10-21 #Smile : TSMC’s fab located outside Phoenix, Arizona will start making 5nm chips in 2024; OPPO is allegedly developing high-end mobile chips for its premium handsets; Foxconn has unveiled 3 electric vehicle prototypes; etc.

TSMC’s USD12B fabrication plant (fab) located outside Phoenix, Arizona will start making 5nm chips in 2024. The company says it will produce 20,000 wafers each month. TSMC’s chief strategy officer and the president and CEO of TSMC’s project in Arizona Rick Cassidy has indicated that these are parts that are going to be used in lots of different places: CPUs, GPUs, IPUs, etc. (CN Beta, CNBC)

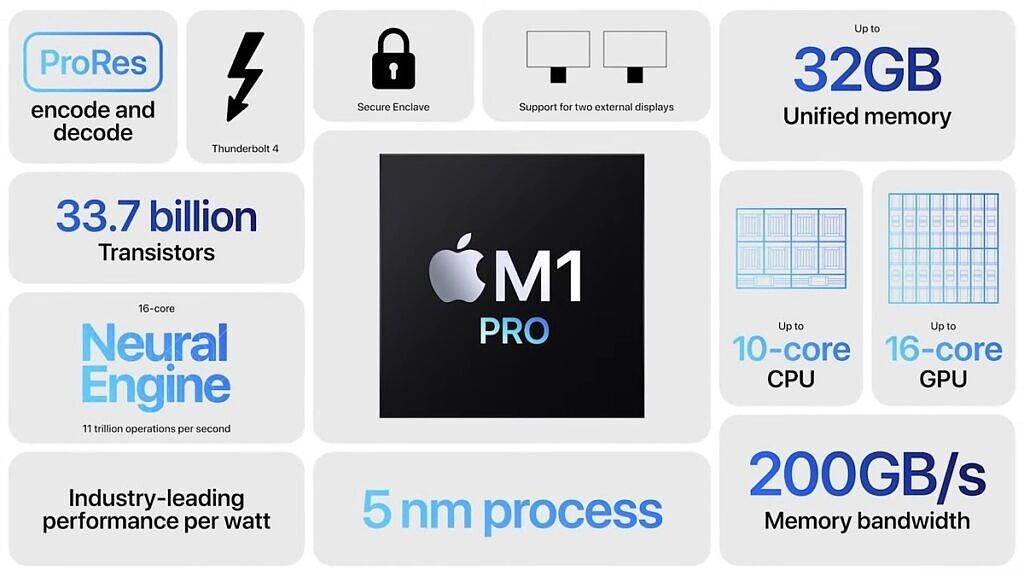

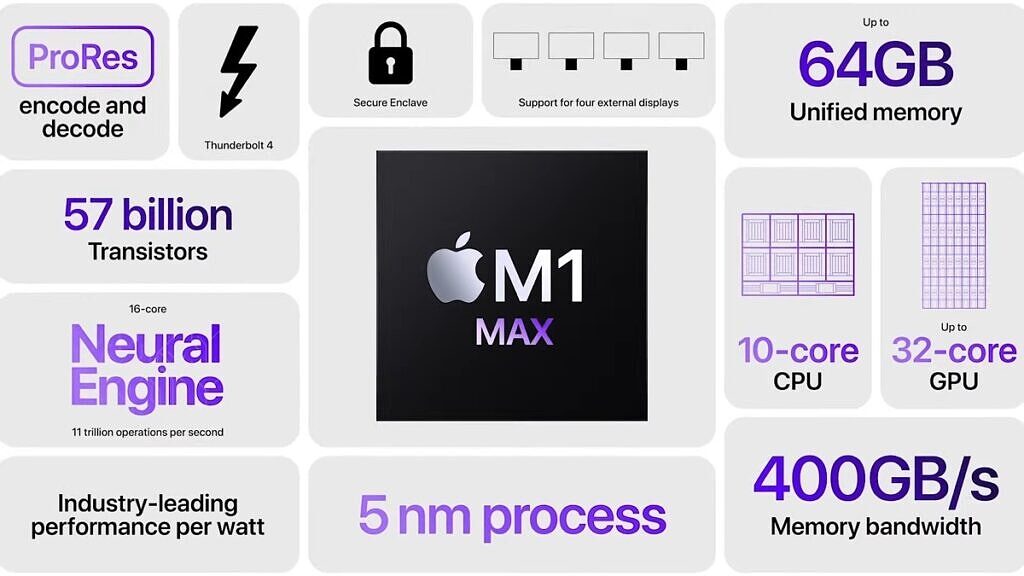

Apple has unveiled its two latest computer-focused ARM-based Systems-On-a-Chip (SOCs), the M1 Pro and M1 Max. Utilizing the industry-leading 5nm process technology, M1 Pro packs in 33.7B transistors, more than 2x the amount in M1. A new 10-core CPU, including eight high-performance cores and two high-efficiency cores. M1 Max features the same powerful 10-core CPU as M1 Pro and adds a massive 32-core GPU for up to 4x faster graphics performance than M1. (GSM Arena, GizChina, Apple Insider, Apple, XDA-Developers)

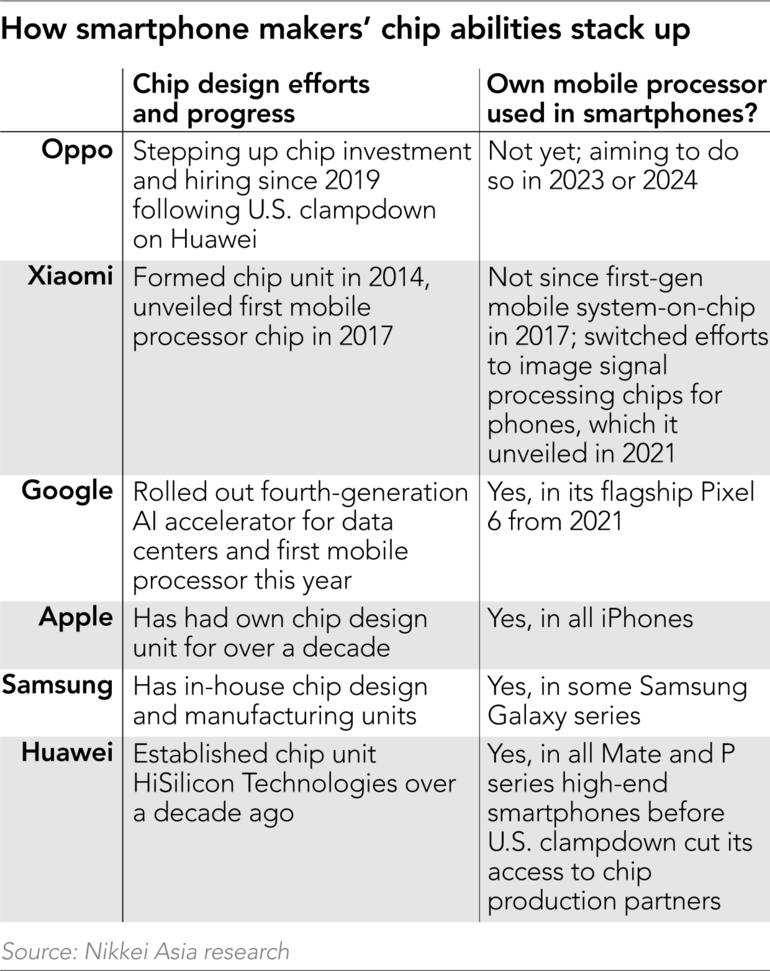

OPPO is allegedly developing high-end mobile chips for its premium handsets in a bid to gain control over core components and reduce its reliance on foreign semiconductor suppliers Qualcomm and MediaTek. The company plans to use its own mobile systems-on-a-chip (SoC) in phones due out in 2023 or 2024. OPPO is looking to use the 3nm chip production technology offered by TSMC. (Android Central, Asia Nikkei)

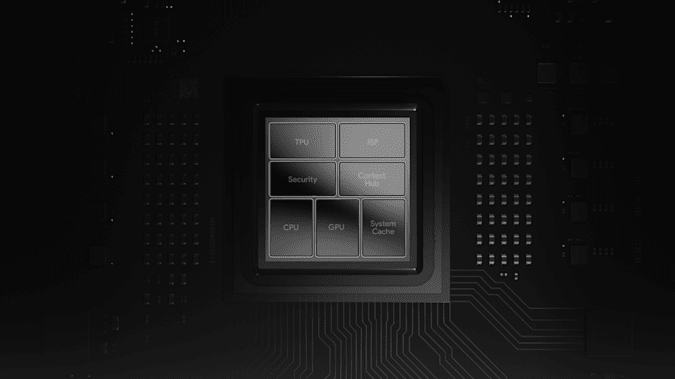

Google positions Tensor as something of an AI powerhouse, giving its new phones better hardware for image processing and voice recognition. Google Tensor is a 5nm eight-core design broken down into big, medium and small cores. Leading the way is two ARM Cortex-X1 cores running at 2.8GHz. The SoC also features two Cortex A76 cores running at 2.25GHz, as well as four 1.8GHz A55 cores as the “small” bits. (GSM Arena, Engadget)

Samsung and Intel are reportedly trying to get orders for M-series chips from Apple. Currently, M1, M1 Pro, and M1 Max are all based on TSMC’s 5nm process. The main reason why Samsung and Intel think there is an opportunity is that the A14 and A15 processors themselves account for a large part of TSMC’s 5nm production capacity. (My Drivers, Digitimes, Apple Insider, CN Beta)

Samsung is reportedly considering using Chinese OLED panels for the Galaxy A73. Samsung Display has previously been supplying all OLED panels used in Samsung smartphones. To secure OLED panels at lower prices, Samsung Electronics is now expected to source OLED displays from BOE and CSOT. The two companies are said to be already developing panels for the Galaxy A73, which is expected to launch in 1H22. (Gizmo China, The Elec, Sam Mobile)

Apple’s new MacBook Pro adopts mini-LED display that supports Apple’s 120Hz ProMotion technology. The new Mini LED screens are brighter, too, offering 1,000 nits of sustained brightness with 1,600 peak brightness, a 1M to 1 contrast ratio and wide DCI-P3 colour gamut. Apple is reportedly courting Epistar and Sanan Optoelectronics as suppliers. (The Verge, CN Beta, Android Authority, UDN)

BOE will reportedly supply 15M OLED panels for Apple’s iPhone in 2021. This will account for about 10% of the total OLED panels required by the iPhone. With this figure, BOE will remain Apple’s third-largest display supplier after Samsung Display and LG Display. In 1H21, BOE supplied 6M iPhone 12 OLED panels, and this number is expected to reach 10M before the end of October. As for the iPhone 13, BOE expects to supply up to 2M units of OLED display in 2021. However, analysts are optimistic that this number may be as high as 5M units. (CN Beta, My Drivers, GizChina, IT Home)

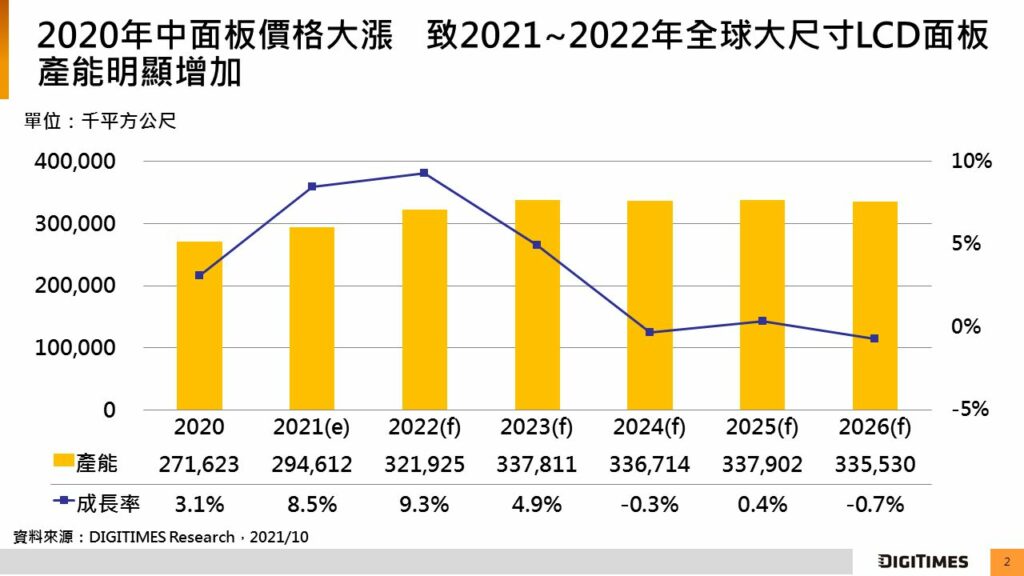

There will be 887M large-size (9” and above) LCD panels shipped globally in 2021 and the shipments will increase to 918M units in 2026 at a CAGR of 0.69%, according to Digitimes Research. BOE Technology will remain as the globally largest producer of large-size LCD panels during 2022-2026, occupying 28-29.3% of global production capacity. If BOE sets up its third Gen-10.5 production line or acquires fellow makers’ production lines, it will occupy over 30% of global production capacity by the end of 2026. (Digitimes, press, Digitimes)

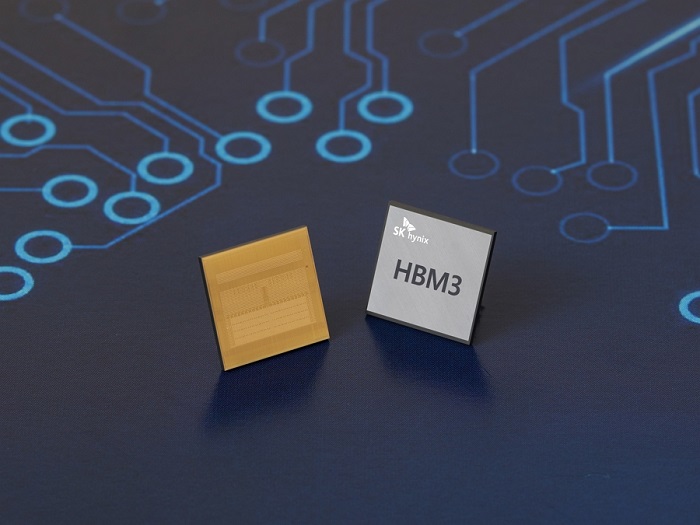

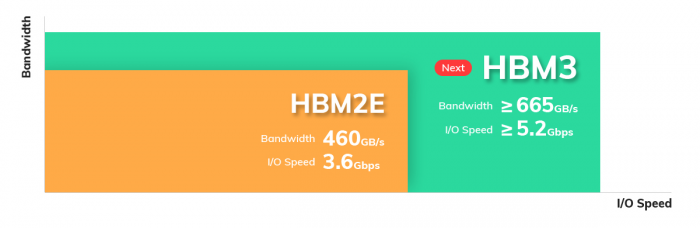

SK hynix has announced that it has become the first in the industry to successfully develop the High Bandwidth Memory 3, the world’s best-performing DRAM. SK hynix’s HBM3 will be provided in two capacity types of 24GB – the industry’s biggest — and 16GB. For the 24GB product, SK hynix grounds the height of a DRAM chip to approximately 30μm, before vertically stacking 12 chips using the through silicon via technology. (CN Beta, SK Hynix)

Micron Technology will build a new factory at its Japanese production site in Hiroshima at a cost of JPY800B (USD7.0B). The new facility will make DRAM chips, which are widely used in data centres, with production set to begin in 2024. Japan wants to lure chipmakers to the country to ensure its companies have ready access to supplies of semiconductors necessary to keep its economy competitive. (CN Beta, Reuters, Bloomberg)

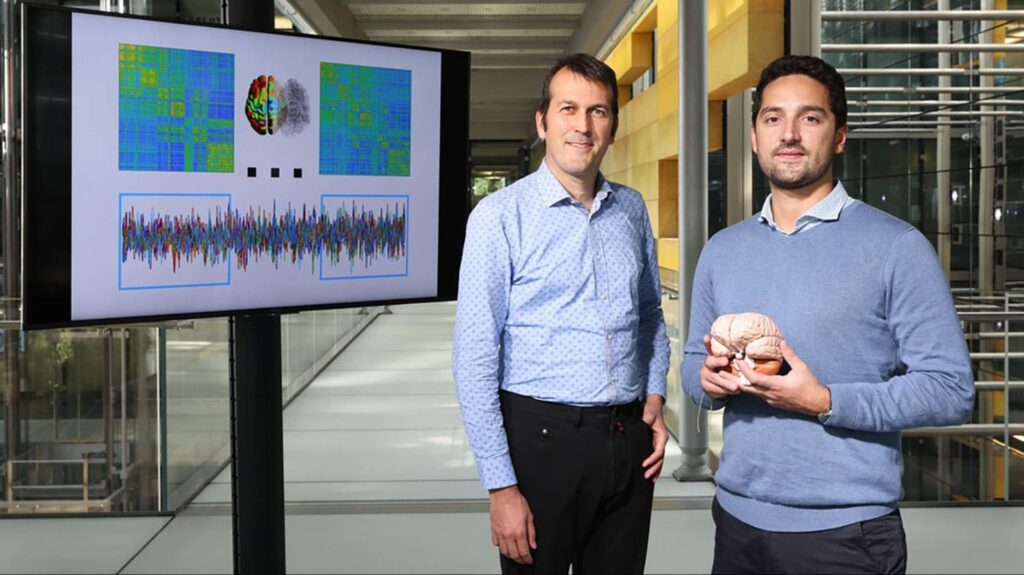

Swiss Federal Institute of Technology Lausanne in Switzerland has learned that every human brain is made up of seemingly countless connections that come together as a type of biological map of the mind. Scientists call this map the “connectome”. They process the scans to generate graphs, represented as colorful matrices, that summarize a subject’s brain activity. They have found that while longer time scales allowed for better differentiation between individuals, 1 minute and 40 seconds was all it took for enough data to be collected for reliable identification. (CN Beta, Swiss Info, Science Alert, Daily Beast, Eureka Alert)

Huawei Digital Energy Technology and Shandong Electric Power Construction (SEPCO3) have signed the Saudi Red Sea New City energy storage project. Huawei has stated that the energy storage capacity of the project reaches 1300MWh, which is by far the world’s largest energy storage as well as off-grid energy storage project. (Gizmo China, IT Home, Sina, Sohu)

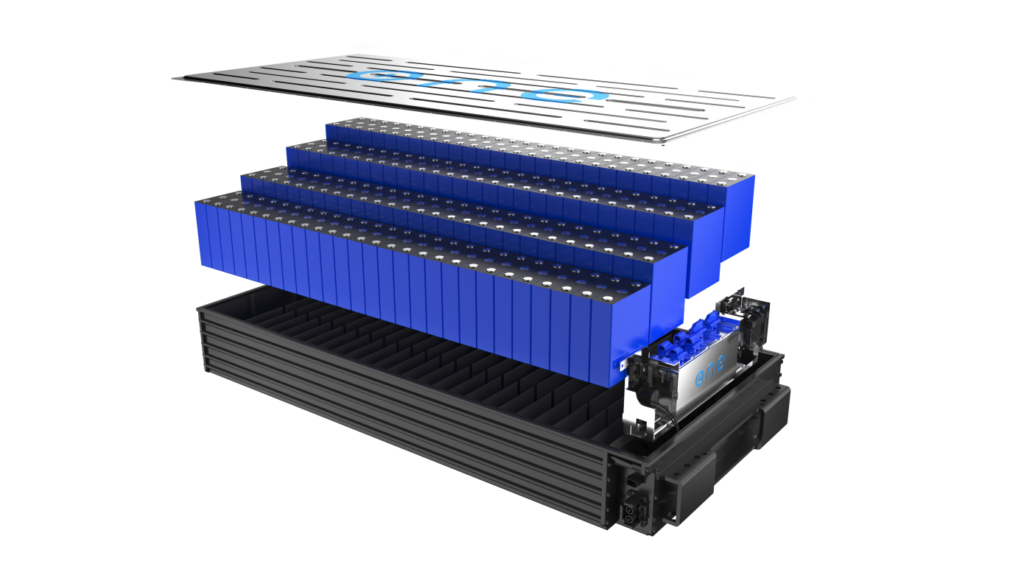

Michigan-based startup Our Next Energy (ONE) has closed a USD25M Series A for tech that it says can double the range of EVs. ONE is developing a hybrid cell-to-pack system composed of two batteries: the Aries, a cobalt-free battery that the company says avoids fire risk from thermal runaway; and a battery range extender called the Gemini, which ONE estimates will be capable of a staggering 700-mile range on a single charge. (TechCrunch, PR Newswire)

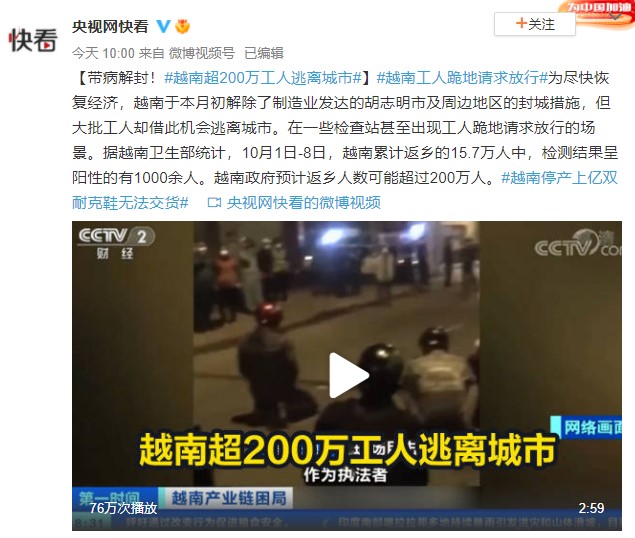

With the ongoing global pandemic, Vietnam, as a world-renowned “holy land” for manufacturing, has also suffered a huge blow, which has had a huge impact on the supply chain. Currently, many internationally renowned large companies have suffered heavy losses, and Apple iPhone and Nike shoes are facing the risk of supply interruption. 51% of Nike’s footwear products are made in Vietnam. In Jul-Sept 2021, the Nike factory in Vietnam is basically closed. Camilo Lyon, an analyst for BTIG has estimated Nike’s output alone has already been reduced by 180M pairs of shoes. (My Drivers, Weibo, Supply Chain Brain, Retail Dive, Sohu)

Facebook has been fined a total of GBP50.5M for breaching the UK’s Competition and Markets Authority’s (CMA) initial enforcement order (IEO) in relation to its acquisition of Giphy. Facebook is fined because it resisted producing timely reports required by the IEO and it changed its Chief Compliance Officer on two occasions without first seeking consent. (Android Headlines, Neowin, Gov.uk)

For the 9th year in a row, global brand consultancy firm Interbrand has placed Apple at the top of its annual list of the world’s most valuable brands, assigning Apple a “brand value” of USD408.6B. Amazon and Microsoft took the second and third place spots with respective valuations of USD249B and USD210B, while Google and Samsung rounded out the top-five. (Interbrand, report, Apple Insider, CN Beta)

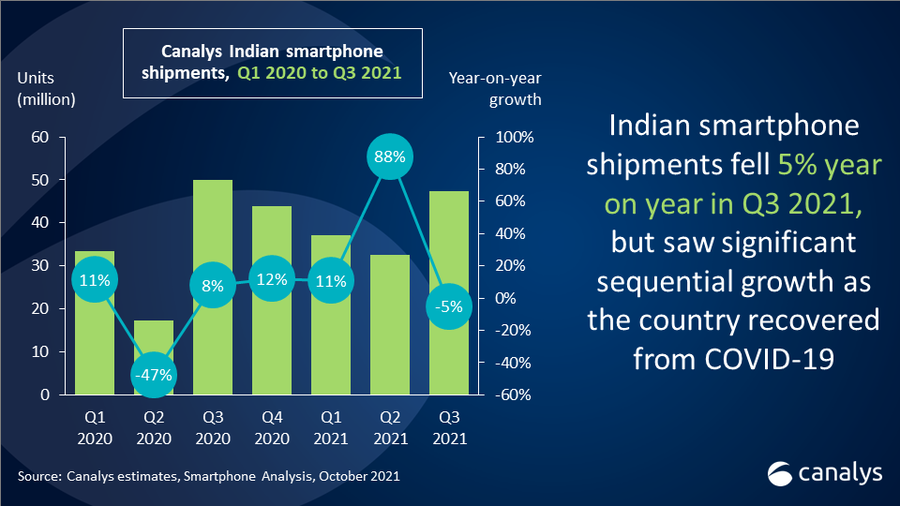

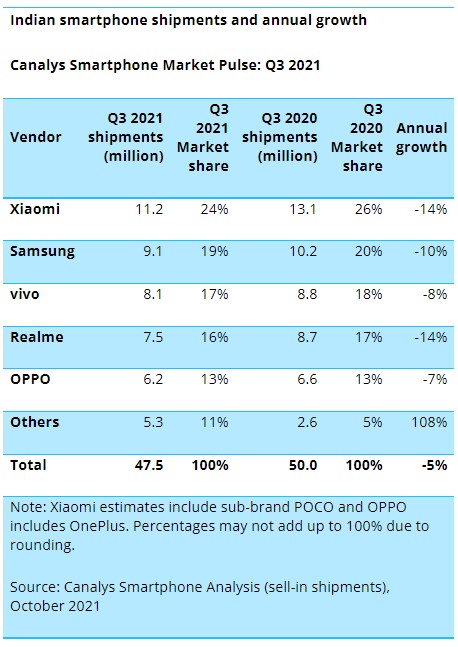

Smartphone shipments in India fell 5% year on year in 3Q21 to 47.5M units as vendors struggled with supply issues for low-end models. But 3Q20 makes for a tough YoY compare, due to pent-up demand in 2020. Shipments in 3Q21 are 47% higher than in 2Q21, as consumer demand bounced back rapidly thanks to the suppression of India’s COVID-19 wave. Xiaomi has maintained its lead, shipping 11.2M units for a 24% share. (Canalys, CN Beta)

Google Pixel Pass is a new subscription bundle designed to let US customers pay for a Pixel phone in monthly installments while also getting access to Google’s premium subscription services like 200GB of Google One cloud storage, YouTube Premium, YouTube Music Premium, and Google Play Pass. Prices start at USD45 a month for Pixel 6 or USD55 for a Pixel 6 Pro. (CN Beta, Google, The Verge)

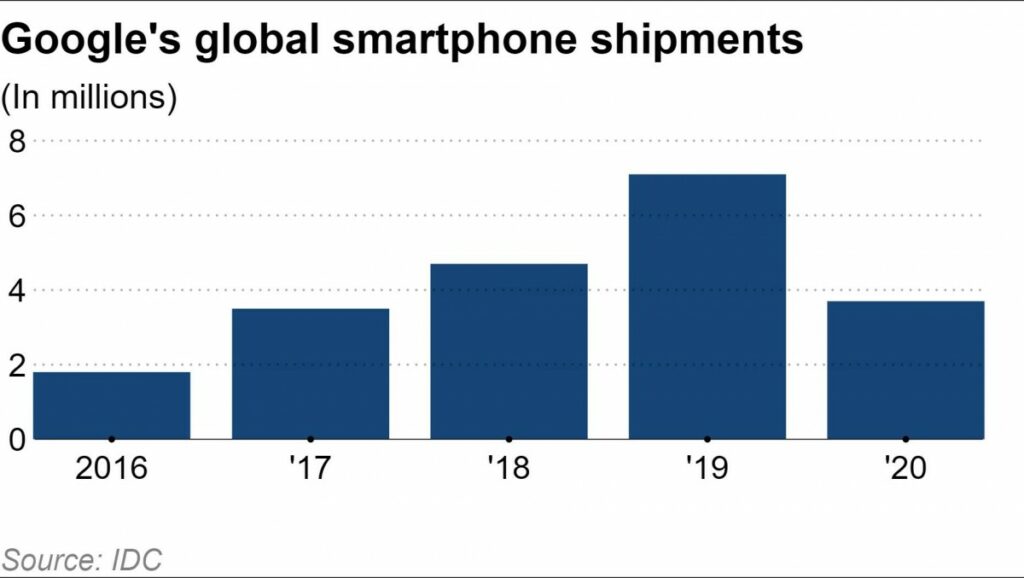

Google has reportedly asked suppliers to produce more than 7M of its upcoming Pixel 6 smartphones. Google is attempting to capitalize on its position as the only U.S. maker of smartphones running on the Android operating system. The company has also asked suppliers to build over 5M of its Pixel 5A phones unveiled spring 2021. Its total smartphone shipments in 2020 came to just 3.7M. (Asia Nikkei, Android Authority)

Google Pixel 6 series is announced, powered by Google Tensor: 6 – 6.4” 1080×2400 FHD+ HiD AMOLED 90Hz, rear dual 50MP 1.2µm OIS-12MP ultrawide + front 8MP, 8+128 / 8+256GB, Android 12.0, fingerprint on display, 4614mAh 30W, 21W fast wireless charging, reverse wireless charging, IP68 rated, start from USD599. 6 Pro – 6.71” 1440×3120 QHD+ HiD LTPO AMOLED 120Hz, rear tri 50MP 1.2µm OIS-48MP telephoto 4x optical zoom OIS-12MP ultrawide + front 11.1M, 12+128 / 12+256 / 12+512GB, Android 12.0, fingerprint on display, supports UWB, 5003mAh 30W, 23W fast wireless charging, reverse wireless charging, IP68 rated, start from USD899. (GSM Arena, Android Headlines, Android Authority)

vivo S10e is official in China – 6.44” 1080×2404 FHD+ u-notch AMOLED 90Hz, MediaTek Dimensity 900 5G, rear tri 64MP OIS-8MP ultrawide-2MP depth + front 32MP, 8+128 / 8+256GB, Android 11.0, fingerprint on display, 4000mAh 44W, CNY2,399 (USD373) / CNY2,599 (USD404). (GSM Arena, MySmartPrice)

vivo Y3s (2021) is launched in India – 6.51” 720×1600 HD+ v-notch, MediaTek Helio P35, rear 13MP + front 5MP, 2+32GB, Android 11.0, no fingerprint scanner, 5000mAh 10W, INR9,490 (USD126). (Gizmo China, NDTV, vivo)

vivo T1 and T1x are unveiled in China: T1 – 6.67” 1080×2400 FHD+ HiD IPS LCD 120Hz, Qualcomm Snapdragon 778G 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 8+128 / 8+256 / 12+256GB, Android 11.0, side fingerprint, 5000mAh 44W, CNY2,199 (USD345) / CNY2,399 (USD375) / CNY2,599 (USD405). T1x – 6.58” 1080×2408 FHD+ v-notch IPS LCD 120Hz, MediaTek Dimensity 900 5G, rear dual 64MP-2MP macro + front 8MP, 6+128 / 8+128 / 8+256GB, Android 11.0, side fingerprint, 5000mAh 44W, CNY1,699 (USD266) / CNY1,799 (USD281) / CNY1,999 (USD313). (GSM Arena, GizChina, vivo, vivo)

vivo iQOO Z5x is launched in China – 6.58” 1080×2408 FHD+ v-notch 120Hz, MediaTek Dimensity 900 5G, rear dual 50MP-2MP macro + front 8MP, 6+128 / 8+128 / 8+256GB, Android 11.0, side fingerprint, 5000mAh 44W, CNY1,599 (USD250) / CNY1,699 (USD265) / CNY1,899 (USD300). (GSM Arena, Weibo, vivo)

realme Q3s is unveiled in China – 6.6” 1080×2412 FHD+ HiD IPS LCD 144Hz, Qualcomm Snapdragon 778G 5G, rear tri 48MP-2MP macro-2MP depth + front 16MP, 6+128 / 8+128 / 8+256GB, Android 11.0, side fingerprint, 5000mAh 30W, CNY1,499 (USD234) / CNY1,599 (USD250) / CNY1,999 (USD312). (GizChina, GSM Arena)

realme GT Neo 2T is unveiled in China – 6.43” 1080×2400 FHD+ HiD Super AMOLED 120Hz, MediaTek Dimensity 1200 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 8+128 / 8+256 / 12+256GB, Android 11.0, fingerprint on display, 4500mAh 65W, CNY1,899 (USD297) / CNY2,099 (USD327) / CNY2,399 (USD405). (realme, GSM Arena, NDTV)

OPPO K9s is official in China – 6.59” 1080×2412 FHD+ HiD IPS LCD 120Hz, Qualcomm Snapdragon 778G 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 6+128 / 8+128GB, Android 11.0, side fingerprint, 5000mAh 30W, CNY1,699 (USD265) / CNY1,899 (USD297). (GSM Arena, OPPO, Tech Androids)

Nokia C30 is announced in India – 6.82” 720×1600 HD+ v-notch, Unisoc SC9863A, rear dual 13MP-2MP depth + front 5MP, 3+32 / 4+64GB, Android 11.0, rear fingerprint, 6000mAh 10W, INR10,999 (USD147) / INR11,999 (USD160). (Gizmo China, Nokia)

Apple introduces new MacBook Pro featuring new M1 Pro and M1 Max SoC – 14.2” 3024×1964 120Hz Liquid Retina Pro XDR mini-LED display / 16.2” 3456×2234 Liquid Retina CDR mini-LED display, advanced 1080p camera, 6-speaker sound system, ports include MagSafe 3, HDMI port, SDX card, Thunderbolt 4 ports, headphone jack, start from USD1,999 / USD2,499. (Apple Insider, Apple Insider, GSM Arena)

Apple unveils third generation AirPods. Features include Adaptive EQ, IPX4 water and sweat resistance, force sensor controls, and support for Find My. Battery life is now promised up to 6 hours on a single charge with a combined 30 hours with the case. It is priced at USD179. (GSM Arena, Apple Insider)

Snap has announced that it is launching a global creative studio to help brands develop augmented reality (AR) advertising and experiences. The new studio is called Arcadia and aims to help companies develop experiences that can be used across web platforms and app-based AR environments. The studio will partner with brands and creators to engage with Snapchat’s millennial and Gen Z audience. (CN Beta, Snap, TechCrunch, AdWeek)

Foxconn has unveiled 3 electric vehicle prototypes as the iPhone assembler attempts to turn its nascent auto segment into a NTD1T (USD35.78B) business in just 5 years. The three EV prototypes are made by Foxtron, a joint venture between Foxconn and Yulon Motor, a Taiwanese automaker founded nearly 70 years ago that produces Nissan and Mitsubishi cars for the local market. It also has its own brand, Luxgen. Foxconn’s Model C, Model E and Model T — an SUV, luxury passenger car and bus — are designed for mass production and to serve as reference designs that EV brands can customize to their own specifications. (Nikkei, Engadget, CN Beta)

Foxconn Chairman Young Liu has revealed that Foxconn will build electric vehicle factories in Europe, India and either North or South America by 2024. TSMC has made EVs a key part of its growth strategy, reflecting a maturing smartphone market. He has further said all plans will involve partnering with local governments or government-recommended enterprises. (CN Beta, Reuters, Asia Nikkei)

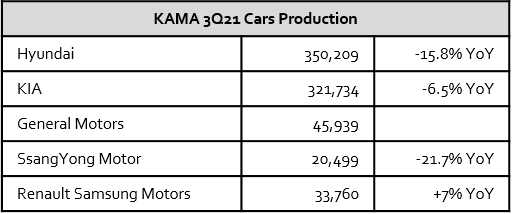

According to Korea Automobile Manufacturers Association (KAMA), the combined number of automobiles domestically manufactured during the Jul-Sept 2021 period reached 761,975, down 20.9% on-year. The figure is the lowest since 2008, when local carmakers’ production reached 760,121 during the 3-month period. KAMA explained the ongoing global semiconductor shortage has mainly affected domestic car production in 3Q21. (CN Beta, Korea Herald)

Xiaomi Corp CEO Lei Jun has revealed that Xiaomi will mass produce its own cars in 1H24. In Mar 2021, Xiaomi said it would commit to investing USD10B in a new electric car division over the next 10 years. After mass production, his goal is to sell 100K units in the first year, and the total sales volume will reach 900K units in 3 years after mass production. He has said that after 6 years of exploration, the new retail model of Xiaomi’s Mijia has initially run through. Approximately 10% of the retail price of the entire sales process, to achieve offline retail, while achieving 30% ROI (return on investment) for channel partners. It is expected that in Oct 2021, the number of offline stores of Mijia will exceed 10,000. (CN Beta, Sina, STCN, Reuters, GSM Arena)

HT Aero, an urban air mobility (UAM) company that is an affiliate of Chinese electric vehicle manufacturer Xpeng, has announced a USD500M Series A raise. HT Aero has recently revealed its fifth-generation flying vehicle, the Xpeng X2, which can handle autonomous flight take-off and landing for certain city scenarios, back-end scheduling, charging and flight control. (Gizmo China, TechCrunch, CN Beta)

PayPal may soon make a foray into social media and image sharing as the company has reportedly offered to buy digital pinboard site Pinterest for USD45B. (Apple Insider, Reuters, Sina, 163)