6-14 #Treadmill : The Japanese government will start investigating how Apple and Alphabet’s Google deal with Japanese smartphone makers; Panasonic Liquid Crystal Display (PLD) has decided to withdraw from the LCD panel business within 2021; Midea is actively deploying chips for household appliances; etc.

Mexico’s main autopart association INA forecasts that the severe semiconductor chip shortage that has slammed the brakes on the global auto industry will subside in Jul 2021 and return to normal by the end of 2021. The chip shortage in North America alone has caused the region’s carmakers to cut previously expected output by 1.16M vehicles in May, a figure that has accelerated each month since the start of the year, according to IHS Markit. INA’s head of foreign trade, Alberto Bustamante, has noted that after Mexico’s autoparts output dropped 20% in 2020 in value terms due to the pandemic, a nearly 18% uptick is expected in 2 (Yahoo, Bharat Express, Laoyaoba)

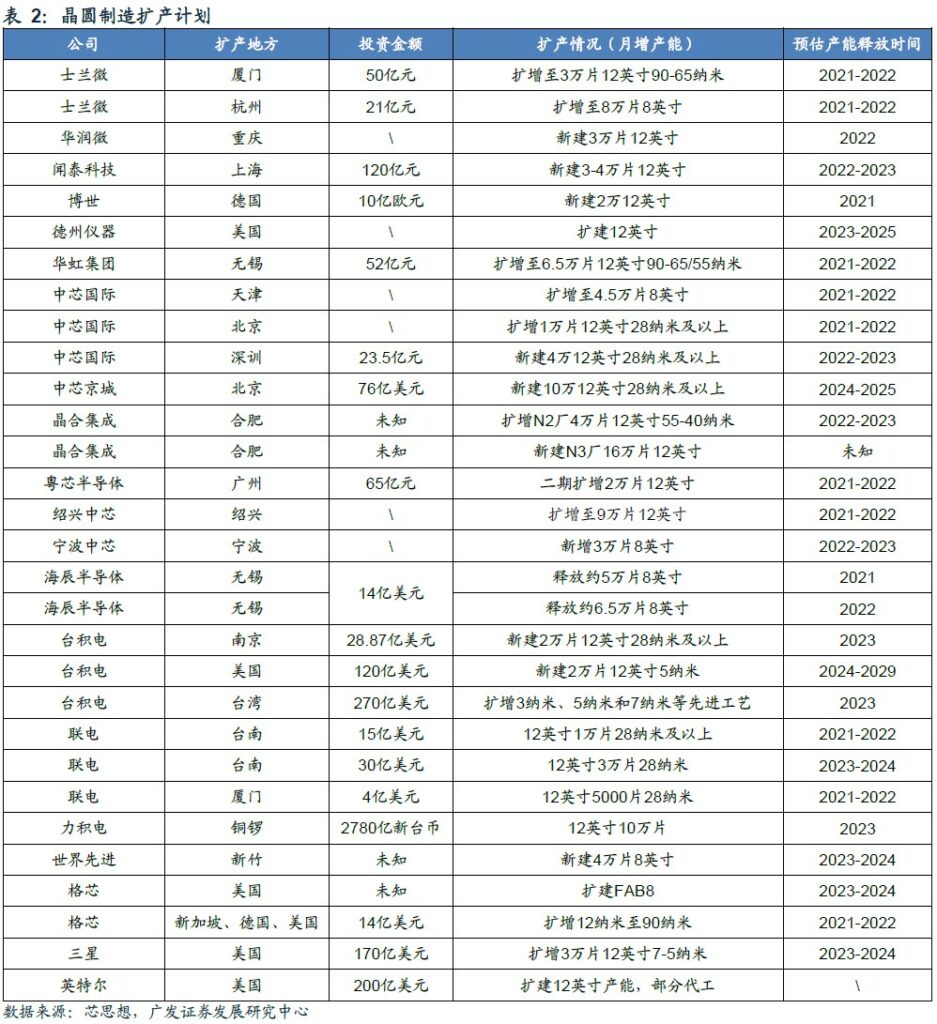

According to GF Securities, the reasons for the shortage of manufacturing capacity are: 1) Due to the pandemic, the fab’s expansion plan originally scheduled for 1H20 is delayed, and the capacity utilization rate continued to rise; 2) Due to the US sanctions against the SMIC incident, various design companies re-adjustment of the cooperative relationship with foundries reduces the efficiency of the industrial chain; 3) High-end products such as automotive semiconductors squeeze low-end products to reduce the production efficiency of fabs; 4) New fabs construction snap up various equipment (composed of thousands of parts), debugging process, capacity ramping, etc. all take time. It is expected that the problem of insufficient semiconductor supply will continue until the end of 2022. (GF Securities report)

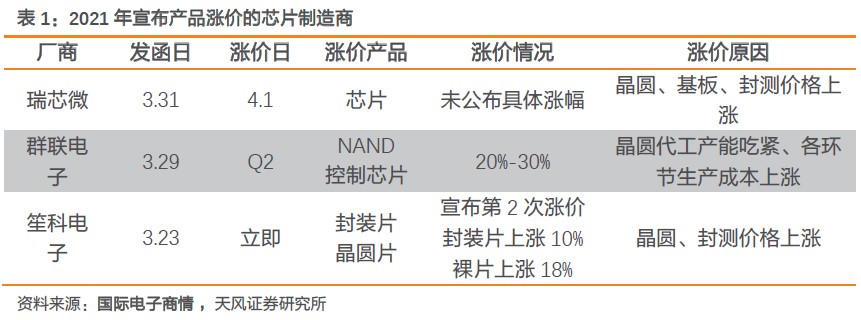

According to TF Securities, the shortage of wafers has become the norm, expanding from the 8” wafer to the 12”. Many chip foundries have been operating at full capacity, but the production capacity is still tight and it is difficult to meet the huge demand for foundries. As a result, domestic and foreign media and the industry chain predict that at least the global chip shortage caused by the wafer shortage will not begin to ease until 2H22. Downstream chip makers are facing shortages of wafers due to shortages of wafers, and for this reason they have raised prices. In 1Q21, electronics manufacturers such as Rockchip, Phison Electronics, and Amiccom have announced that they will increase product prices due to the rising cost of raw materials such as wafers. (TF Securities report)

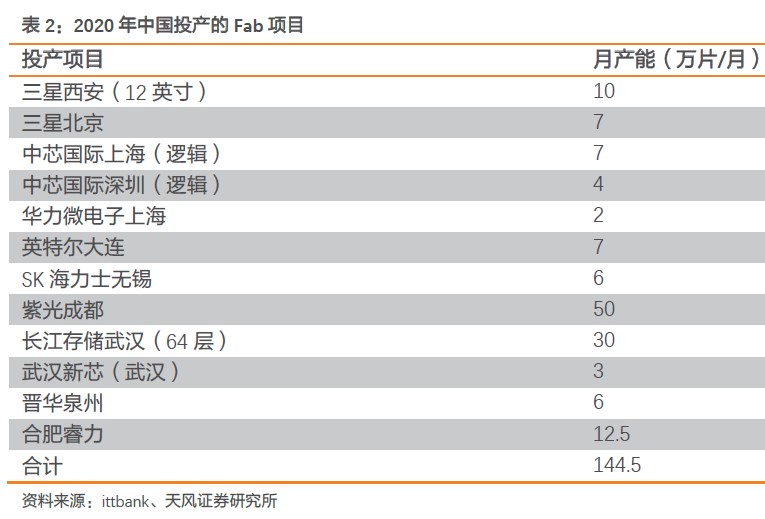

According to TF Securities, to cope with the capacity gap, wafer manufacturers have expanded their capacity. According to statistics, a total of 12 wafer fabs will be built and put into production in Mainland China in 2020, with an additional capacity of 1.445M wafers/month. (TF Securities report)

According to TF Securities, as of Apr 2021, some fab projects under construction in China have been counted. The known investment scale is CNY95.72B, which can provide a production capacity of 450K-550K wafers per month. Semiconductor equipment is the largest investment item in a wafer manufacturing plant, accounting for about 75-80% of the total investment. It is expected that with the construction of the wafer plant capacity expansion project, a large amount of semiconductor equipment will be required. (TF Securities report)

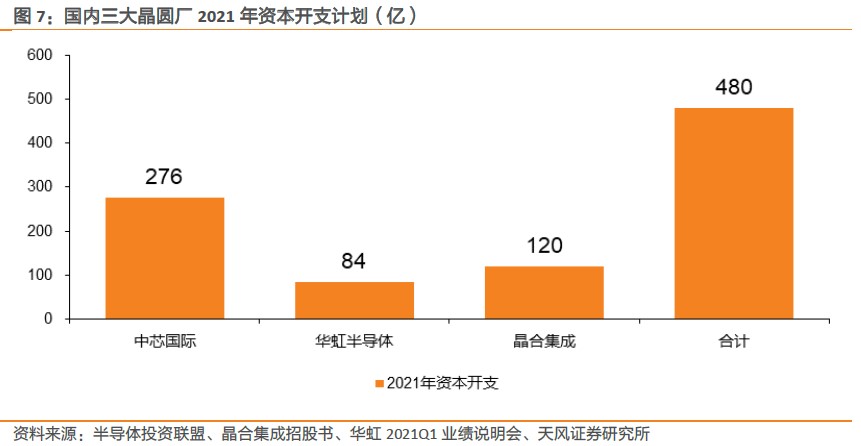

According to TF Securities, among the 3 three domestic fabs SMIC, Hua Hong, and Nexchip, SMIC and Hua Hong have announced their capital expenditure plans for 2021, which are respectively USD4.3B / USD1.3B, and Nexchip is about to raise CNY12B for the construction of Hefei Nexchip Plant with a capacity of 40,000 wafers/month. The total capital expenditure of the 3 fabs will reach CNY48B in 2021, an increase of 11.22% YoY. (TF Securities report)

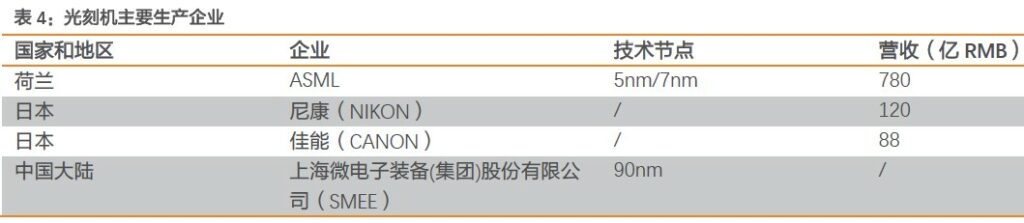

Among the major global companies, ASML (The Netherlands) covers all types of lithography machine products and is in a leading position in the world with the production of high-end lithography machines. Other well-known lithography machine manufacturers include Japan’s Canon and Japan’s Nikon. The technical level of China domestic lithography machines is far from that of overseas leaders. Among them, SMEE has achieved mass production of 90nm node lithography machines. (TF Securities report)

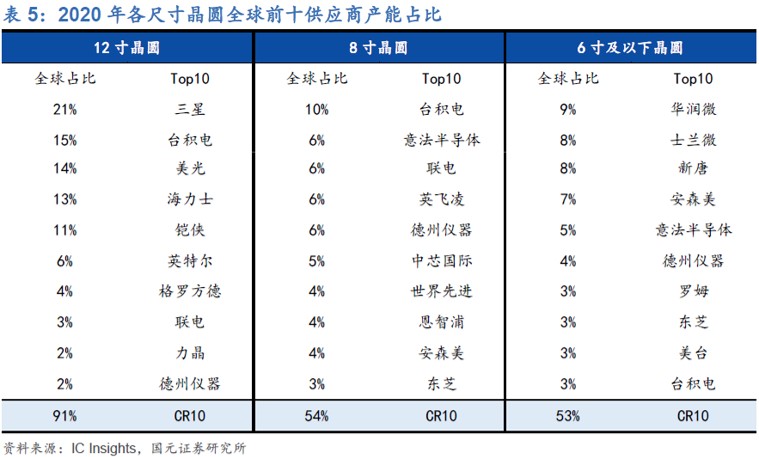

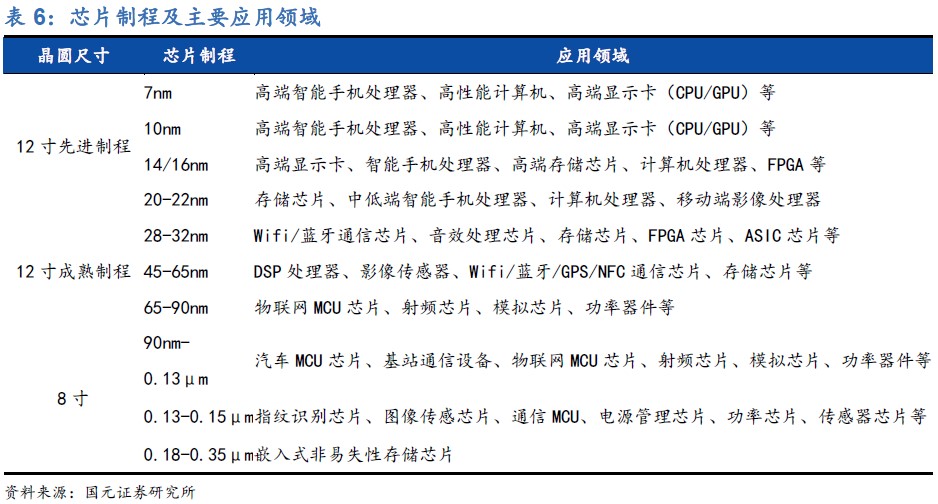

According to Guoyuan Securities, process applications below 16 / 14nm mainly include high-density DRAM and 3D NAND flash memory, high-performance microprocessors, low-power application processors, and advanced ASIC/ASSP/FPGA devices. Most of the production capacity below 20nm in mainland China includes Samsung, SK Hynix, Intel and TSMC. YMTC and SMIC are the only domestic companies that provide process technology less than 20nm. (Guoyuan Securities report)

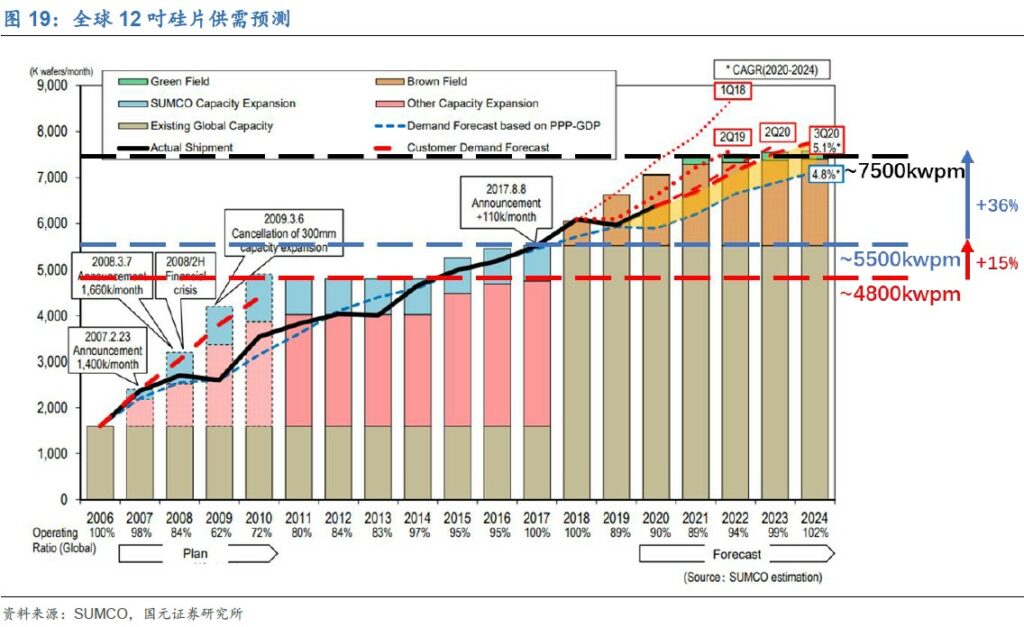

Due to the expansion of the wafer manufacturing line is expected to be limited, and some of the 8” products are gradually shifting to the 12” line due to trends such as performance iteration and cost optimization. In the future, the demand for 12” wafers will have more room for growth, with a compound annual growth rate of 5%. According to SUMCO, the production capacity of 12” wafers remained at 4,800Kwpm in 2011-2014, it is increased by 15% to 5,500Kwpm in 2015-2017. It is expected to increase by 36% to 7,500Kwpm in 2018-2024. (Guoyuan Securities report)

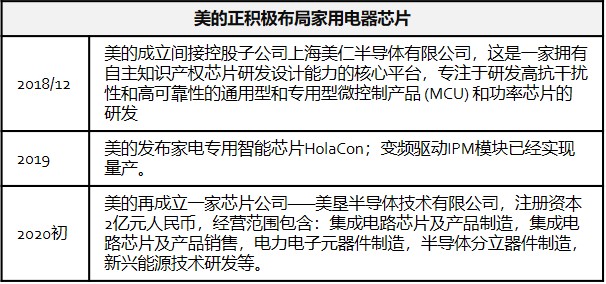

Midea is actively deploying chips for household appliances, and its products cover chip technologies in MCU, power, power, IoT and other related fields. Midea has already deployed chips in the field of household appliances. In the automotive field, although Midea’s Welling Automotive Parts Company has launched core products such as drive systems, thermal management systems, and auxiliary autopilot systems, Midea has stated that it will not involve automotive chips for the time being, and will plan later based on the progress of market expansion. (Laoyaoba, Sina, IT Home)

A shortage of mini-LED components has reportedly been the cause of delays to the production of Apple’s redesigned 14” / 16” MacBook Pros, according to Digitimes. Apple originally planned to mass-produce the 2 notebooks in the 2Q21, but has pushed the schedule back due to the weaker-than-expected yield rates for miniLED modules. (CN Beta, Mac Rumors, Digitimes)

Panasonic Liquid Crystal Display (PLD) has decided to withdraw from the LCD panel business within 2021, and will bid for the production equipment of its Himeji 8.5-generation plant. Including about 1,000 equipments and instruments, the number of subject matter is as many as 9,000. It also includes measuring instruments that can be used in addition to semiconductor and liquid crystal manufacturing processes. The Gen-8.5 production line of the PLD Himeji factory has a monthly production capacity of 40,000 to 50,000 large panels. At the beginning, it was put into the production of LCD screens for TVs, but since 2016, it has shifted to the production of high-end LCD screens for medical use. (Laoyaoba, TechNews, LED Inside)

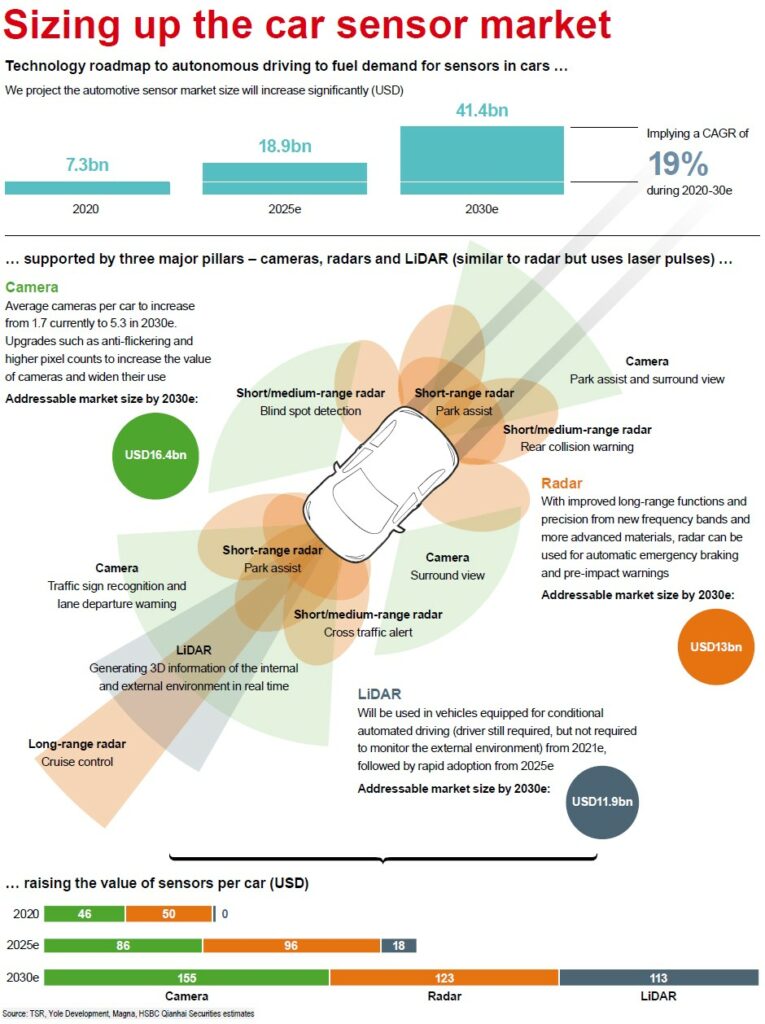

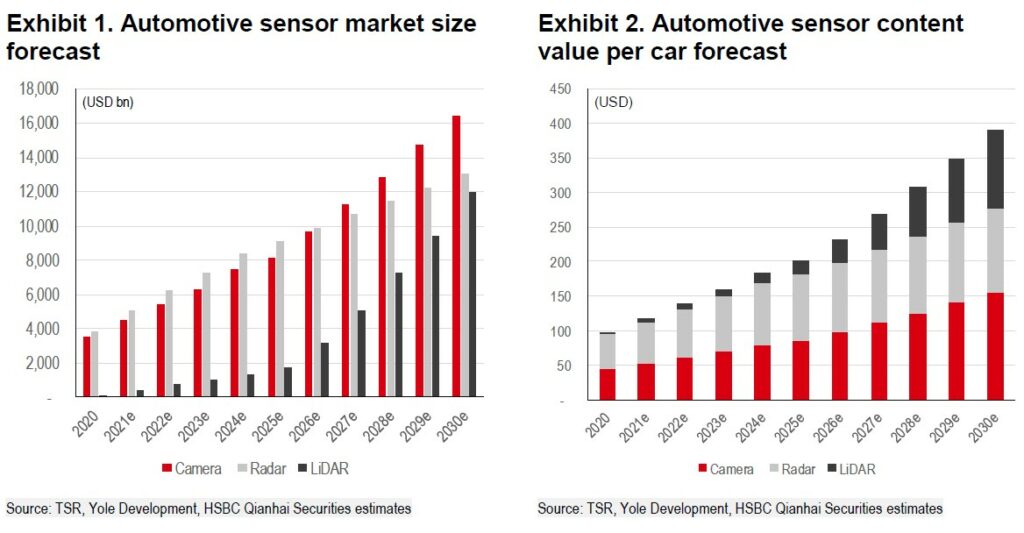

With more drivers switching over to electric cars equipped with all the latest gadgets, that means a lot more demand for increasingly complex sensors. HSBC forecasts the market for them – which includes cameras, radars and laser-based LiDAR – to jump from USD7.3B in 2020 to USD18.9B in 2025 and USD41.4B in 2030. Over 80% of advanced driver-assistance systems (ADAS) and recognition functions are applied to cameras, or used as the major solution. While the average car has just 1.7 cameras currently, a few leading smart car manufacturers like Tesla and Nio are already featuring as much as 8-12 cameras. HSBC expects the market for camera modules in cars to increase from USD3.5B in 2020 to USD8.1B in 2025 and reach USD16.4B in 2030. (HSBC report)

LiDAR is similar to radar but uses laser pulses instead. It can generate a 3D image of the surrounding environment and is faster. The technology is changing from mechanical spinning LiDAR, which is prone to vibrations, to semi-solid and or pure solid-state LiDAR. HSBC estimates long-range detection LiDAR will be used in vehicles equipped for Level 3 autonomous driving (conditional automation) in 2021, followed by scalable mid-range and short-range LiDAR adoption from 2025e. HSBC estimates by 2030 the total addressable market size will increase to USD11.9B, from almost nothing today. (HSBC report)

Manufacturers are reportedly seriously considering releasing smartphones without ports. And according to Xiaomi, there will be commercial versions of smartphones without a charging port in 2022. (GizChina, CN Beta, Sina)

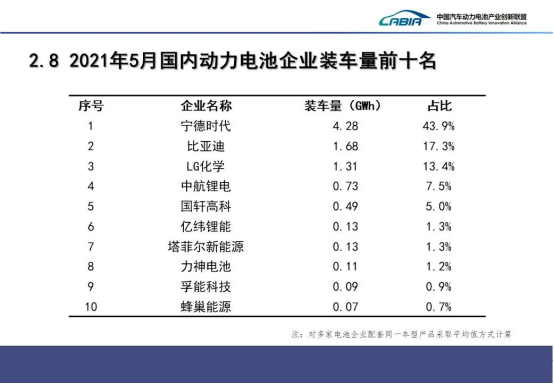

According to data from the China Automobile Association, in May 2021, the production and sales of new energy vehicles will be 217,000, an increase of 1.5 times and 1.6 times respectively YoY, continuing to refresh the historical record of the month. From Jan to May of 2021, the production and sales of new energy vehicles will be 967,000 and 950,000 respectively, a YoY increase of 2.2 times. The growth of new energy vehicles will of course drive the increase in the number of power batteries installed. (Laoyaoba, IT Home, Sina)

Shenzhen-based BYD chairman and president Wang Chuanfu has indicated that BYD has decided to insist on using lithium iron phosphate batteries since 2008. The main reason behind this is that ternary batteries use a lot of cobalt and nickel. China has no cobalt and very little nickel. China cannot switch from oil to cobalt and nickel. (My Drivers, Sohu, Sina, Min.news, India Times)

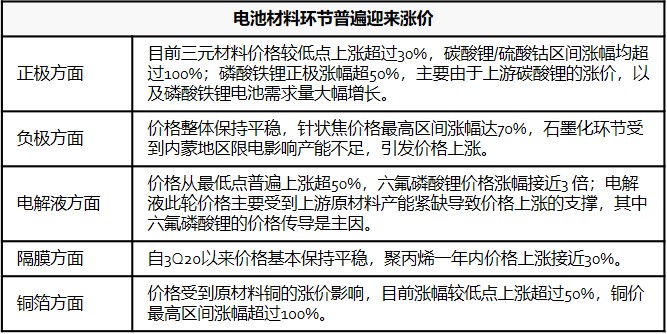

According to Pingan Securities, since 2H20, with the strong recovery on the demand side, the electric vehicle industry chain has experienced price increases in multiple links in the middle and upper stream the industry chain. The price increase in some streams is mainly due to the slower capacity expansion than the recovery of demand, which leads to an imbalance between supply and demand, such as lithium carbonate, lithium hexafluorophosphate, VC, lithium iron phosphate, etc. The price increase in some streams is mainly driven by the price increase of raw materials, such as cathodes and electrolysis, liquid, negative electrode, etc. (Pingan Securities report)

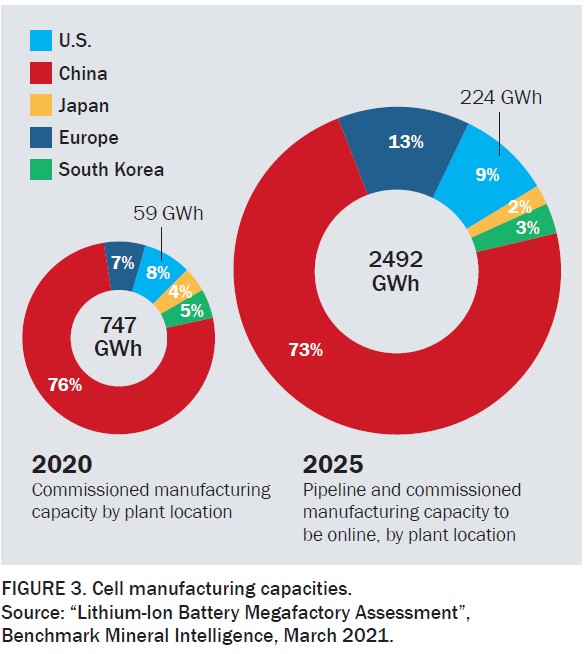

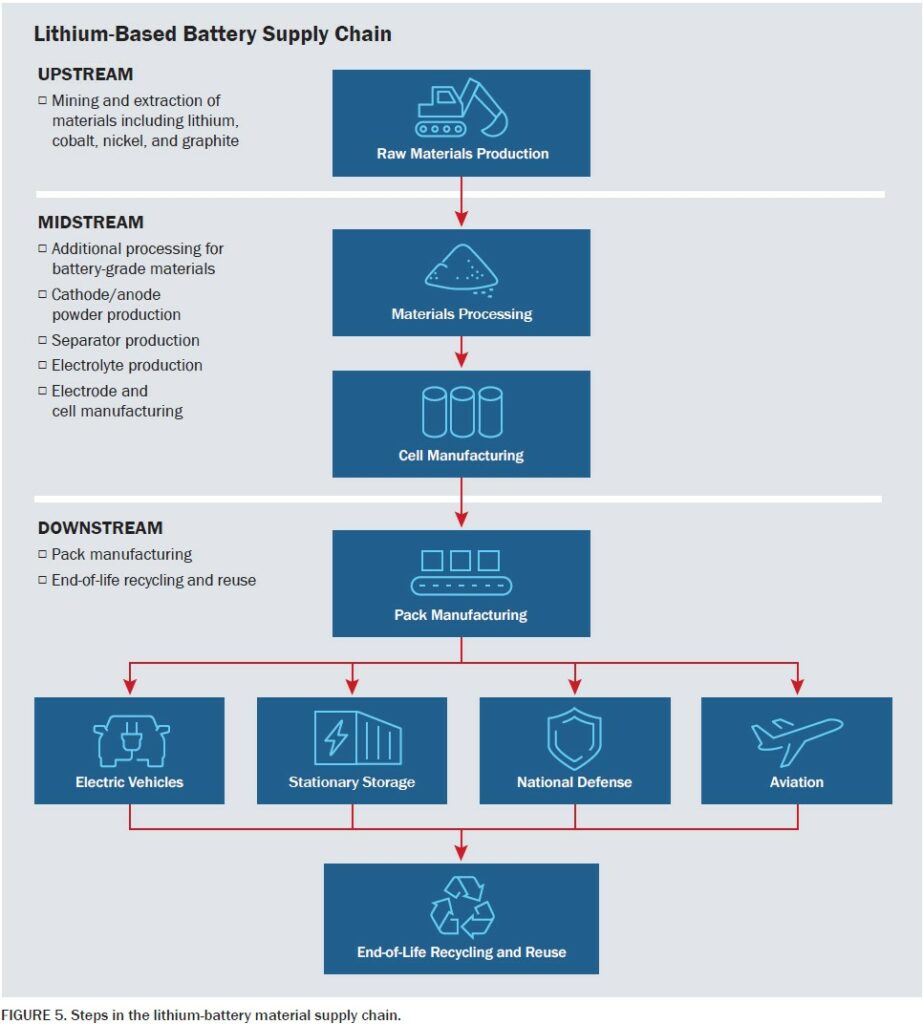

The Federal Consortium for Advanced Batteries (FCAB) has released the National Blueprint for Lithium Batteries 2021–2030 to guide investments in the urgent development of a domestic lithium-battery manufacturing value chain. (Energy, blueprint, Green Car Progress, CN Beta)

Sony has created an environmentally friendly and sustainable paper material called “Original Blended Material” based on bamboo, sugarcane, and recycled paper, the raw material of which is strictly controlled. The material does not require additional coloring since the role of dyes is played by various shades of the raw material itself. Sony intends to use Original Blended Material for several other projects in the future. (CN Beta, Sony, Techobig)

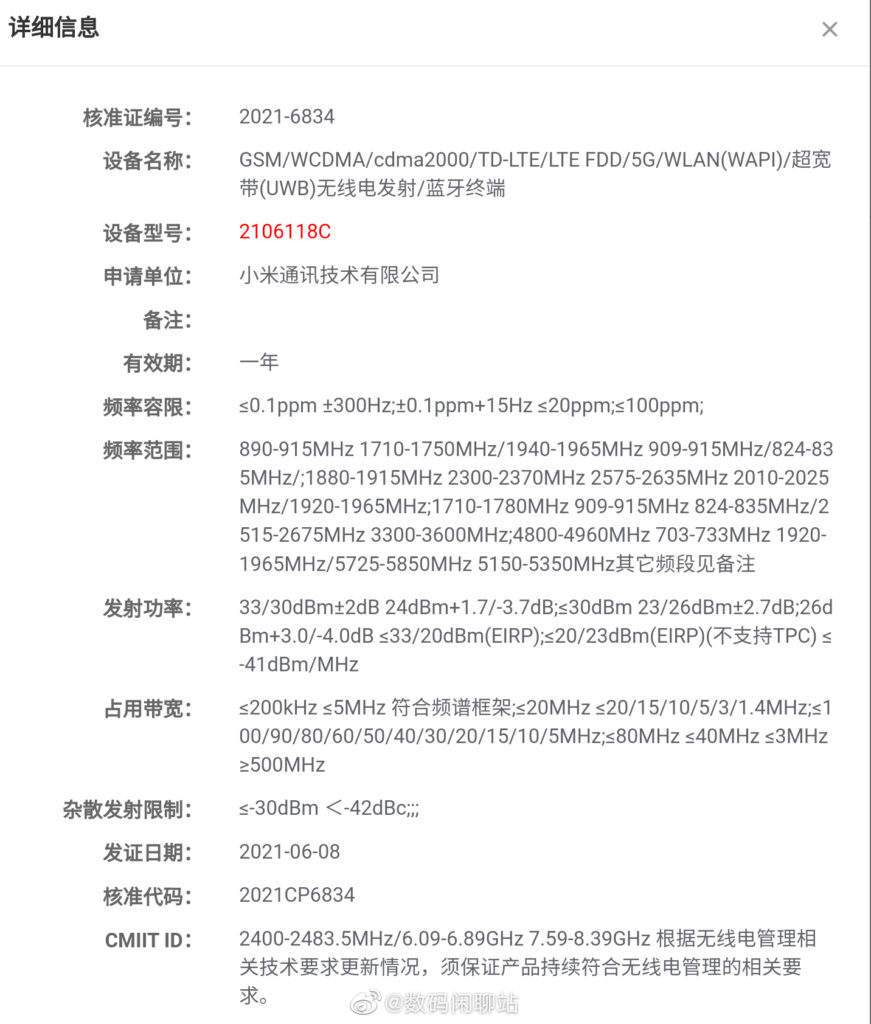

Xiaomi is reportedly planning to release a flagship that features UWB (ultra-wide band) tracking technology and an under-display selfie camera. Xiaomi could be planning to introduce UWB-compatible, trackable accessories. (GSM Arena, Phone Arena, Weibo)

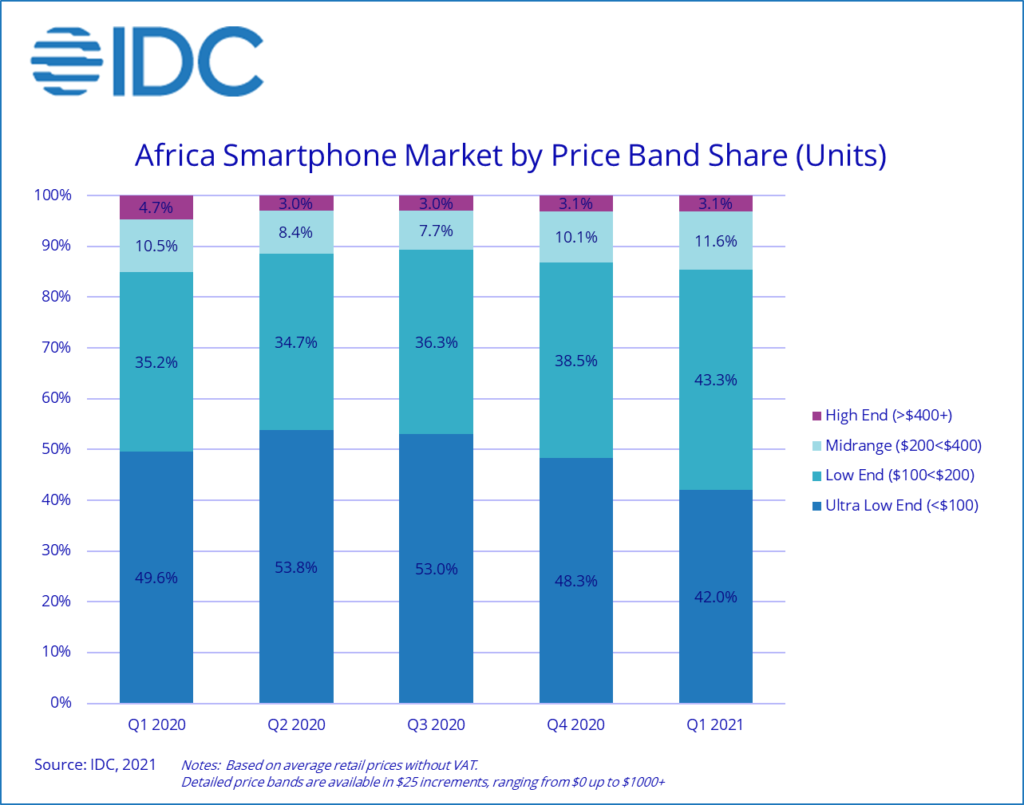

IDC’s data shows that Africa’s overall mobile phone market enjoyed YoY growth of 14.0% in 1Q21 to total 53.3M units. The region’s smartphone market grew 16.8% over the same period to 23.4M units, while the feature phone market was up 11.9% to 29.9M units. Transsion brands (Tecno, Infinix, and Itel) continued to lead Africa’s smartphone space in 1Q21, with a combined unit share of 44.3%, followed by Samsung and OPPO with respective shares of 22.9% and 8.3%. (Laoyaoba, IDC)

Since the Redmi Note 10 series launched in India in early Mar 2021 Xiaomi has sold 2M units worth over INR30B. Those joined the 200+ million Redmi Note phones sold globally since the family was first introduced. (GSM Arena, GizChina)

The Japanese government will start investigating how Apple and Alphabet’s Google deal with Japanese smartphone makers, which could lead to tightening antitrust regulations. Apple’s iOS and Google’s Android software stands at more than 90% of the Japanese smartphone market The probe will include input from executives from domestic smartphone handset makers as well as manufacturers of smart speakers and personal computers. (Apple Insider, CN Beta, Mercury News)

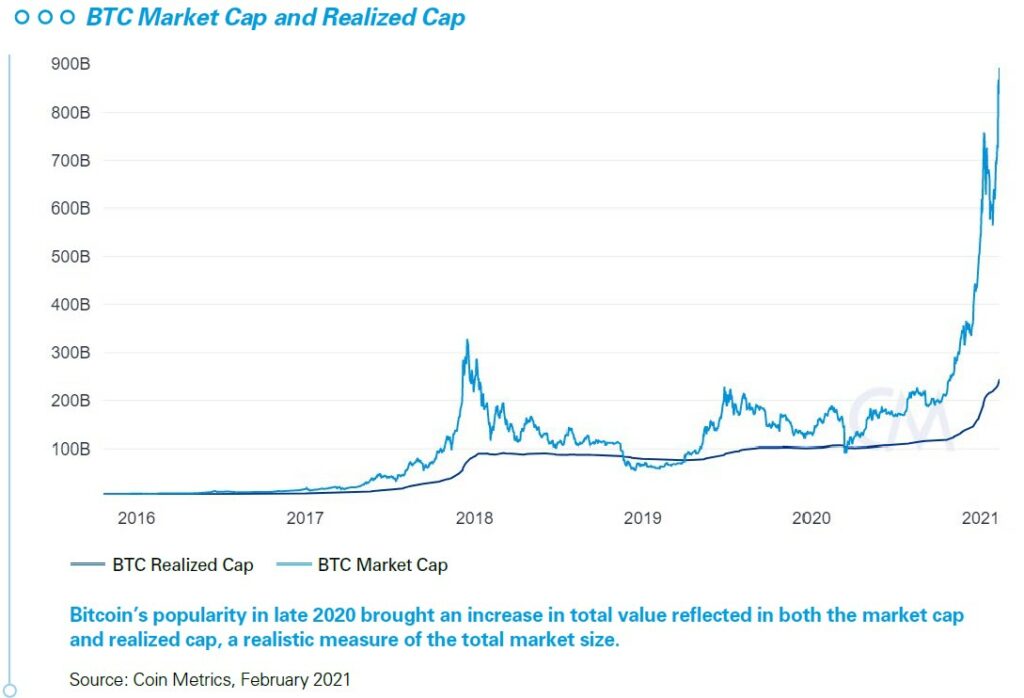

Measured by usage, adoption and value, bitcoin’s surge over time is impossible to ignore. According to Coin Metrics data as of Jan 2021, active bitcoin addresses (wallets with activity in the past 30 days) numbered nearly 1M per day, the highest in history and nearly doubling since a short-lived valley in 2018.15 Notably, addresses holding greater numbers of bitcoin (2,000+ equating to roughly USD2M in dollar value) are still a minority, but started rising through 2020 and into 2021—a further sign of increased institutional investments and holdings. (KPMG report, KPMG report)