6-27 #Principles : Huawei will set up its first wafer fab in Wuhan with production expected to kick off in phases starting 2022; Biren Technology’s first 7nm GPU is expected to tape out in 3Q21 and will be officially released in 2022; Tesla would ‘recall’ nearly 300,000 China-made and imported Model 3 and Model Y cars; etc.

Huawei will set up its first wafer fab in Wuhan, China’s Hubei province, with production expected to kick off in phases starting 2022, according to Digitimes. Its creation started in 2019, and the company call the project itself “Hisilicon Factory”. The company has invested CNY1.8B in it and should receive a return on investment in 2022. The factory itself initially specialized in the production of microcircuits and optical communication modules. (GizChina, Huawei Central, Digitimes, My Drivers)

Chinese chip design company Biren Technology’s first 7nm GPU is expected to tape out in 3Q21 and will be officially released in 2022. Founded in Sept 2019, Biren Technology set a new funding record in China’s chip design sector with a Series A round of CNY1.1B (USD170M) in 2020. Biren Technology specializes in general-purpose AI training and reasoning capabilities, stripping away designs. (Neowin, CN Techpost, CN Beta, Sina)

Intel CEO Pat Gelsinger has predicted the shortage of semiconductors that is hurting industries from automotive to consumer electronics will bottom out in 2H21 before starting to improve. He does not expect the chip industry is back to a healthy supply-demand situation until 2023. He thinks for a variety of industries, it is still getting worse before it gets better. (CN Beta, Apple Insider, Bloomberg)

Eric Tseng, CEO of Isaiah Research, has indicated that Taiwanese chip foundries such as TSMC and UMC, as well as Shanghai-based SMIC are currently undergoing a “long review process”, waiting for the 22nm and 28nm nodes machines to be imported to Mainland China to expand production capacity. Although the United States has not explicitly prohibited the export of equipment to Taiwanese manufacturers in mainland China, this may delay their capacity expansion plans. Joanne Chiao, an analyst of TrendForce, believes that in addition to the longer delivery time of the equipment, there is currently no significant impact on the foundries in mainland China. (EE World, Isaiah Research, Laoyaoba)

STMicroelectronics and Tower Semiconductor, the leading foundry of high-value analog semiconductor solutions, have announced an agreement by which ST will welcome Tower to its Agrate R3 300mm fab under construction on its Agrate Brianza site in Italy. The fab is expected to be ready for equipment installation later in 0221 and start production in 2H22. (Laoyaoba, Globe Newswire)

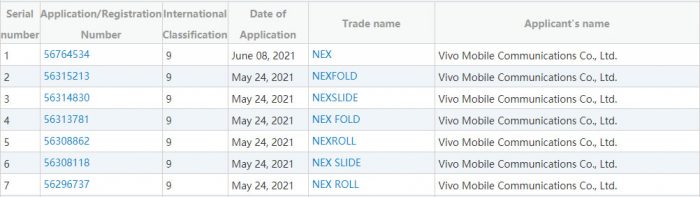

vivo has trademarked 3 NEX devices – NEX Slide, NEX Fold and NEX Roll, which implies slidable, foldable and rollable phones. (GSM Arena, Myfixguide, Sina, My Drivers)

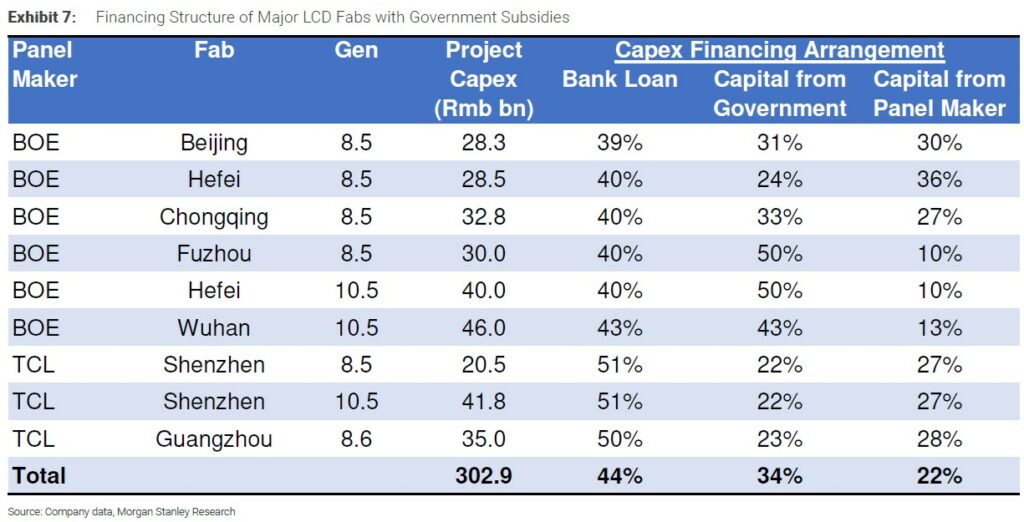

Since the Chinese panel makers became more aggressive in the display sector around a decade ago, Chinese central and local governments have been playing a critical role in their expansion, as their subsidies have helped finance the majority of the capacity expansions. The usual practice has been that the panel makers sign an investment agreement with a local government to set up a joint venture, which will be running the new fab. The balance sheet is often structured as 40-50% bank loans and 50-60% equity. (Morgan Stanley report)

Morgan Stanley thinks there are 2 factors that could influence the capacity expansion schedule: 1) Market dynamics: For the expansion at existing fabs, there will be no government subsidies, so panel makers will have to finance their own capex with their own capital, which will think will lead to more rational decisions. 2) Component supply: The believe the IC component supply issue might continue to linger into 2022 or even beyond, given some display ICs’ inherent nature of carrying lower margins from the perspective of foundry players. Based on the current plans for both greenfield projects and expansion at existing fabs, Morgan Stanley estimates that the global display supply should grow at 7% / 7% / 5% in 2021 / 2022 / 2023. (Morgan Stanley report)

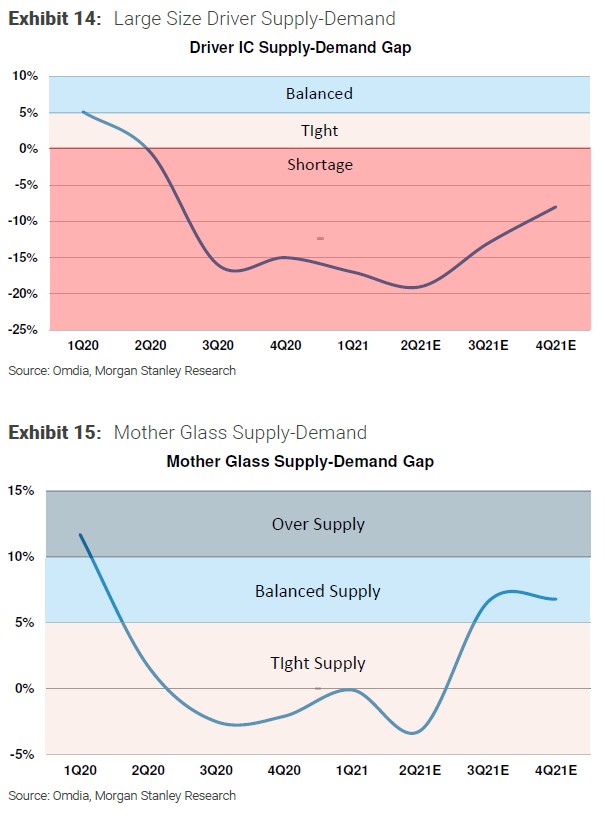

Various display related component supplies have been tight since 2H20. The mother glass supply tightness is mainly caused by the disruptions at the manufacturing facilities among major players since 4Q20, while that for polarized glass is primarily due to the raw materials shortage and slower capacity expansion. Morgan Stanley believes the supply of these 2 components should normalize heading into 2H21. For driver IC, the supply issue stems from the fact that it has to compete against other IC products for the limited foundry capacity, and driver ICs carry lower margins, so it has a lower priority among foundry players. Driver IC has been the one of the major bottlenecks for the display supply chain since 2H20. They believe driver IC supply is still in shortage. (Morgan Stanley report)

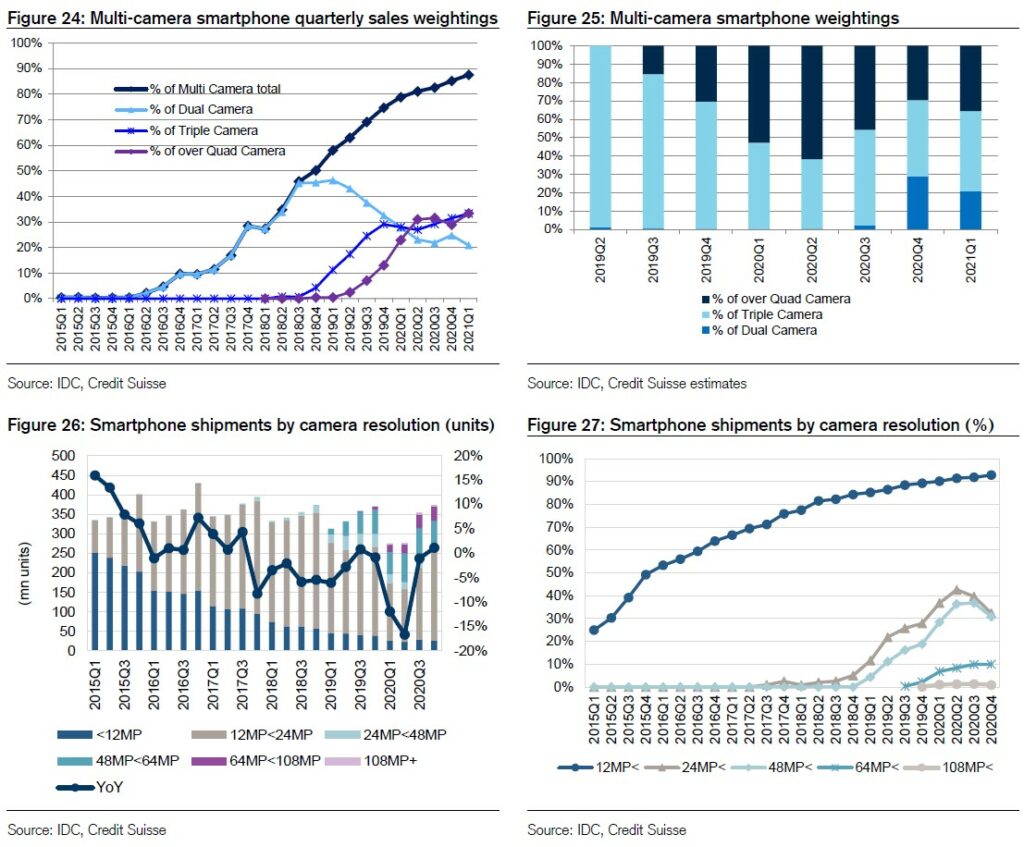

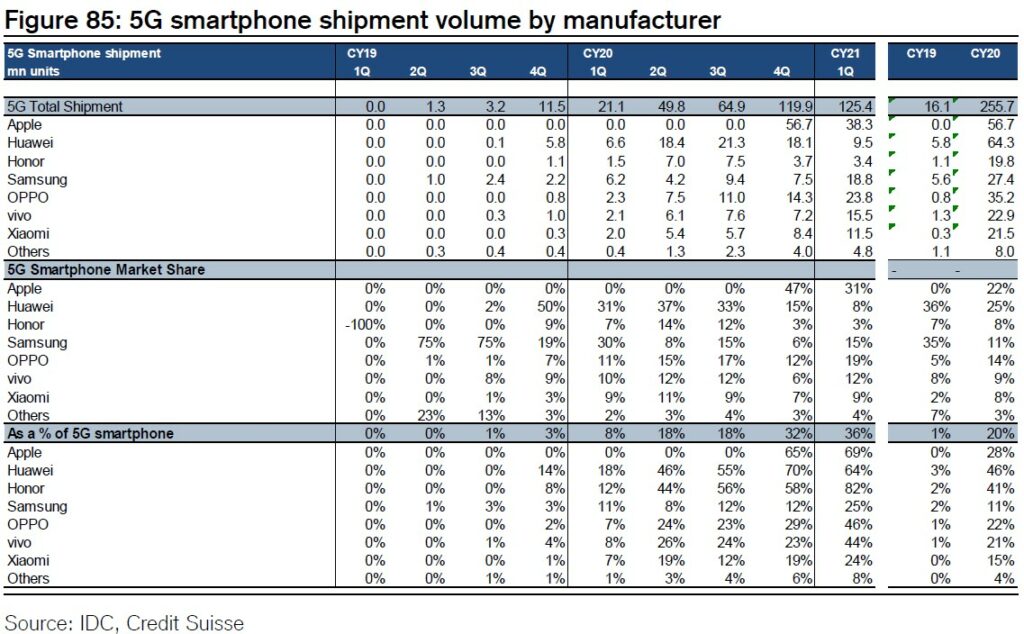

According to Credit Suisse, for CIS-related logic chips (image signal processors, ISP), Samsung plans migration to 28nm processes in 2020 and 14nm in 2022. The ratio of multi-camera smartphones is 88% in Jan–Mar 2021 (+9ppt YoY, +2ppt QoQ). Within this, triple-plus camera models accounted for 67% of the total (+15ppt, +6ppt). The ratio for four-plus cameras was 33%, up slightly from the flat trend seen over the past 3 quarters. Triple-plus cameras remain the standard for 5G smartphones. (Credit Suisse report)

University of Cambridge has reportedly developed a new technology for lithium-ion batteries that has the potential to replenish power to 100% in only 5 minutes. this system is “low-cost” and works by figuring out the how to maximize charging cycles for batteries helping them to charge faster without creating any overheating. (Phone Arena, The Independent, University of Cambridge, Nature)

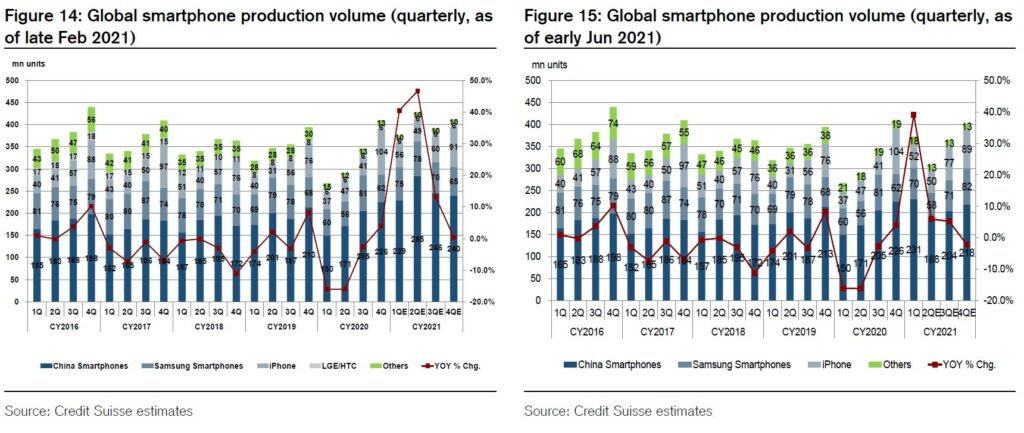

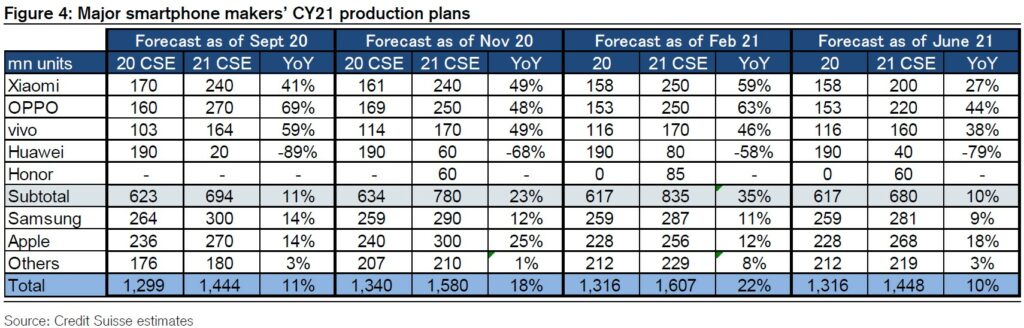

According to Credit Suisse, 2021 smartphone production plans have been lowered to 1.45B units (+10% YoY) from 1.6B (+22%) as of the end-Feb 2021 survey, including a 19% cut for the 5 major Chinese smartphone makers in aggregate global smartphone production volume for Apr–Jun alone is down by around 120M units (28%) versus the previous survey. Samsung cut production in India and Vietnam in Apr−May as COVID cases rose in those countries. Downward revisions centered on low-end phones, with 5G models mostly unchanged. (Credit Suisse report)

According to Credit Suisse, based on year-end production plans for Apple iPhone 13 series, planned production in 2021 of the 4 models combined will be 40M units in Jul–Sep and 64M in Oct–Dec, for a full-year total of 104M units. This would be the highest peak production of any series since the iPhone 6 series (peak production of the iPhone 7 series was 99M units in Jul–Dec 2016). (Credit Suisse report)

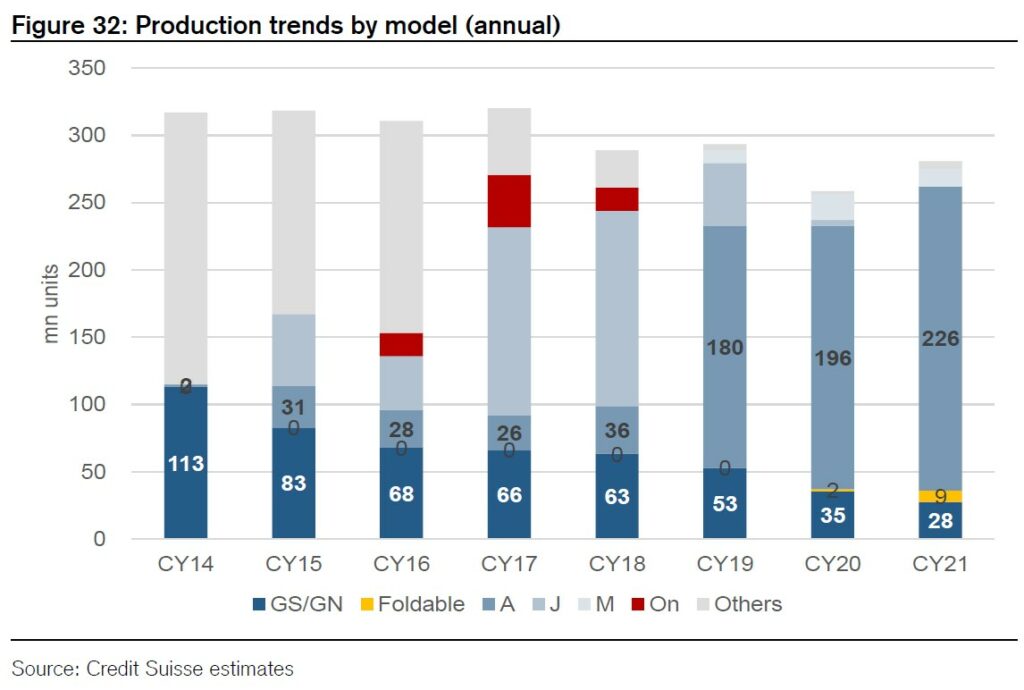

According to Credit Suisse, Samsung’s 2021 production will drop to about 280M units (+8% YoY). The company appears to be targeting quarterly output of 70M units in Jan–Mar (+19% YoY, +14% QoQ), 58M units in Apr–Jun (+3%, −18%), 71M units in Jul−Sep (−13%; +23%) and roughly 80M units in Oct−Dec (+16%; +33%). Samsung plans to produce 36M units (-4% YoY) of its Galaxy S / Note flagship models, including foldable models. It now aims to produce roughly 8M units of two foldable models in 2H21. In non-flagship ranges, production of the A series is on track for about 226M units (+15% YoY), and at the current pace, output of the M series looks likely to come in at only around 13M units. (Credit Suisse report)

Credit Suisse’s latest survey estimates Samsung’s subcontracted manufacturing to other ODMs output in Jan–Sep 2021 is around 25-30M units. This suggests the annual total for 2021 could only reach around 40M units. (Credit Suisse report)

Credit Suisse’s current survey (early Jun 2021), China’s vendors production plans in 2021 totaled around 840M units (+12% YoY)——Xiaomi 200M, OPPO 220M, vivo 160M, Huawei 40M, and Honor 60M. It appears that the major downward revisions were made in early Apr 2021, followed by slight reductions in May and Jun. By model, the production plan cuts involved LTE models and especially low-end models. (Credit Suisse report)

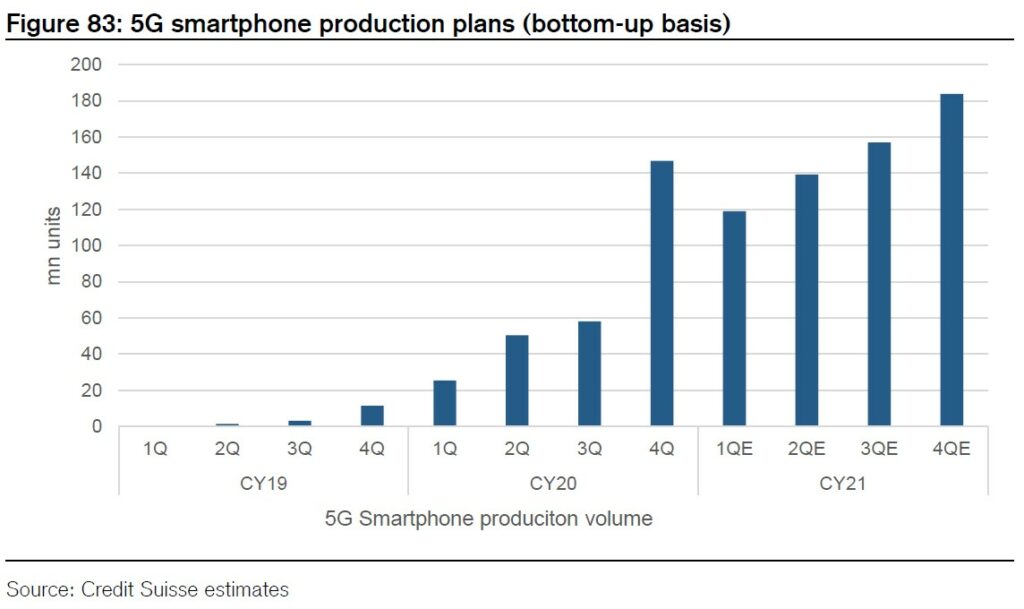

Credit Suisse projects that 5G smartphone shipment will rise from 255M units in 2020 to 551M in 2021 and 707M in 2022. The target 5G ratios are just over 25% at Samsung, around 30% at Huawei, 20–30% at Xiaomi, and around 50% at OPPO, vivo, and Honor. The aggregate 5G smartphone production plan is about 600M units. (Credit Suisse report)

German carmaker Volkswagen will stop selling combustion engines cars in Europe by 2035 as it shifts to electric vehicles, but later in the United States and China. Klaus Zellmer, Volkswagen’s board member for sales, has revealed that the company would “exit the business with internal combustion engine cars in Europe in 2033-2035”. (The Verge, Reuters)

Chinese regulators have indicated that Tesla would ‘recall’ nearly 300,000 China-made and imported Model 3 and Model Y cars for an online software update related to assisted driving, with owners not required to return their vehicles. The State Administration for Market Regulation has said that the move is linked to an assisted driving function in the electric cars, which can currently be activated by drivers accidentally, causing sudden acceleration. (Engadget, Bloomberg, Nikkei, My Drivers)

Automobiles is the most valuable sector across the continent, with the 27 brands that feature in the Brand Finance Europe 500 2021 ranking accounting for 14% of the total brand value (EUR237.7B). German brands still command the auto industry across Europe, with the 7 brands represented totaling EUR171.5B or 3 quarters of the sector’s total. Mercedes-Benz once again leads the pack as the most valuable brand in Europe, with a brand value of EUR49.6B. Volkswagen (down 1% to EUR40.0B), BMW (down 6% to EUR34.4B), and Porsche (down 5% to EUR29.2B) all claim places in the top 10 in 3rd, 5th, and 6th, respectively. (Brand Finance report)

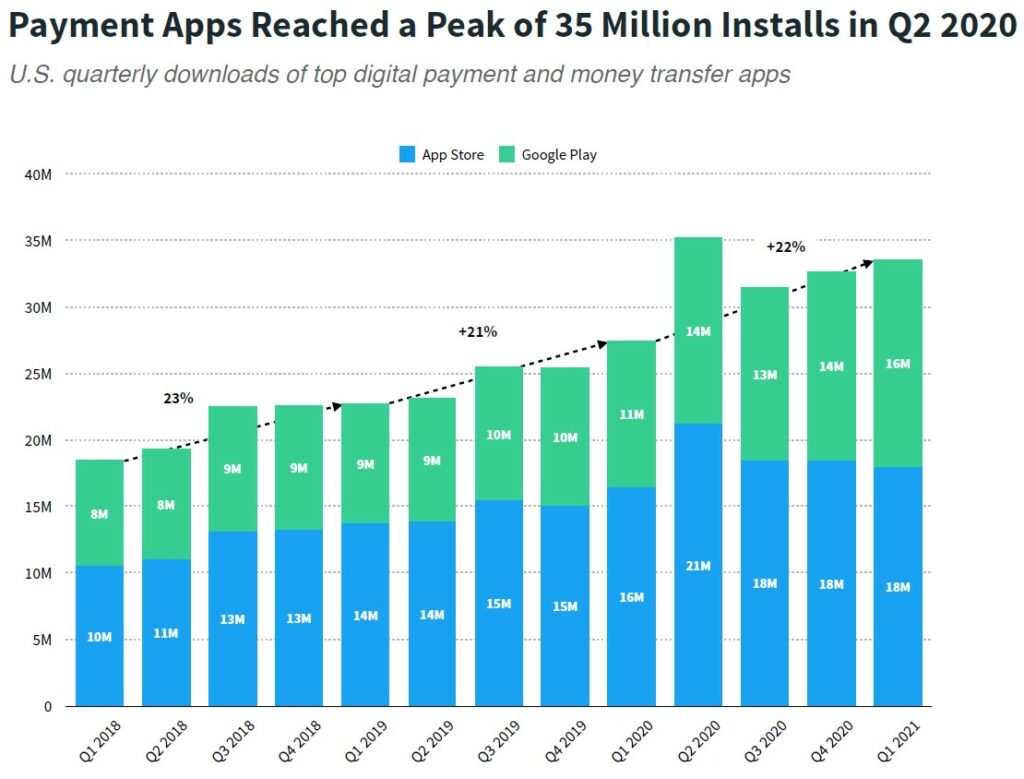

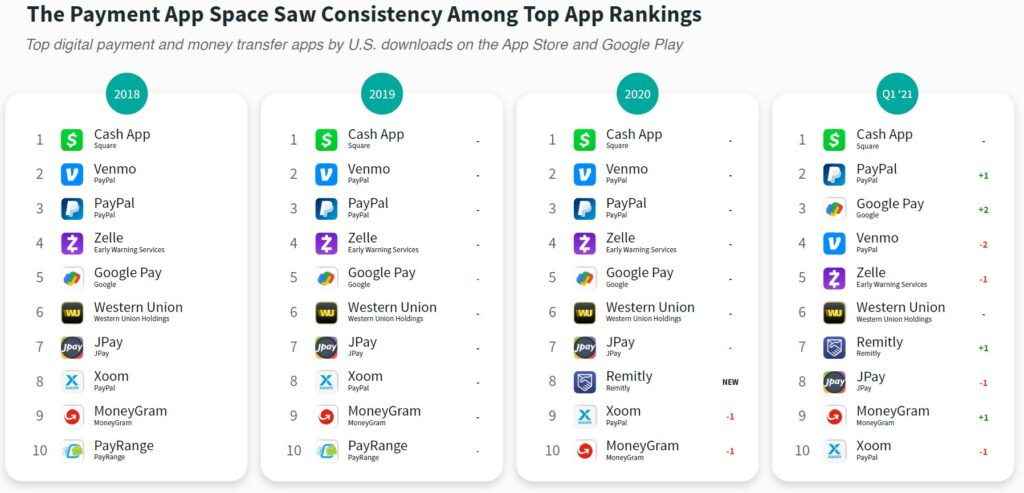

Top digital payment and money transfer apps saw record adoption in 2Q20, surpassing 35M downloads and soaring 53% YoY. As the first federal stimulus checks were issued in the U.S. in Apr 2020, money transfer services also saw high demand. Despite the drop in adoption in 3Q20, digital payment and money transfer apps saw consistent growth QoQ. U.S. payment apps are on the rise, kickstarting 2021 with total installs of 34M in 1Q21. (SensorTower report)

Top digital payment apps started to add cryptocurrency trading and payment features in 2021, signaling cryptocurrency’s entrance as mainstream feature. PayPal launched its cryptocurrency payment feature in Mar 2021, after the first introduction of cryptocurrency trading in Oct 2020. (SensorTower report)