7-17 #What’sThePoint : TSMC’s Arizona plant with USD12B investment has been expected to begin production in 1Q24; Intel is allegedly in talks to buy semiconductor manufacturer GlobalFoundries for about USD30B; MediaTek has announced Helio G96 and G88; etc.

TSMC chairman Mark Liu has confirmed that the company’s Arizona plant with USD12B investment has been expected to begin production in 1Q24. C.C. Wei, CEO of TSMC, has said the company is conducting “due diligence” to determine the feasibility of a chip facility in Japan. (Apple Insider, CN Beta, CN Beta, Asia Nikkei, 9to5Mac)

Taiwan Semiconductor Manufacturing Co (TSMC) expects sales to rise more than 20% in 2021, affirming its crucial role in helping alleviate a global chip shortage that’s walloped automaking and other industries. The company’s CEO C. C. Wei has indicated that he expects semiconductor supply to remain tight into 2022. The company will ramp up production of microcontrollers by close to 60% in 2021, which will help to greatly boost supplies for its automobile clients starting in the current quarter. (CN Beta, The Verge, WSJ, Business Hala, Bloomberg)

Intel is allegedly in talks to buy semiconductor manufacturer GlobalFoundries for about USD30B. GlobalFoundries, which is owned by Abu Dhabi sovereign wealth fund Mubadala Investment, has a manufacturing footprint across the U.S., Europe and Asia. Intel has said it intended to open its factories to outside chip designers. (CN Beta, WSJ, Reuters, The Verge)

Samsung Electronics will supply automotive semiconductors (Exynos Auto) to Volkswagen, the world’s largest automaker after Audi. Samsung Electronics’ System LSI Division has been supplying ‘Exynos Auto’, the latest system semiconductor product, to Volkswagen finished car models since the beginning of 2021. Exynos Auto is Samsung Electronics’ own vehicle system-on-a-chip (SoC) component and plays a role as the brain to be applied to the vehicle infotainment system. (GizChina, MK.co.kr, Sina, CN Beta)

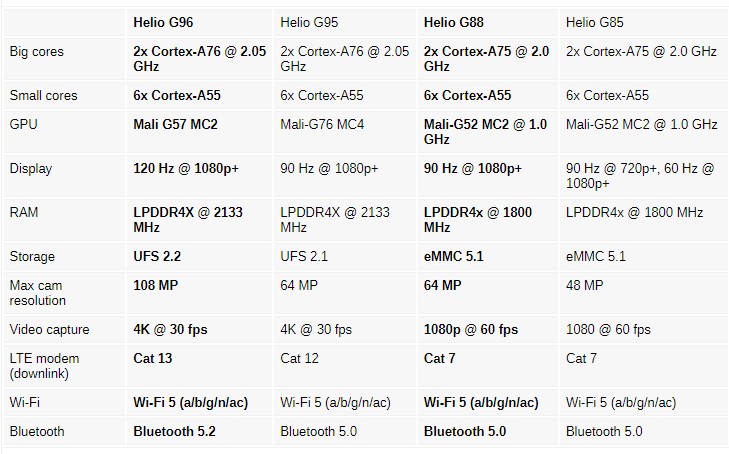

MediaTek has announced new members of its Helio G series with the unveiling of Helio G96 and G88. Both chipsets are designed with mobile photography in mind along with improvements to the display and the overall OS experience. (GSM Arena, Neowin, MediaTek)

According to Semiconductor Equipment Association of Japan (SEAJ), for fiscal 2021, as firm logic / foundries investment will be greatly added to by a recovery in memory, forecast sales of JPY2.92T (USD26.4B), an increase of 22.5% from the previous year. For fiscal 2022, expecting a further increase in investment amounts, we forecast sales of JPY3.07T (USD27.7B), an increase of 5.1%, and for fiscal 2023 as well, forecast sales of JPY3.22T (USD29.1B), an increase of 4.9%. (Sohu, report, Laoyaoba)

Samsung Electronics has recently introduced a roadmap for its semiconductor foundry business. Although the roadmap includes plans for mass-production of first-generation 4nm chips in 2H21, mass-production of second-generation 4nm chips in 2022 and mass-production of second-generation 3-nm chips in 2023, it does not include a plan for volume production of first-generation 3nm chips. Samsung Electronics has previous announced that it would introduce 3nm process technology from 2022.(Laoyaoba, Business Korea, Sohu)

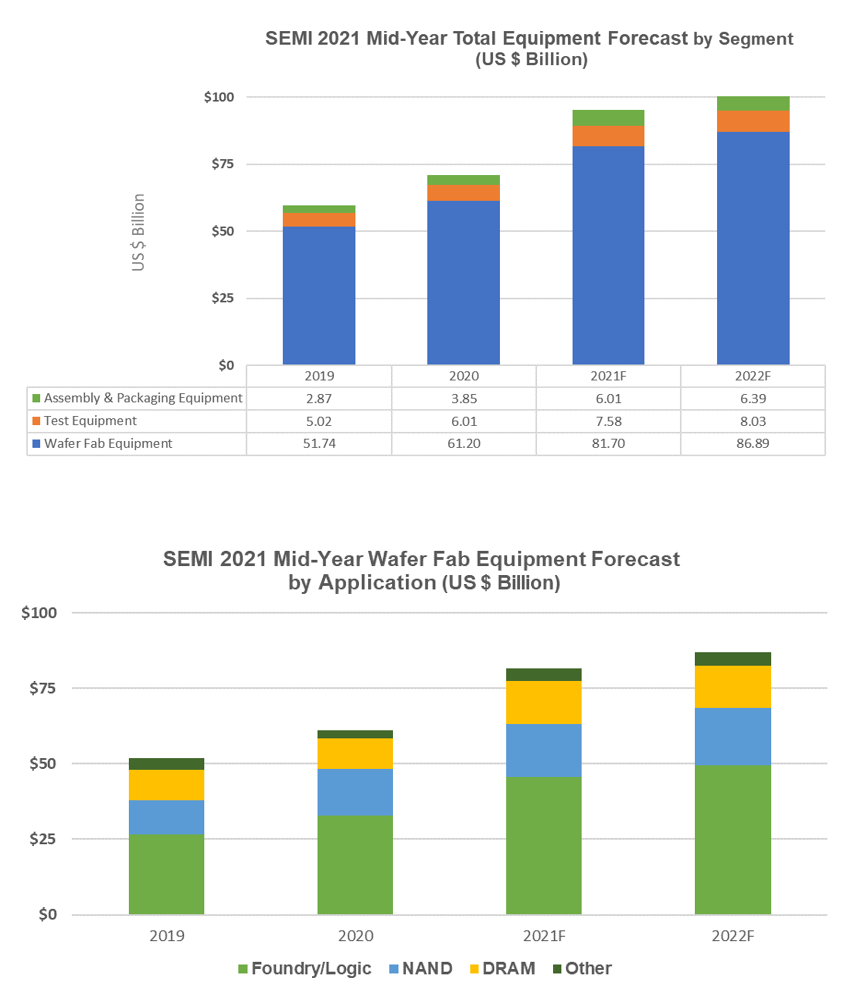

Global sales of semiconductor manufacturing equipment by original equipment manufacturers are forecast to surpass USD100B in 2022, a new high, after jumping 34% to USD95.3B in 2021 compared to USD71.1B in 2020, according to SEMI. The wafer fab equipment segment, which includes wafer processing, fab facilities, and mask/reticle equipment, is projected to surge 34% to a new industry record of USD81.7B in 2021, followed by a 6% increase in 2022 to more than USD86B. (SEMI, Evertiq, EET Asia, Laoyaoba)

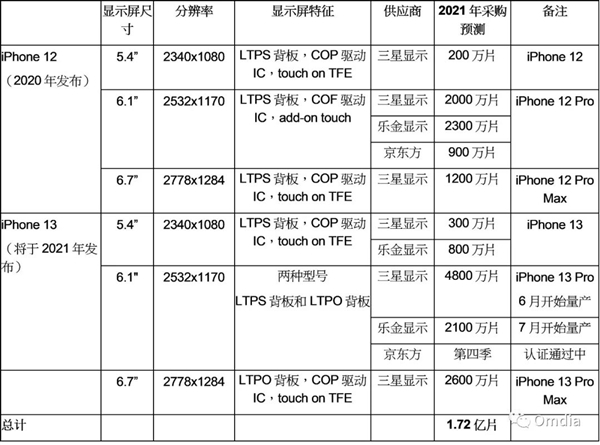

According to the Omdia, in 2021, Apple is expected to purchase 172M flexible OLED display panels from Samsung Display (SDC), LG Display (LGD) and BOE. Of the 172M pieces, 106M pieces are used in the new iPhone 13 series. Omdia has said that Apple will launch the iPhone 13 model in 3Q21. The new technology applied is the LTPO backplane. BOE is currently a supplier of flexible OLED panels for the iPhone 12. For the new iPhone 13, BOE’s panel is in the process of being certified, and mass production is expected to begin in 4Q21. (CN Beta, Min.news)

Rockley Photonics, a leading global silicon photonics technology company, has revealed its complete full-stack, “clinic-on-the- wrist” digital health sensor system. Rockley’s sensor module and associated reference designs for consumer products integrate hardware and application firmware to enable wearable devices to monitor multiple biomarkers, including core body temperature, blood pressure, body hydration, alcohol, lactate, and glucose trends, among others. Apple is listed as the largest client of Rockley Photonics. (Phone Arena, 9to5Mac, Rockley Photonics)

Foxconn (Hon Hai) has disclosed it will invest in Singapore-based SolidEnergy Systems (SES), a maker of Li-metal batteries, a move in line with its ambitious deployments in the electric vehicle (EV) sector. SES seems to be a better investment target than QuantumScape or Solid power for Foxconn because SES is at a stage of private placement, through which Foxconn could see solid returns in the future. (CN Beta, Digitimes, Business Wire)

University of California San Diego has developed a thin, flexible strip that can be worn on a fingertip and generate small amounts of electricity when a person’s finger sweats or presses on it. The device also generates extra power from light finger presses. From 10 hours of sleep, the device collected almost 400 millijoules of energy—this is enough to power an electronic wristwatch for 24 hours. (CN Beta, UC San Diego, Science Daily, ScienceNet, Independent)

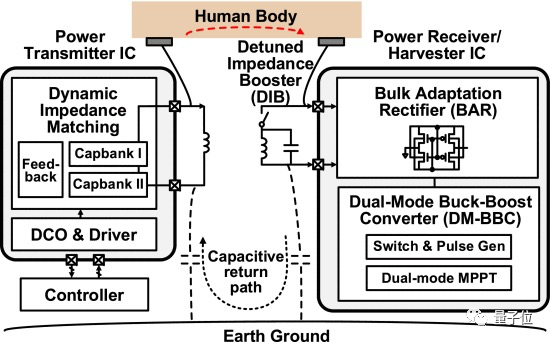

National Institute of Singapore (NUS) has developed a “body-coupled power transmission” device that can wirelessly power other wearable devices. The device can provide power by using the human body as a medium for power transmission and can harness energy from nearby home or office electronics such as laptops. The energy harvesting devices contain an electrode to pick up the electric field (20-80MHz) on the skin and relay it to the receiver. By varying the separation distance between transmitter and receivers, the researchers mapped the power received over the entire body. In terms of received power, the body-coupled transmission outperformed radiofrequency (RF) power transmission by up to 70 and 50 dB, at 2.4 GHz and 900 MHz, respectively. (CN Beta, Nature, EE Power, Physics World)

SVOLT, a subsidiary of Great Wall Motors, held the first mass production off-line ceremony of cobalt-free batteries in Jiangsu. This means that the world’s first cobalt-free battery has stepped out of the laboratory and officially achieved mass production. The mass-produced cobalt-free battery is a product with an energy density of 240wh/kg and a capacity of 115Ah-MEB. (Laoyaoba, Sina, OfWeek, 163, Auto Evolution)

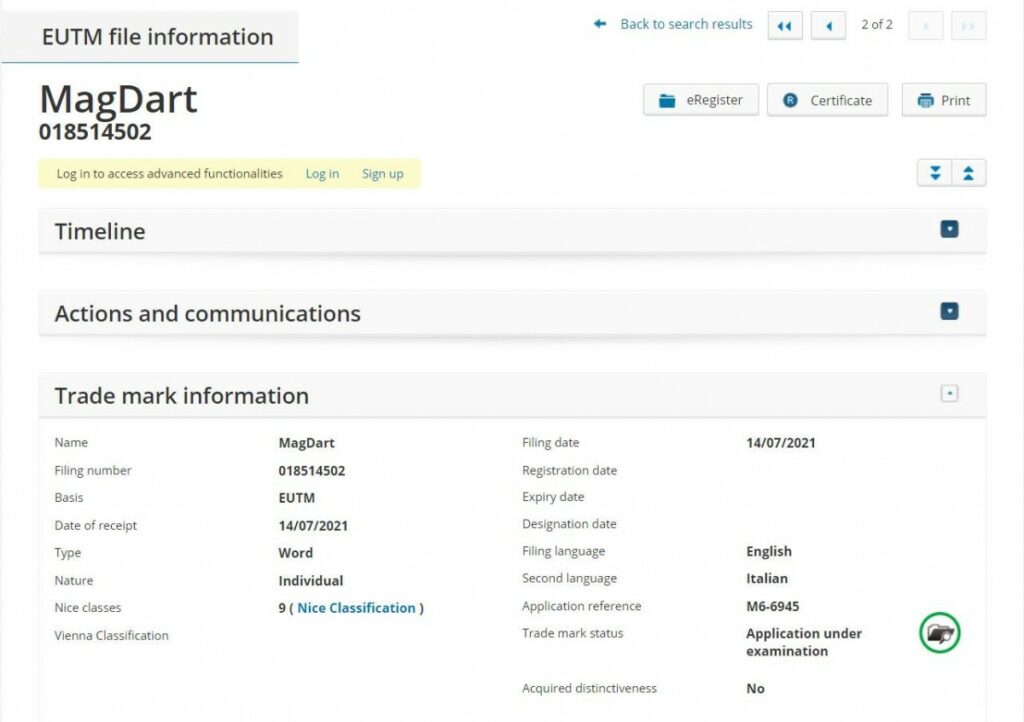

realme has registered the Magdart trademark, which is most probably a wireless charging technology. The description of the trademark filing also mentions wireless charging pads, which hints that it is a wireless charging technology like Apple MagSafe. (CN Beta, GSM Arena, Droid Maze)

LG Uplus, a major South Korean telecom operator, has said it has signed a memorandum of understanding with Japan’s largest mobile carrier KDDI to find new business applications for 5G network technology and strengthen cooperation to prepare for future 6G networks. (CN Beta, CWW, Korea Herald)

Virginia Governor Ralph Northam, a Democrat, has announced that the commonwealth will invest USD700M of federal funds to provide universal broadband to its residents by 2024. The state expects to have commitments on the majority of connections in the next 18 months. (The Verge, CNBC)

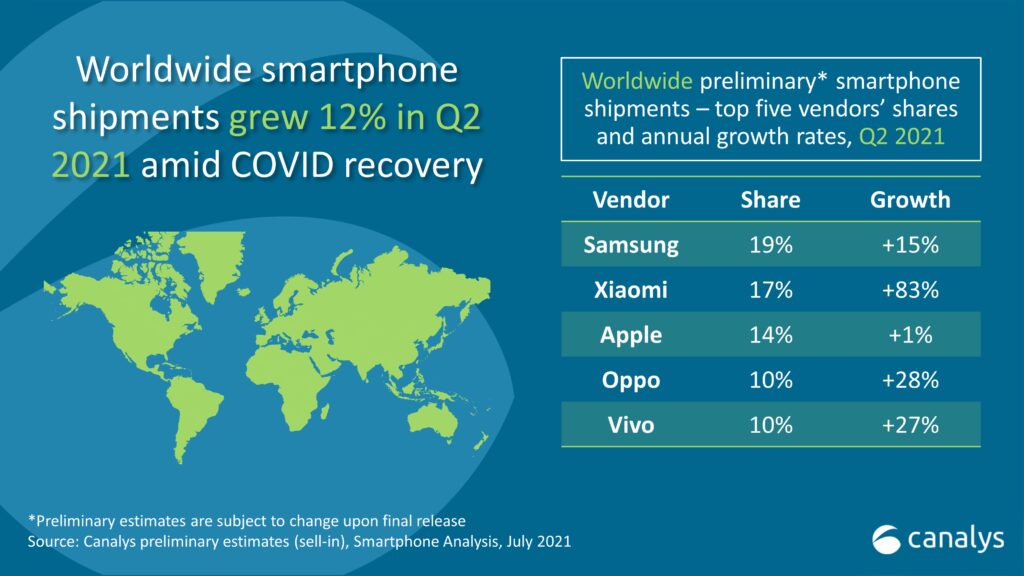

In 2Q21, global smartphone shipments increased 12%, as vaccines rolled out around the world, and the new normal for economies and citizens started to take shape. Samsung was the leading vendor with a 19% share of smartphones shipped. Xiaomi took second place for the first time ever, with a 17% share. Apple was third, with 14%, while vivo and OPPO maintained strong growth momentum to complete the top 5. (GSM Arena, Android Authority, Gizmo China, Canalys)

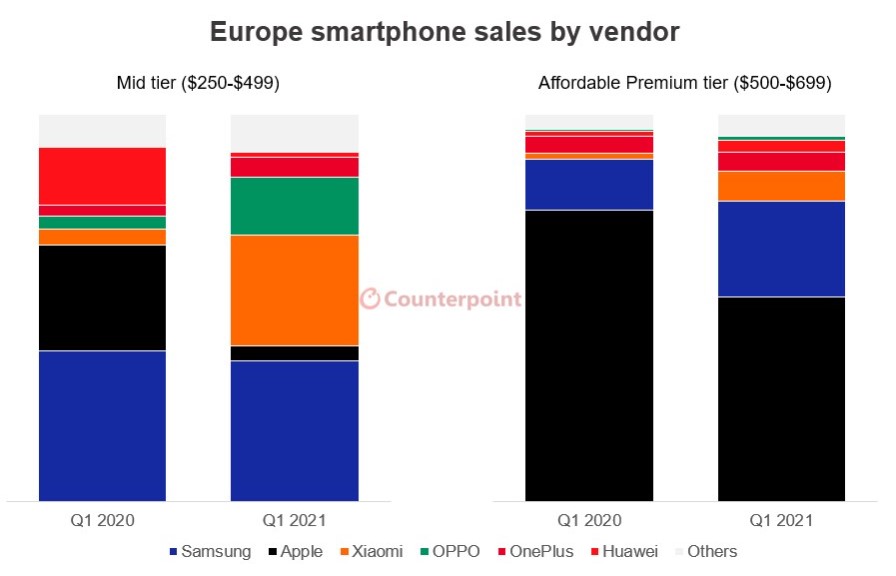

In 1Q20 there were no mid-range 5G phones available on the European market. In 3Q20 they made up 20% of the segment. In 1Q21 5G mid-rangers account for half of devices sold in Europe in the USD250-500 range, according to Counterpoint Research. Support for the next-gen networks is only part of the story – the mid-tier (USD250-500) and “affordable premium” tier (USD500-700) are what drove the growth of smartphone sales in Europe in 2020. This came at the expense of Huawei. (Gizmo China, GSM Arena, Counterpoint Research)

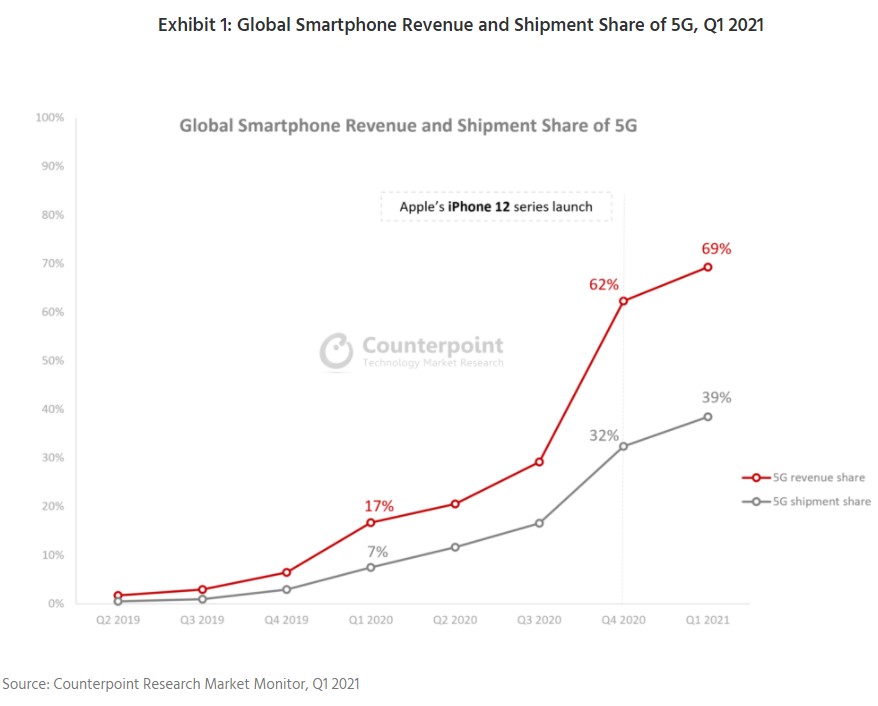

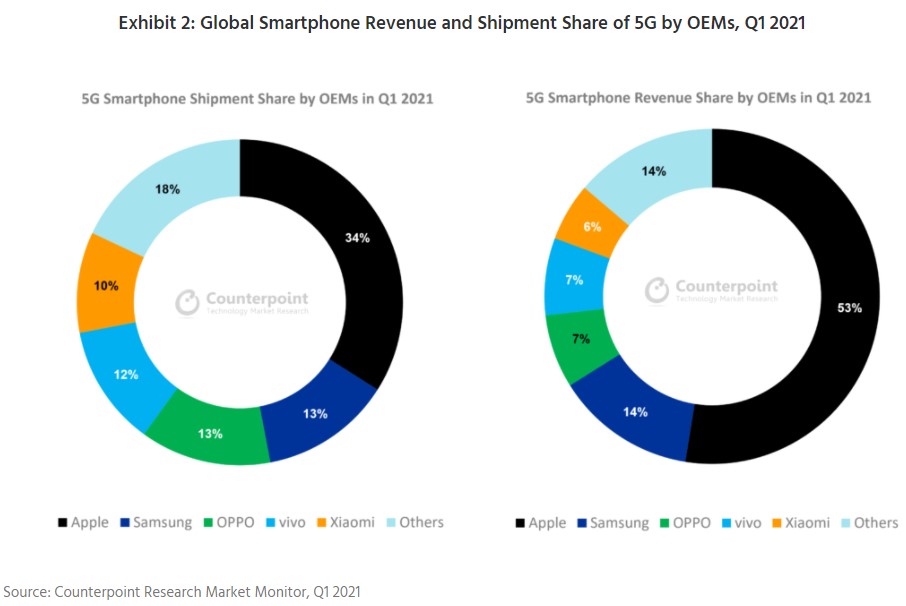

According to Counterpoint Research, 5G devices captured more than two-thirds (69%) of global smartphone revenue in 1Q21, with their shipments reaching 39% of the global total for the quarter. The launch of Apple’s 5G capable iPhone 12 series in 4Q20 gave a boost to the 5G smartphone market. The momentum continued in 1Q21 when 5G smartphone shipments grew 7% QoQ despite total shipments declining 10% QoQ. (GizChina, Counterpoint Research)

China Telecom will release Maimang 10 SE 5G. The “Maimang” now belongs to China Telecom’s own brand. Since China Telecom does not have a phone manufacturing plant, it is speculated that Maimang 10 SE should be built by ODM. It is unknown if Huawei is involved. (CN Beta, My Drivers, Huawei Update)

vivo S10 and S10 Pro are announced in China, featuring 6.44” 1080×2400 FHD+ notch Super AMOLED 90Hz, MediaTek Dimensity 1100 5G, fingerprint on display, 4050mAh 44W: S10 – Rear tri 64MP-8MP ultrawide-2MP macro + front 44MP, 8+128 / 12+256GB, Android 11.0, CNY2,799 (USD433) / CNY2,999 (USD464). S10 Pro – Rear tri 108MP-8MP ultrawide-2MP macro + front dual 44MP-8MP ultrawide, 12+256GB, Android 11.0, CNY3,999 (USD618). (GSM Arena, Gizmo China, vivo)

Tecno Camon 17 and 17 Pro are launched in India: Camon 17 – 6.6” 720×1600 HiD HD+ 90Hz, MediaTek Helio G85, rear tri 48MP-2MP depth-AI lens + front 16MP, 6+128GB, Android 11.0, rear fingerprint, 5000mAh 18W, INR12,999 (USD175). Camon 17 Pro – 6.8” 1080×2460 HiD FHD+ 90Hz, MediaTek Helio G95, rear quad 64MP-8MP ultrawide-2MP depth-2MP monochrome + front 48MP, 8+128GB, Android 11.0, side fingerprint, 5000mAh 25W / 33W, INR16,999 (USD228). (GSM Arena, Gizmo China)

Samsung is expanding SmartThings with the release of SmartThings Energy. The new feature gives users of the SmartThings app visibility into their electricity utilization so that they can understand and make changes in their life to reduce their overall usage. Currently, SmartThings Energy will only support Samsung home appliances and Samsung HVAC products. (Neowin, Samsung, Engadget)

Japan Airlines (JAL) plans to enter the flying car business in fiscal year 2025. The airline will start a passenger transportation service connecting airports and tourist destinations in Mie Prefecture, among other areas. JAL will use the aircraft of Volocopter, a German startup in which it invested in 2020.(CN Beta, Simple Flying, Asia Nikkei, CN Beta)

The European Commission has proposed a plan to reduce the EU’s carbon emissions by 55% compared with 1990 levels by 2030. The “Fit for 55” package comprises 12 legislative proposals aimed at hitting the target. The overarching goal is to make the EU carbon neutral by 2050 as part of the European Green Deal. According to the proposals, no more combustion engine cars, whether powered by petrol or diesel, would be manufactured in the European Union by 2035 including hybrid vehicles. (Laoyaoba, EU, DW)

Germany expects to have 14M electric and plug-in hybrid vehicles on its roads by 2030 as Europe’s biggest economy attempts to comply with increasingly stringent emissions rules. The forecast is at least 40% higher than a previous estimate thanks to a recent surge in EV sales, says the Economy Minister Peter Altmaier. Germany expected to have about 1M such cars on its roads in Jul 2021. (CN Beta, Bloomberg, Reuters)

PayPal users can now buy USD100,000 of bitcoin and other digital assets per week, up from a previous limit of USD20,000. PayPal is also scrapping its annual purchase limit of USD50,000. PayPal first started letting users buy cryptocurrency in Oct 2020. (Engadget, CNBC)