3-30 #Dilemma : YMTC has allegedly entered Apple’s Flash supply chain; Leadcore Technology is exiting mobile phone SoC market; Apple allegedly plans to make about 20% fewer iPhone SE in 2Q22 than originally planned; etc.

Datang Telecom Technology has announced that it has agreed its subsidy Leadcore Technology to transfer part of the supporting assets related to LC1860 chip, LC1881 chip related technology and supporting assets to Morningcore Technology, a subsidiary of the company’s controlling shareholder, involving a total transaction amount of CNY33.646M (excluding tax). Leadcore’s last self-developed product that debuted on the market should be the dual-core Cortex A9 1.2GHz smartphone chip LC1810 10 years ago, manufactured with a 40nm process, targeting the CNY1,000 smartphone market. Since 2018, Datang Telecom has adjusted its strategy and withdrawn from the field of mobile communication chip design. Subsidiary Leadcore Technology has carried out business adjustment in an orderly manner, with its self-developed intangible assets and other assets accumulated in consumer terminals as its capital contribution.(CN Beta, Sina, CWW, EET China)

Huawei’s rotating chairman has revealed that will use the area for performance and stacking for technology. This will allow less advanced processes to continue to make Huawei competitive in future products. This is the first time Huawei has publicly confirmed the chip stacking technology. That is to say, by increasing the area and stacking, we can achieve higher performance. This can also help to achieve the competitiveness of low-tech processes to catch up with high-performance chips. This also means that Huawei’s chips using chip stacking technology are likely to come out in the near future.(GizChina, My Drivers, CN Beta)

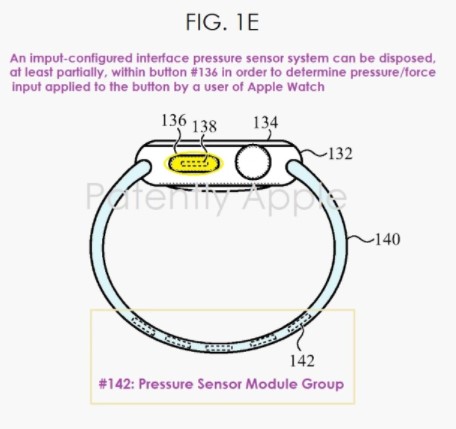

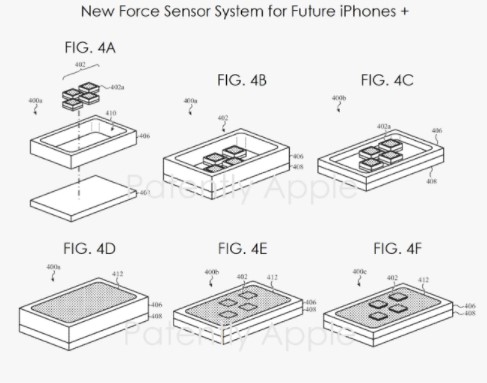

Apple has filed multiple patents related to force-pressure sensors. These patents cover how these sensors can be used for different purposes in Apple devices. One of the patents reveals force sensors designed for “small form factor devices” like the Apple Watch and even AirPods. Regular force sensors take up “substantial volume” inside the product, making them difficult to fit inside certain devices. With the new technology, Apple would be able to make a pressure-sensitive surface using microelectromechanical fluid pressure sensors. Other Apple patents show how microelectromechanical fluid pressure sensors can be used in the trackpads of MacBooks and even under the iPhone display to “precisely detect small or gradual changes in force”.(CN Beta, Tom’s Guide, 9to5Mac, Business Insider)

GalaxyCore has revealed that the company’s “12-inch CIS integrated circuit process R&D and industrialization project” is advancing rapidly. The construction of the fab and clean workshop has been basically completed, and the move-in and installation of the main equipment will begin on 16 Feb 2022. On 24 Mar, GalaxyCore once again ushered in an important and iconic moment for the establishment of the factory. The most critical equipment in the entire production line – ASML’s advanced ArF lithography machine was successfully moved into.(CN Beta, TechWeb)

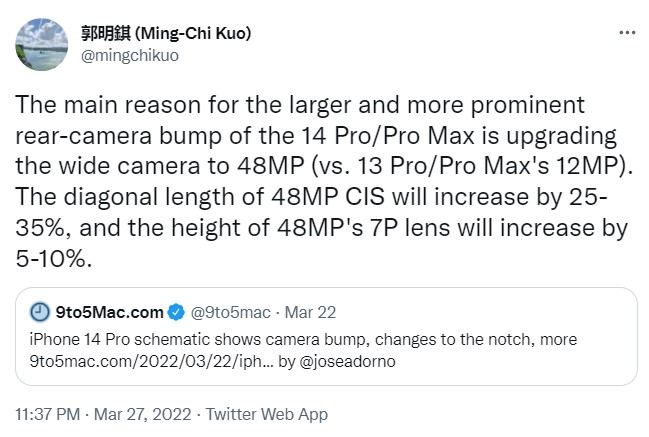

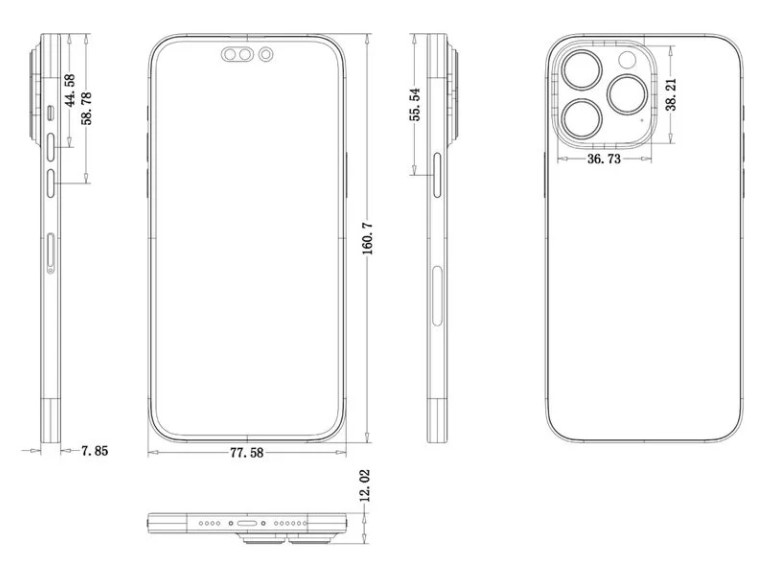

According to TF Securities analyst Ming-Chi Kuo, the increased size of Apple’s iPhone 14 Pro and iPhone 14 Pro Max’s rear camera array is due to all-new 48MP wide camera systems. The rear camera plateau of the iPhone 14 Pro models will increase by about five percent in each dimension, increasing from a width of 35.01mm to 36.73mm and a height of 36.24mm to 38.21mm. The bump itself is also set to protrude further from the device, increasing from 3.60mm on the iPhone 13 Pro to 4.17mm on the iPhone 14 Pro. He has further added that the diagonal length of the iPhone’s contact image sensor (CIS) is set to increase by to 25%-35% with the jump to 48MP. Likewise, the height of the camera’s lens system will increase by 5%-10%. (CN Beta, Apple Insider, Mac Rumors, Mac Rumors, Twitter)

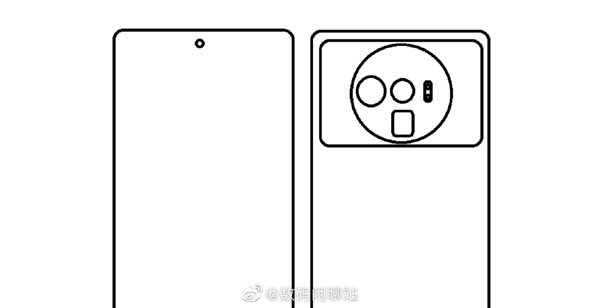

Xiaomi’s upcoming new flagship Mi 12 Ultra will cooperate with Leica and will be officially released in 2Q22. In the latest version of MIUI Album, the relevant information of Leica has been added to the code. According to the code, Leica effects will be added to MIUI filters, including Leica Monochrom, Leica Monochorm HC, Leica Natural, Leica Vivid, etc.(CN Beta, XDA Developers, GizChina)

Xiaomi may have switched from a Samsung-made image sensor to a Sony Exmor primary camera for its latest flagship phone. Sony has yet to make the rumored Exmor IMX800 sensor official, but assuming that the leaked specifications are accurate, the IMX800 should have a 50-megapixel resolution similar to the ISOCELL GN2 from Samsung. Xiaomi may have decided to end its collaboration with Samsung in favor of Sony.(GizChina, My Drivers, SamMobile)

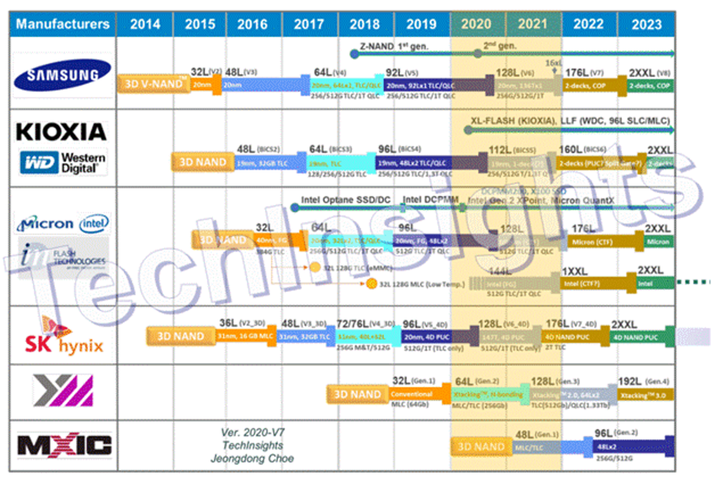

Yangtze Memory Technologies Co (YMTC) has allegedly entered Apple’s Flash supply chain. According to the current schedule of YMTC’s shipments, it should enter Apple’s iPhone SE supply chain. In the past, Flash suppliers for iPhone were mainly SK Hynix and Kioxia. YMTC is the first IDM company in mainland China to achieve mass production of 64-layer 3D NAND. Its wholly-owned subsidiary Wuhan XMC focuses on NOR Flash and complements the Flash layout with YMTC NAND. (TechNews, EET China, CN Beta, IT Home)

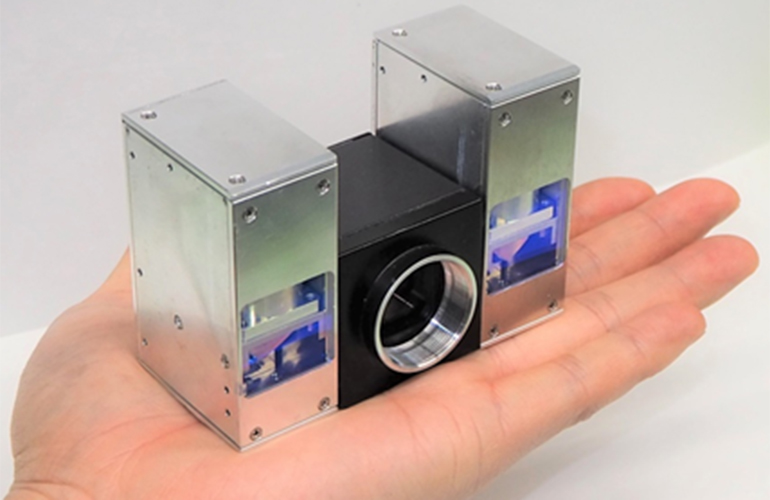

Toshiba has made major advances in shrinking the laser projector unit of its LiDAR to one quarter the size of the previous version released in June 2021. Using two of the new projector units, the LiDAR is just 206 cm3 in volume that can fit into the palm of the hand. Its range has been pushed out to 300 m, with an image resolution of 1200×84 pixels. It can be configured with flexible combinations of projector units to handle a variety of long-range and wide-angle detection applications. The LiDAR will advance progress in Toshiba’s focus application areas, autonomous driving and infrastructure monitoring. It also opens the way to exploring partnerships in other areas, including robotics, drones and small security devices.(CN Beta, Toshiba, Yahoo, The Robot Report)

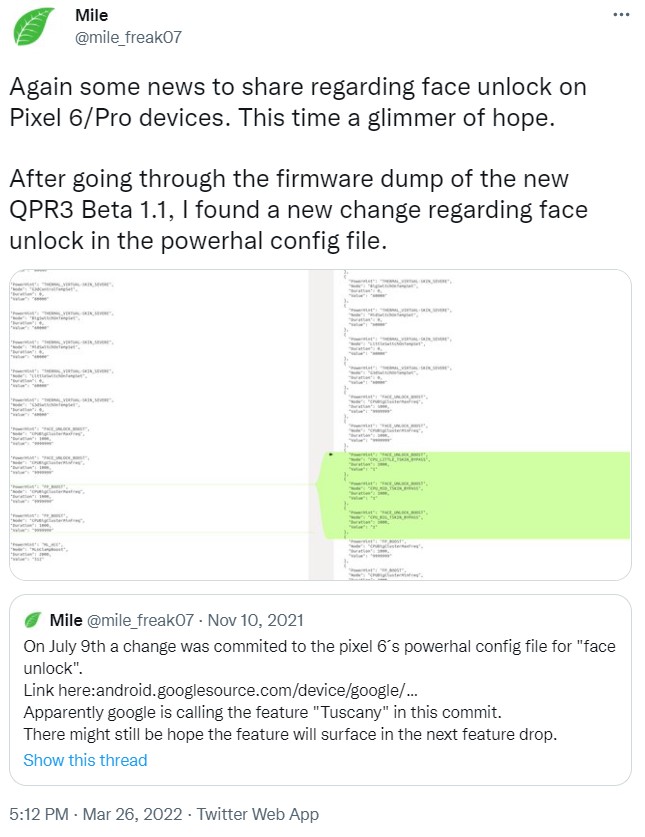

Google is reportedly still working on adding Face Unlock on the Pixel 6 series. While digging the new Android 12 QRP3 Beta 1.1 build, new change related to the feature in the PowerHAL config file is found. The evidence suggests that Google might still push Face Unlock for Pixel 6 phones as a future software update but there is no release timeframe for now. (GSM Arena, XDA-Developers, Twitter)

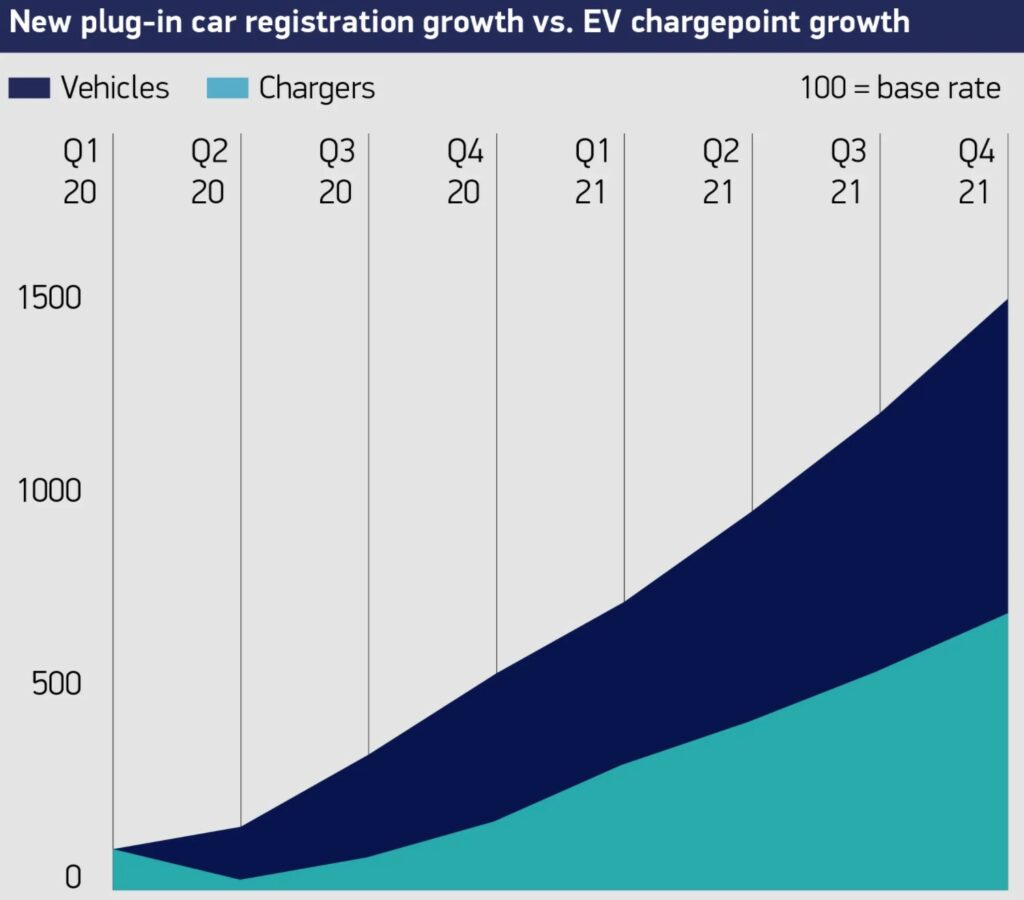

The UK government is investing GBP1.6B in a bid to build a nationwide network of 300,000 public electric vehicle (EV) chargepoints by 2030 – a tenfold increase on the current 30,000. At present, there are an estimated 60,000 fuel pumps on UK roads. Chargepoints will provide one or more actual charging unit. The GBP1.6B is made up of new and existing money dedicated to improving the UK’s transition to an electric and hybrid vehicle fleet. 2030 is the year the government is planning to ban the sale of new petrol and diesel cars. The Electric Vehicle Infrastructure Strategy is intended “to make charging easier and cheaper than refuelling a petrol or diesel car”. The strategy includes a GBP450M Local Electric Vehicle Infrastructure (LEVI) fund, intended to support projects such as EV hubs and on-street charging for those without driveways. (GizChina, Forbes, Yahoo, Investor Chronicles)

Panasonic Electric Group president, Yuki Kusama, has indicated that Panasonic will achieve mass production of cobalt-free batteries within 3 years. At the same time, 4680 batteries will become the main force of circular batteries in the future. He has said that by 2030, all of Panasonic’s business companies will achieve virtually zero carbon dioxide emissions. It is reported that since 2010, Panasonic began mass production of 1865 prototype batteries for vehicle power batteries; in 2016, it began mass production of 2170 cylindrical batteries, mainly for Tesla and other customers. This year, Panasonic will mass-produce the 4680 cylindrical battery. It was previously reported that the battery will be installed on Tesla’s new Model Y as soon as the end of Mar 2022.(CN Beta, Laoyaoba, Realmi Central)

Renewable energy startup Span.IO wants to give consumers more control over how their cars and homes are powered. Founded in 2018, Span is best known for its smart electrical panel, which allows homeowners to use an app to monitor power consumption and optimize it by adjusting and prioritizing their electrical circuits. The San Francisco-based company has just raised USD90M in funding, which will go in part toward continuing to build products that rest upon that technology. The company announced its first foray outside of the electrical panel market in Oct 2021 with Span Drive, a USD500 electrical vehicle charger that connects to the company’s USD3,500 electrical panel to allow people to customize the energy source that is charging their car. (BNN Bloomberg, TechCrunch)

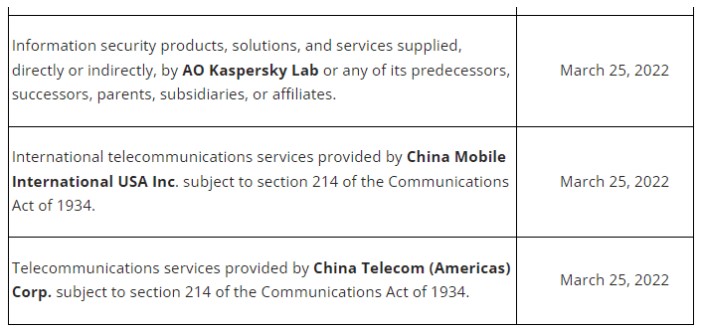

The U.S. Federal Communications Commission (FCC) has added China Telecom and China Mobile to a list of “communication equipment and services that pose a threat to U.S. national security”. The top 3 companies on the list are AO Kaspersky Lab, China Mobile, and China Telecom. There are currently eight companies on the list. In addition to the three companies, there are also Huawei, ZTE, Hytera, Hikvision, and Dahua shares. The latter companies were listed in Mar 2021. The FCC law in 2019 is to protect the security of the US communication network. The FCC claims that all the companies on the list pose a serious security threat to the United States. (Laoyaoba, Reuters, Fierce Wireless, FCC, Gizmo China)

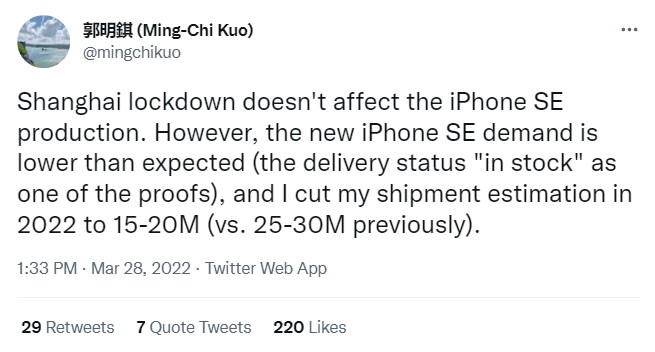

Apple allegedly plans to make about 20% fewer iPhone SE in 2Q22 than originally planned, in one of the first signs that the Ukraine war and looming inflation have started to dent consumer electronics demand. Apple has informed suppliers to cut back on production of the iPhone SE for this quarter by as much as 2M-3M units, citing “weaker-than-expected demand”. TF Securities analyst Ming-Chi Kuo is cutting estimates on shipments of the new iPhone SE from 25M-30M to around 15M-20M units for 2022. He has explained the lower shipments were a result of low demand. (MacRumors, Gizmo China, Asia Nikkei, Twitter, Apple Insider)

Tecno has globally launched the world’s first-ever immersive mobile Augmented Reality (AR) experience in the football world. The campaign, dubbed #AnnounceYourself, was an unprecedented AR experience that successfully ran throughout Jan-Feb 2022. Users could even take part in the TECNO Mobile 3D penalty shootout games before showing off their skills and scores on social media. The AR experience campaign culminated in a grand lucky draw where lucky contestants won rare VIP matchday tickets and travel to a Manchester City home fixture during the season. (GizChina, Mancity, Facebook)

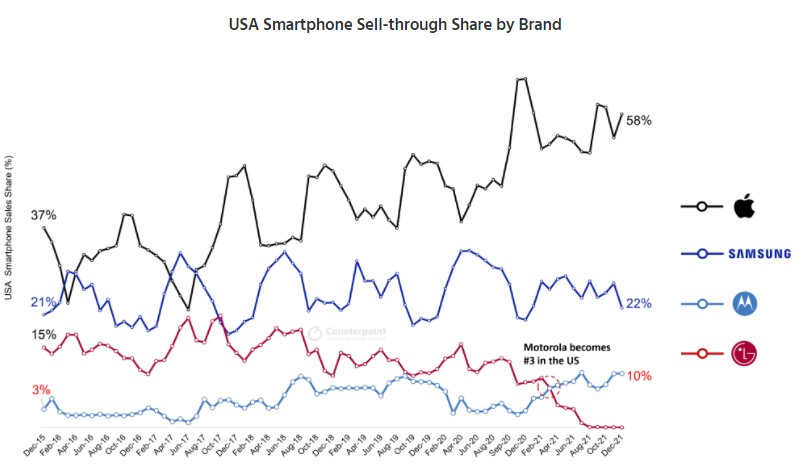

Motorola emerged as the third-largest smartphone brand in the US in 2021, according to Counterpoint Research. Motorola’s sales more than doubled in 2021, growing 131% YoY. While Apple and Samsung dominate the premium price bands, Motorola rose through the ranks to become the #2 smartphone player in the $400 and below price segment in the US. Motorola has been a key OEM filling the void left by LG’s exit. The OEM has all the key characteristics major carriers look for – a full portfolio, ability to ramp volumes, and low return rates. Motorola’s sub-USD300 portfolio – Moto G Stylus, Moto G Power and Moto G Pure – has driven its success in the US. (GSM Arena, Android Authority, Counterpoint Research, CN Beta)

Samsung Electronics GmbH, Germany, has been sued by Moving Picture Experts Group Los Angeles (MPEG LA) for infringing HEVC (H.266) patents under MPEG LA’s Patent Portfolio License. Unlike AV1, which is an open standard codec, High Efficiency Video Coding (HEVC) requires a license for use and distribution, and according to the lawsuit filed, Samsung was still continuing to offer products, like smartphones, TVs, among others, that came with HEVC support even after its license had expired in Mar 2020. (Neowin, MPEGLA)

vivo iQOO U5x is announced – 6.51” 720×1600 HD+ v-notch, Qualcomm Snapdragon 680, rear dual 13MP-2MP macro + front 8MP, 4+128 / 8+128GB, Android 11.0, microUSB, side fingerprint, 5000mAh 10W, CNY899 (USD140) / CNY1,099 (USD170). (GizChina, Gizmo China, GSM Arena, vivo)

vivo iQOO Z6 is launched in India – 6.58” 1080×2408 FHD+ v-notch 120Hz, Qualcomm Snapdragon 695 5G, rear tri 50MP-2MP macro-2MP depth + front 16MP, 4+128 / 6+128 / 8+128GB, Android 12.0, side fingerprint, 5000mAh 18W, INR15,499 (USD203) / INR16,999 (USD223) / INR17,999 (USD235). (GSM Arena, vivo, Financial Express, India Times)

Honor X9 is launched – 6.81” 1080×2388 FHD+ HiD 120Hz, Qualcomm Snapdragon 695 5G, rear tri 48MP-2MP macro-2MP depth + front 16MP, 8+128GB, Android 11.0, side fingerprint, 4800mAh 68W, price to be announced.(GizChina, Gizmo China)

Redmi 10A is launched in China – 6.53” 720×1600 HD+ v-notch, MediaTek Helio G25, rear 13MP + front 5MP, 4+64 / 4+128 / 6+128GB, Android 11.0, rear fingerprint, microUSB, 5000mAh 10W, CNY649 (USD102) / CNY799 (USD125) / CNY899 (USD141). (Gizmo China, Mi.com, IT Home)

Bloomberg’s Mark Gurman expects Apple’s new iPad Pro models, to be launched in fall 2022, would feature MagSafe charging, as well as the “M2” chip. The M2 chip is expected to have the same 8-core CPU as the M1, but will benefit from speed and efficiency improvements thanks to TSMC’s 4nm process. It is also rumored to have additional GPU cores, with 9- and 10-core GPU options, up from the 7- and 8-core GPU options in the M1 chip. (MacRumors, CN Beta, Gizmo China)

Hewlett-Packard (HP) has announced it would buy audio and video devices maker Poly for USD1.7B in cash as it looks to capitalise on the hybrid work led boom in demand for electronic products. The acquisition accelerates HP’s strategy to create a more growth-oriented portfolio, further strengthens its industry opportunity in hybrid work solutions, and positions the company for long-term sustainable growth and value creation. HP CEO Enrique Lores has indicated that the rise of the hybrid office creates a once-in-a-generation opportunity to redefine the way work gets done. The transaction is expected to close by the end of 2022. (CN Beta, Reuters, Barron’s, Yahoo, HP)

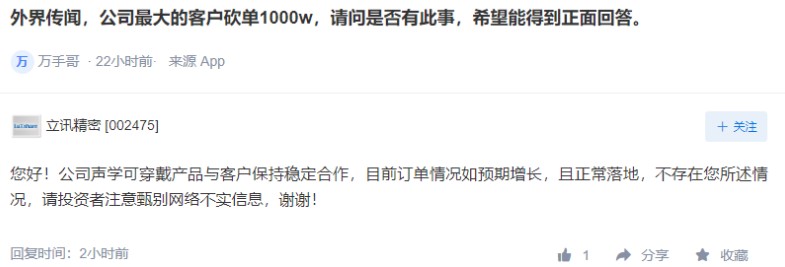

Apple is rumored to cut its annual production of AirPods by more than 10M units in 2022, citing moderate demand forecasts and a desire to reduce inventory levels. In this regard, Luxshare Precision has said that the company’s acoustic wearable products have maintained stable cooperation with customers. At present, the order situation has grown as expected and has landed normally. There is no case that the company’s biggest customer has cut 10M orders. (CN Beta, Realmi Central, IT Home, UDN)

Singapore-based E-commerce company Shopee has abruptly shut down its operation in India shortly after making its foray into the country. To recall, Shopee India launched back in Nov 2021. Shopee India is shutting down citing “global market uncertainties”. The company will be closing its early-stage Shopee India initiative. Moreover, the company’s focus during this transition will be to provide support to its local seller and buyer communities and its team in India. (GizChina, Shopee)