12-31 #ComingNewYear : Huawei allegedly intends to build a fab in Shenzhen in conjunction with SMIC; LGD has unveiled its next generation of OLED technology; Xiaomi intends to take on the global leaders in the smartphone industry; etc.

AMD CEO Lisa Su has expressed to be impressed by the ongoing high demand for both the PS5 and Xbox Series X|S. AMD will be ramping up the production of chips in 2022, and she expects 2022 to be another strong year for both Sony and Microsoft, although she expects that 2023 will be the “peak year” for the next-gen consoles. (CN Beta, WCCFTech)

Huawei allegedly intends to build a fab in Shenzhen in conjunction with SMIC, the largest foundry in Mainland China. Huawei hopes to cut into wafer manufacturing through official funds, Huawei’s chip design capabilities, and SMIC. Huawei would also approach TSMC’s supply chain to seek cooperation to expand independent chip manufacturing capabilities. (GizChina, My Drivers, UDN)

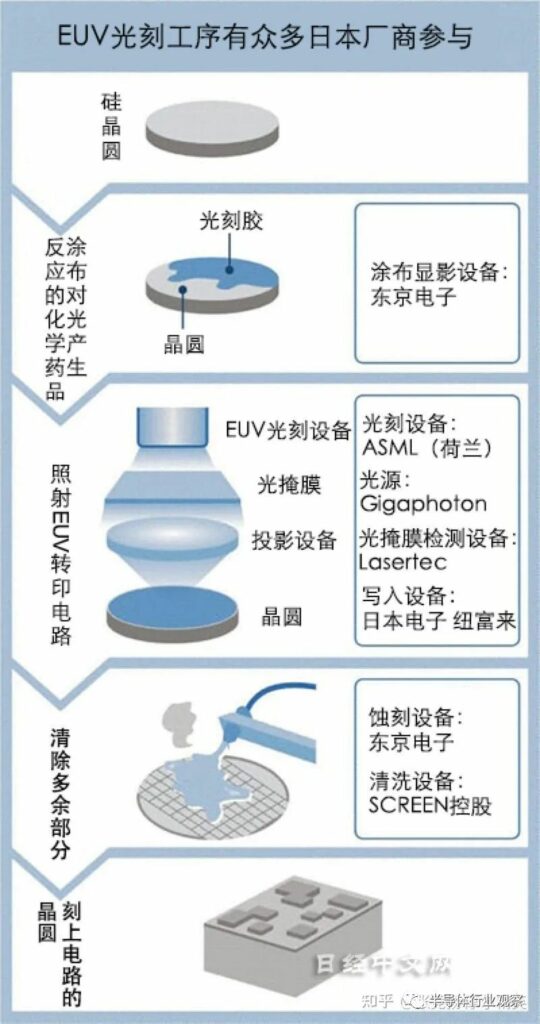

Japan must aim for 2nm mass production within a decade, says Tetsuro (Terry) Higashi, former CEO of Tokyo Electron who sits on a government chip industry advisory panel. Japan should offer tax breaks in the next fiscal year to produce USD88B in investment over the next decade to revive domestic chipmaking. The Japan government has approved USD6.8B in supplementary spending. Japan made reviving its chip industry a national project in 2021, aiming to boost the annual revenue of domestic semiconductor companies roughly 3 times to JPY13T (USD114B) by 2030. (CN Beta, Electronics Weekly, Semiinsights)

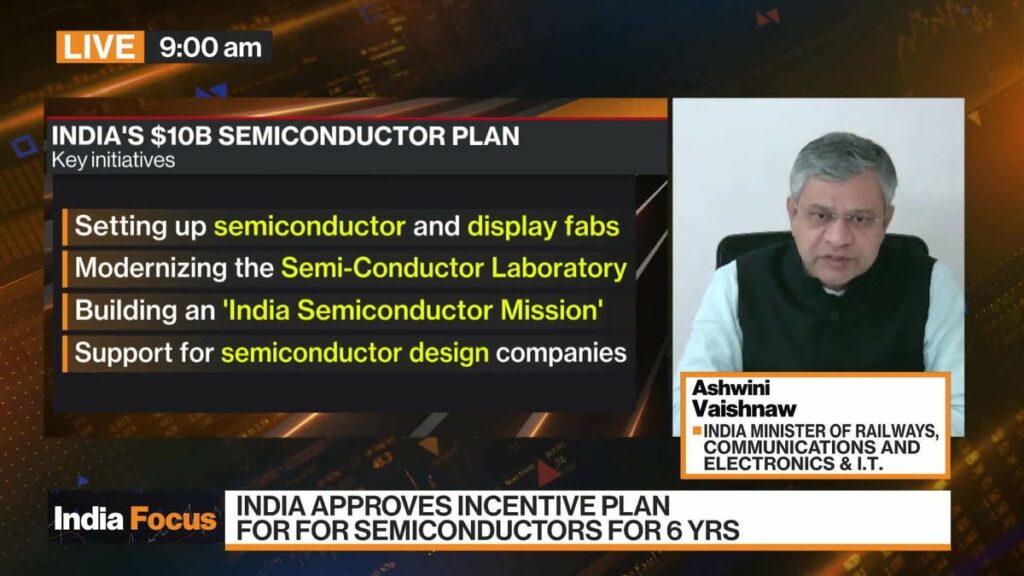

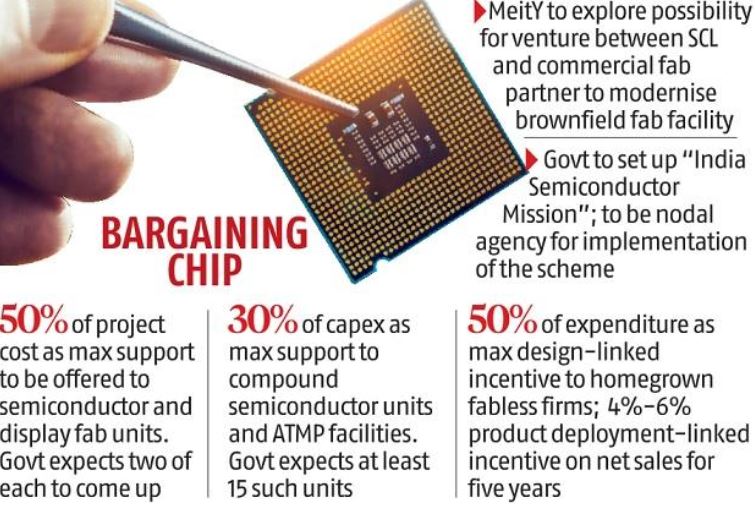

Information Technology Minister Ashwini Vaishnaw has launched the India Semiconductor Mission. He has said companies that are interested in tapping the INR76,000-crore (USD10B) incentives earmarked by the Centre for development of semiconductors and display manufacturing ecosystem in India can begin applying for the same from 1 Jan 2022. The financial support is for 6 years from the date of approval. He has indicated that in next 2-3 years time frame, they see at least 10-12 semiconductors going into production, and they see display fab going into production or may be finalizing completion. The highest levels of wafer fab incentive scheme are set at up to 70 percent support for fabs capable of making 28nm technology or below and would reduce for 45nm to 28nm and reduce again for 65-45nm. The government support would be set at 50% for 28nm and below, then 40% at 45-28nm and 30% at 65-45nm, while the hosting Indian state could offer additional top-up incentives. Several states have already announced 10-15% subsidies on capital expenditure. (Business Standard, Indian Express, Bloomberg Quint, PC Gamer, EE News)

Suppliers of power management ICs, networking chips, and industrial and automotive MCUs are still capable of raising their prices in 1Q22, as 8” fab capacity stays persistently tight, according to Digitimes. IDMs including in Europe, the United States and Japan, as well as the available capacity of foundries in Taiwan and China, the total 8” capacity of the automotive supply chain will still be in short supply by 2025. (Digitimes, Laoyaoba)

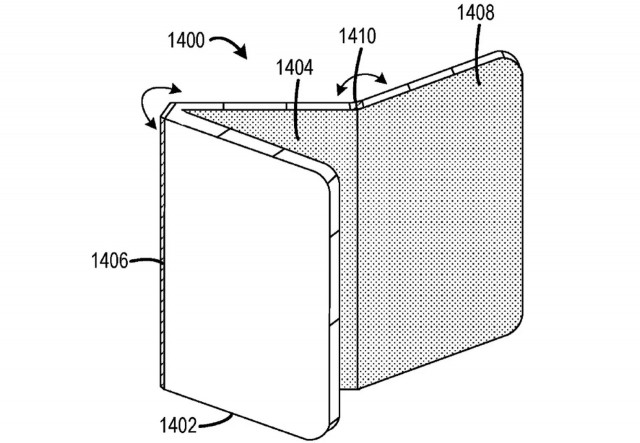

Microsoft’s patent shows a sketch of a device with two hinges that opens up to reveal one massive screen made up of 3 distinct sections. When folded back up the device can serve as a traditional smartphone. (GSM Arena, USPTO, Patently Apple)

The chief analyst of Sigmaintell Ellike Chen predicts that Chinese domestic flexible OLED mobile phone screen shipments will reach 95M units in 2021 and nearly 156M units in 2022. The 27%-28% in 2021 will increase to 37%-38% in 2022, an increase of about 10ppt. Zhang Xin, VPof TCL CSOT and general manager of Display Innovation Center, confirmed that the POLED display of recently announced Xiaomi 12 is exclusively supplied by TCLCSOT. (CN Beta, iFeng, Yicai)

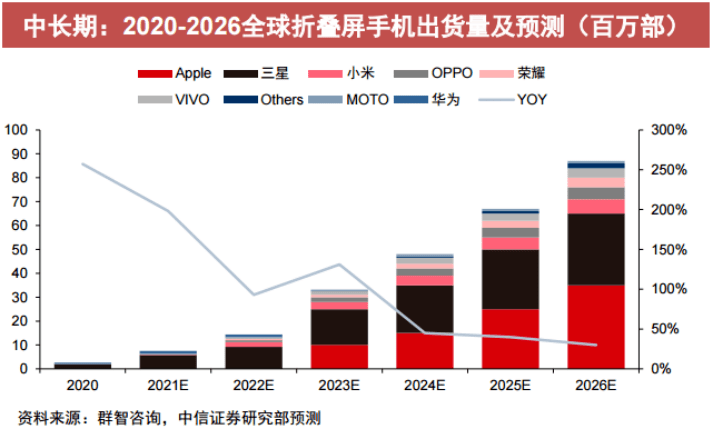

The standard for mass production of foldable display is generally 200,000 times. If the display is folded 100 times a day, it will have a 6-year lifetime. Zhang Xin, VP of TCL CSOT and general manager of Display Innovation Center, has revealed that the company’s Wuhan Gen-6 flexible OLED panel production line is ready to ship 100% foldable display, and by introducing localized materials to reduce the cost. Ellike Chen, deputy general manager and chief analyst of Sigmaintell, predicts that the price of foldable display and folding phones will continue to drop in 2022, and foldable phones will drop to about CNY5,000-6,000. (CN Beta, 36Kr, Yicai)

OPPO’s patent application describes 3 smartphone models, each with a unique secondary rear display implementation housed within the camera module itself. While the square module will only have 2 cameras that sit atop a display, the circular design is a bit more exotic, comprised of 4 lenses surrounding the secondary display. (My Drivers, Gizmo China, LetsGoDigital)

LG Display (LGD) has unveiled its next generation of OLED technology, “OLED EX” (Evolution/eXperience), which is able to “enhance brightness up to 30% compared to conventional OLED displays”. To make OLED sets brighter, OLED EX uses deuterium compounds to allow the light-emitting diodes to emit stronger light. OLED EX uses algorithms to predict the usage of 33 million OLED diodes in an 8K display. LGD plans to integrate OLED EX technology into all of its OLED panels starting from 2Q22. (Engadget, PR Newswire, CN Beta)

BOE’s Gen-6 flexible AMOLED production line project in Chongqing, China has now officially commenced mass production. BOE has spent CNY46.5B (USD7.3B) to build this production line. Currently, BOE has deployed 6 key projects in Chongqing, including the Gen-6 flexible AMOLED production line. It also has the Gen-8.5 TFT-LCD production line, and the BOE Chongqing Smart System Innovation Center. These production lines have a cumulative investment of over CNY86B (USD13.5B). (GizChina, My Drivers, Sina, CN Beta)

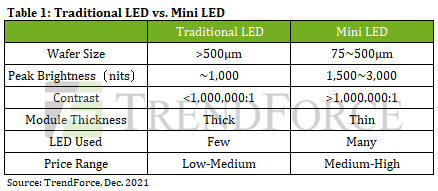

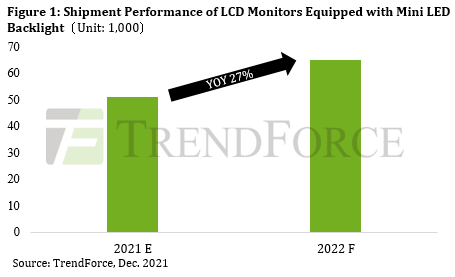

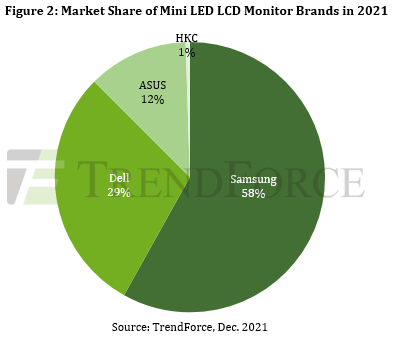

In 2021, the price of Mini LED-backlit LCD monitors fell in USD2,300-5,000. For example, a 31.5” Mini LED backlit model is priced about 4-8 times that of model of the same size featuring a traditional LED backlight. Due to high pricing and its recent introduction, market scale is relatively limited. Total shipments of LCD monitors equipped with Mini LED backlights is estimated at 51,000 units in 2021. Looking forward to 2022, QD OLED LCD monitors and OLED LCD monitors will join the ranks of products fighting for a share of the high-end LCD monitor market. Mini LED LCD monitor shipments are forecast to reach 65,000 units at most in 2022, or an annual growth rate of 27%. (TrendForce, TrendForce)

Samsung Electronics and Micron Technology have warned that a Covid-19 lockdown in the Chinese city of Xi’an could affect their chip manufacturing bases in the area. Micron has said the lockdown could lead to delays in the supply of its DRAM memory chips, which are widely used in data centers. Samsung Electronics has also said that it will temporarily adjust operations at its Xi’an manufacturing facilities for NAND flash memory chips, used for data storage in data centers, smartphones and other tech gadgets. (CN Beta, Micron, CNBC, Reuters, Tom’s Hardware)

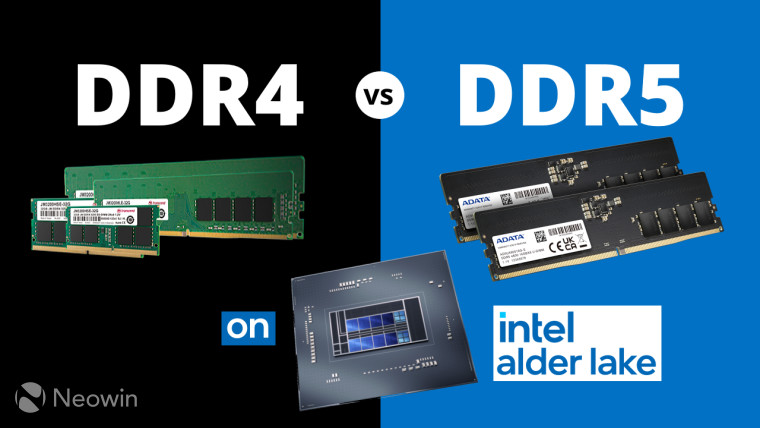

Guy Chalev, Intel’s general manager of engineering and verification responsible for the development of the 12th-generation Core has responded to the high price of DDR5 and the lack of stock. The 12th generation Core can be compatible with DDR5 and DDR4 memory at the same time, and OEM can choose to manufacture DDR5 or DDR4 memory motherboards. Judging from Intel’s statement, they believe that supply problems are unavoidable in the initial stage of the DDR5 upgrade. Intel has tried its best in this regard. However, due to their own considerations, motherboard manufacturers are now willing to support DDR5 and only support DDR4 Z69. (CN Beta, Neowin)

Currently, the consequences of Xi’an’s lockdown on Samsung is weighted most heavily towards the difficulty of scheduling shifts for personnel, according to TrendForce. Samsung is currently making active adjustments to reduce impact on output and the local government expects a return to normalcy within 1-2 weeks. However, if the pandemic is not properly controlled, short-term impact on the production utilization rate of the local factory campus cannot be ruled out, resulting in a slight decline in output. (TrendForce, TrendForce)

Apple’s patent application “Through-Display Wireless Charging” is making the display the charging point. A section of the screen could be enabled for wireless charging, and that area might not display anything. (Apple Insider, USPTO, CN Beta)

CATL, the power battery supplier to Tesla and NIO, has announced that it will invest up to CNY24B (USD3.8B) in power battery manufacturing projects in Yibin, Sichuan province. This is the 7th to tenth phase of CATL’s Yibin manufacturing base, with a planned site area of approximately 3,200mu and a construction time of no more than 20 months for each phase. (CN Beta, Sina, JRJ, CNEVpost, CATL)

Samsung SDI has announced that it has launched its battery brand PRiMX. Samsung SDI is to promote the super-gap technology strategy through the launch of the brand that conveys the company’s identity. PRiMX stands for ‘Prime Battery for Maximum Experience.’ The brand was developed under the three keywords, ‘Absolute Quality,’ ‘Outstanding Performance,’ and ‘Proven Advantage.’ (Sammy Hub, Samsung SDI)

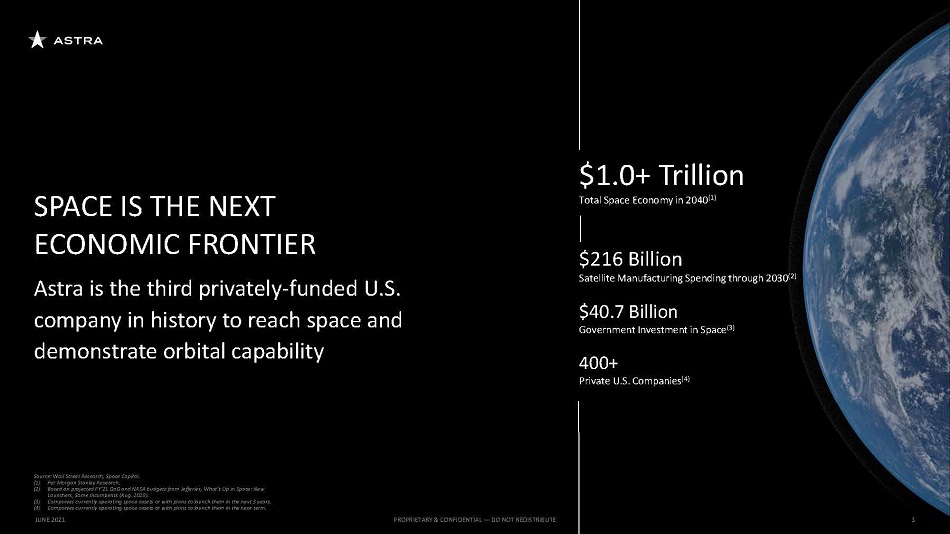

Tesla CEO Elon Musk’s SpaceX has raised USD337.4M in equity financing. SpaceX, which counts Alphabet Inc and Fidelity Investments among its investors, hit USD100B in valuation. The company competes with former Amazon.com Chief Executive Jeff Bezos’s space venture Blue Origin and billionaire Richard Branson’s Virgin Galactic in the burgeoning constellation of commercial rocket ventures. According to Morgan Stanley, the space economy could be worth USD1T by 2040. (CN Beta, Reuters, US News)

Tesla CEO Elon Musk has predicted that SpaceX will be able to fly humans to Mars within the next 5-10 years. SpaceX has begun testing prototypes of the 400-foot rocket ahead of a planned orbital launch. (CN Beta, NY Post, Business Insider)

Up to now, there are more than 140 members of the SparkLink Alliance, including Xiaomi, OPPO, vivo, Lenovo, and Honor. Car companies that have already joined include Changan, Great Wall, Geely, SAIC and Dongfeng. The Star Alliance is an industrial alliance dedicated to globalization. The goal is to promote the innovation and industrial ecology of SparkLink, a new generation of wireless short-range communication technology. (My Drivers, ZOL, Huawei, EET-China)

Ericsson has launched beta version of Ericsson Routes. Before Apr 2021, customers in California and San Francisco can sign up for the beta version for free to get Basic Service. After the beta version, there will also be a Premium Service, which will solve the key connection requirements on the road and provide more details. With Ericsson Routes, self-driving cars can obtain optimized routes to speed up travel time. (CN Beta, Ericsson)

Richard Yu, CEO of Huawei CBG has revealed that Huawei Wallet has launched the industry’s first digital car key that supports Bluetooth and NFC. Currently, the digital car key function of Huawei Wallet is supportive on Huawei smartphones running on HarmonyOS 2.0 and the Watch 3 series. However, more Huawei smartwatches will be upgraded to support this function. (My Drivers, IT Home, Sina, Huawei Central)

Apple has put Foxconn Technology Group’s factory in southern India on probation following worker protests and an investigation that revealed substandard living conditions. Foxconn has apologized for the lapses in health standards and pledged to revamp its management and operations in the country. (Bloomberg, MacRumors, Apple Insider)

Apple has allegedly increased its reliance on Mainland Chinese supply chain partners, including Luxshare, which is reportedly poised to unseat Foxconn as Apple’s primary supplier. Apple CEO Tim Cook fulfilling his pledge to help Beijing expand its local technology industry. Foxconn, worried about the fast-rising Chinese firm, has even reportedly assembled a team to study the company. (Apple Insider, The Information, Sina, Sohu)

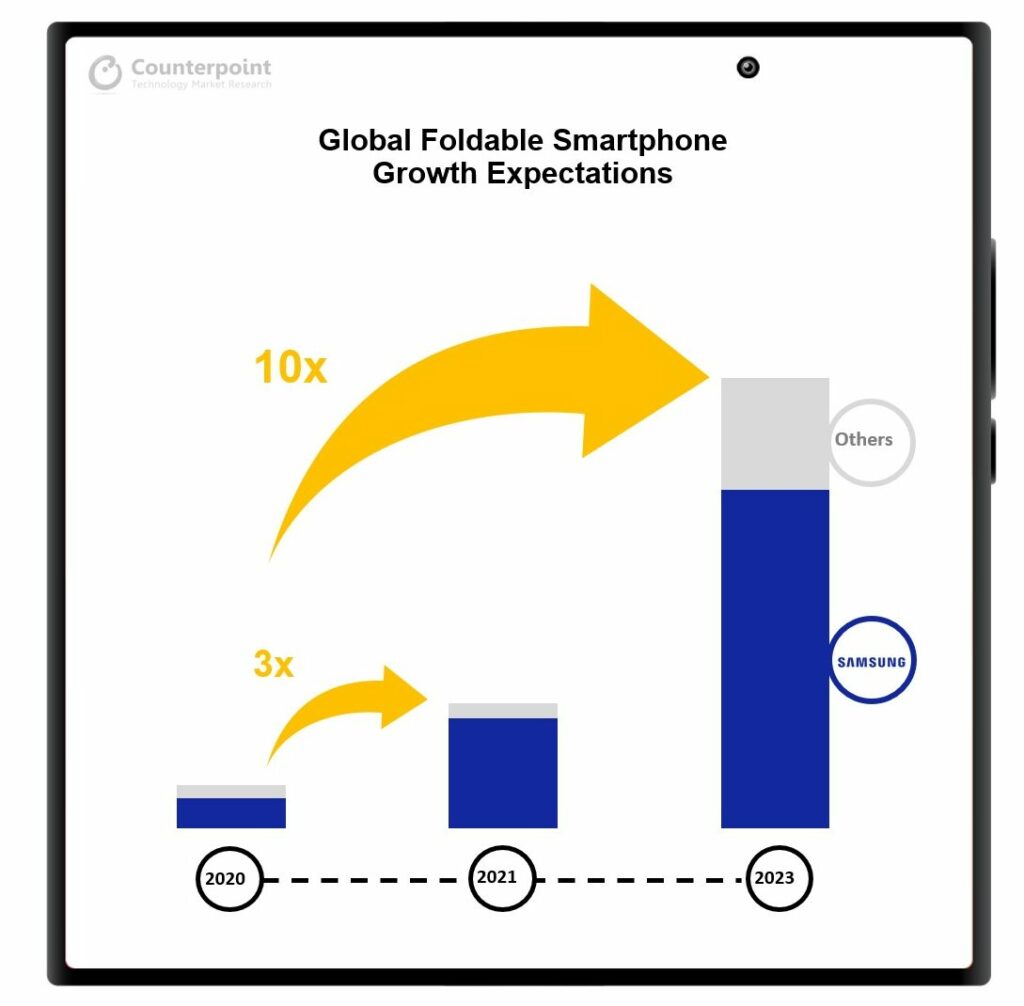

According to Counterpoint Research, the shipments for 2021 will remain in single digit, at around 9M units. However, it will still be a 3x growth over 2020, with Samsung dominating with over 88% market share. By 2023, Counterpoint expects a 10x growth in foldable smartphone shipments. Even with more OEMs entering the foldable smartphone space, Samsung is expected to continue dominating with nearly 75% market share. If Apple is on track to release its foldable smartphone by 2023, it will not only be an inflection point in taking foldables mainstream but also improve the component yield and scale for the entire supply chain. (Android Central, Counterpoint Research)

Xiaomi’s CEO and Founder Lei Jun has announced that the company intends to take on the global leaders in the smartphone industry and become the number one smartphone brand in the next 3 years. (Android Headlines, Gizmo China, Sohu)

Xiaomi chairman and founder Lei Jun has announced that the company’s goals for investment into R&D in the next 5 years have been increased to CNY100B (USD15B). The CEO has further revealed that CNY22B had already been invested over the past 2 years and that Xiaomi now has 16,000 engineers. (Gizmo China, East Money, Sina)

Xiaomi 12 series is unveiled in China featuring Qualcomm Snapdragon 8 Gen 1: 12 – 6.28” 1080×2400 FHD+ HiD POLED 120Hz, rear tri 50MP 1.0µm OIS-13MP ultrawide-5MP telephoto macro + front 32MP, 8+128 / 8+256 / 12+256GB, Android 12.0, fingerprint on display, 4500mAh 67W, 50W fast wireless charging, 10W reverse wireless charging, CNY3,699 (USD580) / CNY3,999 (USD628) / CNY4,399 (USD690). 12 Pro – 6.73” 1440×3200 QHD+ HiD LTPO POLED 120Hz, rear tri 50MP 1.22µm OIS-50MP telephoto-50MP ultrawide + front 32MP, 8+128 / 8+256 / 12+256GB, Android 12.0, fingerprint on display, 4600mAh 120W, 50W fast wireless charging, 10W reverse wireless charging, CNY4,699 (USD738) / CNY4,999 (USD785) / CNY5,399 (USD848). (GSM Arena, Neowin, Mi.com)

Xiaomi 12X is also announced in China – 6.28” 1080×2400 FHD+ HiD POLED 120Hz, Qualcomm Snapdragon 870 5G, reat tri 50MP 1.0µm OIS-13MP ultrawide-5MP telephoto macro + front 32MP, 8+128 / 12+256GB, Android 12.0, fingerprint on display, 4500mAh 67W, CNY3,199 (USD502) / CNY3,799 (USD596). (GSM Arena, Neowin, Mi.com)

Tecno Pova 5G is unveiled – 6.9” 1080×2460 FHD+ HiD 120Hz, MediaTek Dimensity 900 5G, rear tri 50MP-2MP-QVGA + front 16MP, 8+128GB, Android 11.0, side fingerprint, 6000mAh 18W, price to be announced. (GSM Arena, Tecno Mobile, GizChina)

Tecno Spark 8 Pro is announced in India – 6.8” 1080×2460 FHD+ HiD IPS, MediaTek Helio G80, rear tri 48MP-2MP depth-AI lens + front 8MP, 6+128GB, Android 11.0, side fingerprint, 5000mAh 33W, INR10,599 (USD142). (GSM Arena, Tecno Mobile)

Tecno Spark Go 2022 is launched in India – 6.52” 720×1600 HD+ v-notch, MediaTek Helio A22, rear dual 13MP-2MP + front 8MP, 2+32GB, Android 11.0 Go, rear fingerprint, 5000mAh INR7,499 (USD101). (Gizmo China, NDTV, Amazon, Twitter)

Xiaomi TWS Earphones 3 is announced, bringing active noise cancellation (ANC) that should cancel out up to 40dB noise. Xiaomi claims up to 7-hours on a single charge with ANC off and 30 hours with the charging case. It is priced at CNY499 (USD70). (CN Beta, IT Home, My Drivers, GSM Arena, GizChina)

Xiaomi Watch S1 is officially released featuring a 1.43” 466×466 AMOLED retina display, a BES2500BP chip, 4GB memory and 32GB storage, 470mAh battery, dual-frequency GPS, and supports four satellite positioning (Beidou, GLONASS) , GALILEO, QZSS). It supports 117 sports modes, including 19 professional modes. Prices start from CNY1,099 (USD173). (GSM Arena, GizChina, My Drivers)

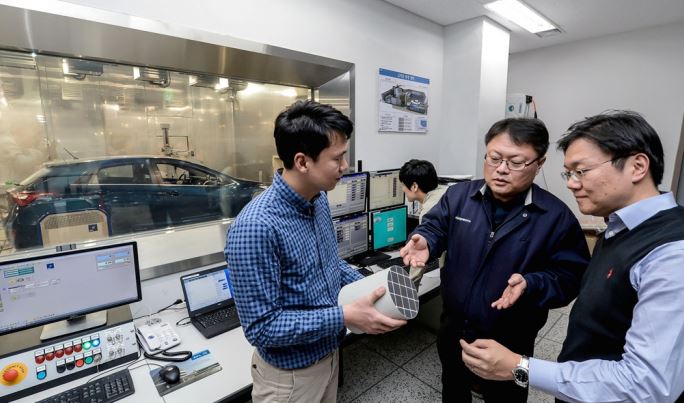

Hyundai Motor Group will stop developing new internal combustion engines in order to accelerate its transformation into an electric vehicle manufacturer. It has closed its engine development division at its research and development center. Hyundai Motor has converted its teams focusing on the powertrain, which creates power from the engine and delivers it to the wheels on the ground, into units for electrification development. (Engadget, KED Global)

Rivian Automotive CEO RJ Scaringe has said that the company will delay deliveries of its electric pickup truck and sports utility vehicle with big battery packs to 2023. (CN Beta, Yahoo, Reuters)

Deliveries of McLaren’s new Artura supercar will be delayed due to chipsets shortage. The Artura was expected to hit the road by the end of 2021 but will now arrive in Jul 2022. (CN Beta, CNET, Auto News, Auto Blog)

Autonomous trucking startup TuSimple has completed its first autonomous truck run on open public roads without a human in the vehicle. TuSimple’s Autonomous Driving System (ADS) navigated 100% of the 80-mile run along surface streets and highways between a railyard in Tuscon, Arizona and a distribution center in Phoenix, which took place with no human intervention, marking a milestone for the company that aims to scale its technology into purpose-built trucks by 2024. (TechCrunch, AP News, ABC News)

Samsung BioLogics has denied a media report that said the company was in talks to buy U.S. drugmaker Biogen. The biotechnology firm has allegedly approached Samsung to sell its shares, which could be valued at more than KRW50T (USD42B), including a control premium. Biogen’s current market cap is slightly less than USD35B. Back in 2011, Samsung formed a partnership with Biogen for joint ownership and management of its biosimilar business. Samsung Group unveiled ambitious spending plans in Sept 2021, saying it would invest a combined KRW240T (USD206B) over the next 3 years in its core businesses such as semiconductors, displays and biopharmaceutical products. (CN Beta, Yahoo, Reuters, Pulse News, KED Global)