11-23 #GrowingOld : Qualcomm has confirmed it will issue a rebrand to its Qualcomm Snapdragon chipsets; Apple’s talks with CATL and BYD have allegedly been mostly stalled; OPPO is reportedly planning to launch EVs in India; etc.

Qualcomm has confirmed it will issue a rebrand to its Qualcomm Snapdragon chipsets in 2021. The naming of chipsets will be changed, but the company has not disclosed the names yet. The company will also drop its own name from the branding, leaving just Snapdragon. (Android Authority, Digital Trends, CN Beta)

Samsung Electronics vice chairman Lee Jae-yong, who is on a business trip to the United States, has met with senior White House officials and U.S. Congressmen to discuss semiconductor supply chain issues. In addition, Lee met with executives of Microsoft and Amazon to discuss cooperation in such fields as semiconductors, metaverse, and artificial intelligence (AI). (CN Beta, Business Korea, WCCFtech)

Ultraleap (Ultrahaptics) has demonstrated a technology that pioneered ultrasound to replicate the sense of touch. Ultrahaptics went on to raise USD23M, began to interest car companies and later absorbed the much-hyped Leap Motion, which, it turns out, was a match made in heaven, by uniting both hand tracking and mid-air haptics. (CN Beta, TechCrunch, Ultraleap)

Visionox has stated that the company continues to introduce brand customers in different stages of development. So far, it has supplied Honor, ZTE, Nubia, Lenovo, Motorola, Xiaomi and other smartphone brands; and it has supplied OPPO, Xiaomi, Fitbit, Huami, Nubia, etc. for their wearable products. (Laoyaoba, Sohu, 163)

Shenzhen Tianma has said that the company’s self-developed HTD technology (Hybrid TFT Display) is currently in the stage of mass production verification. The company has carried out HTD layout on the flexible AMOLED production line, and will realize mass production of technologies such as advanced drive backplanes with improved low power consumption. Xiamen Tianma Display Technology’s G6 AMOLED production line (TM18) has a total investment of CNY48B. It is currently the largest flexible AMOLED monomer factory in China. (Laoyaoba, Sohu, 163)

Samsung Display’s new microsite will serve as a platform for Samsung to showcase its developments and will feature announcements and offer first looks into all the future folding OLED displays. (GSM Arena, Samsung Display)

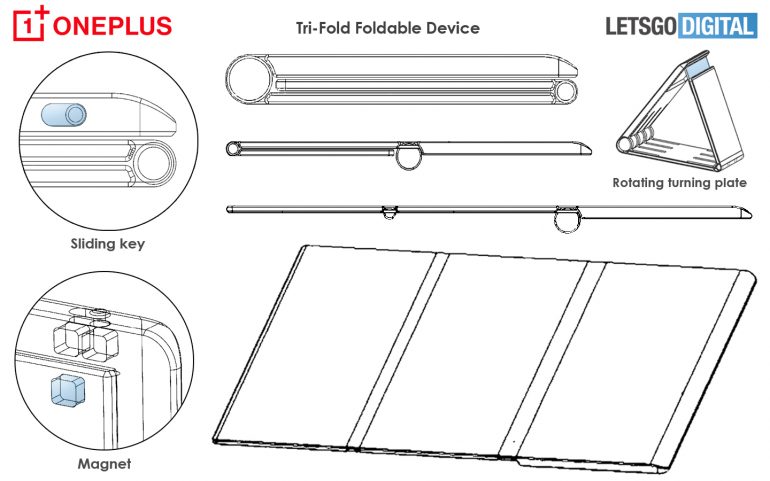

OnePlus patents a tri-fold foldable phone with a sliding key to lock the folding position. The patent shows off a hinge mechanism that allows multiple displays to fold and unfold, extending the display surface area. (Gizmo China, Pocket Now, LetsGoDigital)

The 8K ultra-high-definition image sensor chip independently developed by GPixel has passed the acceptance, with 49MP pixels. The chip has a resolution of 49MP pixels, uses a 4.3µ pixel design, has a readout noise of less than 2e-, and a single-frame dynamic range of 87dB; the chip uses the most advanced back-illuminated, stacking process, under the 16bit ADC output, The frame rate in 8K mode is up to 120fps, and the frame rate in 4K mode is up to 240fps. (CN Beta, IT Home, My Drivers, EET China)

Samsung has announced that five of its memory products achieved global recognition for successfully reducing its carbon emission, while 20 additional memory products received carbon footprint certification. Samsung’s automotive LED packages also had their carbon footprint verification, further expanding Samsung’s portfolio of eco-conscious ‘green chips’. Five Samsung memory products – HBM2E (8GB), GDDR6 (8Gb), UFS 3.1 (512GB), Portable SSD T7 (1TB), microSD EVO Select (128GB) – recently earned ‘Reducing CO2’ labels from the Carbon Trust. (CN Beta, Samsung)

Apple’s talks with China’s CATL and BYD over battery supplies for its planned electric vehicle have allegedly been mostly stalled after they refused to set up teams and build U.S. plants that would solely cater to Apple. Chinese battery makers are more advanced than rivals in the development of lithium iron phosphate (LFP) batteries which are cheaper to produce and sources have previously said Apple favors this battery technology. (My Drivers, Reuters, Clean Technica, Autoblog)

The UK government has announced that electric vehicle (EV) charging stations will be required for all new homes and businesses in the UK starting in 2022. The new measure aims to boost EV adoption in the nation by adding up to 145,000 extra charging points each year. The UK government aims to completely ban the sale of fossil fuel cars by 2030 — 10 years earlier than planned. The government previously said that it’s prepared to spend GBP500M (about USD660M) on building EV charging infrastructure in the country. (Engadget, UK Gov, BBC, Financial Times)

Federal Communications Commission (FCC) chair Jessica Rosenworcel has circulated an order among the commissioners to approve Verizon Communications’ more than USD6B proposed acquisition of TracFone Wireless. TracFone is one of the largest providers of telecommunications services under the government subsidy program known as Lifeline with around 1.7M low-income subscribers in 43 states and the District of Columbia. (Phone Arena, Fierce Wireless, Euro News)

Ericsson has announced that it is acquiring Vonage for USD6.2B. Ericsson said the purchase will help it reach its goal of expanding globally in wireless enterprise. Vonage is a cloud-based communications provider and one of its offerings is the Vonage Communications Platform (VCP). (Neowin, Ericsson)

Reliance Jio has put the Redmi Note 11T through 5G trial. It will support seven 5G bands: n1, n3, n5, n8, n28, n40 and n78 for standalone (SA) operation and n1, n3, n40, n78 in non-standalone (NSA) mode, which leverages the existing 4G infrastructure, which helps simplify the deployment of 5G. (GSM Arena, India Times)

Apple has signed a 7-year lease on a planned extension to its existing Research and Development facility in Herzliya Pituach, Israel. Apple originally opened a new research and development office in Herzliya Pituach, north of Tel Aviv, in Feb 2015. (CN Beta, Apple Insider, Globes)

Facebook, now rebranded to Meta, is delaying plans to use end-to-end encryption for Messenger and Instagram messages until at least 2023, a year later than the previous deadline promised by Facebook. Meta claims this delay is meant to give it extra time to coordinate with experts in the field of combating online abuse while also protecting user privacy. (MacRumors, The Telepgraph, GizChina)

Motorola has announced that its ThinkShield for mobile security system has acquired FIPS 140-2 certification from the U.S. National Institute of Standards and Technology (NIST) proving that the solution provides a high level of encryption to protect user data on Motorola phones. ThinkShield for mobile is a multi-layered security solution that is backed by hardware to deliver secure boot and hardware root of trust as well as elevated security features in Android. (CN Beta, Neowin, Motorola)

Motorola has launched a number of G series smartphones: G71 5G – 6.4” 1080×2400 FHD+ HiD AMOLED, Qualcomm Snapdragon 695 5G, rear tri 50MP-8MP ultrawide-2MP macro + front 16MP, 6+128 / 8+128GB, Android 11.0, rear fingerprint, 5000mAh 30W, from EUR300. G51 5G – 6.8” 1080×2400 FHD+ HiD 120Hz, Qualcomm Snapdragon 480+ 5G, rear tri 50MP-8MP ultrawide-2MP macro + front 13MP, 4+64 / 6+128GB, Android 11.0, side fingerprint, 5000mAh 10W, from EUR230. G41 – 6.4” 1080×2400 FHD+ HiD AMOLED, MediaTek Helio G85, rear tri 48MP OIS-8MP ultrawide-2MP macro + front 13MP, 4+128 / 6+128GB, Android 11.0, side fingerprint, 5000mAh 30W, from EUR250. G31 – 6.4” 1080×2400 FHD+ HiD AMOLED, MediaTek Helio G85, rear tri 48MP-8MP ultrawide-2MP macro + front 13MP, 4+64 / 4+128GB, Android 11.0, side fingerprint, 5000mAh 10W, from EUR200. (Zhihu, Pocket Lint, GSM Arena, Money Control, XDA-Developers)

Moto G200 5G is launched – 6.8” 1080×2400 FHD+ HiD 144Hz, Qualcomm Snapdragon 888+ 5G, rear tri 108MP-8MP ultrawide-2MP depth + front 16MP, 8+128 / 8+256GB, Android 11.0, side fingerprint, 5000mAh 33W, from EUR450. (GSM Arena, Neowin, Motorola)

Moto G Power (2022) is launched in US – 6.5” 720×1600 HD+ HiD 90Hz, MediaTek Helio G37, rear tri 50MP-2MP depth-2MP macro + front 8MP, 3+32 / 4+64GB, Android 11.0, side fingerprint, 5000mAh 10W, USD199 / USD249. (Money Control, Motorola, GSM Arena)

vivo Y74s 5G is launched in China – 6.58” 1080×2408 FHD+ v-notch IPS, MediaTek Dimensity 810 5G, rear dual 50MP-2MP macro + front 8MP, 8+256GB, Android 11.0, side fingerprint, 4100mAh 44W, CNY2,300 (USD360). (GSM Arena, vivo, TechAndroids)

Virtual reality (VR) startup and organizers of the largest VR event in the world HIKKY has announced that they have raised JPY6.5B (USD57M) in an initial stage of their Series A funding round. The capital raised will help expand HIKKY’s virtual reality services both domestically and abroad, as well as to strengthen their organizational foundation. (CN Beta, Forbes, Business Wire)

Samsung has introduced SmartThings Energy and now they are introducing new features that will help users to save on their monthly energy bills. The partnership with players like Copper Labs, Eyedro, and Wattbuy allows the service for whole energy home monitoring and energy switching. (Sammy Hub, Samsung, BizJournals)

Life360, the leading family safety platform, has announced that it plans to acquire Tile, the pioneer in finding technology, creating the world leader in finding and location solutions. The deal, which will provide families and individuals across all life stages with a comprehensive cross-platform solution that enables location-based finding of people, pets and things, is valued at USD205M and is expected to close in 1Q22. (The Verge, PR Newswire)

Ford CEO Jim Farley has revealed that Ford Motor and Rivian no longer plan to co-develop an electric vehicle. The two companies initially announced development of a joint vehicle when the automaker invested USD500M in Rivian in 2019. In early 2020, the two, citing the pandemic, canceled a Lincoln-branded EV. (CN Beta, CNBC, Auto News, TechCrunch, Engadget)

Ford has announced that it doubles its planned electric vehicle production capacity by 2023 to 600,000 electric vehicles per year. Ford CEO Jim Farley expects the Blue Oval to become America’s second-largest producer of electric vehicles (behind Tesla) in just 2 years, and that that does not take into account Ford’s planned Blue Oval City EV hub in Tennessee. (CN Beta, CNET, Auto News, Electrek)

General Motors (GM) BrightDrop has scored a second customer for its EV410 electric delivery vans: fleet management company Merchants Fleet. It has placed an order for 5,400 of the mid-sized electric vans. The new order is in addition to Merchants’ previous commitment to purchase 12,600 of BrightDrop’s flagship EV600 van. The total order, which now stands at 18,000 vehicles, is BrightDrop’s largest client order to date. (TechCrunch, Detroit News, Auto Week)

OPPO is reportedly planning to launch electric vehicles (EVs) in India. OPPO’s EVs launch is slated between 2023-end and early 2024. OPPO Carlink, released in 2020, currently has more than 70 cooperative manufacturers, covering auto manufacturers, two-wheel electric vehicle manufacturers, Tier1 manufacturers, and travel service providers. OPPO’s plan is to land 15M + vehicles in 2022. (CN Beta, GizChina, 91Mobiles)

Tesla is planning to spend more than USD1B on its new vehicle factory in Austin, Texas, and plans to complete construction by the end of 2021, public filings with a Texas state agency showed. Tesla plans to start limited production of its Model Y mid-size SUV in 2021, and high-volume production in 2022. (CN Beta, Teslarati, Reuters)

General Motors (GM) has bought a 25% stake in Pure Watercraft, valuing the electric boat startup at USD600M. Pure Watercraft makes all-electric outboard motor systems, which it calls Pure Outboard, that can be used as a drop-in replacement for boats that would use a 25-50 horsepower gas-powered motor. (CN Beta, TechCrunch, Reuters)

Wedbush Securities managing director and senior equity analyst Dan Ives has indicated that Apple’s project to build an electric car with full autonomous capabilities has a “75%, 80% plus chance” of becoming a reality. The project, referred to as “Titan”, would launch Apple into the USD10T-a-year global mobility market. The industry, which now accounts for 13% of global GDP, has grown rapidly for the past four decades at a rate of 3.8% a year. (CN Beta, Yahoo, Seeking Alpha, Barron’s)

Google’s parent company Alphabet has announced that its Every Day Robots Project committed to bringing robots to the office to perform daily tasks. The robot is provided by X-Alphabet’s moonshot factory. X-Alphabet’s team is building robots to learn office tasks, including wiping tables, sorting garbage, opening doors, and arranging chairs in conference rooms. (GizChina, The Verge, X-Alphabet, 9to5Google)

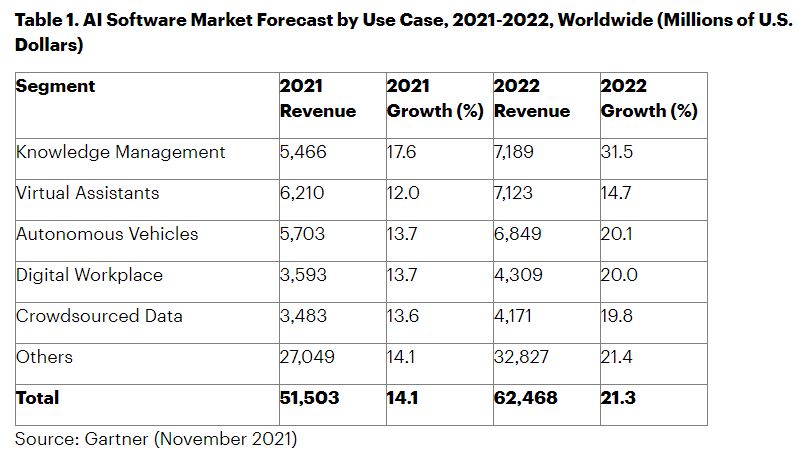

Worldwide artificial intelligence (AI) software revenue is forecast to total USD62.5B in 2022, an increase of 21.3% from 2021, according to a new forecast from Gartner. Gartner forecasts that the top five use case categories for AI software spending in 2022 will be knowledge management, virtual assistants, autonomous vehicles, digital workplace and crowdsourced data. (Neowin, Gartner)