11-12 #InSync : TSMC and Sony have jointly announced that TSMC will establish a subsidiary JASM in Kumamoto, Japan; TSMC will set up a new chip factory in Kaohsiung; BOE’s B12 line at Chongqing, China has allegedly started production; etc.

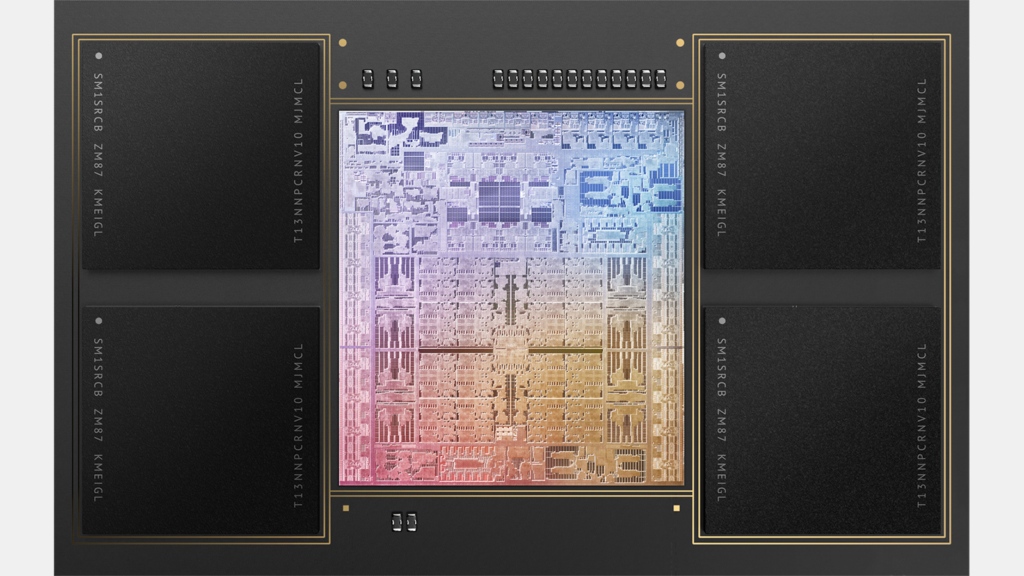

Apple’s aggressive Mac system-on-chips (SoCs) development plan reportedly now includes three 3nm chips — codenamed Ibiza, Lobos, and Palma — that will arrive in 2023 and will offer up to 40 general-purpose CPU cores. In 2022, Apple plans to introduce its 2nd generation M-series SoCs for Mac computers, reports The Information. These processors will be made using an enhanced version of TSMC’s N5 node, which is currently used to make Apple’s M1-series SoCs (N5P, N4, N4P). (CN Beta, The Information, Tom’s Hardware)

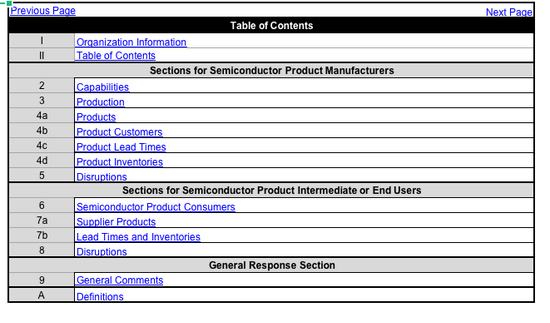

Taiwan Semiconductor Manufacturing Co (TSMC) has submitted its answers to the US inquiry, although like other chipmakers, it has removed sensitive customer data from the details. On 24 Sept 2021, the US requested data on inventories, backlogs, delivery time, procurement practices, and measures companies were taking to increase production output. It also specifically included a request for a list of each company’s top customers. According to the information on the website of the US Department of Commerce, 23 companies and institutions including TSMC, UMC, Tower, Micron, ASE, Western Digital, and Global Wafer have submitted relevant information. Some documents are confidential and are not disclosed; Samsung, Intel and other semiconductors and manufacturers Infineon, NXP and others have not disclosed information. (CN Beta, Apple Insider, Bloomberg)

TSMC and Sony Semiconductor Solutions Corporation (SSS) have jointly announced that TSMC will establish a subsidiary, Japan Advanced Semiconductor Manufacturing (JASM), in Kumamoto, Japan to provide foundry service with initial technology of 22 / 28nm processes to address strong global market demand for specialty technologies. The production targeted to begin by the end of 2024, with a monthly production capacity of 45,000 12” wafers. The initial capital expenditure is estimated to be approximately USD7B with strong support from the Japanese government. s set to invest USD500M and will hold no more than a 20% stake in the joint company. The sensor part of the mobile phone will be manufactured by Sony, but the semiconductor processing image data will be manufactured by TSMC and other foundries. (CN Beta, Reuters, The Verge, TSMC, Asia Nikkei)

Due to TSMC’s technical challenges, Apple’s A16 bionic chips intended for iPhone 14 will not be manufactured at TSMC’s 3nm node. The company’s A14 chips were the first to adopt TSMC’s N5 technology, while the A15 chipsets continued to use N5P, an enhanced version of TSMC’s 5nm process. TSMC’s 4nm technology is also a response to the increasingly higher cost of extending Moore’s Law, and N4 will also see a reduction of EUV layer. TSMC also unveiled an enhanced version of N4, known as N4P. Apple’s A16 chips would possibly opt for TSMC’s 4nm process. (CN Beta, GizChina, TechTaiwan, The Information, Digitimes)

Taiwan Semiconductor Manufacturing Co (TSMC) has said it will set up a new chip factory in the island’s southern city of Kaohsiung. After completion, advanced 7nm technology and mature 28nm technology will be used to manufacture chips for related companies. The factory plans to start construction in 2022 and put into production in 2024. TSMC’s board of directors approved a capital expenditure plan of USD9.036B. It would be used for the construction of fabs, equipment installation and capital asset leasing. (CN Beta, Reuters, Taiwan News)

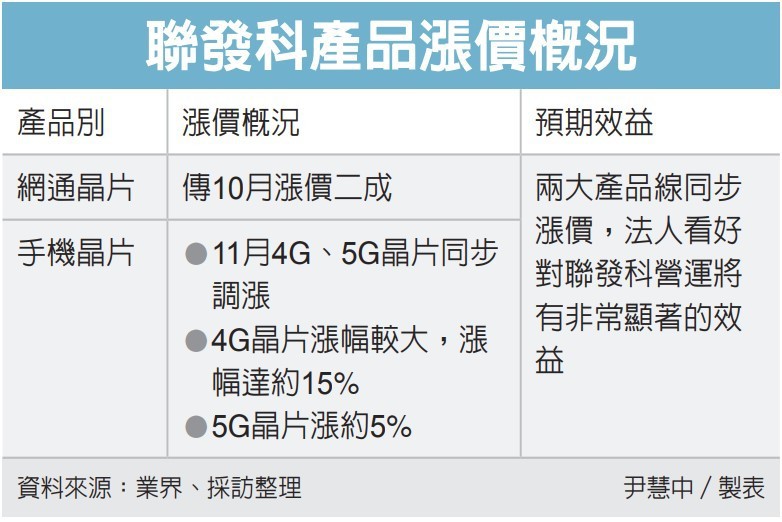

MediaTek is raising the prices for some of its smartphone chips that are in high demand in Nov 2021. The bump in prices are as high as 15% for 4G chips and 5% for 5G enabled chips. The company has also raised the prices of its WiFi chips by about 20% as well while other foundries like Samsung raising their prices. (Gizmo China, UDN)

Shen Bo, global vice president with ASML, has indicated that ASML is already expanding production capacity and using the company’s safety stock to improve delivery, but due to the long industrial chain, there is no way to fully meet user needs for the time being. He has also emphasized that the company is open to the export of integrated circuit lithography machines to China and fully supports it under the framework of laws and regulations. At present, except for EUV lithography machines that cannot be supplied to Chinese customers, other products of ASML can be shipped normally. (CN Beta, NBD, My Drivers, Airvers, Global Times)

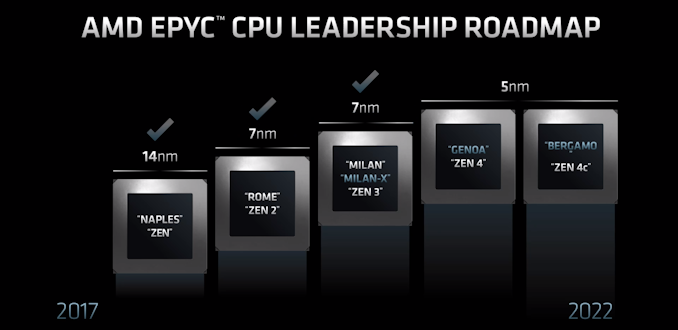

AMD has unveiled its first processors based on its new Zen 4 architecture. AMD has outlined its early Zen 4 roadmap. The first two CPU families are Epyc chips aimed at servers and other heavy-duty computing tasks. The first, nicknamed Genoa, is built for general-purpose computing and packs up to 96 cores (thanks in part to a 5nm process) as well as support for DDR5 memory and PCIe 5.0 peripherals. It arrives sometime in 2022, and partners are sampling chips now. (My Drivers, WCCFTech, AnandTech, Engadget, Tom’s Hardware)

China’s Loongson Technology has announced to sign Contributor License Agreement (CLA) and joined the OpenEuler open source community. Loongson is the name of a family of general-purpose, MIPS architecture-compatible, microprocessors, as well as the name of the Chinese fabless company (Loongson Technology) that develops them. As an operating system that supports diverse computing power, OpenEuler supports multiple processor architectures such as x86, Arm, RISC-V, and LoongArch. (CN Beta, My Drivers, IT Home, Huawei Central)

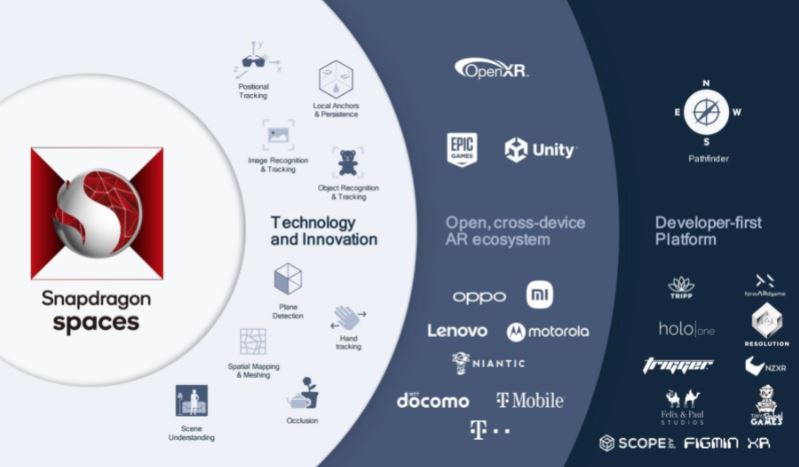

Qualcomm is revealing its Snapdragon Spaces XR Developer Platform, a kit that will help devs expand existing apps and create new ones to take advantage of AR devices. Qualcomm is lining up some important partners for the mixed reality future including Lenovo, Motorola, OPPO, and Xiaomi. Lenovo’s ThinkReality A3 glasses, based on Qualcomm’s XR1 Smart Viewer reference design, will be the first to “commercialize” Snapdragon Spaces. (CN Beta, Qualcomm, The Verge, Hot Hardware, VR Focus)

Infineon, which gets around 40% of its sales from the automotive sector, expects the supply of crucial semiconductors to the sector to remain tight well into 2022, according to the CEO Reinhard Ploss. (CN Beta, CNBC, Reuters)

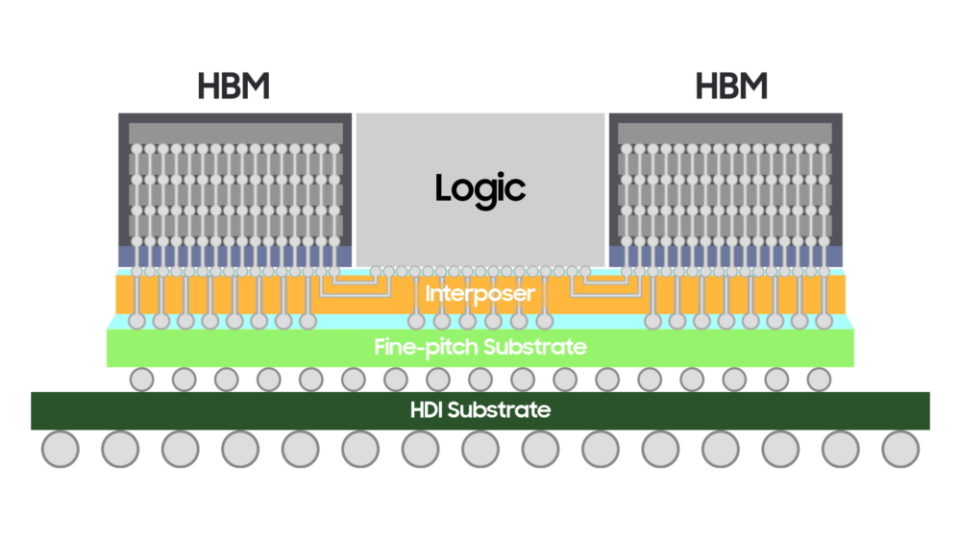

Samsung Foundry has announced that its latest 2.5D semiconductor chip packaging technology Hybrid-Substrate Cube (H-Cube) is now available for its foundry clients. H-Cube, which is developed in collaboration with Samsung Electro-Mechanics and Amkor Techology, allows complex logic and HBM (High-Bandwidth Memory) chips to be packed in compact sizes. (CN Beta, IT Home, SamMobile, Samsung)

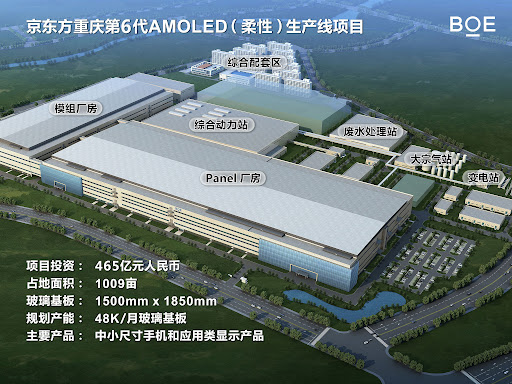

BOE’s B12 line at Chongqing, China has allegedly started production. B12 line consists of three stages: the first stage has started production. The second stage will start operations during 1H22. The third stage is expected to start operations during 2H22 or early-2023. B12’s first customer will be OPPO. Mother glasses are already being put in B12, which means panels will likely start delivery to the Chinese smartphone maker before the year’s end. When all three stages of B12 are complete, the factory will have a capacity of 48,000 Gen-6 (1500×1850) substrates per month. Each stage adds 16,000 substrates per month in production capacity. BOE’s other two OLED lines at Sichuan Province, B7 and B11, also have capacities of 48,000 substrates per month. (CN Beta, The Elec)

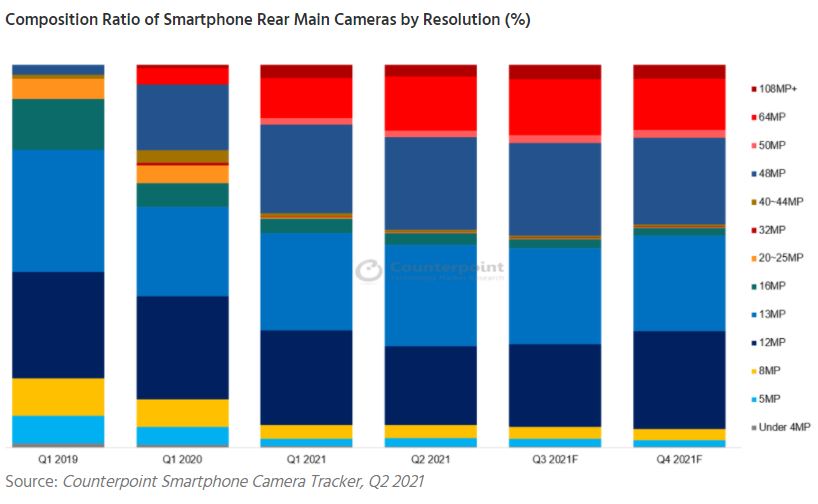

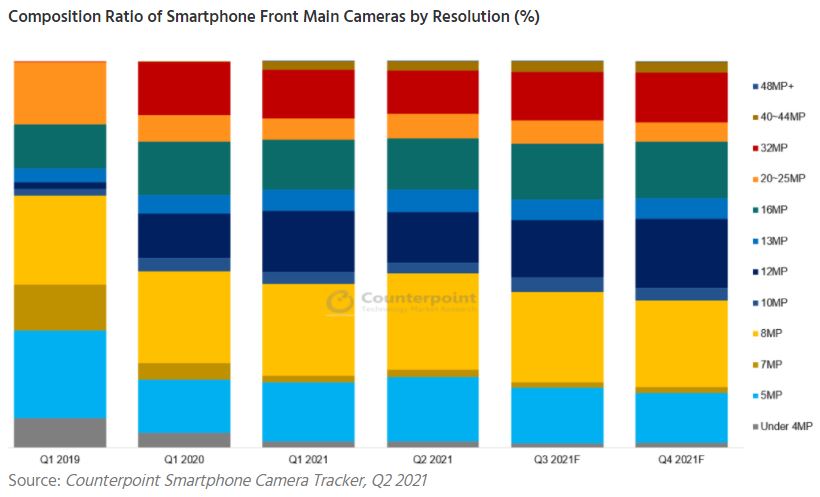

According to Counterpoint Research, smartphones featuring rear main cameras powered by 48MP and above megapixels accounted for 43% of total sales in 2Q21, rising significantly from 38.7% in 1Q21. The share of 64MP alone increased 3.5% QoQ to 14% in 2Q21. 48MP and 64MP have become the mainstream for models priced USD200-400, while flagship smartphones resort to large-area sensors to deliver a DSLR-like professional performance, of which 50MP is the most adopted. Meanwhile, the share of 8MP and below resolutions further increased to 45.2%, with 5MP and 8MP together accounting for 41.7% on strong demand for low-end smartphones in 2Q21. (GizChina, Counterpoint Research)

OmniVision has announced the OV32C, a 32MP image sensor in a compact 1/3.2” optical format (OF)―the ideal performance/size ratio for next-generation front-facing mobile phone “selfie” cameras. RGBC technology is built into the sensor to provide the highest quality images in challenging lighting conditions. The “always-on” user experiences is enabled by facilitating AI processing to automate many of the common tasks of the camera, such as face detection, QR code scans, etc. (Gizmo China, Business Wire)

The optical under-display sensor on Google Pixel 6 series has been criticized for being slow and unreliable by users across the web but Google does not seem to think it’s a problem. Now Google claims the “enhanced security algorithms” are to blame as they may take longer to authenticate users’ fingerprints. (GSM Arena, Twitter, Android Headlines)

Google has reportedly worked on face unlock for the Pixel 6 duo, but it missed the deadline. Google’s leak of Pixel 6 series has promised the return of the feature face unlock, only for the official unveiling to make no mention of it. (CN Beta, Twitter, GSM Arena)

Google Pixel 6 series reportedly disables the in-display fingerprint scanner when the batter is completely discharged. The scanner does not work after restarting the device, and the option to re-enroll one’s fingerprint was also missing from the Settings menu. (GSM Arena, Reddit, Google Issue Tracker, Android Police)

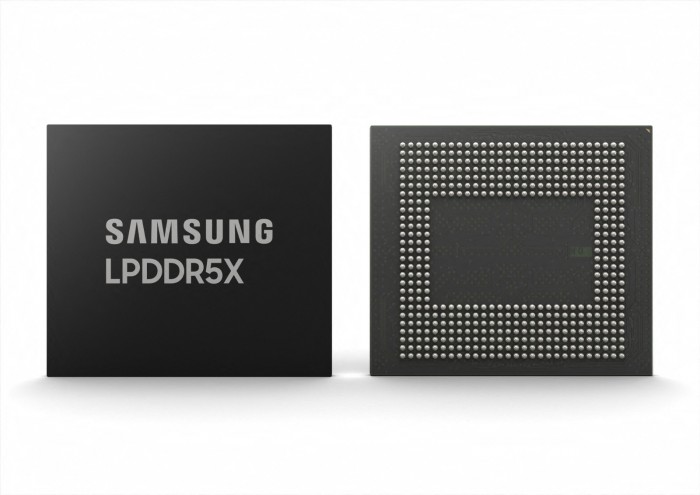

Samsung has developed the industry’s first 14nm based 16-gigabit (Gb) Low Power Double Data Rate 5X (LPDDR5X) DRAM. The LPDDR5X DRAM will offer data processing speeds of up to 8.5Gbps, which are over 1.3 times faster than LPDDR5’s 6.4Gbps. (My Drivers, CN Beta, Samsung)

Jiangsu Huacun (MMY)’s PCIe 5.0 master chip has been taped out. Founded in 2017, Jiangsu Huacun is a high-tech enterprise that provides storage control chips, storage solutions and storage finished modules, and integrates R&D and manufacturing capabilities. The PCIe 5.0 main control chip HC9001, which was developed by the company for 4 years, has been developed and entered into tapeout. This is the first PCIe 5.0 main control chip with a 12nm process in China. (CN Beta, 163, My Drivers)

LG Energy Solution, South Korean battery maker, has signed a deal to supply batteries to Nikola, a US hydrogen fuel cell electric truck maker, for 8 years from 2022 to 2029. Currently, Nikola has a factory in Coolidge near Phoenix, Arizona of the United States. It plans to expand facilities to have a production system of 2,400 units per year by 2022. It expects to be able to roll out 20,000 units annually by 2023 after the second stage of its facility expansion. Hydrogen fuel cell trucks will be produced at the same factory, too. LG is currently running a battery plant in Holland, Michigan of the United States. (CN Beta, KED Global, Business Korea)

French company Gaussin is pushing hard on hydrogen-based long-haul trucking, playing up hydrogen’s excellent range figures and quick refueling times as a benefit over heavy, slow-charging batteries. It is developing a flexible skateboard chassis developers can build all sorts of heavy vehicles on top of. The H2 Racing Truck, built upon Gaussin’s skateboard chassis, will run two 300-kilowatt (402 horsepower) electric motors, a fuel cell capable of generating a continuous 380 kW (510 horsepower), and an 82 kWh buffer battery to handle the full-throttle demands of desert racing. (CN Beta, Gaussin, New Atlas)

Samsung Electronics has announced that it is collaborating with the telecom company, Orange, to disaggregate the software and hardware elements of traditional RAN. Samsung will provide its virtualized RAN (vRAN), “which has been proven in the field through commercial deployments with global Tier one operators including the U.S.”, for the operation. (Neowin, Samsung)

Huawei has said that it will donate its self-developed openEuler operating system (OS) to the OpenAtom Foundation, China’s first open source foundation, marking the OS’ evolution from a company-led open source project to industrial co-construction and community autonomy. Huawei launched the openEuler OS in Sept 2021, which is another self-developed OS following the company’s HarmonyOS platform. (My Drivers, Sohu, Sina, Gizmo China, Global Times)

The European Union General Court has upheld a 2017 ruling against Google by the European Commission. The original ruling found that the company broke antitrust law using its search engine. Although Google’s parent company, Alphabet, has appealed this decision previously, the General Court has now dismissed the appeal, thus upholding a fine of EUR2.4B (USD2.8B). Alphabet can now appeal this decision with the European Court of Justice (ECJ). (Android Headlines, The Verge, EU General Court)

Google parent Alphabet has breached USD2T in market value for the first time, fueled by a rebound in spending on digital ads and growth in its cloud business. Its market cap is currently at USD1.98T. The Google company has almost doubled its value in less than two years. It breached the USD1T mark in Jan 2020. (Android Headlines, Business Standard, Bloomberg, Yahoo)

Samsung Electronics has announced that it is collaborating with Internet Matters to celebrate Anti-Bullying Week that is starting on 15-19 Nov 2021 and has “One Kind Word” as its theme. On internetmatters.org, the Samsung microsite offers a wide array of resources for guardians and parents on how children can stay safe online with the help of connected devices. It also features The Online Together Project that acts as an interactive tool designed for various age groups, ranging from under 11’s to 14+ year-olds. (CN Beta, Samsung, Neowin)

China’s Tencent Music Entertainment Group says it has signed a deal to distribute its artists worldwide through Apple Music. As of Nov 2021, artists who are with a specific Tencent Music Entertainment Group’s TME Music Cloud will be able to distribute their music via Apple’s service. (Apple Insider, Sohu, IT Home)

Infinix Note 11S is official in Thailand – 6.95” 1080×2460 FHD+ HiD IPS 120Hz, MediaTek Helio G96, rear tri 50MP-2MP macro-2MP depth + front 16MP, 8+128GB, Android 11.0, side fingerprint, 5000mAh 33W, THB6,999 (USD210). (GSM Arena, GizChina)

Moto E30 is unveiled in Europe – 6.5” 720×1600 HD+ v-notch 90Hz, Unisoc T700, rear tri 48MP-2MP macro-2MP depth + front 8MP, 2+32GB, Android 11.0 Go, rear fingerprint, 5000mAh 10W, EUR100. (GSM Arena, Motorola)

vivo Y15s is launched in Singapore – 6.51” 720×1600 HD+ v-notch IPS, MediaTek Helio P35, rear dual 13MP-2MP depth + front 8MP, 3+32GB, Android 11.0 Go, side fingerprint, 5000mAh 10W, 5W reverse charging, SGD179 (USD133). (GSM Arena, vivo)

POCO M4 Pro 5G is announced in Europe – 6.6” 1080×2400 FHD+ HiD IPS 90Hz, MediaTek Dimensity 810 5G, rear dual 50MP-8MP ultrawide + front 16MP, 4+64 / 6+128GB, Android 11.0, side fingerprint, 5000mAh 33W, EUR199 / EUR219. (GSM Arena, Android Authority)

realme Q3t is announced in China – 6.6” 1080×2412 FHD+ HiD IPS 144Hz, Qualcomm Snapdragon 778G 5G, rear tri 48MP-2MP macro-2MP monochrome + front 16MP, 8+256GB, Android 11.0, side fingerprint, 5000mAh 33W, CNY2,099 (USD330). (GSM Arena, realme)

vivo V76s is announced in China – 6.58” 1080×2400 FHD+ v-notch IPS, MediaTek Dimensity 810 5G, rear dual 50MP-2MP macro + front 8MP, 8+128 / 8+256GB, Android 11.0, side fingerprint, 4100mAh 44W, CNY1,799 (USD281) / CNY1,999 (USD313). (GizChina, MySmartPrice)

Nokia X100 is announced in United States – 6.67” 1080×2400 FHD+ HiD IPS, Qualcomm Snapdragon 480 5G, rear quad 48MP-5MP ultrawide-2MP macro-2MP depth + front 16MP, 6+128GB, Android 11.0, side fingerprint, 4470mAh 18W, USD250. (Digital Trends, Nokia, GizChina)

Lava Agni 5G is launched in India – 6.78” 1080×2400 FHD+ HiD IPS 90Hz, MediaTek Dimensity 810 5G, rear quad 64MP-5MP ultrawide-2MP macro-2MP depth + front 16MP, 8+128GB, Android 11.0, side fingerprint, 5000mAh 33W, INR20,000 (USD270). (GizChina, GSM Arena, Lava)

Lyft and Motional, the USD4B joint venture of Aptiv and Hyundai aimed at commercializing autonomous driving technology, have announced plans to launch their first fully driverless ride-hail service in Las Vegas in 2023. (CN Beta, TechCrunch, Reuters)

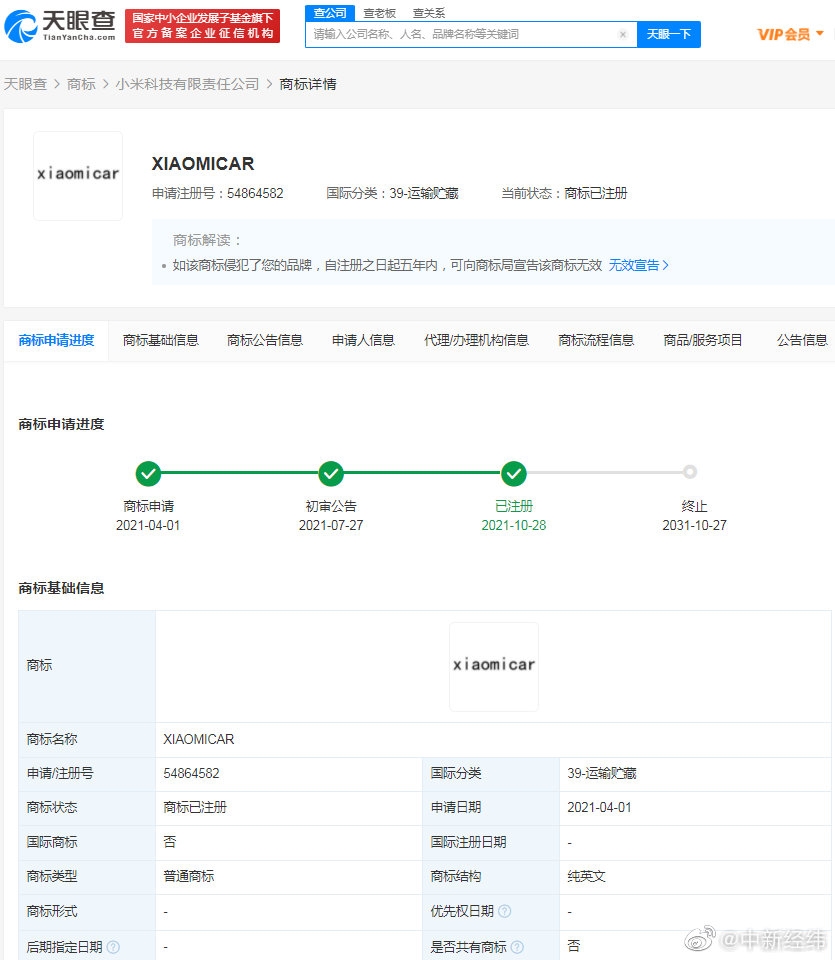

Xiaomi has made progress in its auto-making. Recently, the Tianyancha App showed that the trademarks of “Xiaomi Auto”, “XIAOMICAR”, “MICAR” and “Mi car” that had been applied for registration by Xiaomi Corporation were now changed to show as registered trademarks or with a preliminary announcement. (CN Beta, ZOL, Sina, Pandaily)

Hyundai has spun off a company dedicated purely to air mobility. Supernal expects its electric VTOL aircraft to enter service in 2028. Supernal is initially created as an internal unit of the Urban Air Mobility Division and assigned with working on a concept craft called the S-A1. Supernal is leveraging advanced technologies, systems, and airframe materials – including artificial intelligence, autonomous control, and electric powertrain – to develop its vehicles. (CN Beta, PR Newswire, DroneDJ, New Atlas)

Electric light-duty truck manufacturer Lordstown Motors has officially sold its Lordstown, Ohio factory to Foxconn for USD230M. Foxconn has also agreed to pursue a contract agreement with Lordstown to help the struggling EV company manufacture its Endurance pickup truck. (CN Beta, CNBC, TechCrunch, Lordstown Motors)

Two of the US’ Big Three automakers have signed a major pledge at the 2021 United Nations Climate Change conference (COP26). General Motors (GM) and Ford have agreed to the Glasgow Accord on Zero Emissions Vehicles, which calls for automakers to only sell zero-emissions vehicles by 2040. Volvo, Jaguar Land Rover and Mercedes-Benz also signed onto the pledge. The pledge calls to phase out tailpipe emissions from new vehicles in “leading markets” by 2035. (CN Beta, CNET, BBC, MSN)

General Motors (GM) plans to produce a military prototype vehicle based off the forthcoming GMC Hummer EV in 2022. The so-called “electric Light Reconnaissance Vehicle” (eLRV) will use modified versions of the Hummer EV’s frame, electric motors, and GM’s new Ultium battery pack, though it may not look exactly like the consumer version. (The Verge, TechCrunch, CNBC)

Apple CEO Tim Cook has said the company is mulling cryptocurrency integration for Apple Pay, though users should not expect to buy, sell or manage such assets on Apple’s platform anytime soon. He has touched on Apple’s cryptocurrency ambitions, or lack thereof. (Apple Insider, Apple Insider, NY Times)