1-10 #PoorEfficiency : A fire occurred at ASML’s factory in Berlin; Xiaomi’s liquid camera is able to realize the coexistence of telephoto and macro; Samsung has finally discontinued its Tizen Store platform from its Tizen phones; etc.

A fire occurred at ASML’s factory in Berlin, Germany on 3 Jan 2022, according to TrendForce’s investigations. ASML is the largest supplier of key equipment (including EUV and DUV) required for foundry and memory production. According to TrendForce’s preliminary inquiry, approximately 200m2 out of a factory floor covering 32,000m2 was affected by the fire. This factory primarily manufactures optical components used in lithography systems such as wafer tables, reticle chucks, and mirror blocks. Reticle chucks used for affixing photomasks are in short supply. Currently, the majority of components produced at this factory go towards supplying EUV machines while the lion’s share of demand for these products come from foundries. If the fire delays component delivery, it cannot be ruled out that ASML will prioritize the allocation of output towards fulfilling foundry orders. (Laoyaoba, TrendForce, TrendForce)

Samsung Electronics has announced that it will make its eco-friendly technologies openly available to its competitors as part of its commitment to sustainable growth and efforts to protect the environment. Samsung’s efforts to reduce carbon emissions throughout the production cycle have earned recognition from the Carbon Trust, the world’s leading carbon footprint authority. In 2021, the company’s Carbon Trust-certified memory chips helped reduce carbon emissions by nearly 700,000 tons. To achieve what Samsung called “everyday sustainability,” the company’s visual display business plans to use 30 times more recycled plastics than it did in 2021. (Laoyaoba, KED Global, Korea Times)

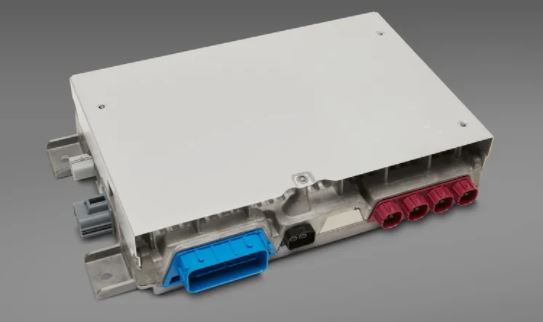

General Motors (GM) has completely redesigned the compute architecture that powers its next-generation “hands-free” driving system thanks to Qualcomm. GM’s Ultra Cruise system, which will make its debut in the 2024 Cadillac Celestiq electric sedan, will be the first advanced driver assist system (ADAS) to use Qualcomm’s new Snapdragon Ride Platform. (The Verge, Motor Authority, Reuters)

Intel’s autonomous driving unit, Mobileye, plans to work with Geely -backed Zeekr to launch in China what the companies claim will be the world’s first mostly self-driving car in 2024. The two companies has announced that the car will have what automotive engineers call level 4 autonomy, meaning that it will still have a steering wheel and require a licensed driver but will be able to drive itself in many situations. It will use six of Mobileye’s “EyeQ 5” chips and also employ Mobileye’s road-mapping data. (The Verge, Asia Nikkei, Auto News)

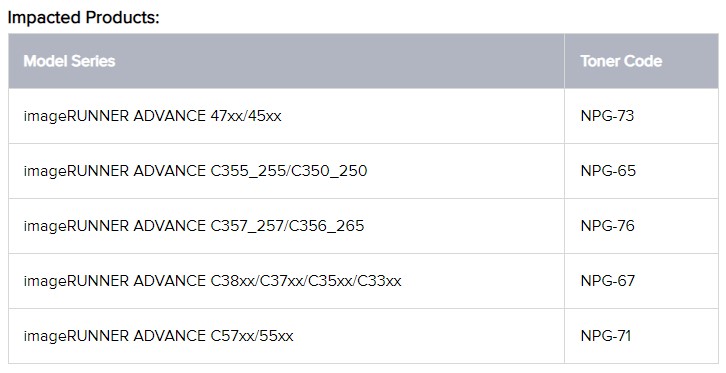

The global semiconductor chip shortage is impacting the supply of many electronic devices and some accessories. The impacted accessories include toner cartridge for Canon’s business printers and multifunction devices (MFDs). The role the chip plays in the toner cartridges is to communicate information, this includes toner level and to confirm that the toner is a genuine Canon product. The company has opted to go chip-less for the time being as an interim measure and hence will be manufacturing chip-less toner cartridges for its printers and its various other multi-function devices. The chip-less toners will begin circulation around Feb 2022. As this is an interim measure, Canon expects normal toner cartridges to return in the future. (Neowin, Twitter, Canon)

Samsung and Qualcomm hit a new 5G download speed record in a lab trial that aggregated millimeter wave and C-band spectrum to reach 8.08Gbps on a single user device. According to Samsung, the test was conducted in the vendor’s Plano, Texas facility and used New Radio-Dual Connectivity (NR-DC) mode combining 800MHz of mmWave in the 28GHz band with 100 MHz of mid-band C-band spectrum. Samsung solutions included its fully-virtualised RAN and Core, mmWave 5G Compact Macro and Massive MIMO radio, featuring Qualcomm 256 Quadrature Amplitude Modulation (QAM) technology for enhanced performance. (Android Headlines, Fierce Wireless, Rapid TV News)

LG has announced joining the IBM Quantum Network to advance industry applications of quantum computing. By joining the IBM Quantum Network, LG will receive access to IBM’s quantum computing systems, as well as to IBM’s quantum expertise and Qiskit, IBM’s open-source quantum information software development kit. Using IBM Quantum technology, LG aims to explore applications of quantum computing in any areas requiring processing a large amount of data including AI, connected cars, digital transformation, IoT and robotics applications. (Neowin, LG)

BOE has recently converted the layout of parts of its B12 OLED panel factory so that it can manufacture OLED panels for IT products and automobiles besides just smartphones. The phase 3 production line at B12 in Chongqing, China will be able to manufacture OLED panels for smartphones, IT and automobiles. Phase 3 was initially designed to handle Gen 6 (1500×1850mm) flexible OLED panels for smartphones like phases 1 and 2. The change of plan hints that BOE is likely aiming to supply OLED panels for Apple’s IT products, from tablets to PCs. Rivals Samsung Display and LG Display are also developing Gen 8.5 (2200×2500mm) IT OLED panel technology, as making larger panels on larger substrates is more cost-effective. (MacRumors, The Elec)

Tianfeng International analyst Ming-Chi Kuo has indicated that Meta’s high-end VR headset “Oculus Quest 3” to be unveiled in 2022 will be equipped with two 2.48” Mini LED panels with a resolution of 2160×2160 and a unit price of USD25-30. for Sharp and JDI. Quest 3 is the first Meta VR device to use a 2P Pancake lens (previously it was a 1P Fresnel lens). The Quest 3 is equipped with two 2P Pancake lenses priced at $10-15 each. The suppliers are Genius Electronic Optical (GSEO) and Sunny Optical (both take half of the order). He expects shipments of 1-2M units in 2022. He has also said that Apple’s AR/MR headset will be delayed until the end of 2022, and the more significant shipments will not be until 1Q23. This device uses two 3P Pancake lenses, each priced at USD15-20. If the contribution from the camera lens is included, each Apple AR/MR contributes about USD45-55 to GSEO’s revenue. This revenue contribution is about the equivalent of 25–35 units of high-end 7P lens. He also predicts that Sony’s PS5 VR will start shipping in 2Q22, and GESO and Goertek will be suppliers of high unit price Fresnel lenses (both take half of the orders). (TF Securities, Laoyaoba, CN Beta)

Tecno is announcing a telescopic macro lens that promises to significantly improve not only the quality of macro shots but also the whole experience taking them. This is a telephoto macro lens that extends from the body. It offers 5x optical zoom and the end result is comparable to the main camera. (GSM Arena, Unbox.ph)

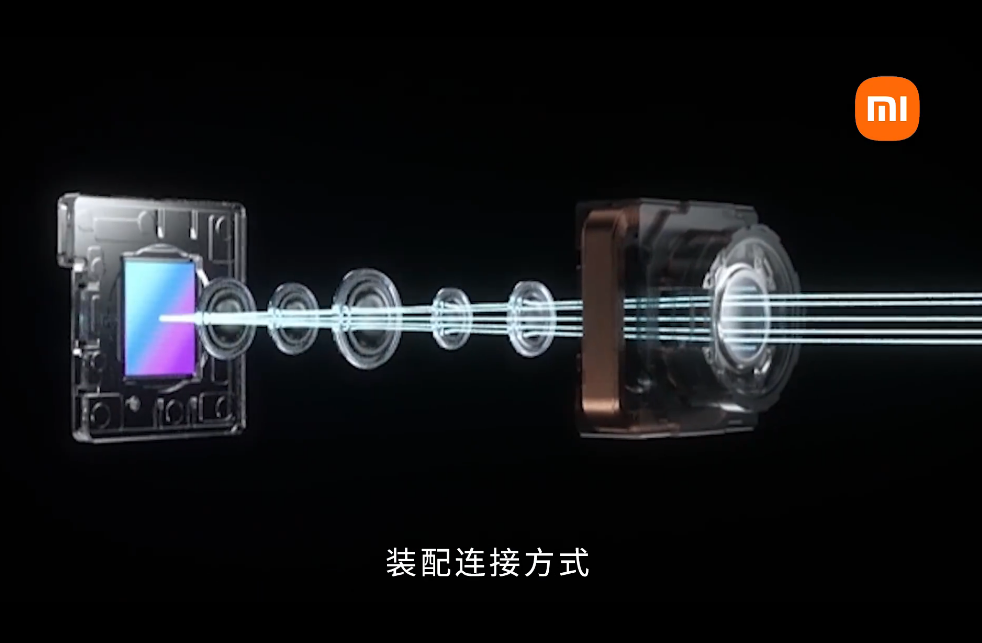

Xiaomi’s liquid camera featured on Xiaomi Mix Fold foldable phone is able to realize the coexistence of telephoto and macro. It is also the first liquid lens camera in the industry to achieve mass production. Under the premise of ensuring high pixels and module size, this camera achieves the same 3cm macro imaging, and the image quality of the central field of view is nearly doubled. Mix Fold’s mobile phone screen can present up to 12.25 times the lossless magnification effect. (My Drivers, IT Home, iFeng, Realmi Central)

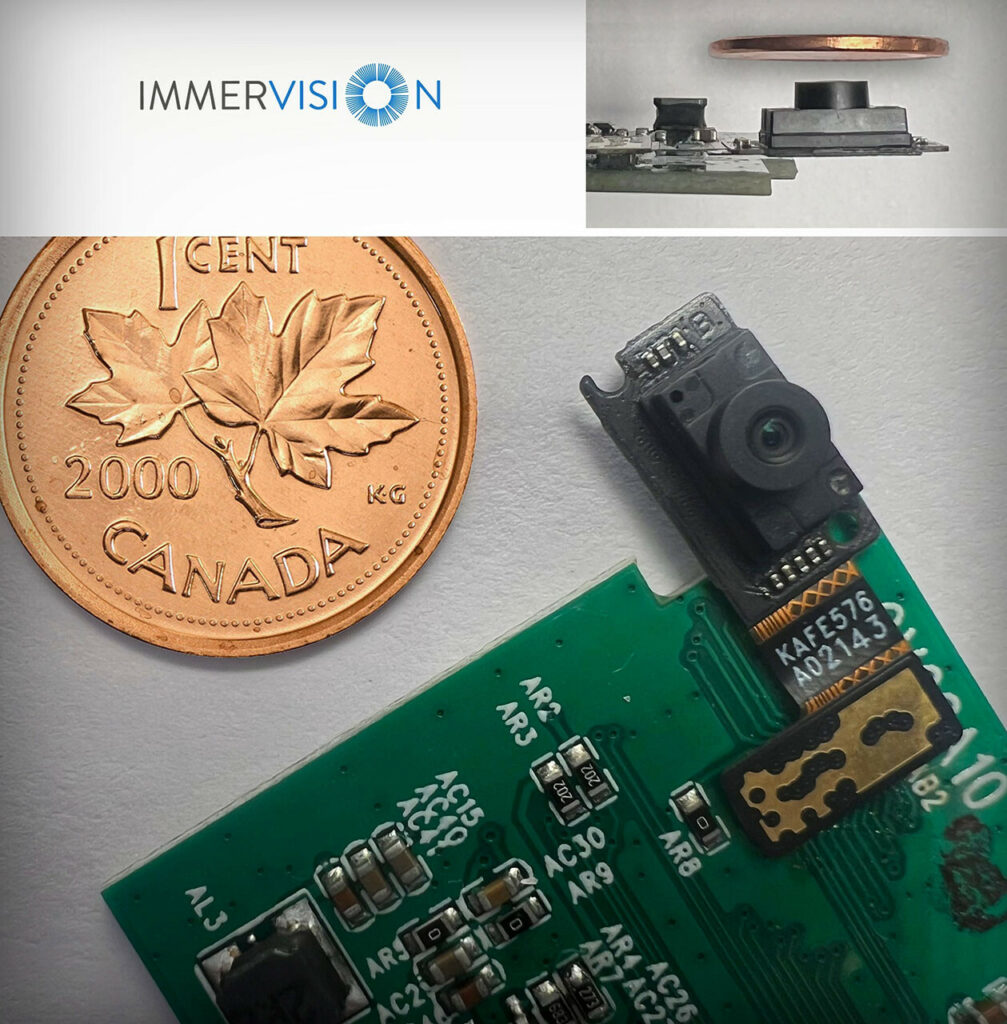

Immervision has announced its new 8 MP wide angle camera module for laptops, tablets and notepads with Immervision patented technology bringing image clarity edge-to-edge. Immervision’s 8 MP ultra-wide-angle lens-and-sensor combination is only 3.8 mm thick and offers a high-quality solution for a variety of applications that require higher resolution, a wide field of view and advanced distortion control. This solution can handle a variety of videoconferencing scenarios capturing larger scenes with optimal image sensor coverage, pixel density, and quality. (CN Beta, Immersion, PR Newswire)

DDR3 and other specialty DRAM prices are expected to stop falling and begin to rise as early as between the end 1Q22 and 2Q22, according to Digitimes. As South Korean suppliers gradually withdraw production, Taiwanese suppliers will receive a large number of order transfers. DDR3 suppliers in Taiwan are finding that some customers are more willing to accept price increases, especially those for 4Gb and higher-density DDR3 chips. At the same time, Mainland Chinese memory chip companies are increasing DDR3 production yields in preparation for entering the DDR3 field. However, sources believe that DDR3 chip prices should not be affected by supply in the short term. (Digitimes, Laoyaoba)

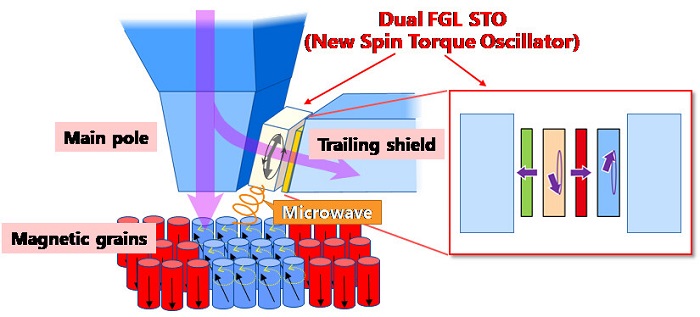

Toshiba Group has announced the world’s first demonstration of HDD recording performance improvement with Microwave Assisted Switching-Microwave Assisted Magnetic Recording (MAS-MAMR), a next-generation magnetic recording technology. The demonstration confirms that the technology delivers substantial storage capacity gains, and Toshiba now aims to realize early commercialization of nearline HDDs with capacities exceeding 30TB. Toshiba is placing considerable R&D effort on MAMR, a breakthrough technology that boosts HDD recording density. (CN Beta, Business Wire, Citizen Tribune)

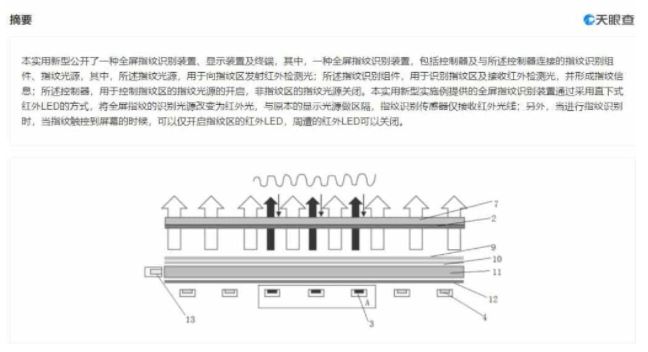

Xiaomi is awarded a patent for a new fingerprint scanning technology. This newfangled technology will reportedly enable the entire screen to detect fingerprints. Moreover, this will minimize the inaccuracy users experience with the current under-display fingerprint scanner. The all-screen fingerprint scanner will not require touching and holding on a specific spot for fingerprints detection. Instead, users will be able to tap anywhere on the screen to unlock the phone. (GizChina, IT Home, Sina)

Google has been publicly building tiny radar chips since 2015. Now, Google has launched an open-source API standard called Ripple that could theoretically bring the tech to additional devices outside Google — perhaps even a car, as Ford is one of the participants in the new standard. Technically, Ripple is under the auspices of the Consumer Technology Association (CTA). (CN Beta, The Verge, 9to5Google, Gizmo China, Ripple)

FarmSense, a Riverside, California-based agtech startup attempting to solve the insect pest problem. The company creates optical sensors and novel classification systems based on machine learning algorithms to identify and track insects in real time. They claim real-time information provided by their sensors allows for early detection and thus the timely deployment of pest-management tools, such as insecticide or biocontrols. The current mechanical traps used for monitoring may only yield important intel 10-14 days after the bugs’ arrival. (CN Beta, TechCrunch)

Ossia CEO Doug Stoval has revealed that the company’s wireless charging technology Cota will start appearing in products from French electronics maker Archos later in 2022. Products sporting Cota will include an entirely wireless security camera, an air monitoring sensor and a pet tracker due to arrive in stores in 2022. Ossia partner is working on commercializing its Cota Power Table, which uses Ossia’s technology to beam power from the ceiling to conventional phone-charging pads. Energous has displayed a host of devices that use its WattUp charging technology, which also beams juice across a room. The products include EarTechnic hearing aids, Gokhale PostureTracker medical monitors and Williot smart tracking tags. The rollout of products using Ossia’s and Energous’ technologies highlights the maturation of charging systems that don’t require a physical connection to a power source. (CN Beta, Ossia, Rethink Research, CNET, Wired)

LG Energy Solution CEO and vice chairman Kwon Young-soo has claimed that it will overtake CATL, the world’s largest battery maker, in the future. He has said that LG Energy Solution’s market capitalization is currently behind CATL but the pair would soon be “competing on equal footing”. The company is expected to be valued at around KRW70T. CATL’s market capitalization is KRW234T, over triple that of LG Energy Solution’s initial valuation. (My Drivers, The Elec, Korea Times)

NXP has announced first monolithic tri-radio family to support Wi-Fi 6, Bluetooth 5.2 and 802.15.4, enables simultaneous transmit and receive for higher performance in smart solutions. It Supports Matter, the interoperable, secure connectivity standard for the future of the smart home, providing unprecedented coexistence, performance, and radio integration. It Seamlessly connects smart devices across protocols and ecosystems, simplifying development and reducing cost and board space for smart home, automotive, and industrial devices. (The Verge, NXP)

Samsung has finally discontinued its Tizen Store platform from its Tizen phones. From 31 Dec 2021, no one can download or update apps from the store. The service has closed for all Samsung Z1, Z2, Z3 and Z4 smartphones in all the countries. Samsung has already left Tizen smartwatches for Android’s Wear OS 3 platform. (GSM Arena, Tizen Help)

Samsung Electronics has announced the 2022 sustainability initiatives that will accelerate the development of eco-conscious home appliances. Samsung is coming together with American clothing company Patagonia to promote environmental sustainability by addressing the issue of microplastics and its impact on the ocean environment. Samsung has also partnered with Q CELLS to establish a new Zero Energy Home Integration feature for SmartThings Energy. This feature provides production and storage data from solar panels and energy storage systems to help users establish energy self-sufficiency. SmartThings Energy monitors power usage of consumers’ connected devices and recommends energy-saving methods based on their usage patterns. Partnering with Wattbuy in the U.S. and Uswitch in the U.K., SmartThings Energy allows users to switch over to the most cost-efficient energy provider in their area. (CN Beta, Samsung, Sammy Fans)

Tencent Group is allegedly planning on buying the Black Shark brand and integrating it with its own Content Business Group. The move from the company arrives as it apparently plans to step into the Metaverse. It adds that the gaming smartphone making company will also undergo a business transformation after the acquisition process is complete. In other words, Black Shark as a brand would likely see an expansion once the transaction is completed. This diversification process will reportedly grow to include VR (Virtual Reality) based technologies and devices. So, the software content for VR will be provided by Tencent while Black Shark manufactures the hardware. (Gizmo China, 36Kr)

HTC is announcing a new wrist-based controller for its Vive Focus 3 virtual reality headset. The wireless Vive Wrist Tracker fits like a watch around a user’s arm, tracking the orientation and position from hand to elbow. It is designed to complement the business-focused headset’s existing controllers, particularly for simulation and training experiences where body position is important. It is priced at USD129. (The Verge, Road To VR, HTC Vive)

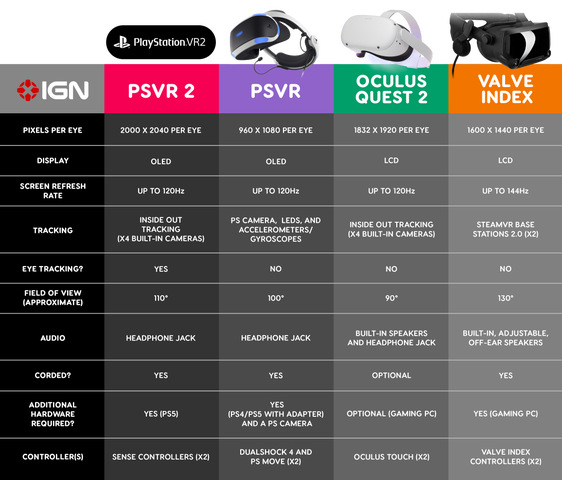

Sony has revealed the official name of its headset, PlayStation VR2, as well as the official name of its new VR controller, PlayStation VR2 Sense controller. Using the headset’s new technology and the PlayStation VR2 Sense controller’s haptic feedback and adaptive triggers, Sony believes it will be able to offer “a heightened range of sensations unlike any other”. With inside-out tracking, PS VR2 tracks user and user’s controller through integrated cameras embedded in the VR headset. User’s movements and the direction the user looks at are reflected in-game without the need for an external camera. (CN Beta, IGN, PlayStation, TechRadar)

Hyundai Motor and Unity, the world’s leading platform for creating and operating real-time 3D (RT3D) content, have announced a partnership to jointly design and build a new metaverse roadmap and platform for Meta-Factory. The partnership will realize Hyundai’s vision of becoming the first mobility innovator to build a Meta-Factory concept, a digital-twin of an actual factory, supported by a metaverse platform. The Meta-Factory will allow Hyundai to test-run a factory virtually in order to calculate the optimized plant operation, and enable plant managers to solve problems without having to physically visit the plant. (CN Beta, PR Newswire, Seeking Alpha)

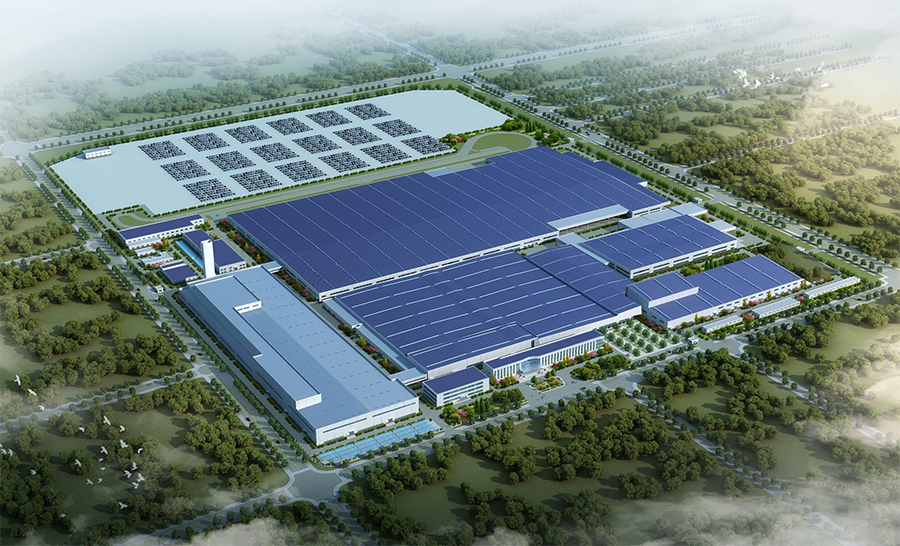

Honda Motor and its Chinese joint venture partner Dongfeng Motor have said that they would build a new factory in Wuhan to exclusively manufacture electric vehicles (EVs) from 2024. Aiming to begin production in 2024, the new dedicated EV plant will be built in Wuhan Economic Development Zone in Hubei Province, China, with a lot size of 630,000 square meters, and a basic annual production capacity of 120,000 units. (Laoyaoba, Reuters, Honda)