2-12 #Nag : GlobalWafers will pursue a USD3.6B expansion plan; Kioxia and Western Digital have reported that unspecified contamination issues; Samsung mobile will focus on a 2-track strategy; etc.

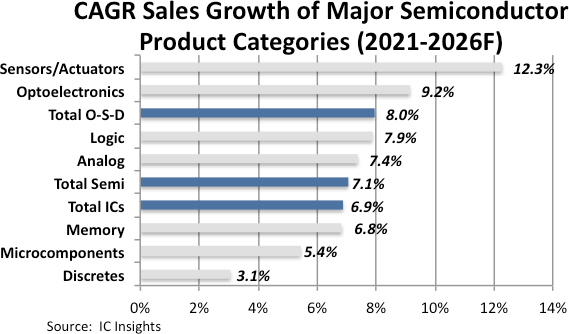

IC Insights forecasts total semiconductor sales will rise 11% this year following a very strong 25% increase in 2021 and an 11% increase in 2020. If achieved, it would mark the first time since 1993-1995 that the semiconductor market has enjoyed three consecutive years of double-digit growth. From 2016-2021, the compound annual growth rate (CAGR) for the total semiconductor market was 11.0%—a very strong period that included a big surge in DRAM and flash memory markets in 2017 and 2018 and strong post-Covid recovery in 2020 and 2021. However, most industry observers—including IC Insights—realize that the semiconductor industry is very cyclical and ongoing annual double-digit gains are unsustainable. As a result, IC Insights now forecasts total semiconductor sales will rise over the next five years at a more moderate compound annual growth rate of 7.1%.(Laoyaoba, IC Insights)

Isaiah Research has pointed out that ASML’s EUV machine shipments may reach 54-57 units in 2022, an increase of 25-30% YoY. Customers such as TSMC and Samsung fabs will be ASML’s priority for shipments. In addition, the fire accident in Berlin, Germany in early 2022 has little impact on ASML’s EUV and DUV tool shipments in the short term due to longer equipment lead times. From the supply side, Isaiah Research has noted that ASML’s latest EUV machine model (NXE:3600D) can produce 150~170 wafers per hour. According to this deduction, the output target of the next-generation NXE:NEXT, which may be released in 2023, is 220~240 pieces/hour. In addition, ASML has also received orders for High NA (EXE5000 and EXE5200) and is expected to ship to Intel in 1H24. (Isaiah Research)

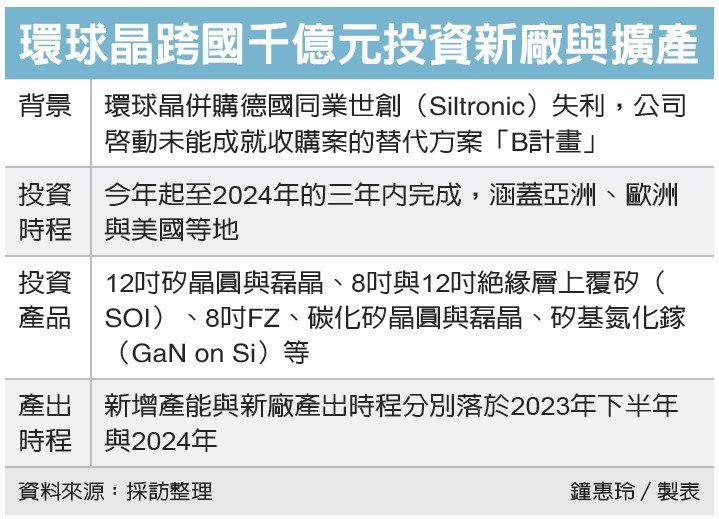

Taiwan’s GlobalWafers has said it will pursue a three-year, TWD100B (USD3.6B) expansion plan in the U.S., Europe and Asia after Berlin failed to approve its acquisition of German peer Siltronic. The new capacity expansion plan consists of two parts — a new 300mm fab, or green field investments of USD2B, and brown field investments of USD1.6B on capacity expansion of factories in multiple sites throughout Asia, the US and Europe. GlobalWafers plans to ramp up production in the new fab in 2024, along with adding capacity from existing factories in 2H23. The company plans to expand capacity for polished wafers, epitaxial wafers, silicon-on-insulator wafers, float-zone wafers, silicon carbide wafers, gallium nitride-on-silicon wafers and other large next-generation products.(Laoyaoba, C114, China Times, UDN, Asia Nikkei, Taipei Times)

Samsung Display will use its patent in a variety of ways amid aggressive competition in the mobile OLED field. The executive vice president of Samsung Display Choi Kwan-Young has indicated that the company “uses its patents in a variety of ways”.(Laoyaoba, IAM, Sammy Fans)

Isaiah Research has pointed out that Samsung Display may reach OLED DDI cooperation with Himax and Ilitek after stopping cooperation with Magnachip. Himax may secure 2~3K/m fab capacity for Samsung Display in 2023. In addition, Samsung Display may also propose a maximum capacity demand of 2K/m to Illitek in 2025. Earlier Samsung Display approached several suppliers, including Novatek, Raydium and Focaltech, but these deals may have been aborted for some reason. On the other hand, the price of TDDI may stop rising soon and is expected to decline in 2Q22. (Isaiah Research)

Kioxia (formerly Toshiba) and Western Digital have reported that unspecified contamination issues have impacted several of their joint NAND production factories. Western Digital says the problems impact up to 6.5 exabytes of flash memory, but Kioxia has yet to give an estimate of the impact. Kioxia and Western Digital operate several NAND production factories as part of their 20-year-old joint venture. However, two of those plants, the Yokkaichi and Kiakami factories in Japan, have apparently ceased production due to the contamination.(Bloomberg, Apple Insider, Tom’s Hardware, Laoyaoba)

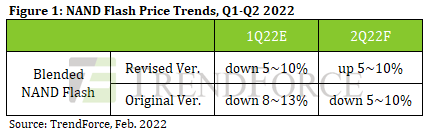

Western Digital (WDC) has recently stated that certain materials were contaminated in late January at NAND Flash production lines in Yokkaichi and Kitakami, Japan which are joint ventures with Kioxia, according to TrendForce. Before this incident, TrendForce had forecast that the NAND Flash market will see a slight oversupply the 2022 entire year and average price from 1Q22 to 2Q22 will face downward pressure. However, the impact of WDC’s material contamination issue is significant and Samsung’s experience during the previous lockdown of Xi’an due to the pandemic has also retarded the magnitude of the NAND Flash price slump. Therefore, the 1Q22 price drop will diminish to 5~10%. In addition, according to TrendForce, the combined WDC/Kioxia NAND Flash market share in the 3Q21 was as high as 32.5%. The consequences of this latest incident may push the price of NAND Flash in Q2 to spike 5~10%. (TrendForce, TrendForce)

Kioxia has allegedly already notified its customers about a shortfall in its 3D NAND flash shipments starting Apr 2022, and has stopped offering its quotes in the spot market, following a Western Digital statement indicating contamination of materials used in flash NAND manufacturing. (Digitimes, CN Beta)

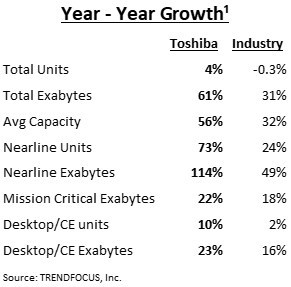

Toshiba Electronic Components Taiwan Corporation has announced HDD shipment unit and Exabyte grew 4% and 61%, respectively in 2021. The company shipped 54.68M units equaling 187.24 Exabytes for the year. Nearline, Mission Critical, Desktop/CE segments posted higher unit and Exabyte results for the year with Nearline HDDs leading all applications with units surging 73% and Exabytes skyrocketing 114%. Toshiba set a new shipment record for Nearline HDDs in 4CQ21, as units grew to 2.90M units totaling 33.93 Exabytes for the quarter and was up over 94% from a year ago. (CN Beta, PR Newswire)

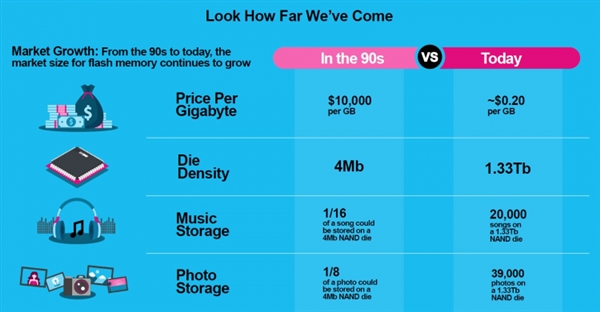

Kioxia has announced that it has reached a new milestone – 2022 marks the 35th anniversary of the company’s invention of NAND flash memory. NAND flash memory has ushered in entire new technological eras, and obsoleted technologies and products that had been in use for years. Today we are looking at around USD0.20 per GB (gigabyte) of storage and die density of 1.44Tb. Back in the 90s we had just 1/16 of a song on 4Mb NAND die, we now have 20,000 songs on 1.33Tb NAND die, while 1/8 of a photo was all you could store on 4Mb NAND in the 90s you can store a huge 39,000 photos on a 1.33Tb NAND die. (My Drivers, Yahoo, Kioxia)

According to Tianyancha, OPPO has indirectly invested in Jiiov Technology, a mobile phone fingerprint solution provider. Jiiov Technology was formally established in February 2020 with a registered capital of CNY143M. It is a consumer electronics supplier with mobile phone fingerprint solutions, smart devices and innovative sensing as its core. (Laoyaoba, CNStock)

In the iOS 15.4 update, Apple is introducing the ability to use Face ID while wearing a mask. According to various user experience diagrams, the system prompt will say “iPhone can recognize the characteristics of the area around the eyes” but it is more accurate not to wear a mask. (CN Beta, Business Insider, CNET)

Password management platform 1Password aims to continue its strong growth with businesses in 2022 through its new $620 million series C funding round, which will help the company to go even deeper around meeting security needs for B2B customers. In connection with the funding, 1Password has more than tripled its previously disclosed valuation to USD6.8B. While 1Password’s original focus area — offering a password manager to consumers — continues to thrive, the company’s offering for businesses now accounts for 60% of its revenue. (VentureBeat, CN Beta, 1Password)

The U.S. Departments of Transportation and Energy has announced nearly USD5B that will be made available under the new National Electric Vehicle Infrastructure (NEVI) Formula Program established by President Biden’s Bipartisan Infrastructure Law, to build out a national electric vehicle charging network, an important step towards making electric vehicle (EV) charging accessible to all Americans. The program will provide nearly USD5B over 5 years to help states create a network of EV charging stations along designated Alternative Fuel Corridors, particularly along the Interstate Highway System. (Laoyaoba, Bloomberg, Clean Technica)

Samsung has partnered with software company Amdocs to deliver one of the first campus-wide private 5G networks at a major U.S. university, allowing students and faculty to securely access learning and information resources from anywhere on the campus. The agreement includes delivery of Samsung’s complete set of private network solutions, including Citizen Broadband Radio Service (CBRS) products, to enable private network and Fixed Wireless Access (FWA) use cases. This will also provide the ability to transition from 4G to 5G through a simple software update. Amdocs acts as the systems integrator, leveraging its 4G and 5G, IT, and cloud capabilities to provide full end-to-end solutions to enterprises solving the challenges of tomorrow. In the U.S., private 5G technology uses the Citizens Broadband Radio Service (CBRS) spectrum — an unlicensed chunk of midband radio frequencies in the 3.55GHz to 3.7GHz range. (Digital Trends, Samsung, Fierce Telecom)

Apple has announced that it will be making several updates to its Find My network to cut down on instances of AirTag trackers being used for stalking or crime. Apple will implement a number of changes in an upcoming software update, including adding a new warning advising users during the setup stage that AirTags are linked to their Apple ID and that stalking is a crime.(Apple Insider, CN Beta, MacRumors)

Avanci has announced that LG Electronics has joined its one-stop licensing marketplace. Following this announcement, all existing Avanci licensees and those who join Avanci in future will be licensed to 4G, 3G and 2G essential patents created and owned by LG Electronics, together with 48 other patent owners already in the marketplace.(Laoyaoba, Business Wire, Bloomberg)

The global smartphone market is gradually emerging from the recession that has been exacerbated by the pandemic in the past 2 years. In 2022, the smartphone market will further show signs of recovery. JW Insights believes that in 2022, as the pandemic situation is further controlled and the capacity supply problem is gradually alleviated, it is expected that global smartphone shipments will reach 1.4B units. Among them, 5G mobile phone shipments will reach 600-650M units. At present, from the judgment given by the mobile phone chip company, the shortage problem will be alleviated in 2022. Qualcomm has gradually increased its chip production in TSMC, ensuring the supply of advanced process chips through the production capacity of diversified foundries. MediaTek, on the other hand, said that it is expected that new production capacity will be opened after 2023, and the problem of tight supply will become clearer. Compared with the main chip of mobile phones, the shortage is mainly concentrated in power management IC, driver IC, touch IC, MCU and other components. In the case of shortages and price increases, if mobile phone manufacturers fail to effectively pass on costs to consumers, it may lead to corresponding adjustments in mobile phone design. (JW Insights)

Samsung’s mobile chief TM Roh has revealed that the company’s operation will focus on a 2-track strategy: flagship S series in the first half of the year and innovative foldable lineup in the second half. They will keep this strategy until there is another major breakthrough and they are working hard to make it happen. He has further added that Samsung will focus on the premium segment as its growth engine and plans to expand the Note experience across its Galaxy hardware ecosystem, spanning tablets and laptops as well as phones. Foldables will also grow into new categories and the company plans to add one or two new smartphone form factors to its lineup within the next 3 years.(CN Beta, BGR, Bloomberg, Yahoo)

OnwardMobility is allegedly not moving forward with the project of releasing a 5G BlackBerry phone after its license to use the BlackBerry name is canceled. BlackBerry is rumored looking to further distance itself from its days as a smartphone vendor after selling the remainder of its mobile patent portfolio for USD600M earlier Feb 2022. (Liliputing, OnwardMobility, CrackBerry, Android Police)

A new study has revealed the nations with the highest rates of smartphone addiction. McGill University has used data on smartphone use between 2014 and 2020 from nearly 34,000 participants in 24 countries around the world. China, Saudi Arabia and Malaysia had the highest rates of smartphone use, they found, while Germany and France had the lowest. The Smartphone Addiction Scale is widely used to measure smartphone addiction. It includes aspects related to impact on daily life, uncontrolled use of mobile phones, and withdrawal from smartphone addiction. (CN Beta, Gizmo China, Daily Mail, Science Direct)

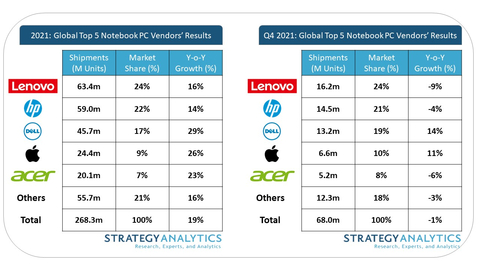

Commercial demand stayed strong for notebook PCs in 4Q21 thanks to Windows 11 performance and growth of DaaS (Device as a Service) while SMBs and consumers grabbed huge holiday discounts to end the year strong. The industry prioritized notebook PC production in the face of supply constraints to keep up with hybrid working needs. According to Strategy Analytics, notebook shipments grew 19% over the previous highs reached in 2020 to reach 268M units. As 2022 begins, the industry must be cautious about lingering supply issues and increased freight and manufacturing costs. (Strategy Analytics, CN Beta)

Garmin Instinct 2 smartwatch is unveiled, which is built for rugged individualists and the additional unlimited battery feature in the solar versions of the model will offer greater depth and functionality of the smartwatch. The unlimited battery life may just be an additional layer of energy for the Instinct 2 which originally boasts of up to 28 days battery life. It starts at USD350.(Gizmo China, Garmin, GSM Arena)

Tag Heuer Connected Calibre E4 smartwatch is unveiled, featuring 1.28” 412×412 / 1.39” 454×454 OLED display with sapphire glass, Qualcomm Snapdragon 4100 Plus, 330mAh / 440mAh battery, 50 meters of water resistance, ambient light sensor, barometer, compass, heart rate monitor, accelerometer, gyroscope, NFC, and microphone. The price starts from USD1,800.(CN Beta, The Verge, 9to5Google, Mens Health)

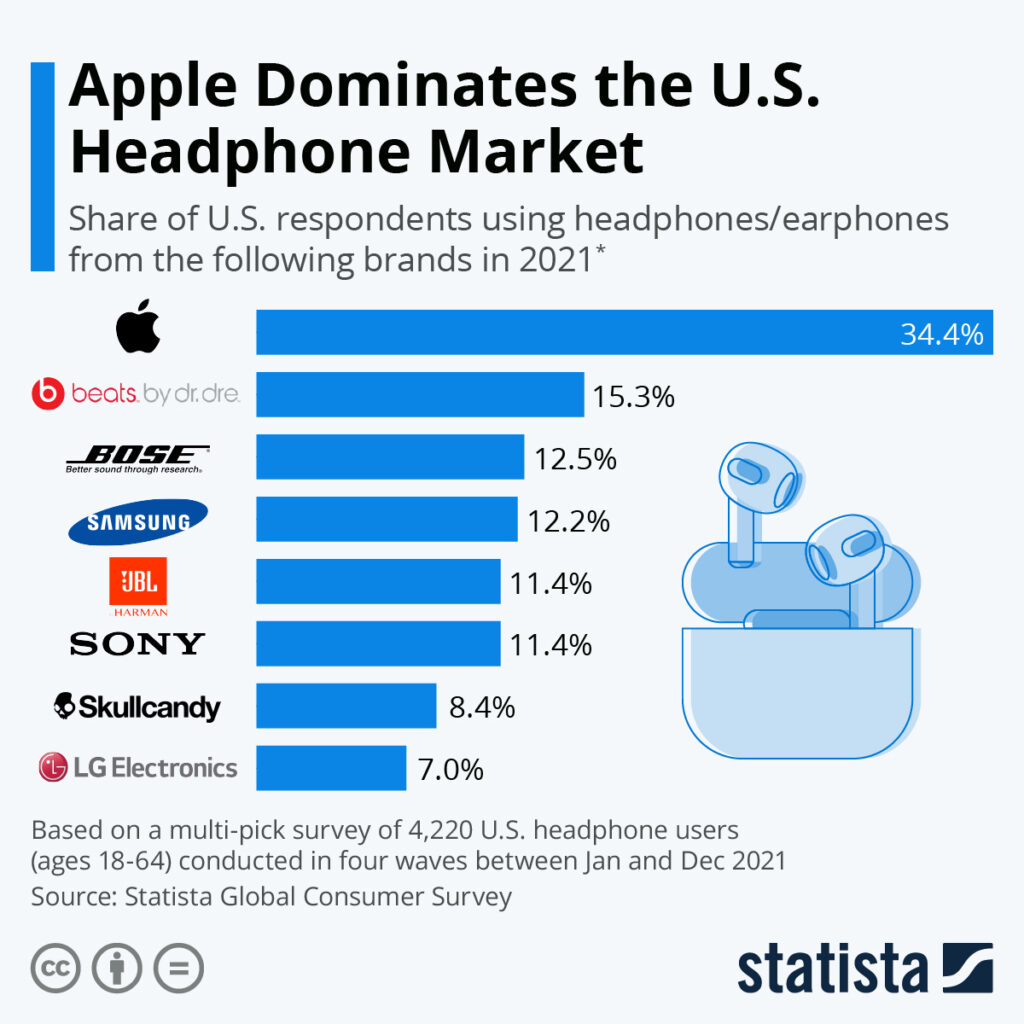

According to Statista’s Global Consumer Survey, Apple is the most popular headphone brand in the U.S. by a considerable distance. Having asked 4,220 U.S. adults about their personal headphones, Statista found that 34.4% of respondents used one of Apple’s products, followed by Apple-owned Beats in second position at 15.3%. (CN Beta, 9to5Mac, Statista)

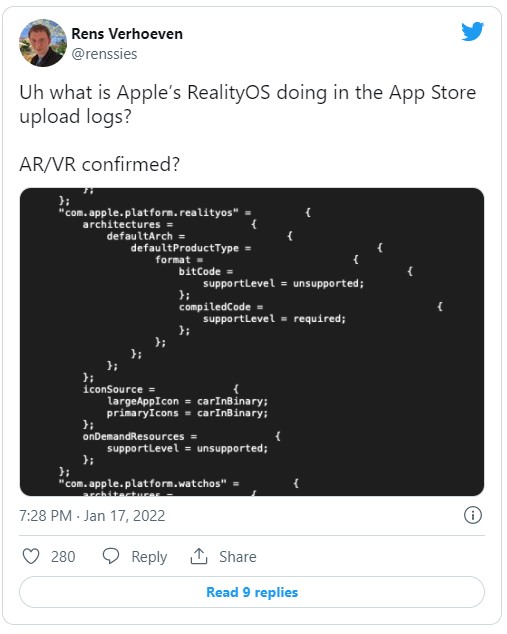

Apple’s long-awaited augmented/virtual reality headset won’t arrive until the end of 2022 at the earliest, but hints at the operating system it will run on have already been uncovered. References to a “realityOS” have been found in App Store upload logs.(Gizmodo, Apple Insider)

Google will have to pay USD20M as a result of the EcoFactor patent lawsuit. EcoFactor sued Google in 2020, claiming that its Nest thermostats infringe on its patents. Google is reportedly planning to appeal the verdict. In Jan 2022, Google lost a patent suit against Sonos and had to revamp its smart home controls. (Android Central, Lawsuit, Reuters)

Toyota Motor North America plans to invest USD90M into two components plants, one each in West Virginia and Tennessee, to expand and prepare for regional production of hybridized and battery-electric vehicles. The bulk of the funds will go to its plant in Buffalo, W.Va., where USD73M will be used to expand production of hybrid transaxles to 600,000 per year. In Nov 2021, the auto maker said it would invest USD240M in its West Virginia facility to add a dedicated production line for hybrid transaxles. In total, the company has spent more than USD2B on the plant so far.(Engadget, Auto News, Barron’s, Market Watch, Toyota)

XPENG has announced today that it has reached strategic partnerships in the Netherlands and Sweden, and it will open its self-operated experiencing retail stores in Europe. XPENG reached a strategic Agency Retail collaboration agreement with Emil Frey for the Netherlands. Emil Frey will develop XPENG’s sales and service network while managing XPENG branded stores throughout the Netherlands. (Laoyaoba, Sina, Auto Home, Business Wire)

Binance, the world’s biggest cryptocurrency exchange, is making a USD200M strategic investment in Forbes, the 104-year-old magazine and digital publisher. The funds will help Forbes execute on its plan to merge with a publicly traded special purpose acquisition company, or SPAC, in 1Q22. Binance will replace half of the USD400M in commitments from institutional investors announced earlier, making it one of the top two biggest owners of Forbes after its listing. (CN Beta, CNBC)