1-22 #VIP : Intel plans for more than USD20B in the construction of chip factories in Ohio; Samsung Display is reportedly advancing its withdrawal from the LCD business; Ericsson has filed another set of patent infringement lawsuits against Apple; etc.

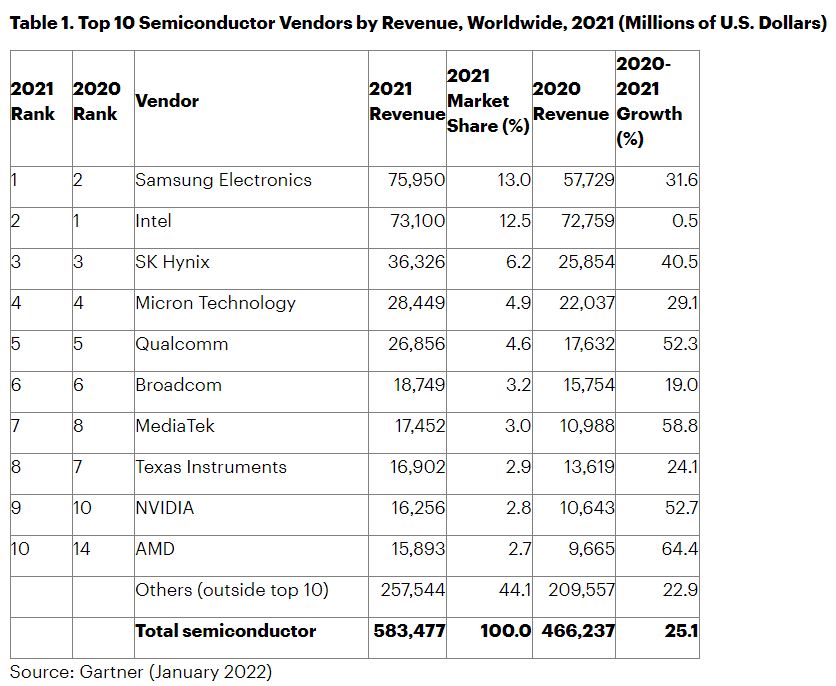

Worldwide semiconductor revenue increased 25.1% in 2021 to total USD583.5B, crossing the USD500B threshold for the first time, according to Gartner. As the global economy bounced back in 2021, shortages appeared throughout the semiconductor supply chain, particularly in the automotive industry. The 5G smartphone market also helped drive semiconductor revenue, with unit production more than doubling to reach 555M in 2021, compared to 250M in 2020. (My Drivers, Gartner)

MediaTek is working on hardware to support the upcoming Wi-Fi 7 standard, which could start showing up in devices as early as 2023. Wi-Fi 7, also known as IEEE 802.11be, is an upgrade from the existing Wi-Fi 6 (IEEE 802.11ax) standard. The current plan for Wi-Fi 7 adds the ability to utilize 320Mhz channels, 4K quadrature amplitude modulation (QAM) technology, multi-user resource unit (MRU) features, and other changes — all while using the same 2.4, 5, and 6GHz bands currently supported by Wi-Fi 6. MediaTek has announced the world’s first live demo of Wi-Fi 7 technology, highlighting the capabilities of its forthcoming Wi-Fi 7 Filogic connectivity portfolio.(GSM Arena, XDA-Developers, MediaTek)

Citi Research analyst Christoper Danely thinks that demand for personal computers has been “well above expectations” given the “resurgent enterprise refresh”. That trend could help Intel positively surprise with its fiscal year 4Q21 results and 1Q21 outlook. Beyond that, he sees some longer-term challenges in store for Intel. For one, he has argued that “considerable effort and focus still will be needed by Intel, especially in manufacturing, to catch up to its competitors”. Danely also thinks that PC demand will “revert to the mean given two straight years of double digit growth”. (My Drivers, Barron’s, Market Watch, Yahoo)

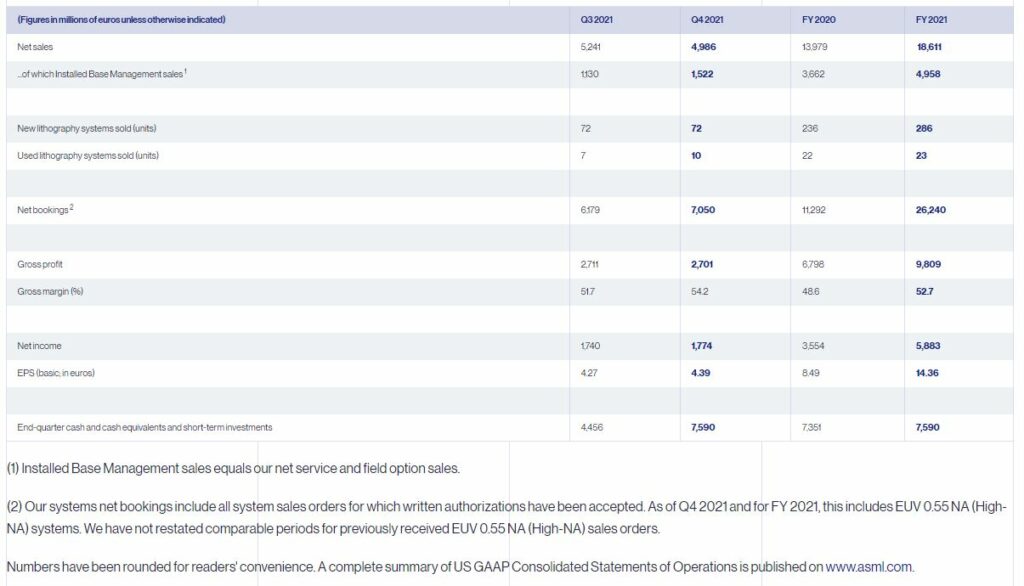

ASML has reported better-than-expected 4Q21 earnings of EUR1.77B (USD2.01B) and said it expected sales growth of 20% in 2022. The total net sales for 2021 was EUR18.6B, including EUR6.3B from 42 EUV systems. The increased demand for chips saw a growth of over 24%, selling 286 systems in 2021, and the company is speeding up delivery of systems by testing at a customer fab rather than in the factory.(My Drivers, CNBC, ASML, EE News Europe, Market Screener)

Intel has announced plans for an initial investment of more than USD20B in the construction of two new leading-edge chip factories in Ohio. The investment will help boost production to meet the surging demand for advanced semiconductors, powering a new generation of innovative products from Intel and serving the needs of foundry customers as part of the company’s IDM 2.0 strategy. To support the development of the new site, Intel pledged an additional USD100M toward partnerships with educational institutions to build a pipeline of talent and bolster research programs in the region.(GSM Arena, Business Wire, Engadget)

Qualcomm has acquired Augmented Pixels, a Ukrainian-founded AR/VR software developer now headquartered in California. Founded in 2013 in Odesa, southern Ukraine, Augmented Pixels has developed a proprietary simultaneous localisation and 3D mapping technology. This approach has applications in augmented reality navigation and 3D mapping for mobile phones, drones and robots. (CN Beta, Forbes, BNE Intellinews, Sina, Ukraine Digital News)

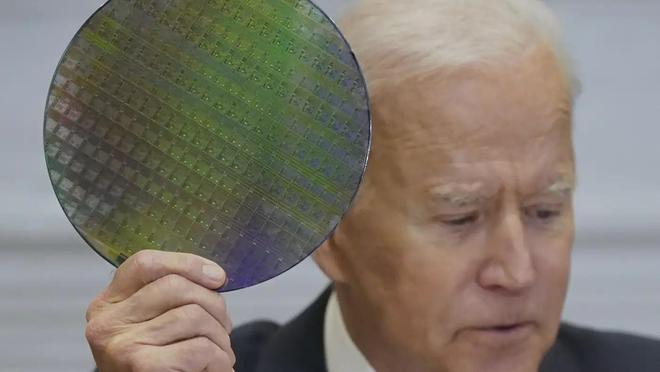

The U.S. House of Representatives will soon introduce a bill to increase U.S. competitiveness with China and boost federal spending on semiconductors, as the Biden administration seeks to boost domestic chip production. President Joe Biden’s administration is pushing to persuade Congress to approve funding to help boost chip production in the United States, as shortages of the key components used in autos and computers have exacerbated supply chain bottlenecks. The Senate passed the U.S. Innovation and Competition Act last year, which includes USD52B to increase U.S. semiconductor production and authorizes USD190B to strengthen U.S. technology and research to compete with China. (CN Beta, SCMP, White House, ZDNet, Reuters)

According to Deloitte, in 2022, the global semiconductor chip industry is expected to reach about USD600B. But while it is still dwarfed by farming, oil, and gas—industries that are worth an annual USD10T and USD5T in revenue respectively—80% of the world’s food or fuel doesn’t come from a handful of manufacturers concentrated in a just a few countries. The chip shortage of the past two years resulted in revenue misses of more than USD500B worldwide between the semiconductor and its customer industries, with lost auto sales of more than USD210B in 2021 alone. Over the long run, semiconductor revenues are likely to oscillate around a trend line. Still, that trend line looks steeper than ever before as we enter a period of robust secular growth. (VentureBeat, Deloitte, report)

Terra Quantum, a Zurich, Switzerland-based startup that aims to build a quantum-as-a-service platform (including, eventually, its own proprietary quantum hardware), has announced that it has raised a USD60M Series A round. The idea behind Terra Quantum is to build a new end-to-end quantum platform. With its own quantum chips still a couple of years out, this currently means the company focuses on offering to its customers a library of quantum algorithms and quantum security tools, including a quantum key distribution service.(TechCrunch, Sifted, Business Wire)

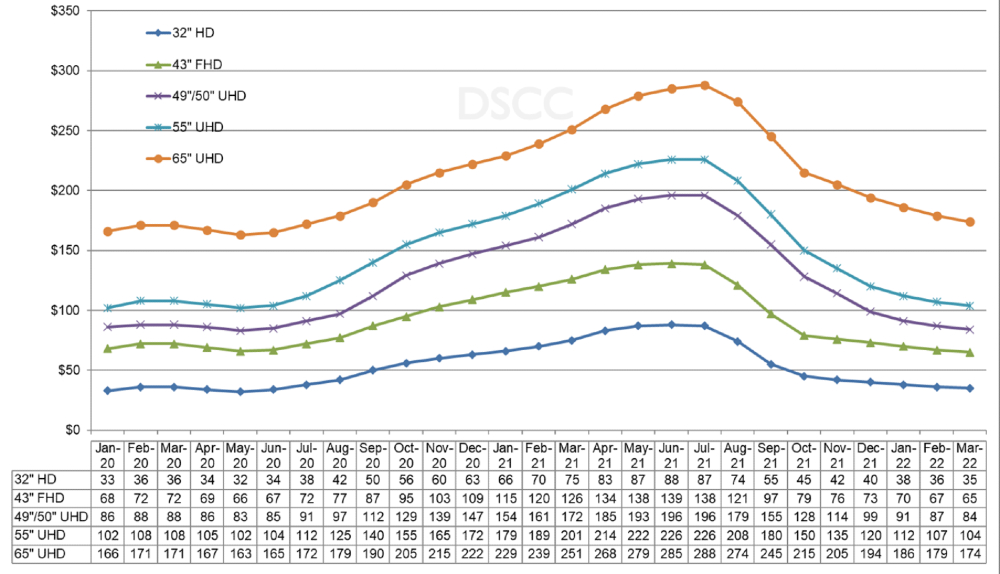

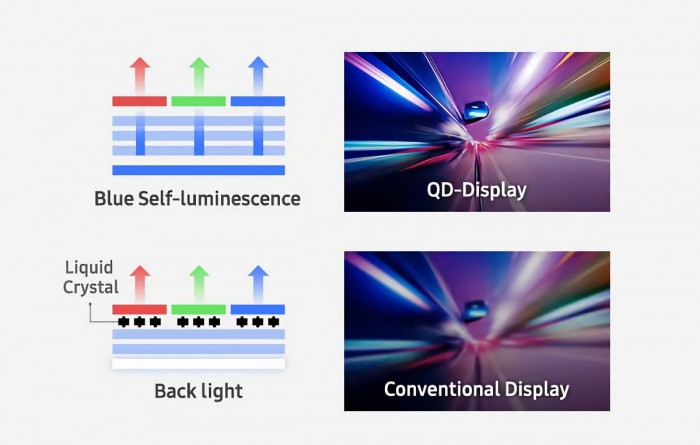

Samsung Display is reportedly considering advancing its withdrawal from the liquid crystal display (LCD) business from the planned end of 2022 to Jun 2022. Samsung Display is producing LCD panels for TVs at L8-2, a large LCD production line at the Asan Campus in South Chungcheong Province. It will make a final decision after a consultation with Samsung Electronics, its largest customer and a sister company. Samsung Electronics has decided to increase the purchase volume of low-priced LCD panels from China’s BOE, Taiwan’s AOU and Innolux to boost its market share and price competitiveness. Samsung Display has decided to focus on fostering QD organic light emitting diode (OLED) panels instead of LCDs. (CN Beta, Business Korea, TechNews)

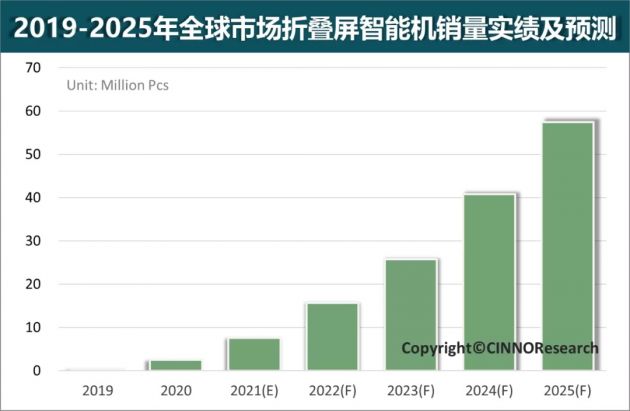

CINNO Research believes that foldable phone will continue to be enriched and prices will continue to drop. In the future, the product form of foldable phone will be mainly vertical folding, and the price will drop to CNY5,000-8,000, targeting the mid-to-high-end market. The horizontal and inward folds are the second, positioning the high-end business market, and mainly in the stalls around CNY10,000. CINNO Research predicts that the sales of foldable smartphones in the global market in 2022 are expected to reach 15.69M units, a YoY increase of 107%. Among them, Samsung will still dominate, with an estimated market share of over 70%. In the future, with the continuous decline in the cost of folding machines, technological innovation, the gradual enrichment of products and the continuous upgrading of software, the market size will continue to expand. CINNO Research believes that the global sales of folding screen smartphones are expected to reach 57.4M in 2025, with an average annual compound rate of 66%。 (CN Beta, CINNO)

SK Hynix to reveal its latest and faster HBM3 memory standard. The new memory is reportedly capable of achieving speeds of up to 896GB/s, up from the initial 820GB/s that was first touted when it launched its 12-Hi HBM3 in 2021. Like its predecessor, the new HBM3 memory is expected to be a 12-layer DRM, with a capacity of 196Gb or 24GB. How this is achieved is through a process called Through Silicon Via (TSV) auto-calibration and machine-learning optimizations. SK Hynix’s first HBM3 specs featured a 5.2 Gbit/s data rate per pin (665 GB/s) only to be updated by 23% to 6.4 Gbit/s (819 GB/s) a few months later. The latest 7 Gbit/s memory would provide an additional 10% upgrade over Oct 2021 spec.(CN Beta, Lowyat, VideoCardz)

Kioxia has announced the launch of Universal Flash Storage (UFS) Ver. 3.1 embedded flash memory devices utilizing the company’s innovative 4-bit per cell quad-level-cell (QLC) technology. Kioxia’s UFS proof of concept (PoC) device is a 512 gigabyte prototype that utilizes the company’s 1 terabit (128 gigabyte) BiCS FLASH 3D flash memory with QLC technology, and is now sampling to OEM customers. The PoC device is designed to meet the increasing performance and density requirements of mobile applications driven by higher resolution images, 5G networks, 4K plus video and the like.(CN Beta, Kioxia, Business Wire)

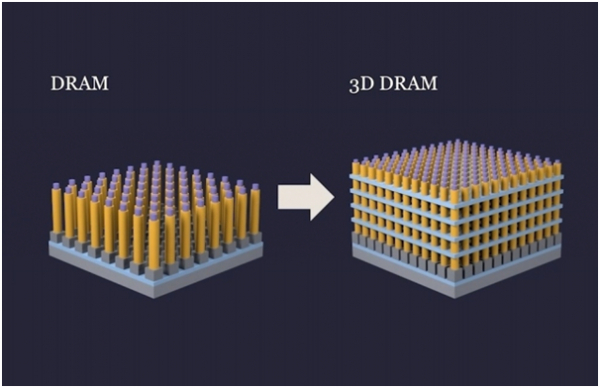

Samsung Electronics is speeding up research and development (R&D) of 3D DRAMs. Samsung Electronics has reportedly started developing a technology for stacking cells lying down. It is a different concept from high-bandwidth memory (HBM), which is produced by stacking multiple dies atop each other. In addition, Samsung Electronics is also considering increasing the contact surface between the gate (current gate) and the channel (current path) of the DRAM transistor. This means that three-side-contact FinFet technology and four-side-contact gate-all-around (GAA) technology can be utilized for DRAM production. A transistor can control the flow of current more precisely when the contact surface between gates and channels increases.(CN Beta, Business Korea, Blocks and Files)

Despite having sold its fab in Lehi, Utah to Texas Instruments (TI) back in Oct 2021, it looks like Micron is ready to build a new, most likely more advanced fab and rumours are now circulating that it might end up in Austin, Texas. Micron currently has two fabs in Virginia and one in Idaho, plus four in Singapore, four in Taiwan, one in the PRC and one in Japan. Micron announced in 2021 that it is looking to invest some USD150M in expanding and improving upon its current fabs, plus potentially building additional ones. (CN Beta, Tech Powerup, The Real Deal)

Mercedes-Benz has revealed it plans to use Luminar’s lidar technology in future vehicles as part of a broader deal that includes data sharing and the automaker taking a small stake in the company. Mercedes-Benz will acquire up to 1.5M Luminar shares, in exchange for certain data and services. Luminar’s agreement with Daimler North America Corporation will involve developing and integrating its technology on its next-generation series production passenger vehicles as well as other defined activities. Mercedes-Benz has said that its model year 2023 S-Class and EQS sedans will come with the automaker’s Drive Pilot advanced driver assistance system, which it describes as capable of Level 3 automation.(CN Beta, CNBC, The Verge, TechCrunch)

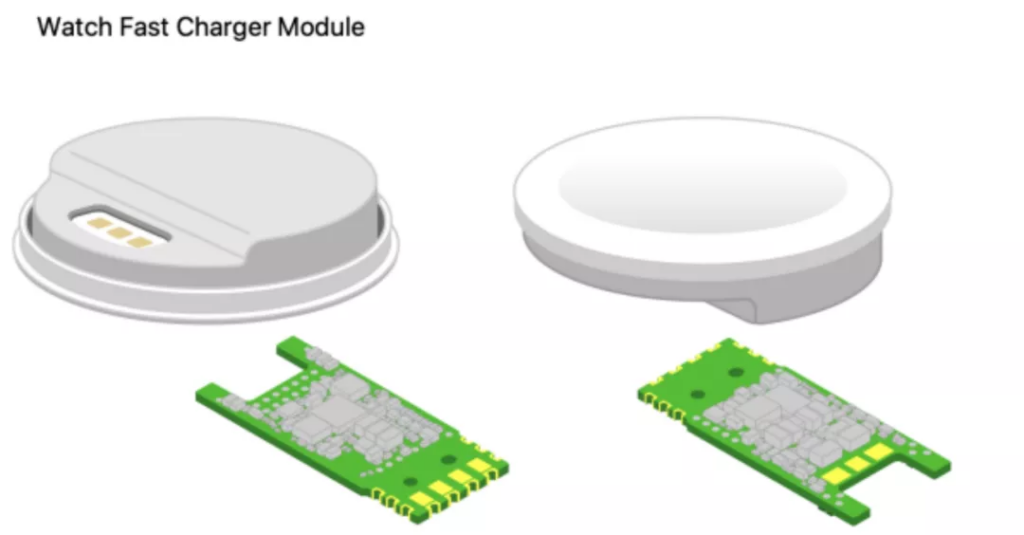

Apple has officially announced the unveiling of a new USB-C interface watch magnetic suction wireless fast charging module and benefits Apple Watch Series 7. Apple has released the latest watch fast charging module Watch Fast Charger Module. This module has a separate design, the power supply portion and the coil are C interface, and it allows wireless fast charging of Apple Watch Series 7 watches.(CN Beta, TechGenYZ, Sina)

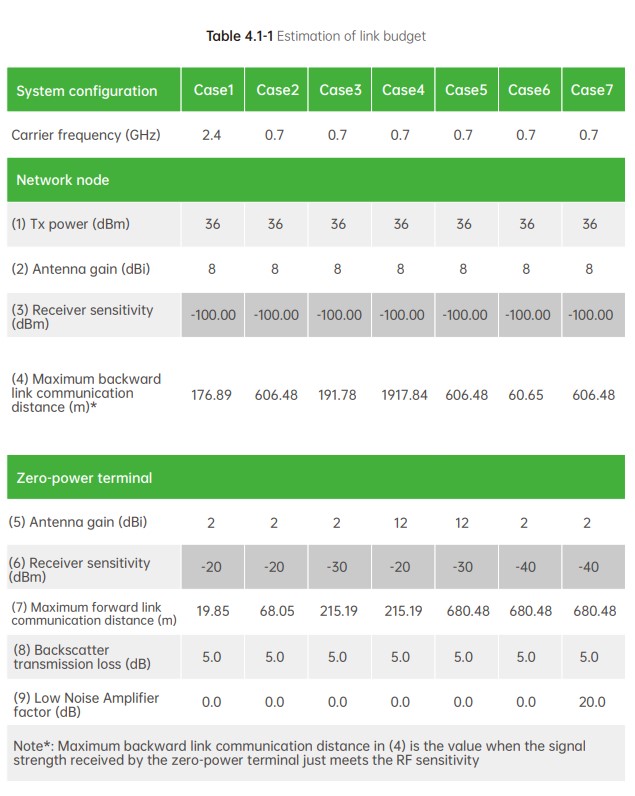

OPPO envisions a battery-free, “zero-power communication” system for small, low-powered IoT devices. The company leans into the idea of ambient radio frequency (RF) wave-powered electronics that need not rely on onboard power sources to function. OPPO explains that in the future IoT devices will be able to harvest energy directly from Bluetooth, Wi-Fi, and cellphone signals, resulting in excellent features such as smaller size, better durability, and lower cost. (Android Authority, OPPO)

General Motors (GM) is expanding its reach in the hydrogen fuel cell business, having confirmed three new commercial applications for its HYDROTEC technology as it targets heavy-duty trucks, locomotives and aerospace applications. GM states that its HYDROTEC-based power generators will soon be powering a Mobile Power Generator (MPG) to fast-charge electric vehicles, an EMPOWER rapid charger for retail fuel stations and a palletized MPG to power military camps and installations. In addition to the MPG project, GM and Renewable Innovations are also teaming up to enhance direct current (DC) fast charging capabilities at retail fuel stations with an EMPOWER rapid charger, offering more efficient fuelling and a more affordable price. (CN Beta, General Motors, Inside EVs, H2-View)

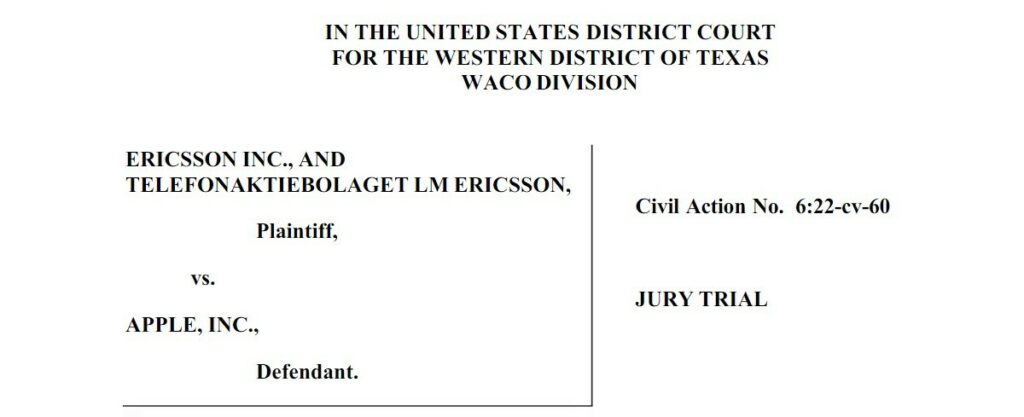

Sweden’s Ericsson has filed another set of patent infringement lawsuits against Apple in the latest salvo between the two companies over royalty payment for use of 5G wireless patents in iPhones. Ericsson holds over 57,000 patents, royalties from which account for around a third of its operating profit. As for its 5G patent, the company usually collects USD2.5-5.0 in royalties per phone. Apple believes it now holds a share of declared 5G patent families that is comparable to Ericsson’s share. As such, Apple thinks its net payments to Ericsson should decrease compared to the 2015 license. (GSM Arena, Foss Patents, Reuters, IAM)

Apple is firing back with a countersuit that aims to ban imports of Ericsson mobile base station equipment in the US. Apple’s suit was filed with the United States International Trade Commission (ITC). Apple is now asking the ITC to ban all US imports relating to Ericsson’s mobile network infrastructure with Apple citing infringements of its own mmWave patents.(GSM Arena, Foss Patents)

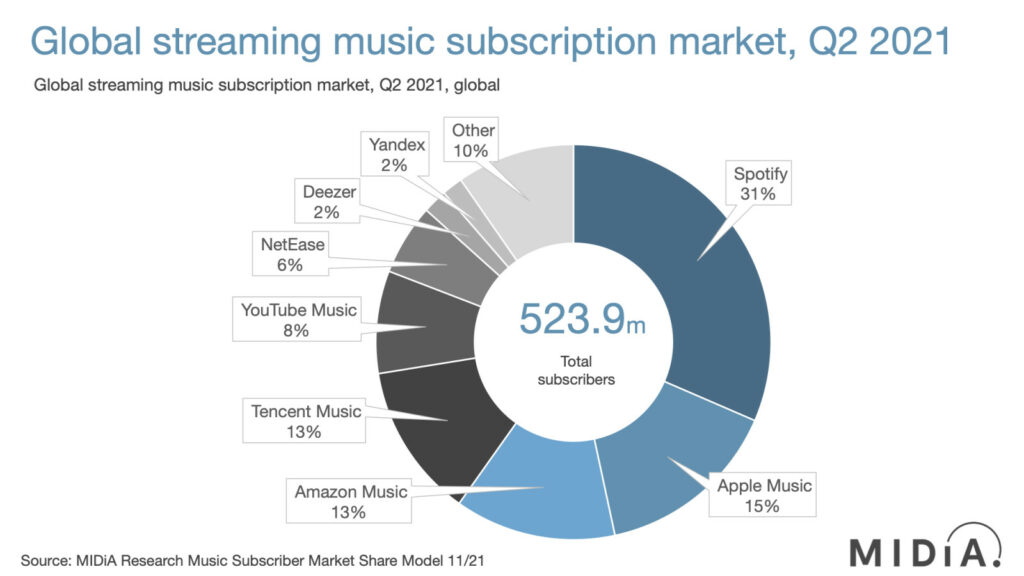

According to Midia Research, the global base of music subscribers continues to grow strongly with 523.9M music subscribers at the end of 2Q21, which was up by 109.5M (26.4%) from one year earlier. Spotify remains the digital service provider (DSP) with the highest market share (31%), but this was down from 33% in 2Q20 and 34% in 2Q19. With Apple Music being a distant second with 15% market share, and Spotify adding more subscribers in the 12 months leading up to 2Q21 than any other single DSP, there is no risk of Spotify losing its leading position anytime soon – but the erosion of its share is steady and persistent. (GSM Arena, Midia Research, 9to5Mac)

Geely Group is allegedly in contact with the mobile phone manufacturer Meizu to discuss potential acquisition. In Sept 2021, Geely Group established Hubei Xingji Times, targeting high-end mobile phones. Geely has responded that it would not comment on market rumors. Currently, the high-end mobile phone research and development business of Xingji Times is progressing in an orderly manner, and it hopes to create an open and integrated ecological partnership. The company has applied for 4 trademarks, including “comer”, “portable large screen”, “UPON”, “UPUPHONE”. (Gizmo China, 36Kr, My Drivers, My Drivers, Sina)

Tecno Pova Neo is launched in India – 6.8” 720×1640 HD+ v-notch, MediaTek Helio G25, rear dual 13MP-AI lens + front 8MP, 6+128GB, Android 11.0, rear fingerprint, 6000mAh 18W, INR12,999 (USD174). (GSM Arena, Gizmo China)

Tecno Pop 5 Pro is launched in India – 6.52” 720×1600 HD+ v-notch, MediaTek Helio A22, rear dual 8MP-AI lens + front 5MP, 3+32GB, Android 11.0 Go, no fingerprint scanner, 6000mAh, INR8,499 (USD114). (GSM Arena, Gizmo China)

vivo Y21A is launched in India – 6.51” 720×1600 HD+ v-notch, MediaTek Helio P22, rear dual 13MP-2MP macro + front 8MP, 4+64GB, Android 11.0, side fingerprint, 5000mAh 18W, price not yet announced. (GizChina, GSM Arena, vivo, Gizmo China)

Google has reportedly begun ramping up work on an AR headset, internally codenamed Project Iris, which it hopes to ship in 2024. Google’s device uses outward-facing cameras to blend computer graphics with a video feed of the real world, creating a more immersive, mixed reality experience than existing AR glasses. Project Iris will be powered by custom Google silicon. Early prototypes of the headset reportedly resemble a pair of ski goggles. The headset will also run Android, or at least a version of Android built specifically for AR headsets. (Android Authority, The Verge, Android Headlines)

Meta is reportedly exploring plans to let users create, showcase, and sell NFTs (non-fungible tokens) on Facebook and Instagram. Facebook and Instagram are “readying” a feature that will let users display NFTs as their profile pictures, as well as working on a prototype to let users mint new NFTs. Others at Meta are reportedly discussing “launching a marketplace for users to buy and sell NFTs”. (CN Beta, TechCrunch, Financial Times, The Verge)

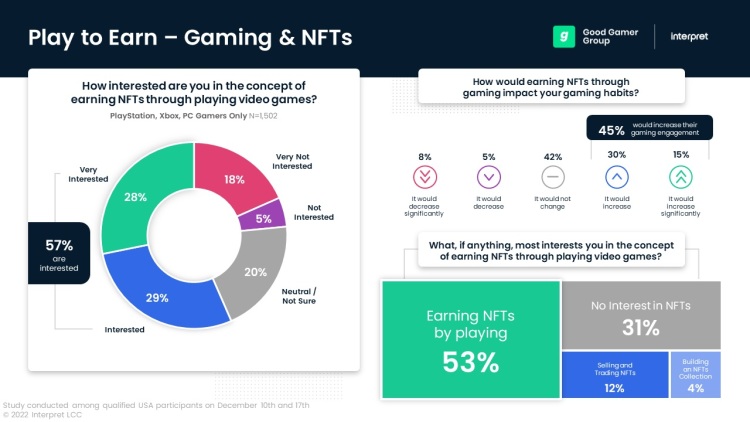

A study of 1,500 console and PC gamers found that 56% of them are interested in earning nonfungible tokens (NFTs) through gaming, according to market research firm Interpret. Interpret has also said that NFTs could play a major role in retention (of critical importance to live-service games), as over 45% indicated that being able to earn NFTs through gaming would increase their current engagement levels with games. Additionally, over 53% indicated that earning NFTs is the primary driver, compared to being able to sell/trade NFTs, and the idea of building an NFT collection. (VentureBeat, Interpret)

Varjo Technologies has upgraded its Varjo Reality Cloud solution with global cloud streaming, bringing the company closer to its vision of a real-life collaborative platform for the Metaverse. The company’s world-first tool will also stream VR/XR content with human-eye resolutions to its VR-3, XR-3, and Aero headsets, providing a massive increase in immersive workflow scalability with tethering to smaller, less powerful devices. Varjo’s Reality Cloud will also provide professionals with immersive workflows with “infinite” computing power, backed by Amazon Web Services (AWS) and NVIDIA’s graphic processing units (GPUs), to significantly reduce local computing requirements.(VentureBeat, XR Today, Road to VR)

Veritone has developed a product called MARVEL.ai that allows content producers to generate and license what it calls “hyper-realistic” synthetic voices. Veritone has access to petabytes of data from media libraries and uses that to train its AI product, creating a synthetic version of the original voice that can be tuned for different kinds of sentiment or emotion, or with interpretation, speak a foreign language. This technology will likely first be used in advertisements, but as it migrates to higher-quality content, it will open up potential opportunities and pitfalls for celebrity talent.(CN Beta, Veritone, Business Wire, Axios)

Parallel Systems, a company founded by three former SpaceX engineers to build autonomous battery-electric rail vehicles, came out of stealth mode on Wednesday with a USD49.55M Series A raise. The funds will be used to build Parallel System’s second-generation vehicle and launch an advanced testing program that will help the startup figure out how to integrate its vehicles into real-world operations. (CN Beta, CNBC, TechCrunch)

Baidu has announced the official release of the JiDU brand vision. Inspired by automotive robots, JiDU combined the concept of “pixel” with the letter “J” to create the industry’s first automotive robot brand logo “Pixel-J”. Jidu is an automotive robot startup company initiated by Baidu Group and invested by Geely Group. Jidu will announce its first concept car in 1H22 and deliver its first automotive robot in mass production in 2023.(CN Beta, Sina)

Mitsubishi Electric is partnering with Cartken, a company developing autonomous delivery robots, to start a pilot program in Tokyo. The companies plan to launch the project at Aeon Mall Tokoname beginning this month. Customers will be able to order from the Starbucks Coffee app and have their order delivered to designated delivery points inside or outside of the mall. Customers will be able to use their Starbucks app to select robotic delivery for their order, and a Cartken robot will meet the customer at one of the delivery points inside or outside the mall. (CN Beta, TechCrunch, Robot Report, e-logit)

Huawei has announced its partnership with Curve, which enables contactless payments in stores using the NFC chip on you HMS-powered Huawei smartphones. Curve is a smart wallet service that gathers all of credit and debit cards in one place for easier payments in stores.(GSM Arena, CN Beta)

Google Labs is building a brand new group focused solely on blockchain and other next-gen distributed computing and data storage technologies. Google Labs is a subdivision and incubator at Google for upcoming technology. Google Labs is meant to work on “long-term technology projects that are in direct support of [its] core products and businesses”.(9to5Google, Android Headlines, Bloomberg)

Google is allegedly planning to make its Google Play more compelling by adding features like crypto payments. Google’s president of commerce Bill Ready stated that Google has hired former PayPal executive Arnold Goldberg as part of a company-wide push into financial services, including crypto. Arnold Goldberg has been recruited to become the vice president and general manager for the payments and emerging market efforts, an initiative Google calls Next Billion Users (NBU). (Bloomberg, Gizmo China, Coin Telegraph, Business Insider)

Cryptocurrency exchange Crypto.com has acknowledged that the company had lost well over USD30M in Bitcoin and Ethereum after a hack that took place on 17 Jan 2022. The company has been criticized for vague communication around the hack, which has been officially confirmed by CEO Kris Marszalek. The total value of the unauthorized withdrawals was 4,836.26 ETH and 443.93 BTC — equivalent to roughly USD15.2M and USD18.6M, respectively, at current exchange rates — as well as USD66,200 worth of other currencies. (The Verge, Crypto.com)