5-5 #Run : Samsung Electronics would invest KRW171T in non-memory chips through 2030; LGD is planning to expand the production capacity of its TV OLED panel factory in Guangzhou; Kioxia Corporation has announced a JPY20B investment; etc.

The chip shortage is causing production disruption for Samsung’s best-selling Galaxy A phones. The company has been unable to expand its production as much as it would like. This has delayed the release of some variants such as A52 and A72 in crucial markets. (Android Authority, Sam Mobile, The Elec)

MediaTek has announced its latest 5G chipset, designated for midrange smartphones, the Dimensity 900. It is built on the 6nm process technology. It brings an octa-core CPU with two clusters – one with two Cortex-A78 cores at 2.4GHz for power and six Cortex-A55 units at 2 GHz for efficiency. (GSM Arena, MediaTek, CN Beta)

MediaTek is seeking to invest over NTD100B (roughly USD3.5B) in research and development in 2021. The company has stated that it invested about NTD77B (roughly USD2.75B) back in 2020 on research and development. (Gizmo China, IT Home, UDN)

Samsung Electronics has said it would invest KRW171T (USD151.10B) in non-memory chips through 2030, raising its previous investment target of KRW133T announced in 2019. Samsung will accelerate research and development of advanced chip contract manufacturing processes and construction of production lines. (CN Beta, CNA, Samsung, Reuters)

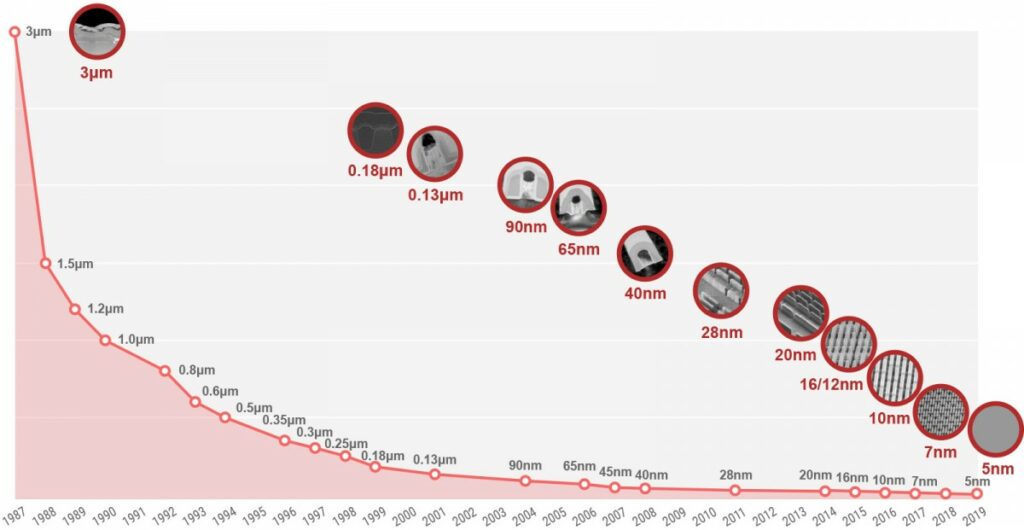

Samsung is losing the semiconductor race to TSMC. Samsung has trailed TSMC by several months in the launch of 5nm smartphone chips, and this technology gap has been widening ever since. As such, it is losing market share in contract manufacturing. Samsung has apparently failed to secure enough semiconductor production equipment from ASML in 2020 fall, allowing its rival to edge ahead. ASML has reportedly shipped about 100 units of advanced EUV production equipment worldwide. (Asia Nikkei, Android Headlines)

ASML will start supplying pellicles used in extreme ultraviolet (EUV) systems with transmittance of over 90% in 2021. ASML Korea marketing manager MyoungKuy Lee has said that the company will begin production of pellicles with over 90.6% transmittance rate. The pellicles have secured 400W power durability. (CN Beta, The Elec, Sina)

The South Korean government has said that it will offer tax benefits and subsidies to local chipmakers to encourage them to invest a total of KRW510T (USD450B) in research and development (R&D) and facilities by 2030. The government planned to create a “K-semiconductor belt” to build supply chains in the southern region of Gyeonggi province and the northern area of Chungcheong province, according to the Ministry of Trade, Industry and Energy. (CN Beta, YNA, Xinhuanet)

TSMC announced in 2020 a USD10-12B investment to build one chip factory in Phoenix, Arizona (first of up to 6) for producing chips on a 5nm process with a relatively low target of 20,000 12” wafers a month. TSMC is now considering a more advanced 3nm foundry that will cost USD23-25M. Initially, TSMC was looking at sites in Europe to build its advanced factory, the focus has allegedly shifted to building the factory in Phoenix, next to the first one. The site there will continue to be developed over the next 10-15 years, including building a 2nm foundry sometime in the future. (GSM Arena, Reuters)

The global semiconductor chip shortage will cost automakers USD110B in lost revenues in 2021, up from a prior estimate of USD61B, consulting firm AlixPartners said, as it forecast the crisis will hit the production of 3.9M vehicles. The chip crunch has driven home the need for automakers to be “proactive” right now, and create “supply-chain resiliency” longer term to avoid disruptions in the future. (Reuters, Gizmo China)

LG Display (LGD) is planning to expand the production capacity of its TV OLED panel factory in Guangzhou, China. The factory, which makes panels based on Gen-8.5 (2200×2500mm) substrates, currently has a capacity of 60,000 substrates per month. This will be expanded to 90,000 substrates per month by Jun 2021. Once the upgrade in China is complete, combined with its capacity of 80,000 substrates per month at its factory in Paju, South Korea, LGD will have a TV OLED panel production capacity of 170,000 substrates per month. (Gizmo China, The Elec, Sohu, 51Touch)

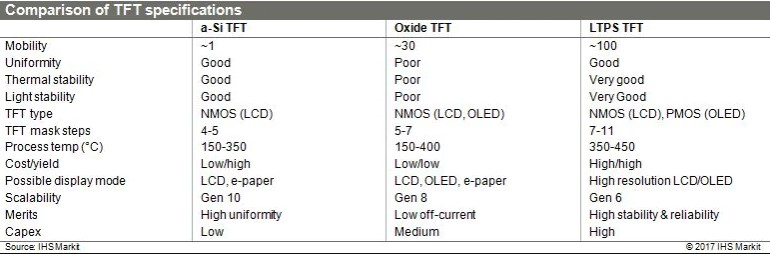

Samsung Display has chosen to lead a national project to develop oxide thin-film transistor (TFT) technology for 1,000ppi OLED panels. The company will aim to develop the oxide TFT which will support electron movements ten times faster than it is currently available now by 2024. Samsung Display will aim to lower power consumption and production costs for the oxide TFT. (CN Beta, The Elec)

Samsung has detailed its next-gen LED module for intelligent headlights, PixCell LED. It is an Adaptive Driving Beam (ADB) solution that leverages Samsung’s advanced semiconductor technology to improve upon the ADB concept in several ways. PixCell LED follows a Monolithic Integrated Architecture comprising 100 ultra-small LED segments onto a single chip. Samsung has confirmed that it has shipped enough PixCell LED modules to light more than 300,000 EVs (electric vehicles). (CN Beta, Samsung, Sam Mobile)

A senior Republican U.S. senator has asked the chief executives of Toshiba America Electronic Components, Seagate echnology, and Western Digital Corp if the companies are improperly supplying Huawei with foreign-produced hard disk drives. (CN Beta, Seeking Alpha, Reuters)

Kioxia Corporation has announced a JPY20B investment to expand its Technology Development Building at its Yokohama Technology Campus and to establish its new Shin-Koyasu Advanced Research Center. The new facilities are expected to be operational by 2023 and will strengthen Kioxia’s research and technology development by bringing together its R&D sites in Kanagawa Prefecture to improve efficiency and to create a more conducive working environment for innovation through collaboration. (CN Beta, Business Wire)

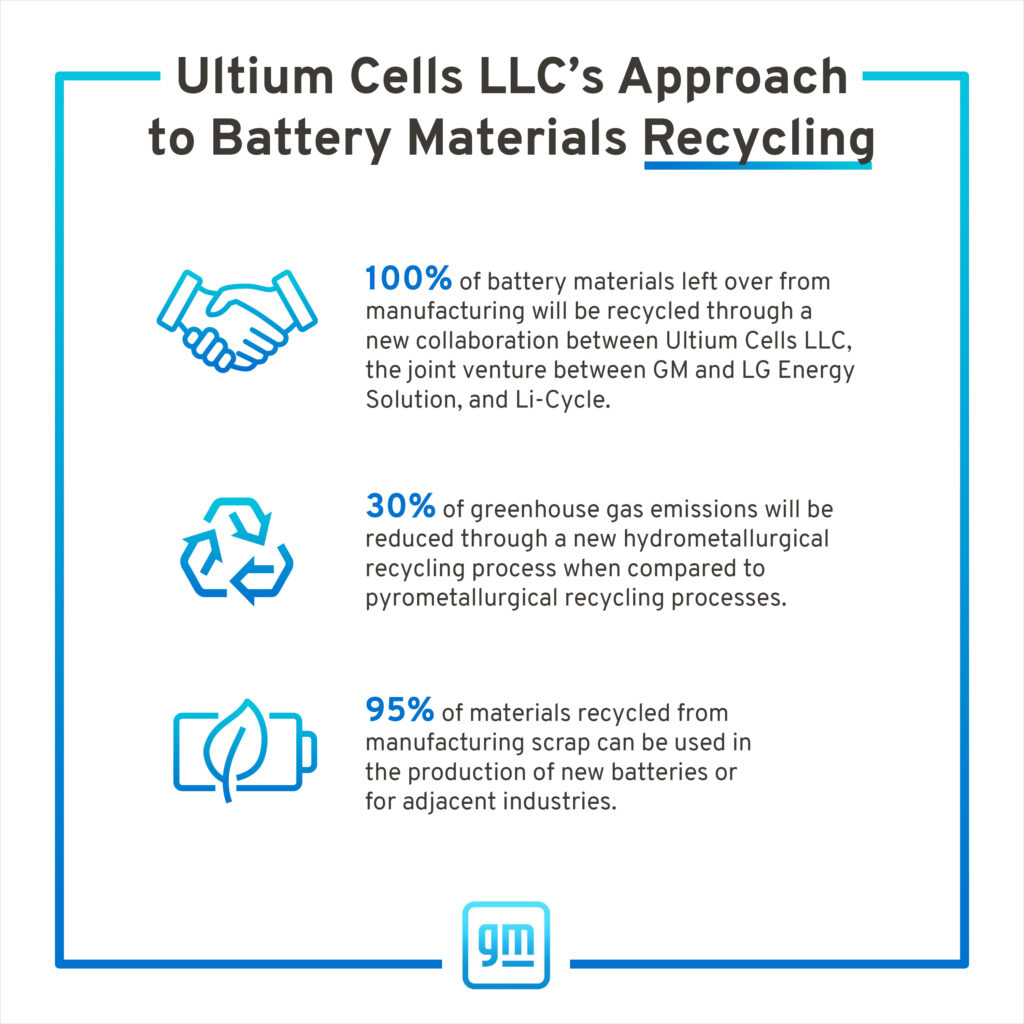

Ultium Cells LLC, a joint venture between General Motors (GM) and LG Chem, has been steadily building up its battery cell manufacturing capacity in the U.S. since the venture was first announced in Dec 2019. Ultium Cells has announced an agreement with Li-Cycle to recycle up to 100% of the material scrap from battery cell manufacturing. The new recycling process will allow Ultium Cells to recycle battery materials, including cobalt, nickel, lithium, graphite, copper, manganese and aluminum. (TechCrunch, GM, NBD, Sina)

GuRu Wireless, a global leader in customizable, over-the-air power solutions, and Motorola announce efforts to bring over-the-air wireless power to its smartphones. GuRu RF Lensing powers devices at watts-over-meters, bringing a new wave of energy to consumer devices. (Android Central, Android Authority, PR Newswire, Sina, Guru.inc)

Google Cloud and SpaceX have announced a new partnership to deliver data, cloud services, and applications to customers at the network edge, leveraging Starlink’s ability to provide high-speed broadband internet around the world and Google Cloud’s infrastructure. Under this partnership, SpaceX will begin to locate Starlink ground stations within Google data center properties. (VentureBeat, PR Newswire)

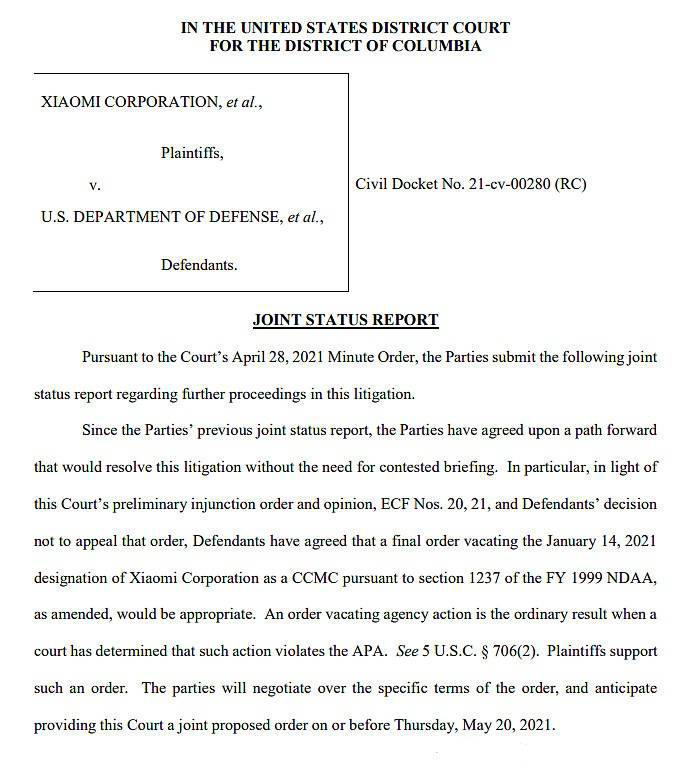

The U.S. Department of Defense (DOD) has agreed to remove Xiaomi from a blacklist that would have barred Americans from investing in the Chinese smartphone maker. (CN Beta, Law360, Yahoo, CNET, CNN)

Angus Ng, POCO global head of product marketing says bringing differentiated software features is one of the goals for 2021. They are going to add some special features to make MIUI for POCO into a more exclusive look for customers. He also reveals that POCO has no plans to launch Android One smartphones. To date, POCO has sold over 17M phones around the world, and the budget M series is a huge sales driver. (Gizmo China, Android Central)

Lava Z2 Max is announced in India – 7” 720×1640 HD+ v-notch, MediaTek Helio A22, rear dual 13MP-2MP depth + front 8MP, 2+32GB, Android 10 (Go), 6000mAh, INR7,799 (USD105). (GSM Arena, Lava)

Redmi Note 10S is announced in India – 6.43” 1080×2400 FHD+ HiD AMOLED, MediaTek Helio G95, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 13MP, 6+64 / 6+128GB, Android 11.0, side fingerprint, 5000mAh 33W, INR14,999 (USD205) / INR15,999 (USD220). (Gizmo China, GSM Arena, Twitter)

vivo Y21s 2021 is launched in Vietnam – 6.51” 720×1600 HD+ v-notch, Qualcomm Snapdragon 439, rear dual 13MP-2MP depth + front 8MP, 3+32GB, Android 11.0, side fingerprint, 5000mAh 10W, reverse charging 5W, VND3.29M (USD140). (GSM Arena, vivo, GizChina)

realme 8 / 8 5G are launched in UK: 8 – 6.4” 1080×2400 FHD+ HiD Super AMOLED, MediaTek Helio G95, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 4+64 / 6+128GB, Android 11.0, fingerprint on display, 5000mAh 30W, GBP199 / GBP219. 8 5G – 6.5” 1080×2400 FHD+ HiD IPS LCD 90Hz, MediaTek Dimensity 700 5G, rear tri 48MP-2MP macro-2MP depth + front 16MP, 4+64 / 6+128GB, Android 11.0, side fingerprint, 5000mAh 18W, GBP199 / GBP249. (Gizmo China, GSM Arena, realme, realme)

Infinix Note 10 series is launched in America, featuring 6.95” 1080×2460 FHD+ HiD IPS LCD 90Hz: 10 Pro / NFC – MediaTek Helio G95, rear quad 64MP-8MP ultrawide-2MP macro-2MP monochrome + front 16MP, 8+256GB, Android 11.0, side fingerprint, 5000mAh 33W, from USD259. 10 – MediaTek Helio G85, rear tri 48MP-2MP depth-2MP monochrome + front 16MP, 6+128GB, Android 11.0, side fingerprint, 5000mAh 18W, USD199. (GSM Arena, Infinix, Gizmo China)

ASUS Zenfone 8 and 8 Flip are announced in Europe, featuring Qualcomm Snapdragon 888: 8 – 5.9” 1080×2400 FHD+ HiD Super AMOLED 120Hz, rear dual 64MP OIS-12MP ultrawide + front 12MP, 6+128 / 8+256 / 16+256GB, Android 11.0, fingerprint on display, 4000mAh 30W, reverse charging, IP68 rated, from EUR599. 8 Flip – 6.67” 1080×2400 FHD+ Super AMOLED 90Hz, rear motorized flip-up tri 64MP-8MP telephoto 3x optical zoom OIS-12MP ultrawide, 8+128 / 8+256GB, Android 11.0, fingerprint on display, 5000mAh 30W, from EUR799. (GSM Arena, ASUS, The Verge, Engadget)

Lenovo has announced Lenovo Go, a new sub-brand uniting a range of purpose-built PC accessories that are made for better mobile productivity and designed for a hybrid workforce within an ecosystem that works better together. Lenovo also plans to introduce new audio systems that address various challenges including ambient noise, sound quality, and ease of use. (Neowin, Lenovo, IT Home)

Xiaomi FlipBuds Pro is launched in China, featuring active noise cancellation (ANC). It features 11mm driver and a dedicated flagship audio chip by Qualcomm. The equipped QCC5151 Bluetooth chip can listen and filter environmental sounds. It is priced at CNY799 (USD125). (GSM Arena, Mi.com, CN Beta)

Apple’s patent titled “Zone identification and indication system” describes an augmented reality (AR) display can include an indicator of the vehicle speed. This indicator could be “spatially positioned according to the speed of the vehicle relative to the local speed limit”. Most of the patent is concerned with how to help the driver, but there are elements that cover driverless navigation. (Apple Insider, USPTO)

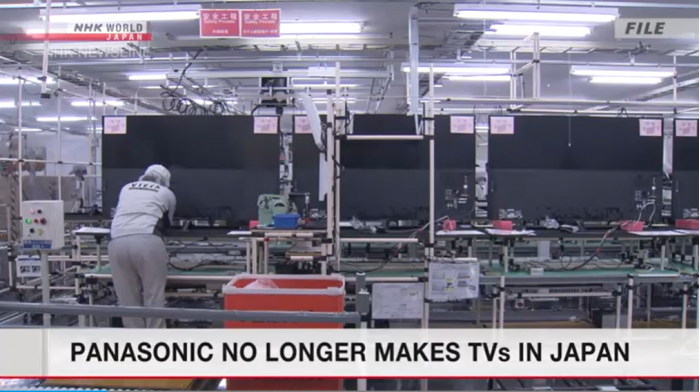

Panasonic has confirmed they no longer make TV sets in Japan. They say they will focus on overseas production. The last made-in-Japan Panasonic TVs stopped rolling off lines at a factory north of Tokyo at the end of Mar 2021. (CN Beta, NHK)

Tesla has announced that it would be supporting the Chinese government’s efforts to standardize the automobile industry in the country. Car makers must get customer permission to acquire user data and government approval to send any sensitive information to any overseas firms. (Gizmo China, Sina, CN Beta)

Italy’s competition watchdog has ordered Google to pay over EUR100M (USD123M) for excluding an EV charging app from Android Auto. The fine is handed down after the Italian Competition Authority found Google barred charging station app JuicePass from Android Auto. (Android Authority, Engadget, AGCM, Yicai, Reuters)

Israeli / American company Eviation is preparing for the first test flights of its gorgeous Alice, an all-electric 11-seat luxury plane with an impressive 506-mile (814-km) range from a single charge of its huge 820-kWh battery pack. The company says it’s just taken delivery of its first electric motor. (CN Beta, Clean Technica, New Atlas)

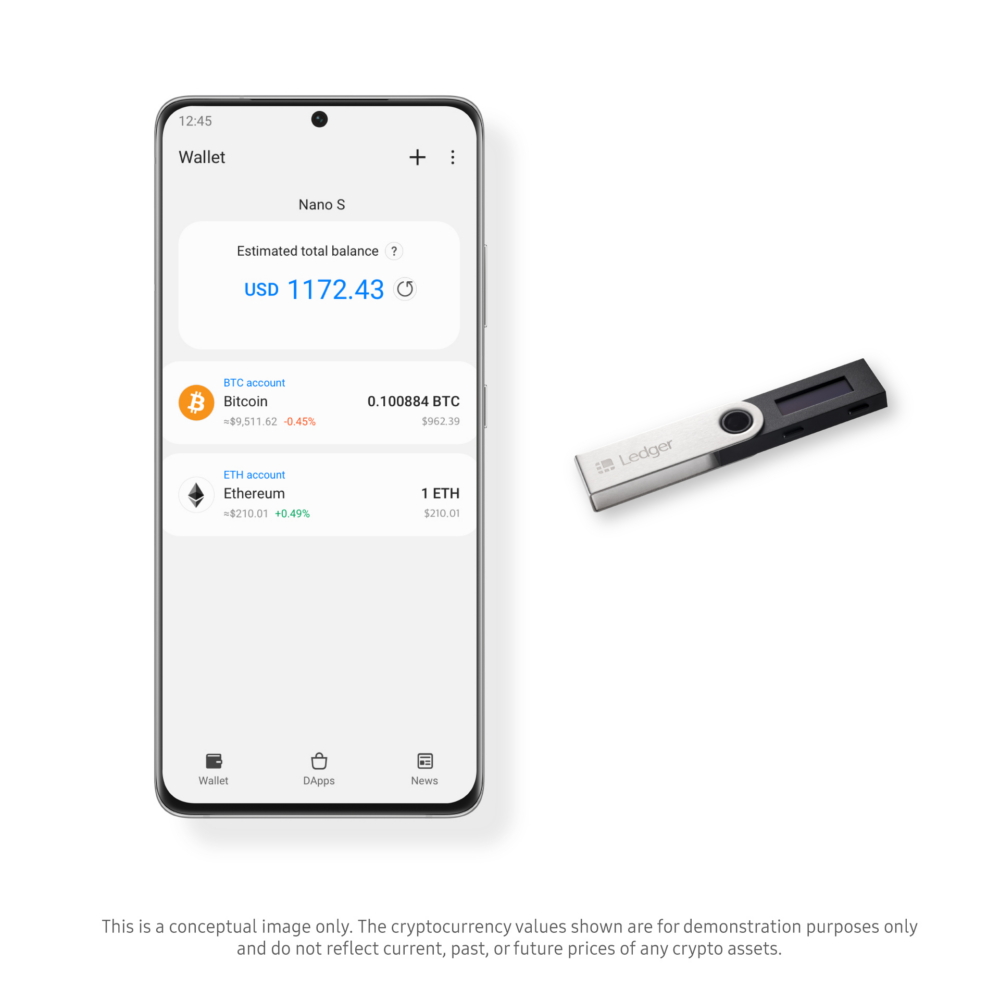

Samsung Electronics has announced that blockchain users can now manage and trade virtual assets from third-party wallets on Samsung Galaxy smartphones. The update makes it easier for blockchain users to access and process transactions by importing virtual assets stored on select cold hardware wallets to the Samsung Blockchain Wallet available on most Galaxy smartphones. (CN Beta, GSM Arena, Android Authority, Samsung)