12-25 #Christmas : Xiaomi has announced its third self-developed chip Surge P1; AMD will acquire about USD2.1B of silicon wafers from GlobalFoundrie in 2022-2025; TSMC has entered into an energy purchase agreement for 1.2GW of wind energy; etc.

Xiaomi has announced its third self-developed chip Surge P1, which will be adopted by Xiaomi 12 Pro. It will be the first to realize a “120W single-cell” charging technology. Xiaomi has developed two smart charging chips and put them into the Surge P1. These two take over the complex structure of the traditional 5 charge pump. The Surge P1 has a 4:1 ultra-high efficiency architecture with adaptive switching frequency. The efficiency of the resonant topology is as high as 97.5%; the efficiency of the non-resonant topology is 96.8%; the heat loss has plummeted by 30%. (GizChina, CN Beta, Weibo)

Advanced Micro Devices (AMD) will acquire about USD2.1B of silicon wafers from GlobalFoundries from 2022 through 2025 in an amended agreement, adding an additional year and USD500M in wafers to the previous agreement. AMD has opted to continue buying 12nm/14nm wafers from GlobalFoundries, with the two firms inking a USD1.6B agreement to buy wafers for the 2022 through 2024 period. (My Drivers, Sina, LTN, UDN, AnandTech, Reuters, AMD)

RoboSense has announced a strategic partnership with Horizon Robotics, a global pioneer in edge AI computing platforms. The two partners will mobilize their respective technological capacity and mass production experience to roll out in-depth cooperation focusing on advanced driver assistance systems (ADAS), autonomous driving, robotics, new intelligent transportation infrastructure and other applications. Based on RoboSense’s second generation smart solid-state LiDAR RS-LiDAR-M1 and Horizon Robotics’ Journey 3 and Journey 5 automotive smart chips, the two companies will collaborate on the development and adaptation of integrated perception solutions for high-level autonomous driving pre-installed mass production. (My Drivers, Business Wire, AZO Robotics)

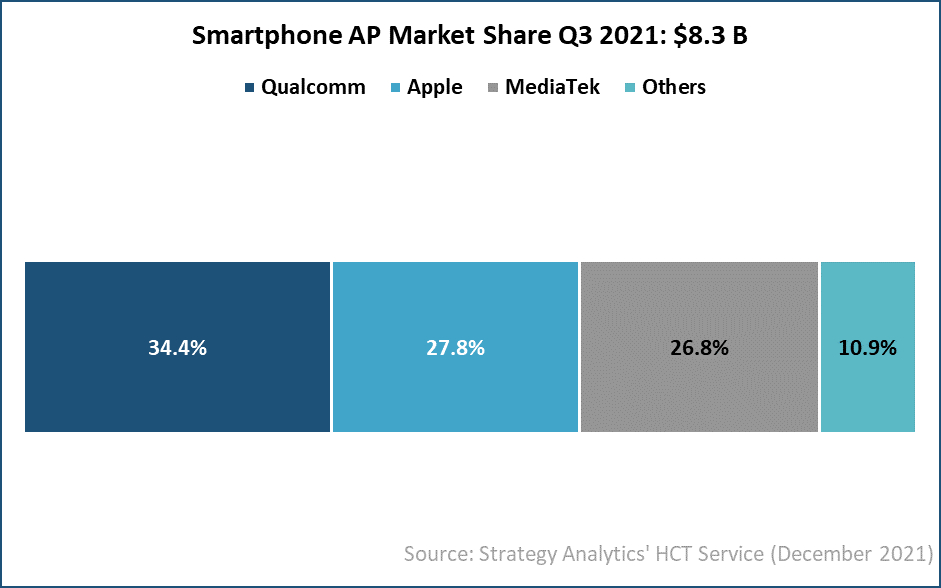

The global smartphone applications processor (AP) market grew 17 percent to USD8.3B in 3Q21, according to Strategy Analytics. Strategy Analytics estimates that Qualcomm, Apple, MediaTek, Samsung LSI and Unisoc captured the top-5 revenue share rankings. Qualcomm maintained its smartphone AP leadership with a 34% revenue share. (CN Beta, Business Wire)

Forrester Analytics research director Glenn O’Donnel has indicated that the global chip shortage is mostly a simple supply and demand problem. Carmakers have lowered their hardware orders at the start of the pandemic, with the assumption that consumers would not be interested in buying new vehicles. It turns out the opposite was true – the overwhelming demand has pushed used car prices up significantly. Chipmakers were also forced to keep up with a rising demand for PCs, game consoles and a wide assortment of gadgets while also dealing with production slowdowns amid COVID lockdowns and other precautions. He has argued that the global chip shortage would continue throughout 2022 and into 2023. (Engadget, Forrester)

Lenovo Executive Chen Jin has revealed that the company is working on a third-generation Motorola Razr foldable. The new foldable from Motorola will come with a tweaked UI, better design and improved performance, with a debut in the Chinese region most likely. (GizChina, Weibo, IT Home)

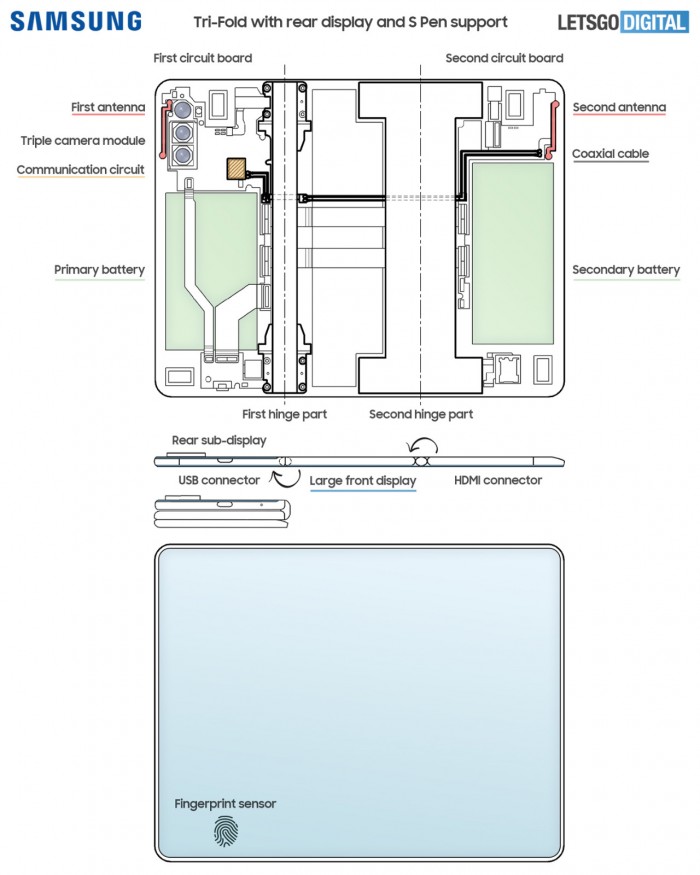

Samsung Electronics has submitted an extended patent for an “Electronic device” with the WIPO (World Intellectual Property Organisation). This is a foldable smartphone with three display sections. It is possible to fold the phone into a Z-shape. In other words, one display component is folded backwards, while the other is folded forward. Two types of hinges are utilised to do this: an in-fold and an out-fold hinge. (CN Beta, LetsGoDigital, Tech Newsroom)

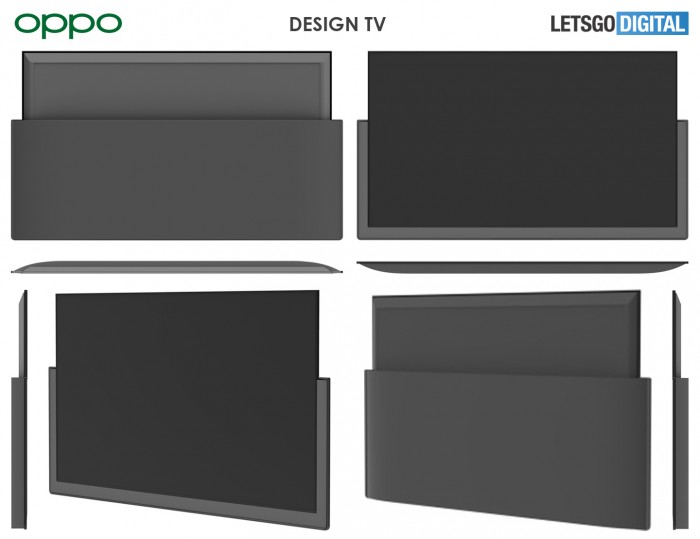

OPPO has submitted a patent application for a TV design to the National Intellectual Property Office (CNIPA), depicting a unique lifting frame design. It is not clear whether this OPPO concept TV uses a rigid display or a flexible display that can be rolled up at the bottom for storage. (LetsGoDigital, CN Beta)

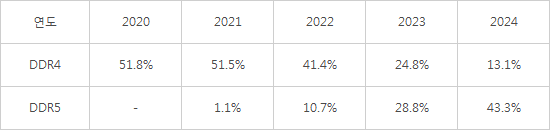

According to Omdia, DDR5 is expected to become the mainstream of the memory market, starting with a market share of 1.1% in 2021, 10.7% by 2022, and 43.3% by 2024. The opening of the DDR5 market for servers is also positive for major memory makers’ improvement. DDR5 DRAM price is 30% higher than DDR4. (CN Beta, My Drivers, ET News)

Taiwan Semiconductor Manufacturing Company (TSMC) has entered into an energy purchase agreement for 1.2GW of wind energy. The agreement covers 600MW of onshore wind energy and an equal amount of wind energy produced offshore. The agreement has been made with the Taiwanese subsidiary of German energy provider wpd AG, namely Dade Energy. (CN Beta, WCCFTech, Sina, wpd, UDN)

vivo iQOO U5 is launched in China – 6.58” 1080×2408 FHD+ v-notch 120Hz, Qualcomm Snapdragon 695 5G, rear dual 50MP-2MP macro + front 8MP, 4+128 / 6+128 / 8+128GB, Android 12.0, side fingerprint, 5000mAh 18W, CNY1,299 (USD204) / CNY1,399 (USD220) / CNY1,499 (USD235). (GSM Arena, Weibo, GizChina, Gizmo China, CNMO)

Tecno Camon 18 is launched in India – 6.8” 1080×2460 FHD+ HiD IPS 90Hz, MediaTek Helio G88, rear tri 48MP-2MP macro-2MP depth + front 16MP, 4+128GB, Android 11.0, side fingerprint, 5000mAh 18W, INR14,999 (USD199). (Gizmo China, 91Mobiles, NDTV)

vivo Watch 2 is launched in China featuring 1.43” 466×466 OLED display, 2GB onboard storage, NFC, built-in GPS, eSIM, supports 5ATM water resistance. It is also loaded the Watch 2 with 47 sport modes covering some of the more common activities, an SpO2 sensor for blood oxygen saturation monitoring, a heart-rate sensor, and sleep tracking smarts. It is priced at CNY1,299 (USD204). (Gizmo China, NDTV, Android Authority)

realme Buds Q2 is launched in China with support for ENC (Environmental Noise Cancellation) over ANC (Active Noise Cancellation). The buds house a 10mm dynamic driver with Bass Boost+ enhancement technology. The Buds Q2 even features a dedicated mode for mobile gaming, which lowers latency to just 88ms to prevent any lag between audio and visuals during gaming. It is priced at CNY169 (USD25). (Gizmo China, realme, 52Audio)

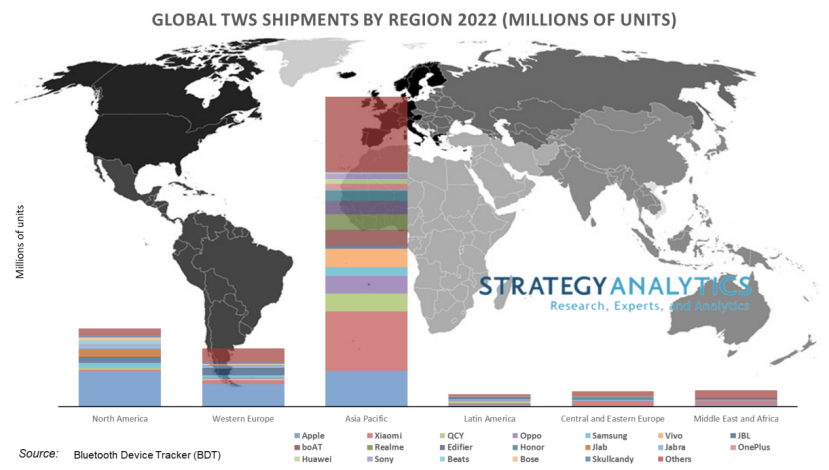

According to Strategy Analytics, the shipments of true wireless stereo (TWS) headsets will reach 500M in 2022. Apple will continue to maintain its leading position. However, emerging brands such as boAT, JBL and Edifier continue to challenge its leadership position. The Apple’s market share may shrink. Strategy Analytics predicts that the average wholesale price of TWS headsets in 2021 will drop 19% YoY, while revenue will surge 54% YoY. (Laoyaoba, Sina, 163)

Back in 2018, Quebec’s Taiga Motors announced an all-electric snowmobile called the TS2 that could get up to 100km/h in just 3 seconds. The company tweaked the design the following year, and expanded the model range to three. Now the first consumer-ready vehicles have rolled off the production line. (CN Beta, Electrek, PR Newswire, New Atlas)

In Apr 2021, Immotors, a domestic high-end smart pure electric vehicle brand jointly created by SAIC, Zhangjiang Hi-Tech and Alibaba Group, announced that its first pure electric vehicle and large sedan will be named Zhiji L7. Its L7 Beta version will be launched on 26 Dec 2021, and the mass production version will be delivered in 1H22. In terms of power, the new car is equipped with front and rear dual motors. The maximum power of the front motor is 175kW and the rear motor is 250kW. The acceleration time of 0-100km/h is only 3.9 seconds. (CN Beta, Sina, My Drivers, Immotors)

Huawei’s first electric vehicle (EV) using its proprietary HarmonyOS operating system will be the Aito M5, a hybrid car that runs on both electricity and gasoline. The first deliveries of the Aito M5 are set to take place in Feb 2022. The Aito M5 will be priced starting at CNY250,000 (USD39,164) after subsidy adjustments have been made. The Aito M5 also features double-layered sound-proof glass for an enhanced driving experience. The Aito M5 is manufactured by the automaker Series. (Gizmo China, IT Home)

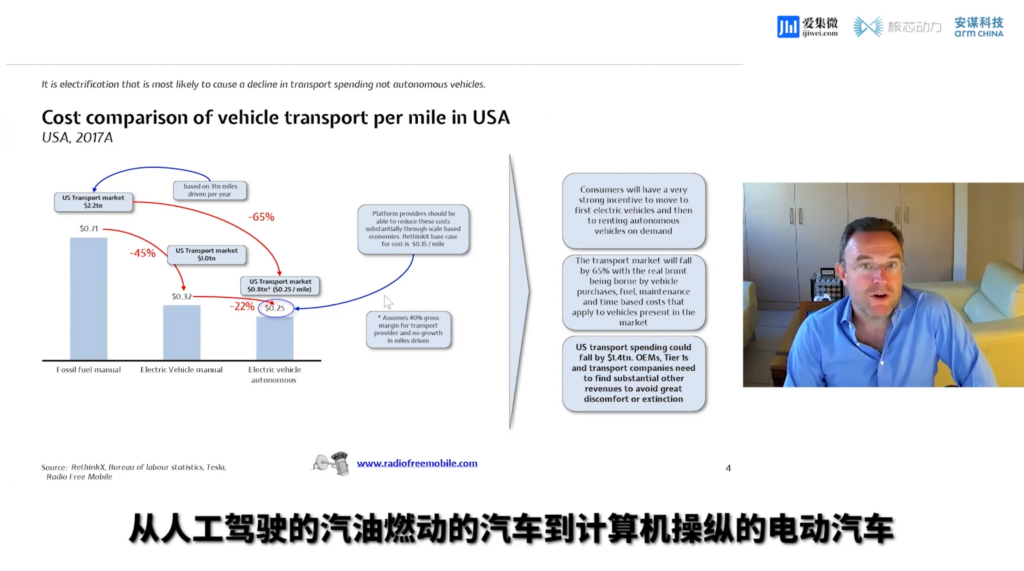

Counterpoint Research Director Richard Windsor predicts that in the next 20 years, the overall demand in the automotive market will decline by at least 65%. Another prediction is that the chip content of each car will double. Soon prices of electric vehicles and fuel vehicles are likely to gradually equalize. Tesla and Counterpoint predict that after driving about 500,000 miles, the battery performance drops to 20%. Simply put, consumers do not need to change cars so frequently. The overall demand for automobiles in the future will show a significant downward trend. By 2047, the number of automobiles will drop to 44M. By then, autonomous vehicles will cover almost the entire market. Counterpoint predicts that by 2024, spending on digital automotive services may reach as much as USD1.6T. (IT Home, Laoyaoba, UDN, GizChina)

Jimmy Goodrich, vice chairman of global policy of the Semiconductor Industry Association (SIA), has said that though the current global semiconductor market of USD500B is mainly driven by PCs, data centers, communications, etc., automotive semiconductors are one of the fastest-growing market segments with CAGR for the next 5 years is expected to be 5%, which is significantly higher than that of the consumer electronics industry. According to World Semiconductor Trade Statistics Organization (WSTS), the global automotive industry accounts for about 11.4% of semiconductor sales demand. An ordinary traditional fuel-powered car usually carries 1,400 chips. He has concluded that with the vigorous development of automobile electrification and autonomous driving technology, China’s role in the global automotive semiconductor industry chain will also become more and more important. (Laoyaoba, UDN)