4-1 #Home : LGD is developing foldable OLED with Apple; Apple is reportedly exploring new sources of the memory chips; Samsung and SK Hynix plan to cease production of DDR3 memory; etc.

Intel is launching its Arc Control graphics software suite for gamers and creators. The application will feature a modern overlay that will be instantly accessible anytime with the press of the Alt+I buttons (this can be configured). One thing that Intel is investing a lot in is its driver support and Arc Control will be providing automatic driver updates (always up to date, or on-demand). The installation process for the drivers will also be fully integrated. There will also be a performance tuning panel that will let you monitor real-time performance metrics, utilize a Telemetry overlay by pressing Alt+O (this can be configured) to show an in-app HUD, and even adjust performance settings such as power, fan speeds, clocks, etc (only available for desktop GPUs).(CN Beta, Liliputing, Digital Trends, GSM Arena, WCCFTech, CNET)

Intel has announced details of its new Arc series of discrete graphics processors, namely Arc 3, Arc 5, and Arc 7 series of GPU, based on its new Xe HPG architecture. This first batch of GPU is dedicated for laptops, with desktop and workstation versions arriving later in 2022. Arc 3 is the entry-level series and is based on the smaller ACM-G11 die while the Arc 5 and Arc 7 will be based on the larger ACM-G10 die. The Arc 3 series currently includes two models, the A350M and the A370M. The A350M features 6 Xe-cores, 6 ray tracing cores, and 1150MHz graphics clock (which is the typical average clock speed and not peak clock speed), and a 25-35W power envelope. The A370M has 8 Xe-cores, 8 ray tracing units, and 1550MHz graphics clock and 35-50W power envelope. Both have 4GB GDDR6 memory, and 64-bit wide memory bus. There will be A550M, A730M, and A770M later in the year with more cores, memory, and higher power envelops but the basic architecture and design will be the same.(Liliputing, CNET, GSM Arena, YouTube)

Taiwan Economy Minister Wang Mei-hua has indicated that Malaysia’s help is needed to resolve the global shortage of auto semiconductors, especially when it comes to packaging, a sector affected by the country’s COVID-19 curbs. She has further added that the bottleneck in fact is in Southeast Asia, especially Malaysia, because for a while the factories were all shut down. The problem is especially acute with auto chip packaging, with companies in Malaysia providing services not offered by Taiwanese firms. Malaysia Semiconductor Industry Association President Wong Siew Hai has said that the major Malaysian semiconductor manufacturers are already running at full capacity to supply the auto industry. He has further added that adding capacity will take time, with most available only in 2023. (GizChina, Car & Bike, Xuan, Reuters, Wapcar)

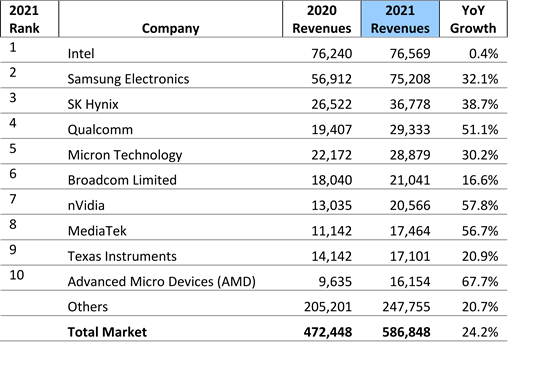

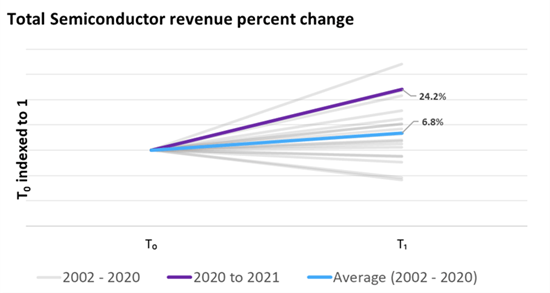

According to Omdia, the market surpassed annual revenue of half-a-trillion dollars for the first time ever in 2021, capping a remarkable year for the industry. Furthermore, nearly 60% of companies in the sector grew by more than 20% in revenues. The review of quarterly performance confirms Samsung maintained the top spot as the largest semiconductor company by revenue in 4Q21 and brought in revenue of USD19.995B compared to Intel’s USD19.976B. Samsung was also the largest semiconductor firm by revenue in 3Q21, taking over after Intel was the largest in 1Q21 and 2Q21. However, on an annual basis, Intel completed 2021 as the number one semiconductor company by revenue in 2021, with revenue at USD76.6B, which represented 13% of all semiconductor revenue for the year. (CN Beta, Omdia)

TSMC chairman Mark Liu has indicated that consumer electronics demand is showing signs of slowing amid geopolitical uncertainties and COVID-related lockdowns in China. The slowdown is emerging in areas “such as smartphones, PCs, and TVs, especially in China, the biggest consumer market”. Liu has also warned that the cost of components and materials are rising sharply, pushing up production costs for tech and chip companies, and such pressure could eventually be passed on to consumers. He has further added that the semiconductor industry already and directly experienced that cost increase, yet the company is not likely to change its growth target and capital expenditure.(Gizmo China, Asia Nikkei, Sina, UDN, TechNews)

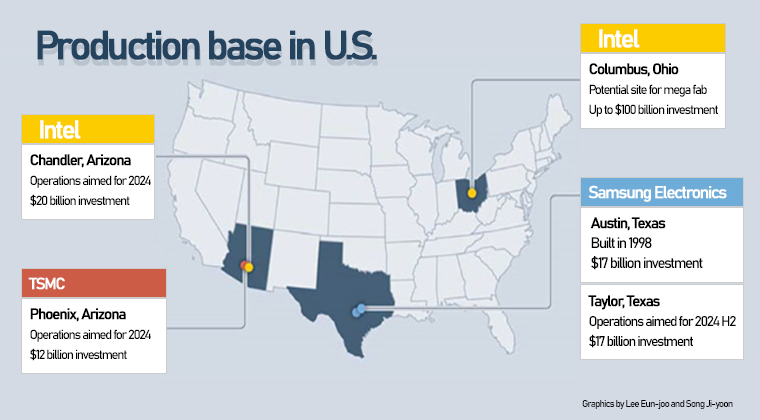

Taiwan Semiconductor Manufacturing Co (TSMC) and Samsung Electronics reportedly want to be eligible to receive part of the USD52B in subsidies meant to bolster chip manufacturing in the U.S. TSMC and Samsung are both planning new multi-billion dollar semiconductor fabs in the U.S. as legislation focused on improving domestic chip manufacturing slowly makes its way through Congress. Intel has previously said that subsidies should only go to domestic firms, although CEO Pat Gelsinger has held back from repeating the suggestion in recent remarks. TSMC is currently building a USD12B fab for 5nm chips in Phoenix, Arizona, which is expected to begin commercial production in 2024. Samsung is planning a USD17B chip facility in Austin, Texas, with production slated to start in 2026. (Bloomberg, The Register, Android Headlines)

At the end of 2021, Shenzhen-based rollable display developer Royole, which once had a valuation of more than CNY50B (USD7.8B), was reported to have a shortage of funds and faced arrears in its employees’ salaries. Royole has been in a state of financial losses from 2017 to 2019, and in Jan-Jun 2020. Within the above period, the net profit attributable to shareholders of the parent company was -CNY359M in 2017, -CNY802M in 2018, -CNY1.073B in 2019 and -CNY961M in 1H21. CEO Bill Liu has said “In fact, everyone has had a difficult time. In the darkest moments of life, do not expect help in the snow, the only thing you can do is to persevere to the end and never give up”. (My Drivers, CN Beta, Pandaily)

LG Display (LGD) will be supplying 17” foldable notebook OLED panels to Hewlett-Packard (HP). LG Display supplied its first foldable notebook OLED panel to Lenovo for ThinkPad X1 Fold in 2020. The panel being developed for HP will be 17-inch in size and 11-inch when folded. It is an in-folding panel with a 4K (3840×2160) resolution. LGD is planning to begin mass production of the panel during 3Q22. The company is expected to manufacture up to 10,000 units of the panel. Meanwhile, the company is also collaborating with Apple to develop another foldable OLED panel. The panel is being designed for tablets and notebooks with ultra-thin glass as the cover window instead of polyimide. (My Drivers, MacRumors, The Elec)

Samsung Electronics only overseas memory production plant, China’s Xi’an NAND Flash plant No. 2 has recently completed expansion and put into operation. This will significantly increase Samsung’s NAND flash production and is expected to expand its market share. According to Digitimes, the second factory is based on 12” (300mm) wafers, with a monthly output of 130,000 NAND flash memory, plus the first factory’s 120,000 chips per month, Samsung’s total output of NAND flash memory in Xi’an will reach 100,000 chips per month. 250,000 pieces per month. After this expansion project, Samsung’s Xi’an NAND flash memory factory has become the world’s single highest-capacity NAND flash memory factory, accounting for more than 40% of Samsung’s total NAND flash production and more than 10% of global NAND flash production. Samsung currently holds about one-third of the world’s NAND flash memory market, leading the industry. With the full operation of the second factory in Xi’an, the industry expects that Samsung’s market share will increase to 35%-40%, and will continue to maintain its No. 1 position.(CN Beta, Sina, TechNews, Digitimes, IT Home)

Samsung and SK Hynix plan to cease production of DDR3 memory, affecting inexpensive devices like routers that still use this type of memory. Micron and makers of specialty DRAM will maintain the production of DDR3 for the foreseeable future. Samsung Electronics has notified customers that the company will take DDR3 chip orders until the end of 2022 and fulfill the orders for deliveries until the end of 2023, according to Digitimes. Popular 1Gb, 2Gb, and 4Gb DDR3 chips are expected to be discontinued. SK Hynix is also reportedly looking forward to phasing out DDR3 SDRAM production, though it is unclear when the company will cease to supply them. Makers of specialty DRAM from Taiwan — Nanya Technology, Winbond Electronics, Etron Technology, and Elite Semiconductor Memory Technology (ESMT) — also do not intend to ship DDR3 SDRAM to their customers, though keep in mind that Etron and ESMT are fabless makers that depend on their contract manufacturers.(Digitimes, Tom’s Hardware)

Apple is reportedly exploring new sources of the memory chips that go into iPhones, including its first Chinese producer of the critical component, after a disruption at a key Japanese partner exposed the risks to its global supply. It is considering expanding a roster of suppliers that already includes Micron and Samsung after Kioxia lost a batch of output to contamination in Feb 2022. While Samsung and SK Hynix are likely to pick up the slack, Apple remains keen to diversify its network and offset the risk of further disruption from the pandemic and shipping snarls. Apple is now testing sample NAND flash memory chips made by Hubei-based Yangtze Memory Technologies Co (YMTC). Apple has been discussing the tie-up with YMTC, owned by Beijing-backed chipmaking champion Tsinghua Unigroup, for months though no final decisions have been made. (GSM Arena, Apple Insider, Bloomberg, Yahoo)

Google is allegedly working on automatic tracker detection for Android. It is a feature that allows user’sphone to detect if there is an unrecognized smart tracker near the phone for prolonged time. This is a feature that prevents ill-intentioned people from planting smart trackers on unsuspecting folk and using them to follow their location. (GSM Arena, 9to5Google)

TF Securities Ming-chi Kuo has indicated that Apple is unlikely to release any iPhone models with under-display Touch ID within the next 2 years. In other words, iPhone released in 2023 and 2024 would not feature under-display Touch ID. He believes that Face ID with a mask on iPhone is already a great biometrics solution. (Mac Rumors, Twitter, Apple Insider)

T-Mobile has said that its shutdown of Sprint’s 3G network is proceeding as planned, beginning on 31 Mar 2022. As part of the shutdown process, it will migrate customers over the next 60 days “to ensure they are supported and not left without connectivity, and the network will be completely turned off by no later than 31 May 2022”.(Android Headlines, The Verge)

Finnish network equipment maker Nokia has said that it had launched a legal challenge to a decision by the Romanian government to exclude it from selling 5G technology in the country. In 2021, Romania’s centrist government approved a United States-backed bill that effectively barred China’s Huawei from taking part in its 5G network development. (CN Beta, Reuters, Comms Update, US News)

Huawei opens in Jundiaí (in the interior of SP), the Huawei Local EMS (Electronic Manufacturing Service) Factory, the first smart manufacturing plant in Brazil that uses 5G in its applications in the production process. The space was equipped with artificial intelligence, cloud and IoT (internet of things) technologies, which made production more efficient and increased productivity. Fourteen 5G antennas were installed to connect an area of 30,000 m², where electronic equipment such as base radios, processor boards, controller boards, among other items are produced. (CN Beta, BNAmericas, Telecompaper)

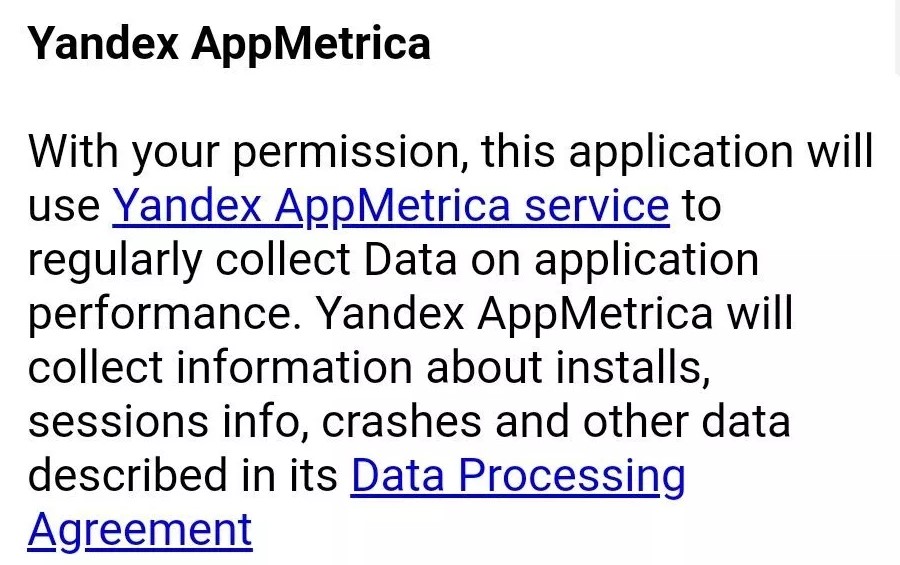

Yandex is reportedly sending data harvested from millions of iOS app users to Russia. The company has embedded code into apps found on mobile devices that allows information about millions of users to be sent to servers located in its home country. Yandex has acknowledged its software collects “device, network and IP address” information that is stored “both in Finland and in Russia”, but it called this data “non-personalised and very limited”. The company said it followed “a very strict” internal process when dealing with governments. (CN Beta, Financial Times, 9to5Mac)

TF Securities analyst Ming-Chi Kuo has said that China’s major Android mobile phone brands have cut orders by about 170M units in 2022, accounting for 20% of the original 2022 shipment plan. If consumer confidence continues to decline, orders may increase again in the next few months. Skyworks and Qorvo RF front-end chips inventory level would have exceeded 6-9 months. (My Drivers, Sohu, IT Home)

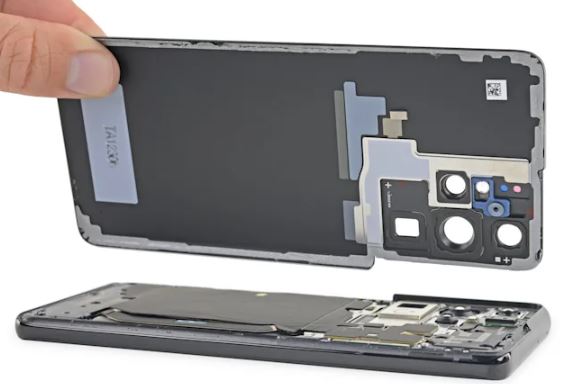

Samsung has announced a new self-repair program that will give Galaxy customers access to parts, tools, and guides to repair their own devices. The program is in collaboration with popular repair guides and parts website iFixit, which has worked with manufacturers such as Motorola and Steam on similar ventures.(The Verge, Engadget, iFixit)

Apple Stores and Apple Authorized Service Providers will now be alerted if an iPhone has been reported as missing in the GSMA Device Registry when a customer brings in the device to be serviced. If an Apple technician sees a message in their internal MobileGenius or GSX systems indicating that the device has been reported as missing, they are instructed to decline the repair. The GSMA Device Registry is a global database designed for customers to report their devices as missing in the event of loss or theft. Devices in the database are identified by their unique IMEI number. (MacRumors, 9to5Mac, Sohu)

OPPO Reno7 4G is announced in Indonesia – 6.43” 1080×2400 FHD+ HiD AMOLED 90Hz, Qualcomm Snapdragon 680 4G, rear tri 64MP-2MP microscope-2MP depth + front 32MP, 8+256GB, Android 11.0, fingerprint on display, 4500mAh 33W, IDR5.2M (USD365). (GSM Arena, OPPO, Gizmo China)

Mojo Vision has revealed that it has created a new prototype of its Mojo Lens augmented reality (AR) contact lenses. This smart contact lens will bring “invisible computing” to life, the company believes. The system is based around what Mojo calls “Invisible Computing”, its heads up display technology that overlays information onto the lens. The system is building around a 0.5 millimeter microLED display with a remarkably dense 14,000 pixels per inch. The text overlays are highlighted through micro-optics, while data is transferred back and forth via a 5GHz band. All of that is powered by an ARM Core M0 processor. An eye-tracking system is on-board, utilizing accelerometer, gyroscope and magnetometer readings to determine the motion of the wearer’s gaze.(CN Beta, CNET, TechCrunch, VentureBeat)

Quintar has raised a second seed round of USD3M to build out its augmented reality platform for live sports and entertainment. Santa Clara, California-based Quintar hopes to change the way that people participate in live sports and entertainment, and it will use the money to build its tech and expand its content creator and app developer collaborations.(VentureBeat, VR Tuoluo, Sohu)

Gemini-owned Nifty Gateway, the premier marketplace for NFTs, has announced its partnership with Samsung to develop the first-ever smart TV NFT platform for exploring, purchasing, and trading digital art and collectibles. Nifty Gateway is now integrated with Samsung’s NFT platform in their 2022 premium TV product lines such as QLED and Neo QLED TV. Nifty Gateway also provides its independent app for The Frame and MICRO LED offerings. Leveraging Samsung’s and Nifty Gateway’s technology, customers can seamlessly browse, display, and interact with NFTs from the comfort of their couch. In addition, customers will have access to more than 6,000 art pieces from emerging and top artists including Beeple, Daniel Arsham, Pak, and more. (PR Newswire, The Verge)

When German automotive startup Sono Motors has introduced a pre-production prototype of its Sion solar-electric family car, the company has also shown a huge solar trailer built with Finland’s Valoe. Now that idea is taking to the streets, but in the shape of a specially developed passenger-carrying trailer bus. Sono reckons that the photovoltaic cells on the hood, roof, sides and back of its upcoming Sion solar-EV could add as much as 245km (152 miles) of range to its batteries per week in ideal conditions. Sono has partnered with Munich’s MVG to find out how much energy could be harvested if solar panels were installed atop a passenger bus. (CN Beta, Sono Motors, New Atlas, Globe Newswire)

Sarcos Technology and Robotics Corporation is acquiring RE2 Robotics, a Pittsburgh-based developer of autonomous and teleoperated mobile robotic systems, for USD100M. The combined company will offer an extended product portfolio. The companies said this will enable it to target a much broader spectrum of customer needs across the commercial (aviation, construction, medical and subsea) and defense sectors.(VentureBeat, Robot Report, TechCrunch, Globe Newswire)

Sony has announced it has set up a new company to develop and commercialize a mobility service platform, Sony Mobility. The new company is also expected to oversee the development of businesses such as the “aibo” autonomous entertainment robot, Airpeak professional drone, and the Sociable Cart: SC-1. Adding to this, Sony says in a press release that the new company will continue to support S.RIDE Inc., which was established in partnership with taxi companies to provide safe and secure transportation utilising AI and sensing technology. (CN Beta, Telecom Paper, Evertiq, Sony)

Apple is reportedly developing payment processing technology and infrastructure such as lending risk assessment, fraud analysis, credit checks, and dispute handling, plus it is working on tools for calculating interest, rewards, approving transactions, reporting data to credit bureaus, increasing credit limits, and more. Part of this project is called “Breakout” internally, as it would see Apple moving away from the current financial systems that it uses. At the current time, Apple works with Goldman Sachs Bank and CoreCard for the Apple Card, Green Dot for Apple Cash, and Citizens Bank for the iPhone Upgrade Program, but Apple’s work on financial services would be aimed at future products rather than its current products. (Mac Rumors, Bloomberg, 9to5Mac)