2-10 #Life : Nvidia has abandoned acquiring ARM; Arm would go public; SUMCO has already sold out its production capacity through 2026; etc.

NVIDIA and SoftBank Group have announced the termination of the previously announced transaction whereby NVIDIA would acquire Arm from SBG. The parties agreed to terminate the Agreement because of significant regulatory challenges preventing the consummation of the transaction, despite good faith efforts by the parties. Arm will now start preparations for a public offering. (Engadget, Nvidia, NY Times)

SoftBank chairman Masayoshi Son has indicated that Arm would go public after a proposed acquisition by Nvidia fell through, and he has suggested that the initial public offering could end up being a more lucrative outcome for SoftBank Group. However, it may not be true according to Bloomberg. Arm is months away from an offering, and it has not yet disclosed the kind of detailed financial information that investors will need to see. Still, the company is likely worth USD25B to USD35B based on the industry’s valuation metrics and analysts’ early projections. (CN Beta, Yahoo, Bloomberg)

Nvidia gave up on Arm acquisition and Arm would go public instead of being sold by SoftBank. These days, M&A deals in the global semiconductor industry are becoming more and more difficult and the number of failed attempts is increasing. Under the circumstances, it is said that Samsung Electronics’ M&A plan may be affected by the trend. Samsung Electronics is currently pursuing at least one sizeable M&A deal. (CN Beta, Business Korea)

From 2020 to 2025, the compound annual growth rate (CAGR) of 12” equivalent wafer capacity at the world’s top ten foundries will be approximately 10% with the majority of these companies focusing on 12” capacity expansion, which will see a CAGR of approximately 13.2%, according to TrendForce. In terms of 8” wafers, due to factors such as difficult to obtain equipment and whether capacity expansion is cost-effective, most fabs can only expand production slightly by means of capacity optimization, equating to a CAGR of only 3.3%. In terms of demand, the products primarily derived from 8-inch wafers, PMIC and Power Discrete, are driven by demand for electric vehicles, 5G smartphones, and servers. Stocking momentum has not fallen off, resulting in a serious shortage of 8-inch wafer production capacity that has festered since 2H19. Therefore, in order to mitigate competition for 8” capacity, a trend of shifting certain products to 12” production has gradually emerged. However, if shortages in overall 8” capacity is to be effectively alleviated, it is still necessary to wait for a large number of mainstream products to migrate to 12” production. The timeframe for this migration is estimated to be close to 2H23 into 2024. (TrendForce, TrendForce, CN Beta)

According to Digitimes, as demand continues to exceed supply, the supply shortage of Wi-Fi core chips is not expected to ease significantly in 2022, although suppliers are seeking more capacity support from contract manufacturing partners, the delivery period will continue to be long. Wi-Fi core chip suppliers, including MediaTek and Realtek Semiconductor, have moved to work more closely with their foundry partners, eyeing a more significant market share in 2022. MediaTek has noted that demand for Wi-Fi 6amp 6e core chips will grow significantly in 2022, thanks to the rapid integration of such chipsets in a variety of smart terminal devices other than routers, including laptops and customer office equipment. Realtek has pointed out that by the end of 2022, the penetration of Wi-Fi 6max 6e alone will soar to more than 50%, and the supply of core chips will remain tight. (Digitimes, CN Beta)

The France finance minister Bruno Le Maire has announced that a new publicly funded multi-billion euro fund is being created to boost investment in Europe’s tech sector, to allow it to compete with U.S. and Asian rivals. He has said home-grown European tech start-ups needed far higher levels of financing if Europe is to reduce its dependence on foreign tech giants. He added that he would give details of the new fund of funds on Tuesday with his German counterpart Christian Lindner, but said it would feed 10 to 20 funds “at a minimum value of one billion euros to finance tech champions”. The ultimate target is to have 10 technology companies worth more than 100 billion euros each by 2030. (Reuters, Yahoo, GizChina)

The European Union’s proposed Chips Act will include more than EUR5B (USD5.7B) of funding from the bloc’s own budget, amounting to less than 15% of what senior officials say the measure will tally. Roughly EUR1.65B will come from the EU’s research budget, EUR1.65B will be directed from its digital program and another EUR1.3B will be taken from an existing public-private partnership that funds key digital technologies. After this EU budget ends in 2027, the commission has planned for more than EUR1B to be allocated toward semiconductors in the next EU budget — a move that politically could be difficult since the bloc’s executive arm does not usually allocate money past its political term. (CN Beta, Yahoo, Bloomberg)

GlobalFoundries CEO Tom Caulfiled has revealed that year 2021 is marked by a growing number of long-term partnership agreements, with 30 customers committing more than USD3.2B toward the continued expansion of our global manufacturing footprint to support strong demand. The company’s CFO David Reeder has said he does not think the current chip shortage will be resolved in 2022. He notes that end-market demand is growing in the mid-to-high single digits, but that announced capacity additions in the segment of the market where GlobalFoundries operates would expand global chip capacity by only 4% a year over the next 5 years. Reeder says that in 2021, about 15M silicon wafers were processed for chips in the 12-to-90-nanometer line width range — which excludes leading-edge technologies for microprocessors and memory chips. If you assume growth of 8% a year in demand, that is about 1.2M additional wafers. B y Reeder’s rough math, that is equal to 3 new chip fabs each year. As Reeder notes, about 70% o the world’s semiconductors are produced in Taiwan.(CN Beta, Yahoo, Globe Newswire, Taipei Times, Bloomberg, Barron’s)

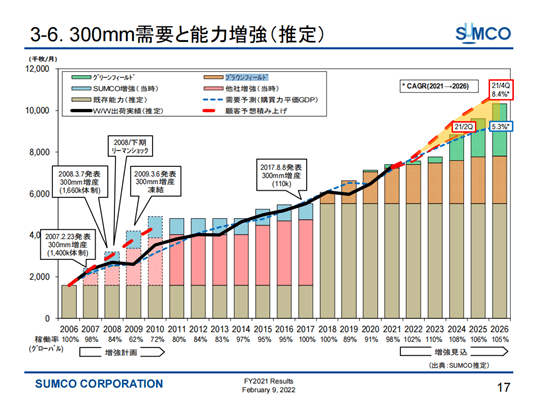

Sumco, a key supplier of silicon wafers for the semiconductor industry, said it has already sold out its production capacity through 2026, a sign shortages in the industry may not abate for years. The company has orders to cover all output of its 300mm wafers for the next five years, it said after reporting earnings on Wednesday. It is not taking such long-term orders for 150mm and 200mm wafers, but demand is likely to keep surpassing supply for years to come. The price of wafers rose by 10% in 2021 over the previous year and Sumco expects to see increases continue until at least 2024. The company has said it will not be able to expand its production this year at all, despite strong demand from customers desperate for long-term supplies. (My Drivers, Bloomberg Quint, CNYES, MoneyDJ)

LG Display (LGD) is reportedly shifting some of its OLED production equipment at its E5 line at its plant in Gumi, South Korea to its plant in Paju. The company is transferring some of its tensioners, used in depositing OLED materials on the panel during production, to its E6-4 line at its P10 plant in Paju. The tensioner is used in Gen 6 (1500x1850mm) OLED panel production. It is used to pull and fix in place the fine metal masks, which are used to align the red, green and blue organic materials during the deposition process. In Aug 2021, LGD plans to spend KRW3.3T to 2024 to expand the production capacity of its Paju plant. The plant already houses E6-1 and E6-2 lines that manufacture OLED panels for iPhones. LG Display is building another line, E6-3, to do the same. All three lines are for flexible OLED panels, while E6-4 line is planning to manufacture rigid OLED panels. Each line has a capacity of 15,000 Gen 6 substrates per month. (CN Beta, Apple Insider, The Elec)

Holland City Council members Wednesday night endorsed a tax incentive for battery maker LG Energy Solution’s proposed expansion on the company’s 48th Street property. The company is proposing increasing its lithium ion battery cell production capacity in Holland, Michigan fivefold by investing USD1.7B in a massive new plant, warehouse and other supporting buildings. LG Energy Solution makes batteries to power electric and hybrid vehicles. The South Korea-based electric vehicle battery manufacturer has recently obtained approval from the Holland City Council on its proposal to increase its annual battery production capacity from 5 gigawatt hours (GWh) to 25 GWh by 2025. (CN Beta, Holland Sentinel, KED Global, Yahoo)\

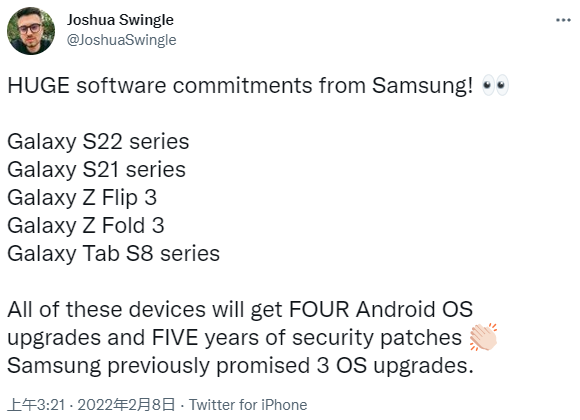

Most Samsung smartphones and tablets are now eligible to receive 3 major Android OS upgrade. Samsung reportedly intends to extend the Android update policy for a handful of devices to 4 major OS updates. The company is also allegedly committed to providing security patches for 5 years instead of 4. (CN Beta, Gizmo China, SamMobile, SamMobile)

Samsung is planning to manufacture components enough to produce 30M units of its Galaxy S22 series of smartphones. This is 20% higher than the initial components it manufactured for the Galaxy S21 series in 2021. The component amount won’t translate directly to the number of finished products. Samsung is aiming to ship late-20M units of the Galaxy S22 series, the components will be enough for this. Samsung is planning to manufacture components for 12M units of the standard 6.1” standard Galaxy S22; 8M units of the 6.6” Galaxy S22 Plus; and 10M units of the 6.8” Galaxy S22 Ultra.(Android Authority, The Elec)

Meta has clarified that it has “absolutely no desire to withdraw from Europe”. The company has confirmed that it hasn’t “threatened” to pull Facebook and Instagram from European countries due to the uncertainty surrounding a transatlantic privacy agreement between America and the European Union. Meta has denied it ever threatened to shut down access to its major web properties such as Facebook and Instagram in the European Union. The company has noted that it was “identifying a business risk resulting from uncertainty around international data transfers”.(Neowin, Meta, The Independent, Euro News)

Honor 60 SE is official in China – 6.67” 1080×2400 FHD+ HiD pOLED 120Hz, MediaTek Dimensity 900 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 8+128 / 8+256GB, Android 11.0 (no GMS), fingerprint on display, 4300mAh 66W, 5W reverse charging, CNY2,199 (USD345) / CNY2,499 (USD390). (GSM Arena, Gizmo China)

vivo T1 5G is launched in India – 6.58” 1080×2408 FHD+ v-notch 120Hz, Qualcomm Snapdragon 695 5G, rear tri 50MP-2MP macro-2MP depth + front 16MP, 4+128 / 6+128 / 8+128GB, Android 11.0, side fingerprint, 5000mAh 18W, INR14,990 (USD200) / INR15,990 (USD214) / INR18,990 (USD254). (GSM Arena, Live Mint, Gadgets360)

Tecno Pova 5G is launched in India – 6.9” 1080×2460 FHD+ HiD 120Hz, MediaTek Dimensity 900 5G, rear tri 50MP-2MP-QVGA + front 16MP, 8+128GB, Android 11.0, side fingerprint, 6000mAh 18W, INR19,999 (USD268). (GSM Arena, Gizmo China)

realme C35 is launched in Thailand – 6.6” 1080×2400 FHD+ v-notch, Unisoc T616, rear tri 50MP-2MP macro-2MP black & white + front 8MP, 4+64 / 4+128GB, Android 11.0, side fingerprint, 5000mAh 18W, THB5,799 (USD178) / THB6,299 (USD193). (Gizmo China, Fone Arena)

Samsung Galaxy S22, S22+ and S22 Ultra are announced:

- S22 – 6.1” 1080×2340 FHD+ HiD Dynamic AMOLED 2X 120Hz, Qualcomm Snapdragon 8 Gen 1, rear tri 50MP 1.0µm OIS-10MP telephoto OIS 3x optical zoom-12MP ultrawide + front 10MP, 8+128 / 8+256GB, Android 12.0, ultrasonic fingerprint on display, 3700mAh 25W, 15W wireless charging, 4.5W reverse wireless charging, EUR849 / EUR899.

- S22+ – 6.6” 1080×2340 1080×2340 FHD+ HiD Dynamic AMOLED 2X 120Hz, Samsung Exynos 2200 / Qualcomm Snapdragon 8 Gen 1, rear tri 50MP 1. 0µm OIS-10MP telephoto OIS 3x optical zoom-12MP ultrawide + front 10MP, 8+128 / 8+256GB, Android 12.0, ultrasonic fingerprint on display, 4500mAh 45W, 15W wireless charging, 4.5W reverse wireless charging, EUR1,049 / EUR1,099.

- S22 Ultra – 6.8”1440×3080 QHD+ HiD Dynamic AMOLED 2X 120Hz, Samsung Exynos 2200 / Qualcomm Snapdragon 8 Gen 1, rear quad 108MP OIS-10MP periscope telephoto OIS 10x optical zoom-10MP telephoto OIS 3x optical zoom-12MP ultrawide + front 40MP, 8+128 / 12+256 / 12+512GB / 12+1TB, Android 12.0, ultrasonic fingerprint on display, 5000mAh 45W, 15W wireless charging, 4.5W reverse wireless charging, supports S Pen, starts at EUR1,249 / USD1,199. (GSM Arena, Liliputing)

Samsung Galaxy Tab S8 series is announced, powered by Qualcomm Snapdragon 8 Gen 1:

- S8 – 11” 1600×2560 TFT 120Hz, rear dual 13MP-6MP ultrawide + front 12MP, 8+128 / 8+256 / 12+256GB, Android 12.0, side fingerprint, quad speakers, 8000mAh 45W, supports S Pen, starts from USD699.

- S8+ – 12.4” 1752×2800 Super AMOLED 120Hz, rear dual 13MP-6MP ultrawide + front 12MP, 8+128 / 8+256 / 12+256GB, Android 12.0, fingerprint on display, quad speakers, 10090mAh 45W, supports S Pen, starts from USD899.

- S8 Ultra – 14.6” 1848×2960 Super AMOLED 120Hz, rear dual 13MP-6MP ultrawide + front dual 12MP-12MP ultrawide, 8+128 / 12+256 / 12+512 / 16+512GB, Android 12.0, quad speakers, 11200mAh 45W, supports S Pen, starts from USD1,099. (GSM Arena, Samsung, Gizmo China, The Verge)

McDonald’s has filed a series of trademarks for a virtual restaurant that will deliver food online and in person. The fast-food chain joins a long list of other companies who have announced plans to cash in on Web3, including the metaverse. The company has filed 10 trademark applications to the US Patent and Trademark Office 4 Feb 2022 covering both McDonald’s and McCafe.(CN Beta, Twitter, Business Insider)

Drone-delivery leader Wing is gearing up to launch its first service in a major U.S. metro area. Up to now, the Alphabet-owned company has been trialing drone-delivery services in several cities in Australia and Finland, as well as the small community of Christiansburg, Virginia, with more than 130,000 commercial deliveries completed globally to date. (Digital Trends, Opera News)

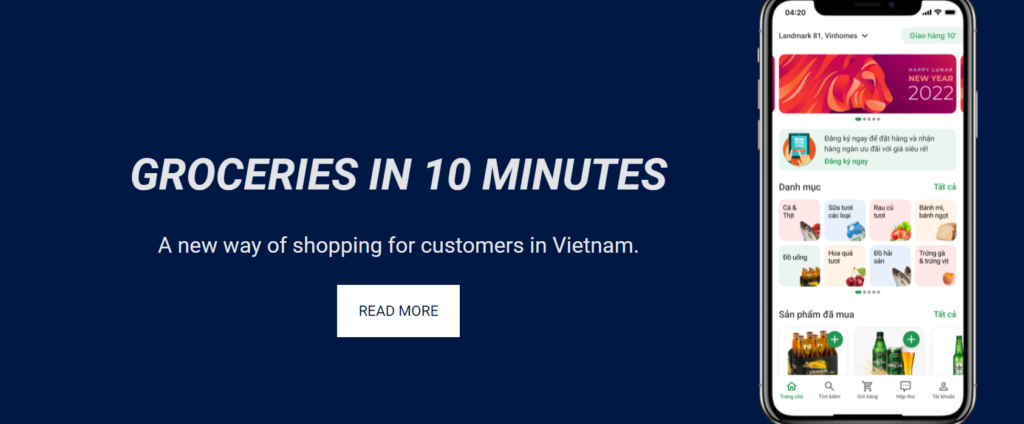

Meal deliveries in Vietnamese cities typically take less than half an hour, but grocery deliveries are lagging behind, sometimes taking up to two to three hours, says Rino founder Trung Thanh Nguyen. By creating a vertically-integrated logistics infrastructure centered around “dark stores”, or stores set up for order fulfillment only, Nguyen says Rino can cut grocery delivery times down to just 10 minutes. The startup, which is launched in Ho Chi Minh City, has announced it has raised a USD3M pre-seed round from Global Founders Capital (GFC), Sequoia Capital India, Venturra Discovery and Saison Capital. (TechCrunch, DealStreetAsia, 36Kr)

Apple has announced plans to introduce a new Tap to Pay feature for iPhone that turns the device into a contactless payment terminal. The company says that later 2022, U.S. merchants will be able to accept Apple Pay and other contactless payments, including Google Pay, by using an iPhone and a partner-enabled iOS app. (TechCrunch, Apple)