8-26 #Running : TSMC plans to increase the price of wafer in 2022; OPPO might be bringing back its N series line of premium smartphones; Samsung Group will invest KRW240T in the next 3 years; etc.

According to Wave7 Research, Apple is able to lock down chipset supply well ahead of time but that this was not the case for other OEMs. Samsung and OnePlus are particularly hard hit since Qualcomm said that demand for its chips was outstripping supply. The shortage is “uneven by carrier, channel, and even by store”. (PC Mag, WSJ, iMore, 9to5Mac, IT Home)

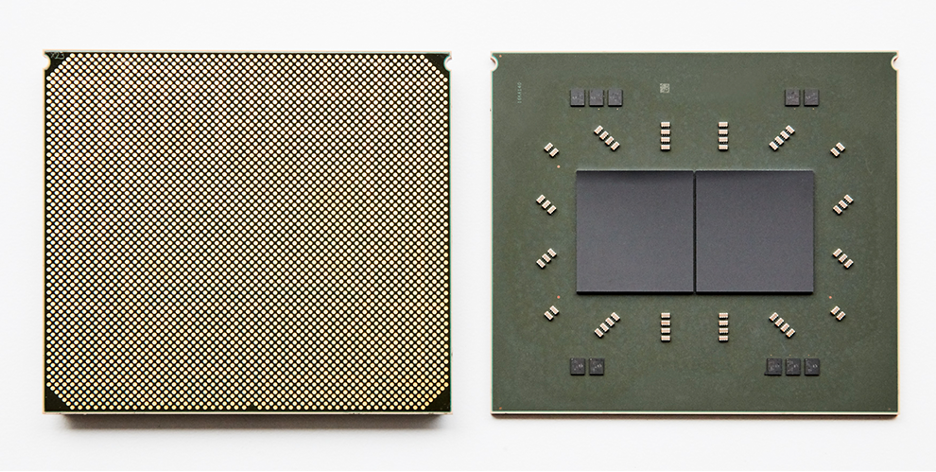

IBM has unveiled details of the upcoming new IBM Telum Processor, designed to bring deep learning inference to enterprise workloads to help address fraud in real-time. Telum is IBM’s first processor that contains on-chip acceleration for AI inferencing while a transaction is taking place. The chip contains 8 processor cores with a deep super-scalar out-of-order instruction pipeline, running with more than 5GHz clock frequency, optimized for the demands of heterogenouss enterprise class workloads. (Digital Trends, IBM, IBM, ZDNet, My Drivers)

TSMC has recently informed clients of the coming change, which will bring an up to 10% increase in quotes on 7nm and smaller processes and a 20% bump for chips fabricated on 16nm and larger technologies, with the new prices set to be effective starting 2022, according to Digitimes. Digitimes reports that GlobalFoundries, Powerchip Semiconductor Manufacturing, Semiconductor Manufacturing International and United Microelectronics have also increased production pricing amid a global rise in demand. (Digitimes, Apple Insider, CN Beta)

U.S. officials have allegedly approved license applications worth hundreds of millions of dollars for China’s blacklisted telecom company Huawei to buy chips for its growing auto component business. Underscoring the shift into smart cars, the company’s rotating chairman Eric Xu has announced pacts with 3 state-owned Chinese carmakers, including BAIC Group, to supply “Huawei Inside”, a smart vehicle operating system, at the Shanghai Auto Show earlier 2021. (GizChina, Reuters, Reuters, Euro News, Sina)

Google will reportedly tap Samsung Electronics to supply the 5G modem for its next flagship Pixel smartphone. Google Pixel 6 and Pixel 6 Pro will use a 5G modem supplied by Samsung instead of one from Qualcomm on versions of the phone to be sold in the United States. (CN Beta, Reuters, 9to5Google)

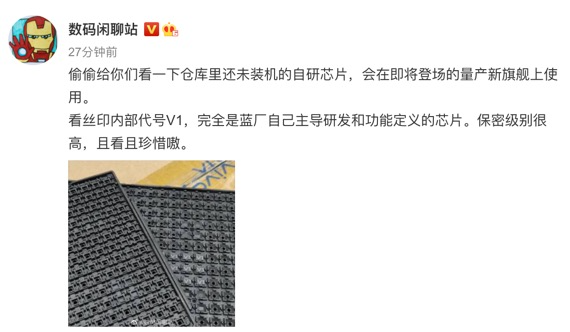

vivo’s self-developed image processor chip (ISP) “Yueying” for imaging is named “vivo V1” and will be released on the X70 series. (CN Beta, Sina, Seek Device)

Samsung is allegedly reconsidering its plan to acquire Eindhoven-based NXP Semiconductors. The company’s asking price has allegedly shot up to KRW80T (USD68B). While Samsung does have the reserves to complete the purchase, additional costs could creep up due to potential legal issues. (CN Beta, Sam Mobile, Korea Times, Seeking Alpha)

Imagination has signed more than 35 cross-field licensing agreements, covering automotive, data center, mobile terminal and DTV, etc. Imagination has a 37% share of smartphone graphics processing units (GPUs) and is the largest GPU supplier in the automotive industry, with approximately 45% share and a quarter of more than 1B vehicle shipments. Imagination has announced its next steps in extending its reach and doubling down on market success: the development and launch of a RISC-V CPU family. RISC-V is an open instruction set architecture (ISA) managed by the RISC-V foundation, a non-profit organization started in 2015. (CN Beta, Tom’s Hardware, Design Reuse, Liliputing)

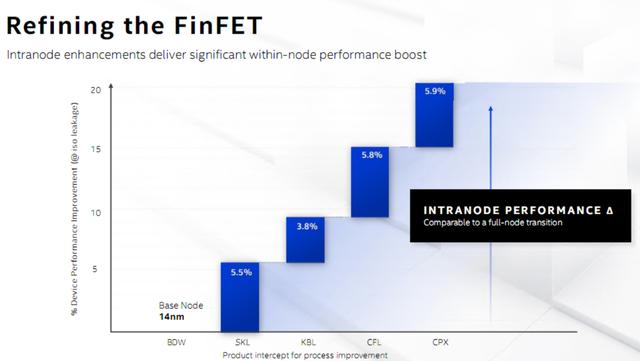

Intel has revealed that the company would adopt TSMC’s 5nm process to build and develop its Ponte Vecchio GPU. The entire SOC consists of over 100B transistors across 47 active tiles manufactured on five different process nodes. The compute tiles at the heart of Ponte Vecchio will be made using TSMC’s N5 process, each with eight Xe-cores. These link to an Intel Foveros base tile (built on the newly renamed Intel 7 process), which also houses the Rambo cache, HBM2e, and a PCIe Gen5 interface. The Xe Link tile meanwhile uses TSMC N7. (CN Beta, Reuters, EE News Europe, Tom’s Hardware)

Huawei has filed a patent for a smartphone camera design with variable aperture. The camera system uses a 6-blade diaphragm design to increase or decrease the aperture. By moving the blades inwards or outwards, the smartphone would be able to increase or decrease the aperture and control the amount of light hitting the camera sensor. (CN Beta, Android Authority, Peta Pixel, LetsGoDigital)

Xiaomi may debut a 200MP camera with its next ‘Ultra’ phone. The next device with the ‘Ultra’ branding is likely the Xiaomi (Mi) 12 Ultra. The company will likely lose the ‘Mi’ branding, as it confirmed recently it started ditching it for its products. Therefore, the device will likely be called the Xiaomi 12 Ultra. (Android Headlines, Weibo, IT Home)

JEDEC Solid State Technology Association, the global leader in standards development for the microelectronics industry, has announced the publication of JESD233: XFM Embedded and Removable Memory Device (XFMD) standard. XFMD (XFM stands for Crossover Flash Memory) is a new universal data storage media providing an NVMe over PCI Express interface in a small, thin form factor. (CN Beta, JEDEC, Yahoo)

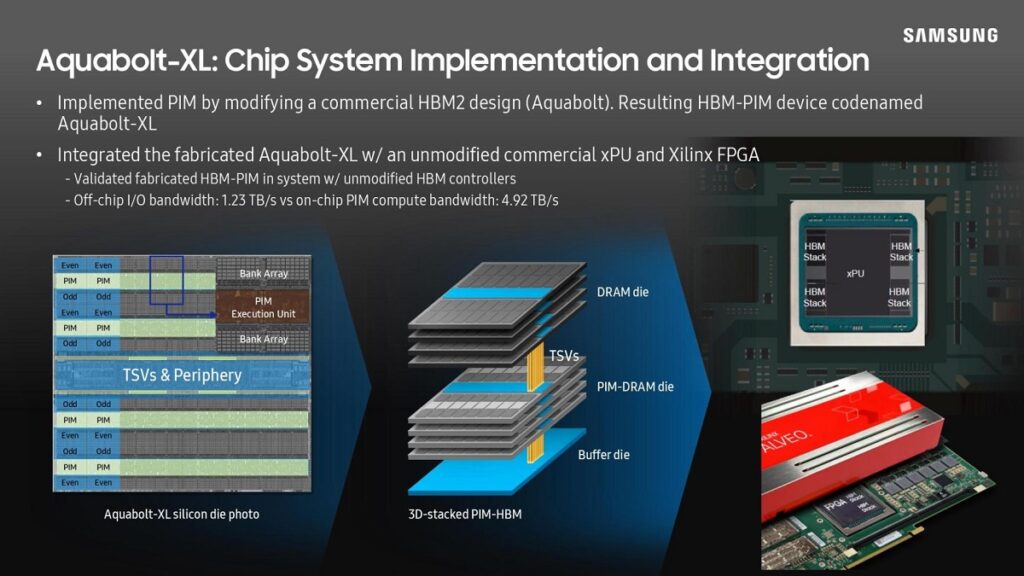

Samsung Semiconductor has announced the first commercial application of HBM-PIM. This futuristic technology has been tested in the Xilinx Virtex Ultrascale+ (Alveo) AI accelerator, where it delivered 2.5x faster processing while offering 60% improved power efficiency. This shows that HBM-PIM is ready for a wider range of applications, including commercial servers and mobile devices. Samsung has also announced that it would soon bring processing-in-memory to mobile devices through LPDDR5-PIM modules. (CN Beta, Samsung, Sam Mobile)

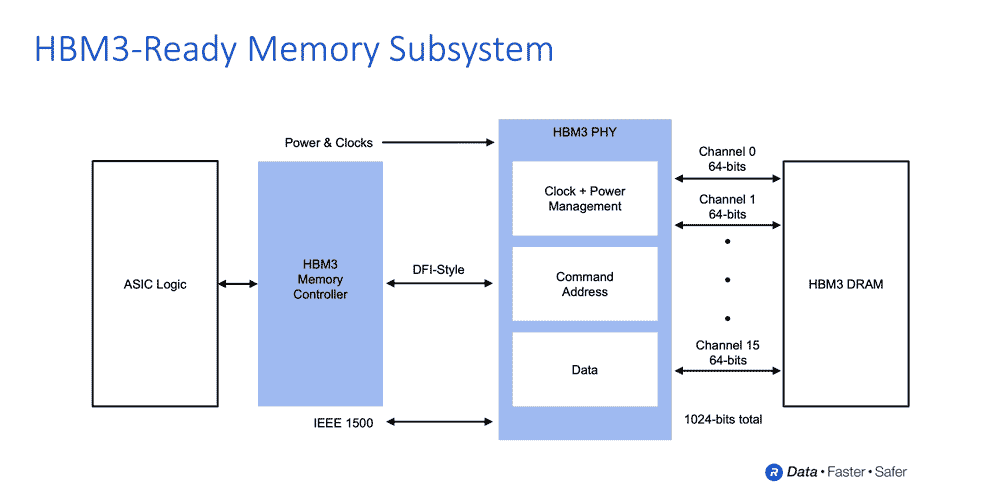

Rambus, a premier chip and silicon IP provider making data faster and safer, today announced the Rambus HBM3-ready memory interface subsystem consisting of a fully-integrated PHY and digital controller. Supporting breakthrough data rates of up to 8.4Gbps, the solution can deliver over a terabyte per second of bandwidth, more than double that of high-end HBM2E memory subsystems. (CN Beta, Rambus, PR Newswire)

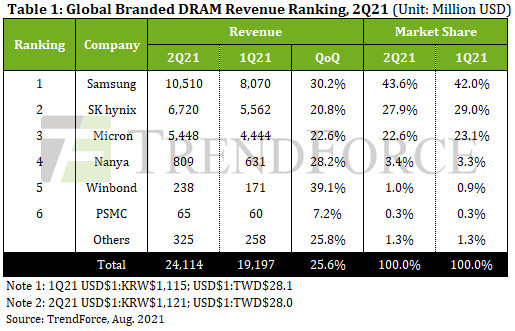

After DRAM prices made a rebound into an upward trajectory in 1Q21, buyers expanded their DRAM procurement activities in 2Q21 as they anticipated a further price hike and insufficient supply going forward, according to TrendForce. Not only was demand robust from clients in the notebook segment, which benefitted from ongoing WFH and distance learning applications, but CSPs also sought to gradually replenish their DRAM inventories. Furthermore, demand for products that are relatively niche, including graphics DRAM and consumer DRAM, remained strong. Hence, DRAM suppliers experienced better-than-expected QoQ increases in their DRAM shipment for 2Q21. At the same time, DRAM quotes grew by a greater magnitude compared to 1Q21 as well. With both shipment and quotes undergoing growths in tandem, DRAM suppliers registered remarkable growths in their revenues in 2Q21. Total DRAM revenue for 2Q21 reached USD24.1B, a 26% QoQ increase. (CN Beta, TrendForce, TrendForce)

Apple is allegedly testing an upgraded Face ID array is being tested that works with masks. The tested array is arranged differently than the current Face ID array, and appears slimmer in size. Tests are being conducted with and without masks or glasses on a wide scale. In addition, testers are being asked to test in various environments with different styles of glasses or masks. (CN Beta, Front Page Tech, Apple Insider)

Nobel Prize winner in Chemistry and “Father of Lithium Batteries” Akira Yoshino has indicated that if Apple wants to launch electric cars before 2025, some related content will be released before the end of 2021. In addition to Apple’s predictions, he has also talked about the possibility of fuel cell technology and wireless charging of electric vehicles. (CN Beta, Reuters, PED30)

Faraday Future Intelligent Electric, a California-based global shared intelligent mobility ecosystem company, has announced its plans to partner with Qmerit, a leader in green energy transformation with the largest nationwide network of certified electrical installers for EV charging, to support future FF 91 drivers in need of home charging and other future energy-related installations. (CN Beta, Business Wire, Yahoo)

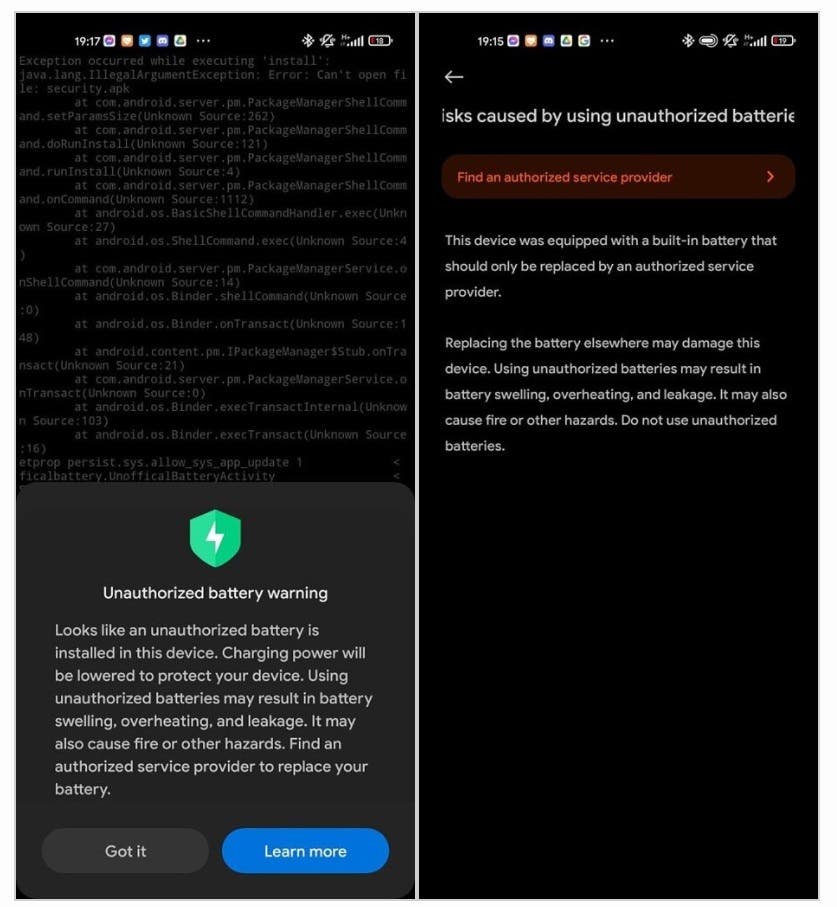

Xiaomi’s new version of the Mi Security 5.6.0 application has new battery and charging settings. Among other things, the company plans to display a warning on the device screen that a non-original battery is available inside, which may negatively affect the operation of the device. (GizChina, XDA-Developers)

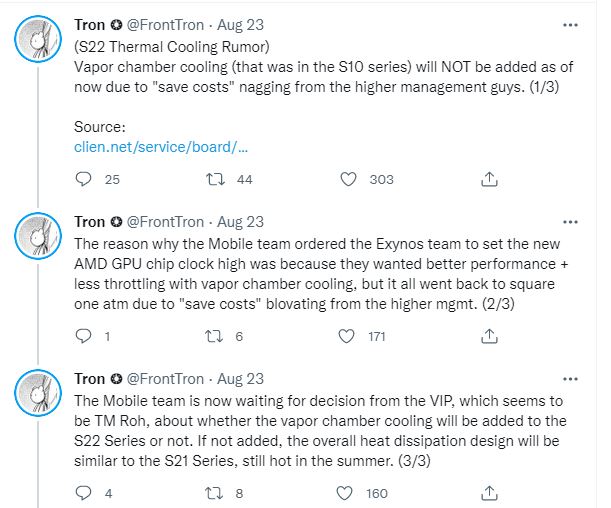

Samsung apparently wants to save costs on heat dissipation tech for the Galaxy S22 series. The company may not use vapor chamber cooling on the new flagships. Samsung reportedly wanted to use vapor chamber cooling alongside the new Exynos chip with the AMD GPU to improve performance and reduce throttling. (Android Authority, Clien, Twitter)

Google has announced a USD10B investment over the next 5 years towards cybersecurity improvements. Google’s pledge includes training Americans in IT and Data analytics, expanding security programs, and enhancing open-source security. Other companies such as Apple and Microsoft have also pledged commitments to cybersecurity efforts. (Android Authority, White House, Google)

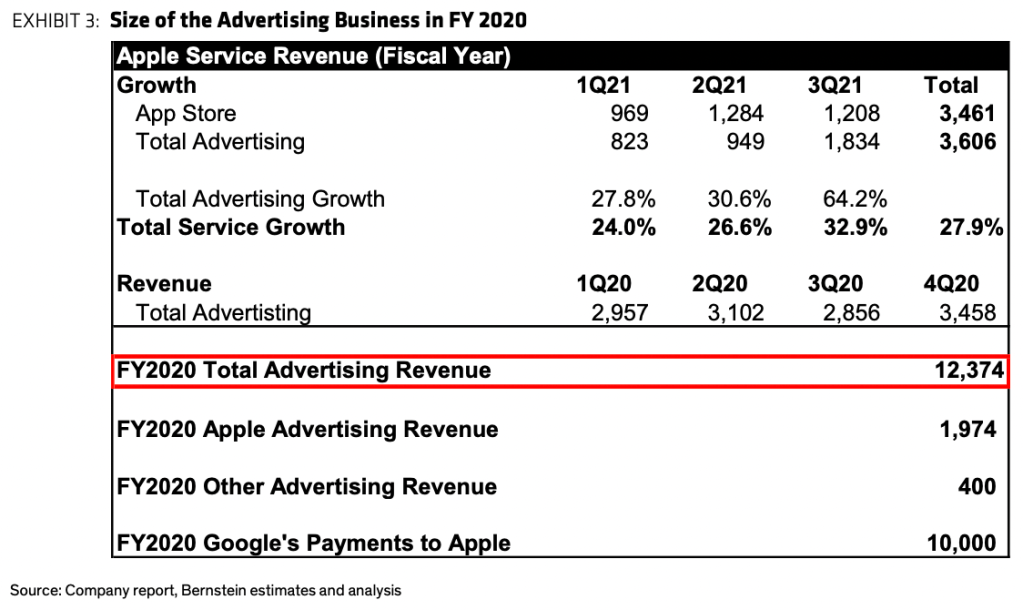

Bernstein estimates that Google’s payment to Apple will increase to USD15B in 2021, and to between USD18B-20B in 2022. The data is based on “disclosures in Apple’s public filings as well as a bottom-up analysis of Google’s TAC (traffic acquisition costs) payments”. Bernstein analyst Toni Sacconaghi says that Google is likely “paying to ensure Microsoft does not outbid it”. (CN Beta, 9to5Mac, Ped30)

OPPO might be bringing back its N series line of premium smartphones. OPPO’s current product line is mainly divided into five series: A, F, K, Reno and Find. The N series would be priced at around CNY4,000 (USD618) and would be positioned between the Find X series and the Reno line. Although 2 two previous N series smartphones need to manually flip the camera, but the third model already supports electric flip. (CN Beta, Sina, GSM Arena)

Samsung Group will invest KRW240T (USD206B) in the next 3 years to expand its footprint in biopharmaceuticals, artificial intelligence, semiconductors and robotics in the post-pandemic era. These investments will be made through 2023. (GizChina, SamMobile, Reuters)

Samsung Electronics holds more than 200,000 patents worldwide. The company held 205,816 patents as of the end of Jun 2021, according to a half-year report it released on Aug. 22. This is a 4.1% increase from 197,749 patents it held at the end of 2020. Nearly 7,000 patents had been added to Samsung Electronics’ patent list since 1Q21. (Laoyaoba, Business Korea)

Samsung Galaxy A21 has reportedly exploded on a passenger plane at Seattle-Tacoma International Airport. Samsung has emphasized that security remains the top priority of the company. It has also promised that it will conduct a full investigation into the event in Seattle. After the investigation, it can then decide whether to recall the model or not. (GizChina, Gizmo China, Seattle Times)

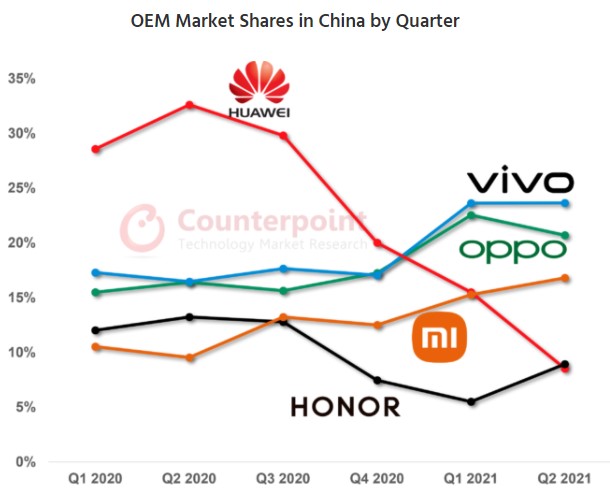

According to Counterpoint Research, vivo has a 24% market share in 1Q21 and 2Q21, up from 16% in 1Q20. vivo is followed by OPPO at 21% and Xiaomi at 17% in 2Q21. With vivo’s powerful supply chain, vivo can maintain a consistent supply of chipsets for its key volume segments — Y series and the newly launched S series. Within the Y series, there are 5G models available for as low as CNY1,298 (~USD200). The newly launched S series of vivo is a liberator. Its focus on the CNY2,000-3,500 segment means the X series is now free to focus on the CNY3,500 and above segment. (CN Beta, Counterpoint Research)

Samsung Galaxy M32 5G is announced in India – 6.5” 720×1600 HD+ v-notch, MediaTek Dimensity 720 5G, rear quad 48MP-8MP ultrawide-5MP macro-2MP depth + front 13MP, 6+128 / 8+128GB, Android 11.0, side fingerprint, 5000mAh 15W, INR20,990 (USD280) / INR22,999 (USD310). (GSM Arena, Android Central)

Moto G50 5G is launched in Australia – 6.5” 720×1600 HD+ v-notch 90Hz, MediaTek Dimensity 700 5G, rear tri 48MP-2MP macro-2MP depth + front 13MP, 4+128GB, Android 11.0, side fingerprint, 5000mAh 15W, AUD399 (USD289). (GSM Arena, CN Beta)

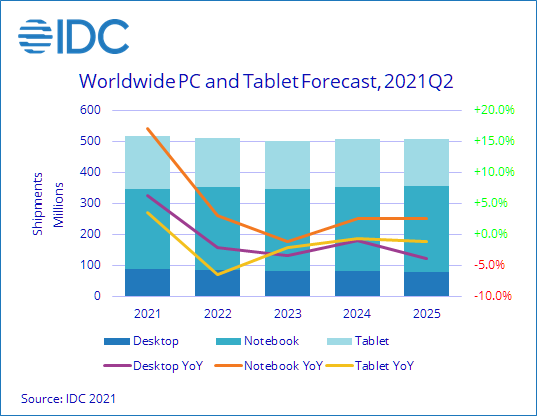

According to IDC, worldwide shipments of PCs are expected to grow 14.2% to 347M units in 2021. This is down from IDC’s May forecast of 18% growth with continued supply chain and logistical challenges cited as the main reasons. The tablet market is also expected to grow in 2021 but at a much slower pace of 3.4%. Over the full 2021-2025 forecast period, Traditional PCs, inclusive of desktops, notebooks, and workstations, are expected to have a compound annual growth rate (CAGR) of 3.2% while tablets are expected to decline 1.5%. (IDC, CN Beta)

OPPO is rumored to enter tablet market soon. OPPO’s tablet is said to feature a large 12.6”, features a modified version of ColorOS and will come with a dock and widgets. (GSM Arena, Weibo, Sina, iFeng)

Fitbit Charge 5 is announced, which is the company’s first band-style fitness tracker with an ECG feature. It also has a skin temperature sensor as well an ElectorDermal Activity (EDA) sensor. There is also a heart rate sensor that calculate Heart Rate Variability (HRV) and Resting Heart Rate (RHR), as well as blood oxygen saturation sensor (SpO2). Its starting price is USD180. (CN Beta, GSM Arena, Fitbit)

Samsung has revealed its TVs can be remotely disabled if the company finds out the units have been stolen. The feature is called the “Television Block Function” and Samsung says it is recently activated in South Africa after a number of Samsung TVs were taken from a company warehouse during a wave of protests and unrest in Jul 2021. (Android Central, Digital Trends, The Verge, Samsung)

Xiaomi Corporation has announced that it is acquiring the entire shareholding in DeepMotion Tech, a 4-year-old Chinese autonomous driving startup, for about USD77.37M. DeepMotion is an autonomous driving technology company focused on providing algorithms for the perception, positioning, planning and control of advanced driver assistance systems, as well as a complete set of software solutions for autonomous driving applications. (CN Beta, SCMP, Gasgoo)

Tesla’s lofty goals for its Full Self-Driving suite are recently reiterated by CEO Elon Musk, who has noted that ultimately, the company is looking to develop a driver-assist system that is about 10 times safer than the average human driver. With this level of safety achieved, regulators would likely be incentivized to allow FSD to operate as a hands-off system on public roads. (CN Beta, The Driven, Teslarati)

Los Angeles delivery robot startup Coco has announced USD36M in funding. The UCLA spinout, formerly known as Cyan Robotics, is operating in a crowded field that includes names like Starship, Nuro and UC Berkeley alum Kiwibot. Rather than pushing for full autonomy, Coco’s solution utilizes remote drivers (which are a more popular solution than many companies care to admit). (CN Beta, TechCrunch)

Alphabet drone delivery company Wing has announced that it is set to hit 100,000 customer deliveries. The news comes on the second anniversary of the service’s pilot launch in Logan, Australia, a city of roughly 300,000 people in the Brisbane metropolitan area. (TechCrunch, The Verge, Wing)

UPS has begun using Matternet drones to deliver COVID-19 vaccines to a hospital in North Carolina. This new initiative — operated by UPS and its subsidiary, UPS Flight Forward — expands Atrium Health Wake Forest Baptist’s existing drone program, which is launched in Jul 2020. (VentureBeat, Wake Wealth, Aviation Week)

As the US National Park Service turns 105, Apple is sharing new ways for customers to learn about and celebrate America’s parks. In 23-29 Aug 2021, Apple will make a USD10 donation to the National Park Foundation for each purchase made with Apple Pay on apple.com, in the Apple Store app, or at an Apple Store in the US. (CN Beta, Apple, Mac World)