11-3 #NoSelfPity : SMIC has unveiled more details about its new 12” fab project In Shenzhen; UMC reportedly is mulling setting up a new 12” wafer fab in Singapore; Samsung plans to triple its foundry production capacity by 2026; etc.

Qualcomm has announced plans to achieve net-zero global emissions for Scopes 1, 2 and 3 by 2040 and committed to the Science Based Targets initiative’s (SBTi) Business Ambition for 1.5°C. This builds on the Company’s existing greenhouse gas (GHG) emissions reduction goal and includes interim 2030 science-based emissions reduction targets across Scopes 1, 2 and 3. (Android Central, Qualcomm)

According to Digitimes, after lasting for almost 2 years, global semiconductor shortage is on track to ease as the pandemic continues to subside in many countries, and semiconductor demand is expected to fall quarter by quarter in 2022, particularly in 2H22. From 2H22, chip manufacturers are not expected to see rapid growth in shipments of all their product lines. It is expected that for most of 2022, first-tier suppliers of non-consumer chips will maintain strong shipments, but weak demand for consumer electronics equipment will bear the brunt of second- and third-tier suppliers. In terms of foundries, TSMC reiterated that its foundry capacity will continue to be tight until the end of 2022, whether it is mature or advanced process nodes. UMC is also optimistic that strong customer demand will continue throughout 2022. (Digitimes, Digitimes, 199IT, CN Beta)

Xiaomi has invested in AisinoChip Electronics Technology, further expanding its ecosystem for vehicle-use microcontroller units (MCU). It is an integrated circuit design service provider focusing on the development of independent controllable information security chips. The company is established in 2008. It is a security control chip company that can provide a complete set of solutions from chips to applications. (Digitimes, Sohu, Sina)

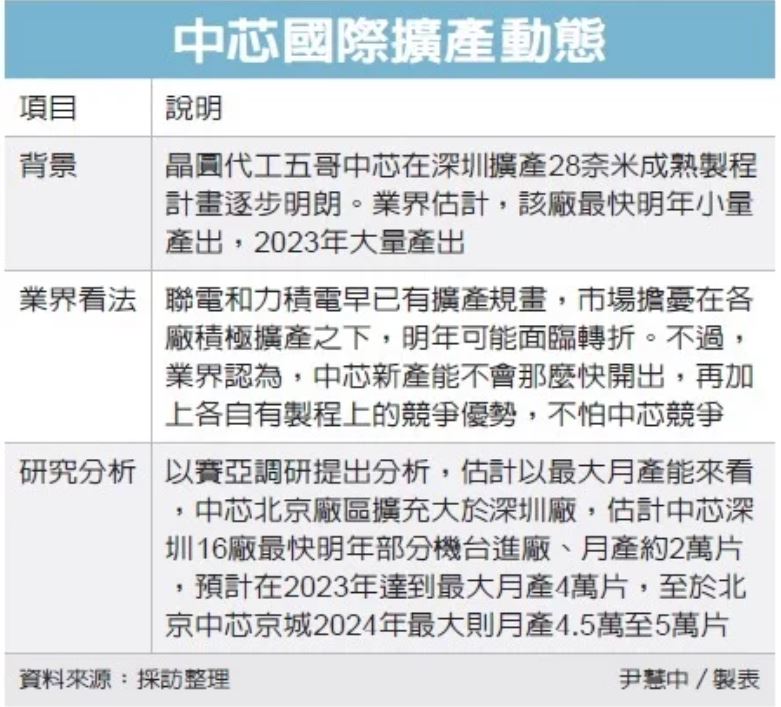

China’s Semiconductor Manufacturing International (SMIC) has unveiled more details about its new 12” fab project In Shenzhen, such as the fab’s initial focus on the manufacture of display driver ICs, CMOS image sensors and power management chips. SMIC has revealed the latest detail of its 300mm fab construction plan in the southeastern city of Shenzhen, China. SMIC has estimated to spend USD2.3B on the new fab, with volume production beginning in 2022. The initial capacity will be 20,000 wafers per month, eventually reaching 40,000 wafers per month by 2023. SMIC is simultaneously planning another 300mm fab in Shanghai, with monthly capacity at 100,000 wafers per month. SMIC expects to spend USD8.8B on it. (Digitimes, Tech Taiwan, UDN, CTEE)

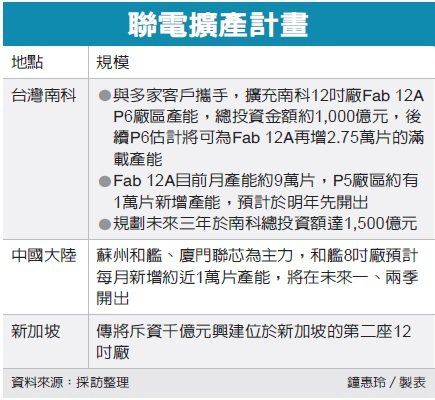

Pure-play foundry United Microelectronics (UMC) reportedly is mulling setting up a new 12” wafer fab in Singapore, with a monthly production capacity of at least 20K-30K pieces, and an investment of more than NTD100B (USD35.9B). UMC’s Singapore plant Fab 12i has started mass production since 2004. It is located in the Baisha Wafer Technology Park. The process is 0.13um to 40nm. The monthly production capacity is 50K wafers. Its products cover FPGA (programmable logic components) and wireless Communication chips, etc. UMC announced in Apr 2021 that it will expand the production capacity of Nanke’s Fab 12A P6 plant, using a 28nm process with a monthly production capacity of 27.5K pieces. It is expected to start production in 2Q23. It is reported that customers who have paid advance deposits include MediaTek and Qualcomm. , Samsung LSI, Novatek, etc. (Digitimes, EET China, UDN, Sohu)

Samsung Electronics has said that it plans to triple its foundry production capacity by 2026 amid a global chip shortage disrupting production in key industries from autos to smartphones. It will expand its production lines in Pyeongtaek, south of Seoul, and may build a new factory in the U.S. Samsung has also reaffirmed that it is scheduled to produce its first 3nm-based chip designs for customers in 1H22, while its second generation of 3nm is expected in 2023. (Asia Nikkei, Digitimes, Tom’s Hardware)

Tencent has touted progress in semiconductor chip development and investment. The company has announced 3 self-developed chips—a chip for AI computing called “Zixia”, another for video processing, known as “Canghai”, and a chip for high-performance networks that is designated “Xuanling”. The company has also announced its Orca cloud operating system. (My Drivers, CN Beta, Bloomberg, Reuters, US News)

The ongoing shortage of foundries in the global semiconductor industry is adversely affecting domestic fabless companies’ R&D activities. This is because it is becoming increasingly difficult to utilize multi-project wafers (MPWs) for prototype production. South Korean company Key Foundry has recently announced that it would not provide its MPW service for fabless companies starting from 2022. The MPW can be defined as a foundry service a fabless company uses for product R&D. (CN Beta, Business Korea)

The US Department of Commerce has requested for global semiconductor firms to hand over internal data on clients, inventory levels and chipmaking equipment by 8 Nov 2021, so the department can “review” supply-side issues. Shortages of key parts, including chips, have caused disruptions in the US automobile industry. Samsung Electronics and SK Hynix will reportedly accept the demand while not giving trade secrets and confidential information. (CN Beta, Korea Herald, Asia Nikkei, Business Korea)

BOE has allegedly set up a OLED panel production line exclusively for Apple in the B11 factory in Mianyang, China. Recently, shipments from the B11 factory in Mianyang have increased significantly. Apple’s new iPhone 13 display has allegelly been successfully mass-produced on the BOE Mianyang production line. BOE has passed Apple’s qualification review and officially entered the mass production stage of the iPhone 13 display, becoming the exclusive Chinese domestic panel manufacturer participating in the iPhone new product supplier. According to the industry chain, orders for the iPhone 13 series screens come from Samsung, LG, and BOE. (CN Beta, Sohu, iPhone Wired, TechNews)

Micron has announced that its high-performance 16Gb / 16Gbps GDDR6 memory solution is now available with AMD Radeon RX 6000 Series graphics cards built on the AMD RDNA 2 gaming architecture. Using Micron’s advanced 1z process technology, this latest version of GDDR6 enables up to 512GB/s system performance for demanding applications like gaming and graphics. (My Drivers, Sina, Sohu, Globe Newswire, Micron)

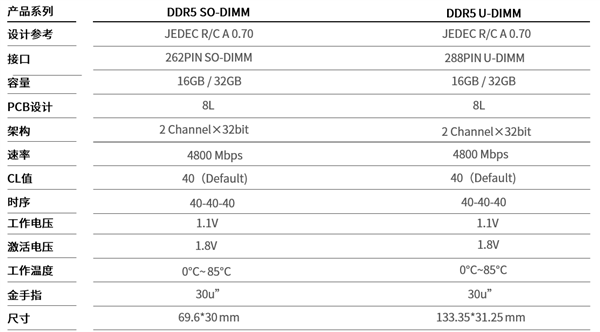

Longsys released DDR5 U-DIMM memory module products in Mar 2021, and is the first to conduct actual tests. Longsys’ DDR5 memory modules have successfully developed two forms including U-DIMM (common desktop products) and SO-DIMM (common ones). The rate is defined at 4800Mbps 2 Channel×32bit brand new architecture product prototype, single Maximum 32GB. Longsys DDR5 memory module is expected to enter mass production in 2022. (My Drivers, CN Beta, Sohu)

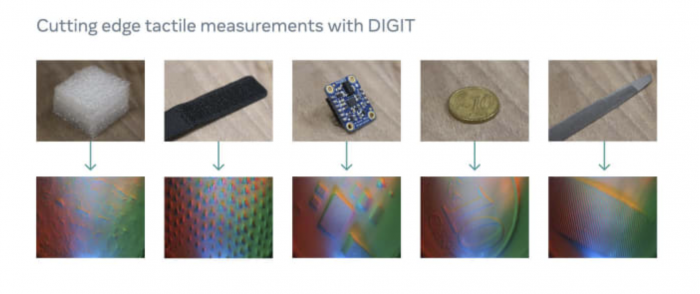

Facebook AI Research (FAIR) and its partners have built a new kind of electronic skin and fingertip that are inexpensive, durable and provide a basic and reliable tactile sense to our mechanical friends. They announce ReSkin, a new open source touch-sensing “skin” created by Meta AI researchers, in collaboration with Carnegie Mellon University, that can help advance their AI’s tactile-sensing skills quickly and at scale. (CN Beta, TechCrunch, Facebook, Engadget)

Apple is reportedly developing a new feature for the iPhone and Apple Watch that can tell if the driver has been in an automobile accident and automatically dials emergency services. Apple’s car-crash-detection feature reportedly works by measuring for an instant jump in gravity forces (g-forces) on impact. (Pocket-Lint, The Verge, WSJ)

Facebook has announced it is shutting down its facial recognition system, which automatically identifies users in photos and videos, citing growing societal concerns about the use of such technology. Facebook has also said it plans to delete the data it had gathered through its use of this software, which is associated with over 1B people’s faces. (CN Beta, Facebook, CNBC, CNN, Reuters)

Tesla is expanding access to its Supercharger charger network. The company is opening 10 locations in the Netherlands to non-Tesla EVs as part of a pilot program. The stations are located in Sassenheim, Apeldoorn Oost, Meerkerk, Hengelo, Tilburg, Duiven, Breukelen, Naarden, Eemnes and Zwolle. (Engadget, Tesla)

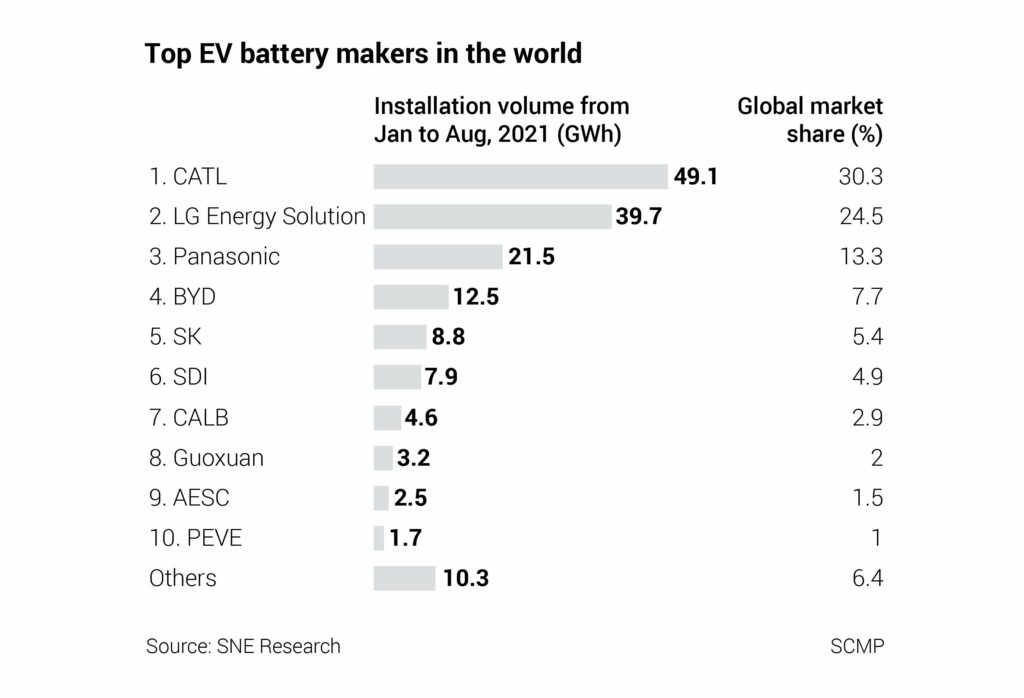

Tesla’s shift to less expensive batteries for its electric vehicles is expected to shake the global battery industry. Tesla is installing lithium iron phosphate (LFP) batteries to all of its standard-range EVs. The move is likely to intensify competition between Chinese battery producers such as CATL and BYD that manufacturers LFP cells and South Korean makers that focus on nickel-cobalt-manganese (NCM) batteries. The LFP batteries’ global market shares rose to 24.1% in 1H21 from 14.8% a year earlier, according to SNE Research, on surging sales of the Tesla Model 3 and the Hongguang MINI EV in China. (Laoyaoba, Electrek, CNBC, KED Global)

According to Digitimes, Apple and Panasonic are in talks to supply batteries for the Apple Car. Batteries for the Apple Car were expected to be supplied by China’s CATL and BYD, but this is no longer possible because Apple is particular about batteries manufactured in the United States. In 2014, Panasonic established “Panasonic Energy North America”, which manufactures lithium-ion batteries, in Nevada, USA. (Digitimes, 9to5Mac, iPhone Wired)

Tesla is launching a new Wall Connector home charger that comes with a J1772 plug, which works with all electric cars in North America. This charger is designed to mainly work with non-Tesla vehicles – though Tesla vehicles can still use it with an adapter. (The Verge, Electrek)

Qinghai Unicom and Huawei have completed the commercialization of the world’s first outdoor F5G super site solution in Dagaoling Village, Huangyuan County, Qinghai Province. The F5G super site is the industry’s first one-stop solution that integrates transmission and access launched by Huawei, realizing “converged deployment of transmission and access”. Its upstream is through the OTN optical transport network to achieve high-quality transmission of services that jump into the cloud; the downstream can be directly connected with the existing PON network to achieve rapid and wide coverage. (CN Beta, My Drivers)

Netflix has announced that its new gaming initiative has officially launched. Five games are currently available on the mobile platform, including “Stranger Things: 1984” and “Stranger Things 3: The Game”. Netflix promises to add more titles to the platform later on. (Digital Trends, Netflix, TechCrunch, BBC)

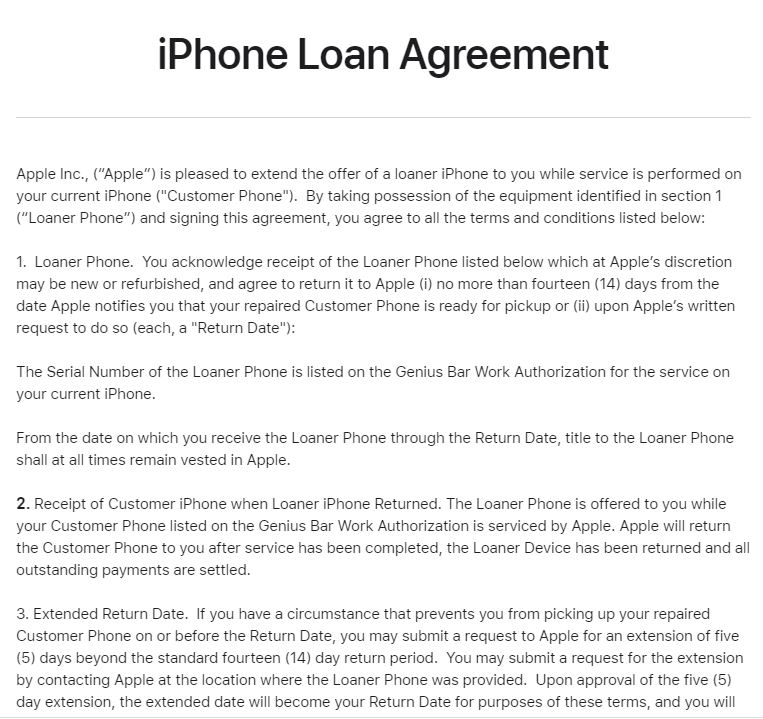

Apple Stores and Apple Authorized Service Providers will be able to offer customers an iPhone XR as a loaner device during lengthier repairs in the U.S. and other regions. (Digital Trends, MacRumors, Apple)

Apple allegedly “has cut back sharply” on iPad production to ensure that there will be enough components for iPhone 13 production. Apple’s iPad production has been cut by 50%, while Apple has also been reducing production of older iPhone models to prioritize the iPhone 13 lineup. As these devices share some of the components, they are all being moved to the newest iPhones. (GizChina, Reuters, Asia Nikkei, CNET, 9to5Mac)

realme China president Xu Qi has revealed that realme will enter the high-end smartphone market. Moreover, he has disclosed that product prices will reach the CNY5,000 (USD781) price range, and the first product to be launched in early 2022. (GizChina, IT Home, Sohu, ZOL)

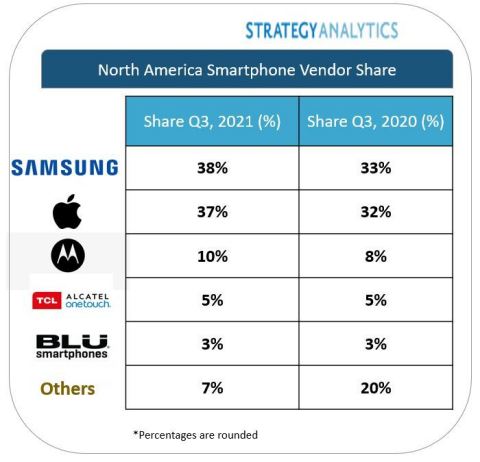

According to Strategy Analytics, Samsung is the top smartphone vendor in North America in 3Q21. The Top-5 smartphone vendors by shipments for the region captured 93% of total shipments to the region. North American smartphone shipments were down -7% annually in 3Q21. (CN Beta, Strategy Analytics)

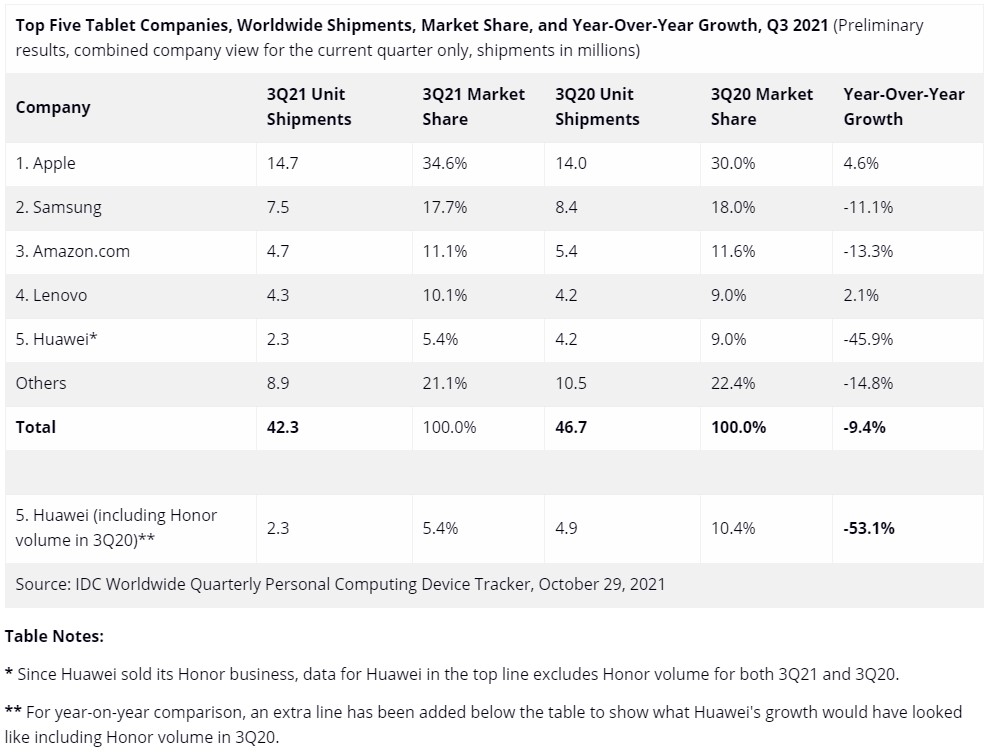

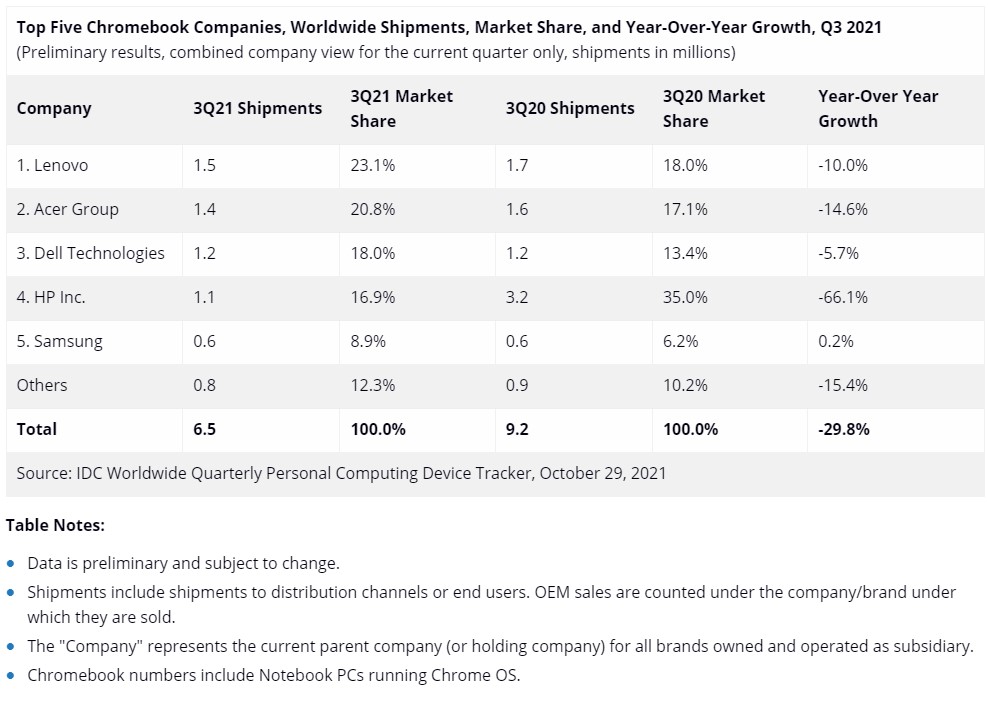

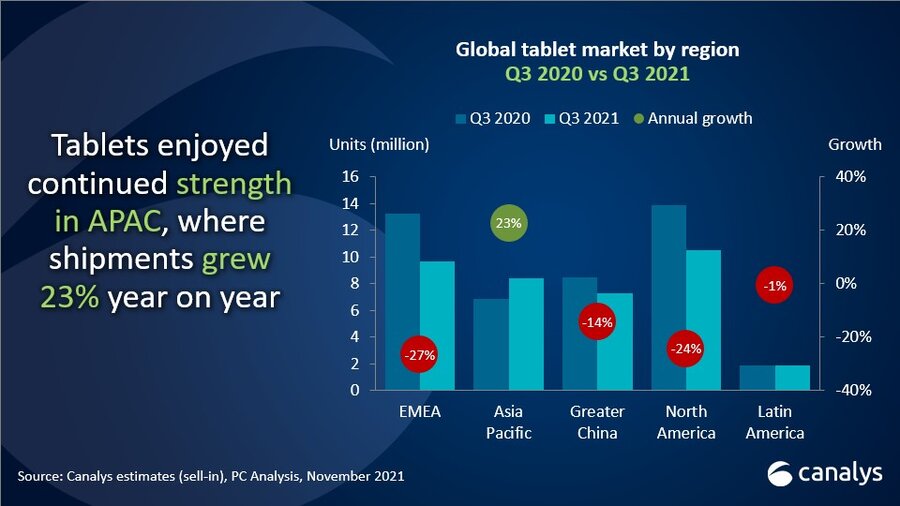

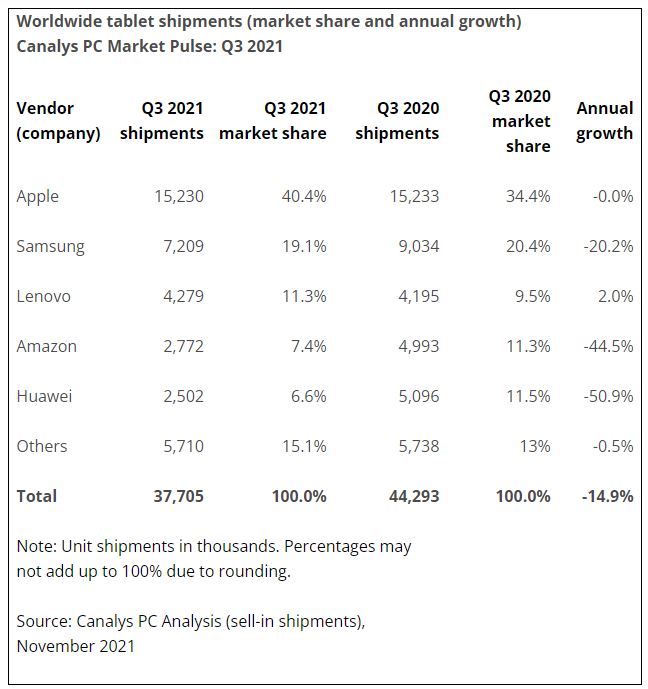

After 5 quarters of growth driven by accelerated buying for remote work and learning, global shipments of Chromebooks and tablets recorded their first decline since the onset of the pandemic in 2020. Chromebook shipments declined 29.8% YoY in 3Q21 with volumes dropping to 6.5M units while tablet shipments recorded a 9.4% YoY decline falling to 42.3M units, according to IDC. Easing restrictions across many geographies led to increased spending in other categories, which weakened Chromebook and tablet demand. The decline also stems from the comparison to a strong third quarter in 2020 when consumer device shipments peaked. (IDC, CN Beta)

According to Canalys, worldwide PC shipments (including tablets) fell by 2% year on year to 122.1M units. But shipments remain well above pre-pandemic levels, with a 2-year CAGR of 10% from 3Q19. Tablet shipments fell 15% year on year to 37.7M units, as the need for tablets to support consumer and education use cases dropped off in most regions. Chromebooks suffered an even steeper decline, with shipments down 37%, primarily due to a slowdown in education spending in the US. Total Chromebook shipments reached 5.8M units in 3Q21. (Canalys, CN Beta)

Smart fitness equipment company Mirror has launched Mirror Weights, which are connected dumbbells and ankle weights track reps in real time and offer suggestions to correct form, as well as when to increase or decrease the weight while using. These weights work in conjunction with Mirror’s new Universal Health Score (UHS) categorized by heart, muscle, and recovery. This system tracks and recommends the amount of cardio, strength, and recovery work that a user needs to do to meet their goals. (Digital Trends, Inside Hook)

Generac, a global designer and manufacturer of energy technology solutions and other power products, has announced the acquisition of ecobee, a provider of sustainable smart home solutions, in a transaction valued up to USD770M contingent on the achievement of certain performance targets. ecobee, which is known to make some of the best smart thermostats, is founded in 2007. (Android Central, Globe Newswire, The Verge)

Tempo, the smart home gym that uses computer vision to track workouts and offer guidance in real time, is launching the Tempo Move, a new home workout setup that ditches the original’s 42” touchscreen with Microsoft’s Azure Kinect sensors built in, in favor of using existing TVs combined with the sensors built into the iPhone XS / XR and up. (The Verge, CN Beta)