2-8 #WorkDays : Intel has announced a new USD1B fund; Intel has joined RISC-V International; Spirit Airlines and Frontier Airlines are merging to become US 5th biggest airlines; etc.

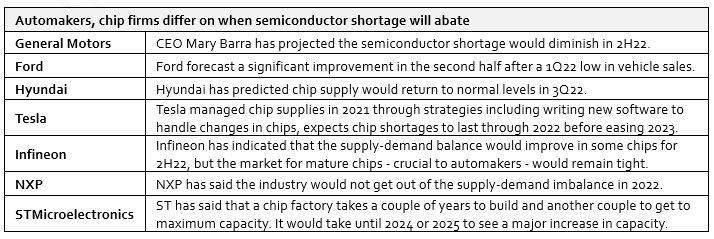

Automakers, including General Motors, Ford Motor and Hyundai Motor, predict a near two-year chip constraint will ease in 2H22, but automotive chipmakers, on the other hand, expect a recovery to take longer. The leading automotive chipmakers like NXP and Infineon forecast a supply squeeze to persist despite production increases. The differing outlooks on the most pressing issue facing the automobile industry prolong uncertainty about its recovery from the coronavirus pandemic and risk hampering its efforts to transition to new, chip-intensive technologies such as electrification and safety and driving-assistant features. The chip shortage will cost the global auto industry in 2021 USD210B in revenues and lost production of 7.7M vehicles, consultant AlixPartners estimated in Sept 2021. (Laoyaoba, Reuters)

Ford Motor plans to suspend or cut production at 8 of its factories in the United States, Mexico and Canada throughout next week because of chip supply constraints. The automaker has warned of a chip shortage that would lead to a decline in vehicle volume in 1Q22 but the company is expecting vehicle volume to increase significantly in 2H22. (CN Beta, The Street, Yahoo, Business Insider, Reuters)

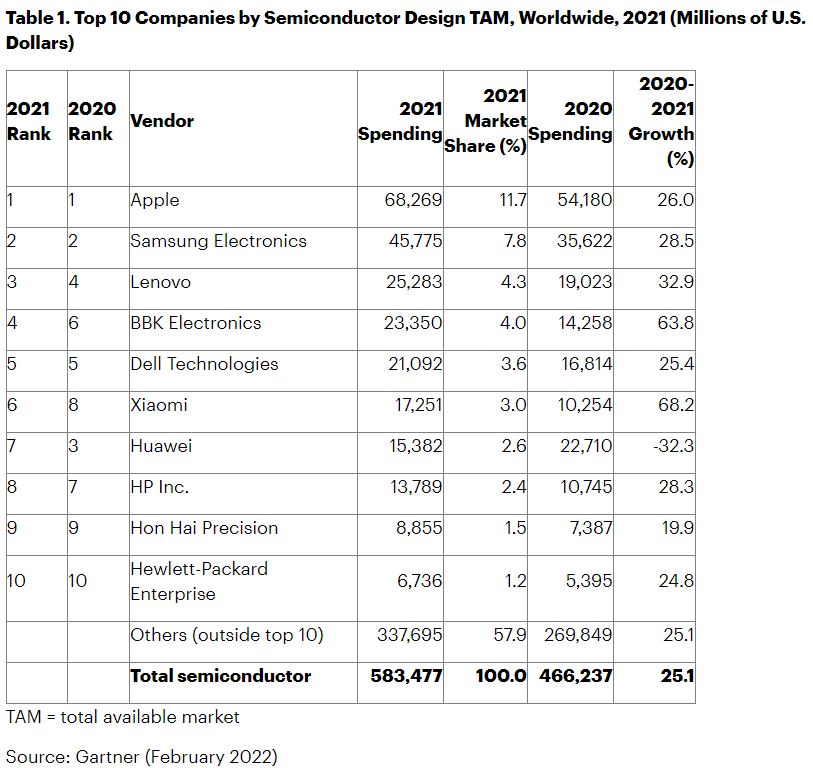

The semiconductor shortage and the COVID-19 pandemic disrupted global original equipment manufacturers (OEMs)’ production in 2021, but the top 10 OEMs increased their chip spending by 25.2% and accounted for 42.1% of the total market, according to Gartner. The average selling prices (ASPs) of semiconductor chips, such as microcontroller units, general-purpose logic integrated circuits (ICs), and a wide variety of application-specific semiconductors, increased by 15% or more in 2021. (Gartner)

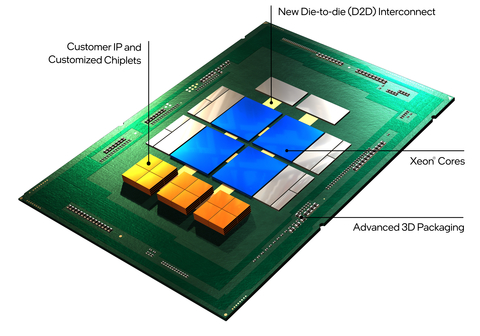

Intel has announced a new USD1B fund to support early-stage startups and established companies building disruptive technologies for the foundry ecosystem. A collaboration between Intel Capital and Intel Foundry Services (IFS), the fund will prioritize investments in capabilities that accelerate foundry customers’ time to market – spanning intellectual property (IP), software tools, innovative chip architectures and advanced packaging technologies. Intel has also announced partnerships with several companies aligned with this fund and focused on key strategic industry inflections: enabling modular products with an open chiplet platform and supporting design approaches that leverage multiple instruction set architectures (ISAs), spanning x86, Arm and RISC-V.(Liliputing, Intel)

RISC-V International, the global open hardware standards organization, has announced that Intel has joined RISC-V International at the Premier membership level. The open RISC-V ecosystem provides open modular building blocks that are essential for modern computing. In joining RISC-V as a Premier member, Intel is leading and expanding RISC-V ecosystem potential for industry stakeholders. (CN Beta, RISV)

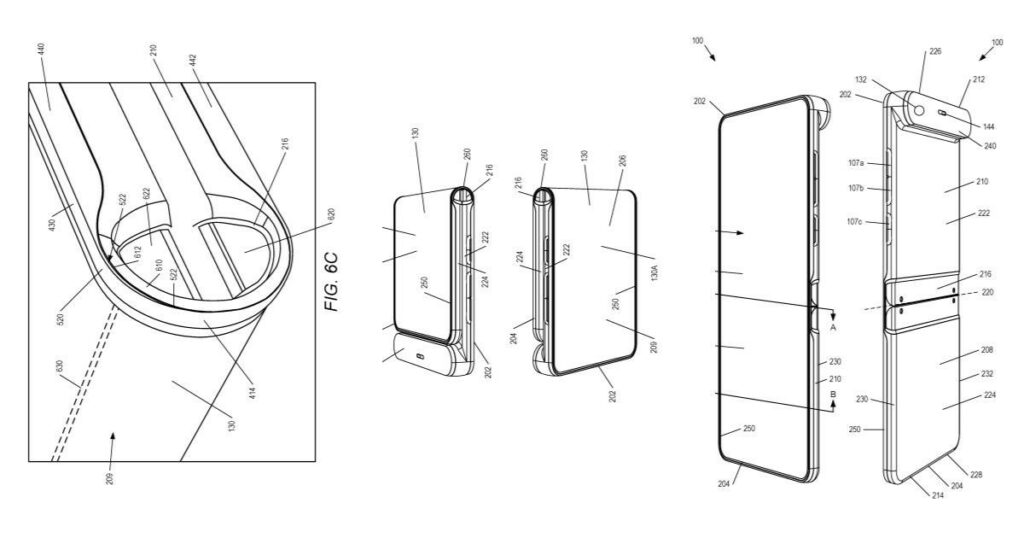

Motorola has filed patent with WIPO (World Intellectual Property Organisation) for a foldbale flip phone with an outward display. The foldable phone would have a flexible display on the outward side of the phone, instead of the inward folding design that has been conventionally seen. The outward display, when folded, would mean that users would get a display on both the front and the rear of the phone. (GSM Arena, My Drivers, MySmartPrice)

Tobii has indicated that the company is in talks to provide eye tracking technology for the next-gen VR headset. Sony has previously confirmed that the PlayStation VR2 would use eye tracking but has not named a tech supplier or explain in detail how the feature would work. The headset will also use camera-based “inside-out” tracking to detect head and controller movement.(CN Beta, Engadget)

Samsung has revealed that the company has started using ocean-bound plastic made from discarded fishing nets in its latest devices. Made with repurposed ocean-bound discarded fishing nets, the use of this material marks another step in Samsung’s Galaxy for the Planet journey that aims to minimize environmental footprint and help foster more sustainable lifestyles for the Galaxy community.(Engadget, Samsung)

According to Federal Communications Commission Chairwoman Jessica Rosenworcel, US carriers have requested approximately USD5.6B in reimbursements to replace their existing Huawei and ZTE infrastructure. In 2020, the FCC established a program to reimburse smaller telecom operators for replacing equipment the law had deemed a risk to national security. At the time, the agency estimated it would cost carriers more than USD1.8B to comply with the order, and it subsequently set aside USD1.9B to cover reimbursements. (Engadget, FCC)

Apple has acquired AI Music, a startup that uses artificial intelligence to generate personalized soundtracks and adaptive music. AI Music has developed an “Infinite Music Engine” meant to create bespoke audio solutions for marketers, publishers, fitness professionals, and creative agencies. The technology is able to generate dynamic soundtracks that change based on user interaction.(Apple Insider, Bloomberg, 9to5Mac, MacRumors, IT Home)

The Netherlands’ Authority for Consumers and Markets (ACM) has fined Apple EUR5M for a third consecutive week for allegedly failing to satisfy the requirements it set regarding alternative payment systems for dating apps. The ACM has said it has still not received enough information from Apple to assess whether Apple has properly complied with the order, the report states. The competition regulator will continue to fine Apple EUR5M per week, up to a maximum of EUR50M, until it finds the company has come into compliance. (MacRumors, Reuters)

Recently, Peloton has come under pressure from activist investors to fire its CEO and consider selling the company. Nike and Amazon are the main candidates for acquiring the company. Peloton’s market value has shrunk from nearly USD50B to less than USD8B in just 12 months. If Amazon acquires Peloton, it would strengthen the company’s overall footprint in the fitness and wellness space. Amazon has launched a fitness brand called Halo in 2020. The latter specializes in monitoring users’ activity and sleep status. The company also added another device called the Halo View late 2021. It offers an USD3.99-a-month health subscription that includes workout plans, recipes, and additional monitoring features. (GizChina, CNN, CN Beta, Financial Times)

Hon Hai Group has announced new progress in the deployment of electric vehicles. The State Petroleum Corporation of Thailand (PTT) revealed that it has a joint venture with the Hon Hai Group in Thailand’s electric vehicle factory, and the fastest mass production is 1Q24. The two parties will finalize the final investment details in 1H22. The total investment in the first phase of PTT and Hon Hai Group is planned to be USD1B (about THB33B). Hon Hai has also bought a factory from U.S. start-up Lordstown Motors to make electric vehicles. In Aug 2021, the company purchased a Taiwanese chip factory to meet future demand for automotive chips. Hon Hai has also set a goal of supplying parts or services to 10% of the world’s electric vehicles by 2025-2027.(Laoyaoba, UDN, ETtoday)

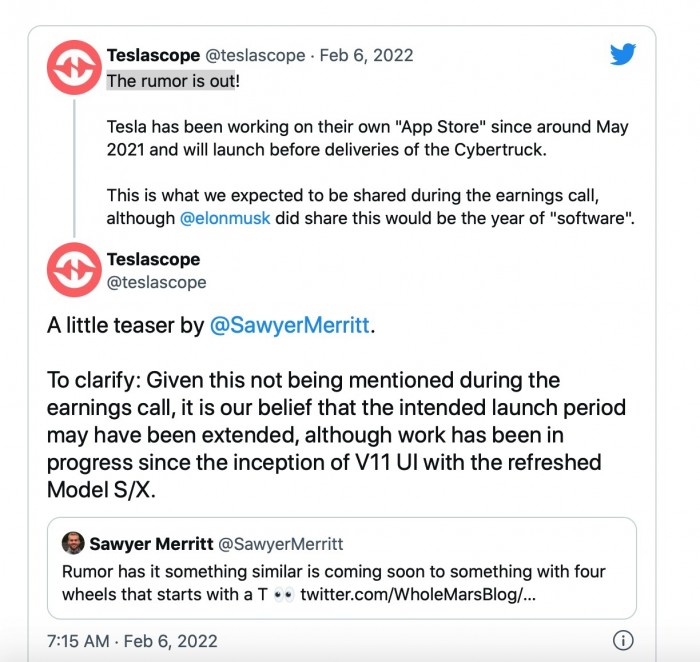

Tesla may be working on its own Apple-like app store that would enable owners of its electric vehicles to download and install apps, much like on an Apple or Android smartphone. The question of whether Tesla is working on an app store surfaced after the latest version 11 update of Tesla’s in-car interface in Dec 2021, when Tesla introduced a customisable icon bar at the bottom of the touchscreen. (Apple Insider, The Driven, CN Beta)

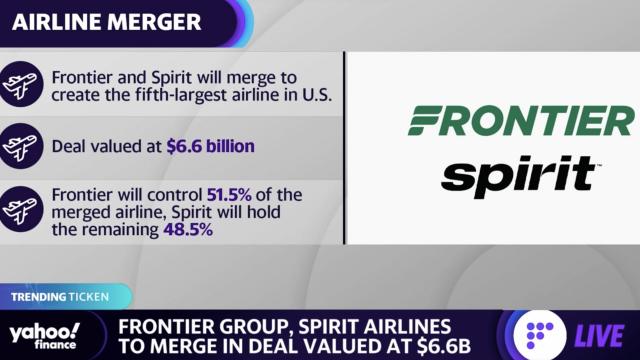

Spirit Airlines and Frontier Airlines expanded aggressively over the last decade offering travelers no-frills service in exchange for ultra-low airfares. Their executives vow to keep it that way, even if the carriers complete their USD6.6B-merger that would turn the carriers into a discount behemoth and the country’s fifth largest airline. Frontier will have a controlling stake. (CN Beta, Reuters, NY Times, CNBC)

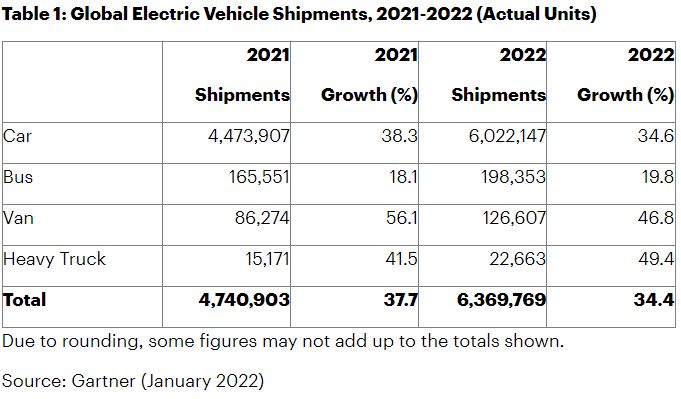

According to Gartner, 6M electric cars (battery electric and plug-in hybrid) will be shipped in 2022, up from 4M in 2021. Gartner forecasts that electric cars will represent 95% of total EV shipments in 2022 and the remainder will be split between buses, vans and heavy trucks. (Gartner)

California-based electric vertical takeoff and landing startup Joby Aviation plans to offer an air taxi service in South Korea in partnership with SK Telecom (SKT), one of the country’s largest telecommunication companies. To provide better integration between land and air travel, the air taxi service will leverage the T Map Mobility platform — an SKT-spinoff that provides subscription-based mobility-as-a-service consisting of rental cars, parking, ride-hailing and other transportation-related services — and the UT ride-hailing service, a joint venture formed between T Map and Uber in 2021, 8 years after the Silicon Valley-based ride-hailing giant first attempted to enter the Korean market. (CN Beta, EVTOL, TechCrunch, Korea JoongAng Daily)

Swedish price comparison site PriceRunner is suing Google for EUR2.1B (USD2.4B) over alleged anti-competitive behavior. The lawsuit relates to a 2017 ruling from the EU Commission that Google breached antitrust laws by giving preference to its own shopping comparison product. It is seeking compensation for damages in relation to a 2017 ruling from the European Commission that Google breached antitrust laws by giving preference to its own shopping comparison product, Google Shopping, through its popular search engine. (CN Beta, Reuters, CNBC, CNN)

Berlin-based mobile banking app Vivid Money has closed a EUR100M Series C funding round at a EUR775M valuation. Launched in Germany in 2020, Vivid offers saving, spending and investment tools from a single app. Users get a German IBAN, share and crypto trading, P2P payments and money management features. The firm has built up a customer base of 500,000 across Europe and seen a 25 times increase in revenue over 2021. (TechCrunch, Finextra)