8-7 #Weekend : Kglass will expand into the foldable ultra-thin glass (UTG) market in China via South Korean software firm Softcen; LGD is reviewing expanding its P-OLED display panel production facilities; Xiaomi has started accepting cryptocurrency payments in Portugal; etc.

Marvell Technology has announced it has reached an agreement to acquire Innovium for USD1.1B in an all-stock deal. The startup, which raised over USD400M, makes networking ethernet switches optimized for the cloud. Innovium’s marquee products are Ethernet switches. Innovium built its TeraLynx switch family from the ground up to cater specifically to data centers. (TechCrunch, OfWeek, Sina, Reuters, Innovium, EE Times)

Huawei Technologies has acquired stake in German Litho, who has recently undergone many business changes and it has recently added Huawei’s investment arm, Hubble Technology Investment as one of its shareholders. German Litho (or Qingdao Tianren MicroNano) is a supplier of equipment and process solution for micro and nanostructuring technology. Its business operations includes applications for Nanoimprint Lithography (NIL). (Gizmo China, OfWeek, Laoyaoba)

Semiconductor Manufacturing International Corporation (SMIC) co-CEO Haijun Zhao has indicated that the company’s FinFET process has reached production, with 15,000 pieces per month. The production capacity is in short supply, and customers continue to come in. Divided by different processes, the 28nm and FinFET process contributes to 14.5% of revenue. (My Drivers, Laoyaoba, SMIC)

South Korea’s small 8” foundry DB HiTek plans to increase its production to 9,000 wafers in 2021. It is said that it has completed 90% of its target. It plans to continue to expand its production by more than 10,000 wafers in 2022 to achieve a monthly production capacity of 15,000 wafers. It is worth noting that DB HiTek, which has always taken a conservative investment, chose to continue to expand its production after seeing a surge in 8” demand. The Key Foundry, which is officially established by MagnaChip in Sept 2020, plans to expand its monthly production capacity by 10,000 units by the end of 2021. Currently, Key Foundry’s core foundry production capacity is about 82,000 pieces, and it plans to have a production capacity of 92,000 pieces in early 2022. (Laoyaoba, CNYes, ET News, China Times)

After Malaysia extended its MCO (movement control order) 3.0, the Filipino government also announced the implementation of ECQ (enhanced community quarantine) measures in Metro Manila until 20 Aug in response to the Delta variant’s rapid spread in Southeast Asia that began in Jul 2021. According to TrendForce, Japanese MLCC supplier Murata operates a manufacturing facility in Tanauan City, primarily for large-sized automotive MLCC (0.06 x 0.03 inches to 0.12 x 0.06 inches) production. This facility manufactures capacitors that meet the auto industry’s requirements of high capacitance, high voltage, and high temperature tolerance, and its monthly automotive MLCC production capacity accounts for about 18% of the industry total. As demand from the automotive market increases, Murata’s Tanauan-based facility is expected to maintain a high-capacity utilization rate going forward. Samsung likewise operates an MLCC manufacturing facility in the Philippines, albeit in Calamba City. While the Calamba facility is primarily responsible for manufacturing normal MLCC, its monthly normal MLCC production capacity accounts for 15% of the industry total and is second only to Samsung’s Tianjin-based facility. As well, the Calamba facility operates at a capacity utilization rate of more than 90%. (TrendForce, TrendForce, Laoyaoba)

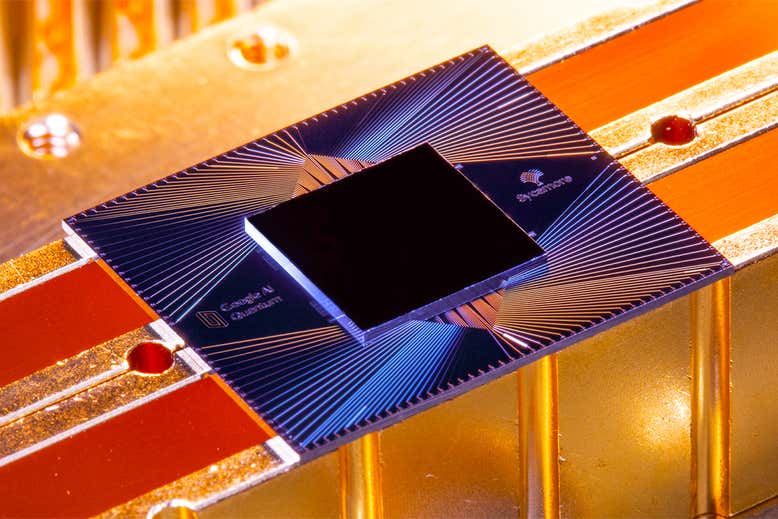

Google’s quantum computing division has published a study claiming to have created physics-defying “Time Crystals” using the company’s Sycamore quantum computer. A time crystal is both stable and constantly in flux, with definable states repeating at predictable intervals without ever dissolving into a state of total randomness. (My Drivers, NewScientist, ZDNet, TechRadar, ARvix, Quanta Magazine)

Orbita has revealed that the mass production of its artificial intelligence (AI) chip Yulong 810 is progressing smoothly; it is vigorously carrying out the promotion and technical support of the Yulong chip, and customer response has been good. (Laoyaoba, 163, iFeng)

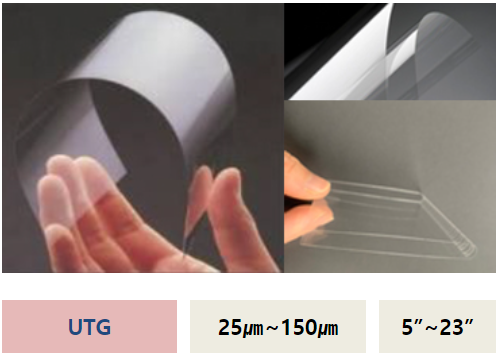

Display glass processing firm Kglass will expand into the foldable ultra-thin glass (UTG) market in China via South Korean software firm Softcen. Kglass will handle the back-end processing of the UTG, where the mother glass is cut into the size of the product. The process require precising cutting, or the cut glass will have durability issues. Samsung Display currently uses Dowooninsys for the process. Softcen signed a KRW20.9B deal in Jun 2021 with Jiangsu Suchuan Technology to supply it with UTG cover window manufacturing system. Kglass will be supplying this system. In May, the software company also invest KRW5B in Kglass, securing 40% ownership. (Laoyaoba, Sohu, The Elec)

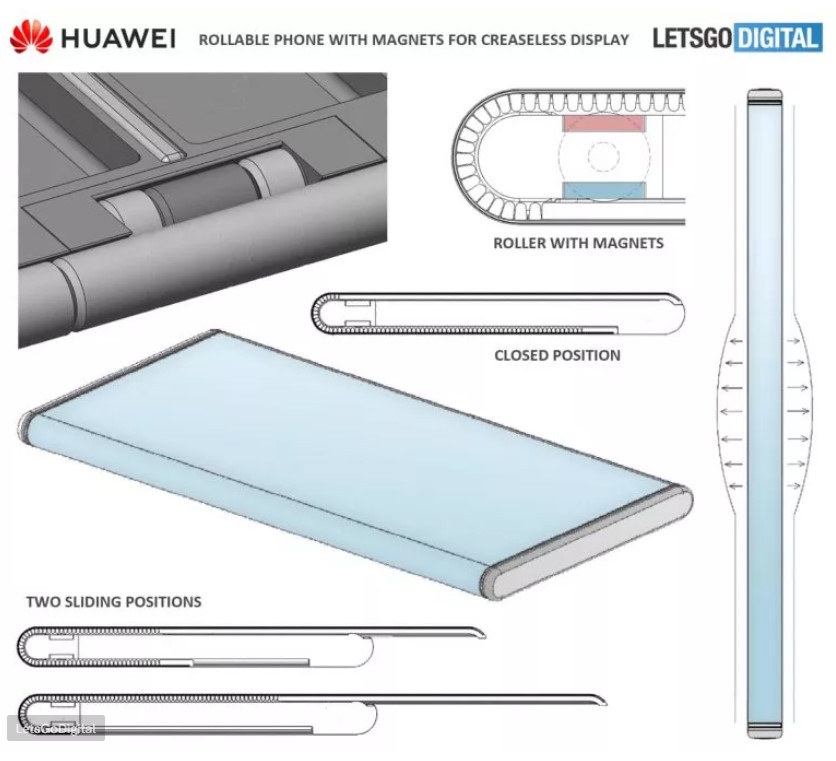

Huawei has filed a patent that showcases a rollable phone. Huawei’s rollable phone will apparently wrap a large plastic OLED screen around its front that covers about four-fifths of its rear, too. The portion at the rear not occupied by the display should pack enough space for a camera array. The screen is pulled taut around the phone’s edge. When the user wants more display, it slides around from the rear along a motorized roller system. (Android Authority, LetsGoDigital)

Zhao Jun, COO of TCL CSOT, has revealed that the goal in 2021 is to achieve 15M gaming display shipment. Sigmaintell predicts that global gaming display panel shipments will increase to 23.6M in 2021, a year-on-year increase of 25%. Shenzhen Refond Optoelectronics has said that e-sports products are not so price sensitive, and the market acceptance will be higher, or it will become one of the important applications of Mini LED. Zhao Jun has revealed that in 2021, TCL CSOT will also release a variety of products based on Mini LED backlight. TCL CSOT will increase the size of the mid-size display, t9 project may be advanced to the end of 2022 mass production. (Sina, Sohu, My Drivers)

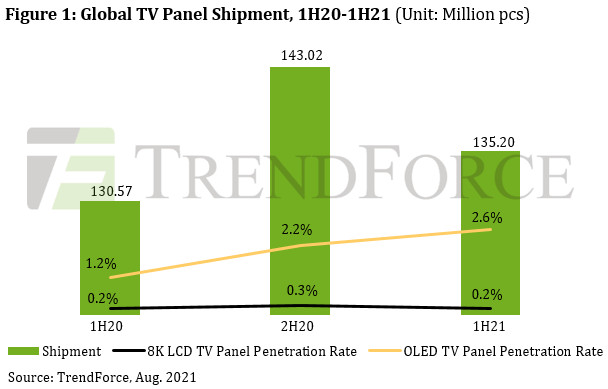

Thanks to TV manufacturers’ aggressive procurement activities, global TV panel shipment for 1H21 reached 135.2M units, a 3.5% YoY increase, according to TrendForce. Notably, high-end OLED TV panels and 8K LCD TV panels showed diametrically opposed movements. The former product category reached a 2.6% market share in 1H21 (with room for further growth going forward) due to LGD’s capacity expansion as well as the narrowing gap between OLED panel prices and LCD panel prices. On the other hand, the latter’s market share fell to a mere 0.2% in 1H21 as panel suppliers were generally reluctant to manufacture 8K LCD TV panels due to these panels’ poor yield rates. (TrendForce, TrendForce)

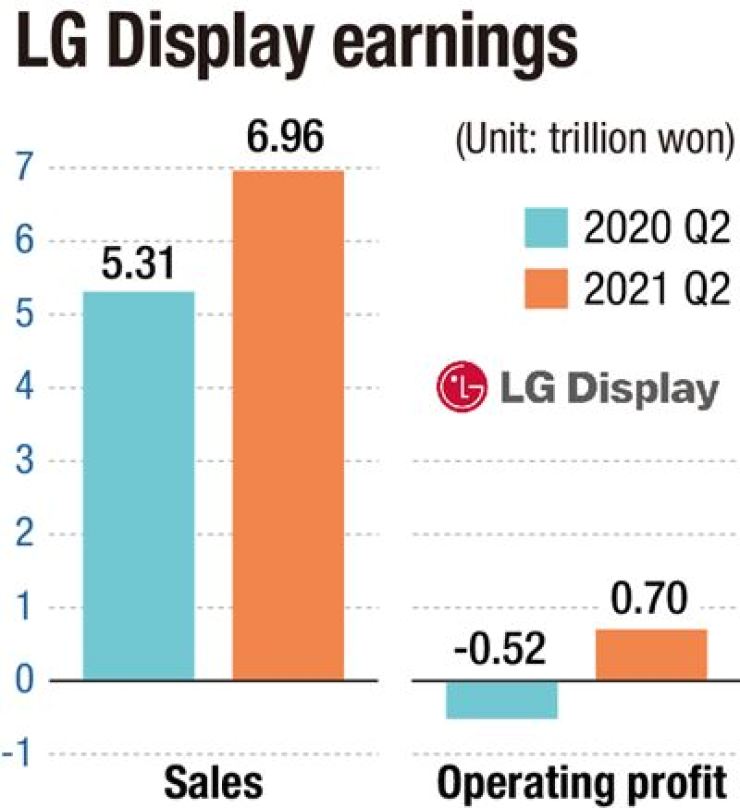

LG Display (LGD) Senior Vice President and CFO Suh Dong-hee has revealed that the company is reviewing expanding its plastic organic light-emitting diode (P-OLED) display panel production facilities, as it is increasingly focusing on its P-OLED business. LGD is focusing on using P-OLEDs for medium-and small-sized display panels because the panels are lighter and more durable than LCD panels. The display maker began mass producing P-OLEDs for smartphones in 2020 and has been seeking to enhance its production system in 2021. (Korea Times)

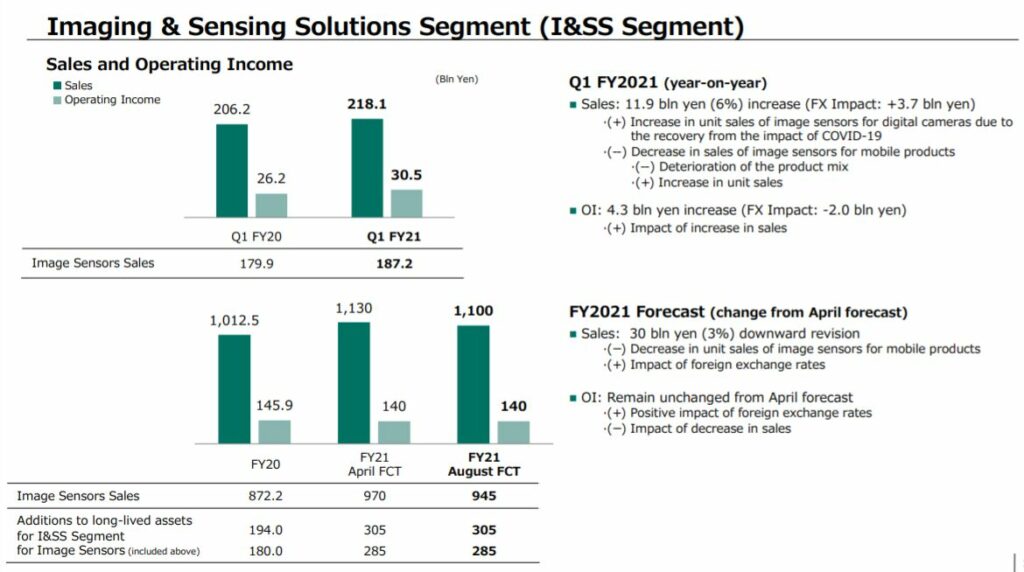

Sony reports its image sensor business quarterly results. The sales and profits grew YoY recovering from COVID impact. However, the company revises its fiscal year 2021 sales forecast by 3% downwards due to the lower mobile sensor sales and less favorable product mix. (Laoyaoba, Sony, Image Sensors Report)

Infineon introduces USB PD 3.1 MCUs with support for high wattage. The new microcontrollers (MCUs) are aimed at embedded systems and support up to 28V at 140W. The EZ-PD PMG1 (Power Delivery Microcontroller Gen1) MCUs support the high-power mandates of the USB PD 3.1 specification and utilizes the capability of the MCU to provide added control capabilities. (Laoyaoba, CN Beta, EE Power)

South Korean energy company SK Innovation (SKI) will spin off its mainstay battery business in Oct 2021 to better focus on the fast-growing electric vehicle market. The new entity, provisionally named SK Battery. SKI has 40GWh of battery production capacity per year, with manufacturing lines in the U.S., China and Hungary as well as South Korea. The company plans to expand capacity to 85GWh in 2023, 200 GWh in 2025 and eventually 500GWh in 2030. (Laoyaoba, Reuters, Bloomberg, Asia Nikkei, Korea Herald)

Huami has officially announced Amazfit Pop Pro, which is specifically designed for kids. The watches are now fitted with games and several learning resources. It will come with built-in sports/fitness modes bringing on features such as rope skipping, sit-ups, running, in order to help the kids improve their sports ability. The watch comes with an IP68 waterproof and dustproof rating and features a food-grade silicone wristband. (Gizmo China, Xiaomi Today)

HMD Global has launched a new series of headphones under the Nokia brand. There are 4 models priced in USD30-70. Nokia Clarity earbuds have a 10mm neodymium driver unit and dual microphone noise reduction using Qualcomm cVc technology. Nokia Clarity Earbuds have IPX5 waterproof performance, the headset can play 6.5 hours of audio, and the charging box can play more than 20 hours. Nokia Go Earbuds+ uses 13mm drivers, listening time is 6.5 hours (battery life), charging case can be used for additional “up to 19.5 hours”, with IPX4 sweat and splash resistance. (CN Beta, HMD Global, Nokia Mob)

Honor Earbuds 2 Lite is unveiled, priced at EUR70 / GBP70. The buds have 10mm drivers with polymer composite diaphragms, 2 microphones each for active noise cancellation and wind noise reduction (with an Awareness mode included), 10 hours of continuous listening time (with ANC disabled) and 32 hours of total playback time, plus fast charging (40% in 10 minutes, this is enough for 4 hours of listening time). (GSM Arena, Gizmo China)

Phillips brand licensee TPV Technology has launched a new lineup of TWS earbuds, dubbed the Philips SBH2515BK/10 and Philips TAT3225BK in India, priced at INR4,999 (USD67) and INR9,999 (USD135), respectively. The Philips SBH2515BK/10 and the TAT3225BK TWS earbuds feature a multi-function button. ((GizChina, NDTV)

Micromax Airfunk 1 and Airfunk 1 Pro TWS earbuds are launched in India, prices start at INR1,299 (USD18) and INR2,499 (USD34), respectively. The Micromax Airfunk 1 has 9mm, dynamic drivers, in each earbud. The earphones feature Bluetooth v5.0 connectivity with AAC and SBC codec support. The Micromax Airfunk 1 Pro pack 13mm dynamic drivers. These earphones have the Qualcomm QCC3040 chipset, which offers Clear Voice Capture (CVC 8.0), Bluetooth v5.2 connectivity, and aptX and AAC audio codecs among other features. (GizChina, 91Mobiles, Micromax)

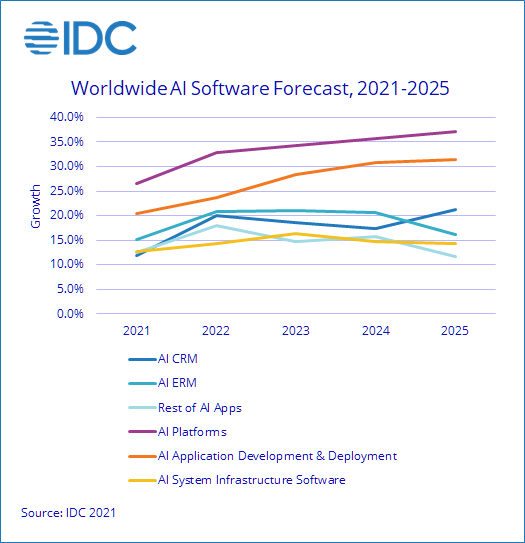

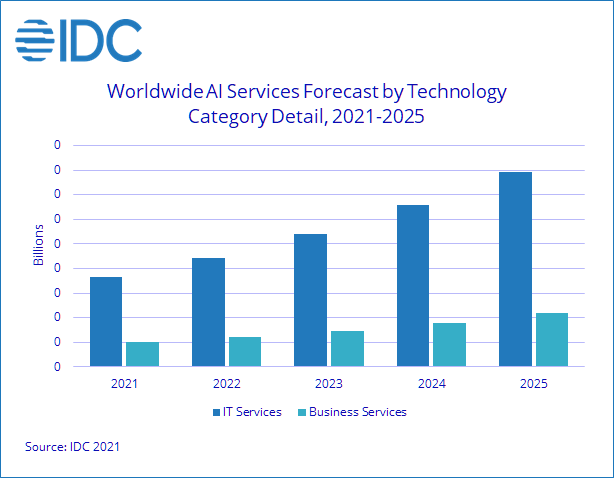

Worldwide revenues for the artificial intelligence (AI) market, including software, hardware, and services, is estimated to grow 15.2% YoY in 2021 to USD341.8B, according to IDC. The market is forecast to accelerate further in 2022 with 18.8% growth and remain on track to break the USD500B mark by 2024. Among the 3 technology categories, AI Software occupied 88% of the overall AI market. However, in terms of growth, AI Hardware is estimated to grow the fastest in the next several years. From 2023 onwards, AI Services is forecast to become the fastest growing category. (VentureBeat, IDC)

Sensorium Galaxy is an upcoming virtual world that will blend human and AI characters so that people can have unscripted conversations with virtual beings. And it is showing off some of those AI characters. Sensorium AI-driven avatars are the first in a new generation of virtual beings. They are capable of supporting complex and unscripted conversations through the prism of their unique personality, built upon their “biography” and interactions with users. (VentureBeat, PC Gamer)

Xiaomi has started accepting cryptocurrency payments in Portugal. The company official retailer, Mi Store Portugal, has recently made the decision to accept payments from known digital currencies like Bitcoin and Ethereum. Xiaomi has collaborated with Utrust, a Swiss cryptocurrency payment service provider whose native token is also accepted by Mi Store Portugal, to enable support for digital assets. (Gizmo China, Bol News, Sohu)