7-24 #Balding : Intel claims it is now manufacturing more 10nm wafers than 14nm; Corning is launching Gorilla Glass optimized for smartphone camera lenses; Samsung has announced it is expanding its portfolio of Software-Defined Networking (SDN); etc.

Intel has some positive news to share regarding its long-delayed 10nm FinFET process. Pat Gelsinger, the new CEO of Intel has stated the company is “now manufacturing more 10nm wafers than 14nm”. As 10nm volumes ramp, economics are improving with 10nm wafer cost 45% lower YoY with more to come. (Neowin, Seeking Alpha)

Brand vendors of 5G smartphones have started building component inventory for their new models for 2H21, but prices of AP solutions are facing difficulties to increase, despite the ongoing rising quotes for ICs that are in shortages, because of fierce competition among suppliers, according to Digitimes. The vendors’ orders for chips are mostly up more than 10% sequentially in 3Q21, but AP supply has remained sufficient, as AP solution developers Qualcomm and Unisoc were able to secure capacity from wafer foundry partners, while Xiaomi’s and OPPO’s new in-house developed 5G APs will soon join the competition. (Digitimes, press, Digitimes)

Hyundai Motor has warned that a prolonged shortage of chips in the auto industry would continue to hit its sales in 3Q21, after posting its best quarterly profit in 7 years. The company is able to mitigate the effect of the global chip shortage in 2020 after stockpiling components, but it has been cutting output of less popular models since Apr 2021 as inventories run out. Hyundai expects the shortage to ease gradually from 3Q21 although some parts will continue to be in short supply. The company has completed orders for chips needed for production in 2022. (Laoyaoba, Financial Times)

TF Securities analyst Ming-Chi Kuo predicts that Apple will release the new MacBook Air in the middle of 2022. The new model will be equipped with a 13.3” mini LED display. If the component shortage continues to improve in 2022, it will benefit from the continuous upgrade of the new MacBook Air and Apple Silicon. It is estimated that MacBook shipments will grow to approximately 20-22M units in 2022. Before comparison, 17-18M units in 2021. (Laoyaoba, TF Securities, My Drivers, Mac Rumors)

E Ink has announced that RICOH, an innovative technology and service company enabling individuals to work smarter, has revealed world’s thinnest and lightest portable digital white board. The RICOH eWhiteboard 4200 is designed to connect remote sites to each other, and to main offices, to promote smarter workplaces through digitizing traditional pen-based analog operations. (Techbang, Digitimes, Business Wire, Bloomberg, UDN)

Corning has launched its latest composite, which is a new version of Gorilla Glass optimized for smartphone camera lenses — Gorilla Glass DX and DX+. The company says that the new composite let in 98% of ambient light while still being just as scratch-resistant as typical Gorilla Glass. In comparison, lens covers with traditional anti-reflective coatings only let in about 95% of light. (GSM Arena, GizChina, Gizmo China, Corning)

ZTE’s consumer experience leader Lv Qianhao has indicated that ZTE is about to introduce the new memory fusion technology Pro. This technology combines UFS3.1 ROM with fast reading and writing speed. It will also use a brand-new Lingxi engine and DY TM. As for the impact, it will add 8GB to the RAM capacity. Thus, it can increase a 12GB RAM smartphone to 20GB. (My Drivers, IT Home, GizChina)

Wedbush analysts have kept a close eye at Apple’s supply chain in Asia and now reiterate their original claim – LiDAR on all models, 1TB options on the iPhone 13 Pro and 13 Pro Max. This might mean that the lower storage options (128 GB and 256 GB) will be doubled too. (CN Beta, 9to5Mac, GSM Arena)

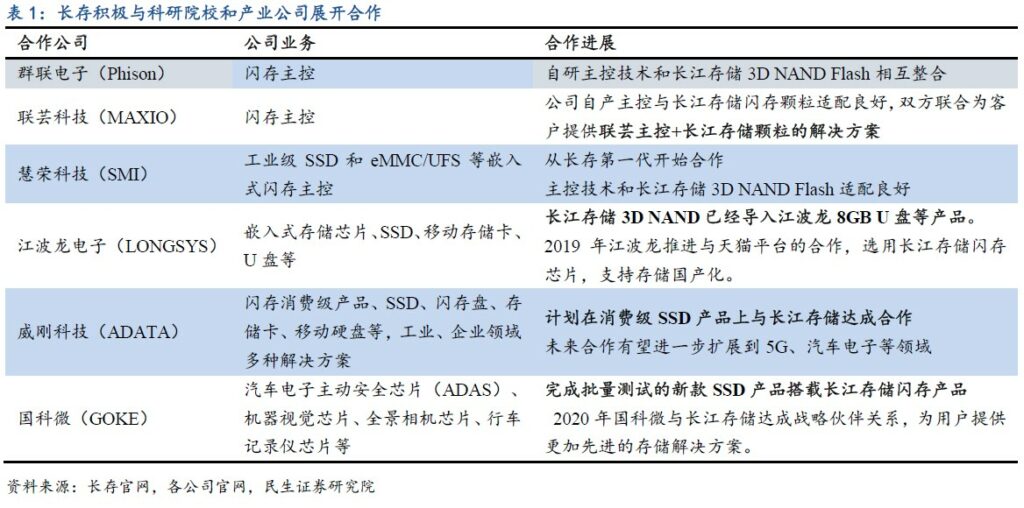

Yangtze Memory Technology Co (YMTC) has invested heavily in research and development. Currently, its research and development centers are located in Wuhan, Shanghai, Beijing and other places, and are cooperating with the Institute of Microelectronics, Chinese Academy of Sciences, Phison, Longsys, ADATA, Lianyun, Huirong, and Goke with other scientific research institutions and industrial companies. (Minsheng Securities report)

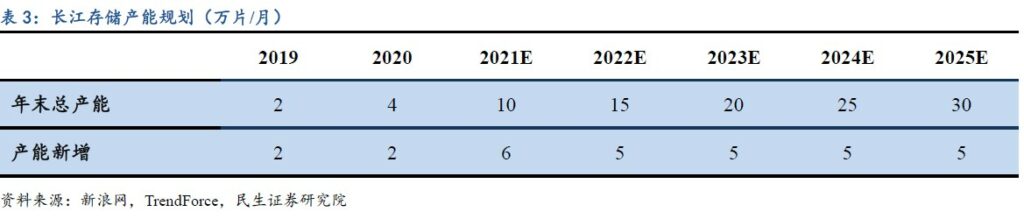

YMTC plans to build 3 large factories, each with a planned production capacity of 100,000 pieces per month, and plans to achieve full production in 2025. After the third phase of the factory is full, it is expected to achieve an annual output value of CNY100B. By the end of 2019 and 2020, the long-term storage capacity will reach 20,000/month and 40,000/month respectively. According to the 14th Five-Year Plan, the long-term storage capacity will reach 100,000 in 2021, 2022, 2023, 2024, and 2025. Pieces/month, 150,000 pieces/month, 200,000 pieces/month, 250,000 pieces/month, 300,000 pieces/month. As of the end of 2020, YMTC has achieved nearly 1% of the global market share, becoming the NAND Flash wafer fab with the largest market share outside of the six major international OEMs. It is expected that the proportion of global total production capacity will reach about 6% by the end of 2025. (Minsheng Securities report)

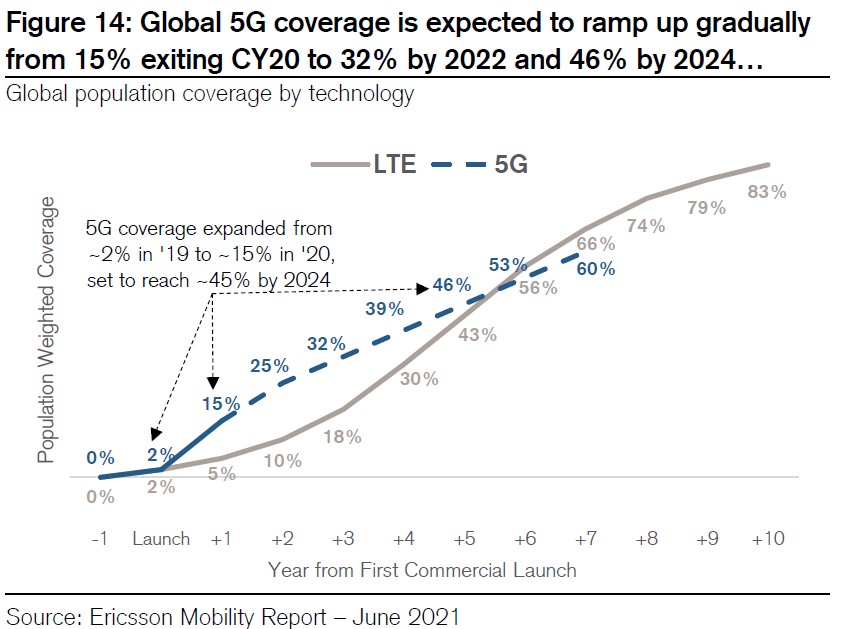

Beyond device enablement, network coverage is a key variable in customers’ ability to take advantage of 5G. Commercial 5G roll-outs began in 2019, but global population coverage has only reached ~15% and would not cross 50% until 2025 (as per Ericsson). This suggests that even with a 5G device, many people may not have access to consistent 5G service for several years (5G phones will still be compatible with 4G coverage). (Credit Suisse report)

Apple has started rolling out the new high-quality streaming options for Android devices, even though they are not specifically mentioned in the Android app’s release notes. Apple has first announced that it is making the streaming options available to subscribers at no extra charge back in May 2021, promising immersive experiences. (Engadget)

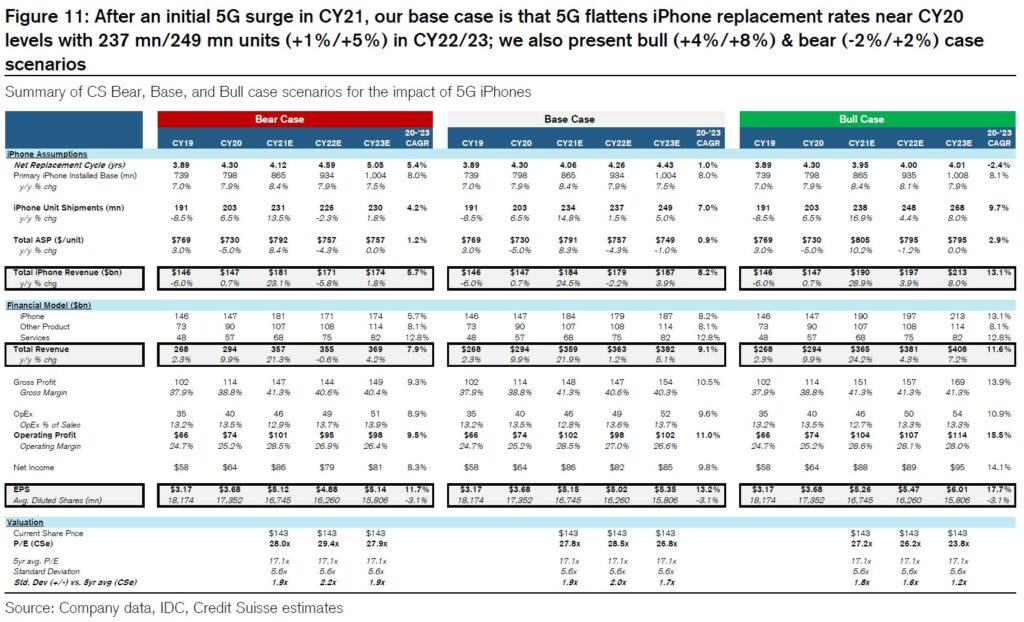

To help frame and quantify a potential range of outcomes, Credit Suisse leverages their proprietary Apple iPhone installed base model as a starting point. Their base case is that 5G halts the prolonged extension in replacement rates near 2020 levels of ~4.3 years (2021 slightly lower on the shift in launch timing) for iPhone sales of 234M / 237M / 249M units in 2021 / 2022 / 2023 (+15% / +1% / +5% YoY growth). In addition to their base case, they present a bull case where stronger 5G upgrade demand drives an inflection in the replacement rate back to near 2019 levels, and a bear case where a structural extension of replacement rates is largely unaffected by 5G. (Credit Suisse report)

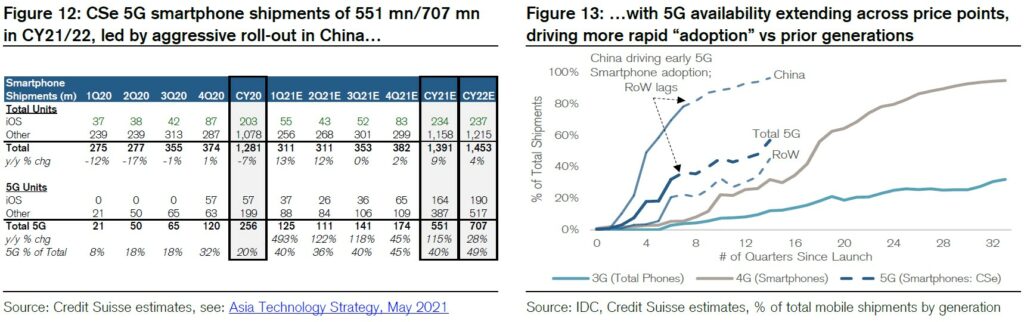

5G-enabled smartphone shipments reached 256M units in 2020 (20% of total, per IDC) and Credit Suisse sees adoption rising rapidly to 551M / 707M units in 2021 / 2022 (40% / 49% of all units), after initial launches starting in 2019; this is much faster than the ~4 years it took for 4G smartphone penetration to pass 30%. The inclusion of 5G on most vendors’ flagship smartphones, and the emergence of sub-6GHz 5G devices at <USD400 likely drives a further pick-up in adoption through 2021. (Credit Suisse report)

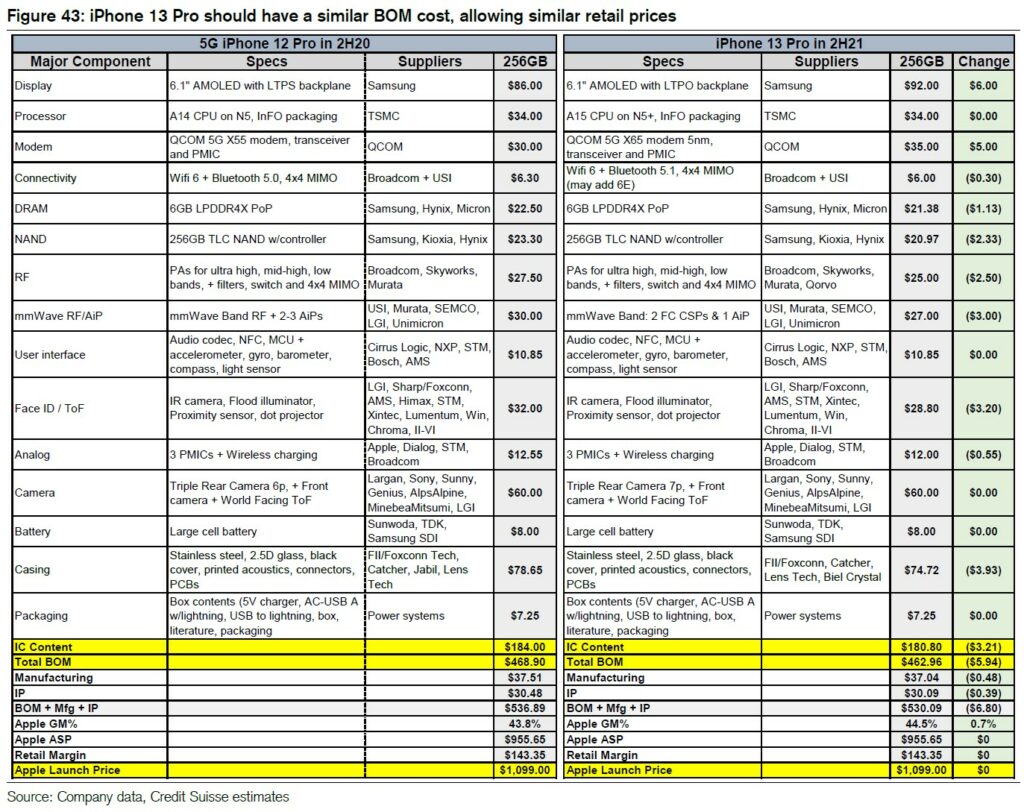

Credit Suisse computes an overall BOM cost within 1-2% of Apple iPhone models in 2020. The cost increases should mainly be on the display changing to LTPO backplane (+USD6) and the modem upgrading to 5nm (+USD5), with modest cost down on AiP design (-USD2.50), face ID integration of multiple VCSELs (-USD3.20), power management integration, memory (-USD3.5) and casing (-USD3.9), along with smaller YoY savings from connectivity and RF integration, unless Wifi 6E pulls into 2021. (Credit Suisse report)

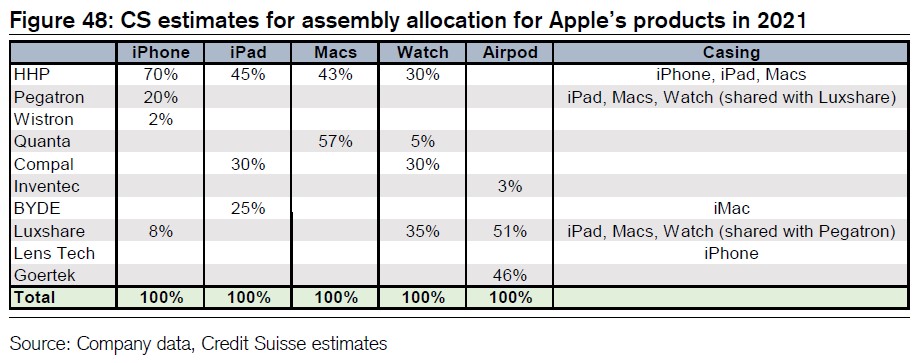

While Credit Suisse still expects Luxshare to garner less than 10% market share in Apple iPhone assembly in the first year, they believe its market share is likely higher than Wistron’s, given Luxshare’s better vertical integration capability and Apple’s China localization strategy. They believe the trend is more negative for Pegatron than Hon Hai, given Pegatron’s relatively weaker vertical integration capability, and bigger revenue dependence on Apple (60-65% of 2020 revenue, vs Hon Hai’s 50-55%). (Credit Suisse report)

Spotify and Giphy have partnered to effectively give GIFs a soundtrack. Find an artist’s GIF on their official Giphy channel and user can tap a “listen on Spotify” button to visit that artist’s Spotify page. This is ultimately about translating GIF views into money for artists. (CN Beta, TechCrunch, Giphy, Spotify, Engadget)

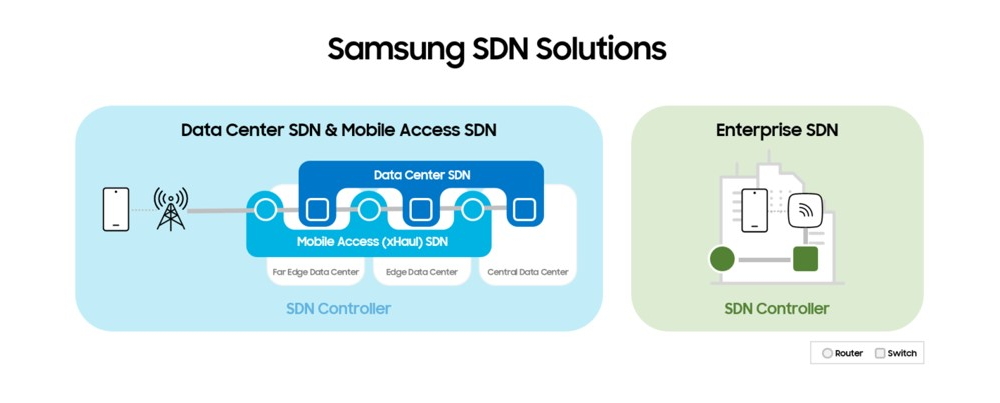

Samsung Electronics has announced it is expanding its portfolio of Software-Defined Networking (SDN) solutions with new capabilities designed to help mobile operators and enterprises manage networks more easily. Samsung’s new SDN solutions will power enterprises in various sectors, including education, retail and energy. This full lineup of SDN will also support mobile access (xHaul), which refers to fronthaul, midhaul and backhaul transport networks. (CN Beta, Neowin, Samsung)

POCO F3 GT is launched in India – 6.67” 1080×2400 FHD+ HiD OLED 120Hz, MediaTek Dimensity 1200 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 6+128 / 8+128 / 8+256GB, Android 11.0, side fingerprint, 5065mAh 67W, INR26,999 (USD362) / INR28,999 (USD390) / INR30,999 (USD416). (GizChina, Android Authority, Gizmo China)

Gionee STYLFIT GSW6 and GSW8 smartwatches launched in India, priced at INR2,999 (USD40) and INR3,499 (USD47). While the Gionee STYLFIT GSW6 adopts a square-shaped watch face, the STYLFIT GSW8 comes with a round dial. The two smartwatches are equipped with a SpO2 monitor, a heart rate monitor, a sleep tracker, a calorie meter, and more. They also pack a built-in speaker and a microphone which allows users to take calls right from the smartwatch when there is an incoming call on a connected smartphone. (Gizmo China, India Times, The Mobile Indian)

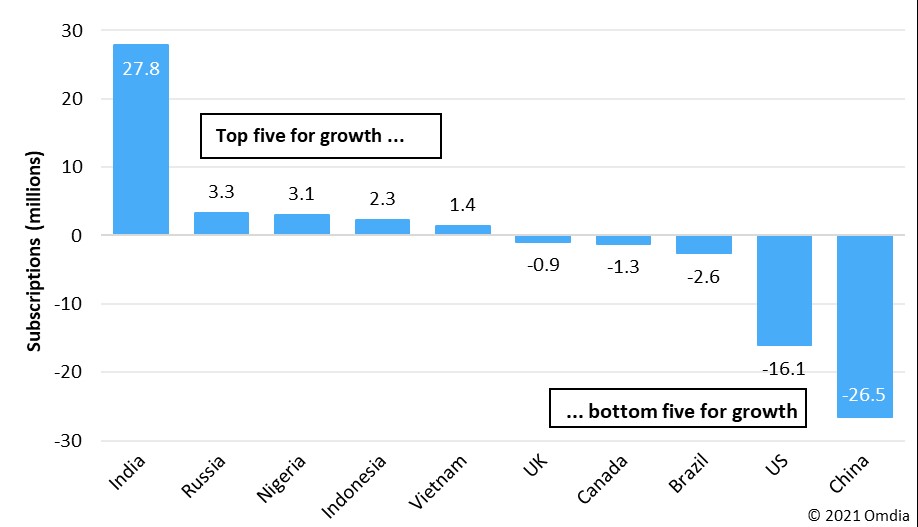

According to Omdia, in terms of net worth, the number of global traditional pay TV subscribers will be reduced by more than 8M in 2020, and the total will drop from 1.073B at the end of 2019 to 1.065B at the end of 2020. During the year of the COVID-19 pandemic, the growth of online video has been greatly promoted. Some people may find that the scale of the decrease in the number of pay TV users is relatively small (only a decrease of 0.7%). The number of pay TV subscribers in the United States has fallen by more than 5.8M in 2020, while the number of pay TV subscribers in India has increased by nearly 3M in 2020. (CN Beta, Omdia)