3-3 #Home : Huawei is reportedly preparing to package on its own the NAND flash memory it procures; Samsung is found to be putting performance limits on over 10,000 apps; etc.

MediaTek has expanded its processor lineup with three new chips — Dimensity 8100, Dimensity 8000, and Dimensity 1300 — and a range of devices powered by the trio will be launched throughout 1Q22 / 2Q22. Dimensity 8100 / 8000 are built with TSMC’s 6nm process and has an 8-core CPU, including a 3GHz Cortex-A78 super-large core, three Cortex A-78 large cores, and four Cortex A-55 efficiency cores. The Dimensity 8100 integrates four premium Cortex-A78 cores clocked at 2.85GHz, and the Dimensity 8000 has four Cortex-A78 cores operating at up to 2.75GHz. Both chips use Mali-G610 MC6 GPU with MediaTek’s HyperEngine 5.0 gaming technologies for graphics. Up to 200MP cameras and 4K60 HDR10+ videography is also supported.In addition, Dimensity 1300 is also equipped with 9-core Mali-G77 GPU, APU 3.0, and HyperEngine 5.0 game engine.(Gizmo China, Android Headlines, MediaTek)

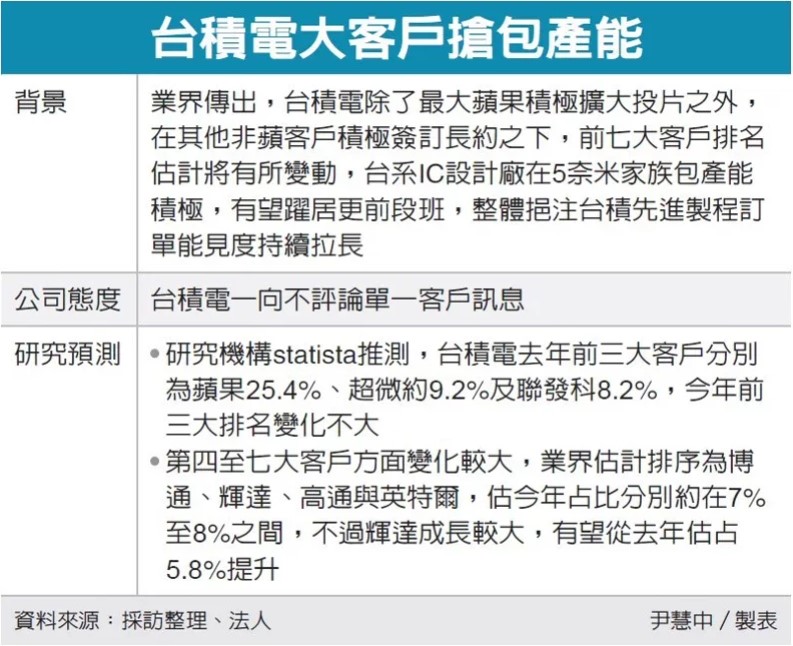

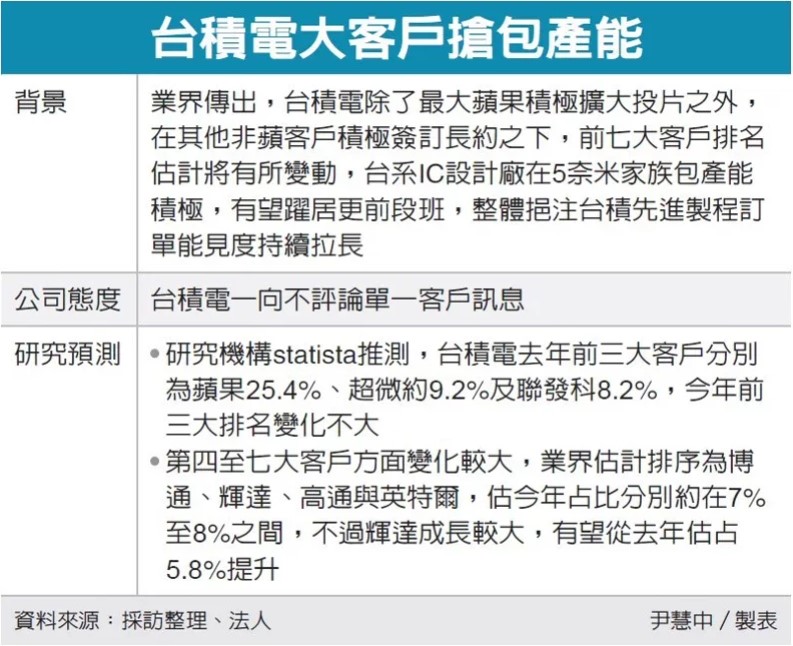

Led by the largest customer, Apple, 7 major customers, including AMD, MediaTek, Broadcom, Nvidia, Qualcomm and Intel, have signed long-term contracts with TSMC for production capacity, covering popular areas such as 5G and high-performance computing. As TSMC’s advanced processes lead in mass production scale and yield, customers have expanded their adoption, targeting the 7nm family (including 6nm) and the 5nm family (including 4nm). According to research firm Statista, TSMC’s top 3 customers in 2021 are Apple (25.4%), AMD (9.2%) and MediaTek (8.2%). In addition, as for TSMC’s 4th to 7th largest customers, the industry estimates that the proportion will be in the middle, the ranking is estimated to be Broadcom, Nvidia, Qualcomm and Intel, and the proportion of TSMC’s revenue in 2022 will be about 7-8%. Among them, NVIDIA has grown more and is expected to increase significantly from about 5.8% in 2021. (UDN, Laoyaoba)

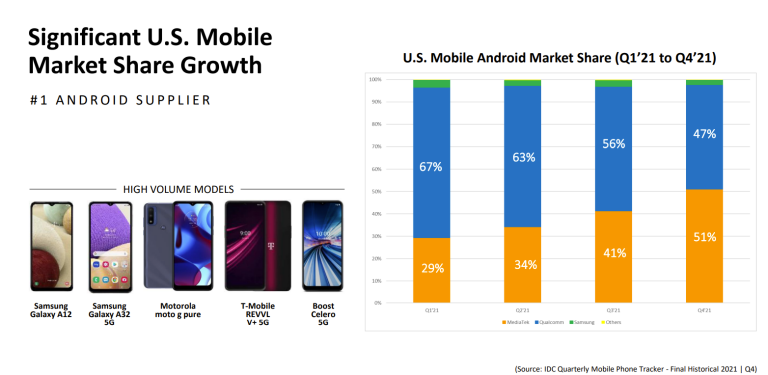

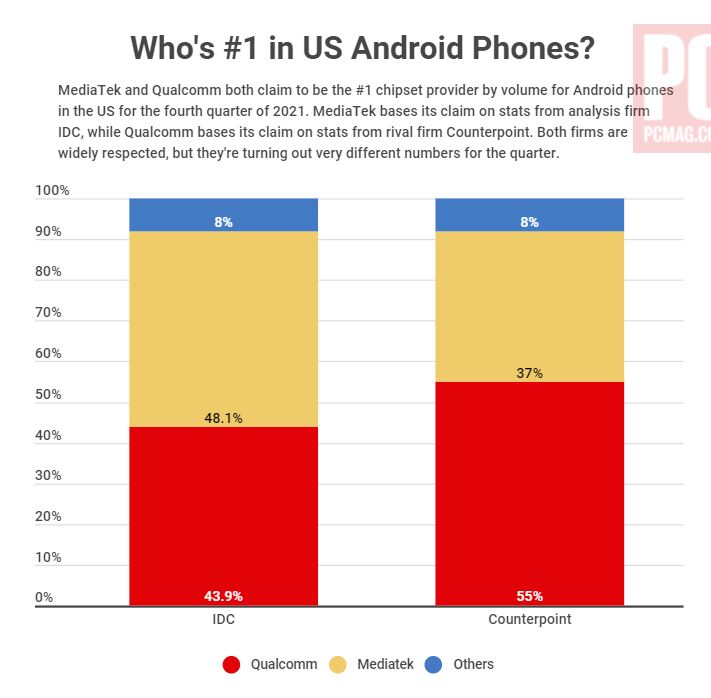

MediaTek has announced that it is now the No. 1-selling chipset vendor in Android phones in the US, but Qualcomm disputes the claim. The news comes courtesy of analysis firm IDC, which says that in 4Q21, MediaTek commanded 51% of US mobile Android market share.Qualcomm has responded with contradictory claims from competing firm Counterpoint Research. Both Counterpoint and IDC agree that Qualcomm is No. 1 for the year of 2021 as a whole.(GSM Arena, The Verge, PCMag, PCMag)

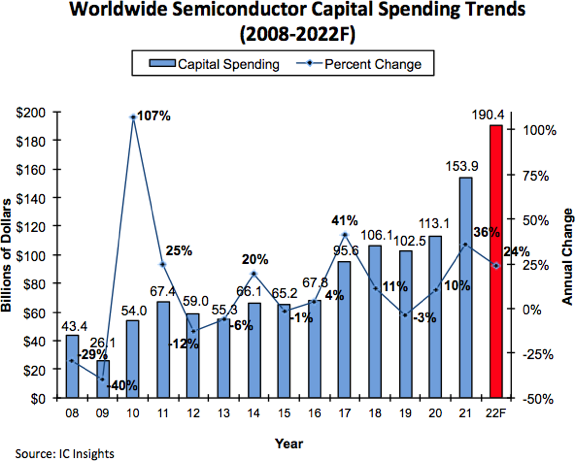

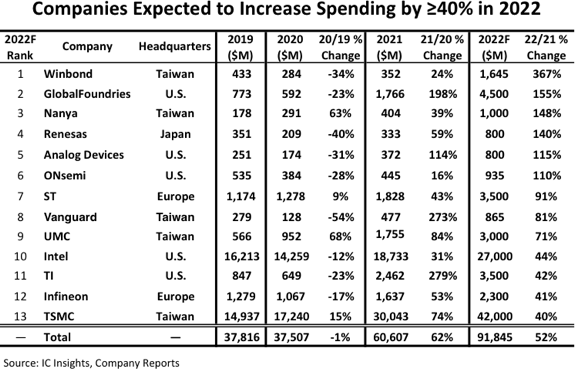

According to IC Insights, after surging 36% in 2021, semiconductor industry capital spending is forecast to jump 24% in 2022 to a new all-time high of USD190.4B, up 86% from just three years earlier in 2019. Moreover, if capital spending increases by ≥10% in 2022, it would mark the first 3-year period of double-digit spending increases in the semiconductor industry since the 1993-1995 timeperiod. With many supply chains strained or broken during the pandemic, the electronics industry, in many cases, was left unprepared for the current rebound in demand. Booming demand has pushed most fabrication facility utilization rates well above 90% with many of the semiconductor foundries operating at 100% utilization. With such strong utilization rates and the expectations of continued high demand, the combined semiconductor industry capital spending in 2021 and 2022 is forecast to reach USD344.3B. (CN Beta, IC Insights)

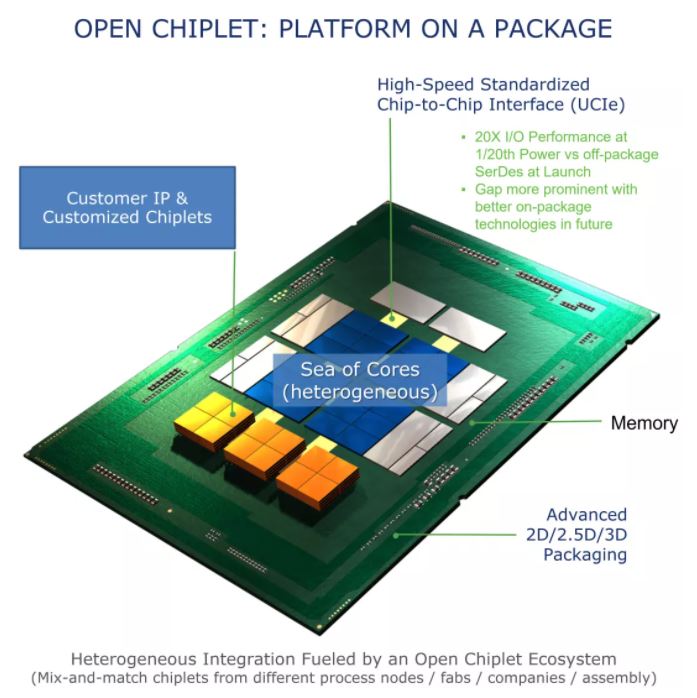

Chip designers, suppliers, makers, and hyperscale users have combined to form a chiplet consortium. The Universal Chiplet Interconnect Express (UCIe) consortium will establish a die-to-die interconnect standard and “foster an open chiplet ecosystem”. The UCIe consortium looks to standardize an open die-to-die interconnect system at the package level that allows companies to use components from different sources to create GPUs, CPUs, SoCs, and more. Currently, UCIe 1.0 specifies the die-to-die I/O physical layer, protocol stack, software model (including PCIe and CXL standards), and compliance testing. The consortium launches with founding members Advanced Semiconductor Engineering (ASE), AMD, Arm, Google Cloud, Intel, Meta, Microsoft, Qualcomm Incorporated, Samsung, and Taiwan Semiconductor Manufacturing Company (TSMC). (My Drivers, Data Center Dynamics, Techspot, AnandTech)

According to Digitimes, TSMC’s 5nm process is still showing big orders. Heavyweight customers such as Apple, Qualcomm, MediaTek, Nvidia, and Bitmain continue to expand their orders in the 5nm family. TSMC has decided to assign the original 3nm production. The 7th plant of the second phase of the Nanke 18th plant of the line first moved to support the strong orders of 5nm, allowing TSMC to dominate the world’s 5nm process, becoming the biggest growth driver for TSMC’s revenue this year. In addition, UMC has also recently announced the construction of a 12” wafer fab in Singapore, because the estimated production capacity of the Nanke P6 plant, which is under construction, is completely unable to meet the needs of major customers. Under the condition that the government provides generous subsidies, it was decided to build a new factory. (Laoyaoba, My Drivers, Digitimes)

Yuichi Horita, president of Japan Advanced Semiconductor Manufacturing (JASM)—the subsidiary co-founded by TSMC and Sony to oversee the project—has given details of the design of the factory. The factory covers an area of 21.3 hectares, will start construction in Apr 2022 and be completed by Sept 2023. After completing the construction of the factory, TSMC’s factory in Japan will then enter the equipment installation and commissioning stage to prepare for the foundry of wafers. He has also revealed that the wafers they manufacture in this fab in Japan are scheduled to start shipping in Dec 2024. In addition to announcing the investment of Denso, TSMC has also announced that their joint venture factory in Japan will increase the 12nm and 16nmprocess technology, the monthly production capacity will also increase to 55,000 12” wafers, and the investment in the factory will increase to USD860M.(CN Beta, TechWeb, Taiwan News)

Samsung Display could be procuring fine metal mask (FMM), which is used in the production of OLED panels, from South Korean firm Poongwon Precision. If Poongwon’s FMM is approved for commercial use by Samsung Display, it could challenge Japan’s Dai Nippon Printing’s dominance in the FMM sector. The Japanese company is currently the sole supplier of the key material and is the market leader. Japan’s Toppan and Taiwan’s Darwin also supply FMMs to Chinese panel makers but they have significantly less share than Dai Nippon Printing in the sector. Poongwon Precision had said it aims to secure revenue of KRW27.1B from its FMM business. (Laoyaoba, The Elec)

Honor CEO Zhao Ming believes that both ordinary phones and foldable phones will become the mainstream of smartphones. In 2022, the folding screen mobile phone market can grow by 10 times. This will be a new growth area, and Honor must invest for the future. Peter Richardson, partner and research vice president of Counterpoint Research, has said that it will take time for the overall share of foldable phones to grow, and prices will remain fairly high in the medium term, with foldable phones accounting for 40%-50% of the high-end market by 2025.(Laoyaoba, Sohu)

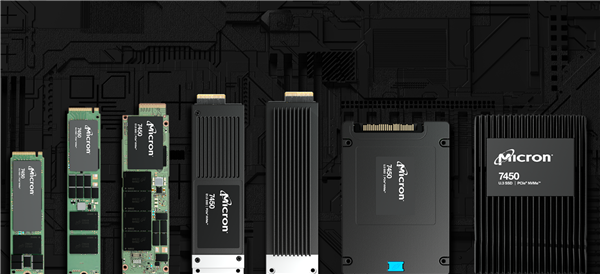

Micron has announced it is sampling the world’s first vertically-integrated 176-layer NAND solid-state drive (SSD) for the data center. The Micron 7450 SSD with NVMeTM delivers quality-of-service (QoS) latency at or below 2ms, a wide capacity range and the broadest set of form. The 7450 SSD achieves latency at or below 2 ms for 99.9999% QoS in common, mixed, random workloads1— driving up performance in databases such as Microsoft SQL Server, Oracle, MySQL, RocksDB, Cassandra and Aerospike, among others. Compared to SATA SSDs, latency is reduced by nearly 50%, and read bandwidth is improved by up to 12 times.(My Drivers, Micron, Yahoo)

Huawei is reportedly preparing to package on its own the NAND flash memory it procures. It is installing the necessary equipment for the process, which could go live during 2H22 at the earliest. Huawei’s move likely reflects the Chinese government’s attempt to strengthen its own supply chain. Huawei currently procures NAND flash from compatriot chip firm YMTC. YMTC held a 1% market share in 2020, according to analyst firm Omdia, but this has grown to 2.5% as of 3Q21. The chipmaker begin manufacturing 128-layer 3D NAND flash last year and is showing growth. (Laoyaoba, The Elec)

Samsung Electronics has announced that Qualcomm has validated Samsung’s 14nm based 16Gb Low Power Double Data Rate 5X (LPDDR5X) DRAM for use on Qualcomm Snapdragon mobile platforms. Since developing the industry’s first 14nm-based LPDDR5X DRAM in Nov 2021, Samsung has worked closely with Qualcomm to optimize its 7.5 Gbps LPDDR5X for use with Snapdragon mobile platforms.(Neowin, Samsung)

China’s global battery equipment maker LEAD has established a joint Innovation Center for Intelligent Production Line with Swedish battery firm Northvolt in Wuxi of eastern China’s Jiangsu Province. According to LEAD, the project will focus on Lithium-ion battery equipment and provide Northvolt with a complete line of higher production capacity at a higher technical level. The Center will significantly improve the efficiency of production line delivery services, reduce labor costs for both, and save the production cycle. It marks Northvolt’s recognition of LEAD.(Laoyaoba, Laoyaoba)

Japanese telecom provider KDDI is continuing its deployment of open standard 5G technology in a new partnership with HPE that allows it to expedite 5G availability throughout the country. According to HPE, KDDI will be using the HPE ProLiant DL110 Gen10 Plus Telco server for its commercial 5G network. This system allows it to seamlessly tie in its other Open Radio Access Network (O-RAN) equipment and run multiple virtual RAN (vRAN) components with fewer physical hardware components. (Digital Trends, HPE, Yahoo)

Netflix has announced that it has entered into a combination agreement to acquire Next Games. Under the terms of the agreement, Netflix will commence a tender offer to acquire all of the issued and outstanding shares of Next Games. Pursuant to the offer, Next Games shareholders will receive EUR2.1 in cash per share of Next Games, for a total equity value of approximately EUR65M. Founded in 2013, Next Games creates and operates engaging mobile games with global appeal and an authentic and social fan experience at its core. (CN Beta, PR Newswire, TechCrunch)

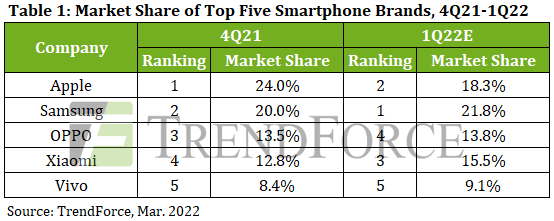

Global smartphone production came to 356M units for 2021, showing a QoQ increase of 9.5%, according to TrendForce. The 2H21 saw demand injections related to the peak promotion season for e-commerce platforms and year-end holiday sales. These factors thus bolstered smartphone production and resulted in 4Q21 seeing the highest QoQ growth rate for the year. Apple’s new iPhones were the primary growth driver. On the other hand, the performances of a few smartphone brands were constrained by the shortage of some key components. Hence, the total smartphone production for 4Q21 was slightly lower compared with 4Q20 or even 4Q19. Assuming that the global spread of the COVID-19 pandemic continues to slow, TrendForce expects annual smartphone production for 2022 to undergo a slight YoY increase of 3.6% to 1.381B units. (CN Beta, TrendForce, TrendForce)

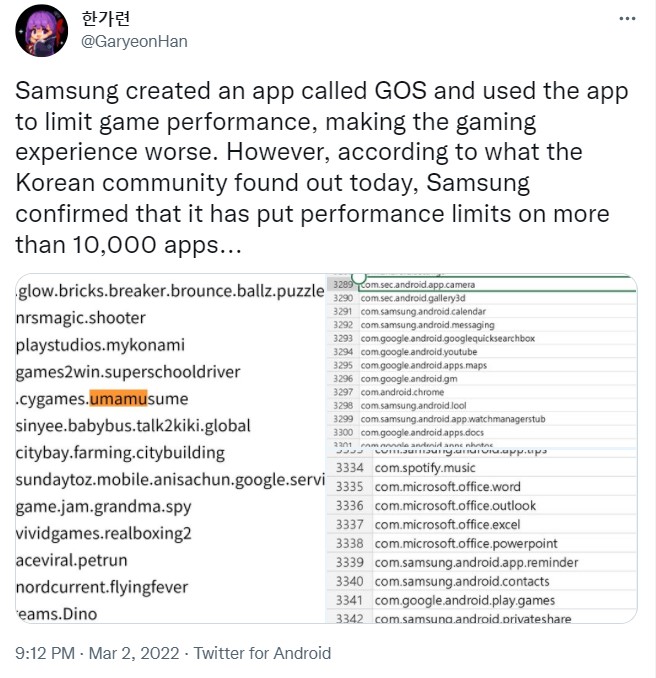

Samsung allegedly throttles its phones gaming performance without even doing any gaming. Samsung appears to be aware of the issue and is actively investigating it. Samsung should be making an official statement soon. (Android Headlines, SamMobile, Naver, YouTube)

Samsung is found to be putting performance limits on over 10,000 apps — a list that includes system apps, Google apps, and numerous third-party apps. The company says that this is to ensure the safety of consumers. The limits are imposed through the Game Optimizing Service (GOS), which is supposed to prevent overheating and throttling issues by optimizing system performance.(Gizmo China, 9to5Google, Twitter)

vivo Y33s 5G is announced in China – 6.51” 720×1600 HD+ v-notch, MediaTek Dimensity 700 5G, rear dual 13MP-2MP macro + front 8MP, 4+128 / 6+128 / 8+128GB, Android 12.0, side fingerprint, 5000mAh 18W, CNY1,299 (USD205) / CNY1,399 (USD221) / CNY1,599 (USD255). (GSM Arena, vivo)

Redmi Note 11E 5G and 11E Pro are announced in China:

- Note 11E 5G – 6.58” 1080×2408 FHD+ v-notch 90Hz, MediaTek Dimensity 700 5G, rear dual 50MP-2MP depth + front 5MP, 4+128 / 6+128GB, Android 11.0, side fingerperint, 5000mAh 18W, CNY1,199 (USD189) / CNY1,299 (USD205).

- Note 11E Pro – 6.67” 1080×2400 FHD+ HiD GOLED 120Hz, Qualcomm Snapdragon 695 5G, rear tri 108MP-8MP ultrawide-2MP macro + front 16MP, 6+128 / 8+128 / 8+256GB, Android 11.0, side fingerprint, stereo speakers, 5000mAh 67W, CNY1,699 (USD269) / CNY1,899 (USD300) / CNY2,099 (USD332).

OPPO Reno7 Z 5G is announced in Thailand – 6.43” 1080×2400 FHD+ HiD GOLED, Qualcomm Snapdragon 695 5G, rear tri 64MP-2MP macro-2MP depth + front 16MP, 8+128GB, Android 11.0, side fingerprint, side fingerprint, 4500mAh 33W, reverse charging, price to be announced. (GSM Arena, India Today, OPPO)

Honor Magic4 series is announced in Europe featuring 6.81” 1224×2664 QHD+ HiD LTPO OLED 120Hz, Qualcomm Snapdragon 8 Gen 1:

- Magic4 – Rear tri 50MP 1.0µm-50MP ultrawide-8MP periscope telephoto 5x optical zoom OIS + front 12MP, 8+128 / 8+256 / 12+256 / 12+512GB, Android 12.0 (GMS market dependent), fingerprint on display, UWB support, IP54 rated, stereo speakers, 4800mAh 65W, reverse charging 5W, starts at EUR899.

- Magic4 Pro – Rear quad 50MP 1.0µm-50MP ultrawide-64MP periscope telephoto 3.5x optical zoom OIS-3D ToF + front dual 12MP-3D ToF, 8+256 / 12+256 / 12+512GB, Android 12.0 (GMS market dependent), ultrasonic fingerprint on display, UWB supports, IP68 rated, stereo speakers, 4600mAh 100W, fast wireless charging 100W, reverse wireless charging, reverse charging 5W, starts at EUR1,099.

(GSM Arena, Pocket-Lint, GizChina)

Samsung Galaxy A03 is launched in India – 6.5” 720×1600 HD+ v-notch, Unisoc T606, rear dual 48MP-2MP depth + front 5MP, 3+32 / 4+64GB, Android 11.0, no fingerprint scanner, 5000mAh, INR10,499 (USD138) / INR11,999 (USD158). (GizChina, India Times, Live Mint)

realme V25 5G is launched in China – 6.6” 1080×2400 FHD+ HiD 120Hz, Qualcomm Snapdragon 695 5G, rear tri 64MP-2MP macro-2MP black white + front 16MP, 12+256GB, Android 12.0, side fingerprint, 5000mAh 33W, CNY1,999 (USD316). (Gizmo China, My Drivers, GizChina)

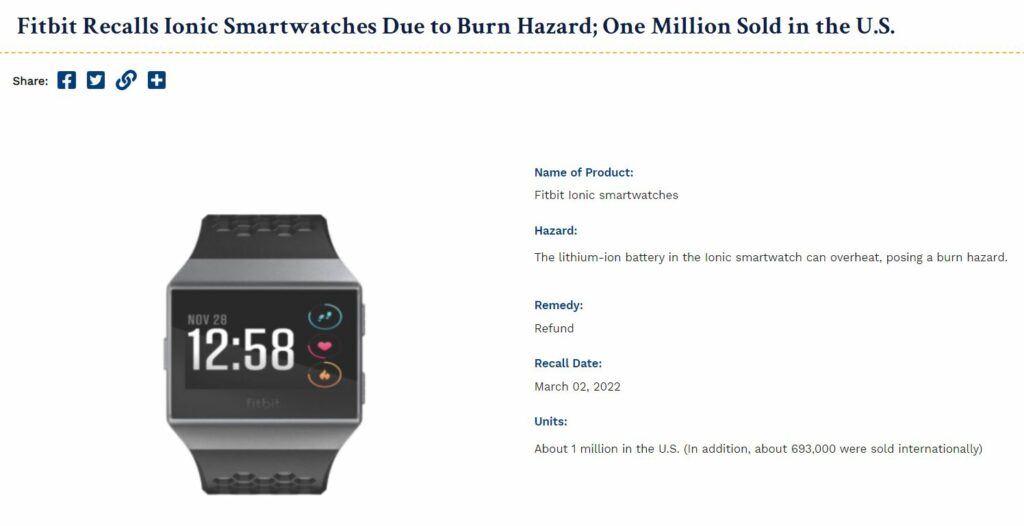

Fitbit has recalled its Ionic wearable after over 150 reports of the watch’s lithium-ion battery overheating, and 78 reports of burn injuries to the users. It will offer a refund of USD299 to the Fitbit Ionic smartwatch users who return the device. Fitbit has received at least 115 reports in the United States and over 50 reports internationally about the Ionic smartwatch’s battery overheating. It is recalling the device as there are two reports of third-degree burns and four reports of second-degree burns out of the 78 total burn injuries report.(Apple Insider, Digital Trends, Fitbit)

Google has been on a buying spree for audio startups. Over the past 15 months, Google has made four acquisitions, spending tens of millions of dollars to acquire intellectual property, technology and talent in audio hardware. The prelude to the acquisition of audio startups began in Dec 2020, when it struck a deal with longtime partner Synaptics to take over part of the company’s audio hardware business for USD35M in total. In the same month, Google also acquired 3D audio startup Dysonics. Dysonics previously developed 3D audio creation software and motion-tracking hardware for headphones. Technology developed by Dysonics could help Google add spatial audio to future headphone projects, among other things. In 2021, Google acquired the intellectual property of RevX Technologies, a defunct Austin startup that built a small portable device optimized for in-ear monitors for performing musicians. Finally, Google acquired French audio wearables startup Tempow in May 2021 for a reported USD17.4M. Tempow has been developing what it calls “the first true wireless earbud operating system”.(CN Beta, 9to5Google, Protocol, Protocol, Realmi Central)

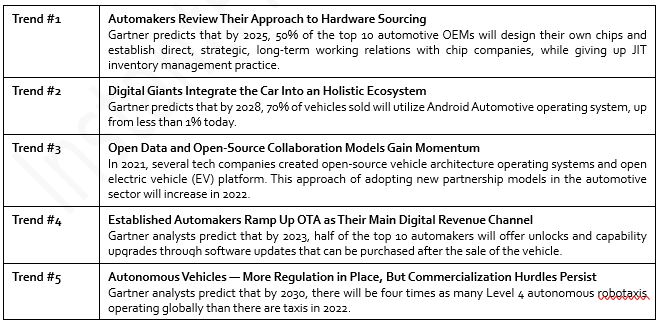

Gartner has identified the top 5 technology trends for 2022 that CIOs need to consider to better prepare for the software, hardware and digital transformations occurring in the automotive sector. (Gartner, Laoyaoba)

Stellantis aims to double revenue to EUR300B (USD335B) a year by 2030 and keep profit margins high, as it steps up efforts to roll out electric versions of its cars, profitable Jeep SUVs and RAM pickup trucks. It would have 75 battery electric vehicle (EV) models on the market and sell 5M EVs a year by 2030. The carmaker expects EVs to make up 100% of its sales in Europe and 50% in the United States by 2030, all while expanding in hydrogen fuel cells for vans and heavy-duty trucks, investing in EV software and using its partnership with Alphabet’s Waymo to develop self-driving delivery vehicles.(Laoyaoba, IT Home, Reuters)

Walmart announced its acquisition of the virtual clothing try-on startup Zeekit in May 2021, which leveraged a combination of real-time image processing, computer vision, deep learning and other AI technologies to show shoppers how they would look in an item by way of a simulation that takes into account body dimensions, fit, size and even the fabric of the garment itself. Today, Walmart says it is bringing that technology to Walmart.com and its Walmart mobile app. The retailer is introducing the computer vision neural network-powered “Choose My Model” try-on feature, now in beta, which will now allow Walmart customers to select a model that better matches their own appearance and body type.(TechCrunch, TechCrunch, Walmart)