12-17 #Angel : TSMC has unveiled N4X pecially tailored for use in high-performance computing (HPC); Tianma has signed an agreement with Xiaomi; India has approved a USD10B (roughly INR76,090 crore) incentive plan to attract semiconductor and display manufacturers; etc.

MediaTek has official unveiled Dimensity 8000 series 5G SoC, launching in 2022. Dimensity 8000 adopts TSMC 5nm process, CPU architecture is 4×2.75GHz A78+4×2.0GHz A55, GPU integrates Mali-G510 MC6, supports 2K 120Hz or 1080P 168Hz resolution, supports LPDDR5 + UFS 3.1 storage combination. Both Redmi and realme have product planning for Dimensity 8000. (My Drivers, CN Beta, Gizmo China)

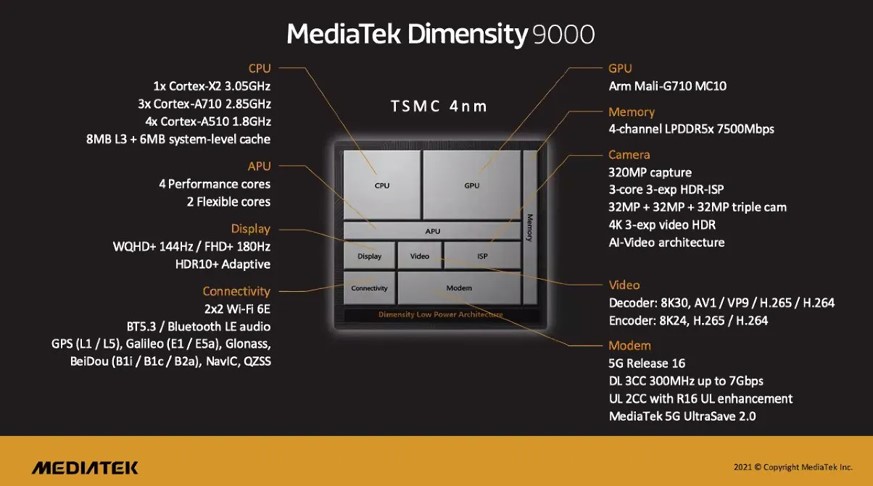

MediaTek has announced the Dimensity 9000, adopting a new generation of ARMv9 architecture, including one Arm Cortex-X2 super core with a main frequency of up to 3.05GHz, three Arm Cortex-A710 cores with a main frequency of up to 2.85GHz and four Arm Cortex-A510 with a main frequency of 1.8GHz Energy-efficient core, built-in 14MB large-capacity cache combination. Devices using the Dimensity 9000 flagship 5G mobile platform are expected to be launched in 1Q22, OPPO Find X’s next-generation flagship will be launched, and Redmi K50 and vivo will be the first to be equipped. (Android Central, CN Beta, My Drivers, Gizmo China)

Taiwan Semiconductor Manufacturing Co (TSMC) has revealed an advanced technology specially tailored for use in high-performance computing (HPC) devices is scheduled to start production on a trial basis in 1H23. According to TSMC, the N4X technology represents ultimate performance and maximum clock frequencies in the advanced 5nm family. The “X” designation is reserved for TSMC technologies that are developed specifically for HPC products. Compared with predecessor N5 processes, the N4X technology will offer a performance boost of up to 15%. (CN Beta, TSMC, Focus Taiwan, TechNews)

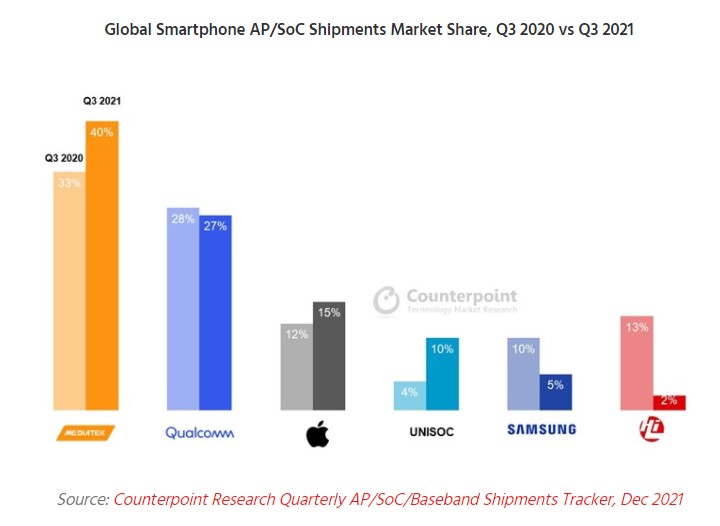

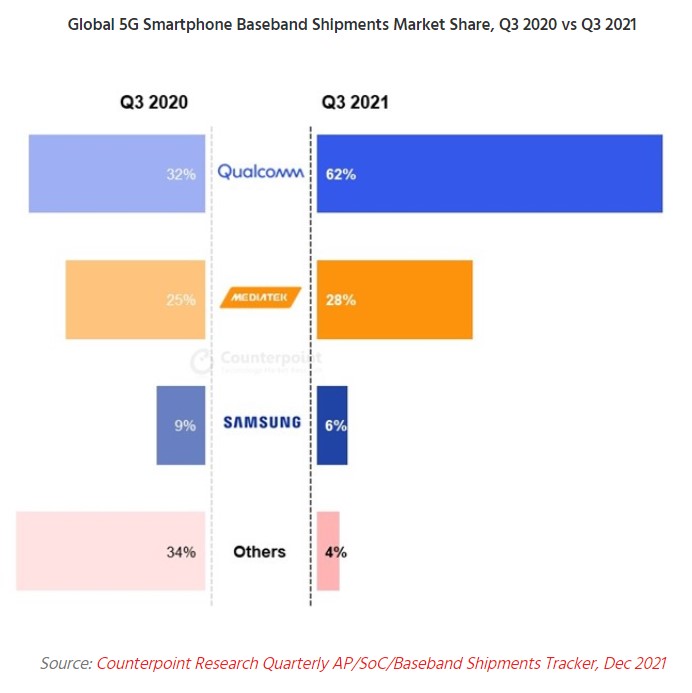

According to Counterpoint Research, global smartphone AP (Application Processor) / SoC (System on Chip) shipments grew 6% YoY in 3Q21. MediaTek led the smartphone SoC market with a 40% share, driven by a competitive 5G SoC and high demand for the 4G SoC. The key to Qualcomm’s revenue growth was its ability to dual-source manufacturing of key components, namely the Snapdragon 800 series SoCs and its premium 5G modem. UNISOC shipment growth continued for the third consecutive quarter in 3Q21. Its market share entered double digits during the quarter at 10%. (Counterpoint Research, CN Beta)

India has approved a USD10B (roughly INR76,090 crore) incentive plan to attract semiconductor and display manufacturers, according to the country’s technology minister Ashwini Vaishnaw. Under the plan, the government will extend fiscal support of up to 50% of a project’s cost to eligible display and semiconductor fabricators. Israel’s Tower Semiconductor, Taiwan’s Foxconn and a consortium from Singapore have reportedly shown interest in setting up chip factories in India while Vedanta Group was keen to set up a display plant. The government has also approved an incentive plan to support 100 local firms working on integrated circuit and chipset designs. (CN Beta, CN Beta, India Times, India Times, Indian Express, Business World)

Intel CEO Pat Gelsinger’s visit to Taiwan in Dec 2021 is treated as an evidence the company is looking to finalize orders for Taiwan Semiconductor Manufacturing Company’s (TSMC) 3nm process. A more likely explanation for his visit is that Gelsinger is here to interfere with TSMC’s corporate strategy. (Gizmo China, Taiwan News, CTEE, ETToday)

Apple reportedly hiring engineers for a new office in Southern California to develop wireless chips that could eventually replace components supplied by Broadcom and Skyworks Solutions. The company is seeking a few dozen people to develop wireless chips in Irvine, where Broadcom, Skyworks and other companies have offices. Recent job listings show that Apple wants employees with experience in modem chips and other wireless semiconductors. (Bloomberg, Gizmo China, MoneyDJ)

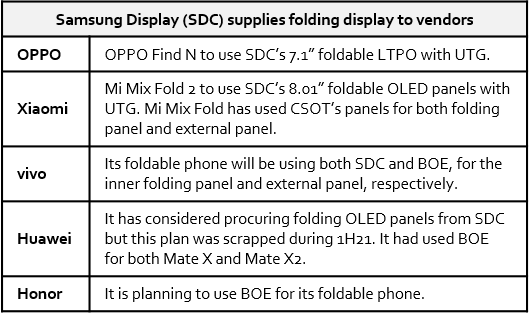

OPPO’s first foldable phone Find N will reportedly use Samsung Display’s foldable OLED panel. Samsung Display has supplied the 7.1” folding LTPO OLED panel to OPPO. The external 5.45” flat OLED panel used on Find N is provided by BOE. Samsung Display used ultra-thin glass, which it calls UTG, as the cover window for the folding OLED panel it provided. (CN Beta, The Elec)

Honor’s first foldable smartphone will be official in Jan 2022. The Honor foldable smartphone will come with BOE and Visionox display panels. In addition, this first foldable smartphone from Honor will use an inward folding solution. (GizChina, Weibo)

Tianma has signed an agreement with Xiaomi at the Wuhan Tianma Gen-6 Industrial Base, pertaining to cooperation between the two sides to build a joint laboratory for the study of new display technology. The joint facility will feature independent labs. (Gizmo China, Pandaily, Tianma)

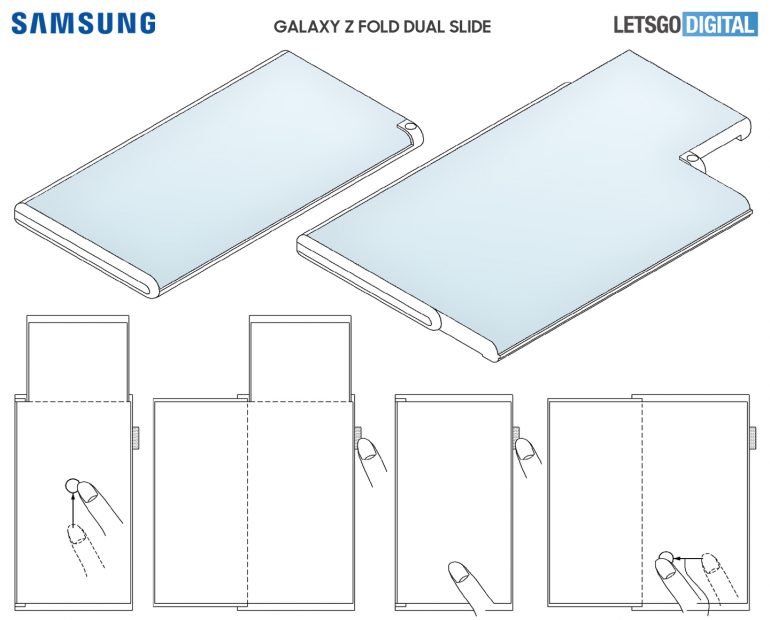

Samsung has filed a patent for a device, dubbed Galaxy Z Fold Dual Slide, with two secondary sliding displays. Firstly, the display will slide out horizontally extending the display a few inches. Then, the display will also extend vertically. (Android Headlines, LetsGoDigital)

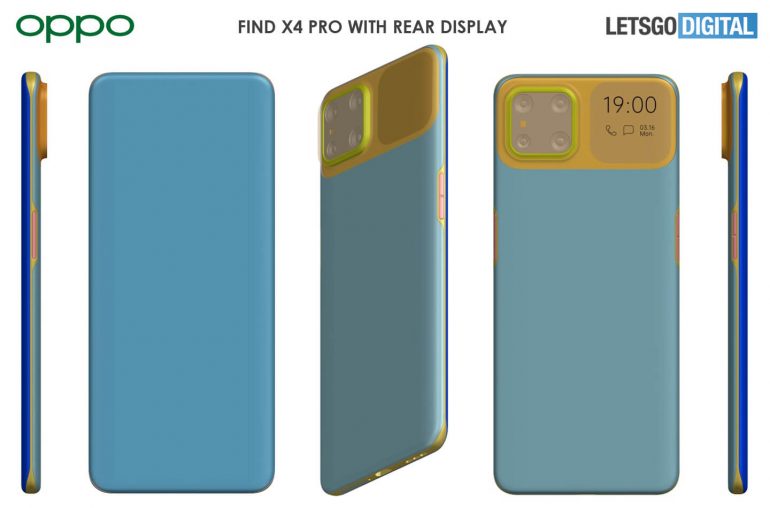

OPPO has filed a patent for a device with camera under display and a small rear display next to the main camera. The patent also reveals the screen is curved from all four sides. The rear camera island is square with four shooters inside. (GSM Arena, LetsGoDigital)

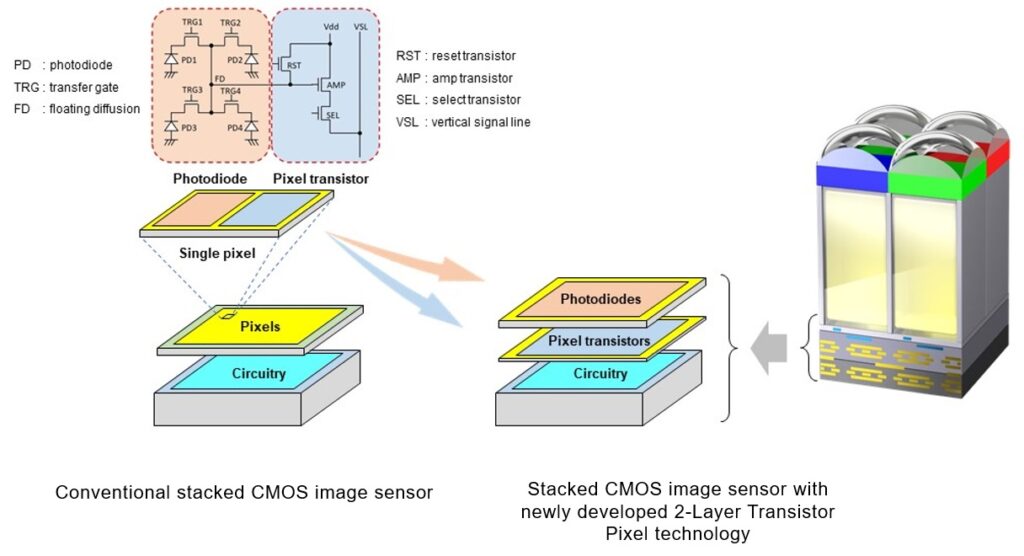

Sony Semiconductor Solutions has succeeded in developing the world’s first stacked CMOS image sensor technology with 2-Layer Transistor Pixel. Whereas conventional CMOS image sensors’ photodiodes and pixel transistors occupy the same substrate, Sony’s new technology separates photodiodes and pixel transistors on different substrate layers. This new architecture approximately doubles saturation signal level relative to conventional image sensors, widens dynamic range and reduces noise, thereby substantially improving imaging properties. (Android Authority, Sony, IT Home)

Arcsoft has stated that its intelligent driving solution has been updated to the 6th generation. With safe driving, smart driving, and unmanned driving becoming the future development trend, more and more cameras will be mounted on a single vehicle. All cameras will use software and hardware solutions centered on visual intelligence algorithms. Arcsoft’s goal in the field of smart driving is to become a one-stop visual algorithm solution provider. (Laoyaoba, 163, East Money)

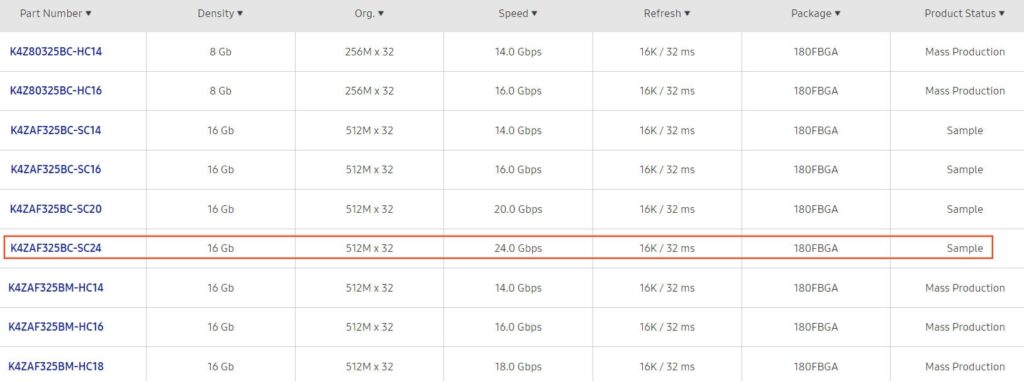

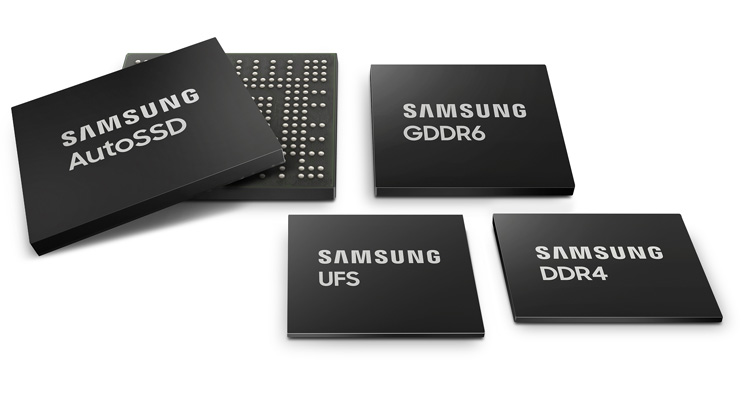

Samsung has started sampling its new GDDR6 memory chips that are faster than even GDDR6X SGRAM devices. Samsung is sampling GDDR6 memory chips featuring a 16Gb capacity and rated to operate at 20Gbps and 24Gbps data transfer rates. The K4ZAF325BC-SC20 and K4ZAF325BC-SC2 memory devices are listed in Samsung’s product catalog, so these are not experimental chips but products that should be available commercially. Samsung’s 16Gb 20Gbps and 24Gbps GDDR6 SGRAM chips come in 180-pin FBGA packages. (My Drivers, CN Beta, WCCFTech, Tom’s Hardware)

SK Hynix has announced that it has shipped samples of 24 Gigabit (Gb) DDR5 DRAM with the industry’s largest density for a single DRAM chip. The new 24Gb DDR5 is produced with the cutting-edge 1anm technology that utilizes EUV process. It has a density of 24Gb per chip, which is up from the existing density of 16Gb in 1ynm DDR5, with improved production efficiency and increased speed by up to 33%. The initial offerings on this product are set to be 48 Gigabyte (GB) and 96GB modules for supply to cloud data centers. (CN Beta, PR Newswire, AnandTech, Korea Herald)

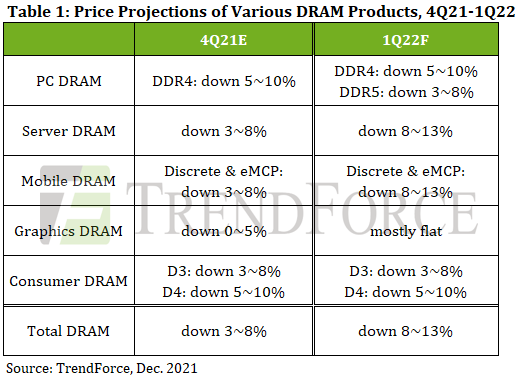

Regarding the shipment of various end products in 4Q21, the quarterly shipment of notebook computers is expected to remain about the same as 3Q21 figures, as prior component gaps were partially resolved during the quarter, according to TrendForce. As such, since PC OEMs’ DRAM inventory has lowered by several weeks, TrendForce has also further reduced its forecast of DRAM price drops for 1Q22. Even so, the overall demand for DRAM will still enter a cyclical downturn in 1Q22, during which DRAM ASP will also maintain a downward trajectory with an 8-13% QoQ decline. Whether this price drop will subside going forward will depend on how well suppliers manage their inventory pressure and how DRAM purchasers anticipate further price changes. (Digital Trends, TrendForce, TrendForce)

Samsung has announced new memory solutions that will enable the next-generation infotainment and autonomous driving systems. The new lineup includes a 256GB AutoSSD, 2GB GDDR6 DRAM and 2GB DDR4 DRAM, and 128GB UFS storage. The 256GB AutoSSD is a PCIe Gen3 NVMe ball grid array (BGA)-based SSD that features an in-house controller and firmware for optimized performance. (Sammy Hub, Samsung, Neowin)

Electric scooter maker Gogoro has codeveloped a smart parking bollard that features battery swapping technology. The solution is developed under the Powered by Gogoro Network program and features lighting systems firm EcoLumina Technologies’ TL Intelligent Parking Bollard system. The bollard has entered mass production. EcoLumina plans to install 500 intelligent bollards in New Taipei City by the end of this year, Gogoro said, adding that battery swapping would be offered from early 2022. (CN Beta, Taiwan News, Taipei News)

Proterra, an American commercial electric vehicle company that produces transit buses and electric charging systems, invests at least USD76M opening up its third battery factory in Greer, South Carolina. The factory should begin production in 2H22 with “multiple gigawatt hours of annual battery system production capacity”. (TechCrunch, Electrek)

Ford Pro Charging offers enterprise-grade charge management software, hardware and services to support commercial customers running a fleet of electric vehicles. Ford Pro Charging lets customers switch between charging at depots, employee homes, and public charging stations. Ford’s goal is to provide integrated end-to-end charging solutions and support all backed by Ford Pro to give customers peace of mind while helping them optimize energy costs and uptime. Ford Pro expects annual U.S. industry sales of full-size all-electric trucks and vans in the commercial and government segments to be over 300K by 2030. (The Verge, Electrek, Ford)

TeleTalk, a telecom operator in Bangladesh together with Huawei to officially launch 5G services in Dhaka, the capital of Bangladesh. Huawei has said that in the initial stage, 5G networks will be deployed in places such as the Capitol, the Prime Minister’s Office, and the National Monument, and will expand coverage in 2022. (Gizmo China, Huawei, Huawei Update)

According to J.P. Morgan analyst Samik Chatterjee, Apple’s rumored iPhone SE 2022 with 5G support may attract nearly 1.4B low to mid-range Android phone users and about 300M older iPhone model users. Apple’s trade-in program for non-iPhone users could lead to an average starting price range of USD269-399 for the 5G iPhone SE. JP Morgan estimates for fiscal 2022 iPhone SE sales to 30M units and annual iPhone shipments expectations to 250M units. (Phone Arena, Reuters, Gizmo China)

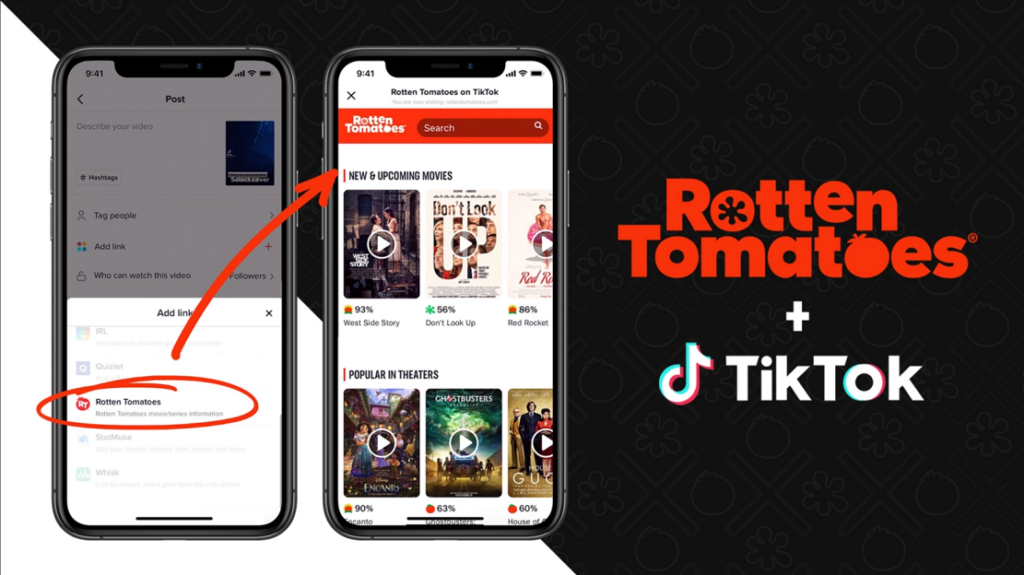

Rotten Tomatoes has announced that it is partnering with TikTok to launch a TikTok Jump that will allow users to link to movies and TV trailers, ratings, reviews, information on where to watch, clips, cast information and more. TikTok Jump is the short-form video app’s third-party integration tool that aims to deepen its relationships with third-party partners. (CN Beta, TechCrunch)

It is rumored that Samsung’s orders for mobile phone ODM manufacturers in 2022 with volume reaching 60M-70M units. Wingtech and Huaqin will benefit. Wingtech will take the majority, with about 40M units. In 2018 and 2019, Samsung successively closed its phone manufacturing plants in Tianjin and Huizhou, China, and transferred its phone production to India and Vietnam; at the same time, Samsung gradually released ODM orders from fully self-developed and self-produced products to ODM. The ODM model was adopted on a larger scale in 2010, and the ODM orders released is further expanded in 2020. (Laoyaoba, Sina, 163)

OPPO Find N is announced in China – 7.1” 1792×1920 HiD Foldable LTPO AMOLED 120Hz + 5.49” AMOLED cover display, Qualcomm Snapdragon 888 5G, rear tri 50MP 1.0µm OIS-13MP telephoto 2x optical zoom-1600MP ultrawide + front 32MP + cover 32MP, 8+256 / 12+512GB, Android 11.0, side fingerprint, 4500mAh 33W, 15W fast wireless charging, 10W reverse charging, CNY7,699 (USD1,200) / CNY8,999 (USD1,410). (Android Central, Gizmo China, GSM Arena)

Honor Play 30 Plus is announced in China – 6.74” 720×1600 HD+ u-notch 90Hz, MediaTek Dimensity 700 5G, rear dual 13MP-2MP depth + front 5MP, 4+128 / 8+128GB, Android 11.0 (no GMS), side fingerprint, 5000mAh 22.5W, CNY1,099 (USD173) / CNY1,499 (USD235). (CN Beta, GSM Arena)

Honor X30 is announced in China – 6.81” 1080×2388 FHD+ HiD 120Hz, Qualcomm Snapdragon 695 5G, rear tri 48MP-2MP macro-2MP depth + front 16MP, 6+128 / 12+256GB, Android 11.0 (no GMS), side fingerprint, 4800mAh 66W, CNY1,499 (USD235) / CNY2,299 (USD361). (My Drivers, GSM Arena)

Tecno Spark 8T is launched in India – 6.6” 1080×2408 FHD+ v-notch, MediaTek Helio G35, rear dual 50MP-AI lens + front 8MP, 4+64GB, Android 11.0, rear fingerprint, 5000mAh, INR8,999 (USD118). (Gizmo China, India Times, 91Mobiles)

iFixit has announced it will collaborate with Microsoft to manufacture and sell official repair tools for some Surface models. The partnership will kick off with a display debonder, a display rebonder, and a battery cover. Motorola has used iFixit as an official source for its OEM smartphone parts, and so has HTC with its Vive. (Gizmo China, Engadget, iFixit, The Verge)

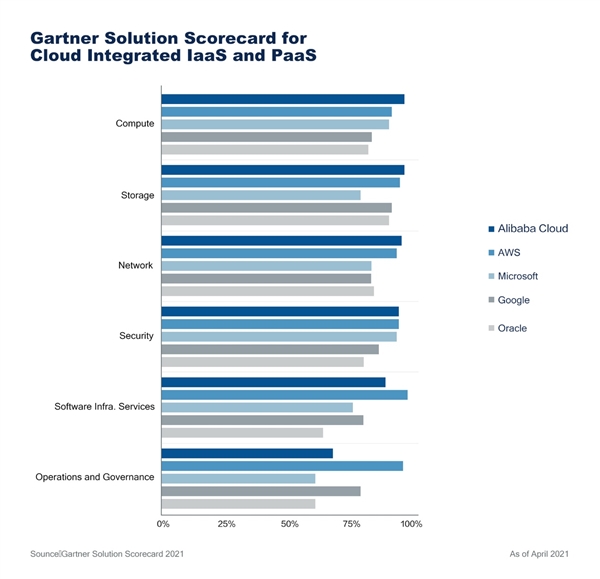

Gartner has released the latest report to comprehensively assess the overall capacity of the world‘s top cloud manufacturers. Among them, Ali Cloud (Aliyun) IaaS infrastructure ability is recognized as number 1. The highest score in the four core evaluation of calculation, storage, network, and security, which is also the first international manufacturer of Amazon, Microsoft, Google, etc. (CN Beta, My Drivers)

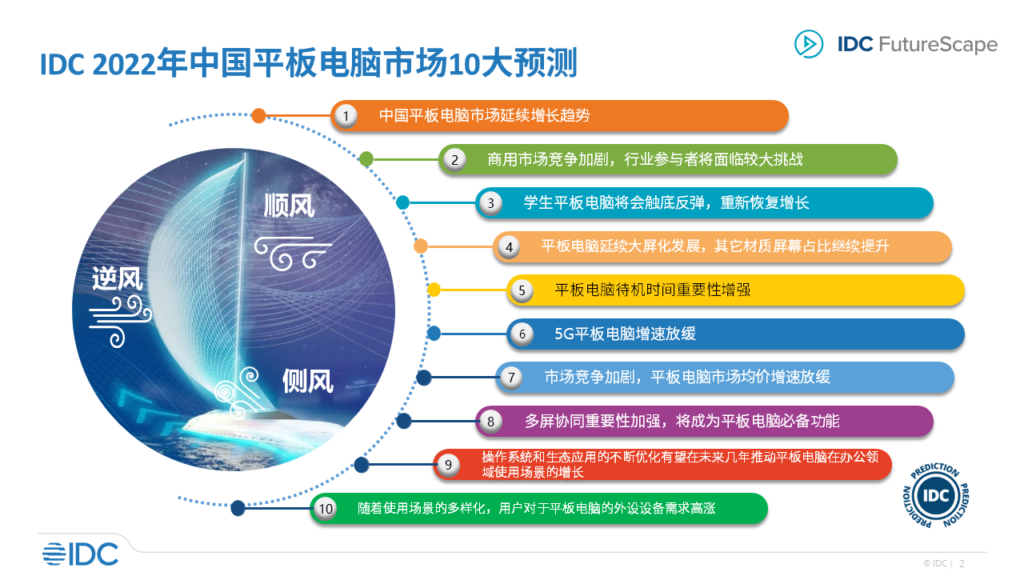

According to IDC, in 2021, the Chinese tablet computer market will create the largest YoY growth rate since 2013. The prediction shows that China’s tablet market will have an annual growth rate of 22.4%. The overall shipment volume is approximately 28.6M units. IDC claims that in 2022, China’s tablet market will have some positives. The tablet market has not really been lucrative even in China. However, since the advent of the pandemic, there has been increasing demand for larger display devices. (Laoyaoba, GizChina, IDC)

Samsung Galaxy Tab A8 is launched in UK – 10.5” 1920×1200 TFT, Unisoc Tiger T618, rear 8MP + front 5MP, 3+32 / 4+64 / 4+128GB, Android 11.0, side fingerprint, 7040mAh 15W, starting from GBP219. (Pocket-Lint, GSM Arena, Samsung)

Nike has filed 7 trademark applications as it prepares to enter the metaverse. As part of the application, the company indicated its intent to make and sell virtual branded sneakers and apparel. Nikehas acquired a startup called RTFKT, which is founded in early 2020. It designs and creates what it calls “Metaverse-ready sneakers and collectibles”, all digital goods that could be purchased with real money. (Engadget, CNBC, The Verge)

The worldwide market for smart home devices grew 10.3% year over year in 3Q21 with more than 221.8M device shipments, according to IDC. Despite persistent supply chain disruptions, unemployment, and an uneven economic recovery, consumer demand remained high for smart home devices like smart TVs, smart speakers, and other devices. (IDC)

Self-driving trucks developer TuSimple has reached a deal to integrate its autonomous vehicle technology into DHL Supply Chain’s operations. DHL has reserved 100 autonomous trucks that are being co-developed by TuSimple and Navistar. The agreement with DHL pushes TuSimple’s total reservations order to 6,875 trucks, the first of which will be delivered in 2024. (TechCrunch, PR Newswire, Benzinga)

Hellobike has announced the launch of its self-driving car rental business. The user opens the app, touch Rent a Car, selects the time and location of the rental car, and can realize one-click car rental. The most convenient is that the platform also provides pick-up and drop-off service. (CN Beta, IT Home, Sohu)

Motional and Uber have announced a partnership to launch autonomous deliveries for Uber customers, starting in Santa Monica in early 2022. Motional’s all-electric vehicles will conduct deliveries of a curated set of meal kits from select restaurants on Uber Eats. (Engadget, Motional)

Rivian Automotive has announced it plans to spend USD5B to build its second factory, in Georgia. Rivian’s new Georgia plant, east of Atlanta in Morgan and Walton counties, will have the capacity to produce up to 400,000 vehicles a year. The company has also said it would expand its Illinois plant to produce up to 200,000 vehicles a year, up from its capacity of 150,000 now. The company’s goal of having this facility producing salable vehicles by 2024. (CN Beta, WGLT, NY Times, Rivian)

BMW Group will see in 2022 the opening of its 3 new or upgraded plants in Shenyang and Zhangjiagang and the production of the second BMW 3 Series all-electric vehicle in Shenyang, further enhancing China’s position as one of BMW’s 3 global production bases for NEVs. In 2022, BMW will present five all-electric models to Chinese customers, including the BMW iX, the BMW i4 and the all-electric BMW 3 Series produced in Shenyang. (My Drivers, CN Beta, SCMP, CNEVPost)

Hyundai Motor Group has unveiled its Mobile Eccentric Droid, or MobED, a small mobility platform using cutting-edge robotics technologies. MobED has a flat rectangular body with four wheels that can each move independently so its body can remain stable even on slopes and bumpy roads. (Digital Trends, Korea Herald, PR Newswire, Hyundai)

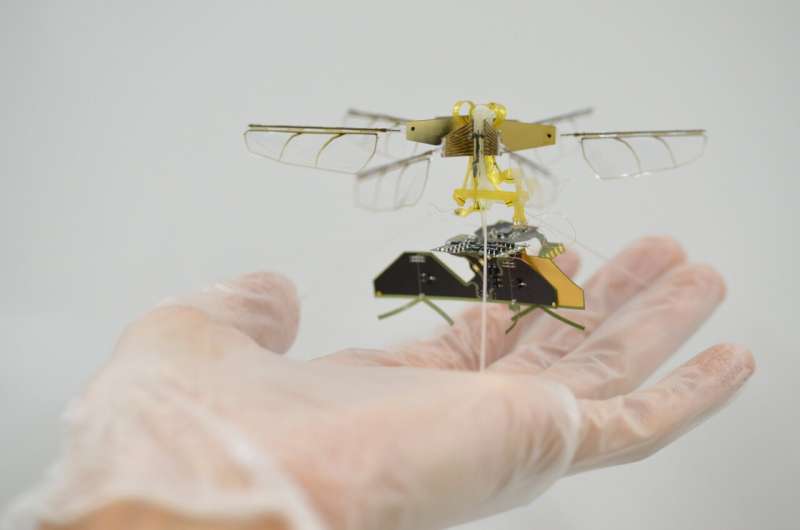

Toyota Central R&D Labs have recently created an insect-scale aerial robot with flapping wings, powered using wireless radiofrequency technology. This robot is based on a radiofrequency power receiver with a remarkable power-to-weight density of 4,900 W kg-1. (CN Beta, Nature, Tech Xplore)

Under the direction of the President Biden administration, a group of 8 companies based in China will be added to the Treasury’s “Chinese military-industrial complex companies” blacklist. The measure will effectively prevent U.S. investors from investing in the companies, alongside the existing 60 Chinese firms that already exist on the blacklist. Drone maker DJI, AI company Megvii, super computer manufacturer Dawning Information Industry, facial recognition firm CloudWalk Technology, cybersecurity firm Xiamen Meiya Pico, AI company YiTu Technology, cloud computing service Leon Technology, and surveillance system producer NetPosa are among the 8 companies. (Apple Insider, Financial Times, Reuters, UDN, DW News)

Canada is still prepared to impose a tax on corporations providing digital services. Canada unveiled the proposed measure in the Apr budget, saying it would stay in place until major nations come up with a coordinated approach on taxing digital giants such as Alphabet’s Google and Facebook. The Organization for Economic Cooperation and Development (OECD) has since agreed a common approach to ensure such firms pay their share of taxes, but a treaty to enforce this has yet to be implemented. (CN Beta, Reuters, NASDAQ)

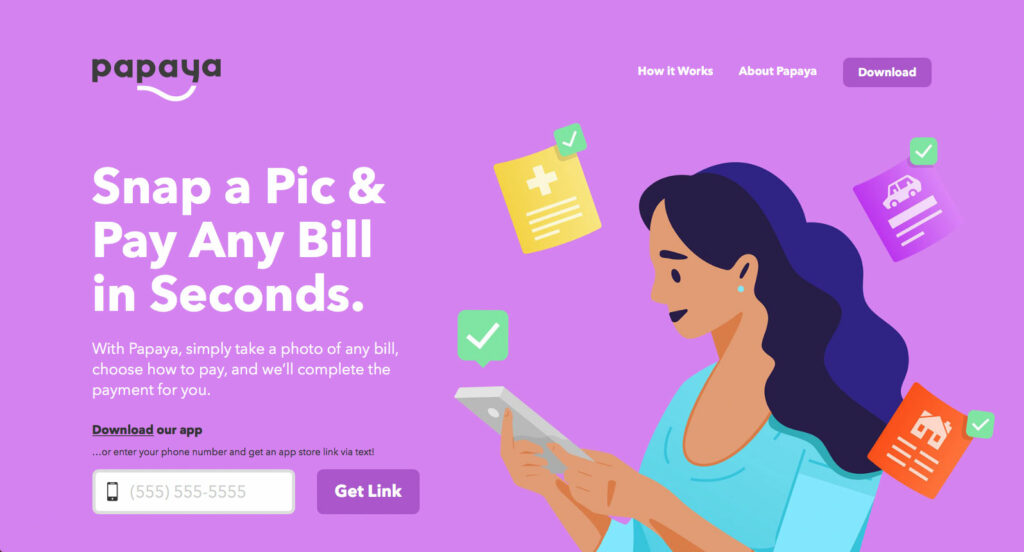

Papaya aims to facilitate payments for businesses by integrating with partners’ billing processes through embedded widget technologies and paper statements. Using Papaya’s mobile app, consumers can pay a bill by taking a photo of it, choosing a payment method, and sending it through the Papaya app. Papaya recognizes the bill using computer vision and automatically routes payments to the appropriate party. In the event that Papaya cannot find an online payment option, the company will mail a check on the consumer’s behalf. Papaya has raised USD50M in a series B funding, which brings Papaya’s total capital raised to more than USD65M. (VentureBeat, TechCrunch, Finextra)

Blockchain indexing firm The Graph awards USD48M grant to The Guild. The Graph indexes web3 blockchain data and makes it securely accessible to developers and users via a decentralized marketplace where queries are sent, prices for processing queries are negotiated, and micropayments are transferred. The firm already offers support to index data from 25 different blockchain protocols including Ethereum, NEAR, Arbitrium, Optimism, Polygon, Avalanche, Celo, Fantom, Moonbeam, IPFS, and PoA. (VentureBeat, The Graph, Coin Telegraph)

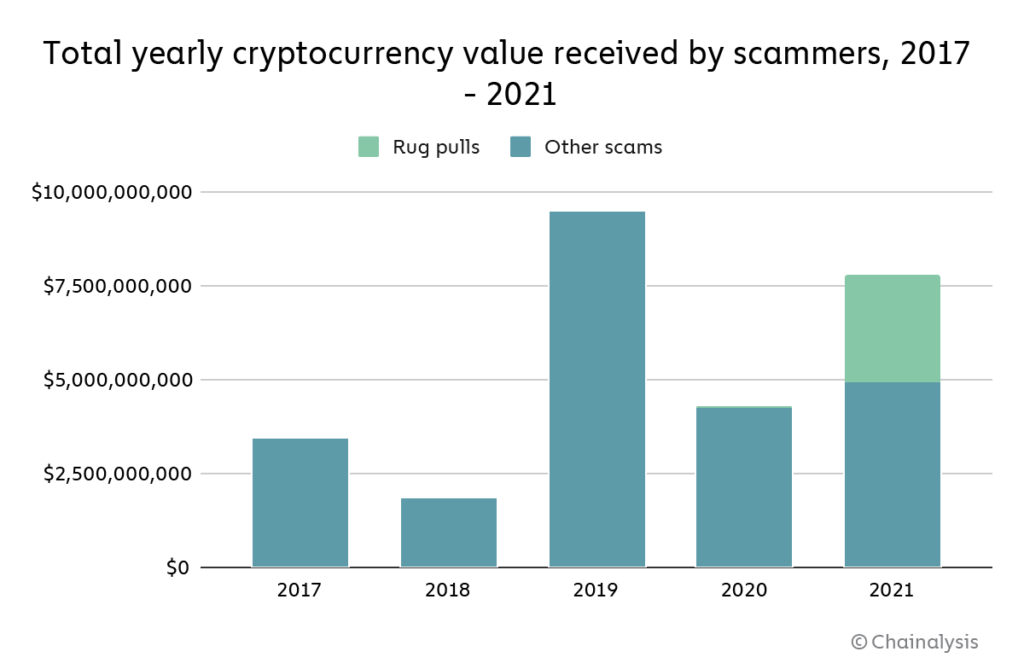

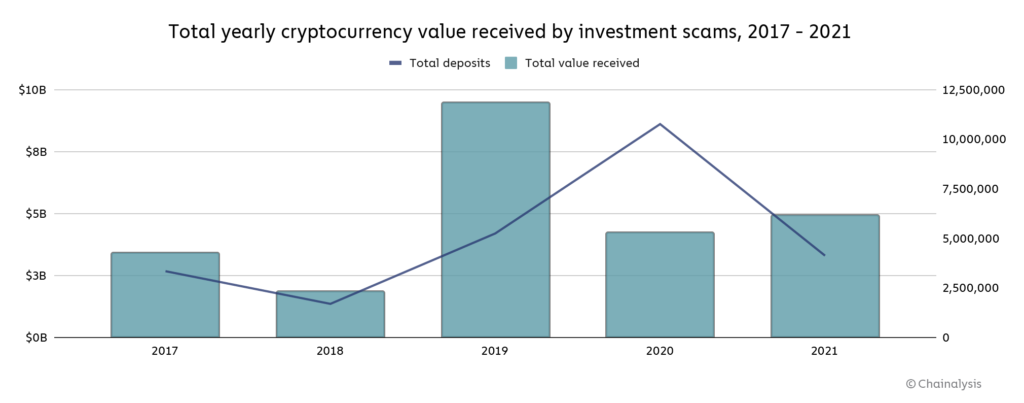

According to Chainalysis, scams were once again the largest form of cryptocurrency-based crime by transaction volume, with over USD7.7B worth of cryptocurrency taken from victims worldwide. That represents a rise of 81% compared to 2020, a year in which scamming activity dropped significantly compared to 2019, in large part due to the absence of any large-scale Ponzi schemes. That changed in 2021 with Finiko, a Ponzi scheme primarily targeting Russian speakers throughout Eastern Europe, netting more than USD1.1B from victims. Another change that contributed to 2021’s increase in scam revenue: the emergence of rug pulls, a relatively new scam type particularly common in the DeFi ecosystem. (CN Beta, Chainalysis)