6-9 #Grateful : Xiaomi is rumored to enter chipset making industry; SK Hynix has admitted some of its DRAM components included defect; OPPO has applied for the registration of the “OCAR” trademark; etc.

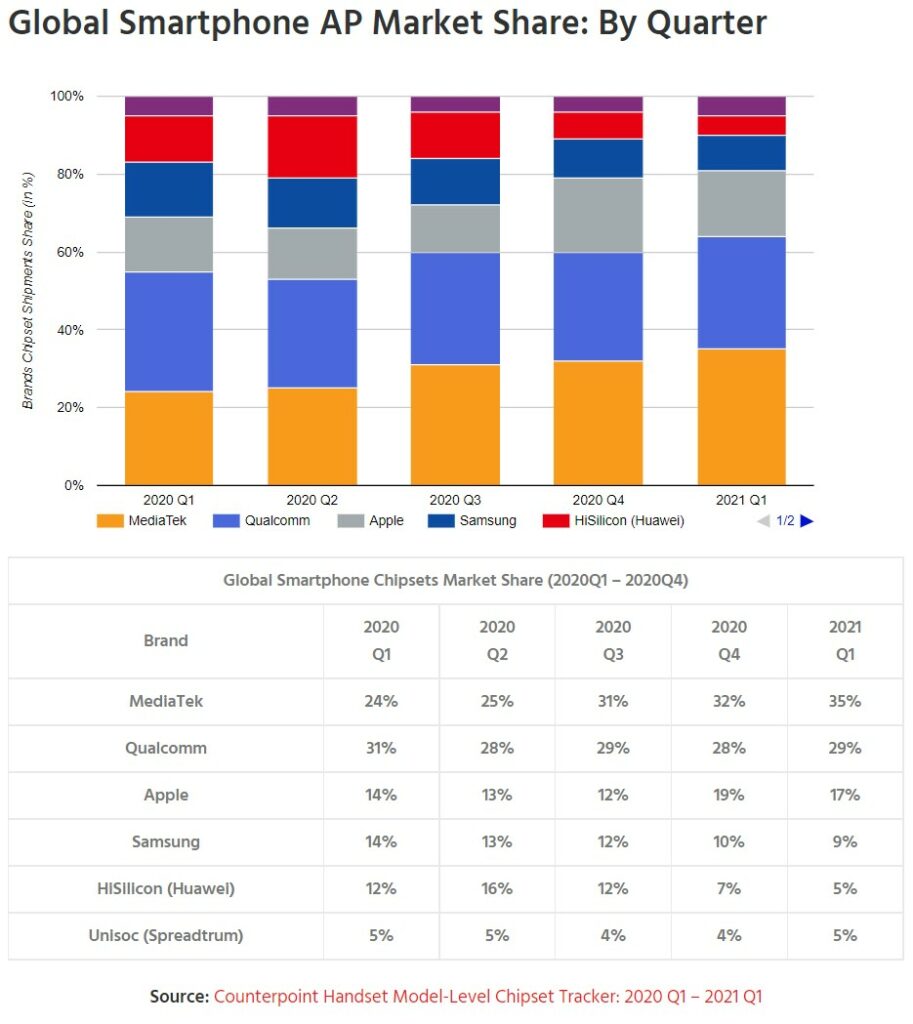

Counterpoint Research has analyzed the Application Processor (AP) market for smartphones in 1Q21 and concluded that MediaTek remains the leader. MediaTek has continued to hold its first place in the table of the largest chip makers over the past 3 quarters and controls 35% of the system-on-a-chip (SoC) market. The annual growth is 11%. Qualcomm took the second place with a share of 29%, which is 2% less than a year earlier. (GizChina, Counterpoint Research)

Goldman Sachs chief Asia economist Andrew Tilton has said that the bank’s analysts are predicting that the global chipset shortage is at its worst at the moment, which suggests that the problem will diminish over 2H21. He has said there have been “noticeable tightening” of supply chains and shipment delays in North Asian economies such as Japan, Taiwan and South Korea, which are involved in the semiconductor supply chain. (Laoyaoba, Barron’s, CNBC)

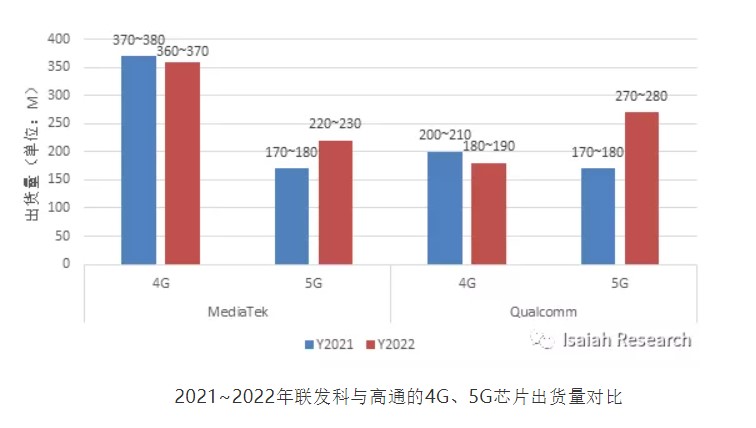

According to Isaiah Research, it is expected that the supply of APs for global smartphones will still be tight in the short term, even if the demand for smartphones in the Chinese and Indian markets has slowed recently. Qualcomm’s 5G AP shipments may increase from 170-180M to 270-280M in 2022, and will fight back with MediaTek in the 5G smartphone market. As for MediaTek, its 5G AP shipments may jump from 170-180M in 2021 to 220-230M in 2022. Therefore, Isaiah Research believes that Qualcomm is likely to begin to increase TSMC wafer input in 2022 to solve the supply problem of its application processor, and then it is expected to improve the supply and demand gap in the smart phone AP market. In summary, Qualcomm may surpass MediaTek in terms of 5G AP shipments in 2022. (Isaiah Research)

Xiaomi is allegedly recruiting new people as it eyes reorganization of the team for the chip production to re-enter the market. Apart from that, it has also started the process of license negotiations with IP providers. While Xiaomi’s aim is to make chips for mobile phones, the next chip getting launched by the company may not be related to phones as it may start with a peripheral chip. (Laoyaoba, Gizmo China, My Drivers)

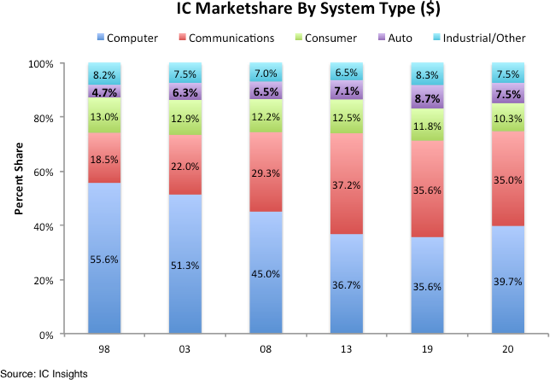

According to IC Insights, since 1998, only the automotive and communications end-use segments have gained marketshare. Driven by the global explosion of smartphone demand, the communications market almost doubled its share of the IC market from 18.5% in 1998 to 35.0% in 2020. Automotive’s market share increased from 4.7% in 1998 to 8.7% in 2019 before falling back to 7.5% during Covid-plagued 2020. (IC Insights, Laoyaoba)

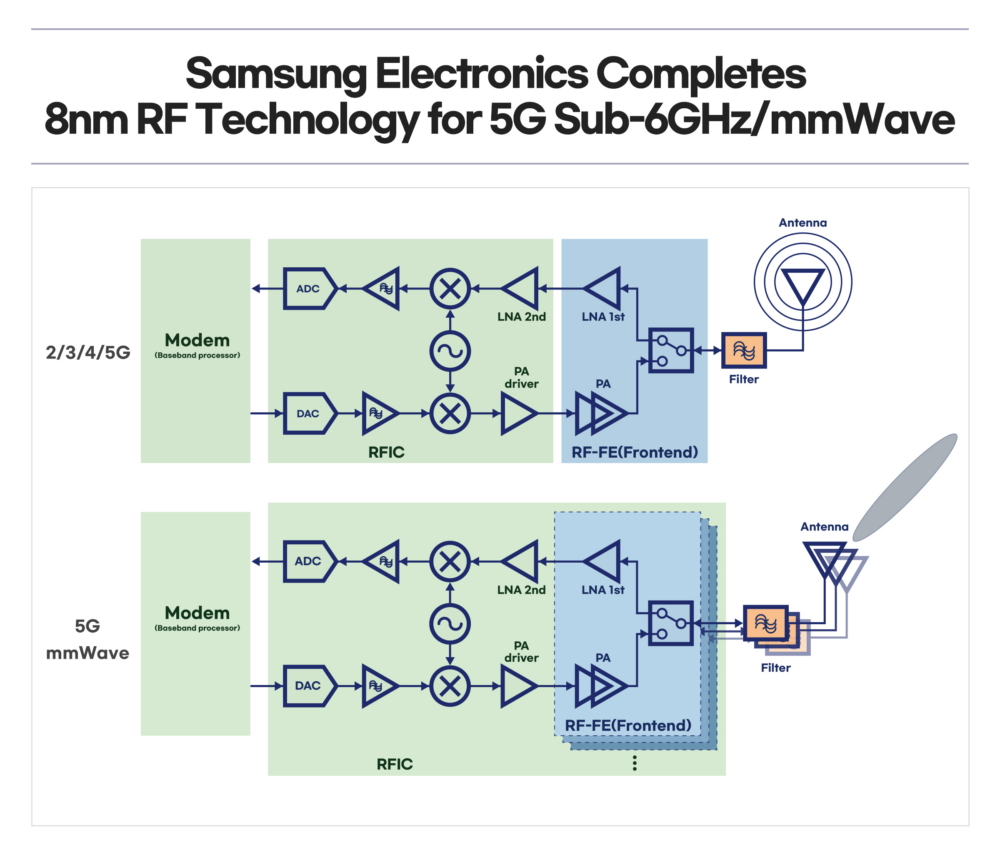

Samsung introduces its newest radio frequency (RF) technology based on 8nm process. Samsung’s 8nm RF process technology is the latest addition to an already broad portfolio of RF-related solutions, including 28nm- and 14nm-based RF. Compared to 14nm RF, Samsung’s 8nm RF process technology provides up to a 35% increase in power efficiency with a 35% decrease in the RF chip area as a result of the RFeFET architectural innovation. (CN Beta, Samsung)

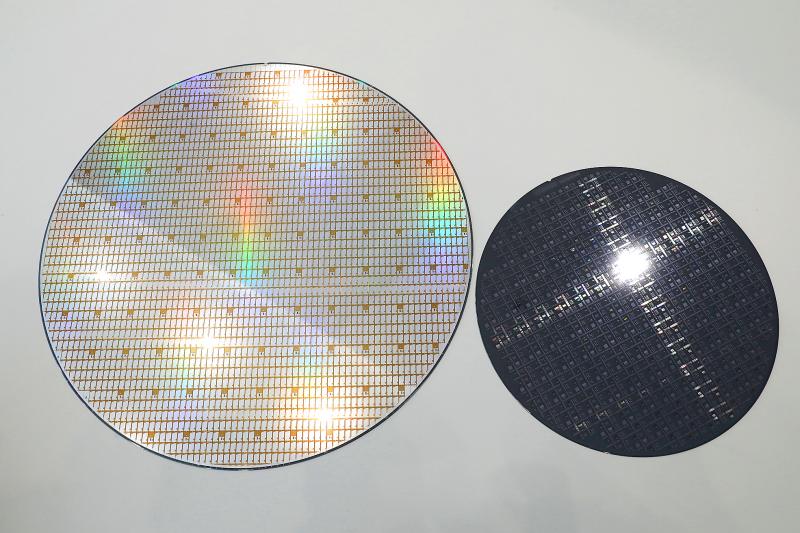

Globalfoundries has announced that the foundry and silicon wafer supplier GlobalWafers have struck a USD800M agreement to add 300mm silicon-on-insulator (SOI) wafer manufacturing and expand existing 200mm SOI wafer production at GlobalWafers’ MEMC facility in O’Fallon, Missouri. GF has indicated that 300mm wafers made at GlobalWafers’ MEMC site in Missouri will be used at GF’s Fab 8 in Malta, New York, and 200mm wafers made at the Missouri site will be used at GF’s Fab 9 in Essex Junction, Vermont. (Digitimes, press, GlobalWafers, TechNews)

In order to digest Apple’s orders, LG Display (LGD) has announced that it will start the Paju E6-3 production line to expand the production capacity of small and medium-sized OLEDs. Omdia expects that Samsung Display will supply 110M units, LGD 50M units and BOE 9M units. In 2020, LGD only supplied 25M units. In 2021, its shipments to Apple have increased by 100% year-on-year. (Laoyaoba, Digitimes)

Nikon Corp is slated to end production of digital single-lens reflex cameras in Japan by the end of Mar 2022, as the digital camera market is shrinking amid the rise of smartphones. Operations at its last-remaining domestic camera factory in Miyagi Prefecture will be transferred to Thailand. The Miyagi factory currently produces the D6 professional-use camera. After the transfer, it will be used for making camera parts and other products. (CN Beta, Japan Times, The Mainichi)

SK Hynix has denied a rumor that it is facing damage worth KRW2T (USD1.7B) over defective DRAMs, saying that it has requested a police probe into such a cyber libel. SK Hynix allegedly is dealing with DRAM defects amounting to 240,000 wafers following its clients’ complaints. However, it has admitted some of its DRAM components included defects, though it says accounts of the issue are overblown. (Neowin, YNA, The Register, TechNews, CNYES, Sina)

Apple is in early-stage talks with China’s battery makers CATL and BYD about battery supplies for its planned electric vehicles. Apple has made building manufacturing facilities in the United States a condition for potential battery suppliers. (Laoyaoba, Reuters, CNET)

Swedish battery maker and supplier to manufacturers including Volkswagen AG and BMW AG Northvolt AB has raised USD2.75B to help pay for extra production capacity and underpin its leading role in Europe. It is developing in northern Sweden to 60GWh from 40GWh to meet increasing demand for electric cars. (CN Beta, Reuters, Bloomberg)

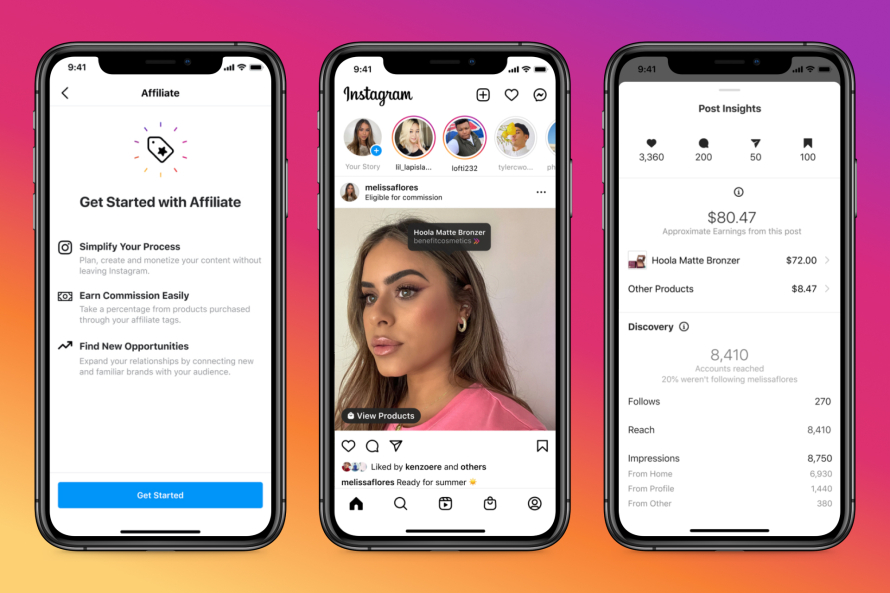

Instagram is working on new tools to help its creators earn more money from the platform. With the new program influencers can earn additional payouts “for hitting certain milestones”. On Instagram, creators can earn “bonuses” by selling a set number of badges within their streams, or streaming with another account. On Facebook, the bonuses will come via “Stars Challenges”, which rewards creators for meeting streaming goals and completing other set tasks. (CN Beta, Variety, Facebook, Dot.LA, Engadget)

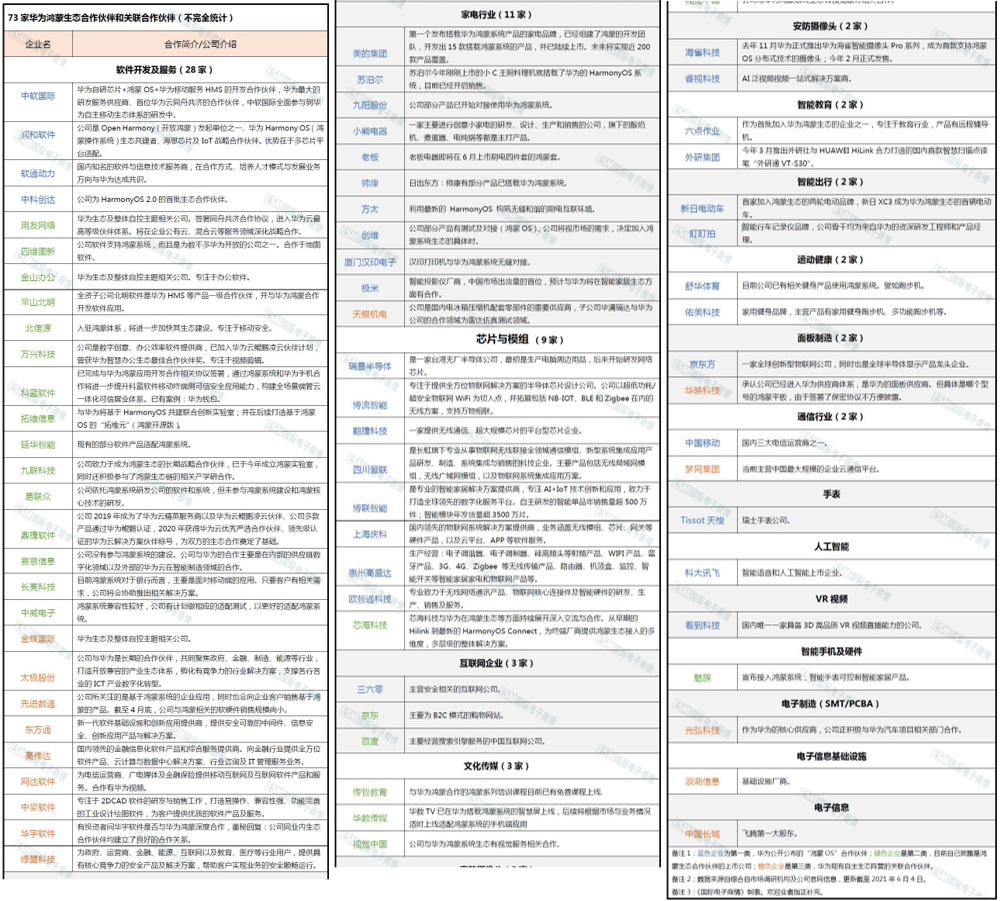

Huawei HarmonyOS 2 eco-partners includes three categories. Huawei’s officially announced partners have 36 partners, 22 listed companies have disclosed that they are HarmonyOS eco-partners, and 15 affiliated partners in the autonomous ecological camp. (My Drivers, CN Beta, ESM China)

Apple has announced that it is opening up Shazam, the audio recognition app purchased in 2017, to third-party apps, even on Android, enabling them to use Shazam’s technology to identify audio. ShazamKit allows developers to match “music to the millions of songs in Shazam’s vast catalog” or by creating prerecorded audio. (Mac Rumors, Apple, TechCrunch)

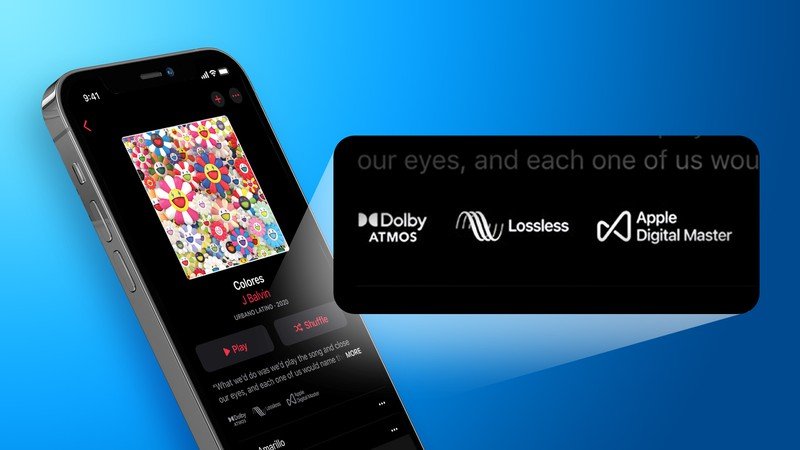

Apple is planning to bring the new Spatial Audio with Dolby Atmos feature to Android devices in the near future, according to a brief mention on the Spatial Audio intro page available in the Apple Music app. The entire Apple Music catalog of 75+M songs will support lossless audio. (Mac Rumors, TechCrunch)

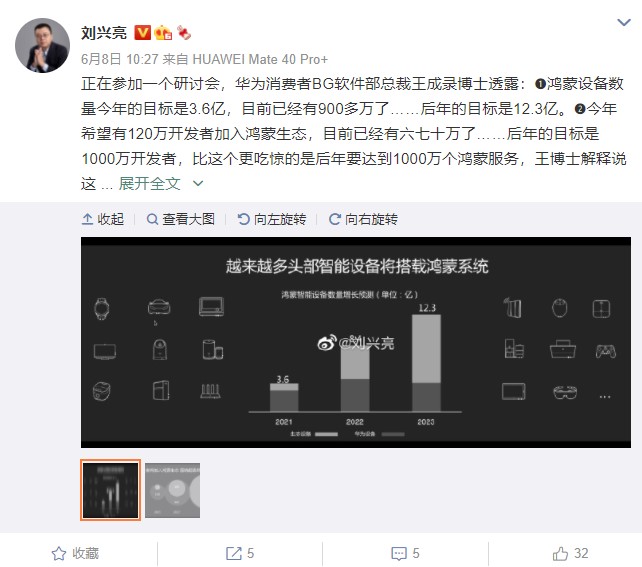

President of Huawei Consumer Business Group Software Department Dr Wang has revealed that over 9M devices are currently running the HarmonyOS operating system. The number of HarmonyOS will exceed 360M in 2021. The software department chief has also announced a big aim to achieve in 2022, which is to install HarmonyOS in 1.23B smart devices. He has further noted HarmonyOS ecosystem currently has 600,000-700,000 developers that will reach around 1.2M developers by 2021. (My Drivers, Sohu, Huawei Central)

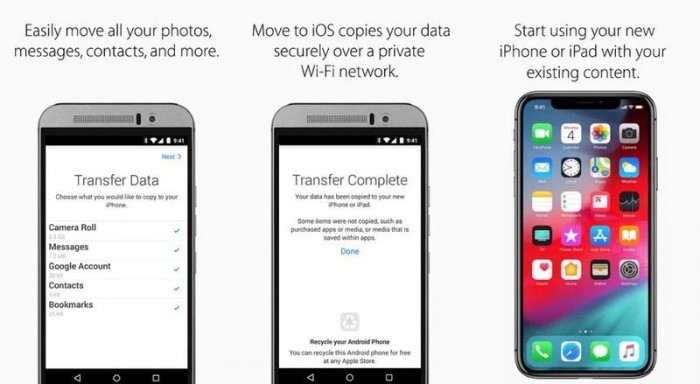

To help new iPhone owners transition from an Android device, Apple uses the “Move to iOS” Android app for transferring content like contacts, message history, photos and videos, web bookmarks, mail account information, calendars, DRM-free songs, wallpapers, and more. (CN Beta, Phone Arena, Mac Rumors)

Apple has released a draft specification of its Nearby Interaction Accessory Protocol, allowing third-party accessory manufacturers to review preliminary hardware and software requirements for developing accessories that interact with the U1 chip in supported Apple devices, like iPhone 11 and iPhone 12 models. (Mac Rumors, Apple)

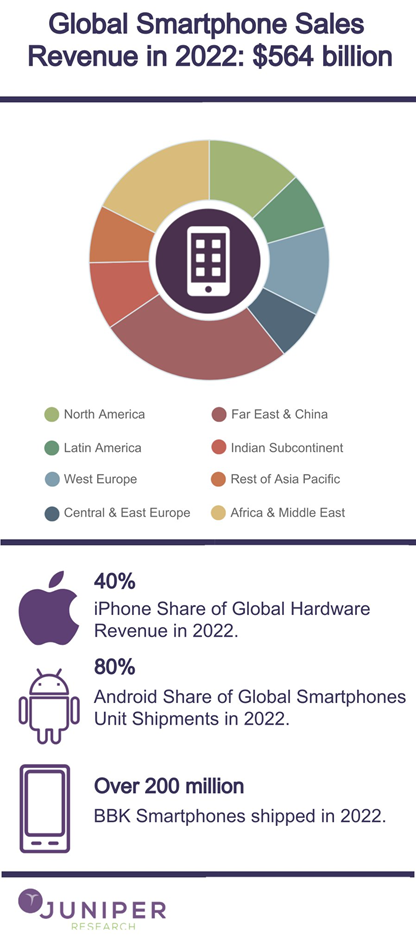

Juniper Research has found sales of Apple iPhones will bring in over USD200B in 2022; nearly 40% of the total smartphone hardware market, despite representing less than 20% of devices sold that year. Although the iPhone is expected to account for nearly half of smartphone sales by 2022, Juniper has Research pointed out that Apple’s market share will be less than 20% in terms of shipments. Juniper Research has added that by 2024, the global average selling price of iPhone is expected to increase to USD700, and if Android devices cannot take advantage of 5G opportunities and expand the coverage of new design features, the price will fall to around USD200. (Laoyaoba, CN Beta, Business Wire, Apple World Today)

vivo Y53s 5G is launched in China – 6.58” 1080×2408 FHD+ v-notch IPS LCD 90Hz, Qualcomm Snapdragon 480 5G, rear dual 64MP-2MP macro + front 16MP, 8+128 / 8+256GB, Android 11.0, side fingerprint, 5000mAh 18W, CNY1,799 (USD281) / CNY1,999 (USD312). (GSM Arena, Nashville Chatter)

Nokia C01 Plus is launched in Russia – 5.45” 720×1440 HD+ 18:9, UNISOC SC9863A, rear 5MP + front 5MP, 1+16GB, Android 11.0 (Go), 3000mAh, RUB6,490 (USD90). (GSM Arena, Nokia)

Apple is due to launch an augmented reality (AR) headset in 2Q22, according to TF Securities analyst Ming-Chi Kuo. The device will provide a video see-through AR experience, so the lens is also needed, and Genius Electronic Optical (GSEO) is a key supplier. (Gizmo China, Apple Insider, TF Securities, GSM Arena)

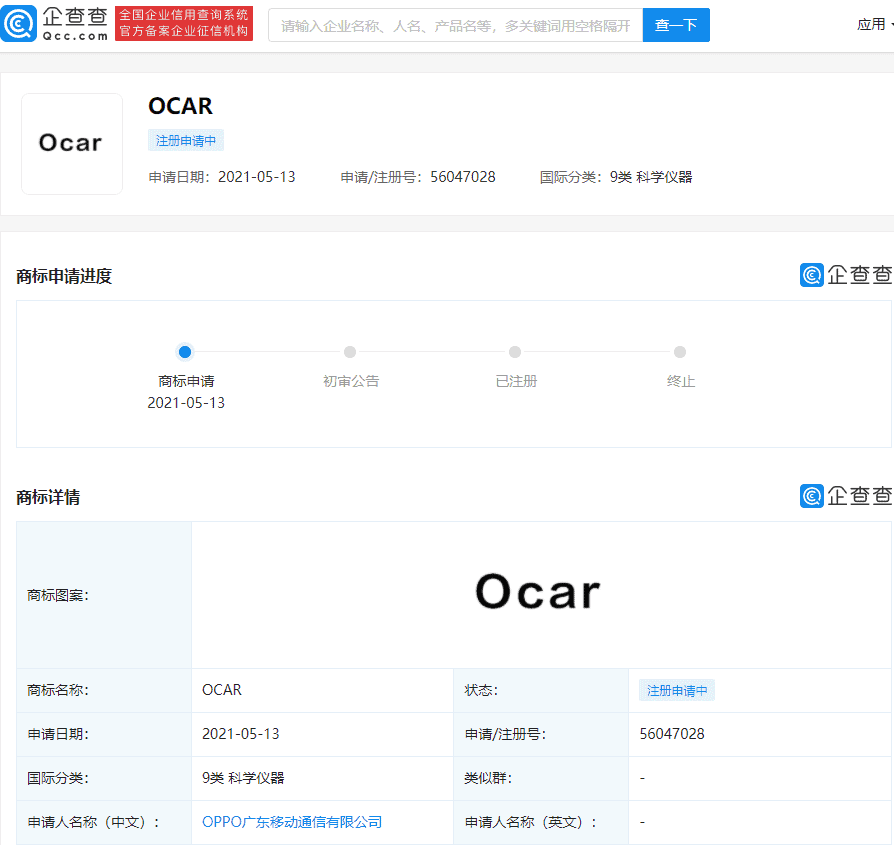

OPPO has applied for the registration of the “OCAR” trademark. The classification of the trademark is “scientific instrument”. OPPO Group is already preparing for car-making matters. (GizChina, Sina, Sohu)