10-22 #Pity : SMIC plans to expand the production capacity of 10,000 mature 12” and 45,000 8” wafers in 2021; Intel’s talks with SiFive have allegedly ended without a deal; Samsung’s new production capacity for NAND flash memory in 2H21 may cause a potential oversupply; etc.

Intel CEO Pat Gelsinger has reiterated that the ongoing global chip shortage is going to be a problem for a lot longer. He expects the shortage to extend until at least 2023. AMD CEO Lisa Su has commented that while supply would be “likely tight” for the near future, “it will get better in 2022” as production capacity continues to ramp”. (The Verge, CN Beta, Intel, CNBC)

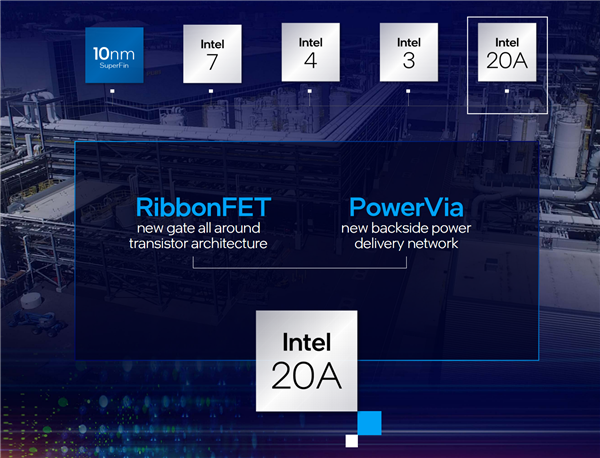

After Intel’s Alder Lake, next CPU node is the Intel 4 7nmEUV process with Meteor Lake as first product, which has already been Tape In and will be officially launched in 2023. Intel 3 will further optimize FinFET and enhanced EUV, the energy efficiency ratio continued to increase by about 18%, and the area is optimized, and production is put into operation in 2H23. In 2024, Intel’s 20A process abandons FinFET transistors and has two revolutionary technologies. RibbonFET is similar to Samsung’s GAA surround gate transistor. PoerVia is the first to eliminate the power supply trace on the front side of the wafer and switch to the rear power supply, which can also optimize the signal transmission. (CN Beta, AnandTech, Bizjournal, Semi Analysis)

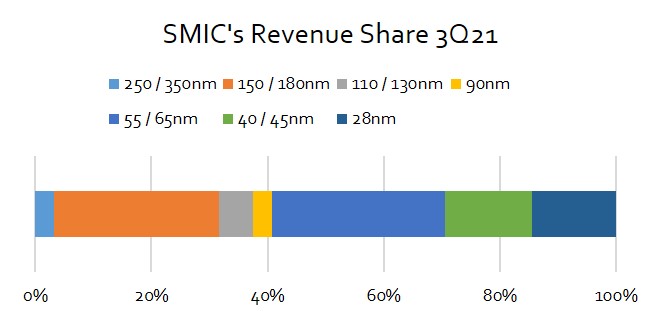

SMIC plans to expand the production capacity of 10,000 mature 12” and 45,000 8” wafers in 2021 to meet more customer needs. In Sept 2021, SMIC announced that it has signed a cooperation framework agreement with Shanghai Lingang Management Committee to establish a joint venture company to plan and build a 12” wafer foundry production line project with a capacity of 100,000 wafers/month. (Laoyaoba, IT Home, NBD, Yicai)

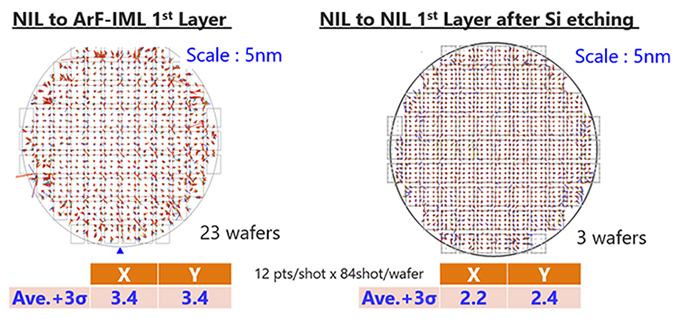

Kioxia has been cooperating with semiconductor equipment manufacturer Canon and semiconductor component manufacturer such as photomasks and templates DNP, since 2017 to develop the mass production technology of nanoimprint lithography (NIL) at the Kioxia factory in Yokkaichi, Mie Prefecture, Japan. Kioxia has mastered the 15nm mass production technology, and is currently conducting R&D of technologies below 15nm, which is expected to be achieved in 2025. As NIL’s lithography process is relatively simple, the power consumption can be reduced to 10% of EUV production method, and the equipment investment can be reduced to 40%. (CN Beta, My Drivers, Digitimes, Kioxia, Min)

Intel’s talks with SiFive have allegedly ended without a deal and the chip designer startup will look for outside investment instead. SiFive is a world’s leading developer of RISC-V-based processor cores and a contract designer of system-on-chips. Earlier 2021 it was reported that Intel had offered USD2B for the startup and the two companies entered negotiations over other terms. (CN Beta, Bloomberg, Tom’s Hardware, Reuters)

The US government’s decision to issue USD100B worth of export permits to suppliers of Huawei Technologies and Semiconductor Manufacturing International Corporation (SMIC). From Nov 2020 to Apr 2021, US suppliers received 113 export licences worth USD61B to sell to Huawei, as well as 188 licenses worth USD42B to sell to SMIC citing documents obtained from the US Congress. (RFI, GizChina, Reuters, SCMP, Bloomberg, WSJ)

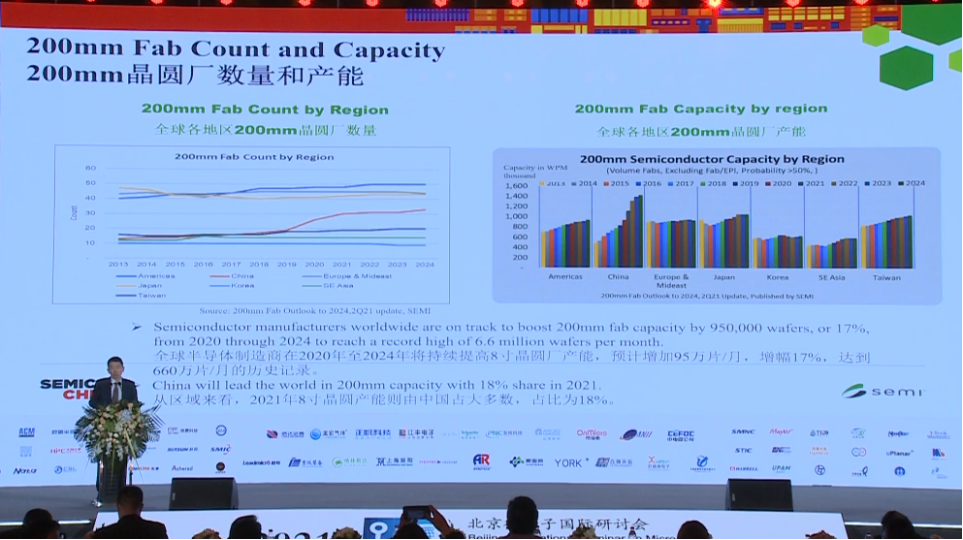

SEMI global VP and president of China, Ju Long, has pointed out that according to statistics, the lack of cores has prevented shipments of about 6M vehicles, accounting for 6-8% of the annual shipments (70-80M). What the automotive industry lacks is not high-end chips manufactured with advanced 10nm and 5nm processes, but MCUs, sensors, power semiconductors and other chips manufactured with mature 40nm and 28nm processes. Global fabs have expanded their 12” and 8” capacity, and South Korea, Taiwan, and China are all continuing to invest. Statistics show that global semiconductor manufacturers will continue to increase the capacity of 8” wafer fabs from 2020 to 2024, with an expected increase of 950,000 wafers/month, an increase of 17%, reaching a historical record of 6.6M/month. From a regional perspective, Mainland China will account for the majority of 8” wafer production capacity in 2021, accounting for 18%. (Laoyaoba, EE World)

Silicon wafer shipments are projected to register robust growth through 2024, with wafer area increasing 13.9% YoY in 2021 to a record high of nearly 14,000M of square inches (MSI), reports SEMI in its annual silicon shipment forecast for the semiconductor industry. (Laoyaoba, Electronics Weekly, SEMI)

With the expansion of major fabs entering the landing phase, the protracted chip shortage is expected to alleviate. TrendForce forecasts that in 2022, the average annual production capacity of global wafer foundries will increase by 6% YoY, and 12” wafers will increase by 14%. More than half of the increased 12” production capacity is the mature process with the most serious shortage, that is, the 1Xnm and above process, which is expected to effectively alleviate the still tight chip supply problem. (Laoyaoba, Sohu)

Arm has said that is next-generation GPU architecture due in 2022 will almost double performance compared to this year’s Arm Mali-G710 as far as FP32 machine learning performance is concerned. The company’s 2022 GPU architecture is now expected to be 4.7 times faster than the Mali-G76 in FP32 ML workloads as far as per-core performance is concerned. The Arm Mali G-710 offers “35% higher ML performance and a 20% higher graphics performance in an ISO-process node GPU configuration compared to a Mali-G78 implementation”. (CN Beta, The Register, Tom’s Hardware, WCCFTech)

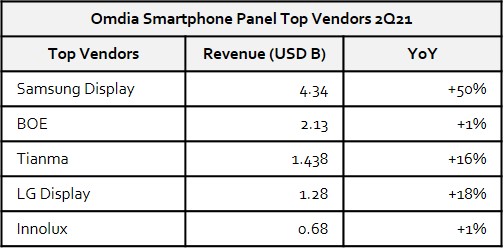

According to Omdia, In 2Q21, the global market for panels below 9” reached USD13.41B, a YoY increase of 15%. Among them, Samsung Display achieves sales of USD4.34B, an increase of 50% over the same period last year; BOE ranked second with quarterly sales of USD2.13B, an increase of 1% YoY. (Laoyaoba, 163)

LG Display (LGD) has allegedly started developing “Under Display Camera” (UDC) technology. The UDC technology, or at least its iteration at the moment, relies on covering the hole, needed for the selfie camera, with another tiny display. For a manufacturer to commit to UDC tech, it means that it first needs to develop a hole-punch display technology. LGD plans to increase the light transmittance of UDC to 20% by 2023 and 40% by 2024. Apple is allegedly trying to land a deal with LGD and get hole-punch displays for the next-generation iPhone 14 Pro devices. (Phone Arena, The Elec, My Drivers)

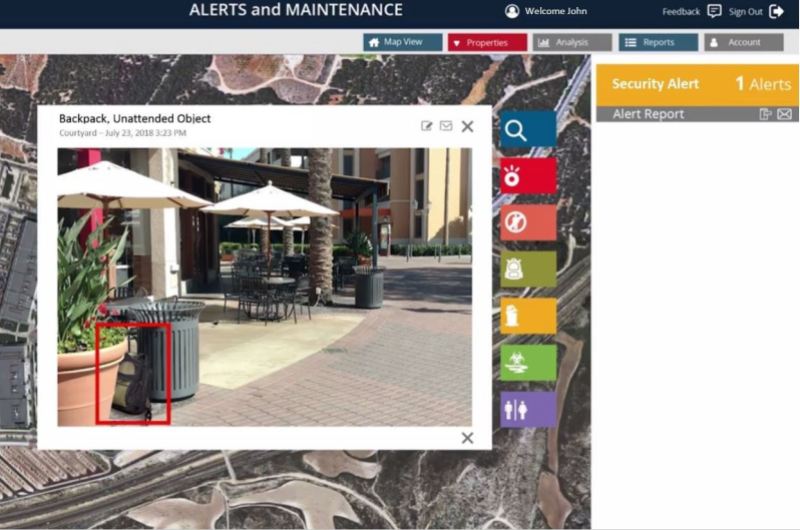

Deep North, a Foster City, California-based startup applying computer vision to security camera footage, today announced that it raised USD16.7M in a series A-1 round. Deep North, previously known as Vmaxx, claims its platform can help brick-and-mortar retailers “embrace digital” and protect against COVID-19 by retrofitting security systems to track purchases and ensure compliance with masking rules. (VentureBeat, PR Web, EET-China)

The gradual commercialization of Samsung Electronics’ new production capacity for NAND flash memory in 2H21 has sparked concerns among market observers about a potential oversupply, according to Digitimes. Xi’an factory will begin mass production of 96-layer V-NAND (with a monthly capacity of 120K pieces) in 2020. The factory is currently commercializing part of the new 128-layer NAND capacity. Once the capacity is fully opened, the monthly capacity will reach 13M pieces. Samsung will reportedly also mass-produce its latest 176-layer NAND flash memory at its PS2 plant in Pyeongtaek, South Korea in 2H21. After the contract price of 256GB and 512GB TLC NAND flash memory rose in the first 2 quarters, it began to decline slowly from 4Q20. Among them, the contract price of 256GB fell from USD4.48 to USD4.40 within a week. (Digitimes, CSIA, Laoyaoba, UDN)

Apple’s patent titled “stretchable blood pressure cuff” describes how such a cuff could be worn continually, so as to provide a record of blood pressure over time. A user may monitor one or more of their physiological parameters by attaching a monitoring device such as a blood pressure monitor to one of their limbs. The blood pressure monitor may include an inextensible cuff that secures an inflatable bladder against a limb of the user. This inflatable bladder, Apple explains, could be expanded, “thereby compressing one or more blood vessels in the limb and restricting and/or stopping blood flow through the vessels”. (CN Beta, Apple Insider, USPTO)

Samsung Galaxy Watch 4 and Galaxy Watch 4 Classic are getting a new software update that brings many new features to the smartwatches including a Fall Detection feature. The wearables can detect hard falls and activate an alert as well as send out an SOS notification to up to four pre-selected contacts. (Pocket-Lint, Samsung, NDTV, 9to5Google)

Samsung SDI has partnered with Dutch-domiciled multinational automaker Stellantis to build a multi-billion-dollar battery facility in the US. The two companies will further discuss details such as the location of the battery plant and construction schedules, according to Samsung SDI. (CN Beta, Laoyaoba, Reuters, KED Global, Korea Herald)

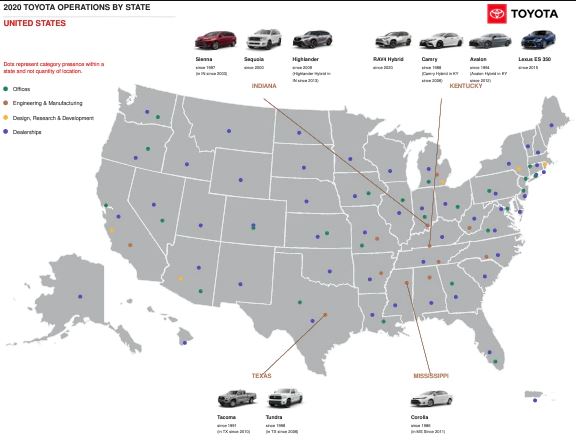

Toyota has announced it is planning to invest JPY380B (USD3.4B) in the US for automotive batteries through 2030. The move is part of Toyota’s global plan to invest a total of USD13.5B for battery development and production announced. As for the US, Toyota will establish a new company and build an automotive battery plant in the country with the aim of starting production in 2025, which includes an investment of approximately USD1.29B until 2031. (AA, Laoyaoba, Auto Bala, Yahoo, USA Today)

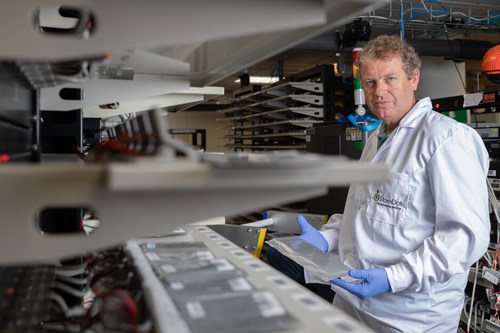

StoreDot, an Israel-based electric vehicle battery startup, today announced that it will open an R&D innovation hub in the US to speed up the development of solid-state batteries. StoreDot’s new California-based R&D hub will work alongside Israel-based R&D headquarters in order to achieve the goal of mass-producing its extreme fast charging (XFC) automotive batteries by 2024. (CN Beta, Electrive, Electrek, PR Newswire)

Apple’s talks with CATL and BYD over battery supplies for its planned electric vehicle have been mostly stalled after they refused to set up teams and build U.S. plants that would solely cater to Apple. Apple allegedly wants to use lithium iron phosphate (LFP) battery for its electric vehicle, partly because they are cheaper to produce than more expensive lithium batteries that need cobalt and nickel. Apple is now being forced to consider Japanese battery suppliers, such as Panasonic, and has sent a group of staff to Japan this month to explore this possibility. (MacRumors, Reuters, Reuters, Sina, iFeng)

T-Mobile has said it will delay its planned shutdown of Sprint’s 3G network by 3 months to ensure its “partners” have time to help customers with the transition. It has originally planned to phase out the network in Jan 2022; that date has now been pushed to 31 Mar 2022. The wireless spectrum vacated from the process of closing 3G base stations will be allocated to faster 4G and 5G networks. (CN Beta, The Verge, Engadget, CNET, T-Mobile)

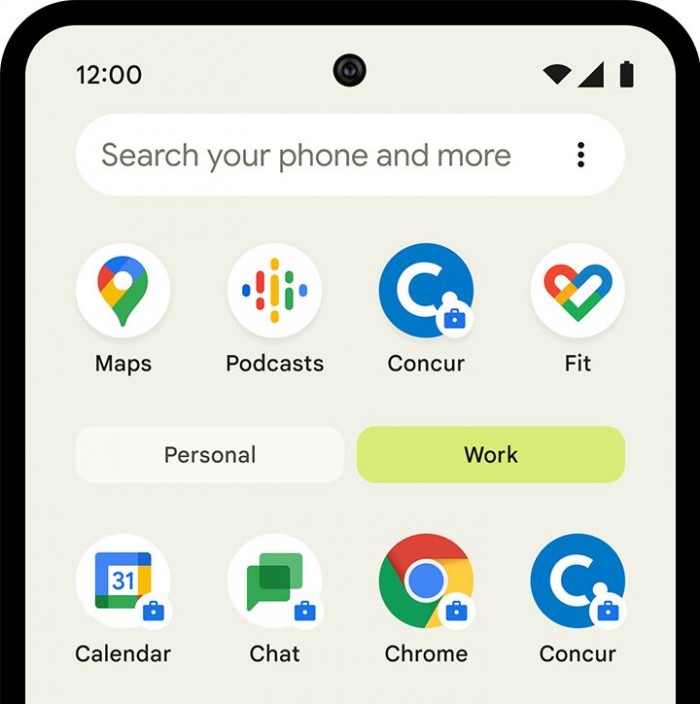

Google plans to bring Android’s work profile feature to more devices. Currently, access is only available to Android devices managed by a company through enterprise mobility management (EMM) software. Android is now getting ready to expand Work Profiles to unmanaged users that have a business identity, like Google Workspace. (CN Beta, 9to5Google, Business Line, Engadget)

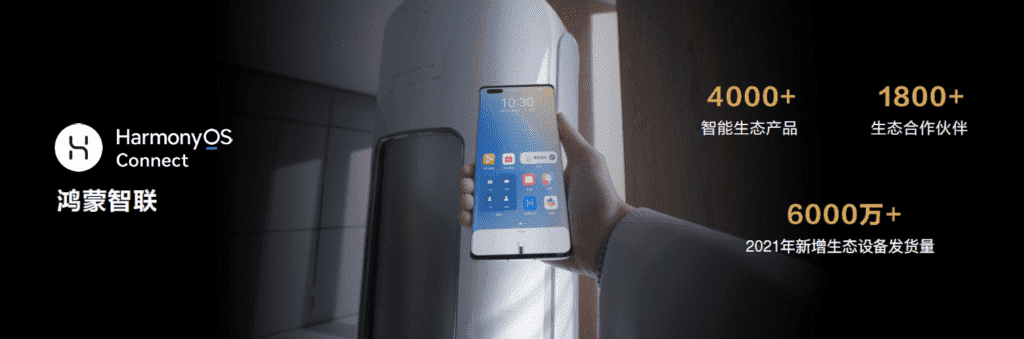

Richard Yu, CEO of Huawei consumer business group, has announced that HarmonyOS upgrade now crossed over 150M users in China, including different types of device platforms – smartphones, tablets, IoT, smart home, and more. By the end of 2021, devices equipped with HarmonyOS will top 200M. (CN Beta, Caixing Global, Huawei Central)

Richard Yu, CEO of Huawei consumer business group, has revealed that HarmonyOS now has more than 1,800 hardware partners and 4,000 ecological devices. At the same time, the number of new shipments this year exceeds 60M. Furthermore, the number of HarmonyOS atomic services developed by more than 400 partners exceeds 16,000. (GizChina, My Drivers)

Russian courts have ruled on the first instance that Samsung is to halt imports and sales of up to 61 models of its smartphones running Samsung Pay including Galaxy Z Fold3 and Z Flip3 over accusations that Samsung Pay violates a patent of Swiss-based mobile payments company Sqwin Sa. Samsung has appealed the decisions and is not yet legally binned to halt sales of its phones. (GSM Arena, Reuters, RIA.ru)

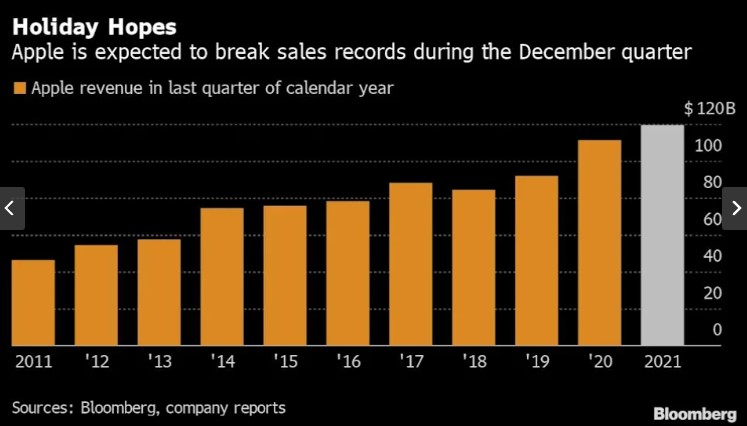

Apple is expected to generate nearly USD120B in the final 3 months of 2021, up 7% from a year earlier. That is more than the combined quarterly sales of Best Buy, Costco Wholesale, Walt Disney and Target. For Apple, certain components have been particularly hard to get. Short supplies from chipmakers like Broadcom and Texas Instruments forced Apple to slash its iPhone 13 production targets for 2021 by as many as 10M units. (Phone Arena, Bloomberg, Yahoo, MacRumors)

vivo Y71t is launched in China – 6.44” 1080×2400 FHD+ u-notch AMOLED, MediaTek Dimensity 810 5G, rear dual 64MP-8MP ultrawide + front 16MP, 8+128 / 8+256GB, Android 11.0, fingerprint on display, 4000mAh 44W, CNY1,799 (USD280)/ CNY1,999 (USD310). (GSM Arena, vivo, Gizmo China)

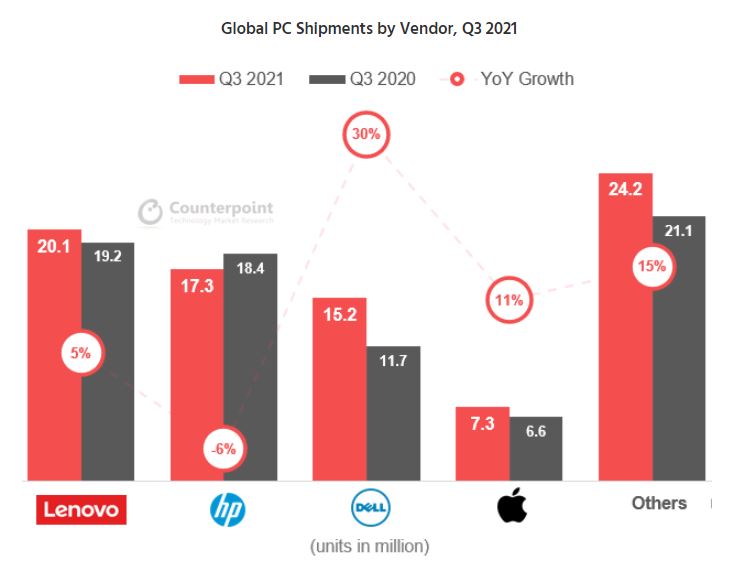

Global PC shipments marked their sixth consecutive YoY growth in 3Q21 at 84.2M units. This came despite the ongoing component shortages and other supply constraints. However, the 9.3% YoY growth during the quarter implied decelerating PC shipment momentum after 4 consecutive quarters of double-digit YoY growth since 3Q20. In addition, most OEMs and ODMs are not seeing any shrinking gap between orders (demand) and shipments (supply). (Apple Insider, Counterpoint Research)

TCL Tab Pro 5G is launched in US Verizon supporting mmWave 5G – 10.36” 1200×2000 FHD+ NXTVISION LCD, Qualcomm Snapdragon 480, rear 13MP + front 8MP, 4+64GB, Android 11.0, stereo speakers, 8000mAh 18W, USD400. (Android Headlines, The Verge, Android Central, Gizmo China)

According to TF Securities Ming-Chi Kuo, Apple may not begin production on its upcoming AR/VR headset until the end 4Q22. Before launching the headset, Apple wants to have “complete software, ecosystem, and services”. In general, Kuo expects head mounted displays to lead to the “next wave of user interface revolution” much like multi-touch on the iPhone. (TF Securities, MacRumors, CN Beta)

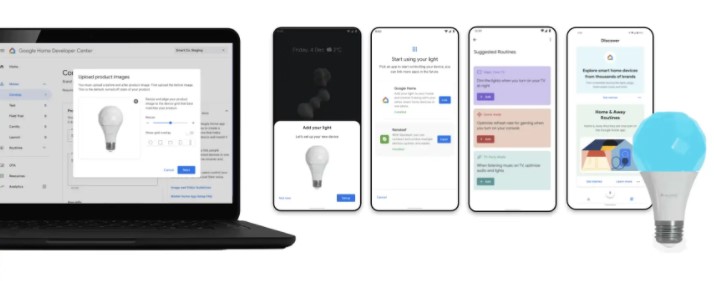

Google’s acquisitions like Nest Labs in 2014 for USD3.2B showed Google’s commitment to smart home technology. Google has announced a complete rebrand of its Smart Home ecosystem, introducing “Google Home”. Google Home will include Google Home speakers, Google Assistant, Nest devices, Android, and new smart displays. Google is updating Nest and Android devices to support Matter, which is a universal and open smart home application protocol. (Android Headlines, Google)

Xpeng Motors CEO He Xiaopeng has said that the penetration rate of new energy vehicles is expected to reach 50% in 2025. Xpeng Motors has officially announced that its world’s first mass-produced lidar smart car, the Xpeng P5, has successfully rolled off the production line. The first batch of car owners will be delivered at the end of Oct 2021. (My Drivers, Sina)

Google is to invest over USD50M in Indian social commerce startup Meesho, which recently secured USD570M in a financing round. Meesho operates a three-sided marketplace that connects suppliers (manufacturers and distributors) and resellers with customers on social media platforms such as WhatsApp, Facebook and Instagram. (TechCrunch, Business Insider, The Economic Times)

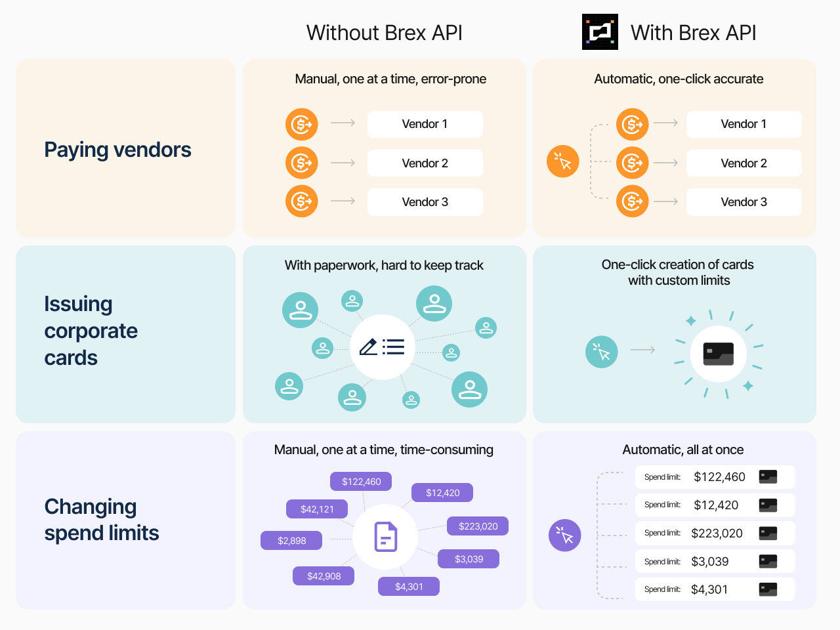

Fast-growing fintech Brex has raised USD300M in funding that propels it to decacorn status, just six months after it was valued at USD7.4B.The startup has announced its new “Brex API”. The new open API is available to all Brex customers for no extra charge, and is designed to allow them to “seamlessly manage financial information in a customizable interface”. (TechCrunch, Insider-Voice, Valdosta Daily Times)

Paytm, India’s digital payments pioneer backed by SoftBank Group, has received approval from the markets regulator that clears the way for its planned INR16,600-crore (USD2.2B) initial public offering (IPO). While INR8,300 crore will be primary share sale, INR8,300 crore will be an offer for sale (OFS), where existing investors can sell their shares. (CN Beta, India Times, Money Control, Live Mint)

Citcon, a mobile wallet payment provider, has closed on USD30M in funding in a Series C round co-led by Norwest Venture Partners and Cota Capital. Citcon provides mobile wallet services to facilitate commerce around the globe and will use the fresh infusion of capital to continue growing worldwide, adding talent, and building out its international presence on four continents. (TechCrunch, PYMNTS, Business Insider)

XanPool, a payment infrastructure provider that facilitates faster crypto and fiat settlements, has announced it has raised a USD27M Series A led by Valar Ventures. XanPool’s software enables a non-custodial crypto-to-crypto (C2C) network that is made up of liquidity providers, including crypto funds, money service operators and traditional-export businesses who have idle capital sitting in their crypto wallets, e-wallets or bank accounts. (TechCrunch, Coindesk, CoinTelegraph)