5-28 #Nephew : Japan’s government wants TSMC and Sony to invest JPY1T to build the country’s first 20nm chip plant; Samsung Display is considering extending the production of large LCD panels by the end of year 2022; Google is working with Jio to launch a low-cost smartphone; etc.

Nvidia has provided an update on how its cryptocurrency (CMP) cards are faring in the market. It booked USD155M in revenue from CMP cards in its fiscal 1Q21, which ended 2 May 2021, and expected sales of USD400M in the fiscal 2Q21. However, Nvidia CEO Jensen Huang talks about the new product line not as an exciting frontier for the company, but as a bone thrown to cryptocurrency obsessives to protect gamers. As it turns out, gaming processors — Nvidia’s original and core business — are still its most important, generating USD2.76B in revenue, an increase of 106% from 2020. (CN Beta, CNBC, Business Insider)

TSMC has kicked off production for Apple’s next-generation iPhone processor dubbed A15, and will see demand for the chip surpass that for its predecessor last year in scale, according to Digitimes. Digitimes reports that demand for the A15 will surpass that of the A14. The A15 will use the same 5nm node as the A14, but Apple is rumored to use 4nm chips in 2022. (GSM Arena, Digitimes, Sohu, UDN)

Japan’s government wants Taiwan Semiconductor Manufacturing Co (TSMC) and Sony Group to invest JPY1T (USD9.2B) to build the country’s first 20nm chip plant. Currently Japanese developers outsource chip production to companies like TSMC and UMC, and there are no advanced fabs in the country. Earlier 2021, TSMC announced plans to build a USD171M R&D center 50km northeast of Tokyo. (Gizmo China, Tom’s Hardware, Reuters, Sohu, Nikkei Asia)

SK Group is allegedly eyeing the acquisition of component and parts suppliers in Japan. SKC, SK Inc., SK Siltron and SK Materials will invest a total of around KRW400B (USD358M) into SK Japan Investment, which is an investment arm of SK Group. Each affiliate will invest around KRW100B. Regarding the specifics of its possible Japanese investment partners, SK is interested in forming partnerships with major Japanese banks including Mizuho. (Laoyaoba, 163, Korea Times)

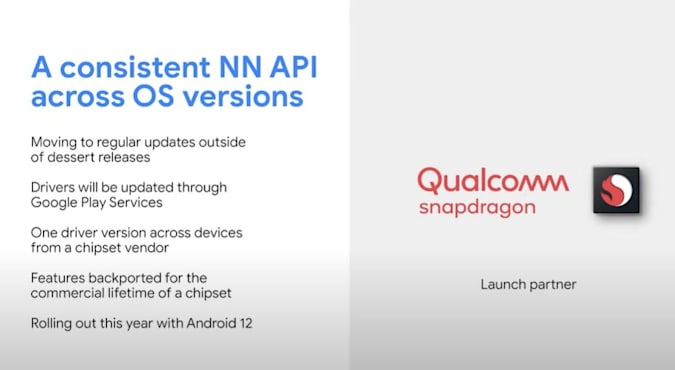

Qualcomm has announced that starting later in 2021, in partnership with Google, it will start offering regular updates for the Neural Net API (NNAPI) on Android devices. These updates are detailed to come to Snapdragon-powered devices via Google Play Services updates, applied automatically in the background on the devices. The regular updates will allow for improvements to services like Google Lens and Google Voice Access, as well as other applications. (Engadget, Droid-Life, Qualcomm)

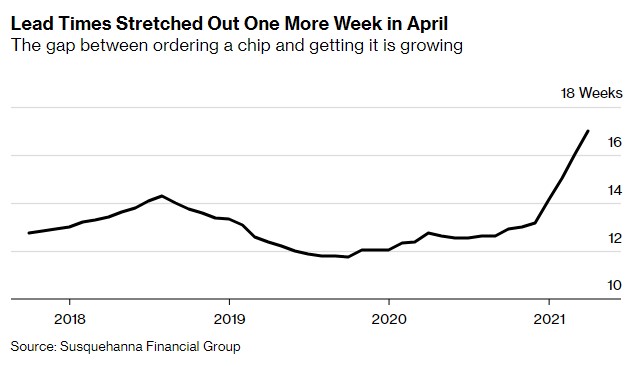

Shortages in the semiconductor industry, which have already slammed automakers and consumer electronics companies, are getting even worse, complicating the global economy’s recovery from the coronavirus pandemic. Chip lead times, the gap between ordering a chip and taking delivery, increased to 17 weeks in Apr 2021, indicating users are getting more desperate to secure supply, according to Susquehanna Financial Group. That is the longest wait since the firm began tracking the data in 2017, in what it describes as the “danger zone”. Before the start of 2021, it was more typically around 13 weeks. (Bloomberg, Apple Insider)

First unveiled on a ConceptD notebook, SpatialLabs combines an eye-tracking stereo camera, a stereoscopic 3D display and real-time rendering technologies to give creators a new way to interact with their creations. The SpatialLabs Experience Center allows for flexible use of the stereoscopic 3D technology, enabling creators to view their models in stereoscopic 3D with a single click. Acer has launched a SpatialLabs developer’s program for Unreal Engine developers interested in presenting projects with SpatialLabs. (Engadget, The Verge, Acer, Engadget)

Samsung Display CEO Joo-sun Choi has confirmed that Samsung Display is considering extending the production of large LCD panels by the end of year 2022. Samsung Display wanted to stop all LCD production by the end of 2020. However, it has postponed its plans at the request of Samsung for some time. (GSM Arena, The Elec, Sam Mobile, Sina)

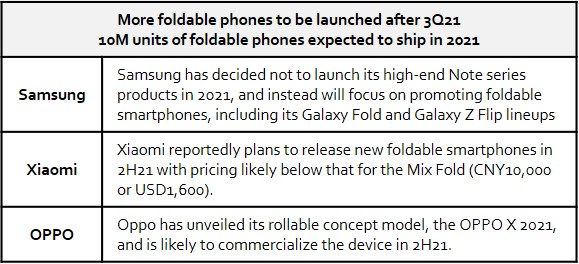

Samsung Electronics and Chinese handset brands, including Xiaomi, OPPO and vivo, all plan to launch foldable smartphones in 3Q21, heating competition in the segment, according to Digitimes. Bolstered by the increasing availability of new models, shipments of foldable smartphones are likely to take off in 2022, pushing total global shipments to over 10M units in the coming year. (Digitimes, Gizmo China)

OmniVision Technologies has announced in advance of COMPUTEX Virtual the industry’s first 1/7”, 2MP image sensor, the OV02C. The sensor offers 60fps and excellent pixel performance in the thinnest 3mm module Y size for high screen-to-body ratio designs. The OV02C’s “Always On” feature senses user presence in ultra-low-power mode and the system can be locked and woken up touchlessly, extending the lifetime of the battery. (CN Beta, IT Home, OVT, Business Wire)

SK Hynix has established ASCA Hynix Semiconductor in Dalian, China, in a move to facilitate its acquisition of Intel’s NAND plant. SK Hynix wholly owns the new corporation, which has KRW100M in capital and will engage in integrated circuit (IC) manufacturing, sales and design. (CN Beta, Business Korea)

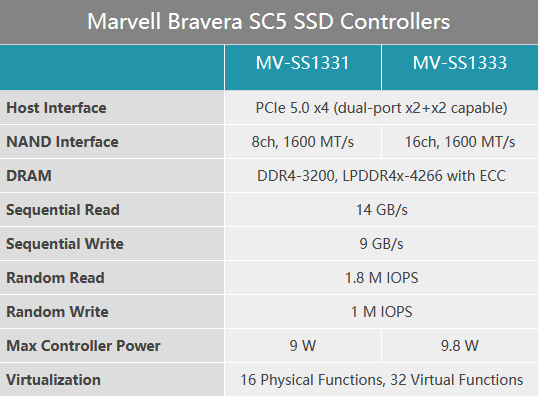

Marvell has introduced Bravera SC5, the industry’s first SSD controller to support PCIe 5.0 and NVMe 1.4b, to potentially double the performance of PCIe 4.0 SSDs. In terms of raw speed, PCIe 5.0 doubles the transfer rate from PCIe 4.0 from 16GT/s to 32GT/s (GigaTransfers per second). Marvell is offering two variants, including an 8-channel model (MV-SS1331) and a 16-channel model (MV-SS1333). (CN Beta, Marvell, Hot Hardware, PR Newswire)

Privacy International (PI) and several other European privacy and digital rights organizations announced today that they’ve filed legal complaints against the controversial facial recognition company Clearview AI. The complaints filed in France, Austria, Greece, Italy, and the United Kingdom say that the company’s method of documenting and collecting data — including images of faces it automatically extracts from public websites — violates European privacy laws. New York-based Clearview claims to have built “the largest known database of 3B+ facial images”. (CN Beta, Engadget, Bloomberg, The Verge)

Tritium, a Brisbane-based developer and producer of direct current fast EV chargers that is taking the SPAC path to the public market in a deal valuing the company at USD1.2B. Founded in 2001, Tritium manufactures charger hardware and software for direct current fast chargers. Its products can recharge an EV battery, adding 20 miles in a minute or 100 miles in 5 minutes. (TechCrunch, PR Newswire, Reuters)

Nissan is in advanced talks with the UK government to build a battery Gigafactory. The new factory at Nissan’s existing Sunderland site would be run by Nissan’s Chinese battery supplier Envision AESC, and support the production of 200,000 battery cars a year. During the first phase of the new project, the site will produce 6GWh of battery capacity per year and should open towards the end of 2024, rising to 18-20GWh once the final project is complete. (My Drivers, The Guardian, BBC, Financial Times)

Tesla has announced that it has sold over 200,000 Powerwall units so far, around double the number it said it had sold at this time in 2020. Powerwall gives solar panel and other customers a powerful battery backup when the power (or sun) goes down. (Engadget, Twitter)

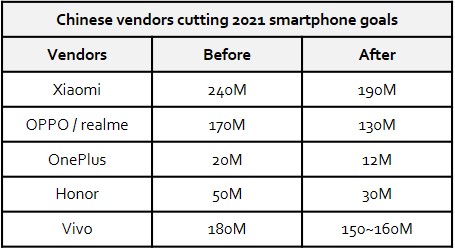

China-based handset brands, including Xiaomi, OPPO, realme and Honor, reportedly have slashed their shipment goals further for 2021, having already lowered their targets earlier in May 2021, according to Digitimes. Meanwhile, vivo and Samsung have allegedly cut their shipment goals as well for 2021. (Digitimes, Gizmo China, East Money)

Sony Interactive Entertainment president and CEO Jim Ryan has revealed that the company plans to launch its major franchises on non-console platforms such as mobile, encouraged by its “very successful” first steps into the PC gaming market. He has presented research suggesting mobile gaming generated USD121B worldwide in 2020, compared to USD62B brought in by the console market and USD42B generated by the PC gaming market, demonstrating the case for the company to move into mobile gaming. (Mac Rumors, Video Games Chronicle, CN Beta)

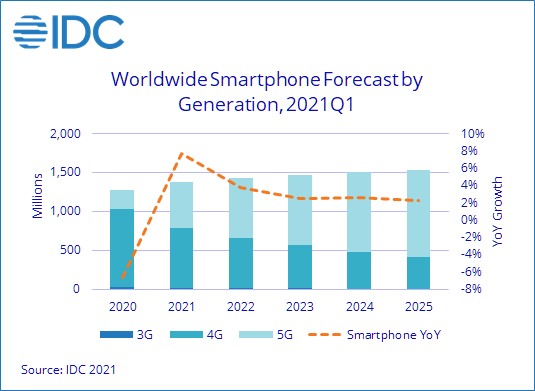

Following back-to-back quarters of growth, IDC has raised its near-term outlook for the global smartphone market. Shipments of smartphones are forecast to reach 1.38B units in 2021, an increase of 7.7% over 2020. This trend is expected to continue into 2022, when year-over-year growth will be 3.8% with shipments totaling 1.43B. (GSM Arena, IDC)

Google CEO Sundar Pichai has revealed that they are working with Jio to launch a low-cost smartphone. Google acquired a 7.7% stake in Jio in 2020 for INR33.77B (USD465M). The company has also reached a commercial agreement with Jio to jointly develop an entry-level cheap smartphone. (GizChina, Live Mint, IT Home, India Times)

Vincent Peng, SVP and board’s member of Huawei Technologies is urging a shift to software in a bid to counter America’s sanctions. Huawei is pleading with the U.S. President Joe Biden to have a conversation. The company is willing to be subject to the most stringent controls to ease the U.S. government’s concerns about Huawei products and technologies. Huawei is even ready to open up manufacturing operations in the United States. (Android Headlines, Asia Nikkei, CN Beta)

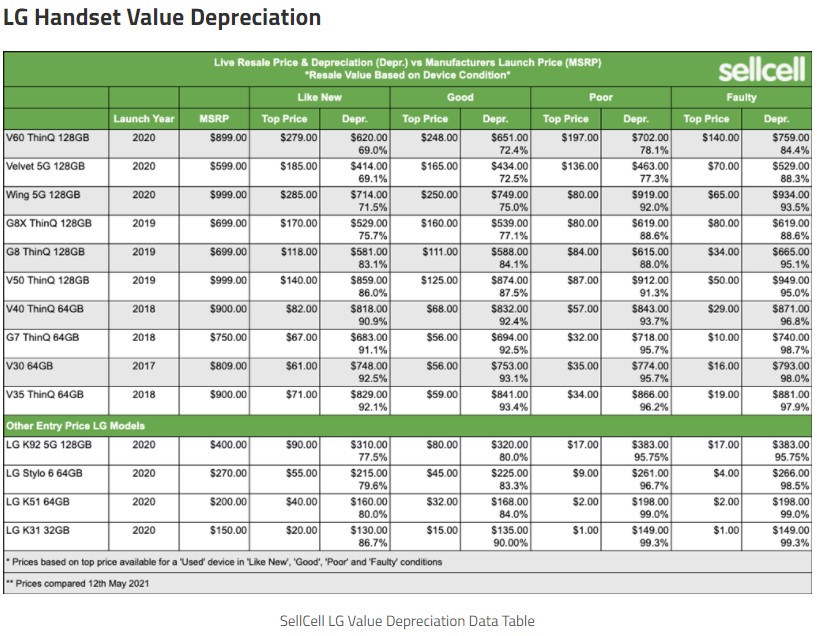

Online smartphones and tablets marketplace SellCell has published a report based on resale data from over 40 buyback companies and has concluded that compared to phones from Apple, Samsung, and Google, LG devices lose their value a lot faster. The results are based on recent LG smartphones and most of them were released in the last 2 years. (Phone Arena, SellCell)

Xu Qi, vice president of realme and president of China region, has revealed that, affected by the shortage of raw materials such as chips and batteries in the upstream of the phone supply chain, changes in supply and demand have triggered price increases, resulting in rising phone costs. It is predicted that the cost of mobile phones in 2H21 will increase by approximately 10%. According to the current situation, the price increase of 2H21 mobile phones is an inevitable trend. (Laoyaoba, Sina, Sohu)

The Global Association for Mobile Communications Systems (GSMA) has announced that Honor has officially joined GSMA as an Associate Member, promoting the development and application of new mobile communications technologies with global industry partners. (Laoyaoba)

Samsung and Apple have launched their trade-in programs for LG smartphones in South Korea in a bid to fill the vacuum left by LG’s exit of the phones business in the country. Both companies are offering to pay the trade-in value of phones as well as an additional KRW150,000 (USD135) for LG smartphone users that turn in their used phones to replace them with a Galaxy smartphone or an iPhone. (Phone Arena, Gizmo China, YNA, ZDNet)

ZTE nubia Red Magic 6R is announced – 6.67” 1080×2400 FHD+ HiD AMOLED 144Hz, Qualcomm Snapdragon 888 5G, rear quad 64MP-8MP ultrawide-5MP macro-2MP depth + front 16MP, 8+128 / 12+256GB, Android 11.0, fingerprint on display, 4200mAh 55W, CNY2,999 (USD470) / CNY3,999 (USD627). (GSM Arena, nubia, Neowin, Android Central)

OPPO Reno6 series is announced in China: Reno6 – 6.43” 1080×2400 FHD+ HiD AMOLED 90Hz, Qualcomm Snapdragon 768G 5G, rear quad 64MP-8MP ultrawide-5MP macro-2MP depth + front 32MP, 8+128 / 12+256GB, Android 11.0, fingerprint on display, 4500mAh 65W, CNY2,799 (USD440) / CNY3,199 (USD500). Reno6 Pro – 6.55” 1080×2400 FHD+ Super AMOLED HiD 90Hz, MediaTek Dimensity 1200 5G, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 32MP, 8+128 / 12+256GB, Android 11.0, fingerprint on display, 4500mAh 65W, CNY3,499 (USD549) / CNY3,799 (USD595). Reno6 Pro+ – 6.55” 1080×2400 FHD+ Super AMOLED HiD 90Hz, Qualcomm Snapdragon 870 5G, rear quad 50MP(1.0µm) OIS-13MP telephoto 2x optical zoom-16MP ultrawide-2MP macro + front 32MP, 8+128 / 12+256GB, Android 11.0, fingerprint on display, 4500mAh 65W, CNY3,999 (USD627) / CNY4,499 (USD705). (CN Beta, My Drivers, Engadget, Sina, GSM Arena)

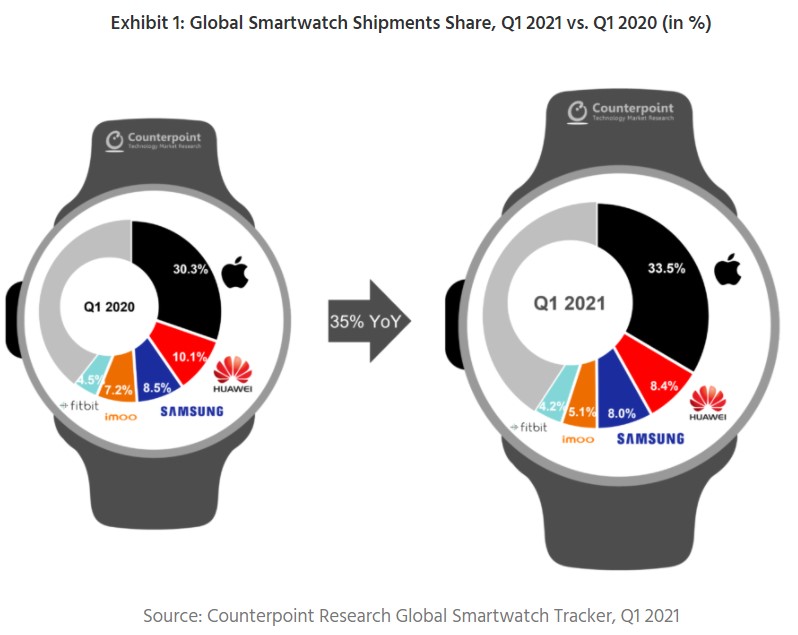

Global smartwatch shipments in 1Q21 grew 35% YoY, according to Counterpoint Research. Apple maintained its leadership position, catalyzing the overall market growth by recording a 50% YoY increase in the demand for the new Series 6 models. As a result, Apple saw its market share climb by 3% points. Samsung’s shipments also rose 27% YoY, with the popularity of the Galaxy Watch 3 and Galaxy Watch Active series. But the South Korean vendor’s growth was below the market average and it saw a small dip in its market share. (Gizmo China, Counterpoint Research)

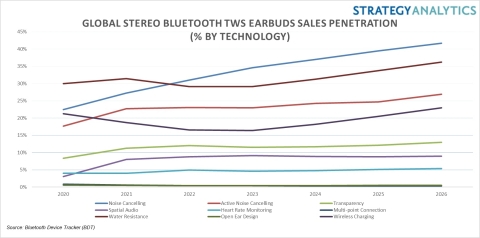

According to Strategy Analytics, global Truly Wireless (TWS) earbuds are out-competing traditional Bluetooth headsets by rapidly adding advanced capabilities found previously only in premium headsets. In 2021 TWS earbuds will account for 70% of all Bluetooth headsets sold. Over 30% of TWS earbuds sold in 2021 will be water resistant, meaning consumers engaging in high-impact activities. Heart rate monitors are in 4% of TWS earbuds that will be sold in 2021, allowing users to track a key health metric. (Strategy Analytics, Laoyaoba)

Redmi AirDots 3 Pro true wireless stereo (TWS) earbuds are launched, priced at CNY299 (USD47). It packs 9mm drivers and 3 microphones for optimal voice pickup and noise cancellation. Redmi advertises its ANC mode can decrease outside noises by 35dB. (Laoyaoba, GSM Arena, NDTV, 52Audio)

realme Watch 2 Pro is announced in Malaysia, priced at MYR299 (USD70). It features 1.75” 385×320 30Hz display, supports 100+ watch faces, packs with 390mAh battery claimed to provide 14 days of battery life. It has a built-in dual-satellite GPS. (GSM Arena, realme, Sogi)

Huawei Freebuds 4 is announced featuring Kirin A1 chip, 14.3mm dynamic drivers and has 3 microphones for voice and surrounding noise pick up. The active noise cancellation can reduce up to 25db of surrounding noise. It is priced at CNY999 (USD155). (My Drivers, GSM Arena, Huawei Central)

Huawei X Gentle Monster Eyewear II is official. It features brand new stylish color lens series, which uses titanium alloy elastic hinges, 12º opening and closing range, and the temples integrate pressure sensors, vibration sensor, sliding sensor, etc., to support 3D touch. It is equipped with 128mm2 of ultra-thin large-diaphragm dual speakers, and with volume adaptive technology, it can automatically reduce the call volume according to environmental noise. It is priced at CNY2,699. (CN Beta, Huawei, GizChina)

Mobvoi TicWatch Pro 3 LTE is launched in France, priced at EUR306. It features 1.4” AMOLED display, Qualcomm Snapdragon 4100, 1GB RAM + 8GB storage, supports fitness tracking, heart rate monitoring, sleep tracking, stress level, blood oxygen level, activities tracking, and others. (Gizmo China, XDA-Developers)

Xiang Jiangxu, vice-president and chief technology officer of Midea IoT, has revealed that the company would continue to work closely with the Huawei’s operating system HarmonyOS in the near future, aiming to realize a more efficient smart internet of things (IoT) system. (Gizmo China, China Daily, Sina)

Ford Motor has announced the company plans to invest USD30B in vehicle electrification efforts by 2025, and the company anticipates that 40% of its global sales by 2030 will be fully electric vehicles. Ford CEO Jim Farley has said the new initiative is called “Ford+”. Ford plans to invest in battery technology and infrastructure that would allow it to manufacture its own batteries. (TechCrunch, Axios, NY Times, Bloomberg, Ford, CN Beta)

Most eVTOL companies are thinking at air taxi scale, offering just 2-5 seats. Lilium is a notable exception, putting forth a whopping 7-seat “air minibus” design and prioritizing longer trips. But there are very few companies thinking at the kind of scale Kelekona’s talking about. (CN Beta, New Atlas, Sina)

Alphabet’s Google and national hospital chain HCA Healthcare have struck a deal to develop healthcare algorithms using patient records, the latest foray by a tech giant into the USD3T healthcare sector. Google and HCA will work to develop algorithms to help improve operating efficiency, monitor patients and guide doctors’ decisions. (The Verge, WSJ, HCA Healthcare, 163)

Samsung, Bayer, and a few other firms have invested USD90M in Ada Health, the firm which works on the Ada health app which uses artificial intelligence to give more accurate results about what may be wrong with user based on symptoms. Following this round of investment, Ada Health has received investments of up to USD150M. (Neowin, PR Newswire, 163)

Amazon and MGM have announced that they have entered into a definitive merger agreement under which Amazon will acquire MGM for a purchase price of USD8.45B. MGM has a vast catalog with more than 4,000 films. (CN Beta, Android Authority, Android Central, Amazon)