12-20 #Sweat : MediaTek will be launching the first 5G mmWave mobile SoC in 2022; Samsung will manufacture Tesla’s next-generation hardware 4 (HW 4.0) chip; Google has announced Android 12 (Go edition) for the entry level smartphones; etc.

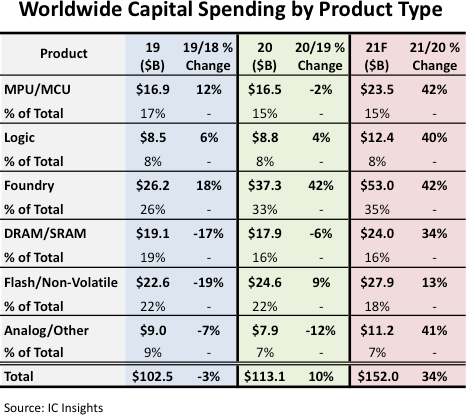

According to IC Insights, worldwide semi capex is on track to surge 34% in 2021, its strongest percentage gain since a 41% increase in 2017. The USD152.0B in outlays in 2021 would represent a new record high annual amount of spending, surpassing the previous high mark of USD113.1B set just in 2020. The foundry segment is forecast to represent 35% of all semiconductor capital spending in 2021, easily the largest portion of capex spending among the major product/segment categories. (Laoyaoba, IC Insights)

Intel has delayed its decision for its new multi-billion chip manufacturing sites in Europe and the U.S. until 2022. The delay will have little impact on an industry that cannot meet the demand for its products now, but it emphasizes the complexity of these decisions. Intel has hoped to announce the next locations in the United States and Europe early 2022. (CN Beta, Reuters, Tom’s Hardware)

Intel’s original 7nm node is now renamed Intel 4, which is Intel’s first process using EUV lithography. Sanjay Natarajan, general manager of Intel’s logic process development, confirmed that Intel will quickly switch to this process. EUV can simplify many processes, reducing the 30-step process to 3-step operations, reducing the possibility of errors. Sanjay Natarajan has confirmed that Intel’s first-generation EUV lithography processor will be shipped in 2023. The desktop version is Meteor Lake and the server side is Granite Rapids processors. (CN Beta, My Drivers, Protocol)

MediaTek CEO Rick Tsai has recently revealed that MediaTek will be launching the first 5G mmWave (millimeter-wave) mobile SoC in 2022. It will be paired with a Wi-Fi 7 solution, also set to be launched early 2022. He hopes it will allow the company to achieve 10-20% revenue growth in 2022. (Digitimes, Gizmo China, CTEE, iFeng, IT Home)

Samsung will manufacture Tesla’s next-generation hardware 4 (HW 4.0) chip for the top US electric carmaker’s fully autonomous driving technology. Samsung plans to mass produce the Tesla HW 4.0 chip at its main Hwasung plant in Korea using the 7nm processing technology in 4Q21 at the earliest. HW 4.0, dubbed the FSD Computer 2, is the successor to the HW 3.0 chip used in Tesla’s current vehicles. The HW 3.0 chip was manufactured by Samsung. Tesla plans to unveil its all-electric pickup, the Cybertruck, in late 2022 and has already received 1.2M units in pre-orders. (CN Beta, Electrek, KED Global)

IHS Markit has indicated that the global automotive chip market is expected to grow from USD45B in 2021 to USD74B in 2026. Under the circumstances, more and more automakers are developing automotive chips on their own. General Motors (GM) is working with Qualcomm, NXP and TSMC and Ford is cooperating with GlobalFoundries. In Hyundai Motor Group, the development is being led by Hyundai Mobis. (Business Korea, UDN, Sohu)

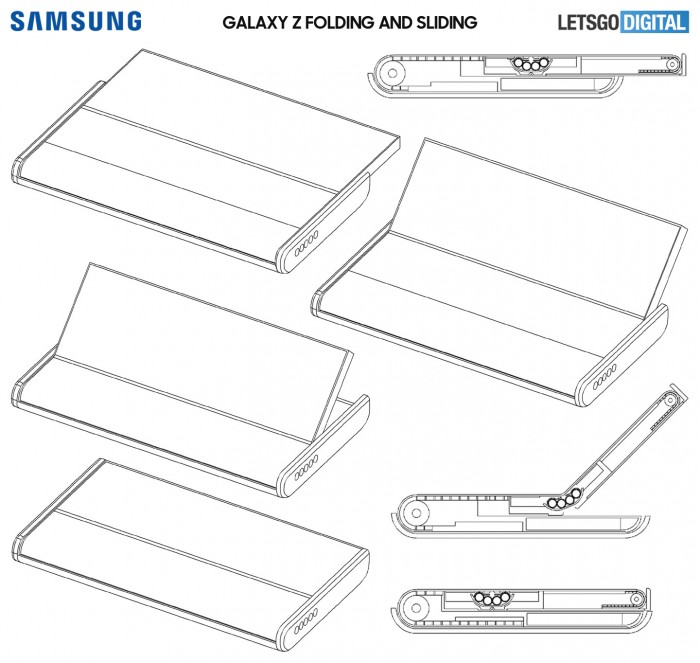

Samsung has filed a patent application for a “foldable and sliding electronic device” to the World Intellectual Property Organization (WIPO). The display position of the patented device can be fixed, and users can easily increase the display area from the front left to the right as needed. Samsung has installed an additional hinge inside the device this time so that the surface of the screen can be bent to the desired position (supports four use postures). When placed flat, it can be used as a tablet, and the 2-3-4 posture can be used like a laptop. (CN Beta, LetsGoDigital)

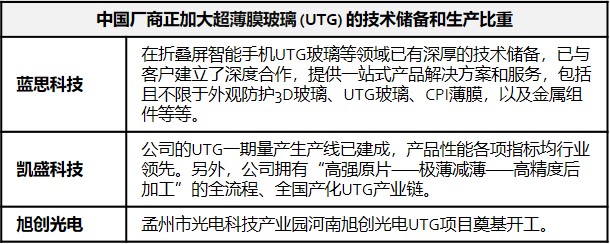

Samsung Display will reportedly supply ultra-thin film glass (UTG) foldable panels to Xiaomi’s second-generation foldable smartphone “Mi MIX Fold2”. Chinese manufacturers are increasing UTG’s technical reserves and production. CINNO Research has pointed out that UTG cover glass is made of glass that is thinly processed at the level of 30μm, and is made through a strengthening process that improves flexibility and durability. (Laoyaoba, CN Beta, EET-China)

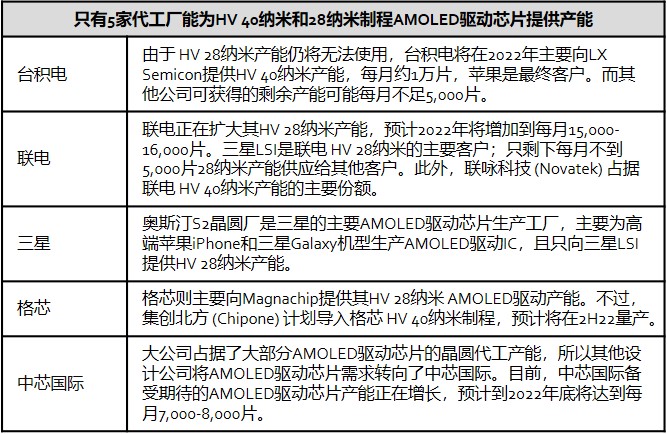

Omdia has indicated that only 5 foundries can provide mature production capacity for HV 40nm and 28nm AMOLED driver chips, including Samsung Foundry, UMC, TSMC, Global Foundries, and SMIC. (IT Home, Laoyaoba, UDN)

Wingtech has revealed that after the acquisition of O-Film Image Technology Guangzhou, the sampled products have passed the final verification of specific overseas customers, and the products have entered formal mass production and normalized batches in accordance with the shipping plan agreed with the customer. It is said that the specific overseas customer is Apple, and the product supplied is the iPhone rear camera. Wingtech has stated that the company’s optical business will expand from specific overseas customers to Android, Windows and automobiles, covering phones, tablets, laptops, IOT, car cameras and other fields. (CN Beta, My Drivers)

Intel’s USD9B sale of its memory fabrication facilities to SK Hynix is likely to be approved by Chinese authorities by the end of 2021. The sale has been approved by authorities in the U.S., South Korea and the United Kingdom, after being scrutinized for anticompetitive risks. The potential Chinese approval also signals that Intel’s smaller rival, Advanced Micro Devices (AMD) might also secure the go-ahead for its bid to acquire configurable integrated circuit designer Xilinx. However, a confirmation for AMD is not guaranteed yet. (CN Beta, WCCFtech, Seeking Alpha)

Bluetti, a well-known company that makes solar generators and batteries for them, has announced the world’s first sodium-ion solar generator. Bluetti says that the energy shift is facing the lithium supply crunch with rising large-scale demand. Bluetti’s sodium-ion solar generator is called ‘NA300’. Bluetti also announced a compatible battery pack for this generator, the B480. (Android Headlines, WCCFtech)

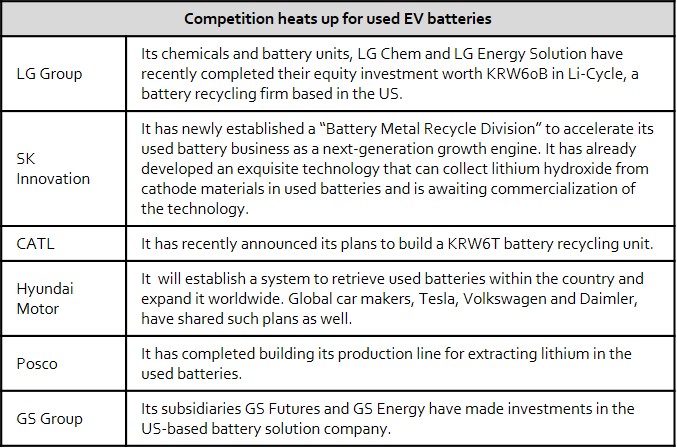

The competition to enter the used battery business for electric vehicles is heating up among domestic and global car and battery makers, amid market prospects that the market size would grow to hit KRW20T (USD16.8B) in less than 10 year. According to SNE Research, the global market size of used EV batteries is anticipated to surge to KRW20.2T by 2030, up by 1,124.24% compared to 2 years ago. By 2050, it might reach KRW600T. The key reason behind the fierce competition is that the world is running out of lithium, a key raw material for electric vehicle batteries. (Laoyaoba, Korea Herald)

Google has announced Android 12 (Go edition) for the entry level smartphones. It will start rolling out in 2022. Android (Go edition) was launched in 2017 with the goal to help more people access the Android and Google through affordable, entry-level phones. Google has indicated that over 200M people actively use an Android (Go edition) phone. (Gizmo China, GSM Arena, Google, Live Mint)

Facebook is set to gain EU antitrust approval for its acquisition of Kustomer after offering remedies that allow rival products to function with those of the U.S. customer service startup. Kustomer, which sells CRM software to businesses so they can communicate with consumers by phone, email, text messages, WhatsApp, Instagram and other channels, would help Facebook scale up its instant messaging app WhatsApp. (CN Beta, Reuters, US News)

Yahoo! Finance selects a “Company of the Year” that takes into consideration parameters such as market performance and other achievements, with Microsoft taking home the title in 2021. Yahoo! Finance also selects selects a “Worst Company of the Year” based on audience surveys about a company that upset them the most. Based on surveys conducted of 1,541 respondents, Facebook has earned the crown of “Worst Company of the Year”. (MacRumors, Yahoo, Neowin)

vivo Y32 is announced in China – 6.51” 720×1600 HD+ v-notch, Qualcomm Snapdragon 680, rear dual 13MP-2MP depth + front 8MP, 8+128GB, Android 11.0, side fingerprint, 5000mAh 18W, CNY1,399 (USD220). (GSM Arena, Gizmo China, vivo, GizChina)

According to Bloomberg’s Mark Gurman, Apple may produce a large-screen iPad perhaps with a 15” display. This iPad is to support more powerful speakers. Additionally, the cameras could have a landscape-first orientation, a rear-facing power plug, and support for a wall mount. It could do double duty propped up on a desk in the living room or carried like a tablet outside of the house. (Gizmo China, My Drivers, Bloomberg, Bloomberg, Phone Arena)

Global shipments for wearables grew 9.9% during the 3Q21 reaching 138.4M units, according to IDC. Hearables led the growth as the category grew 26.5% compared to 2020 and accounted for 64.7% of wearable device shipments. Following hearables were wrist-worn wearables, the category most often associated with health and fitness tracking, which captured 34.7% of the market. Apple captured the top position in 3Q21 despite a 35.3% decline in Apple Watch shipments during the quarter. (GizChina, IDC)

The Competition Commission of India (CCI) has suspended its approval of Amazon’s 2019 deal with Future Coupons (FCPL), on the sole basis of which Amazon was fighting several legal battles to block Future Group’s proposed sale of assets to Reliance Retail for INR25,000 crore. In addition, it has slapped a INR200-crore penalty on Amazon for making “false and incorrect statements” and suppressing the “actual purpose” of the deal while seeking approval. (CN Beta, Indian Express, India Times, Business Standard)