3-5 #GreenCode : Panasonic allegedly plans to build a U.S. factory to supply Tesla with lithium-ion batteries; vivo Nex series will be carried by their flagship vivo X Series; Sony and Honda Motor would pair up to develop and sell battery-powered electric vehicles; etc.

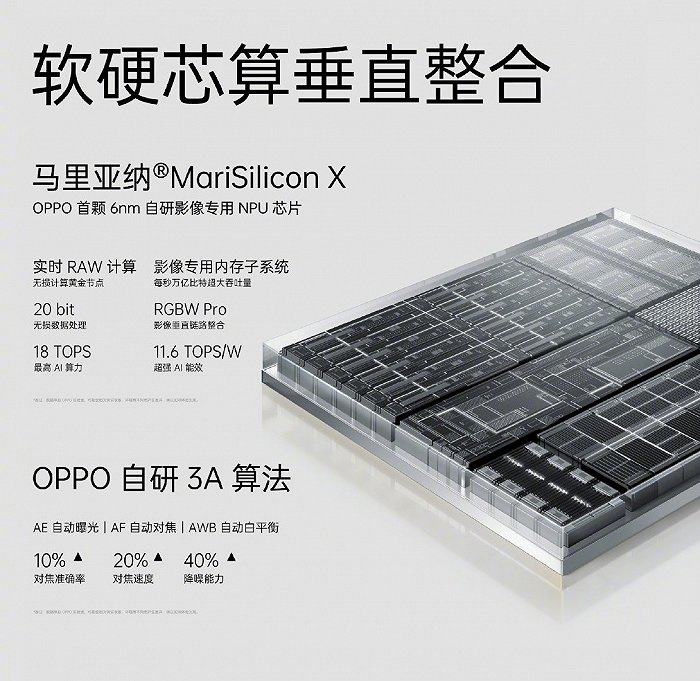

OPPO’s President, Liu Bo has revealed that the Find X5 series sales are relatively higher than its predecessors. He has further added that the company has also placed 10M orders for its newly self developed NPU MariSilicon X with TSMC.(Gizmo China, IT Home)

Lightmatter, LightOn, Celestial AI, Intel, and Japan-based NTT are among the companies developing photonics technologies. So is Luminous Computing, which has announced that it raised USD105M in a series A round. Photonic chips use light to send signals, rather than the electricity that conventional processors use. Photonic chips could, in theory, lead to higher performance because light produces less heat than electricity, can travel faster, and is less susceptible to changes in temperature and electromagnetic fields. (VentureBeat, Business Wire, Crunch Base)

Taiwan reported a massive blackout on 3 Mar 2022 that is affecting its 2 biggest cities as well as its most important Apple iPhone processor production hub. Over 5M households were affected by the power outages, including in Taipei, the capital, and Kaohsiung, the second-biggest city. Taiwan Power has said that its southern power grid system encountered a malfunction causing blackouts in southern Taiwan. Tainan Science Park — the site of TSMC’s most cutting-edge chip production plants for iPhone processors — reported sudden and abnormal voltage changes to the site’s power supply but said it is still determining whether those changes have had any impact on the park. The science park is home to major tech plants for TSMC, UMC and Foxconn display affiliate Innolux. TSMC has indicated that it is still checking whether the power outages across the island have affected its operations. (Asia Nikkei, GizChina)

China-based LED epitaxial wafer and chip maker Sanan Optoelectronics has recently obtained certification from Apple for backlighting-use miniLED chips and may begin shipments in second-quarter 2022 at the earliest, according to Digitimes. Taiwan’s Epistar is currently Apple’s main supplier of mini-LED chips, but the company’s growing number of devices with mini-LED displays has reportedly forced it to seek additional suppliers. To meet Apple’s growing demand, Epistar is expanding its production facilities in China to ramp up production starting in 2Q22, and Sanan Optoelectronics could begin shipments around the same time. (Digitimes, MacRumors, Pocket Now, CN Beta)

Samsung Display has begun the development of OLED panels with a two-stack tandem structure where the panel has two emission layers (EML). Samsung Display is developing the panels to win the orders from Apple for its OLED iPads that are expected to launch in 2024. Having a two-stack structure (as opposed to the single-stack structure currently manufactured by Samsung Display) doubles the brightness of the OLED panel while its life span is expected to be quadrupled. Samsung Display has named the material set for the new OLED panels at the T series (T standing for tandem). Samsung Display is aiming to develop the T1 material set first and get customer evaluation. It is aiming to apply the material for commercial production in 2023. For the set’s successor, T2, Samsung Display is currently aiming to start commercial production in 2024. OLED panels made with the T2 material set will likely be the first panels used by Apple for its iPads. (Apple Insider, The Elec, WCCFTech)

Western Digital (WD) and Kioxia have been grappling with contamination affecting their Japanese manufacturing plants, with an estimated loss of more than 3% of global NAND production. In Feb 2022, both companies discovered a contamination issue affecting BiCS 3D NAND lithography equipment, causing it to cease operations at two manufacturing plants. The contamination caused a staggering 6.5EB of NAND die loss (slightly higher than the initial estimate in Feb), which could have been used in hundreds of millions of solid-state storage devices. According to Wells Fargo semiconductor analyst Aaron Rakers, Kioxia and WD expect a capacity loss of around 29EB in 1H22, which will undoubtedly affect the company’s financial performance in the short term. In addition, considering that Kioxia and Western Digital accounts for about one-third of the NAND market share, market research firm TrendForce expects NAND prices to rise by 5-10% in the next few months. The good news is that the pollution problems affecting Yokkaichi and Kitakami factories were resolved in late Feb 2022.(CN Beta, Blocks and Files, Asia Nikkei, Techspot)

Micron has expressed optimism about DRAM and NAND flash chip demand for handsets, particularly 5G smartphones, in 2022. In response to the growing concerns about excess inventories held by Android phone vendors due to sluggish sales in China, Micron executive VP and chief business officer Sumit Sadana has said that the global handset market will be in a healthy state in 2022 with 5G smartphones triggering both DRAM and NAND flash memory demand. About 500M 5G smartphones were shipped globally in 2021, said Sadana, adding that the shipments are expected to top 700M units in 2022. Besides, the DRAM content in 5G smartphones is 50% higher than in their 4G predecessors. The NAND flash content in 5G smartphones has doubled.(Digitimes, 796T, Laoyaoba)

According to the Securities Times, there are recent market rumors that CATL and some lithium iron phosphate manufacturers have lowered their production schedules for Mar 2022. CATL has responded to the media that the news was not true. CATL has a strong ability to guarantee supply, but rumors of production cuts reveal the overall cost pressure of the industry. Excessive prices may dampen demand, and resistance has emerged in the industry chain. According to Xinyu Lithium Battery data, the domestic battery-grade lithium carbonate price exceeded 500,000 yuan/ton on 2 Mar 2022, an increase of about 67% compared to the beginning of the year. It took a month to increase from 300,000 yuan/ton in Jan 2022 to 400,000 yuan/ton, and it took only about 20 days to increase from 400,000 yuan/ton to 500,000 yuan/ton. (CN Beta, My Drivers)

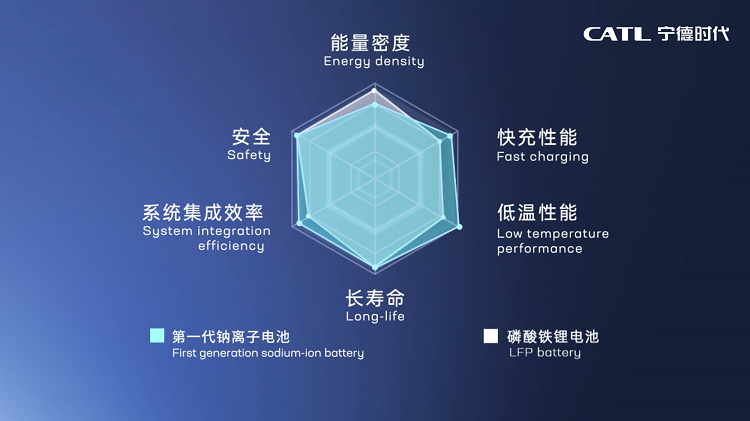

CATL has said that the company has started the industrialization of sodium-ion batteries and will form a basic industrial chain in 2023. In Jul 2021, CATL released the first generation of sodium-ion batteries. The energy density of the first-generation sodium-ion battery is slightly lower than the current lithium iron phosphate battery, but it has obvious advantages in low-temperature performance and fast charging, especially in high-power application scenarios in alpine regions. In the future, CATL is still in the process of continuous innovation, and it is expected that the energy density of the next-generation sodium-ion battery will exceed 200Wh/kg.(Laoyaoba, Sohu, 36Kr, East Money, CATL)

Panasonic allegedly plans to build a U.S. factory to supply Tesla with lithium-ion batteries, seeking to ramp up production to meet anticipated demand for electric vehicles. Panasonic is looking at sites in Oklahoma and Kansas to build the plant. Yayoi Watanabe, a spokeswoman for Osaka-based Panasonic, has said that the news was not based on information from the company. Panasonic has said it will start mass production of 4680 batteries in the fiscal year ending March 2024, with plans to establish two additional production lines as well as facilities at its Wakayama factory. Panasonic plans to invest JPY80B (about USD700M) in the plant, which is expected to have an annual production capacity of 10GWh, accounting for about 20% of Panasonic’s production capacity, enough to power about 150,000 electric vehicles. (CN Beta, Wall Street CN, Sohu, Japan Times)

Foxconn has revealed that it will manufacture battery packs and cells for the first time at new facilities in southern Taiwan, moving to gain more control over the supply of strategic materials central to the booming electric vehicle industry. Foxconn Chairman Young Liu has indicated that the company will manufacture battery packs and cells for the first time at new facilities in southern Taiwan. The company’s plan is to build factories for battery packs, cells and energy storage systems, as well as for the design and assembly of electric buses in Kaohsiung. Foxconn has a goal to have a 5% share in designs, components and parts in the global EV markets by 2025. The company also wants to turn its EV segment into an over TWD1T (USD35.6B) business by 2026. (CN Beta, Yahoo, Asia Nikkei, TechWire, Techspot)

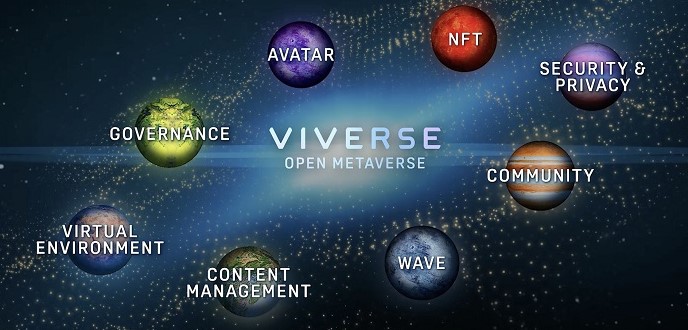

HTC’s general manager for the Asia-Pacific region, Charles Huang has revealed that the company would be introducing a new high-end smartphone next month with unspecified “metaverse” features. HTC has debut of a nebulous “Viverse” — the company’s metaverse concept that promises to fuse VR, XR, 5G, blockchain technology, NFTs, and more together into a new, futuristic platform. (CN Beta, The Verge, Digitimes)

In recognition of its continued environmental leadership and innovation, Samsung Electronics America has received two awards from the U.S. Environmental Protection Agency (EPA). Samsung’s honors include a Gold Tier Award, the EPA’s highest award for the responsible recycling of electronic waste (e-waste) and a Sustained Excellence Award, a new EPA accolade, recognizing our legacy of Sustainable Materials Management (SMM) product innovation, including our groundbreaking Solar Cell Remote for Samsung TVs. (Digital Trends, Samsung, EPA)

NEX series smartphones have disappeared from the shelves of vivo’s official website. vivo brand VP and GM, Jia Jingdong had indicated that the original NEX series’ mission to explore and innovate new experiences and forms will not disappear and will be carried by their flagship vivo X Series.(GSM Arena, Motorola, CN Beta)

Honor’s CEO George Zhao has revealed that the company wants to double its sales in 2022. HONOR is now partnered with over 200 major carriers and channel partners—98 of them are in Europe, and include Vodafone, Orange, Telefonica, H3G, Bouygues, and SFR, amongst others. (Android Headlines, EET China, PRNewswire)

Samsung is reportedly throttling the Galaxy S22 and many of the other best Samsung phones with Game Optimizing Service (GOS). A list of over 10,000 apps and games was found to be throttled, even though Samsung claims the service is only supposed to throttle games. Samsung has said that this issue should be a temporary one and that reprieve is coming soon. (Neowin, Android Central)

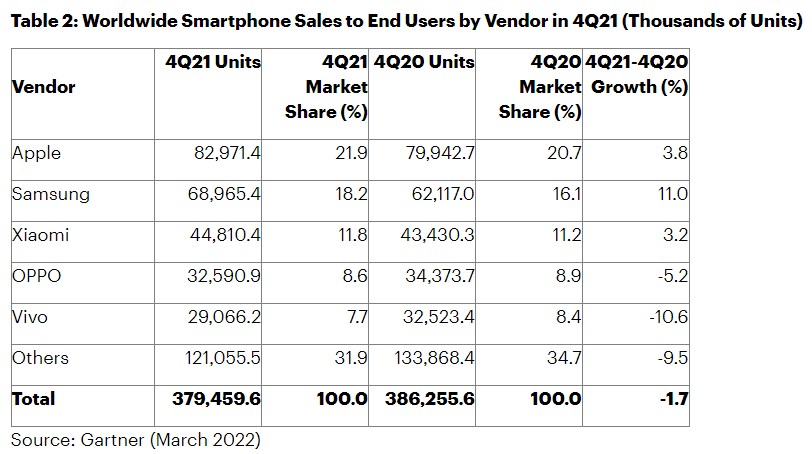

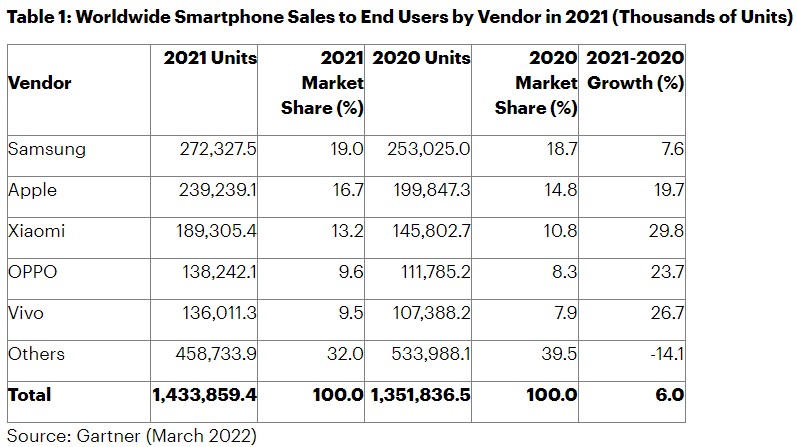

Worldwide smartphone sales grew 6% in 2021, according to Gartner. Smartphone sales rebounded in 1H21, following a 12.5% decline in 2020. Previous year’s lower smartphone sales because of COVID-19 and the bounce back to growth in 1H21 helped propel the market to growth. However, component shortages and supply chain issues disrupted smartphone sales in 2H21. The increase in discretionary spending, opening of marketplaces post lockdown, along with a lower base for comparison from 2020 led to 6% growth in 2021. The introduction of 5G at lower price points to meet future proof needs influenced upgrade purchases. As a result, smartphone sales grew for all the top five vendors in 2021. (Gartner, CN Beta)

Moto G22 is announced – 6.5” 720×1600 HD+ v-notch 90Hz, MediaTek Helio G37, rear quad 50MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 4+64GB, Android 12.0, side fingerprint, 5000mAh 15W, EUR169.(GSM Arena, Motorola, CN Beta)

Samsung Galaxy A13 and A23 are unveiled, featuring 6.6” 1080×2408 FHD+ v-notch TFT, rear quad 50MP-5MP ultrawide-2MP macro-2MP depth + front 8MP, side fingerprint, 5000mAh 25W:

- A13 – Qualcomm Snapdragon 680 4G, 4+64 / 4+128GB, Android 12.0, EUR189 / EUR209.

- A23 – Exynos octa-core, 4 / 6 / 8 + 64 / 128GB, Android 12.0, price to be announced.

(GSM Arena, CN Beta, Samsung, Samsung, XDA-Developers, Pocket-Now)

Samsung Galaxy M33 and M23 are official, featuring 6.6” 1080×2408 FHD+ v-notch TFT, octa-core processor:

- M33 – Rear quad 50MP-8MP ultrawide-2MP macro-2MP depth + front 8MP, 6+128 / 8+128GB, Android 12.0, side fingerprint, 6000mAh, price to be announced.

- M23 – Rear tri 50MP-8MP ultrawide-2MP depth + front 8MP, 4+128GB, Android 12.0, side fingerprint, 5000mAh, price to be announced.

Lava X2 is announced in India – 6.5” 720×1600 HD+ v-notch, MediaTek Helio G35, rear dual 8MP-QVGA + front 5MP, 2+32GB, Android 11.0 Go, rear fingerprint, 5000mAh, INR6,999 (USD90). (GSM Arena, Amazon)

Sennheiser, the German audio pioneer renowned for its enthusiast-grade consumer audio products is now officially a part of the Sonova Holdings AG Group. The change in ownership is not likely to affect the branding or products of the brand but Sonova Holdings AG Group will now be using the Sennheiser branding for its future products. Sonova Holding AG Group is a Swiss multinational company headquartered in Stäfa and it specializes in hearing care solutions. It is one of the biggest providers in the sector worldwide. The group operates via its core business brands such as Phonak, Unitron, Hansaton, Advanced Bionics, and AudioNova. (Gizmo China, Sennheiser, TechnoSports, Sonova)

Apple suppliers Foxconn and Luxshare Precision are among possible candidates to produce the rumored Apple Car, as both companies have made forays into the future vehicle market, according to Digitimes. While Apple might not work with Foxconn and Luxshare for its Apple Car in the beginning, there is a possibility that the two suppliers could play a key role in Apple’s future vehicle plans. South Korea-based Hyundai Motor and Canada-based Magna International, both of which have been in partnership talks with Apple, hold advantages over Foxconn when it comes to car manufacturing. South Korea’s LG Energy Solution (LGES), SK On, and Samsung SDI are possible candidates to supply EV batteries to Apple Cars in the US. Meanwhile, Apple might turn to CATL and BYD to supply batteries for Apple Cars sold in China, the sources explained. (Digitimes, press, Apple Insider, CN Beta)

Japan’s Sony and Honda Motor have said they would pair up to develop and sell battery-powered electric vehicles, as the electronics maker furthers its ambitions to become a key player in next-generation automobiles. The two companies would form a joint venture in 2022 and aim to begin selling the first model in 2025. Honda will be responsible for manufacturing the first model, while Sony will develop the mobility service platform. (The Verge, Honda, CN Beta, Reuters)

Volocopter, the pioneer of urban air mobility, has raised USD170M in the initial signing of its Series E funding, at a pre-money valuation of USD1.7B. The money raised will assist with the certification of Volocopter’s electric passenger air taxi and is expected to help Volocopter achieve commercial launch in first cities worldwide. Volocopter is developing new and sustainable mobility options for cities around the world. With its family of aircraft (the VoloCity, VoloConnect, and VoloDrone), the company takes a unique approach by developing urban air mobility (UAM) as a holistic ecosystem. (TechCrunch, Reuters, PR Newswire)

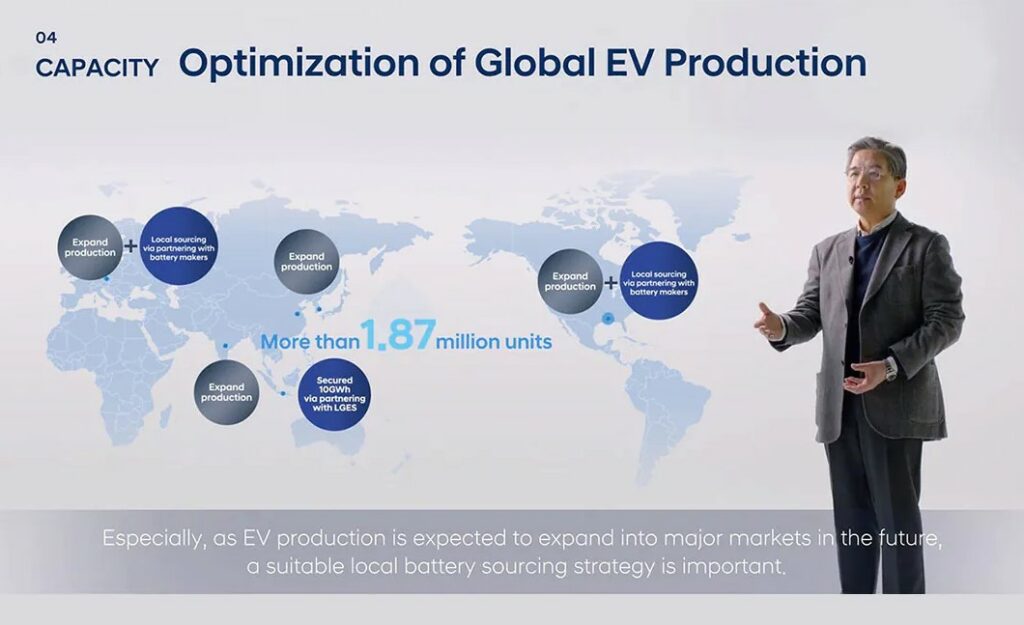

Hyundai Motor CEO Jaehoon Chang has revealed that the company targets to sell 1.87M BEVs annually by 2030 by strengthening line-up, caputring a 7% market share in the global EV market. The company plans to introduce 17 new BEV models by 2030 — 11 for Hyundai models and six for Genesis luxury brand.(Engadget, Hyundai)