10-8 #Life : TSMC is poised to comprehensively expand production capacities for both its 7nm and 28nm; TSMC and Sony are reportedly considering jointly to build a semiconductor factory in western Japan; Ireland has announced that it will join an Organization for Economic Cooperation and Development (OECD) agreement; etc.

TSMC is poised to comprehensively expand production capacities for both its 7nm and 28nm process technologies, in addition to its planned 5nm process expansion, which may prompt the foundry to raise again its capex outlook in 2021, according to Digitimes. (Digitimes, Laoyaoba)

Intel CEO Pat Gelsinger suggests software will play a much larger role in the future of the company. He wants Intel to adopt a “software-first” approach to help the company trump the competition in all applications, from the cloud to the edge. (Digital Trends, CRN, TechRadar, Gizmo China)

Taiwan Semiconductor Manufacturing Co (TSMC) and Sony are reportedly considering jointly investing about JPY800B (USD7B) to build a semiconductor factory in western Japan. Sony may also take a minority stake in a new company that will manage the factory, which will be located in Kumamoto Prefecture. The factory will make semiconductors used in camera image sensors, as well as chips for automobiles and other products, and is slated to go into operation by around 2023 / 2024. (CN Beta, Nikkei Asia, Reuters)

Lepton Computing has applied for several interesting patents for foldable smartphone models. Three different models are discussed. The first model has a clamshell design. The second model is very similar in terms of design to the first model. It is not a Flip phone, unfolded this variant has a significantly larger tablet-sized display. A front screen has also been integrated. The third model is “Lepton Flex” , which is a foldable smartphone with an inwardly flexible screen that unfolds to a tablet size. (CN Beta, LetsGoDigital, LetsGoDigital)

According to TF Securities analyst Ming-chi Kuo, Mini-LED is the key display technology for Apple iPad in 2021-2023. He believes that the reasons why iPad Air will continue to adopt LCD display technology in 2022 because of marketing and technical aspects. He is optimistic about the growth trend of Mini-LED displays in the next 2-3 years, predicting that the shipments of Apple devices using Mini-LED displays will reach 5.5-6.5M and 13-15M in 2021 and 2022, respectively. (TF Securities, CN Beta, MacRumors, Apple Insider)

Apple and Samsung Display have reportedly cancelled their joint project to develop a 10.86” OLED iPad. Apple has continued to insist on the two stack tandem structure. The technology Apple is planning for its two OLED iPads, one of them to likely be 12.9” in size, launching in either 2023 or 2024 is also different from the one that was planned for the 10.86” OLED iPad. Apple is planning to both apply the two stack tandem structure as well as thin-film transistor (TFT) low-temperature polycrystalline oxide (LTPO) for the two OLED iPads. For the 10.86” OLED iPad, it was TFT low-temperature polycrystalline silicon (LTPS). (WCCFTech, The Elec, Laoyaoba)

Samsung Electronics has launched the first open-source software solution, the Scalable Memory Development Kit (SMDK) that has been specifically developed to support the Computer Express Link (CXL) memory platform. Samsung introduced the first CXL memory expander that enables bandwidth and memory capacity “to scale to levels far exceeding what is possible in today’s server system” in May 2021. Samsung’s CXL platform is being upgraded to provide software tools that are easy to integrate. (Neowin, Samsung)

Facebook Connectivity has shown off new technologies designed to help bring the next billion people online to a faster internet. The tech includes a robot Bombyx that can rapidly install fiber-optic cable over telephone wires in a fraction of the time it usually takes. It has also shown off Terragraph, a wireless tech that can deliver fiber-like wireless networking in the “last mile” in areas that are harder to reach with cables. Facebook has also shown a new segment of subsea cables, dubbed 2Africa Pearls, that has become the world’s longest subsea cable system, connecting the internet across Africa, Europe, and Asia. (CN Beta, VentureBeat, Facebook)

Ireland has announced that it will join an Organization for Economic Cooperation and Development (OECD) agreement that brings an end to the country’s low-tax policy for large multinationals, an incentive that attracted companies like Apple and Google to its shores. By joining the OECD agreement, Ireland is ditching its longstanding 12.5% tax rate to comply with a minimum effective corporation rate of 15% for multinationals with global revenues that exceed EUR750M (about USD867M) annually. (Apple Insider, Ireland.gov, The Guardian, RFI)

Japan’s Fair Trade Commission will investigate whether Apple and Google are leveraging their dominance in the smartphone operating system market to eliminate competition and severely limit options for consumers. The study will involve interviews and surveys with OS operators, app developers and smartphone users, according to commission Secretary-General Shuichi Sugahisa. The initiative will explore market conditions not only for smartphones, but for smartwatches and other wearables. (Apple Insider, Nikkei Asia)

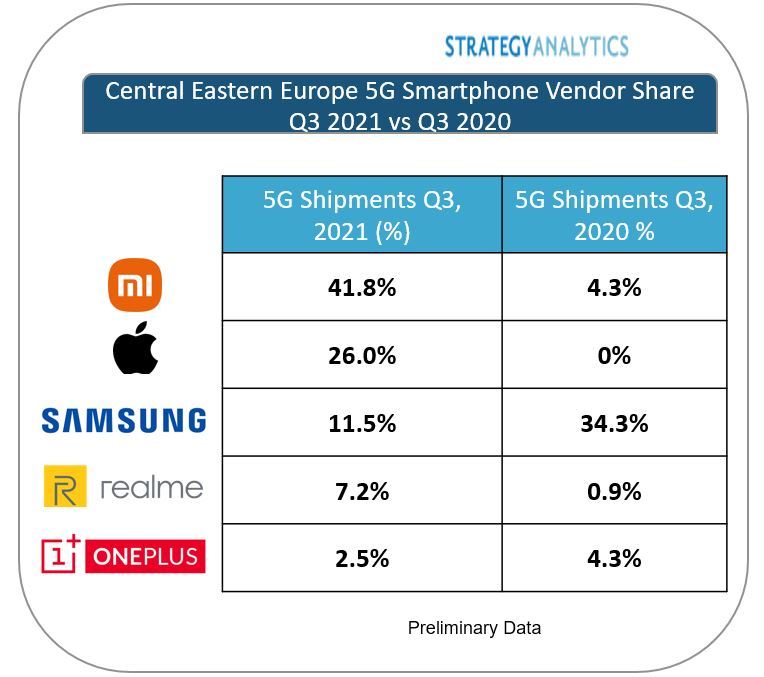

According to Strategy Analytics, in 3Q21, Xiaomi captured an estimated 42% of total 5G smartphone shipments in Central and Eastern Europe, on annualized shipment growth of 5,700%. Xiaomi is expected to maintain its lead in Central and Eastern Europe region for the full-year 2021 and remain the 5G smartphone shipment leader in 2022. (GizChina, Strategy Analytics)

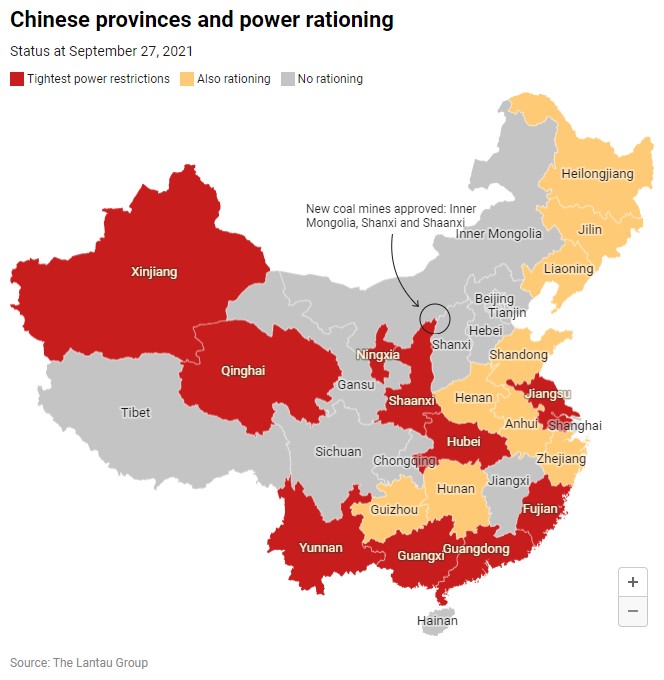

Widespread power outages in China are reigniting a push by tech manufacturers to shift production away from Asia’s biggest economy, with suppliers to Apple, Amazon and others scrambling to keep production on track ahead of the busy holiday season. At a midsize electronics accessories maker in Zhongshan, Guangdong Province, power outages have become the new normal. (Asia Nikkei, Apple Insider, Sydney Morning Herald)

Moto G Pure is launched in United States – 6.5” 720×1600 HD+ v-notch IPS LCD, MediaTek Helio G25, rear dual 13MP-2MP depth + front 5MP, 3+32GB, Android 11.0, rear fingerprint, 4000mAh 10W, USD160. (GSM Arena, Phone Arena, Motorola)

Mobicel Legend Max is launched in South Africa – 6.82” 720×1640 HD+ v-notch, Unisoc SC9863A, rear tri 13MP-2MP macro-2MP depth + front 8MP, 2+32GB, Android 11.0 Go, rear fingerprint, 4000mAh 10W, ZAR1,799 (USD119). (Gizmo China, Mobicel, Technobugg)

Hisense E31 Lite is launched in South Africa – 6.52” 720×1600 HD+ v-notch, Unisoc SC9863A, rear dual 8MP-CIF + front 8MP, 1+16GB, Android 11.0 Go, no fingerprint, microUSB, 4500mAh, ZAR1,699 (USD114). (Hisense, Gizmo China)

Sony announces earbuds WF-C500. The earbuds are is equipped with Sony’s DSEE (Digital Sound Enhancement Engine) that restores some of the detail lost when music is compressed for streaming over Bluetooth. The earbuds also support Sony’s 360 Reality Audio. The earbuds are priced at USD250. (GSM Arena, Sony, Engadget)

Whithings has announced ScanWatch Horizon in German, France and UK markets, featuring a hybrid design of digital display + traditional mechanical design. The watch supports 10 ATM water resistance and can automatically identify and track more than 30 activities including walking, running, swimming, and cycling. In addition, it has built-in Bluetooth function, can track and record routes with the help of phone GPS, and the longest battery life can reach 30 days. The price is EUR500. (CN Beta, Tech Advisor, Withings, Forbes)

Fairphone TWS is announced, which is made from recycled materials. The earbuds and the accompanying charging case are made from 30% recycled plastics. Both earbuds have a 45mAh battery with a 500mAh charging case. It offers hybrid Active Noise Cancelation (ANC) via Bluetooth 5.3. The earphones also come with IPX4 splash resistance. It is priced at EUR100. (CN Beta, Gizmo China, GSM Arena)

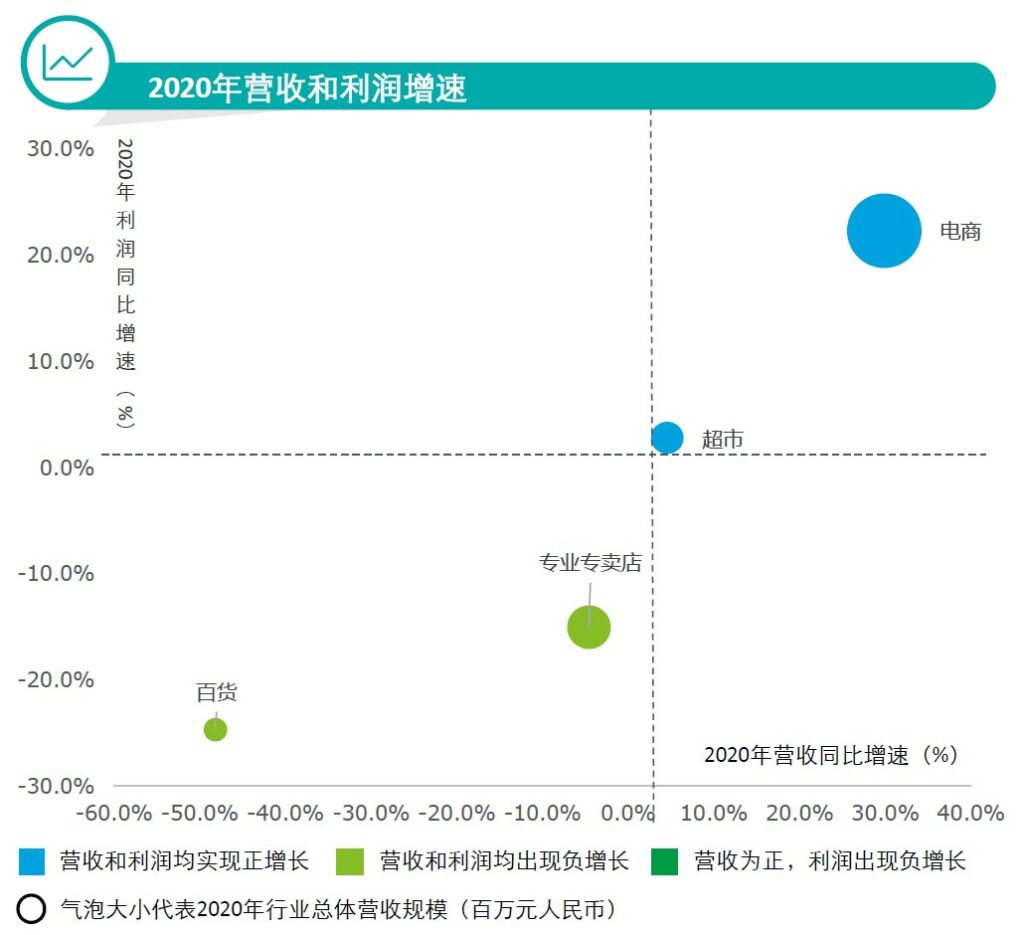

According to Deloitte, in 2020, with the help of the online and offline integrated community model, the supermarket format will become the only offline format that achieves positive growth in revenue and profit. After the outbreak of the pandemic, offline purchase demand quickly flooded online, resulting in a rapid increase in e-commerce revenue growth. At the same time, the gross profit of e-commerce companies has also maintained a high growth rate without a significant increase in sales costs. (Deloitte report)

Ula, an Indonesian B2B ecommerce marketplace, has raised USD87M in its series B funding round co-led by Tencent, Prosus Ventures, and B Capital. Other new investors that joined the round include Bezos Expeditions. Launched in Jan 2020, Ula serves neighborhood mom-and-pop shops (locally known as warungs) by offering them a full catalog of physical goods through an ecommerce application and a doorstep service, allowing these shops to carry less inventory. (TechCrunch, SCMP, Tech in Asia)