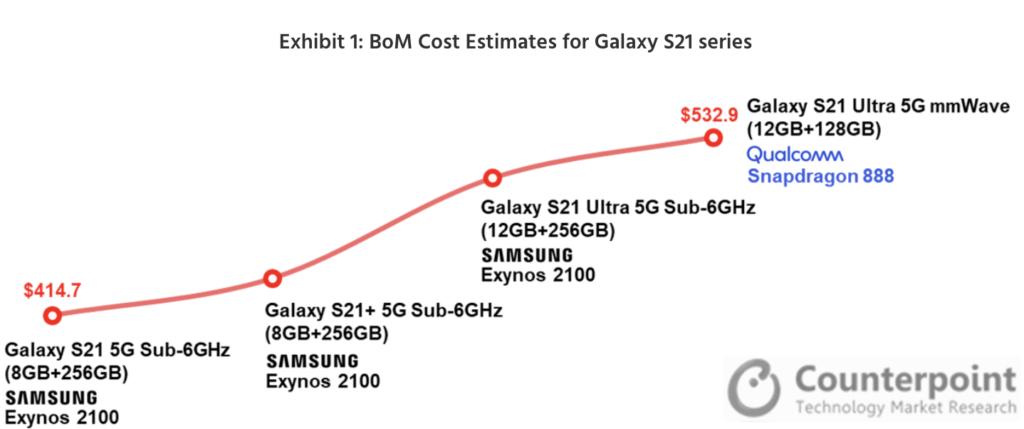

Producing Samsung’s 128GB Galaxy S21 Ultra mmWave smartphone costs Samsung up to USD533, around 7% less compared to the Galaxy S20 Ultra 5G, according to the latest bill of materials (BoM) analysis by Counterpoint Research. The Galaxy S21 series has an optimized cost structure with the models’ cost USD400-600. (Phone Arena, Counterpoint Research)

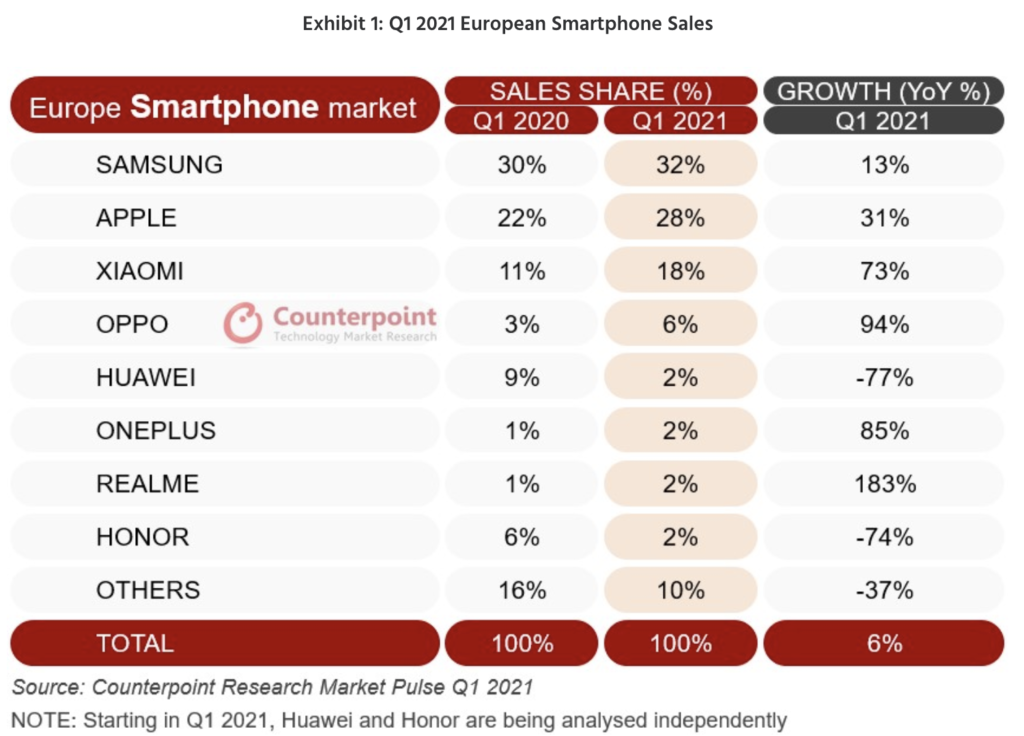

According to Counterpoint Research, an improving COVID-19 outlook compared to this time in 2020 (the end of 1Q20 marked the beginning of a major downturn for the smartphone market as the pandemic started to take its toll), helped European smartphone sales grow by 6% annually in 1Q21. (Phone Arena, NokiaMob, Counterpoint Research)

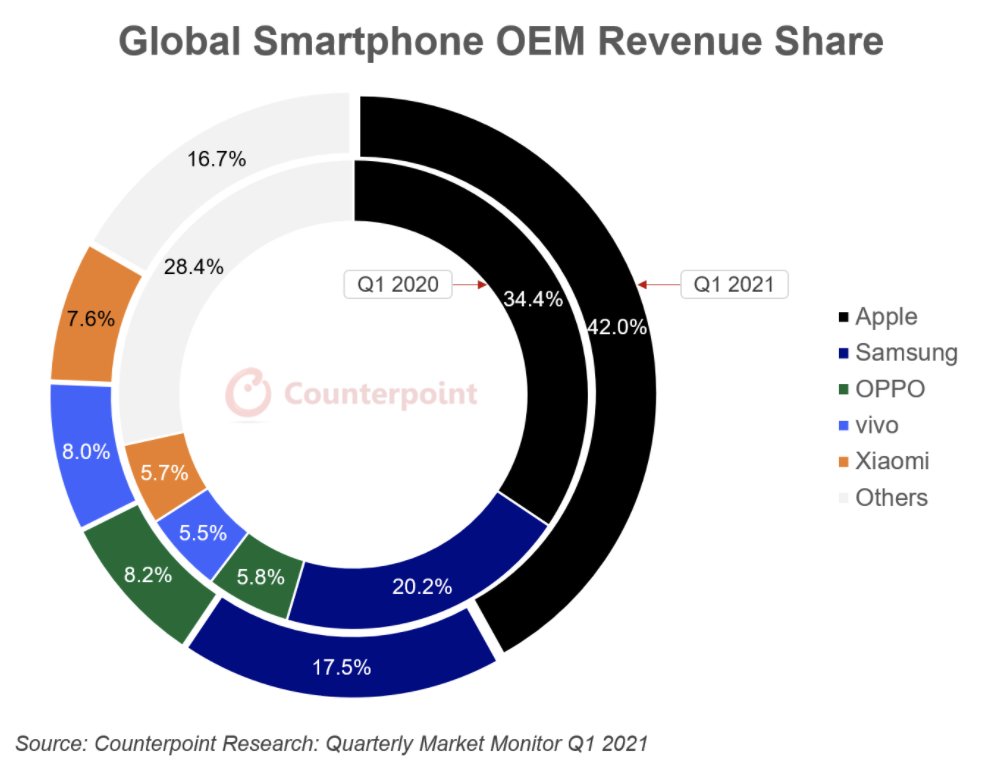

According to Counterpoint Research, global smartphone segment clocked a record 1Q21 wholesale shipment revenues of USD113B, up 35% YoY. Apple captured a record 1Q21 revenue share driven by the strong performance of the iPhone 12 Series and demand spill-over from the previous quarter due to delayed launch. (Counterpoint Research)

Amazon Fire HD 10 / 10 Plus tablets are announced – 10.1” 1920×1200 FHD+ IPS LCD, MediaTek Helio P60T, rear 5MP + front 2MP, 3+32 / 4+64GB, Android 9.0, 6300mAh, 15W wireless charging (10 Plus), starts from USD150. (Liliputing, Amazon, The Verge, CN Beta, GSM Arena, Ars Technica)

In 2021, Revel launched a monthly e-bike subscription in New York City and announced plans to build an electric vehicle charging hub in Bed-Stuy. Revel is introducing an all-electric, and all-Tesla, rideshare service in Manhattan. The new rideshare venture will launch in late May 2021 with a fleet of 50 Revel-branded Tesla Model Ys. (CN Beta, TechCrunch, The Verge)

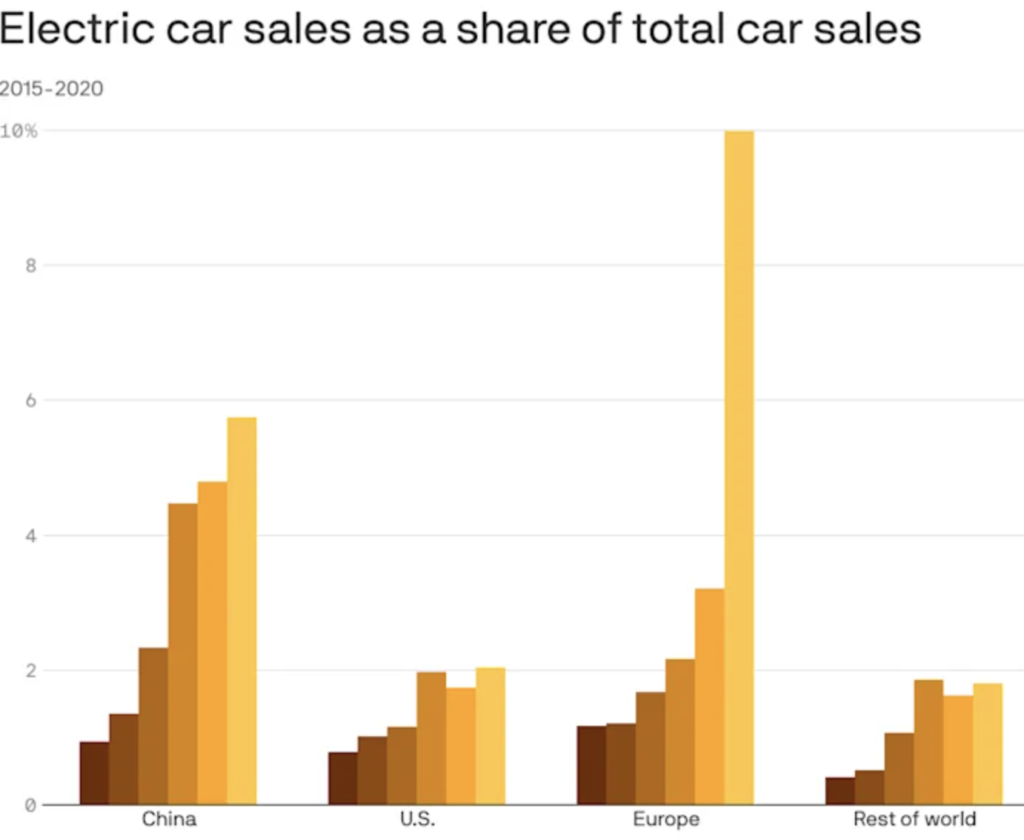

International Energy Agency (IEA) finds that electric vehicles are set for significant growth over the coming decade. Based on current trends and policies, it projects the number of electric cars, vans, heavy trucks and buses on the road worldwide to reach 145M by 2030. But the global fleet could reach 230M if governments accelerate efforts to reach international climate and energy goals. (CN Beta, CNBC, IEA, Yahoo)

General Motors (GM) plans to invest more than USD1B in a plant in Mexico to produce electric vehicles. The facility will begin producing at least one EV beginning in 2023. The plant as well as supporting facilities currently produce the Chevrolet Equinox and Chevrolet Blazer as well as engines and transmissions. (CN Beta, General Motors, Reuters, CNBC)

Huawei Technologies is allegedly in talks with Chongqing Sokon to acquire a controlling stake in the latter’s Chongqing Jinkang New Energy Automobile. The move will allow Huawei to make intelligent cars bearing its own nameplate, they added. Jinkang counts U.S. EV brand Seres, formerly known as SF Motors, as its main asset. (Laoyaoba, Reuters)

Meizu Technology has announced that it is partnering up with an automobile maker. The company will work together with Mini JCW (the brand behind the popular Mini Cooper line of cars) and is developing the Flyme for Cars in vehicle system. (Gizmo China, Sohu, Sina, QQ)

Coinbase is allowing U.S. users to buy cryptocurrency with their PayPal accounts in a major expansion of the exchange’s funding rails. Coinbase users can now buy up to USD25,000 in crypto daily using PayPal, according to the exchange’s settings page. They will lose nearly 4% of such purchases to PayPal-specific fees. (CN Beta, Coinbase, Coindesk, Yahoo)