7-15 #MultiScreens : Samsung Electronics has introduced ISOCELL Auto 4AC; LG InnoTek and Corning are collaborating in the research of liquid lens; OPPO has announced that its new factory in Istanbul, Turkey; etc.

Huami has announced Huangshan 2S, which uses a dual-core RISC-V architecture. It is the first wearable artificial intelligence processor with dual-core RISC-V architecture. The large-core system also integrates FPU to support floating-point operations, and its performance is 18% higher than that of Huangshan 2. %, the operating power consumption is reduced by 56%, and the sleep power consumption is directly reduced by 93%. Huangshan 2S is also equipped with a convolutional neural network acceleration processing unit. (CN Beta, Sparrow News, Breaking Latest)

Audi CEO Markus Duesmann has indicated that the local semiconductor shortage has been a huge challenge for Audi, cutting down production by a five-digit number. He has revealed that the company is fighting hard every day to recover as many of those units as possible. They do not expect this problem to be completely solved until late 2022. (CN Beta, Auto News, Automotive News)

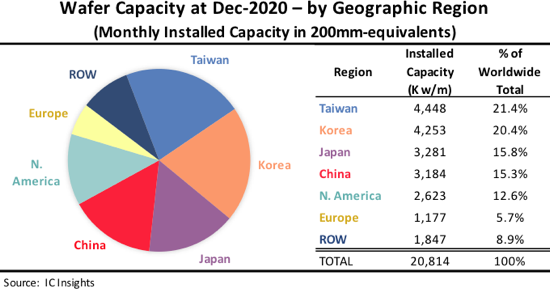

According to IC Insights, As of Dec 2020, Taiwan led the world with 21.4% of global wafer capacity installed in that region. In second place was South Korea, which accounted for 20.4% of global wafer capacity. Taiwan was the capacity leader at 200mm wafers. For 300mm wafers, South Korea was at the forefront followed closely by Taiwan. At the end of 2020, China held 15.3% of the world’s capacity, which was nearly the same as Japan. It is expected that China will surpass Japan in 2021 in terms of the amount of installed capacity. (CN Beta, IC Insights)

SK Siltron CSS, a unit of South Korean semiconductor wafer manufacturer SK Siltron, has announced plans to invest USD300M in Bay County, Michigan, which is a couple of hours north of Detroit, the country’s first automaking haven. The wafer manufacturer already has a presence in nearby Auburn. Over the next 3 years, SK Siltron says its investment will provide manufacturing and R&D capabilities of advanced materials for electric vehicles. (CN Beta, TechCrunch, Reuters)

TCL Technology has stated that it has a relatively competitive advantage in the semiconductor display industry. The t1, t2, and t6 projects are fully operational. The t7 project is ramping up as planned. It plans to achieve 60K/month full production by 2H21, and TV product shipment to rank the second in the world, the shipment of interactive whiteboards ranks first in the world; t3 LTPS phone panel shipments are the top three in the world, the first phase of the t4 Gen-6 AMOLED production line has been completed, and the second and third phases have accelerated construction. (Laoyaoba, NBD, Sohu)

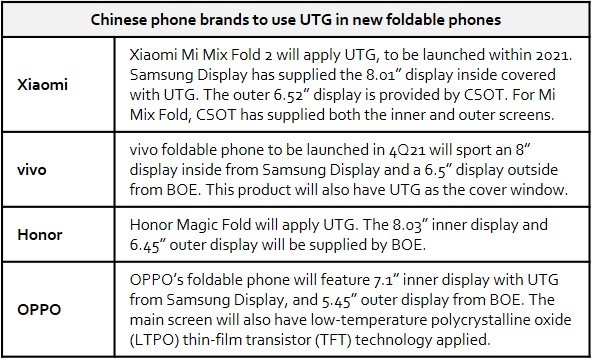

Major Chinese phone brands are expected to apply ultra-thin glasses (UTG) for their upcoming foldable smartphones to be launched in 2H21. Samsung’s original Galaxy Fold in 2019 used polyimide, but its subsequent smartphones Galaxy Z Flip and Galaxy Z Fold 2 launched in 2020 used UTG. Huawei Mate X2 and Xiaomi Mi Mix Fold that launched earlier 2021 used polymide films. (CN Beta, The Elec)

Google is reportedly working with Samsung, releasing a foldable smartphone with 7.6” display applying ultra thin glass (UTG). Google is just one of several mobile phone manufacturers seeking to obtain UTG orders from Samsung, and Samsung is currently the exclusive supplier of the glass. (CN Beta, The Elec)

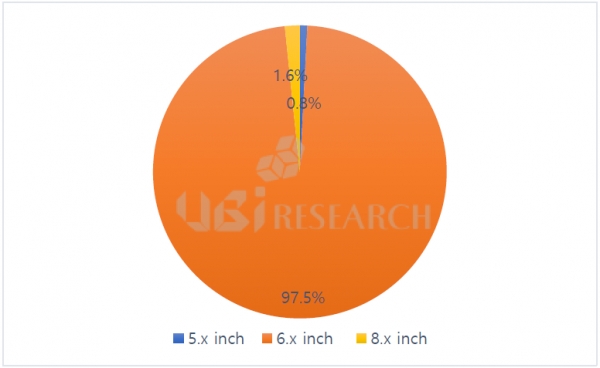

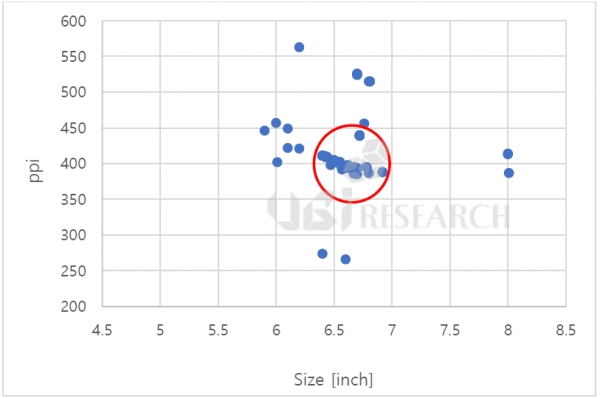

Almost all smartphones with an OLED display released in 1H21 had a diagonal of 6” or higher, according to UBI Research. More specifically, 6”-7” OLED phones have a 97.5% share in the market, compared to 78% in 2018. That is 119 models out of 122 released in the first 6 months of 2021. This is a 20 point increase from 2018, when 78% of OLED smartphones had 6” screen sizes. (GSM Arena, UBI Research, The Elec)

Samsung’s new flagship premium phone Galaxy S22 series are rumored to be out in Jan 2022, with the most premium model Galaxy S22 Ultra 5G to be fitted with a 200MP five-lens camera on the back powered by Japan’s Olympus technology and Samsung’s S Pen. (Android Headlines, Sam Mobile, Pulse News)

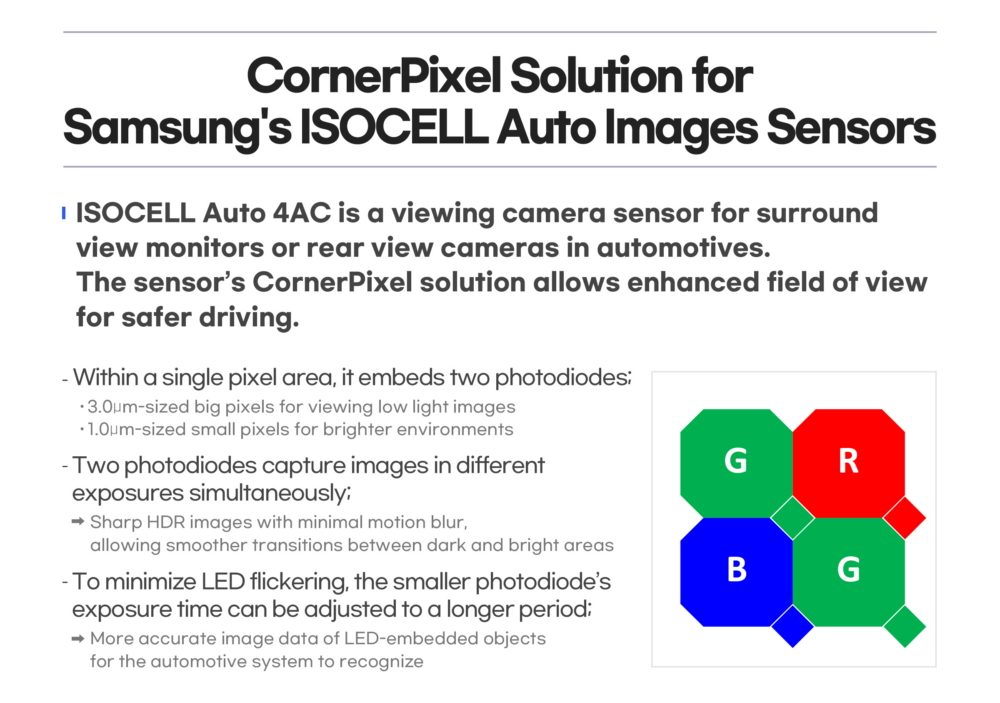

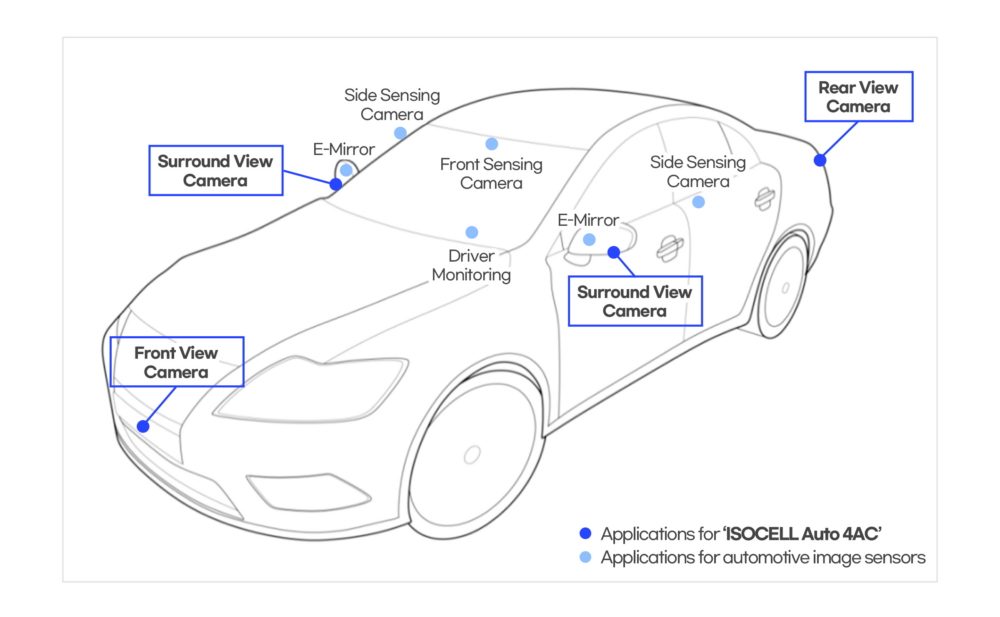

Samsung Electronics has introduced ISOCELL Auto 4AC, an automotive image sensor that offers advanced 120-decibel (dB) high dynamic range (HDR) and LED flicker mitigation (LFM) especially for surround-view monitors (SVM) or rear-view cameras (RVC) in high-definition resolution (1280 x 960). The new sensor is Samsung’s first imaging solution optimized for automotive applications. (Engadget, Samsung, My Drivers)

Samsung Electro-Mechanics (SEMCO) has struck a deal with Tesla worth USD436M, and as a result, Samsung will reportedly supply the biggest EV manufacturer in the USA with its camera modules. Samsung has supplied Tesla with other EV-related technologies before, including batteries, and reports indicate that the new PixCell LED headlamp developed by Samsung will also be used by Tesla for its future EVs. The AWD (all-wheel drive) Tesla Cybertruck model was originally planned to enter production later this year, with the the RWD (rear-wheel drive) model being slated for release in late 2022. (CN Beta, Electrek, Sam Mobile, Gizmo China, KED Global, ET News)

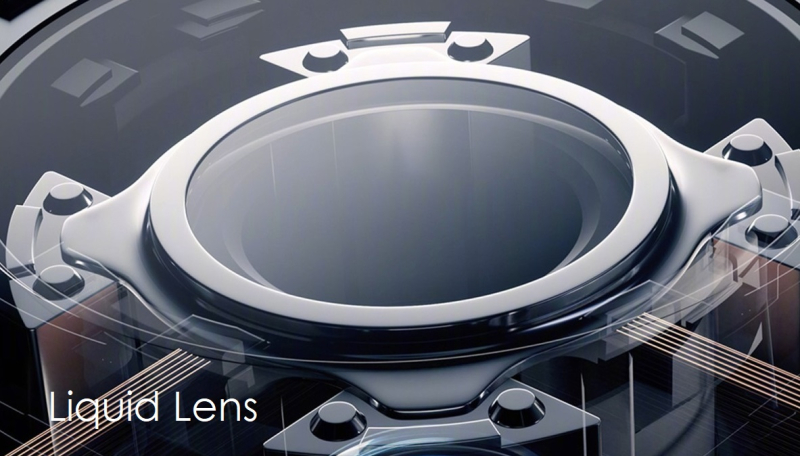

LG InnoTek and Corning are collaborating in the research of liquid lens. Corning decided to share stakes in six of its patents with LG InnoTek: the South Korean company shared stakes of 3 of its patents with the US firm. The core technologies listed on the 16 co-owned patents include liquid lens system, how to control a camera lens that include a liquid lens, and lens curvature varying instrument. Liquid lens fill vinyl bag shaped lens with liquid material. (CN Beta, The Elec, Patently Apple)

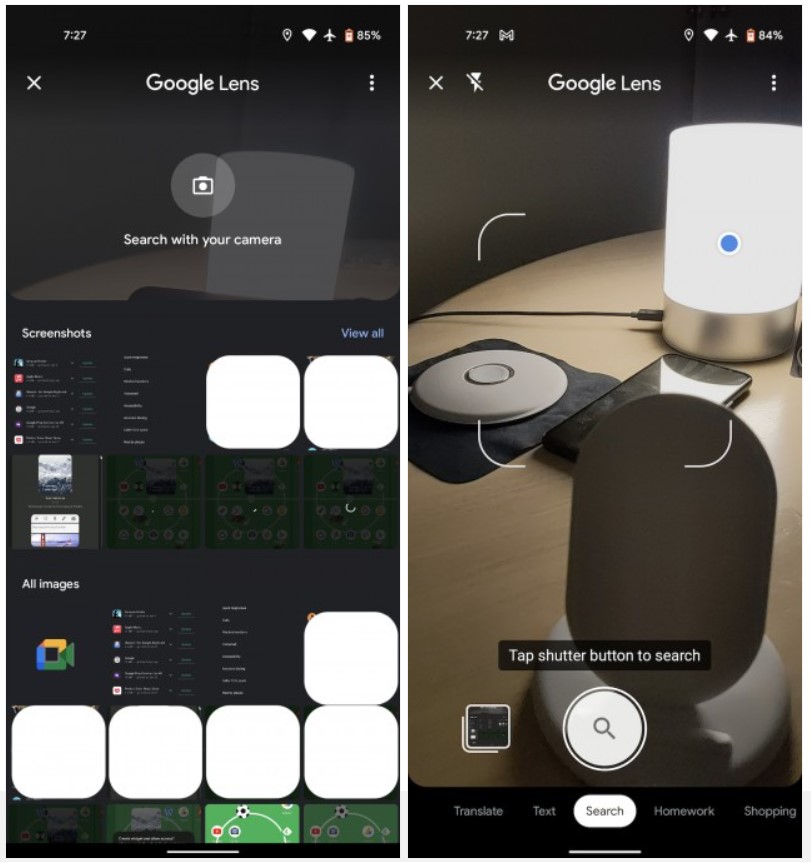

The Google Lens app receives an update with new design and features. The new design emphasizes on the ability to analyze already saved photos and screenshots rather than analyzing in a live preview. This Google Lens redesign sees tapping the homescreen icon open to an entirely new view. The top third of this screen belongs to a “Search with your camera” section that shows a live preview. (GSM Arena, 9to5Google)

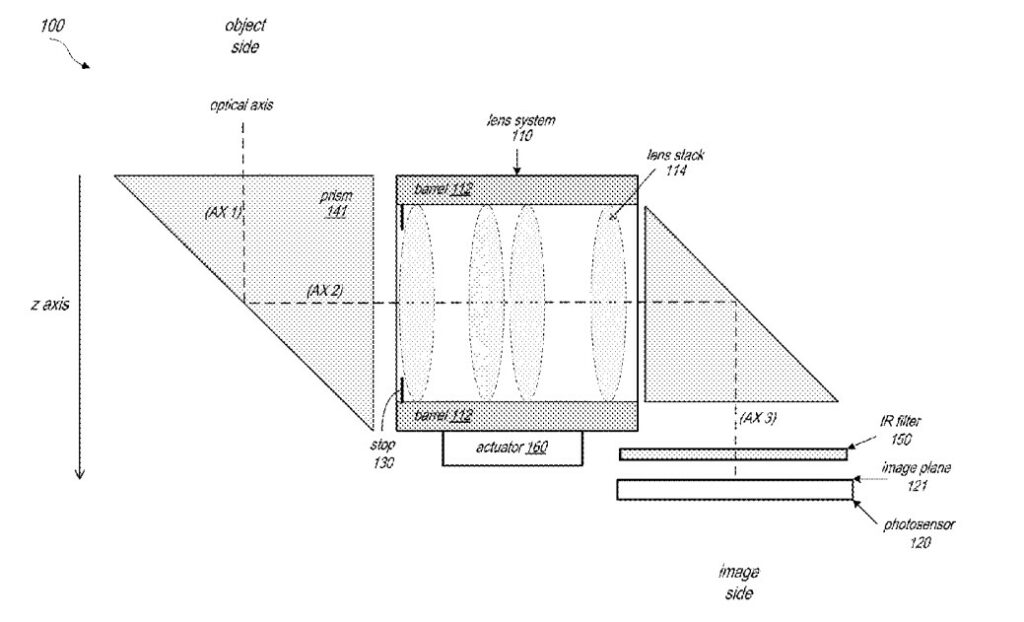

Apple’s patent titled “Folded Camera” details a system that includes “two light folding elements such as prisms and an independent lens system, located between the two prisms, which includes an aperture stop and a lens stack”. Apple appears to be placing specific emphasis on allowing high-resolution images and complex camera technologies such as autofocus or optical image stabilization (OIS). (Apple Insider, USPTO)

DRAM contract prices, which registered a substantial increase in 2Q21, are expected to continue their rally in 3Q21, according to Nanya Technology. The company expects that its fourth-generation 10nm process will be incorporated into EUV lithography technology, and related research and development will start in the next 1-2 years. (Digitimes, Laoyaoba)

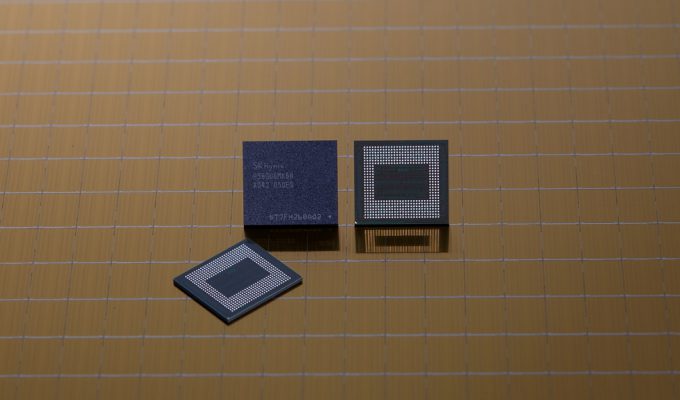

SK Hynix has started in Mar 2021 the production of LPDDR5 Mobile DRAM for their smartphone lines. The LPDDR5 Mobile DRAM is currently the only DRAM on the market to offer the largest capacity in the mobile industry. The newer memory will also feature 6400Mbps, an improvement from their current 5500Mbps model by close to 16%. It will be able to run ten FHD 5GB movies per second. (CN Beta, WCCFTech)

Amazon is interested in using radar sensors to enable sleep tracking and gestures on its smart devices, according to new permissions granted by the Federal Communications Commission (FCC). Amazon’s initial filing request from Jun 2021 describes how the company envisions the radar feature potentially providing “significant benefits to consumers with mobility, speech, or tactile impairments” in addition to sleep tracking and improving the user’s “awareness and management of sleep hygiene”. (The Verge, FCC, CNET, Bloomberg)

Baidu’s autonomous driving unit Apollo and the U.S.-based semiconductor supplier ON Semiconductor have recently set up a joint studio dedicated to exploring and developing autonomous vehicle image sensor solutions. Baidu plans to invest CNY50B (USD7.7B) in the production of smart cars in the next 5 years. At the same time, in Jan 2021, Baidu announced the establishment of Jidu Automobile with Zhejiang Geely Holding Group to make full use of its intelligent driving expertise and Geely automobile manufacturing capabilities. (Sohu, Laoyaoba, Sina, Gasgoo, AutoBala)

IC design manufacturer EgisTec has announced that the company’s products have successfully expanded into the automotive field, becoming the exclusive supplier of fingerprint identification chips for the 2 major Korean car manufacturers, Hyundai and Kia. In addition to Hyundai Genesis models, EgisTec will make another success in May 2021. Kia’s highest-spec flagship RV K9 also uses EgisTec’ fingerprint recognition products, which are used for car activation/unlocking and replace the original password-based mode, supports Kia Pay payment system, and makes this flagship car model both safe. (Laoyaoba, Sohu, CNYES, LTN, MoneyDJ)

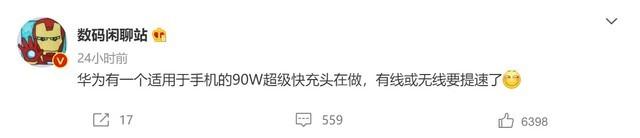

Huawei reportedly has a 90W fast phone charger, which is currently under development. Moreover, its wired or wireless charging speeds will usher in a major upgrade. Huawei Mate 40 flagship smartphone supports 66W wired charging and 50W wireless charging, upgrading from 40W wired, and 27W wireless charging. (GSM Arena, Sina, Sohu, Huawei Central, Weibo)

Apple reportedly is mulling manufacture batteries for Apple Car in the US. It may work with Taiwanese makers rather than Chinese ones, according to Digitimes. Foxconn or Advanced Lithium Electrochemistry (Aleees), both of which plan to set up factories in the US. Apple reportedly was looking to work with China’s two largest battery suppliers, CATL and BYD, but Apple’s insistence on using US-made batteries for Apple Car is making such partnerships seem unlikely. Apple may want a separate supply chain for lithium iron phosphate battery (LFP) from lithium-manganese-cobalt-oxide battery (MNC). (Apple Insider, Digitimes, press, IT Home)

LG Chem, South Korea’s top chemical maker, has said it will invest KRW10T (USD8.7B) in the battery material, renewable and bio sectors through 2025 to strengthen its green business portfolio. The company forecasts the battery-related materials market will grow to KRW100T by 2026 from KRW39T in 2021. (CN Beta, Reuters, Bloomberg, Ked Global)

Tesla CEO Elon Musk has revealed that demand for the company’s Powerwall is as high as 80,000 units but that Tesla will not be able to produce even half of that in 2Q21. He has said Tesla will only be able to make 30,000-35,000 of its home batteries in a best case scenario for the period ending in Sept 2021, blaming the expected shortfall on chip shortages. (CN Beta, CNBC, Business Insider, Teslarati)

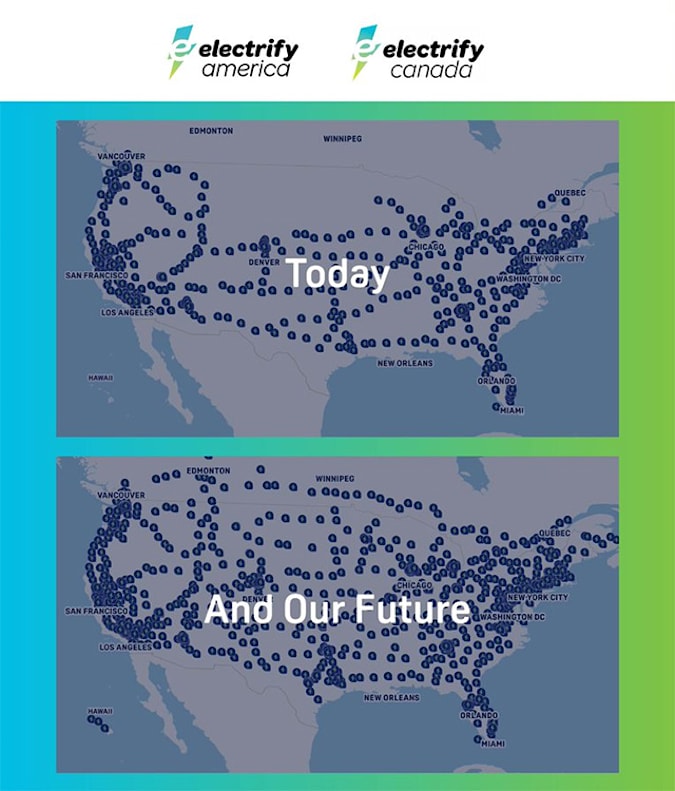

Electrify America has announced its “Boost Plan” to more than double its current electric vehicle (EV) charging infrastructure in the United States and Canada, with plans to have more than 1,800 fast charging stations and 10,000 individual chargers installed by the end of 2025. The expansion will increase the deployment of 150-350 kilowatt chargers. (Engadget, Electrify)

Samsung SDI and LG Energy Solution have reportedly finished developing samples of larger and more powerful “4680” battery cells, a type first presented by Tesla in 2020, in an apparent effort to win contracts from the global electric vehicle leader. (Gizmo China, Korea Herald)

Huawei Technologies and Verizon Communications have agreed in the midst of a federal jury trial in Texas to end 2 patent-infringement lawsuits over royalties on telecommunications technology. Verizon has claimed Huawei breached that contractual obligation by demanding an unfairly high royalty rate, and accused Huawei of unfair competition by defrauding the standard-setting board. (Gizmo China, My Drivers, CN Beta, Reuters, Verizon, SCMP)

OPPO has announced that its new factory in Istanbul, Turkey commenced production in May 2021, enhancing the company’s global manufacturing capability and reinforcing its long-term investment in the region. Constructed in four months and located only a few miles from OPPO’s regional headquarters in Ataşehir, the 10,200m2 plant employs approximately 700 staff. (CN Beta, LetsGoDigital, Free Press)

vivo’s sub-brand iQOO has announced it sold over 25M smartphones globally. Gagan Arora, Director- Marketing, iQOO India has indicated that iQOO will always adhere to its original mission and continue its relentless pursuit for technological advancement and excellence. (GSM Arena, India Times)

French antitrust regulators have given Google 2 months to pay a EUR500M (USD592M) fine for disregarding injunctions related to French news publication negotiations. Google has been accused of not acting in good faith in its negotiations with news agencies and publishers. Google has also refused to have a specific discussion about paying for news content online. (Apple Insider, CNN, Reuters, Sina)

Google has announced several new initiatives for Stadia developers. Stadia developers will receive 85% of sales revenue for games released after 1 Oct 2021. The increased split is only for first USD3M earned and until 2023. Google is giving 70% of Stadia Pro monthly revenue to developers with games on the service. (Android Central, CN Beta, The Verge, Engadget)

Apple has allegedly asked suppliers to build as many as 90M next-generation iPhones in 2021, a sharp increase from its 2020 iPhone shipments. Apple has maintained a consistent level in recent years of roughly 75M units for the initial run from a device’s launch through the end of the year. The upgraded forecast for 2021 would suggest the company anticipates its first iPhone launch since the rollout of Covid-19 vaccines will unlock additional demand. (Apple Insider, Bloomberg)

vivo Y72 5G (India) is launched in India – 6.58” 1080×2408 FHD+ u-notch 90Hz, Qualcomm Snapdragon 480, rear dual 48MP-2MP depth + front 8MP, 8+128GB, Android 11.0, side fingerprint, 5000mAh 10W, INR20,990 (USD282). (Gizmo China, NDTV, Zeebiz)

vivo Y53s is launched in Vietnam – 6.58” 1080×2408 FHD+ u-notch 60Hz, MediaTek Helio G80, rear tri 64MP-2MP macro-2MP depth + front 16MP, 8+128GB, Android 11.0, side fingerprint, 5000mAh 33W, VND6.99M (USD305). (GSM Arena, NDTV, India Times)

Microsoft and NEC have announced an expansion of their decades-long collaboration. Through a new multi-year strategic partnership, the companies will leverage Microsoft Azure, Microsoft 365, NEC’s network and IT expertise, including 5G technologies, and each other’s AI and IoT solutions to help enterprise customers and the public sector across multiple markets and industries further accelerate their cloud adoption and digital transformation initiatives. (CN Beta, Microsoft, Telecom Paper)

Huami has announced the new wearable operating system Zepp OS. The bottom layer of Zepp OS is developed based on the FreeRTOS microkernel open source code. Although the system package is only 55MB in size, it is perfectly compatible with different configurations. Zepp OS has reduced operating power consumption by 65% and increased battery life by 190% compared to the previous version. (Gizmo China, GizChina, My Drivers)

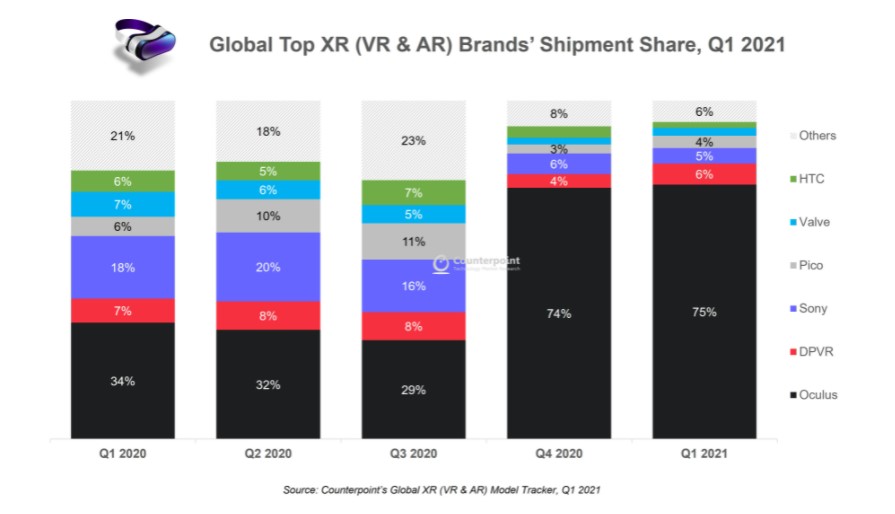

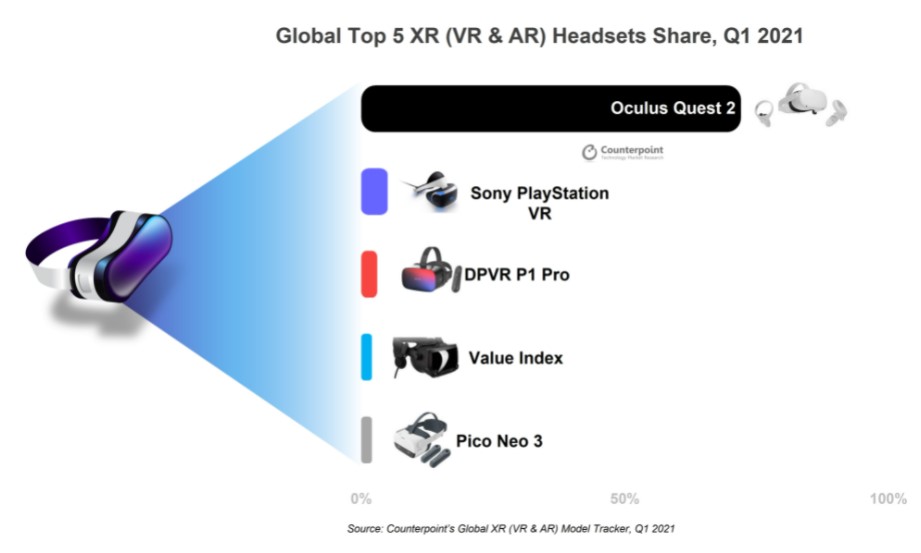

According to Counterpoint Research, the Extended Reality (XR) headset shipments almost tripled annually in 1Q21. The standalone Virtual Reality (VR) form factor led the global XR market with 85% shipment share in 1Q21, compared to 42% in 1Q20. The transition from tethered to standalone VR is being driven mainly by the Oculus Quest series. Other XR headset OEMs are also focusing on the standalone form factor as it is the device of choice among users, especially gamers. The Augmented Reality (AR) segment contributed only 4% in 1Q21, which was driven by the few enterprise-level deals with AR headset OEMs. (Counterpoint Research, Android Authority)

LG has announced that Amazon Alexa will be coming to a wide range of third-party TVs powered by webOS, LG’s proprietary TV platform. TV brands such as Advance, Blaupunkt, Eko, JSW, Manta, Polaroid, RCA, Seiki and Skytech as well as original design manufacturers Ayonz, Dualshine, Konka, Silicon Player, Skyworth and Xianyou, among others, will soon be offering this capability in their compatible webOS-powered TVs with Magic Remote so even more consumers can enjoy Alexa. (CN Beta, LG)

Netflix reportedly will be entering the gaming scene as early as 2022 and has also signed on a leadership role for the venture. Netflix has hired Mike Verdu as the “vice president of game development”. The executive has previously worked at Electronic Arts and was also the managing director of augmented and virtual reality at Facebook. (Engadget, Neowin, Bloomberg)

Woven Planet, a subsidiary of the Toyota Motor, has announced the acquisition of CARMERA, a U.S.-based spatial AI company, which specializes in bringing next-generation road intelligence to automated mobility at scale. This is the second major deal for Woven Planet in North America, following the Apr 2021 announcement to acquire Level 5, the self-driving division of Lyft.(CN Beta, TechCrunch, Business Wire, Nikkei)

Symbotic, a robotics and automation-based company focused on reimagining the traditional consumer goods supply chain and Walmart have announced they will partner to reimagine the retailer’s regional distribution network. Symbotic first implemented its system in Walmart’s Brooksville, Florida distribution center in 2017. (CN Beta, TechCrunch, Walmart, Business Wire)

Samsung SDS has announced the launch of its new service, Paperless, which uses blockchain technology to solve falsification issues and document forgery. The latest utility in Samsung’s cloud-based Blockchain-as-a-service (BaaS) business safely administers a wide range of documents that are susceptible to falsification and forgery like certificates, consent forms, and contracts, with the help of blockchain technology. (CN Beta, Samsung, Neowin)

Apple is reportedly working on a new service that will let consumers pay for any Apple Pay purchase in installments over time, rivaling the “buy now, pay later” offerings popularized by services from Affirm and PayPal. The upcoming service, known internally as Apple Pay Later, will use Goldman Sachs Group as the lender for the loans needed for the installment offerings. (CN Beta, Apple Insider, Bloomberg)