9-11 #LovedOne : UMC is talking about the production capacity in 2022; Samsung Display has unveiled a new 13” stretchable OLED display prototype that can stretch vertically; Apple is reportedly to move to under-display Face ID technology in 2022; etc.

MediaTek has announced its new Kompanio 900T chipset, expanding MediaTek’s portfolio of mobile computing solutions for tablets, portable notebooks and other devices. It is built on the advanced 6nm process and integrates an octa-core CPU architecture with two Arm Cortex-A78 ultra-performance cores and six Arm Cortex-A55 power-efficient cores, plus an Arm Mali-G68 GPU and MediaTek APU (AI processor). (G(Android Central, MediaTek)

Qualcomm CEO Cristiano Amon has indicated that the company is open to working with foundries in Europe if incentive programs to boost automotive chip production on the continent attract the right partners. He has said that foundries in Europe are now geared towards mass production of semiconductors, but there is a welcome debate under way about investing in high-end production that is interesting to Qualcomm. (CN Beta, Forbes, Reuters, Auto News)

Samsung allegedly will be using 3 different types of AMD mRDNA GPU for its Exynos mobile SoCs. They will differ in terms of cores and clock speeds. The flagship like the Galaxy S series will be getting a 6-core GPU at an unspecified clock rate. The mid-range and budget handsets like the Galaxy A series are said to use 4-core and 2-core GPUs respectively. Furthermore, the mRDNA GPU for the Galaxy A series-like devices is being currently tested at 1GHz. (Clien, Gizmo China)

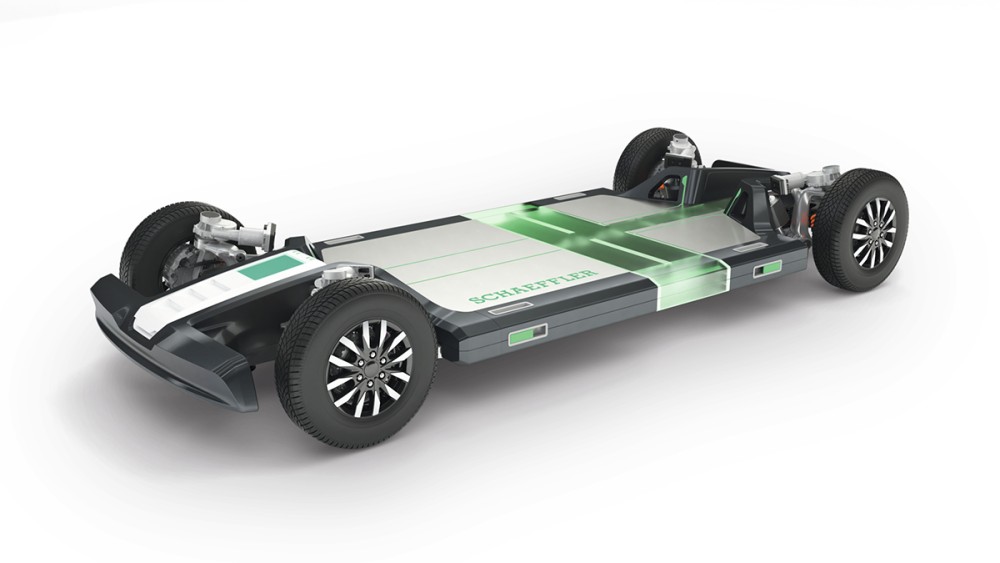

The automotive and industrial supplier Schaeffler and Mobileye, an Intel’s subsidy and leading provider of automated driving solutions, have agreed on a long-term cooperation. The rolling chassis from Schaeffler, a modular platform for new mobility concepts, is combined with the Mobileye Drive self-driving system. The goal: to develop a new, flexible platform for self-driving shuttles and other vehicle products at full automation level 4 and to offer customers worldwide solutions for Mobility-as-a-Service (MaaS) and Transportation-as-a-Service (TaaS). Mobileye Drive is a versatile, scalable solution that enables any vehicle type to become self-driving. (Laoyaoba, Schaeffler, Bloomberg)

General manager and director of United Microelectronics (UMC) SC Chien has indicated that the current supply is still in short supply. The production capacity in 2021 has been sold out. Now they are talking about the production capacity in 2022. Customers tend to talk about long-term cooperation. UMC is carrying out a NTD100B (about USD3.58B) expansion project for its 12” Fab 12A Phase 6 facility (P6) located in southern Taiwan, China. The project will be equipped with 28nm equipment, and its process equipment can be flexible production of smaller nodes as low as 14nm, the expanded P6 factory will be put into production in 2Q23. (Laoyaoba, CTEE, LTN)

Samsung Display has unveiled a new 13” stretchable OLED display prototype that can stretch vertically to offer an immersive media experience. One of the strengths of this new stretchable OLED display is the ability to convert standard 2D content into 3D. (Android Headlines, ET News, SlashGear)

TCL’s chief marketing officer, Stefan Streit, has confirmed that it will no longer launch what would have been its first commercially available foldable phone, codenamed “Chicago”, for at least 12-18 months. (Android Headlines, CNET, Android Central)

According to Digitimes, LCD driver IC designers are raising estimates to reflect the ongoing cost increase in wafer foundry services, but panel prices have continued to fall since the end of the 2Q21. These LCD driver IC design companies are primarily Novatek, Himax, Fitpower Integrated Technology, FocalTech, Sitronix, and Raydium Semiconductor. LCD driver IC designers are confident in raising their quotes, but will face difficulties arising from client resistance. (Digitimes, Laoyaoba)

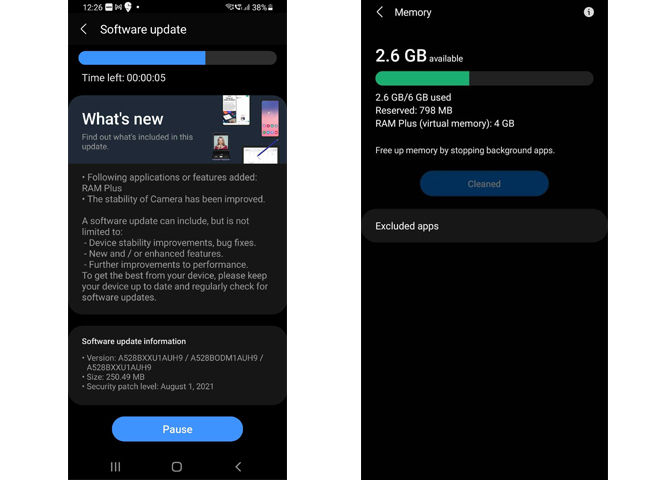

Samsung is enabling the company’s feature RAM Plus in the Galaxy A52s 5G. Samsung has added 4GB virtual memory or RAM Plus to Galaxy A52s 5G in India via an OTA update. Virtual RAM has been around for a while but is currently being marketed for phones by Android brands including OPPO, vivo, OnePlus, realme and Xiaomi. (Phone Arena, Android Authority, SamMobile)

Memory price growth is poised to lose momentum in 4Q21, as chip suppliers, and downstream distributors and module houses see their deliveries disrupted by the ongoing shortages of controller chips and other ICs, according to Team Group. (Laoyaoba, UDN, AAT News, Digitimes, Digitimes)

New research from Canalys shows that advanced driver assistance system (ADAS) features were installed in just 10% of the 1B cars in use worldwide at the end of 2020. A third of new cars now sell with ADAS features in major markets such as Mainland China, Europe, Japan and the US, but it will be several years before they are installed in half of all cars on the world’s roads. (Canalys, CN Beta)

Delaware-based company Hyfe has two published apps, one of which is available for consumers who agree to use it to record their cough for the sake of the research (the other is for the researchers themselves). The company’s chief medical officer Peter Small says the sound and frequency of coughing is abundant in medical information. Different illnesses have some audible differences. (Phone Arena, WSJ, Live Mint)

Apple partner Rockley Photonics has announced a strategic partnership with two major medical device manufacturers that could lead to advancements in non-invasive biomarker sensing for mobile devices like Apple Watch. Rockley will evaluate and incorporate next-generation non-invasive biomarker sensing technologies across a range of form factors. The tech will be used in devices that gather photonics-based data from different parts of the body with a goal of monitoring health conditions and providing early disease detection. (Apple Insider, Rockley)

The automotive safety domain will grow at a CAAGR (compound annual average growth rate) of almost 12% over the 2020 to 2025 timeframe with the market for vehicle safety systems forecast to reach USD81B by 2028. Strategy Analytics forecasts that rapid adoption of ADAS (Advanced Driver Assistance Systems) coupled with continued penetration growth of passive safety systems in emerging markets, and the inclusion of additional safety systems to meet safety mandates and ratings requirements will underpin this growth. ADAS adoption driven by collision warning and other ADAS systems will be a core driver with the resultant semiconductor market forecast to grow by 247% over the 2020 to 2025 timeframe. (Laoyaoba, Strategy Analytics)

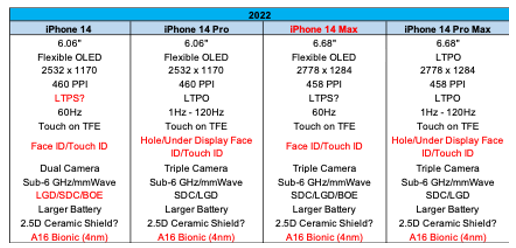

Apple is reportedly to move to under-display Face ID technology in 2022, a shift that ditches iPhone’s TrueDepth “notch” in favor of a “hole-punch” front-facing camera design popularized by Samsung. Moving TrueDepth system components like the dot projector, flood illuminator and infrared camera below iPhone’s display panel is “easier” than doing the same for the handset’s color camera. (Apple Insider, Twitter)

Motorola has demonstrated an updated version of its over-the-air charging solution. The company’s second-generation over-the-air wireless charger can charge up to 4 devices at the same. Motorola’s updated “Space Charging” air charge station features a total of 1,600 antennas, which allows it to easily pass through obstructions and provide a wider 100º area of coverage. (Android Central, Liliputing, Weibo, Gizmo China)

According Daniel Desjarlais, international head of communications and global spokesperson at Xiaomi, Mi 11T Pro uses a dual-cell battery design and says that consumers can expect the same battery life as other more traditional smartphones. He has explained that in general, for the charge level of the battery they tested, after 800 charging cycles (about two years for most people), 80% of the battery is still healthy, which is basically the standard for all charging technologies. (CN Beta, The Verge)

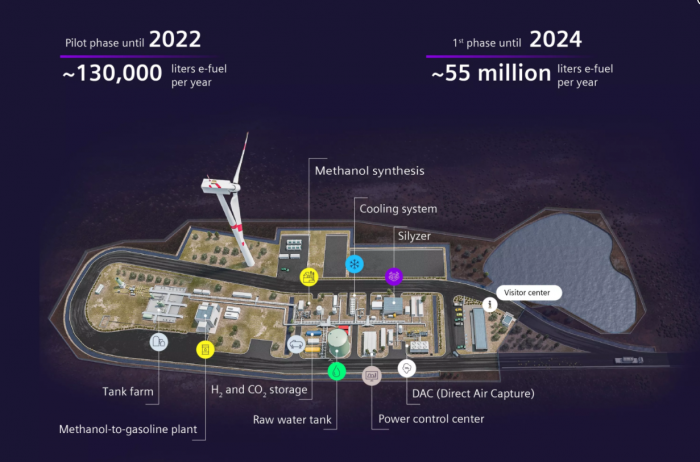

In 2020, Porsche and Siemens Energy announced that they would be partnering with a number of other companies on a synthetic eFuel plant in Southern Chile. Now, it’s time for the building to begin. Porsche has announced that construction has begun on the Chilean eFuel plant, known as the Haru Oni project. It will be constructed in stages, with the pilot plant aiming to produce 130,000 liters (about 34,300 gallons) in 2022. From there, two stages will expand the facility’s production: first to 55M liters in 2024, then to 550M liters by 2026. Production is expected to begin mid-2022. (CN Beta, Porsche, CNET, Just Auto)

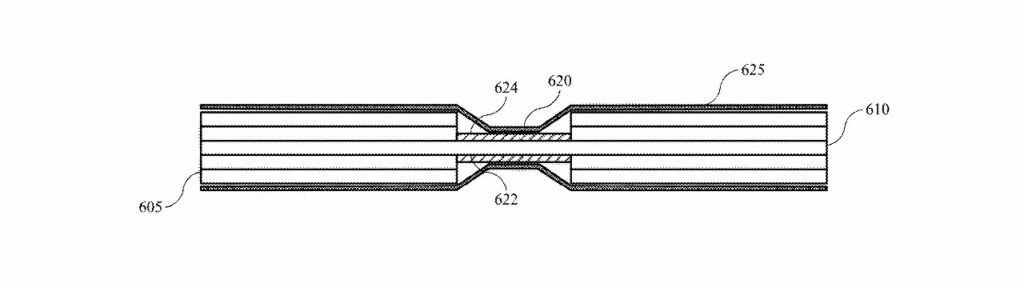

Apple is continuing to investigate ways that battery can fill the entire volume of an iPhone, and is researching batteries that can fill the gaps in flexible devices. Apple’s patent “flexible battery configurations” is concerned with the arrangement of battery cells in a housing. This relates to electronic device configurations providing flexible movement of aspects of the device. (Apple Insider, USPTO)

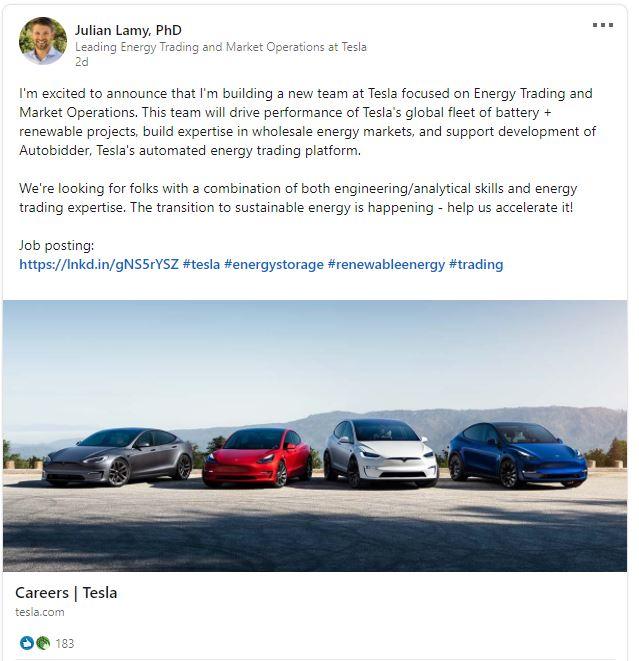

Tesla is looking to staff an energy trading team to support its battery and renewable power projects. The company has expanded operations to include home solar and large battery storage facilities, which currently account for a small portion of its total revenue. It also recently applied to begin marketing electricity in Texas. The company plans to use an in-house automated trading platform, called Autobidder, for “bidding batteries into multiple wholesale energy markets”. (CN Beta, Electrek, Reuters)

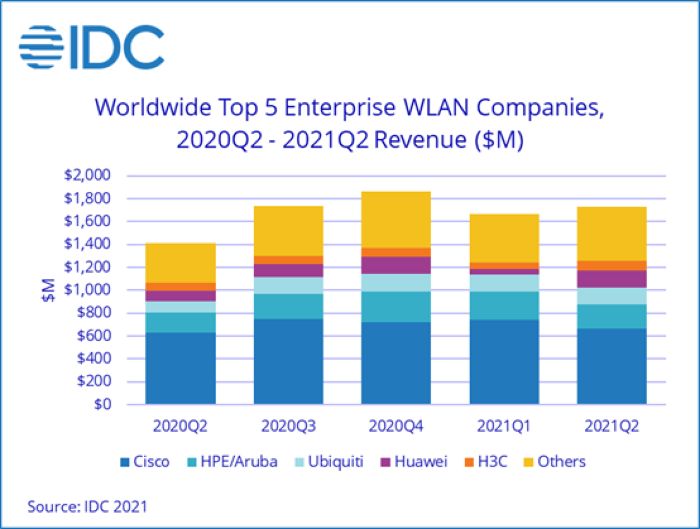

Growth rates remained strong in the enterprise segment of the wireless local area networking (WLAN) market in 2Q21 as the market increased 22.4% on a YoY basis to USD1.7B, according to IDC. In the consumer segment of the WLAN market, revenues declined 5.7% in the quarter to USD2.3B, giving the combined enterprise and consumer WLAN markets YoY growth of 4.6% in 2Q21. The growth in the enterprise-class segment of the market builds on a strong 1Q21 when revenues increased 24.6% YoY. For 1H21, the market increased 23.5% compared to 1H20. Compared to 2Q19, 2Q21 revenues increased 10.8%, indicating that demand in the enterprise WLAN is strong. (CN Beta, IDC)

Xiaomi has announced that the upcoming 11T and 11T Pro will get 3 major Android system updates as well as 4 years of security patches from their launch. (GSM Arena, Android Authority)

Xiaomi seems to be enforcing its export policy that prohibits the use of its smartphones in certain regions of the world. The company is now proactively preventing access to its devices that may have been illegally transferred to some countries. (Gizmo China, Reddit, XDA-Developers)

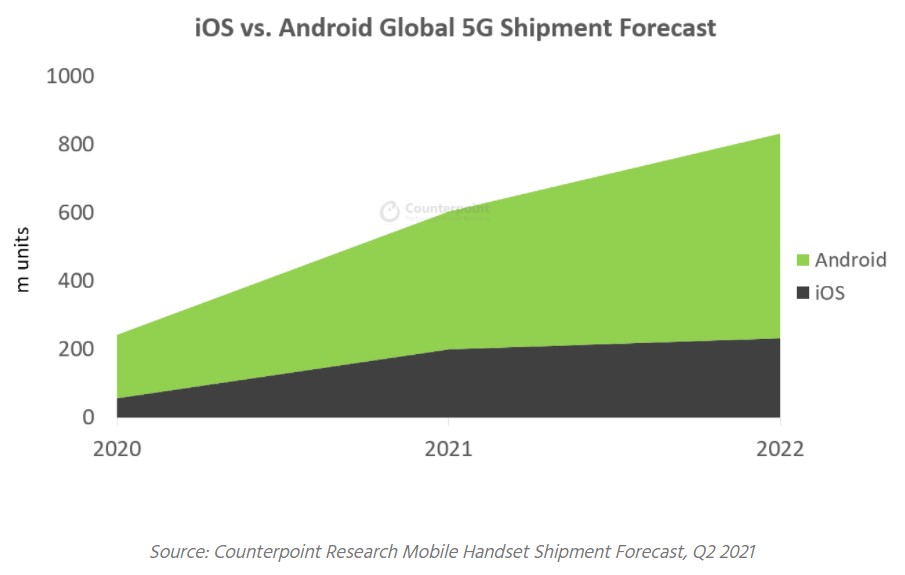

Apple’s iPhone 12 and upcoming 13 series devices are set to spike 4Q21 global 5G shipments to nearly 200M units, helping grow 2021 total shipments to 605m, according to Counterpoint Research. In 2020, Apple’s iPhone 12 accounted for 24% of all 5G smartphone shipments globally, despite a late launch in Oct 2021. In 2021, with an earlier launch for the iPhone 13 and continued strong appetite for iOS, Counterpoint sees Apple taking 33% of all global 5G shipments. (Counterpoint Research, Apple Insider)

Google and Jio Platform have announced that their jointly developed JioPhone Next is delayed missing its planned 10 Sept 2021 launch date. The phone is designed to be an affordable 4G smartphone to help the roughly 300M Indian users currently on 2G networks upgrade to 4G. (CN Beta, The Verge, Jio)

Telling Telecommunication has announced that the company plans to participate in the joint acquisition of a phone brand business, and the scope of the acquisition involves brand trademarks, research and development, and supply chain. The company has stated that the matter is currently in the initial stage of negotiation and planning. (IT Home, East Money, Sina, Laoyaoba)

realme 8s 5G and 8i are announced in India: 8s 5G – 6.5” 1080×2400 FHD+ HiD 90Hz, Mediatek Dimensity 810 5G, rear tri 64MP-2MP macro-2MP depth + front 16MP, 6+128 / 8+128GB, Android 11.0, side fingerprint, 5000mAh 33W, INR17,999 (USD245) / INR19,999 (USD270). 8i – 6.6” 1080×2412 FHD+ HiD 120Hz, MediaTek Helio G96, rear tri 50MP (1.2µm)-2MP macro-2MP depth + front 16MP, 4+64 / 6+128GB, Android 11.0, side fingerprint, 5000mAh 18W, INR13,999 (USD190) / INR15,999 (USD215). (GSM Arena, NDTV, India Today)

Samsung Galaxy Wide5 is announced in South Korea – 6.6” FHD+ v-notch IPS LCD, MediaTek Dimensity 700, rear tri 64MP-5MP wide-2MP depth + front 8MP, side fingerprint, 6+128GB, Android 11.0, 5000mAh 18W, KRW450,000 (USD385). (GSM Arena, T-World, 91Mobiles, Gizmo China)

vivo X70 series in collaboration with Zeiss is launched in China: X70 – 6.56” 1080×2376 FHD+ HiD AMOLED 120Hz HDR+, MediaTek Dimensity 1200 5G, rear tri 40MP (1.0µm)-12MP telephoto 2x optical zoom-12MP ultrawide + front 32MP, 8+128 / 8+256 / 12+256GB, Android 11.0, fingerprint on display, 4400mAh 44W, from CNY3,699 (USD574). X70 Pro – 6.56” 1080×2376 FHD+ HiD AMOLED 120Hz HDR+, Samsung Exynos 1080, rear quad 50MP (1.0µm) OIS-8MP periscope telephoto 5x optical zoom OIS-12MP telephoto 2x optical zoom OIS-12MP ultrawide + front 32MP, 8+128 / 8+256 / 12+256 / 12+512GB, Android 11.0, fingerprint on display, 4450mAh 44W, from CNY4,299 (USD667). X70 Pro+ – 6.78” 1440×3200 QHD+ HiD LTPO AMOLED 120Hz HDR10+, Qualcomm Snapdragon 888+ 5G, rear quad 50MP (1.2µm) OIS-8MP periscope telephoto 5x optical zoom OIS-12MP telephoto 2x optical zoom OIS-48MP ultrawide gimbal stabilization, 8+256 / 12+256 / 12+512GB, Android 11.0, fingerprint on display, 4500mAh 55W, 50W fast wireless charging, from CNY5,499 (USD853). (GSM Arena, GSM Arena, NDTV, IT Home, vivo)

Infinix Hot 10i is official in Philippines – 6.52” 720×1600 HD+ v-notch, MediaTek Helio P65, rear dual 13MP-QVGA + front 5MP, 4+128GB, Android 11.0, rear fingerprint, 6000mAh 18W, PHP5,990 (USD120). (Gizmo China, GizChina, 91Mobiles)

realme Pad is announced in India – 10.4” 1200×2000 IPS LCD, MediaTek Helio G80, rear 8MP + front 8MP, 3+32 / 4+64GB, Android 11.0, Dolby Atmos quad speakers, 7100mAh 18W, Wi-Fi and LTE versions, from INR13,999 (USD190). (GSM Arena, realme, NDTV)

Lenovo unveils Tab P11 5G and P12 Pro 5G tablets supporting keyboard add-on and stylus Precision Pen 2: P11 5G – 11” 1200×2000 60Hz IPS LCD Dolby Vision, Qualcomm Snapdragon 750G, rear 8MP + front dual 8MP-3D ToF, 8+256GB, Android 11.0, 4 JBL speakers with Dolby Atmos, 7700mAh 20W, start from EUR499.P12 Pro 5G – 12.6” 1600×2560 AMOLED 120Hz Dolby Vision HDR10+, Qualcomm Snapdragon 870, rear dual 13MP-5MP ultrawide + front dual 8MP-3D ToF, 6+128 / 8+256GB, Android 11.0, side fingerprint, 4 JBL speakers with Dolby Atmos, 10200mAh 45W, start from USD610.(Gizmo China, GSM Arena, Lenovo)

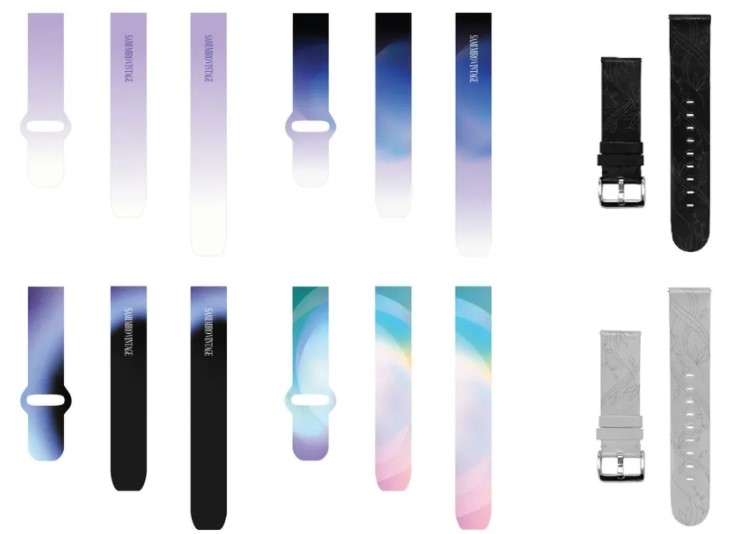

Samsung has announced that it has teamed up with Sami Miró Vintage to create 6 limited-edition watchbands for the new Galaxy Watch4 series. They are sustainably sourced and use materials such as recycled apple peel skin. To accompany the new watchbands, Samsung has also developed 3 ‘beautiful’ watchfaces. (CN Beta, Samsung, Neowin)

TF Securities analyst Ming-Chi Kuo has pointed out that Apple has resolved the issue of panel module quality. Luxshare is currently increasing and replicating production lines, and is expected to start mass shipments in mid-to-late Sept 2021. He predicts that Apple Watch 7 and total Apple Watch shipments will significantly grow to 14–16M units and 40–45M units in 2021, respectively. Benefiting from the large shipments of Apple Watch 7, Luxshare’s Apple Watch business’s profit in 4Q21 will significantly exceed the combined profit of 1Q–3Q21 and beat market expectations. (TF Securities, Sina, GSM Arena, Apple Insider)

Facebook launches USD299 Ray-Ban Stories smart glasses. The glasses come in 20 style combinations and connect to your smartphone to perform basic tasks. The glasses house two 5MP cameras for taking photos from a first-person perspective. They connect to smartphone to make calls, play music, and share photos using voice commands. (Liliputing, Apple Insider, Ray-Ban)

Sonos Chief Financial Officer Brittany Bagley has confirmed that starting 12 Sept 2021, Sonos is raising prices on almost all its products, most will go up about 10%. (Gizmodo, Sonos, Engadget)

Amazon has announced its first lineup of Amazon-branded 4K Fire TVs, which will begin shipping in Oct 2021. This is a major expansion from the company’s “Fire TV Edition” collaborations, where its streaming software comes preloaded on sets manufactured by other TV makers. Its new Omni and 4-Series, Amazon is describing these as “Amazon-built TVs”. Amazon includes far-field microphones in each model of the Omni series, which comes in 43”, 50”, 55”, 65”, and 75”. Only the 65” and 75” models have Dolby Vision, but the others at least get HDR10. (The Verge, CNN, Amazon, Tom’s Guide)

India will reportedly give about USD3.5B in incentives to auto companies over a 5-year period under a revised scheme to boost the manufacturing and export of clean technology vehicles. The government’s original plan was to give about USD8B to automakers and part manufacturers to promote mainly gasoline technology, with added benefits for electric vehicles (EVs). Domestic automaker Tata Motors is the largest seller of electric cars in India, with rival Mahindra & Mahindra and motor-bike companies TVS Motor and Hero MotoCorp firming up their EV plans. India’s biggest carmaker, Maruti Suzuki, has no near-term plan to launch EVs as it does not see volumes or affordability for consumers. (CN Beta, India Times)

Cao Cao Mobility, the ride-hailing unit of Chinese automaker Geely Automobile Holdings, has announced a USD589M (CNY3.8B) Series B raise that the company says will help it upgrade its technology and expand its fleet. The raise brings the company’s total funding to around USD773.2M (CNY5B). (TechCrunch, Cao Cao, Sohu, IT Home, NBD)

The Netherlands’ Volksbank is said to be preparing to accept Apple Pay. Banks in the Netherlands first accepted Apple Pay in 2019, 5 years after Apple created the service, and reportedly following 2 years of trials in the region. Now after further delays, Volksbank is reported to be adding Apple Pay support. (Apple Insider, iCulture)