9-25 #Gaming : Samsung Display will try out using vertical deposition of organic material for the production of Gen-8.5 IT OLED panels; LG Chem has recently sold its OCA business to Genzon Investment Group; Samsung Electronics is reportedly reinforcing its supply chain in Asia; etc.

Global consulting firm AlixPartners’ latest forecast indicates that the shortage related to semiconductors will cost the industry globally USD210B in lost revenues in 2021, up markedly from its estimate in May 2021 of USD110B. In terms of vehicles, AlixPartners is now forecasting that production of 7.7M units will be lost in 2021, up from 3.9M in its May forecast. (CN Beta, Auto Remarketing, AlixPartners)

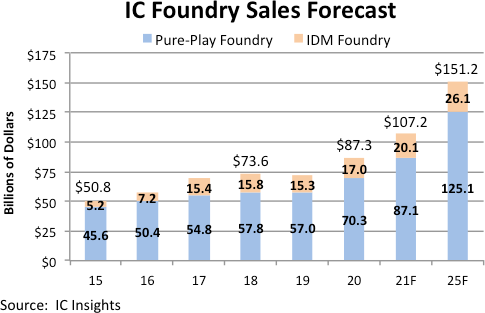

According to IC Insights, robust demand for advanced processors used in networking and data center computers, new 5G smartphones, and ICs used in other high-growth market applications such as robotics, self-driving vehicles and driver-assist automation, artificial intelligence, machine-learning and image recognition systems, is forecast to lift total foundry sales to USD107.2B in 2021, a 23% increase that would match the record growth rate set in 2017. (IC Insights, Laoyaoba)

Tesla CEO Elon Musk has predicted that the ongoing semiconductor crisis would likely be over 2022. He has also noted that he believes the global chip shortage issue is a “short term” problem and not one that would be true for the long term. However, Glenn O’Donnell, a vice president research director at Forrester, has noted that he believes that the chip shortage could last well into 2022 and perhaps even up to 2023. (CN Beta, CNBC, Teslarati)

China-based Jingjia Micro has taped out its next-generation JM9 graphics processing units. Jingjia Micro’s JM9 family consists of two GPUs: the entry-level JM9231 featuring a 2 FP32 TFLOPS performance at 150W and the higher-end JM9271 that offers FP32 performance of around 8 TFLOPS at 200W. (Laoyaoba, ICSmart, Tom’s Hardware)

Silicon Labs’ FG23 and ZG23 low-power wireless SoCs enable IoT end nodes to achieve wireless communication beyond 1 mile. They do so while operating on a coin cell battery for 10+ years. Expanding the company’s Series 2 platform, the FG23 and ZG23 devices offer multiprotocol sub-1-GHz connectivity options. (Laoyaoba, Elecfans, EDN, Silicon Labs)

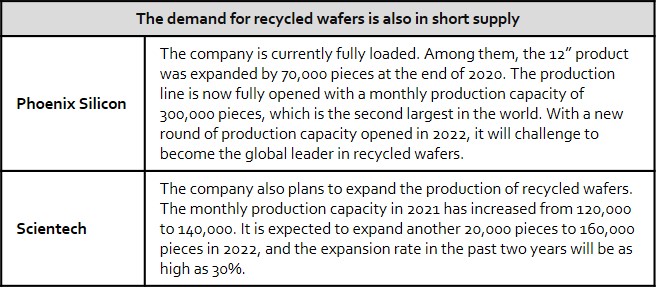

The global foundry production capacity is fully loaded, not only the demand for silicon wafers is strong, but the demand for recycled wafers is also in short supply. Currently, the 3 major wafer manufacturers in Taiwan, Phoenix Silicon, Scientech, and KINIK Company have stated that the newly-added production capacity in 2021 has been fully loaded and will further expand production in 2022. (Laoyaoba, China Hot, C114, CNYES)

Morgan Stanley has stated that the overall semiconductor demand may be overestimated. It has seen the demand for smartphones, TVs, and computer semiconductors weaken. LCD driver ICs, niche memories, and smartphone sensor inventory will increase. There are problems. It is expected that orders from TSMC and Powerchip will be reduced as soon as 4Q21. (Tech Taiwan, Laoyaoba, Min.news)

Samsung Display will try out using vertical deposition of organic material for the production of Gen-8.5 IT OLED panels. The company is collaborating with Japan’s ULVAC in the development of the equipment needed for this process. Vertical deposition method has the glass substrate stand up vertically against the surface. The organic material, in gas form, is deposited on the substrate from the sides. (CN Beta, The Elec, OLED-Info)

Corning and Chongqing Liangjiang New Area have signed an agreement to invest in a new Gorilla Glass project in the Liangjiang New Area Water and Soil New City. Corning and Chongqing have begun cooperation as early as 2015, and have invested in the construction of a display glass substrate rear-end processing project, a motherboard distribution center project, a display glass substrate front-end furnace project, etc. (Laoyaoba, Chongqing, Sohu)

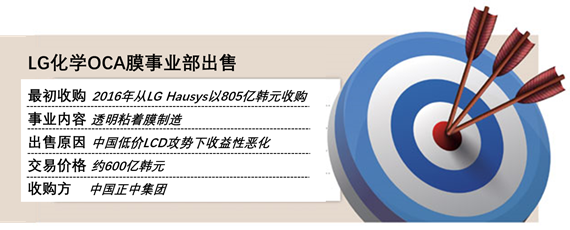

LG Chem has recently sold its OCA business to Genzon Investment Group for about KRW60B (USD51M). OCA is an optically transparent adhesive film used on display devices and touch screen panels to bind optical materials to a primary sensor unit. The company acquired the OCA business from its affiliate LX Hausys (formerly LG Hausys) in 2016 at KRW80.5B. LG Chem is focusing its resources on growing electric vehicle battery and OLED materials businesses. (Laoyaoba, Sohu, EE Focus, Pulse News, MK)

GalaxyCore has revealed that the company’s 12” CIS integrated circuit characteristic process research and development and industrialization projects are progressing smoothly. The construction period of its 12” CIS integrated circuit characteristic process research and development and industrialization project is 2 years. After the project is completed, it will have a monthly production capacity of 20,000 BSI wafers. The company has also stated that the company’s high-end pixel research and development is progressing smoothly, and the CMOS image sensor with 32MP and above has entered the stage of internal evaluation of engineering samples. (Laoyaoba, NBD, 163)

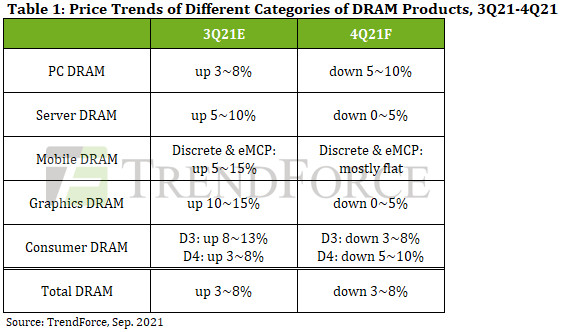

Following the peak period of production in 3Q21, the supply of DRAM will likely begin to outpace demand in 4Q21, according to TrendForce. In addition, while DRAM suppliers are generally carrying a healthy level of inventory, most of their clients in the end-product markets are carrying a higher level of DRAM inventory than what is considered healthy, meaning these clients will be less willing to procure additional DRAM going forward. TrendForce therefore forecasts a downward trajectory for DRAM ASP in 4Q21. More specifically, DRAM products that are currently in oversupply may experience price drops of more than 5% QoQ, and the overall DRAM ASP will likely decline by about 3-8% QoQ in 4Q21. (CN Beta, TrendForce, TrendForce)

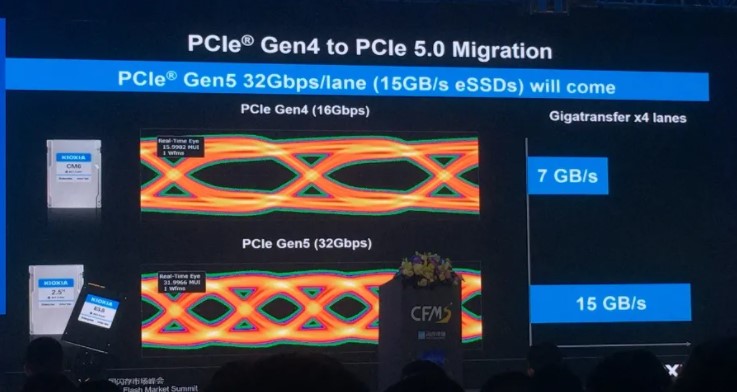

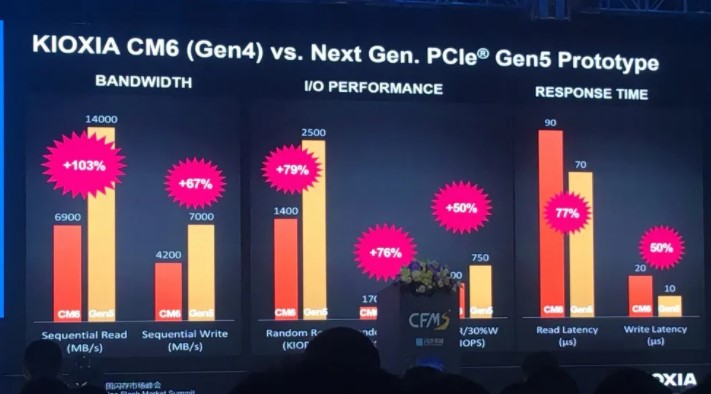

Kioxia has showcased the first performance benchmarks of its next-generation PCIe 5.0 based SSD solutions which will offer twice the bandwidth compared to existing Gen 4.0 solutions. Kioxia will be launching its first PCI Gen 5.0 SSDs as early as 4Q21. The SSDs will be known as the CD7 series and will come in 2.5” EDSFF E3S form factor initially with a Gen 5.0 x4 connection before moving to a standardized NVMe platform. (CN Beta, WCCFTech)

The spot prices of DDR4 and DDR3 chips have fallen to their lowest point in the past 6 months, and the price has fallen by more than 20% since July 2021, according to Digitimes. However, DRAM prices are unlikely to reach the lows in 2020 and will return to the growth trajectory starting from 2H22. (CN Beta, Digitimes, Laoyaoba)

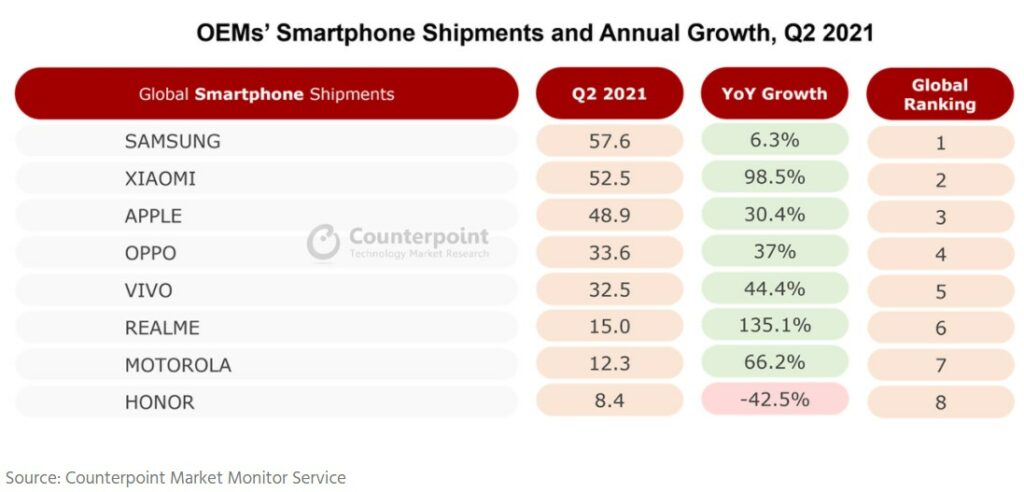

Global shipments of mid-tier 5G smartphones (models priced USD200-399) grew 193% YoY during 2Q21 to increase their share in the total 5G smartphone shipments to 37% against 32% in 1Q21, according to Counterpoint Research. In 1Q21, only 146 5G smartphone models were available in the wholesale price range of USD200-399. That number ballooned to an astonishing 191 models in 2Q21, and it continues to expand. In 2Q21, vivo emerged as the top 5G brand in the mid-tier price band, grabbing 30% market share, with China contributing 90% of these shipments. (Counterpoint Research)

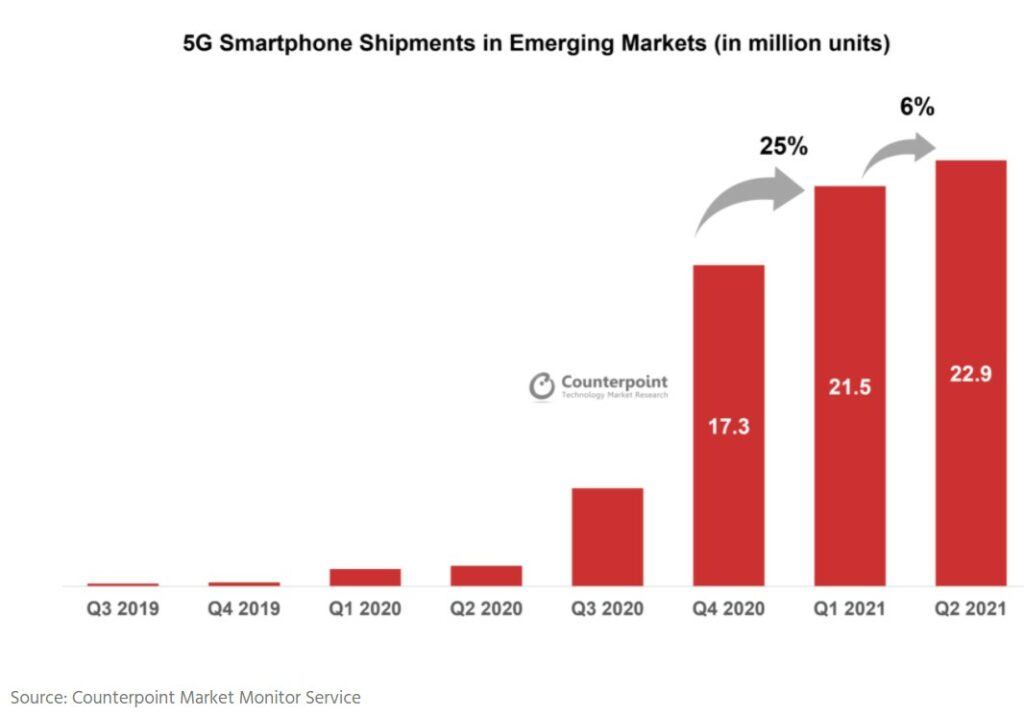

5G smartphone shipments rose 6.5% QoQ in emerging markets in 2Q21, though the total shipments in these regions dropped 5% in the same period, according to Counterpoint Research. The OEM’s 5G share in its emerging market smartphone shipments went up from 8.8% in 1Q21 to 15.9% in 2Q21, ranking 3rd following Apple and OnePlus. The OEM’s global shipments increased 135% YoY to 15M in 2Q21, coming to the sixth for the first time. Globally, realme’s 5G devices took up 37.0% in shipments in 2Q21, increasing from 22.7% in 1Q21. (Counterpoint Research, Gizmo China)

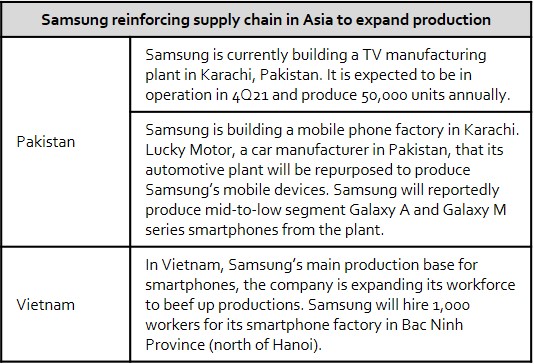

Samsung Electronics is reportedly reinforcing its supply chain in Asia to meet increased demand of its products amid the pandemic, as the company eyes to build more plants and expand its workforce. (CN Beta, Technology Times, Korea Herald)

Huawei’s rotating chairman Eric Xu Zhijun has revealed that Huawei will focus on the two operating systems, namely the HarmonyOS and openEuler at the same time, both will be open source, in an effort to solve the domestic stranglehold problem of lacking its own operating system in basic technology. Harmony is used in smart terminals, IoT terminals, and industrial terminals; openEuler will be used in servers, edge computing, and cloud infrastructure. (CN Beta, CN Beta, CN Beta, My Zaker, ZOL, Global Times, Huawei Central)

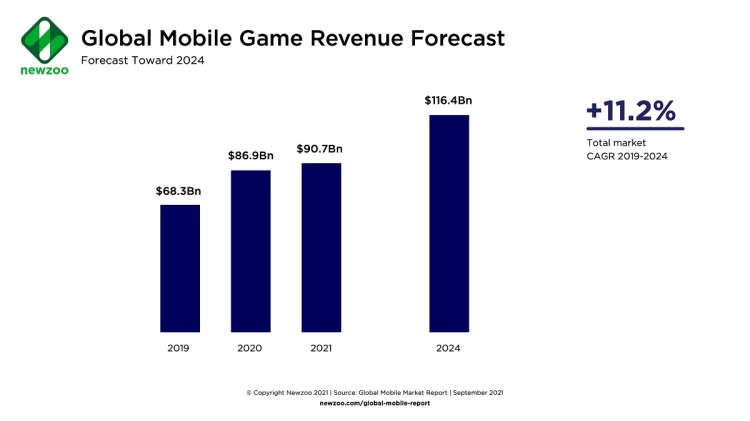

Mobile games will grow 4.4% in 2021 to USD90.7B, according to the market researcher Newzoo and its research partner Apptopia. Newzoo estimates the game industry will grow at a compound annual growth rate of 11% from 2019 to 2024 — in part because 2020 extraordinary revenue growth during the pandemic is very hard to beat 2021. Overall, Newzoo expects gaming to hit USD175.8B in 2021 and USD200B in revenue in 2024. (VentureBeat, Newzoo)

vivo iQOO Z5 is announced in China – 6.67” 1080×2400 FHD+ HiD 120Hz, Qualcomm Snapdragon 778G 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 8+128 / 8+256 / 12+256GB, Android 11.0, side fingerprint, 5000mAh 44W, CNY1,899 (USD293) / CNY2,099 (USD355) / CNY2,299 (USD355). (GSM Arena, GizChina)

realme V11s 5G is announced in China – 6.5” 720×1600 HD+ v-notch, MediaTek Dimensity 810 5G, rear dual 13MP-2MP depth + front 8MP, 4+128 / 6+128GB, Android 11.0, side fingerprint, 5000mAh 18W, CNY1,399 (USD216) / CNY1,599 (USD247). (GSM Arena, realme, Gizmo China)

Huawei nova 9 series is announced, powered by Qualcomm Snapdragon 778G 4G: nova 9 – 6.57” 1080×2340 FHD+ HiD OLED 120Hz, rear quad 50MP-8MP ultrawide-2MP depth-2MP macro + front 32MP, 8+128 / 8+256GB, HarmonyOS 2.0, fingerprint on display, 4300mAh 66W, reverse charging, CNY2,699 (USD418) / CNY2,999 (USD464). nova 9 Pro – 6.72” 1236×2676 HiD OLED 120Hz, rear quad 50MP-8MP ultrawide-2MP macro-2MP depth + front dual 32MP-32MP ultrawide, 8+128 / 8+256GB, HarmonyOS 2.0, fingerprint on display, 4000mAh 100W, reverse charging, CNY3,499 (USD542) / CNY3,899 (USD604). (CN Beta, My Drivers, NDTV, Huawei, Huawei, Gizmo China)

realme Narzo 50A and 50i are launched in India featuring 6.5” 720×1600 HD+ v-notch: 50A – MediaTek Helio G85, rear tri 50MP-2MP macro-2MP depth + front 8MP, 4+64 / 8+128GB, Android 11.0, rear fingerprint, 6000mAh 18W, reverse charging, INR11,499 (USD156) / INR12,499 (USD170). 50i – Unisoc SC9863A, rear 8MP + front 5MP, 2+32 / 4+64GB, Android 11.0 Go (2+32) / Android 11.0 (4+64), no fingerprint, 5000mAh, reverse charging, INR7,499 (USD101) / INR8,999 (USD122). (GSM Arena, NDTV, Live Mint)

Samsung Galaxy M52 5G is announced –6.7” 1080×2400 FHD+ HiD Super AMOLED Plus 120Hz, Qualcomm Snapdragon 778G 5G, rear tri 64MP-12MP ultrawide-5MP macro + front 32MP, 6+128GB, Android 11.0, side fingerprint, 5000mAh 25W, rumored start at EUR380. (GSM Arena, Samsung)

According to IDC, worldwide shipments of PC monitors were just over 35M units in 2Q21, growing 11.2% over the same quarter a year ago (2Q20) – the first full quarter when COVID-19 lockdowns were in full force. Shipments are expected to reach a peak in 2021 at just over 147M units, which is the highest volume since 2012. Volumes are forecast to then taper off in subsequent years settling at 139M by 2025. (CN Beta, IDC)

According to Digitimes, Apple’s augmented reality (AR) headset will enter mass production in 2Q22, with a launch expected in 3Q22-4Q22. Apple’s AR headset has completed its second phase of prototype testing, inching closer to being ready for primetime mass production. (Phone Arena, MacRumors, Digitimes)

Honda and Google have announced that the two companies have agreed to integrate Google’s in-vehicle connected service into an all-new model that will come to market in the 2H22 in North America. Honda will soon begin rolling out vehicles with Google’s embedded Android Automotive OS, which includes Google’s voice-activated Assistant, Google Maps, and other automotive-approved Android apps as the default infotainment. (CN Beta, The Verge, TechCrunch, Honda)

Toyota Motor has that it will invest JPY1.5T (USD13.6B) by 2030 in expanding the production of batteries for its electric and gas-electric hybrid vehicles. Toyota set a goal this spring to sell 8M units of electric-powered vehicles a year in 2030, out of a projected total of 10M vehicle unit sales worldwide. The company’s CTO Masahiko Maeda has said they aim to halve the battery production cost (for EVs). It aims to sell 2M units of electric and fuel cell vehicles, and 6Munits of hybrid and plug-in hybrid vehicles in 2030. The company will build about 10 new production lines for electric-vehicle batteries by 2025 and plans to add at least 10 new lines annually until 2030. However, Toyota CEO Akio Toyoda has previously indicated that going all-EV could cost Japan 5.5M jobs and 8M units of lost vehicle output by 2030. (My Drivers, My Drivers, HypeBeast, Inside EVs, Auto News, Asashi, Autobala)

Rivian, the electric vehicle startup that is gearing up for an initial public offering (IPO), will be opening a service support operations facility for vehicle owners in Plymouth, Michigan, as deliveries of the launch edition of the R1T pickup are expected to commence late Sept 2021. The facility will create 100 new jobs and come at an investment of USD4.6M, USD750,000 of which comes from a business development grant from the state. (TechCrunch, Heart of Illinois, Auto News)

Motional, the autonomous vehicle company that is a joint venture between Hyundai and Aptiv, is growing its presence in Las Vegas as it gears up to launch a commercial robotaxi service in 2023. The vehicle that will be put through this new, rigorous battery of tests will be the Hyundai Ioniq 5, which Motional has said will be the primary vehicle for its robotaxi fleet. (The Verge, TechCrunch, Yahoo, Auto Home, Sohu)

Bay Area-based autonomous farming startup Iron Ox has announced a USD53M Series C round, which brings the firm’s total funding up to USD98M. The startup is looking to revolutionize farming for the 21st century, referring to its approach as a “closed loop system.” It is effectively a robotic greenhouse full of proprietary harvesting technology. (TechCrunch, Business Wire)

In order to increase user subscriptions in the Indian market, Amazon has launched 8 global and local streaming services on its video platform. Gaurav Gandhi, head of Amazon India Prime Video, has said that Amazon Channel Service will help customers who have chosen Prime’s flagship loyalty program to subscribe to multiple streaming services on one interface. (GizChina, Reuters)