11-21 #StepOut : MediaTek’s series of announcement; Samsung talks about DDR6 and 8th Gen VNAND; Apple is reportedly preparing to accelerate development of its electric self-driving “Apple Car”; etc.

MediaTek has announced its latest flagship processor Dimensity 9000, which is the first mobile chip to be built on TSMC’s 4nm process, in addition to using Arm’s new v9 architecture. It uses Arm’s new core designs: a single Cortex-X2 performance core clocked at 3.05GHz, three Cortex-A710 cores at 2.85GHz, and four Cortex-A510 efficiency cores at 1.8GHz. The GPU, meanwhile, is a 10-core Arm Mali-G710, along with MediaTek’s fifth-generation APU. (CN Beta, The Verge, AnandTech, Pocket-Lint)

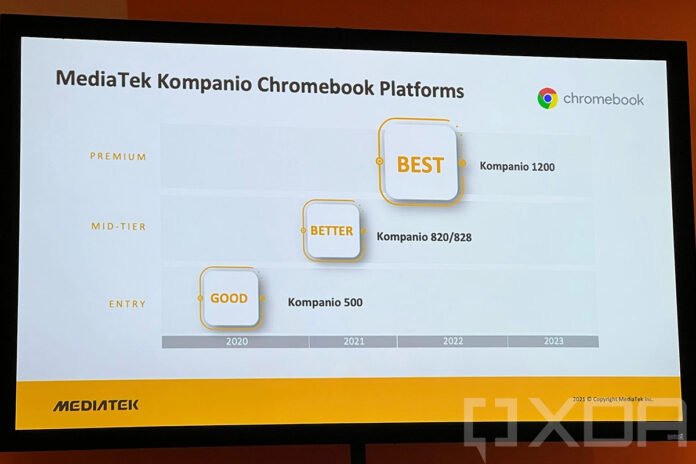

MediaTek will be introducing chips for powering Windows PCs. The company will launch its ARM-based chips for Windows PCs in a couple of years. It is offering low-end and entry-level chips for Chromebooks. It wants to go beyond offering powerful chipsets in the segment. Additionally, the company is also building 5G modems for Intel PCs. (GizChina, XDA-Developers)

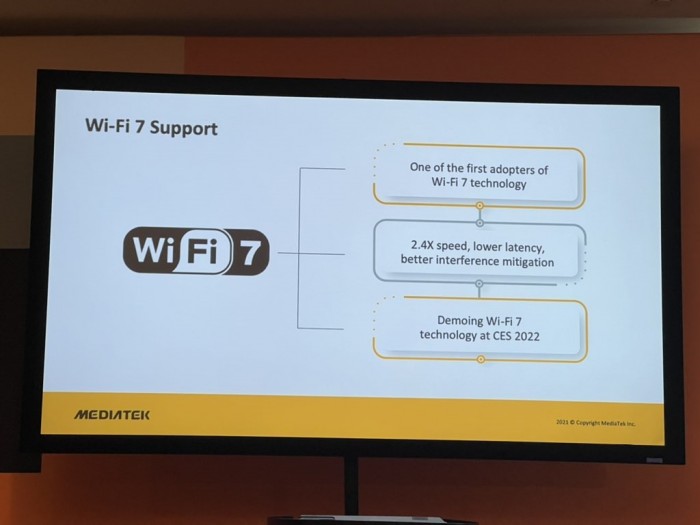

James Chen, MediaTek’s Associate VP of Product Marketing, states that the Wi-Fi 7 would be 2.4 times faster than Wi-Fi 6 and 6E standards that are currently available. Wi-Fi 7 would use new technology to reduce interference from other signals. He has stated that it is still “very early in the Wi-Fi 7 standardization process” but might see a 2Q22 launch. (GizChina, Gizmo China, CN Beta)

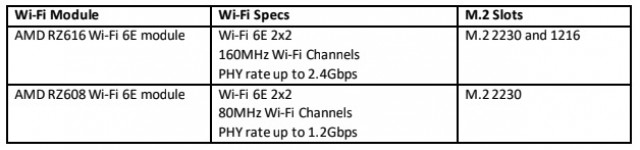

MediaTek and AMD have announced a collaboration to co-engineer industry leading Wi-Fi solutions, starting with the AMD RZ600 Series Wi-Fi 6E modules containing MediaTek’s new Filogic 330P chipset. The Filogic 330P chipset will power next-generation AMD Ryzen-series laptop and desktop PCs in 2022 and beyond, delivering fast Wi-Fi speeds with low latency and less interference from other signals. (GSM Arena, Tom’s Hardware, AMD, CN Beta)

MediaTek has announced the new MediaTek Filogic 130 and Filogic 130A system-on-chips (SoCs) which both integrate a microprocessor (MCU), AI engine, Wi-Fi 6 and Bluetooth 5.2 subsystems, and a power management unit (PMU) into a single chip. Filogic 130A also integrates an audio digital signal processor to allow device makers to easily add voice assistants and other services into their products. (Gizmo China, MediaTek, PR Newswire)

MediaTek Kompanio 1200 is first announced in 2020 as the MT8195, and it has also announced Kompanio 820 or MT8192, which is coming in 2Q21. MT8195 is only said to be coming at a later date. Kompanio 1200 is built on a 6nm process using Cortex-A78 that is aimed at the premium Chromebook segment. (Gizmo China, XDA-Developers)

MediaTek has unveiled its new Pentonic smart TV family with the introduction of the Pentonic 2000, which will power next generation flagship 8K TVs. Pentonic 2000 is the world’s first commercial TV chip manufactured using TSMC’s N7 (7nm-class) process. It is the first chip with an integrated 8K 120Hz MEMC engine. (Pocket-Lint, AP News, GizChina, PR Newswire)

Since 2H22, the problem of chip shortage has become the main theme of the semiconductor industry. Nowadays, due to rising costs and labor shortages, the problem of chip shortages is intensifying. Reinhard Ploss, CEO of German chip manufacturer Infineon, has indicated that chip supply will continue to be tight in 2022. (CN Beta, Reuters)

General Motors (GM) has confirmed that the company will not offer heated and ventilated seats, nor heated steering wheels, on a number of Chevrolet, Buick, Cadillac and GMC vehicles due to the ongoing semiconductor chip shortage. The company has stressed the change is “temporary” until the automaker’s chip supplies improve again. (Gizmo China, CNET, Auto News)

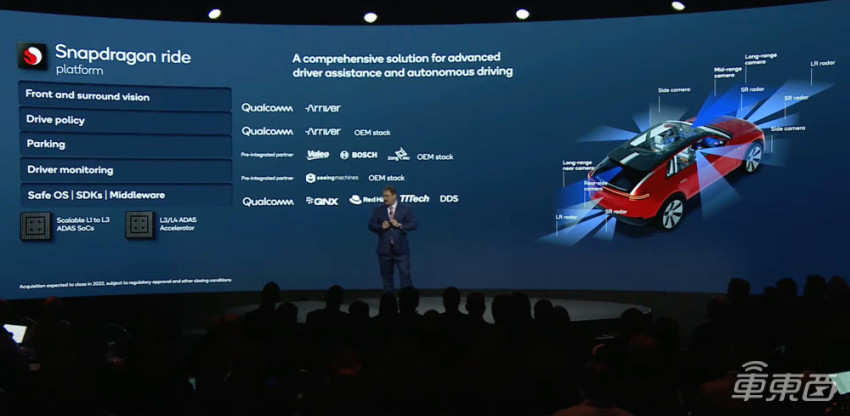

Qualcomm CEO Cristiano Amon sees the revenue potential of its chips built into each car growing more than tenfold in the future. Qualcomm already supplies 36 different car brands, from newcomers like Tesla and Nio, to stalwarts including Cadillac and Mercedes. Currently, the number of connected cars using Qualcomm’s solution has reached 200M, and cooperation has been reached with more than 25 car companies. In fiscal 2021, Qualcomm’s automotive business revenue was USD970M, accounting for less than 4% of Qualcomm’s total revenue, but its growth rate has surpassed the mobile phone business. Qualcomm predicts that in 10 years, the expected annual revenue will reach USD8B. He has mentioned that Qualcomm’s industry trends in the automotive industry are that cars are realizing cloud interconnection and assisted driving are gradually becoming large-scale, and digital chassis is becoming a core component in cars. (CN Beta, Qualcomm, Fortune)

According to Digitimes, Qualcomm will sharply cut back its modem chip supply for Apple’s iPhones starting 2023, sparking speculation that Apple will have its in-house developed modem solution ready for the iPhones slated for launch that year. The 5G modem developed by Apple for its 2023 iPhone model is said to be separate from the A-series chips and is called “A17” for the time being. It is not unreasonable to speculate that the remaining 20% provided by Qualcomm will be used for old or entry-level devices in the 2023 iPhone lineup. (Digitimes, CN Beta, Laoyaoba)

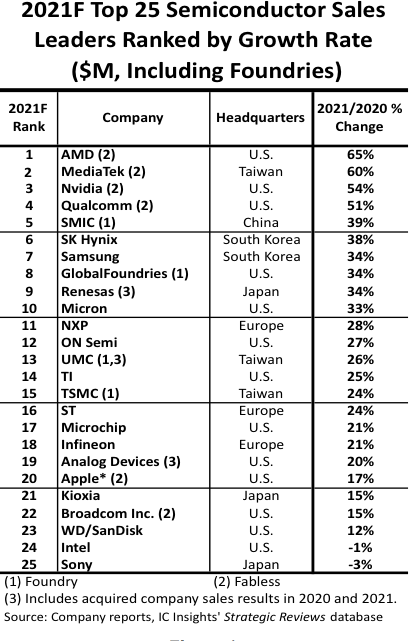

The semiconductor market is forecast to increase 23% in 2021, fueled by changing habits caused by the Covid-19 pandemic and the subsequent economic rebound from it in 2021. A strong 20% increase in semiconductor unit shipments coupled with a 3% increase in the total semiconductor average selling price (ASP) is driving this growth. An increase of 23% would be the largest gain in the global semiconductor market since 2010 when semiconductor sales soared 34% following the financial meltdown and global recession in 2008 and 2009. (Laoyaoba, IC Insights)

Ford Motor plans to increase its short- and long-term supply of semiconductor chips through a new partnership with GlobalFoundries. The tie-up could eventually result in new chip designs specifically for Ford and an increase in the domestic production and supply of chips for the overall automotive industry. Chuck Gray, Ford vice president of vehicle embedded software and controls, has indicated that this can really boost their product performance and their tech independence at the same time. (CN Beta, Euro News, The Verge, Bloomberg, CNBC, Ford)

Dutch semiconductor equipment maker ASML has said that the company sees demand for its products remaining strong in China, with around EUR2B (USD2.3B) in sales in 2021. Chief Financial Officer Roger Dassen said ASML, which is currently operating at full capacity amid the global semiconductor shortage, thinks it will have a similar level of sales in China in 2022. (Gizmo China, Economic Times)

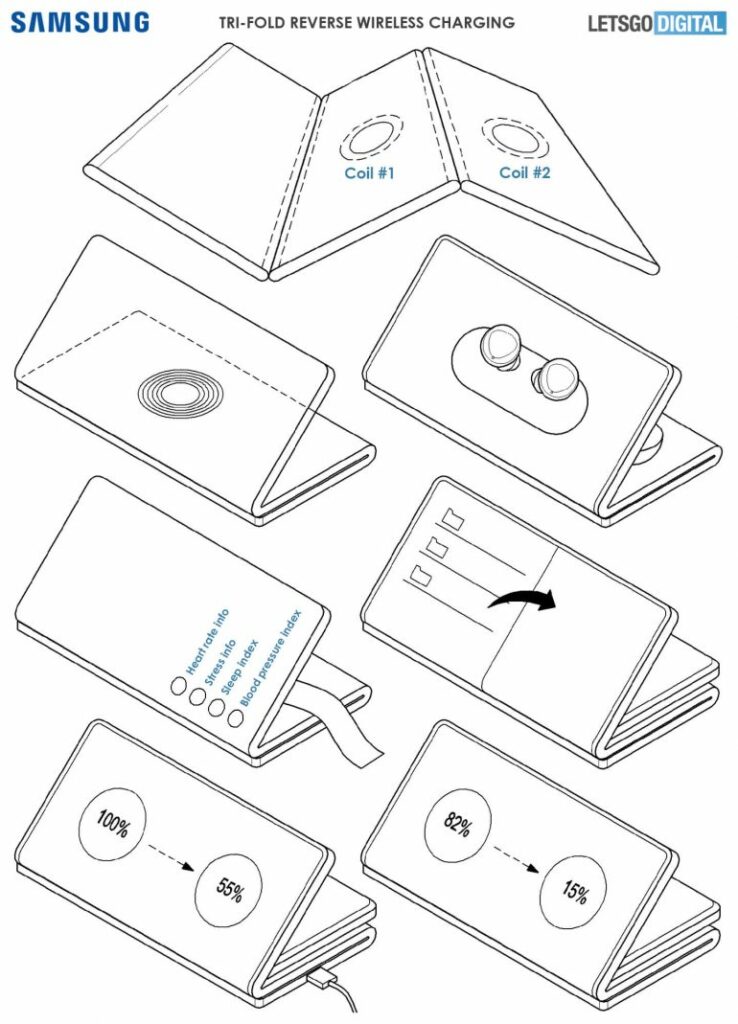

Samsung’s patent titled “Electronic device and method for sharing battery in electronic device” focuses on a Samsung dual-folding smartphone with reverse wireless charging technology. A wireless power transmission device is placed in the second and third parts of the housing. In this way, the user can put the device that needs to be charged between the foldable phone, and the charging process will start. (CN Beta, LetsGoDigital)

UBI Research has claimed that BOE is in the process of converting its 3 factories, namely B7, B11 and B12 to manufacture smartphone flexible OLED panels for Apple. UBI Research CEO Choong Hoon Yi has indicated that BOE will likely overtake LG Display as the larger OLED supplier for iPhones by 2023. BOE’s total flexible OLED panel production capacity will expand from its current 96,000 substrates per month (Gen 6 substrates) to 144,000 substrates per month by 4Q22. BOE will be able to supply 15M units of OLED panels for iPhone 12 and 3M units for iPhone 13 in 2021. This means it will account for 10% of the OLED panels used by Apple for their iPhones in 2021. (The Elec, MacRumors)

Honor is expected to announce two foldable smartphones in 1Q22. Honor has confirmed that it will launch a product called Honor Magic X, which is considered most likely to be a foldable smartphone. (Android Headlines, Sina, EET-China)

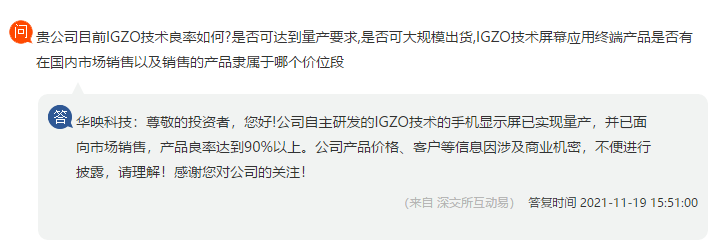

In response to the company’s current IGZO technology-related issues, CPT has responded that the company’s self-developed IGZO technology mobile phone display has been mass-produced and sold to the market, with a product yield rate of over 90%. The project plans to invest CNY2.0305M to purchase some key process equipment on the basis of the original LCD panel production line, expand production capacity, and adjust the product portfolio at the same time, so that the products tend to be miniaturized and diversified. At the same time, it also includes mass production of OLED from the experimental line. (Laoyaoba, Sohu)

Refond Optoelectronics has indicated that currently the company has begun to ship the Mini LED products. Terminal products equipped with the company’s Mini LED backlight products have been launched on the market, and more products equipped with its LED backlight will be launched in the future. Refond Optoelectronics is a national high-tech enterprise specializing in LED packaging and providing related solutions. (Laoyaoba, IT Home, NBD)

TCL CSOT has revealed 125” glass-based transparent direct display MLED. In the first 3 quarters of 2021, its R&D investment will focus on the development of new display technologies such as Mini LED, Micro LED, printed OLED, and QLED. The leading photovoltaic technology platform combining G12 large silicon wafers and shingled 3.0 is complete, and 8” and 12” semiconductor materials improvement, as well as the pre-research, collaboration and the establishment of industrial ecological alliances on the core nodes of the upstream of the industrial chain. (Laoyaoba, Sohu, WCCFTech, Tom’s Hardware, OLED Industry)

LG InnoTek has transferred ownership of 76 patents registered in South Korea and the US to display chip firm LX Semicon. Most of the patents are related to semiconductor wafer technologies. US patents include those related to semiconductor device, wafer manufacturing method and silicon carbide epiwafer. (Laoyaoba, The Elec)

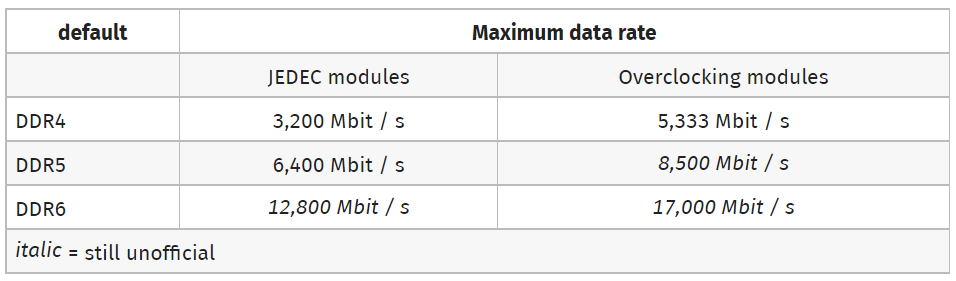

Samsung has revealed new information regarding next-gen memory technologies such as DDR6, GDDR6+, GDDR7 & HBM3. DDR5 memory is said to double the transfer rate over DDR6 and quadruple over DDR4. The JEDEC speeds are suggested around 12,800Mbps and overclocked DIMMs will be hitting 17,000Mbps. Compared to DDR5 memory, DDR6 will feature four 16-bit memory channels for a total of 64 memory banks. (CN Beta, WCCFTech, VideoCardZ)

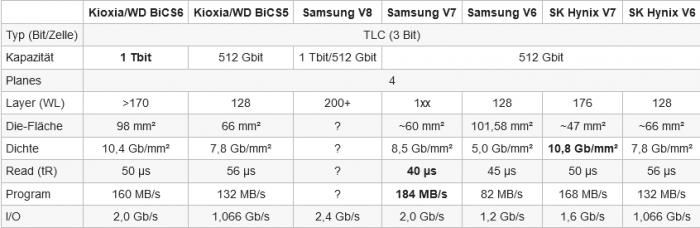

Samsung has announced the details of the eighth generation of V-NAND, with a stack of more than 200 layers and a capacity up to The thickness of 1Tbit and 512GB capacity is only 0.8mm, which can be used in mobile phones. Samsung’s V-NAND flash memory has now developed to the seventh generation of V-NAND V7, with 176 layers of stack, and the core capacity of the TLC version is 512Gbit, while the upcoming V-NAND V8 will have more than 200 layers—Samsung did not mention the specifics. (CN Beta, GamingSYS)

Google has clarified the charging capabilities of the Pixel 6 and Pixel 6 Pro. The Pixel 6 and 6 Pro drawing peak power of 21W and 23W respectively, before reducing power as the battery capacity fills. Pixel may pause charging above 80% under certain conditions, and if Adaptive Charging is enabled, Pixel can optimize charge rates for gradual overnight charging. (The Verge, Android Authority, 9to5Google, Google)

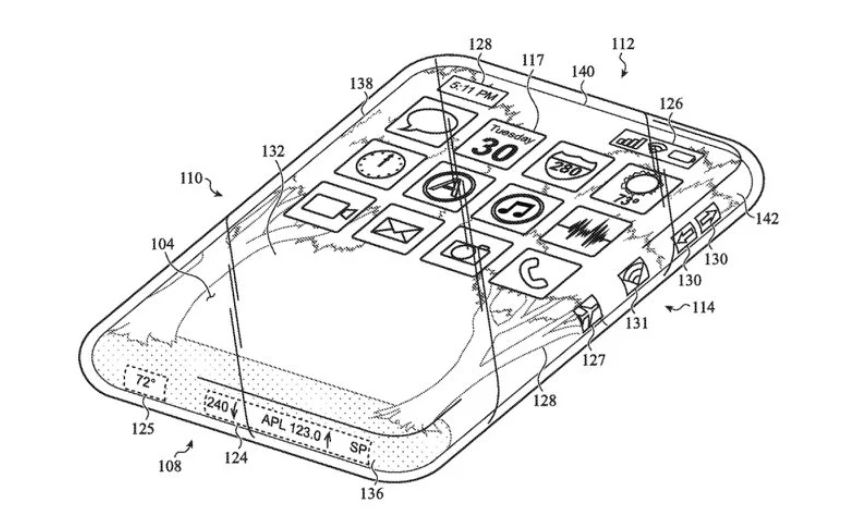

Apple’s patent titled “Electronic device with glass enclosure” focuses on electronic devices with six-sided glass enclosures and glass casings that extend all of the way around a device. Apple’s patent covers how touchscreen displays are enclosed “within the interior volume and positioned adjacent at least a portion of each of the six sides of the six-sided glass enclosure”. (MacRumors, Patently Apple)

Xiaomi has just entered a strategic partnership that will have it sell its products through on-demand delivery service, foodpanda. The company’s products will be available for purchase on the foodpanda shops in Singapore and Thailand. (Gizmo China, Business Times, Foodpanda)

OPPO A55s 5G is launched in Japan – 6.5” 1080×2400 FHD+ HiD 90Hz, Qualcomm Snapdragon 480, rear dual 13MP-2MP depth + front 8MP, 4+64GB, Android 11.0, IP68 rated, Sony Felica NFC, 4000mAh 18W, JPY32,800 (USD287). (GSM Arena, Gizmo China, OPPO)

With Facebook being renamed Meta, the company also seeks to build the metaverse. Nike and Dyson are joining the metaverse. Nike is teaming up with Roblox to create a virtual world called Nikeland. Dyson has built the Dyson Demo VR, which features visualization and simulation technology that is also used by its engineer’s. (Gizmo China, CNBC, Reuters, Dyson, Reuters)

Apple is reportedly preparing to accelerate development of its electric self-driving “Apple Car” with a new focus on a vehicle that is fully autonomous and a potential launch date in 2025. Apple has explored two potential options for its self-driving car: a model with limited autonomous abilities like current production vehicles or a version that can fully drive itself without human intervention. (Apple Insider, Bloomberg)

After the registration of Xiaomi Automobile in Sept 2021, the company has recently registered a second car company, Xiaomi Automobile Technology. Xiaomi CEO Lei Jun is the legal representative. This company has a registered capital of CNY1B (USD156.7M). (My Drivers, GizChina)

Starbucks has opened a new “pickup cafe” in New York City that uses Amazon’s “just walk out” cashierless technology. The store in midtown Manhattan is designed for customers who want to buy coffee or a snack quickly. The new store on 59th Street between Park and Lexington Avenues is one of three Starbucks Pickup with Amazon Go locations planned, with two more scheduled to open in 2022. (CN Beta, CNBC, The Verge, Starbucks)

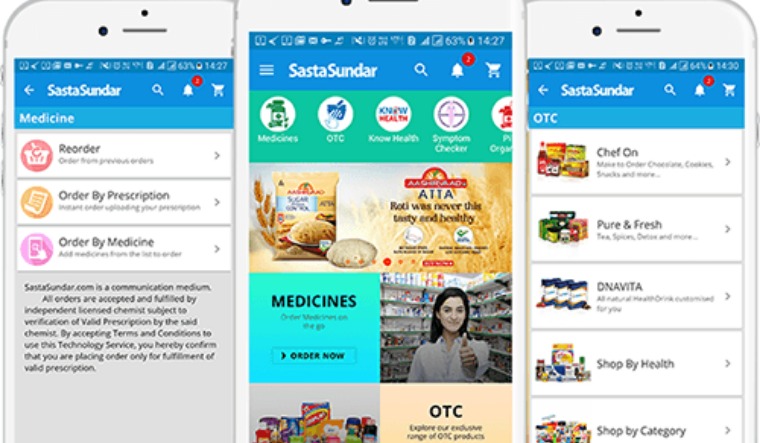

Walmart-backed Flipkart has signed a deal to acquire a majority stake in online pharmacy Sastasundar Marketplace to launch its own healthcare business amid a pandemic-triggered consolidation in India’s healthtech industry. Eight-year-old SastaSundar was last valued at USD125M in a financing round in 2019. Flipkart Health+, as the new entity will be known, will leverage the Walmart Inc.-controlled company’s pan-India network and SastaSundar’s healthtech expertise to provide consumers access to quality and affordable healthcare. (TechCrunch, Live Mint, Economic Times)

The US government has seized USD56M worth of cryptocurrency from an admitted participant in the BitConnect scam and intends to sell the coins and use the proceeds to reimburse victims. According to the Securities and Exchange Commission (SEC), BitConnect convinced people to invest a total of USD2B by telling them that it had a bot capable of generating incredibly high rates of return from crypto trading. (The Verge, Justice.gov, SEC)