9-17 #Soon : GlobalFoundries will incur an additional USD6B to expand its overall production capacity; Apple has reportedly conditionally approved BOE to supply display panels to the iPhone 13; Foxconn to team up with PTT Public Co to invest USD1-2B in launching an electric vehicle (EV) joint venture in Thailand; etc.

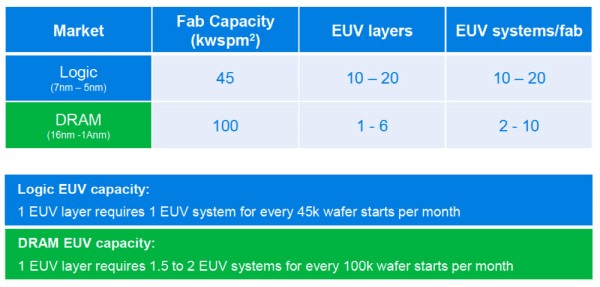

ASLM will exclusively supply more than 100 units of next-generation extreme ultraviolet (EUV) exposure equipment by 2Q21. ASML shipped a total of 102 EUV equipment to the market by 2Q21. In the last 4 quarters (3Q20- 2Q21), shipments totaled 40 units, a 66% increase from shipments of 24 units in the previous 4 quarters (3Q19-2Q20). ASML’s total EUV equipment supply target for this year is about 40 units, and around 25 EUV equipment will be supplied in 2H21. (Laoyaoba, ET News, IT Home)

U.S. chipmaker GlobalFoundries (GF) is on track to at least double its automotive chip output in 2021 and will incur an additional USD6B to expand its overall production capacity. However, the expansion plans will materialize from 2023 as it takes time for new investments to turn into capacity and the overall lead time for silicon chips to make it into the auto manufacturers. GF will ship more than double the wafers into automotive versus 2020 and plans to expand that capacity in 2022, and beyond. (CN Beta, Benzinga, Fierce Electronics, Gadgets Now, Nikkei Asia)

According to Wave7 Research, Apple is beginning to feel the impact of the global chip shortage, it is faring better than rivals, and will see substantial market gains as a result of pre-planning. Early on in the global chip shortage, it was suggested that Apple’s scale and buying power could mean it would benefit from better component pricing. Wave7 Research’s survey of 37 sales representatives at wireless retail stores across the U.S., 26 of them, or 70%, has reported shortages of smartphone inventory in Aug 2021, up from 45% in June and 28% in May. (Apple Insider, The Information, IT Home)

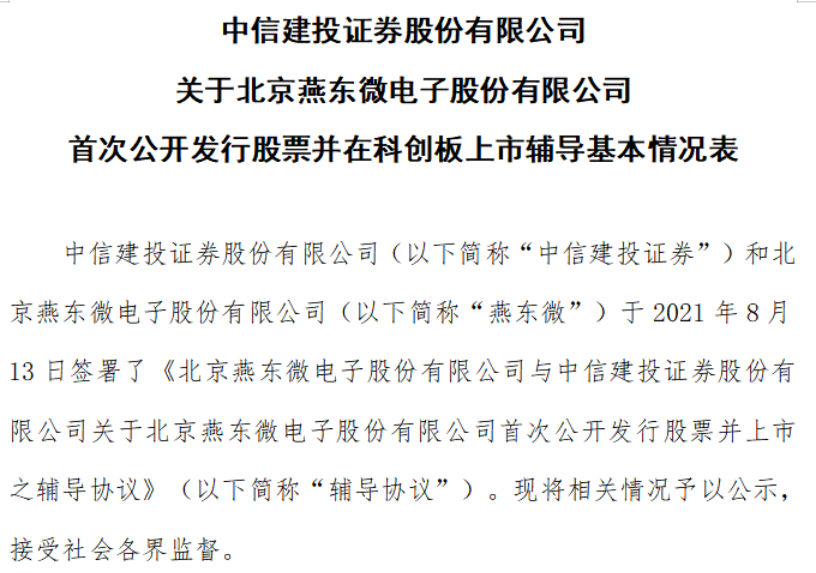

BOE has recently announced its plans to invest CNY1B (USD155.5M) in Beijing Yandong Microelectronics, an IDM semiconductor company, through its wholly-owned subsidiary Tianjin BOE Innovation Investment Company. This marks BOE’s direct entry into the booming IC-making industry in China. (Laoyaoba, Sina, Laoyaoba, Sohu)

GlobalFoundries (GF) and Qualcomm have announced today that they are extending their successful RF collaboration on 5G multi-Gigabit speed RF front-end products for delivering the high cellular speeds, superior coverage, and outstanding power efficiency in the sleek form factors users expect from the newest generation of 5G-enabled products. (Laoyaoba, PR Newswire, Forbes, Telecom Paper)

Samsung Display has announced that the company began mass-producing its 90Hz refresh rate laptop OLED panels, which are featured in the 14” versions of the new ASUS Zenbook and Vivobook Pro. Both laptops support up to a 90Hz refresh rate. Samsung Display has been supplying OLED panels for global laptop manufacturers including ASUS, Lenovo, Dell, HP, and Samsung Electronics, with the market continuing to grow. (Samsung, MacRumors)

AU Optronic’s (AUO) AmLED (adaptive miniLED) display technology is featured in MSI’s new creator notebook series. MSI Creator Z16 Hiroshi Fujiwara Limited Edition, a collaboration between MSI and designer Hiroshi Fujiwara, features a 16:10 display utilizing AUO AmLED’s local dimming technology to deliver QHD+ resolution, ultra-high brightness, and wide color gamut. (CN Beta, Digitimes, LTN, Money DJ)

LG Display (LGD) commercialized 55” transparent OLED displays in 2019. With a transparency ratio of 40%, the products are increasingly being used in the display windows of shops, subway windows and in signage. LGD has estimated that the market will grow to around USD8.5B in the next 10 years. (CN Beta, Korea Times, OLED-Info)

Apple has reportedly conditionally approved BOE to supply display panels to the iPhone 13. If everything goes well, select models will ship within 2021. The conditional approval means that the order is a “risk order”. This means that Apple is not entirely satisfied and there are still some issues that need to be resolved. The issue may include emission materials and touch electrodes. (GizChina, My Drivers)

EnerVenue, the first company to bring metal-hydrogen batteries to the clean energy revolution, has announced that it has raised USD100 million in Series A funding. EnerVenue has announced the framework for a major distribution and manufacturing agreement with Schlumberger New Energy to significantly expand global availability of EnerVenue batteries. (CN Beta, Forbes, TechCrunch, Globe Newswire)

According to data released by Mysteel Group, on 15 Sept 2021, the price of most lithium battery materials will rise. The price of lithium metal will rise by another CNY20,000/ton, lithium carbonate will rise by CNY3,500-5,000/ton, and lithium hydroxide will rise by CNY4,500-7,000/ton. Spodumene concentrate will rise by USD20/ton. The price of cathode materials has also risen, with ternary materials rising by CNY4,500-10,000/ton. Electrolytic cobalt fell CNY2,000-3,000/ton. (Laoyaoba, Jiemian, SFC)

SK Materials, the industrial gas manufacturing affiliate of SK Group, has said it is jointly investing KRW850B (USD726M) with US startup Group14 Technologies to build a battery material plant in South Korea. The joint venture, tentatively named SK Materials Group14, will launch by the end of Sept 2021 with an aim to build a factory in Sangju, North Kyongsang Province. SK Materials said it will hold a 75% stake in the JV, while the US battery material startup will own the remaining 25%. (Laoyaoba, YNA, KED Global)

Contemporary Amperex Technology (CATL) has announced Thursday a strategic partnership with BASF SE on battery materials solutions, including cathode active materials or CAM and battery recycling. The companies will develop a sustainable battery value chain, in support of CATL’s localization in Europe. It also contributes to achieving both companies’ global carbon neutrality goals. (Laoyaoba, BASF, NASDAQ)

Shareholders of SK Innovation have approved the company’s plan to split off its battery and oil exploration and development (E&P) businesses. The two newly established corporations are tentatively named SK Battery Co, and SK E&P and will be officially launched on 1 Oct 2021. (Laoyaoba, Business Korea, Reuters)

SoftBank Group is announcing the launch of the SoftBank Latin America Fund II, its second dedicated private investment fund focused on tech companies located in LatAm. SoftBank is launching the new fund with an initial USD3B commitment. The new fund builds upon SoftBank’s USD5B Latin America Fund, which was first announced in Mar 2019 and was formerly called the Innovation Fund with an initial USD2B in committed capital. (TechCrunch, CNBC, Business Wire)

Indian Telecom Minister Ashwini Vaishnaw has said that Indian 5G spectrum auctions will “most probably” be held sometime in Feb 2022 and that the government may even try for a Jan 2021 timeline. Jio announced a 5G launch by late 2021 back in Dec 2020. However, postponements in the Indian 5G spectrum auctions and a few other factors have now pushed the date to sometime in 2022. (Gizmo China, Indian Express)

Google ended Project Loon earlier 2021. However, the high-speed wireless optical link technology originally developed for Loon is currently being used for another moonshot called Project Taara. Taara’s Director of Engineering, Baris Erkmen, has revealed that the initiative’s wireless optical communications (WOC) links are now beaming high-speed connectivity across the Congo River. (Engadget, Google)

Apple will place orders for around 90M units of the freshly launched iPhone 13 series with its upstream assemblers for 2021, Digitimes Research estimates. According to Digitimes Research analyst Sean Lin, among the 4 models of the iPhone 13 series, the iPhone 13 has the highest order volume, reaching about 40M units, thanks to its price starting from USD799. The iPhone 13 Pro Max and iPhone 13 Pro are 25M units and 20M units, respectively. The entry-level iPhone 13 mini is expected to experience the same fate as the previous generation, with orders for only 7-9M units in 2021. (Digitimes, Laoyaoba, Daytime.cool)

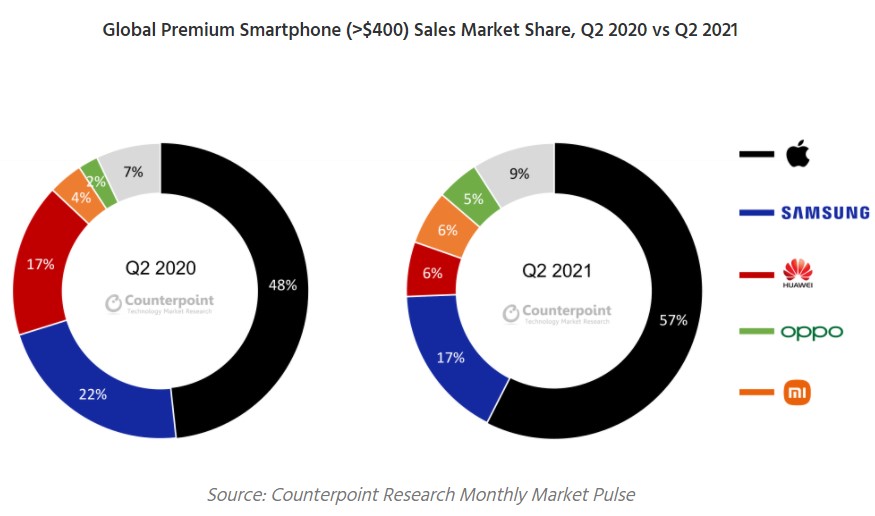

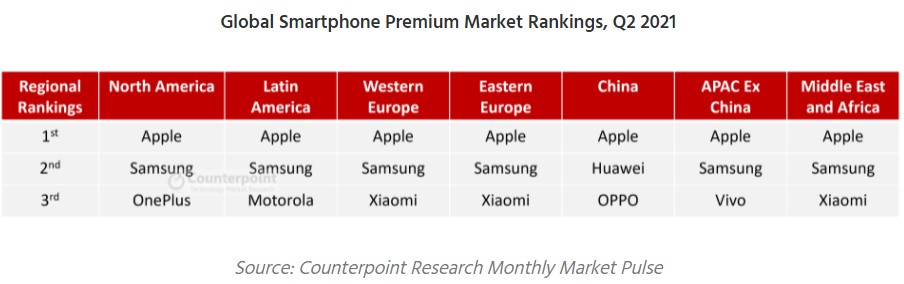

The global premium smartphone market (models priced USD400* and above) recorded a 46% YoY sales growth in 2Q21, according to Counterpoint Research. Apple continued to lead the segment, cornering over half of the sales during the quarter, followed by Samsung and Huawei. (Gizmo China, Counterpoint Research)

Apple iPhone 13 and 13 mini are announced, powered by Apple A15 Bionic, featuring rear dual 12MP 1.7µm sensor-shift stabilization-12MP ultrawide + front dual 12MP-3D depth / biometric sensor, 6+128 / 6+256 / 6+512GB, iOS 15, Face ID, single SIM / dual SIM, IP68 certified, 20W fast charging, 15W MagSafe wireless charging, 7.5W Qi magnetic fast wireless charging: 13 – 6.1” 1170×2532 Super Retina XDR OLED, from USD799. 13 mini – 5.4” 1080×2340 Super Retina XDR OLED, from USD699. (GSM Arena, GSM Arena, Apple Insider, GSM Arena, Apple, Apple)

Apple iPhone 13 Pro and Pro Max are announced, powered by Apple A15 Bionic, featuring rear quad 12MP 1.9µm sensor-shift OIS-12MP telephoto 3x optical zoom OIS-12MP ultrawide-3D ToF LiDAR + front dual 12MP-SL 3D depth / biometrics sensor, 8+128 / 8+256 / 8+512GB / 8+1TB, iOS 15, Face ID, single SIM / dual SIM, IP68 certified, 20W fast charging, 15W MagSafe wireless charging, 7.5W Qi magnetic fast wireless charging: 13 Pro – 6.1” 1170×2532 Super Retina XDR OLED 120Hz, from USD999. 13 Pro Max – 6.7” 1284×2778 Super Retina XDR OLED 120Hz, from USD1,099. (GSM Arena, GSM Arena, Apple Insider, GSM Arena, Apple, Apple)

Xiaomi 11T and 11T Pro are announced in Europe: 11T – 6.67” 1080×2400 FHD+ HiD 120Hz, MediaTek Dimensity 1200 5G, rear tri 108 (0.7um) OIS-8MP ultrawide-5MP macro + front 16MP, 8+128 / 8+256GB, Android 11.0, side fingerprint, 5000mAh 67W, EUR500 / EUR550. 11T Pro – 6.67” 1080×2400 FHD+ HiD 144Hz, Qualcomm Snapdragon 865 5G, rear 108 (0.8um) OIS-13MP ultrawide-5MP macro + front 20MP, 8+128 / 8+256 / 12+256GB, Android 11.0, side fingerprint, 5000mAh 33W, EUR650 / EUR700 / EUR750. (GSM Arena, Android Authority)

Xiaomi 11 Lite 5G NE is announced – 6.55” 1080×2400 FHD+ HiD AMOLED 90Hz, Qualcomm Snapdragon 778G 5G, rear tri 64MP (0.7um)-8MP ultrawide-5MP macro + front 20MP, 6+128 / 8+128GB, Android 11.0, side fingerprint, 4250mAh 33W, EUR369 / EUR399. (GSM Arena, NDTV, Gizmo China)

Moto e20 is launched in Brazil – 6.5” 720×1600 HD+ v-notch, Unisoc T606, rear dual 13MP-2MP depth + front 5MP, 2+32GB, Android 11.0 Go, rear fingerprint, 4000mAh 10W, BRL999 (USD190). (GSM Arena, Gizmo China, Android Planet)

realme C25Y is launched in India – 6.5” 720×1600 HD+ v-notch, Unisoc T610, rear tri 50MP-2MP macro-2MP depth + front 8MP, 4+128GB, Android 11.0, rear fingerprint, 5000mAh 18W, INR11,999 (USD163). (GSM Arena, realme, Gizmo China)

Apple iPad mini (2021) is announced – 8.3” 1488×2266 Liquid Retina IPS LCD, Apple A15 Bionic, rear 12MP + front 12MP ultrawide, 64 / 256GB storage, iPadOS 15, side fingerprint, 19.3Wh battery, supports 2nd-Gen Apple Pencil, start from USD329 (Wi-Fi) / USD459 (Wi-Fi + Cellular). (Neowin, Apple Insider, Apple, Wired)

Huawei MateBook 13s and 14s are announced, priced from CNY6,999 (USD1,088), powered by 11th-generation Intel Core i7 / i5, featuring front 720p camera, 16GB RAM, Windows 10 Home (upgradable to Windows 11), fingerprint scanner power combo, 4x speakers, 60Wh battery: 13s – 13.4” 1680×2520 multi-touch LTPS LCD 90Hz, 512GB SSD. 14s – 14.2” 1680×2520 multi-touch LTPS LCD 90Hz, 512GB / 1TB SSD. (My Drivers, CN Beta, Huawei, Huawei, Gizmo China)

Infinix XE20 and XE25 TWS earphones are announced. XE20 comes with a 10mm high-efficiency composite diaphragm with support for AAC and SBC audio codec. It also comes with a 60ms super-low latency mode for playing games or watching movies. XE25 is touted as “Power Monster” by the company, featuring 6mm graphene speakers. There is also Environment Noise Cancellation (ENC) technology and deep neural networks for speech recognition. (Gizmo China, Infinix, Infinix)

realme Band 2 is official in Malaysia, featuring 1.4” 320×167 colour LCD, heart rate monitoring, sleep tracking, automatic step counter, water drink reminder, and sedentary reminder, as well as stress measurement, women’s health tracking, and an SpO2 sensor to measure blood-oxygen levels. It is priced at MYR169 (USD40). (Android Authority, GSM Arena, realme)

Sonos has announced second-generation Beam soundbar, featuring Dolby Atmos, which is priced at USD449. The new Beam looks nearly identical to its predecessor, aside from a new perforated polycarbonate grille instead of the cloth front found on the original. (TechCrunch, Pocket-Lint, Sonos)

LG is launching a range of Direct View LED (DVLED) Extreme Home Cinema models ranging in size from 81” to 325”. Aimed at “affluent consumers”, the DVLED TVs running webOS will be offered in both 16:9 models (up to 325”) and Ultra Stretch video wall-style 32:9 installations (up to 196”). (Gizmo China, CN Beta, Engadget, CNET, PC Mag, LG)

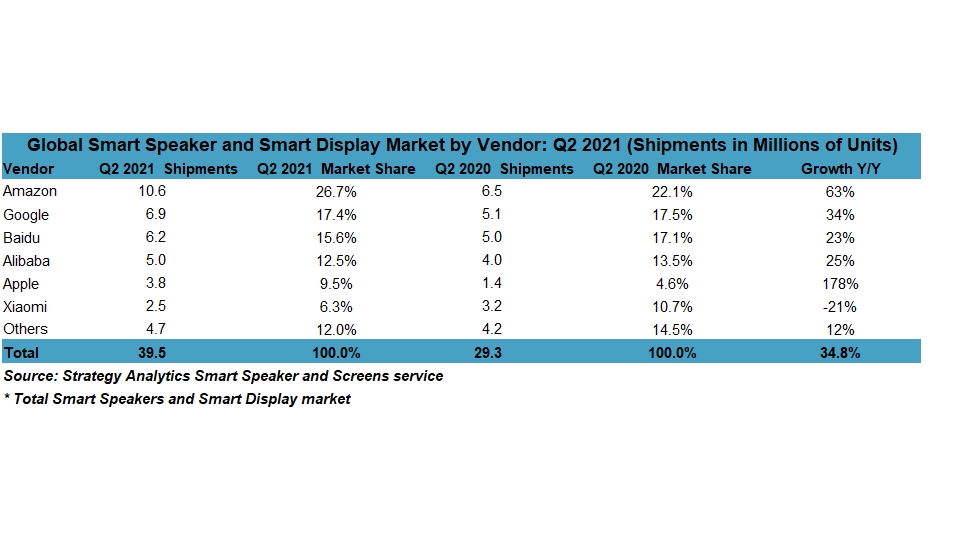

The smart speaker market in 2Q21 surged to new heights as consumers and brands adapt to the ongoing pandemic, according to Strategy Analytics. Global shipments of smart speakers and smart displays in 2Q21 grew 34.8% from 2Q20 to 39.5M units, a record for a second quarter. Sales of Smart Displays in 2Q21 soared YoY by 45% to 11.6M units, while sales of basic smart speakers (without a display) increased 31% over the same period. This led to an overall increase of 35% in smart speaker sales (with or without a display) in 2Q21 compared to 2Q20. (Strategy Analytics, Laoyaoba)

Samsung Electronics has announced a new partnership with the iconic Musée du Louvre. Through this partnership, Samsung will continue to develop the Art Store on its lifestyle TV, The Frame, through an exclusive artwork partnership with the Louvre in Paris, France. (Neowin, CN Beta, Samsung)

Hon Hai Precision Industry (also known as Foxconn) has agreed to team up with Thailand’s state-owned oil supplier PTT Public Co to invest USD1-2B in launching an electric vehicle (EV) joint venture in Thailand. The joint venture aims to produce 50,000 EVs a year, with production expected to expand to 150,000 units per annum in the future. PTT President Auttapol Rerkpiboon has indicated that the firm has signed a deal to produce electric vehicles and parts. PTT subsidiary Arun Plus will hold a 60% stake of the joint venture, while Foxconn’s affiliate Lin Yin will hold the rest. (CN Beta, Asia Nikkei, Caixing Global, Focus Taiwan)

Global automakers are increasingly transforming the traditional practice of keeping only a limited inventory of key components. Companies including Toyota are reportedly seeking to increase chip inventories, while other companies are ensuring their own rare metal supplies. Toyota has begun to require its suppliers to increase chip inventory levels from the traditional 3 months to 5 months. Prior to this, Toyota has always adopted just in time, which means that parts are delivered only when necessary. Nissan is considering increasing its chip inventory from 1 month to more than 3 months, while Suzuki has asked component manufacturers to maintain supply for “several months”. (CN Beta, Asia Nikkei)

Baidu has begun publicly testing its Apollo Go robotaxi mobile platform in Shanghai, China. While Baidu says its robotaxis have achieved Level 4 capabilities, a human safety operator will be present during all rides in order to comply with local regulations. Shanghai’s fleet will be made up of Baidu’s electric Hongqi EVs, its fourth generation autonomous vehicles produced with FAW. (TechCrunch, Sina)

Ford, Walmart and Argo AI plan to launch autonomous vehicle delivery services in Miami, Austin, Texas and Washington DC later in 2021. The service will focus on last mile deliveries and use Ford vehicles equipped with Argo’s AI self-driving system to deliver Walmart orders. Ford and Walmart previously announced a collaboration with Uber’s PostMates to deliver goods in Miami, and it has been operating with Argo AI in Miami and Washington DC since 2018. (Engadget, CNBC, TechCrunch, Reuters)

SAIC-GM has announced that it will officially switch to a new brand LOGO. The new LOGO adopts a more concise design and a more lively color scheme. SAIC General Motors also officially announced the Chinese name of the Ultium platform-Autoneng Platform. The first model of the platform, the Cadillac LYRIQ, is expected to be officially launched in 2022. (CN Beta, Breaking Latest News, Newsdirectory3)

Rivian has introduced a membership program that will grant Rivian owners access to complimentary charging at its soon-to-be-built Adventure Network and Waypoints chargers. It has also pledged to match every mile Rivian Membership customers drive with energy from renewable resources such as wind and solar, as well as offer unlimited access to 4G LTE connectivity. (TechCrunch, Rivian)

Goldman Sachs has announced plans to acquire B2B2C lender GreenSky in a deal worth USD2.24B. GreenSky operates a platform that facilitates loans for big-ticket items like home improvement projects or elective dental or medical procedures. It enables brands like Home Depot, as well as medical and dental practices, to offer installment loans to customers at the point of sale, thereby increasing sales and conversions for its clients. GreenSky then sells off those loans to a number of banks and other lending partners. (CN Beta, CNBC, TechCrunch, Financial Times)

The European Union is reportedly looking to bolster technological development in the region with a planned USD177B investment war chest. EU officials plan to fund direct investments in areas like blockchain, data infrastructure, 5G, and quantum computing, among others. The planned USD177 B investment fund is about 20% of the EUR750B (USD887B) stimulus package agreed upon by EU leaders back in Jul 2020 to kickstart economic recovery amid the ongoing COVID-19 pandemic. (CN Beta, Coin Telegraph, Bloomberg, Europe News)

AMC chief Adam Aron has revealed the theater chain will also accept Ethereum, Litecoin and Bitcoin Cash when crypto payments are available. He did not have a narrower timeframe for digital currency payments beyond “year-end 2021”. (Engadget, Twitter)