6-20 #HappyFather’sDay : German Economy Minister Hubert Aiwanger is in talks with Intel to build a European chip factory; Huawei has indicated that the company has no intention of restructuring chip design subsidiary HiSilicon; Corning has announced that it will expand its display glass processing plant in Chongqing Liangjiang New District; etc.

Intel CEO Pat Gelsinger has indicated that he expects 10 “good years” of growth in the semiconductor industry. The remark suggests that Intel’s investments in chip production, such as plans to spend USD20B to build a chip fabrication plant in Arizona, will create capacity that will be used even after the current global microchip shortage abates. Qualcomm CEO Cristiano Amon said he sees an opportunity to partner with Intel and its foundry service. (My Drivers, CNBC, CNBC, CNBC, SemiWiki)

German Economy Minister Hubert Aiwanger is in talks with Intel to build a European chip factory in a bid to counter supply bottlenecks that have hampered production in the automotive sector. In recent months, the U.S. chipmaker has been seeking EUR8B (USD9.5B) in public subsidies to build a semiconductor manufacturing site in Europe. (CN Beta, Tom’s Hardware, Technosports, Channel News Asia, Reuters)

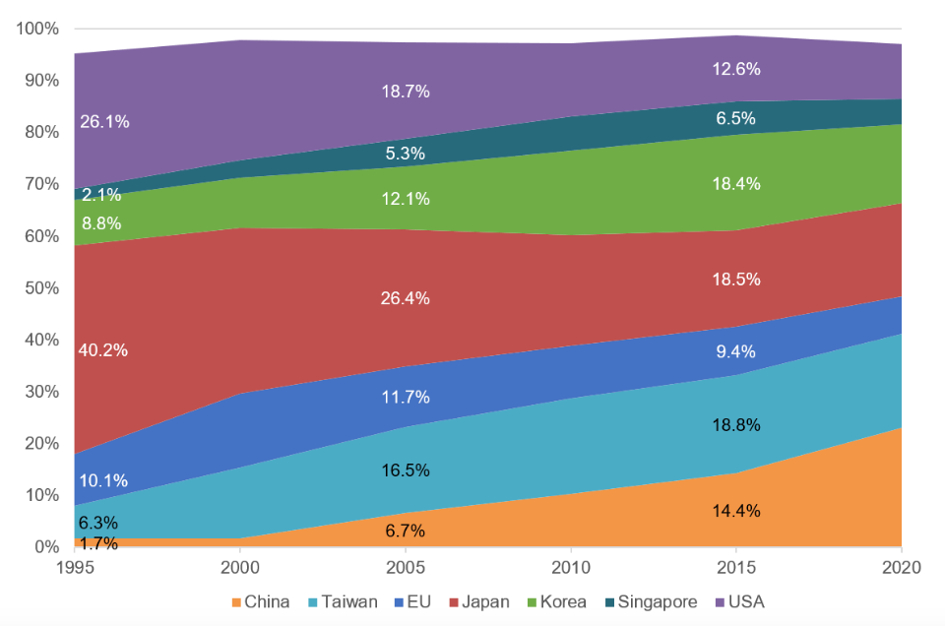

China has nearly doubled its share of global wafer fab capacity in the last 5 years, rising to about 22.8%, according to a chart released by the European Semiconductor Industry Association. China went from about 14.4% of global production in 1995 to 22.8% in 2020. Europe has fallen from 9.4% to 7.2% over the same period. The US is also a relatively small chip manufacturer and provided 10.6% of global wafer capacity in 2020, down from 12.6% 5 years before. (Laoyaoba, EE News Europe)

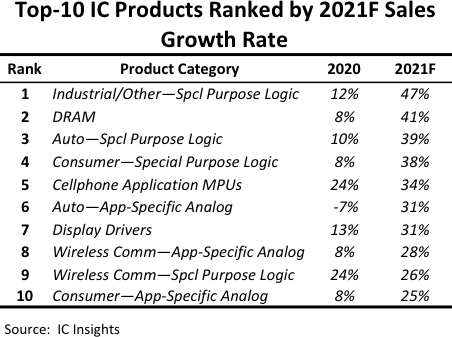

IC Insights has presented its latest forecasts for the 2021 through 2025 IC market segmented by 33 major product types, 32 of which are expected to register growth in2021. Continued per-bit pricing strength in the DRAM and NAND flash markets as well as a better than expected outlook for many of the logic and analog IC product categories were the driving forces behind IC Insights’ full-year 2021 IC market forecast being raised from 19% to 24%. Even if excluding memory, the total IC market is expected to be up by 21% in 2021. After dropping 8% in 2019, the analog IC market registered a small 3% increase in 2020. For 2021, the analog market is expected to surge and display 25% growth with a 20% jump in unit shipments. (IC Insights, Laoyaoba)

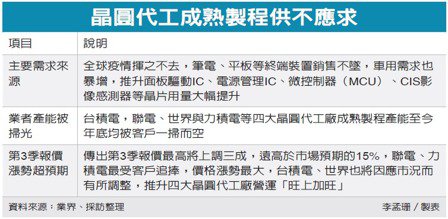

The shortage of mature wafer foundry processes has intensified. According to market sources, the 3Q21 quotations will increase by up to 30%, far higher than market expectations of 15%. As Europe and the United States gradually get out of the epidemic, demand continues to rise, coupled with higher-than-expected price increases, the traditional peak season operations of the 4 major fabs in Taiwan will be booming more in 3Q21. UMC and Power Semiconductor Manufacturing (PSMC) have the largest price increases, and TSMC and VIS will also adjust according to market conditions. (Laoyaoba, CSIA, UDN, WallStreet CN, Sina)

Catherine Chen, a Huawei director and senior vice president, has indicated that the company has no intention of restructuring chip design subsidiary HiSilicon. HiSilicon had more than 7,000 workers on its payroll in 2020. Huawei is privately held and unaffected by external forces, and its management has clearly shown it intends to retain HiSilicon. HiSilicon continues to develop semiconductors and can manage despite the sanctions, which are expected to remain for 2-3 years. (Laoyaoba, Sina, IT Home, Gizmo China, Huawei Central, Nikkei Asia)

Li Dongsheng, chairman of TCL Technology, has said that it will take at least 5 years for the Mainland China to solve the problem of high-end chips. It would be great if China could localize the 5nm chip manufacturing equipment. He has pointed out that this round of chip supply shortage will be gradually resolved in the next 3-6 months. He believes that the bottleneck of the development of Mainland China chips lies in 2 aspects. There is still a big gap between the manufacturing process, capacity and technical team of the United States, Japan and South Korea. In addition, it will take at least 3-5 years for China to solve the problem of high-end chips with limited chip core manufacturing equipment. (Laoyaoba, Sina)

The industry happens to be in a boom cycle. Today, chip demand remains strong. And some fab projects have been accelerated to meet this demand, according to Christian Dieseldorff, an analyst at SEMI. In total, the number of 200mm fabs is expected to increase from 212 in 2020 to 222 in 2022, according to SEMI. In comparison, the number of 300mm fabs is expected to increase from 129 in 2020 to 149 in 2022, according to SEMI. There are fewer 300mm fabs, but they require newer and more expensive equipment. As a result, fab equipment spending in the 300mm market is expected to grow from USD78B in 2021 to USD88B in 2022. After years of sizzling growth, the 200mm equipment market is slowing. Fab equipment spending in 200mm is expected to decline from USD4.6B in 2021 to USD4B in 2022. (Laoyaoba, SEMI Engineering, Sohu)

Japan-based PCB maker Meiko Electronics has announced plans to make total investments of JPY50B (USD453.72M) in 2021-2024 fiscal years, with the focus placed on expanding capacity for automotive PCB to meet robust demand for ADAS and electrical vehicle applications. The company has said it will build a new automotive PCB plant at Japan’s Yamagata prefecture in fiscal 2022 (starting 1 Apr 2022), which will boost its total capacity for high-end PCB products to triple the existing level. (Digitimes, press)

Taiwan-based pure-play foundry Powerchip Semiconductor Manufacturing (PSMC) continues to see orders demanding 8” and 12” wafer fabrication services pull in, and is in talks with clients about orders for 2023, according to company chairman Frank Huang. (Digitimes, Laoyaoba)

Advanced Micro-Fabrication Equipment China (AMEC) has announced the launch of the Prismo UniMax system (UniMax) – an advanced Metal Organic Chemical Vapor Deposition (MOCVD) tool engineered for high performance Mini LED production which enables LED manufacturers enhance productivity and achieve lower cost of ownership (CoO). The system is the newest addition to AMEC’s portfolio of Prismo MOCVD products that are used by most of leading GaN-based LED manufacturers in the world. (Laoyaoba, PRN Asia, Yahoo)

Corning has announced that it will expand its display glass processing plant in Chongqing Liangjiang New District. To serve local customers more efficiently, Corning will add Gen-8.5 and above display glass substrate hot-end process capabilities in Chongqing. The project is expected to be officially put into production in 2023. (Laoyaoba, Corning)

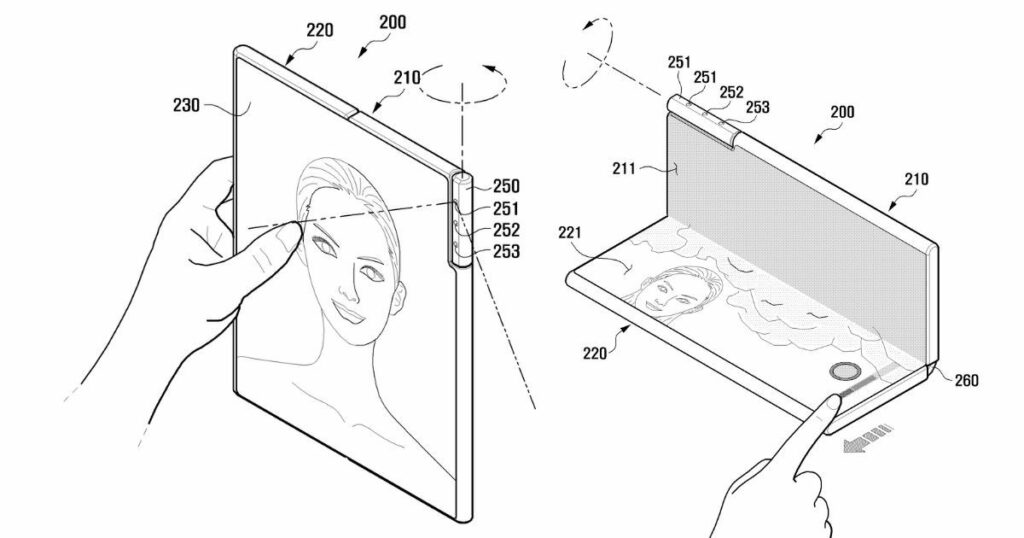

Samsung’s patent indicates that the company is working on a foldable phone design with a rotating camera stalk. The stalk placed on the phone’s top corner or outside edge rotates 180-degrees to face the screen or rear of the foldable phone. The camera body can do this automatically through a sensor that detects device orientation. (Android Authority, WIPO, MySmartPrice)

Visionox has showcased the development of its second generation camera under display (CuD) dubbed “InV see Pro”. It touts a new and improved pixel arrangement for better clarity and less fogging on the embedded selfie camera. (GSM Arena, Weibo, EET-China)

Canon’s Chinese subsidiary Canon Information Technology has reportedly installed cameras using artificial intelligence (AI) in its offices across China that recognize smiling faces only. The camera will only allow workers who put up a smile into the facilities. The camera utilizes AI-enabled “smile recognition” technology in its China offices. (Gizmo China, The Verge, Financial Times)

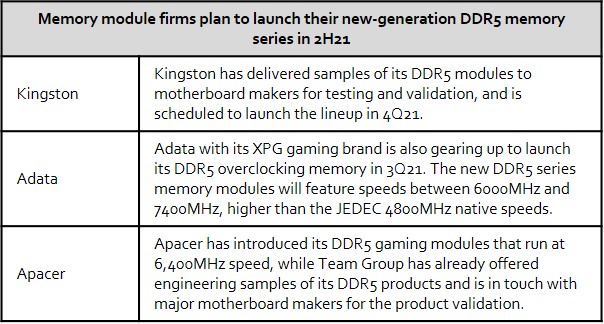

Memory module firms including Kingston Technology, Adata Technology, Apacer Technology and Team Group all plan to launch their new-generation DDR5 memory series in 2H21. Motherboard makers have already kicked off validation for DDR5 products ahead of schedule, and are all striving to be among the first players capable of providing solutions based on new-generation PC processors to be released by Intel and AMD later in 2021. (Digitimes, press, Laoyaoba)

Huang Hexie, chairman of Samsung China Semiconductor, has said that as a key construction project in Shaanxi Province, the second phase of Samsung’s high-end memory chips is progressing smoothly. It is currently in the final stage of equipment installation and commissioning, and mass production is expected to begin in 2H21. In addition to the USD11B investment in Samsung’s high-end memory chip Phase I project and packaging and testing project, Samsung has invested an additional USD15B to build the memory chip Phase II project, with a cumulative investment of USD26B. (Laoyaoba, Sohu, Doit)

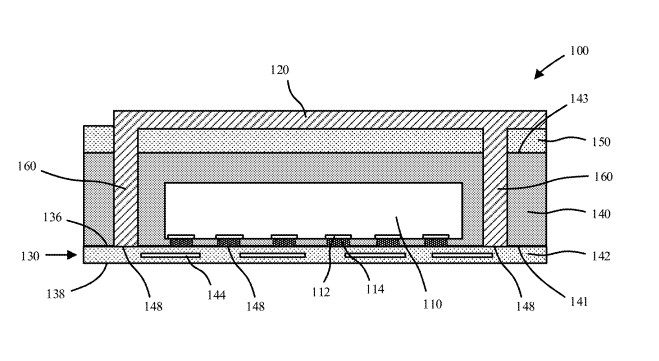

Apple’s patent titled “Packaging Technologies for Temperature Sensing in Health Care Products” implies that a future Apple Watch will be able to sense the temperature of the wearer’s skin. Apple says that the development of “packaging technologies such as system in package”, has meant that it is “possible to develop miniaturized systems and devices”. (Apple Insider, USPTO, Sohu)

Wabtec and General Motors have announced they will collaborate to develop and commercialize GM’s Ultium battery technology and HYDROTEC hydrogen fuel cell systems for Wabtec locomotives. The companies have signed a nonbinding memorandum of understanding for GM to engineer and supply its battery and fuel cell systems for Wabtec locomotives. Wabtec has developed and tested a battery-electric locomotive called FLXdrive, which is powered by about 18,000 battery cells. (CN Beta, CNBC, Reuters, General Motors)

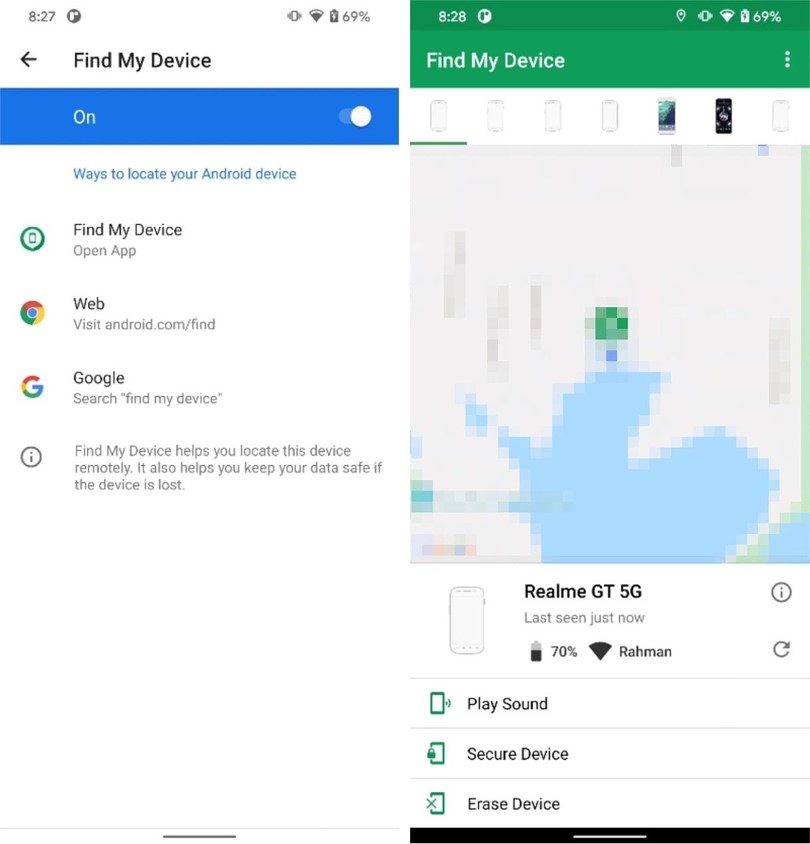

Google already offers a way to locate device remotely via the Find My Device app and secure data if phone is lost. However, the app can find only the devices that are signed into Google account. Now, Google may be developing a new feature to help other Android users find their lost devices through crowdsourcing, like Apple’s Find My network. (Neowin, XDA-Developers, CN Beta)

In 2019, Xiaomi, OPPO and vivo have joined forces to create the Mutual Transfer Alliance (MTA), which a standardized way to transfer files between devices (phones and computers) locally over a 20MB/s wireless connection. Other companies including OnePlus, Meizu, ZTE, Black Shark and HiSense, ASUS have joined the alliance. Now, Samsung has also joined the list. (GSM Arena, Twitter, East Money, IT Home)

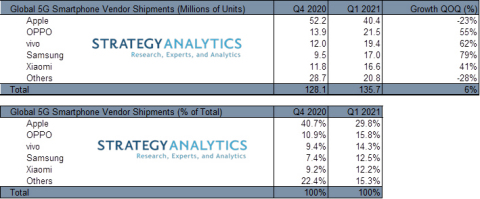

According to Strategy Analytics, Samsung and vivo are the world’s fastest growing 5G smartphone vendors in 1Q21. Samsung grew 79% QoQ, while vivo jumped 62% QoQ. Global 5G smartphone shipments grew a healthy 6% QoQ and hit 136M units during 1Q21. Demand for 5G smartphones remains very strong, particularly in China, United States, and Western Europe. Strategy Analytics forecasts global 5G smartphone shipments to reach a record 624M units for the full-year 2021, soaring from 269M in full-year 2020. (GSM Arena, Strategy Analytics)

LG Electronics is allegedly negotiating with Apple on the sale of the iPhone, the iPad and Apple Watch at more than 400 LG Best Shops across the nation. The shops can use the space and salespeople made available following LG Electronics’ withdrawal from the smartphone business by selling Apple products. (GSM Arena, Phone Arena, Business Korea)

Wang Jun, President of Huawei Smart Car Solution BU discloses that the company will shift its devices over the fully independent operating system, HarmonyOS 2.0 at the end of 2021. It is expected that the company will install HarmonyOS 2.0 in more than 200M Huawei devices by 2021. Wang has also stressed that HarmonyOS will be used in all of the future smart car solutions as well as other third-party smart products. (Laoyaoba, IT Home, CN Beta, Huawei Central)

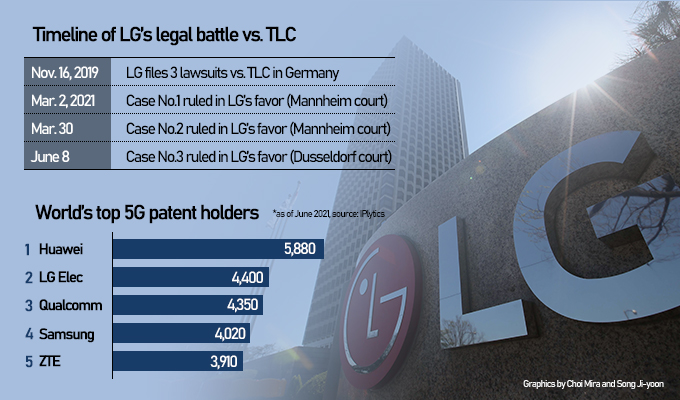

LG Electronics is seeking new sources of revenue by tapping into its trove of telecom-related patents after shutting down its loss-making handset unit from Jul 2021. According to intellectual property research and consulting firm TechIPm, LG ranked No 1 in the world 2012-2016 in the 4G (LTE / LTE-A) SEP category. Berlin-based market intelligence company Iplytics has recently ranked LG third globally in the 5G SEP category with over 3,700 patents. (Laoyaoba, Pulse News, Korea Times)

Motorola Defy (2021) is announced – 6.5” 720×1600 HD+ v-notch, Qualcomm Snapdragon 662, rear tri 48MP-2MP macro-2MP depth + front 8MP, 4+64GB, Android 11.0, rear fingerprint scanner, 5000mAh 20W, IP68 rated, MIL-SPEC 810H compliant, USD390 / EUR325. (GSM Arena, Liliputing, GizChina, Motorola)

Samsung Galaxy Tab S7 FE and Galaxy Tab A7 Lite are launched in India:S7 FE – 12.4” 1600×2560 TFT, Qualcomm Snapdragon 750G 5G, rear 8MP + front 5MP, 4+64 / 6+128GB, Android 11.0, 10090mAh 45W, stereo speakers tuned by AKG, INR46,999 (USD635) / INR50,999 (USD690). A7 Lite – 8.7” 800×1340 TFT, MediaTek Helio P22T, rear 8MP + front 2MP, 3+32GB, Android 11.0, 5100mAh 15W, stereo speakers, LTE INR11,999 (USD160) / Wi-Fi INR14,999 (USD200). (Android Authority, GSM Arena, Samsung, NDTV)

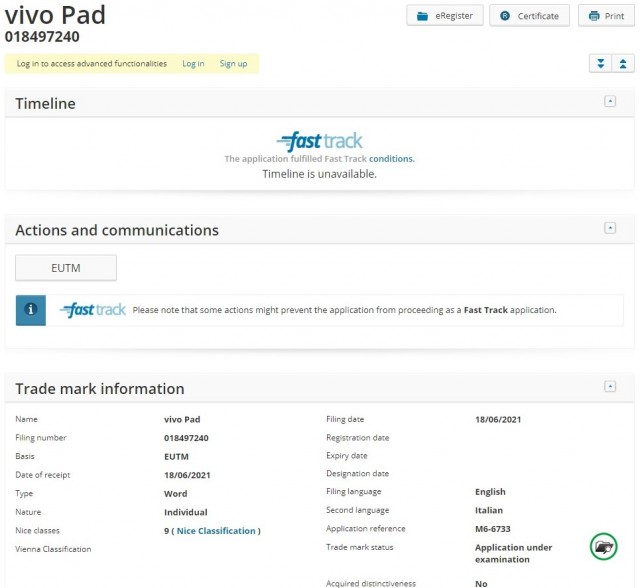

vivo has filed “vivo Pad” trademark with European IP Office. The vivo Pad is trademarked under Class 9, which covers several product categories, including tablet computers and PDAs. (CN Beta, GSM Arena, EUIPO)

Bandai has launched the Tamagotchi Smart wearable featuring touch and voice controls as well as new characters and items. The touch functions let owners pet their character, while the voice recognition commands let them chat. It is priced at JPY7,480 (USD68). (Android Authority, The Verge, Kotaku, Engadget, Sina)

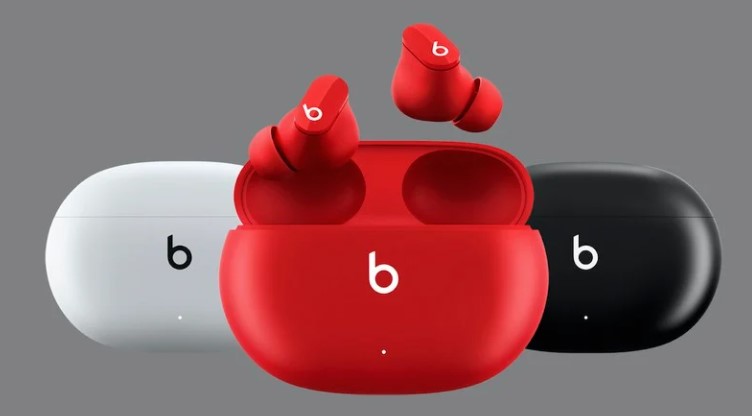

Apple launches Beats Studio Buds, priced at USD150, featuring Active Noise Cancellation (ANC) and Transparency modes. Beats Studio Buds offer up to eight hours of listening time, with two additional charges from the included battery case bringing total battery life to 24 hours. (Laoyaoba, MacRumors, 9t05Mac)

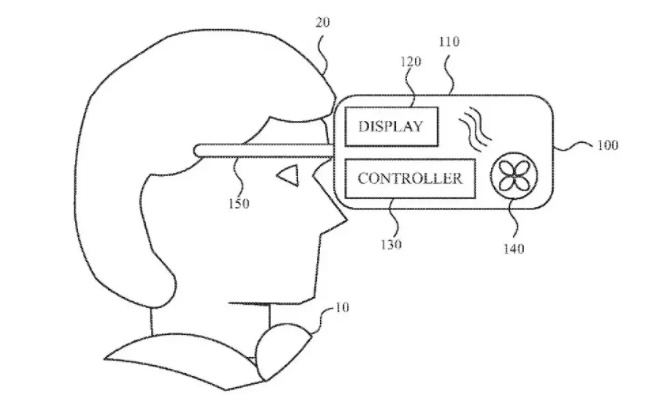

Future “Apple Glass” or other Apple AR headsets, could use air deflectors to direct heat away from a wearer’s head. “Air Deflector for Cooling System in a Head-Mounted Device”, is a newly-revealed patent application that is concerned with meaning a user can comfortably wear such a device for extended periods. “Head-mounted devices are an attractive technology for providing an immersive user experience”, says the patent application. As with other electronic devices, head-mounted devices can employ a cooling system based on circulation of air to maintain electronic components at desirable operating temperatures. (CN Beta, Apple Insider, USPTO)

The newly appointed CEO Tony Aquila of Canoo, the the electric vehicle startup that recently became a publicly traded company through a merger with a SPAC, has indicated that it plans to build a factory in Oklahoma. The factory will be located on a 400-acre site in the MidAmerica Industrial Park in Pryor. The facility, which the company describes as a “mega microfactory” will include a paint shop, body shop and general assembly plant and is expected to open in 2023. (CN Beta, Tulsa World, The Verge, TechCrunch)

Honda Motor will stop production of the Clarity fuel cell car in 2021, as part of a broader push to trim underperforming models. Honda has also decided to stop making the Legend, its high-end gasoline-fueled sedan, as well as the Odyssey luxury sport utility vehicle. Realigning global manufacturing operations, the company will focus on electrics to advance toward its goal of selling only zero-emissions vehicles by 2040. (Engadget, Nikkei)

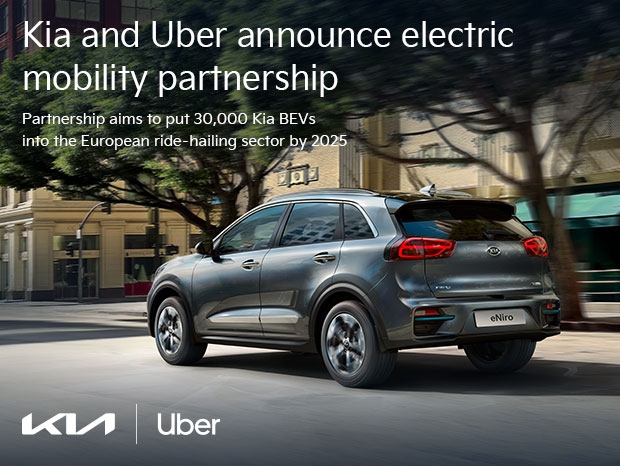

Uber and Kia Europe are teaming up to offer drivers in 20 European markets deals on buying, leasing, financing or renting Kia’s e-Niro and e-Soul, the latest move by the ride-hailing giant to achieve its emissions goals. Uber has committed to being a zero-emission mobility platform across Europe by 2030, and hopes to get up to 30,000 Uber drivers into Kia’s BEV range by the same year. (TechCrunch, Kia, Live Mint, KED Global, YNA)

Ford has 2 electric vehicles in the pipeline — the E-Transit cargo van and F-150 Lighting Pro —aimed at commercial customers. The company has acquired battery management and fleet monitoring software startup Electriphi. Ford is betting that the software developed by the 3-year-old San Francisco startup will help it capture more than USD1B in revenue just from charging by 2030. Ford Pro expects to generate USD45B in revenue from hardware and adjacent and new services by 2025 — up from USD27B in 2019. (TechCrunch, Ford)

China’s new energy vehicle (NEV) sales are expected to grow more than 40% each year in the next 5 years, according to the China Association of Automobile Manufacturers (CAAM). The sales of NEVs will hit 1.9M units in 2021 and 2.7M units in 2022. This includes various NEV types like the battery electric, plug in hybrid, and even hydrogen fuel cell vehicles. Notably, major NEV makers like Tesla, NIO, Xpeng and BYD, are also expanding manufacturing capacities in the region. (Gizmo China, Reuters, EET China, ChinaZ)

The food delivery service Swiggy is set to begin trials for both food and medical packages in India along with its drone delivery partner ANRA Technologies. ANRA Technologies has finally got clearances from the Ministry of Defence (MoD), the Directorate General of Aviation (DGCA), and the Ministry of Civil Aviation (MOCA) to commence drone trials for delivering food. (Gizmo China, NDTV)

Mayor Francis Suarez says Miami’s doors are open to bitcoin miners in China who are currently scrambling to find a new home after Beijing made it clear that their days are numbered. Mining is the energy-intensive process which both creates new coins and updates the digital ledger of all transactions of existing tokens. The mayor is looking to patriate this mining diaspora by promoting the city’s essentially unlimited supply of cheap nuclear energy. (CN Beta, CNBC)