8-6 #Life : Google has unveiled Tensor, its first mobile system on a chip; OPPO has introduced its new under-display camera technology; The UK government is considering blocking chip designer Nvidia’s acquisition of ARM on potential national security risks; etc.

Following an online pilot in the fall of 2020 with Maricopa County Community College District, Intel is expanding its AI for Workforce Program to include 18 additional schools in 11 states, including California, New Mexico and Michigan. The program includes courses on data collection, computer vision, model training, coding and AI ethics. (Engadget, Intel)

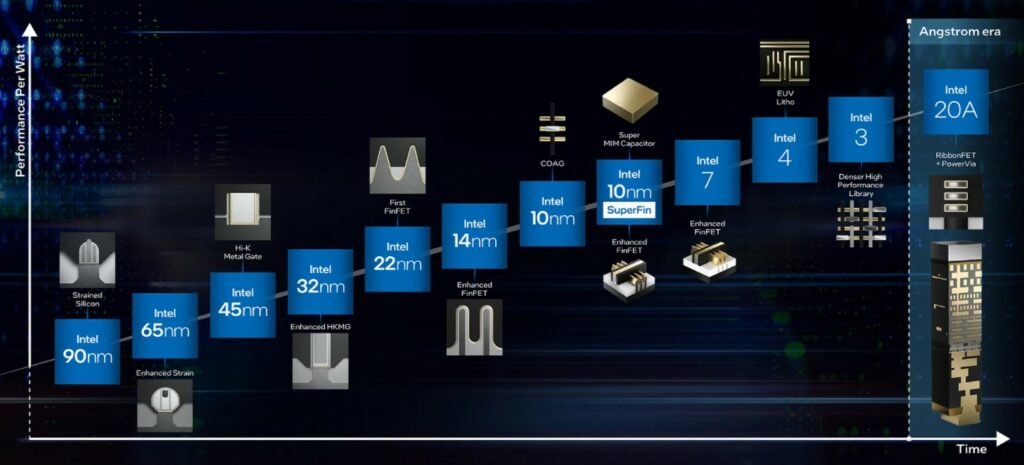

Intel has revealed aggressive plans to shrink chip manufacturing processes to 4nm, 3nm, and eventually as small as 1.8nm, all by 2025. Intel’s current 10nm “Enhanced Superfin” manufacturing is being renamed to “7,” despite not actually being a true 7nm process. Intel is dubbing the 2nm and 1.8nm as “20A” and “18A”, respectively, referring to the angstrom, a unit measuring one ten-billionth of a meter. 18A processors are currently slated to start production in 2025. (Engadget, Android Authority)

Google has unveiled Tensor, its first mobile system on a chip, which is a single chip that integrates a group of processing units and increases computing power in an energy-efficient way. Samsung allegedly handle production using its advanced 5nm process technology. Google has previously teamed up with Broadcom to develop the tensor processing unit for its mega data center servers. The company has been using TPUs in its data center for more than 5 years, to accelerate the computing of customized AI algorithms to help recognize and analyze images, languages, text, and videos in the cloud. TSMC handles the production of those chips. (Nikkei Asia, Android Headlines, Google, CN Beta)

According to Lillian Li, VP and senior credit officer at Moody’s, all the world’s advanced economies, including the U.S., the EU, South Korea, and China have set out plans to advance capacity in the domestic semiconductor industry. But, Li says, Beijing’s push for semiconductor independence could lead to overcapacity in particular chipmaking sectors—such as memory chips—and leave companies with “less access to credit and government support” unprofitable, as total demand falls short of capacity. But even chipmakers with strong government support are at risk of expanding too aggressively. (Phone Arena, Fortune, Moody’s)

The UK government is considering blocking chip designer Nvidia’s USD40B acquisition of British peer ARM on potential national security risks. Nvidia has said that it is working through the regulatory process with the UK government. (Apple Insider, Bloomberg, Reuters)

Taiwan Semiconductor Manufacturing Co (TSMC) stated that construction of its 3nm plant is on schedule to reach mass production in 2H22. The 3nm process production line has been carried out in the Fab 18 factory. The area and power consumption of the 3nm chip are less than 70% of that of the 5nm chip. TSMC plans to start trial production of 3nm process products in 2021, and plans to start mass production in 2022. TSMC is accelerating the development of its 2nm process technology. Taiwan has approved the construction of its 2nm wafer fab, which is scheduled to be completed by the end of 2021. Mass production is expected to start in 2024. (CN Beta, WCCFTech, Taiwan News, Digitimes, CAN, UDN)

The Foxconn Technology Group has announced it is spending NTD2.52B (USD90.76M) on a Macronix International factory specialized in automotive semiconductors production. The deal to purchase the plant and the equipment to manufacture 6” wafers will be completed by the end of 2021. Foxconn and Macronix have said the sale of the 6” wafer fabrication plant (fab) in Taiwan’s chip-making hub of Hsinchu will be finalised by the end of 2021. (CN Beta, Reuters, Asia Nikkei, Digitimes, Macronix)

Qualcomm has revealed it has offered to buy Swedish auto parts maker Veoneer for USD4.6B. Veoneer is a developer of advanced driver assistance systems, decision-making vehicle hardware and software that can perform a limited set of actions under certain conditions, like changing lanes on a highway or emergency braking. Veoneer was spun off from automotive safety system maker Autoliv in 2018. (CN Beta, Qualcomm, Reuters, TechCrunch)

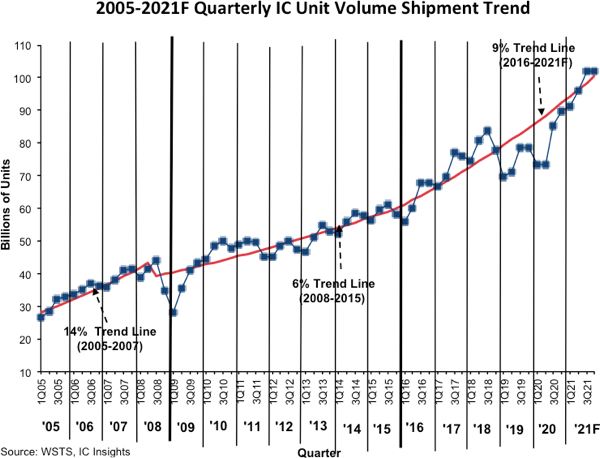

After a 6% drop in IC unit shipments in 2019, and an 8% increase in 2020, IC Insights forecasts a huge 21% jump in IC unit shipments in 2021. Unit shipments in 2021 are forecast to reach 391.2B, more than 11x the 34.1B units shipped over 30 years ago in 1990. The 2020-2025 IC unit volume CAGR is forecast to be 11%, five points more than the unit CAGR from 2015-2020. When ignoring the 5-year CAGR time periods with abnormally high or low endpoints, IC Insights believes that the long-term outlook for IC unit shipments is for a CAGR of 7%-8%, just below its 30-year rate of 9%. (IC Insights, Laoyaoba)

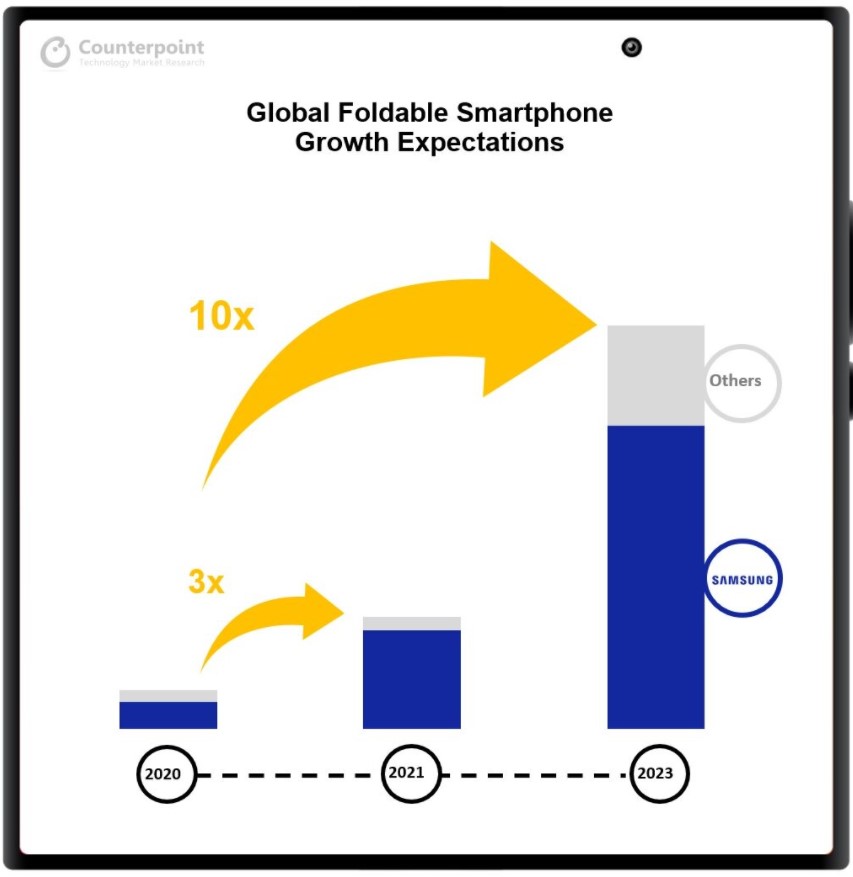

According to Counterpoint Research, the shipments for 2021 of foldable phones will remain in single digit, at around 9M units. However, it will still be a 3x growth over 2020, with Samsung dominating with over 88% market share. By 2023, they expect a 10x growth in foldable smartphone shipments. Even with more OEMs entering the foldable smartphone space, they expect Samsung to continue dominating with nearly 75% market share. If Apple is on track to release its foldable smartphone by 2023, it will not only be an inflection point in taking foldables mainstream but also improve the component yield and scale for the entire supply chain. (Android Headlines, Counterpoint Research)

OPPO has introduced its new under-display camera technology. The panel is developed jointly with BOE. The companies have developed an innovative pixel geometry that shrinks the size of every pixel in the area over the camera lens, reaching 400ppi. OPPO’s US Research Institute worked on imaging AI algorithms to make sure diffraction is reduced. Blurry images and image glare were the main concerns, but OPPO claims it trained its AI model using tens of thousands of images to control problems. (GSM Arena, Gizmo China, OPPO, Weibo, Sohu, IT Home)

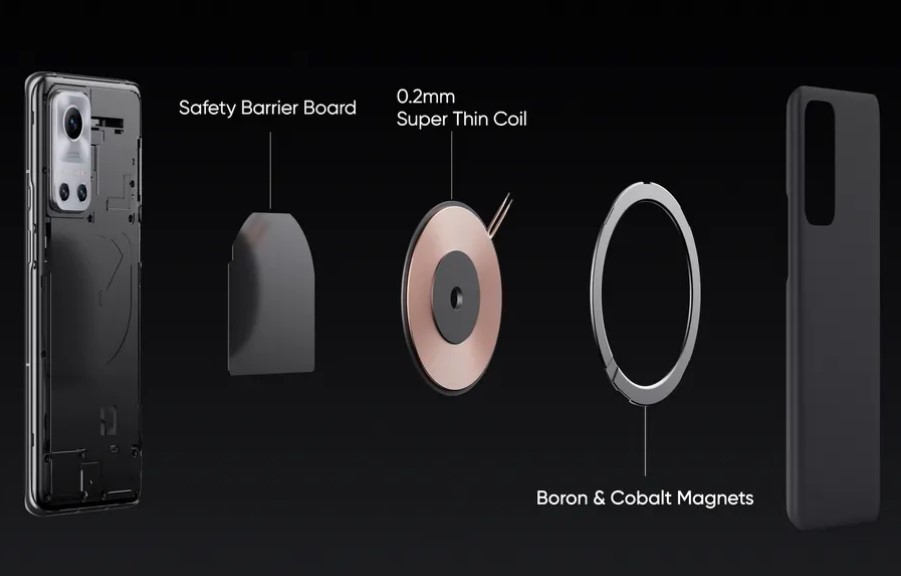

realme has launched MagDart, a wireless charging system which it says is the first magnetic wireless charger for Android phones. realme has also announced a MagDart power bank, a case, a wallet, and even a selfie light that uses the system. At the heart of MagDart is Realme’s SuperDart 50W wall charger and a 15W, 3.9mm thick wireless charging disc. This allows a faster charging speed, with a 4500mAh battery expected to go from zero to 100% in less than an hour. (The Verge, Digital Trends, CN Beta, GSM Arena, Android Authority)

Arizona-based Aira has announced that it has raised a USD12M seed round. The funding will go toward expanding the company’s reach beyond consumer device charging, into the worlds of enterprise, automotive and hospitality, as well as the development of a 2.0 version of its charging tech. (TechCrunch, PR Newswire, Yahoo)

AT&T has announced earlier in 2021 that it would spin its video properties DirecTV, AT&T TV, and U-verse into a new company it would co-manage with private equity firm TPG Capital. That transaction is finally complete, and the services will now operate as a single company under the name DirecTV. (The Verge, AT&T, ArsTechnica)

Samsung allegedly only managed to sell 13.5M units of the Galaxy S21 series during its first 6 months in the market. The sales decreased by 20% and 47% when compared with the Galaxy S20 series and S10 series, respectively. The Samsung Galaxy S21 series models are said to be the worst-performing Galaxy S series smartphones in the initial 6 months post-release. In fact, as per data, the sales of the Galaxy S lineup have been decreasing gradually every year. (Gizmo China, Business Post)

Xiaomi and InterDigital have recently struck a global licensing deal. The move from the brand enables it to resolve legal disputes between the two companies over Xiaomi’s use of InterDigital’s patents that cover various mobile technologies. Both firms have agreed to dismiss all pending legal disputes. Furthermore, the licensing agreements covers InterDigital’s SEPs for 3G, 4G, and 5G cellular, along with Wi Fi and High Efficiency Video Coding (HEVC). (Gizmo China, CN Beta, RCR Wireless)

realme India and Europe CEO Madhav Sheth has shared that the brand now encompasses over 100M users globally. An estimated 50M of realme’s users are from India making it the brand’s number one market. (realme, GSM Arena, Gizmo China, India Today)

Huawei has announced its plan to invest USD100M in startup support. Huawei has said the investment would go towards its Spark Program in the Asia Pacific region, which aims to build a sustainable startup ecosystem for the region over the next 3 years. Huawei has launched its Cloud-plus-Cloud Collaboration and Joint Innovation Program, to further ramp up its support for startups around the world. (Neowin, Huawei)

Samsung Electronics is extending its management review of its mobile business. Depending on how the review goes, Samsung could commence an audit of its mobile business. Special reviews are done without warning when the top leadership considers there is a problem with a particular business unit. The review was being done due to lackluster earnings of Samsung Mobile and supply chain management problems it is facing. Samsung’s latest phone Galaxy S21 series is expected to have sold only 13.5M units during 1H21. (GSM Arena, The Elec, My Drivers)

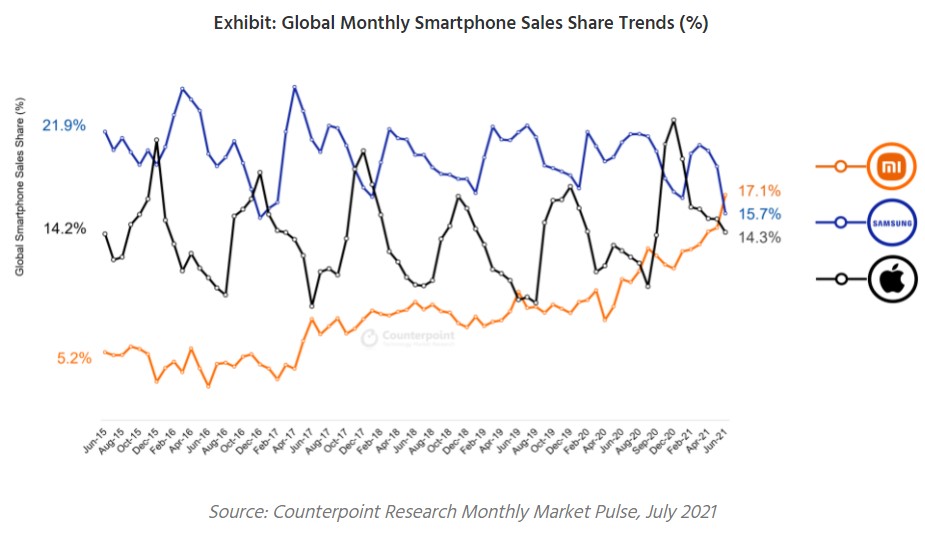

Xiaomi surpassed Samsung and Apple in Jun 2021 to become the number one smartphone brand in the world for the first time ever, according to Counterpoint Research. Xiaomi’s sales grew 26% MoM in Jun 2021, making it the fastest-growing brand for the month. Xiaomi was also the number two brand globally for 2Q21 in terms of sales, and cumulatively, has sold close to 800M smartphones since its inception in 2011. (Neowin, Counterpoint Research, CN Beta)

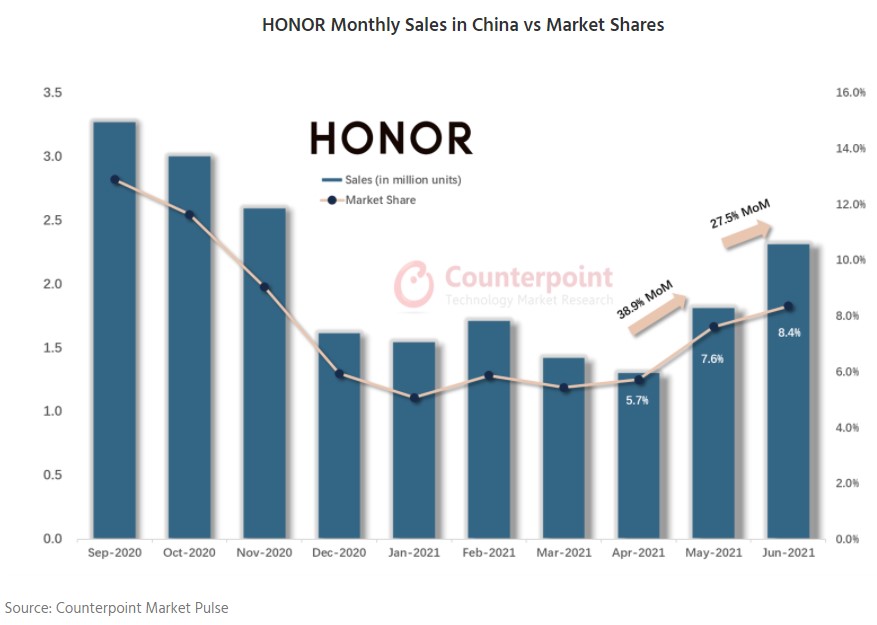

Honor’s China market share stood at 8.4% in Jun 2021 after reaching the bottom of 5.1% in January, according to Counterpoint Research. It is yet to recover its sales peak of 4.55M units which was achieved in Aug 2020. The Jun 2021 sales were only a bit more than half of this peak number. But the current growth momentum appears quite strong as the company’s sales were up 39% MoM in May and 27% MoM in Jun. (Counterpoint Research, Gizmo China)

Google Pixel 6 and 6 Pro details are shared, planned to be launched in fall 2021: Pixel 6 – 6.4” 1080×2400 FHD+ HiD AMOLED 90Hz, Google Tensor SoC, rear dual 50MP-12MP ultrawide + front 8MP, 8+128 / 8+256GB, Android 11.0, fingerprint on display, 4614mAh fast charging, from USD799 (rumor). Pixel 6 Pro – 6.7” 1080×2400 FHD+ HiD AMOLED 120Hz, Google Tensor SoC, rear tri 50MP-48MP telephoto 4x optical zoom-12MP ultrawide + front 12MP, 12+128 / 12+256 / 12+512GB, Android 11.0, fingerprint on display, 5000mAh fast charging, wireless charging, from USD899 (rumor). (Phone Arena, Digital Trends, GSM Arena, Tom’s Guide)

vivo Y12G is official in India – 6.51” 720×1600 HD+ v-notch, Qualcomm Snapdragon 439, rear tri 13MP-2MP macro-2MP depth + front 8MP, 3+32GB, Android 11.0, side fingerprint, micro USB, 5000mAh, INR10,990 (USD150). (CN Beta, GSM Arena, vivo)

Honor Play 5T Pro is announced in China – 6.6” 1080×2400 FHD+ HiD, MediaTek Helio G80, rear dual 64MP-2MP depth + front 16MP, 8+128GB, Android 10.0, side fingerprint, 4000mAh 22.5W, CNY1,499 (USD232). (GSM Arena, Playfuldroid, Anzhuo, HiHonor)

Huawei nova 8 (Global) is launched in Russia – 6.57” 1080×2340 FHD+ HiD OLED 90Hz, Kirin 820E, rear quad 64MP-8MP ultrawide-2MP depth-2MP macro + front 32MP, 8+128GB, Android 10.0 (HMS), fingerprint on display, 3800mAh 66W, 5W reverse charging, RUB39,999 (USD550). (GSM Arena, Huawei, Playfuldroid)

Google announces new Nest Cam battery, Nest Cam Floodlight and Nest Cam wired. All the new products have been designed to look like part of a family and all will use the Google Home app to get them connected and only. The Nest Cam (battery) will be GBP180, the Nest Cam Floodlight will cost GBP250, while the new wired Nest Cam will be GBP90. (Pocket-Lint, Android Central)

Stellatis, formed by the merger of Fiat Chrysler (FCA) and PSA Peugeot Citroen Group (PSA), lags behind its competitors in launching electric vehicles. The company plans to launch 21 new energy vehicles in the next 2 years, including 11 pure electric vehicles and 10 plug-in hybrid electric vehicles. Stellantis has announced that its Alfa Romeo and Lancia brands will be fully electric. Among them, its Alfa Romeo brand will be fully electric in Europe, North America and China by 2027, and its Lancia brand will be fully electric by 2026. (CN Beta, Sina, Carindigo)

Urban eVTOL has announced a 3-seat eVTOL, dubbed Leo Coupe, claiming 250-mph (400km/h) top speeds and extraordinary 300-mile (483km) range figures. The Leo will run 16 10kW vertical thrusters, each about 16 inches (40 cm) in diameter, making 120 pounds of thrust. (CN Beta, New Atlas, Sina)

The U.S. President Biden wants 50% of all new cars sold in the United States in 2030 to be all-electric, plug-in hybrid, or hydrogen-powered — a goal he will lay out in an executive order, according to senior administration officials. Biden will also sign an executive order that tasks the Environmental Protection Agency (EPA) and National Highway Traffic Safety Administration (NHTSA) to develop aggressive long-term rules to support his 2030 target. (The Verge, Twitter, CN Beta)

Arrival, the technology company creating electric vehicles (EVs) using its unique technologies, has announced it will be co-developing its digital fleet and vehicle capabilities for the automotive industry with Microsoft. This cloud-based approach using Microsoft Azure will enable advanced uses of telemetry, vehicle and fleet data management across vehicle fleets. (CN Beta, Arrival, Electrek, Yahoo)

Facebook has open-sourced Droidlet, a platform for building robots that leverage natural language processing and computer vision to understand the world around them. Droidlet simplifies the integration of machine learning algorithms in robots, according to Facebook, facilitating rapid software prototyping. (VentureBeat, CN Beta, Facebook)

Securities and Exchange Commission (SEC) Chair Gary Gensler has indicated that he is “neutral on the cryptocurrencies technology, even intrigued”, having previously spent 3 years “teaching it, leaning into it”. He says there is a need for safety, claiming he is not neutral about investor protection. Admitting the SEC’s powers are already quite broad, Gensler has asked Congress to create a law that grants the commission the authority to monitor cryptocurrency exchanges. The SEC is looking into at least 7 different crypto-related issues, including initial coin offerings, trading venues, decentralized finance, and ETFs. (Apple Insider, Bloomberg)

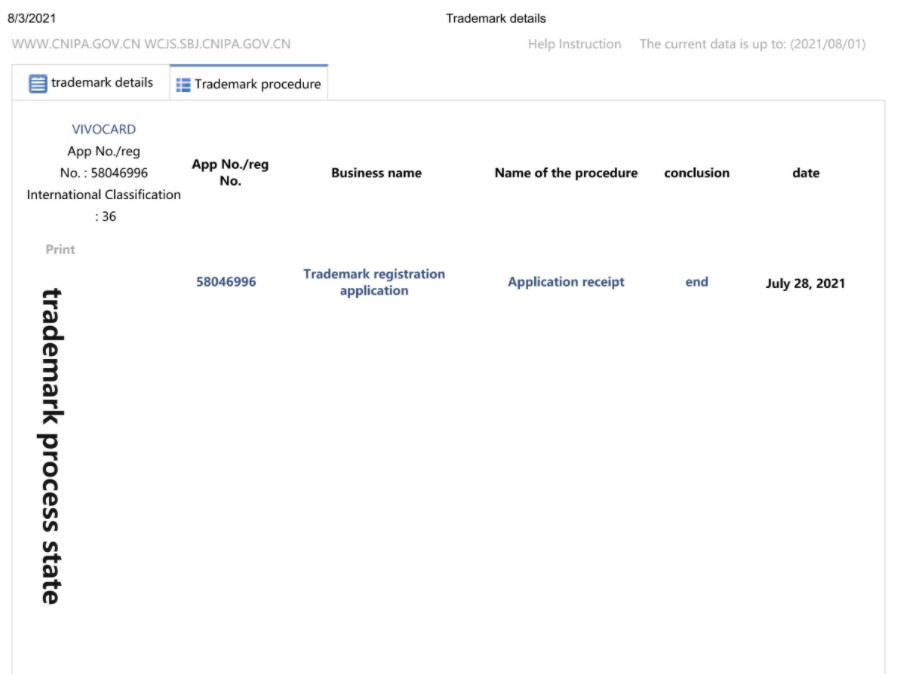

vivo has filed a trademark “VivoCard” with CNIPA. The trademark is filed under international classifications, meaning that the company hopes to use the “VivoCard” brand overseas. (CN Beta, MacRumors, TechNave)

Apple is reportedly set to partner with “buy now, pay later” specialist Affirm’s PayBright subsidiary to launch a new pay-over-time platform in Canada, the latest in the tech giant’s growing quiver of financial services. (CN Beta, Mac Rumors, Apple Insider)