4-3 #KLGroningen : SK Hynix may consider acquiring Arm; TSMC has increased the shipments of its 5nm process technology family; Samsung is likely to step up its outsourcing of OLED display driver ICs in 2022 and 2023; etc.

Dutch semiconductor company ASM International has launched its Singapore manufacturing facility and operations hub today, along with the announcement of the addition of a second manufacturing floor to the facility. The facility and first manufacturing floor was completed in 2020, and the new manufacturing floor is expected to be completed in early 2023. Once that is complete, ASM says its capacity in Singapore will quadruple, and global capacity will more than triple. (Laoyaoba, EET China, The Edge, Evertiq)

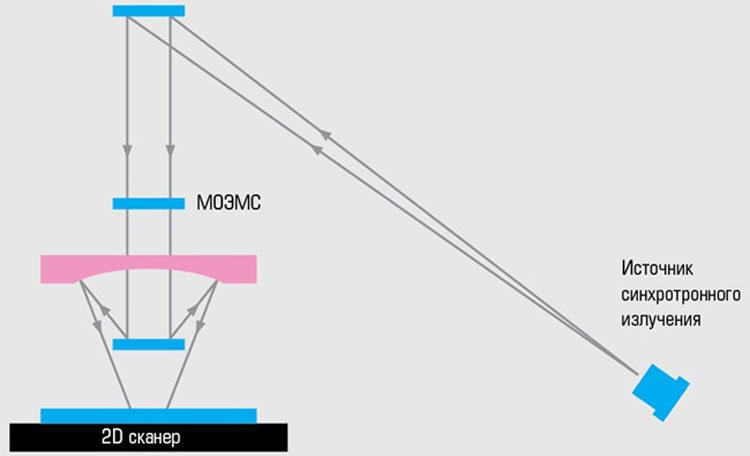

The Moscow Institute of Electronic Technology (MIET) in Russia has now received RUB670M (about USD7.81M) from the Ministry of Trade and Industry to develop a lithography machine for chip manufacturing.And it claims to reach EUV level, but the technical principle is completely different. What they have developed is a maskless X-ray lithography machine based on synchrotron and/or plasma source. The X-ray lithography machine uses X-rays with a wavelength between 0.01nm and 10nm, which is shorter than EUV extreme ultraviolet light, so the lithography resolution is much higher. (CN Beta, Airvers)

SK Hynix’s co-chief executive officer Park Jung-ho has revealed that the company is considering coinvesting in the acquisition of United Kingdom-based semiconductor design firm Arm by taking part in a consortium. Other than SK hynix, Intel has also expressed an interest in taking part in a consortium to buy Arm. Intel Chief Executive Pat Gelsinger said the talks over the consortium have been underway even before SoftBank Group offered a sale of Arm shares to US chip design giant Nvidia.(Laoyaoba, Reuters, Korea Herald)

South Korea’s antitrust regulator has decided to approve the deal by the country’s major chipmaker SK hynix to buy a local foundry firm, Key Foundry. In Oct 2021, SK hynix said it inked a deal to acquire a 100 percent stake in the 8-inch wafer foundry manufacturer for KRW575.8B (USD474.85M) in a move to boost its presence in the non-memory sector. SK hynix runs a foundry business through its affiliate SK hynix system IC, which has a similar production capacity to that of Key Foundry. If combined, their market share in the overlapped business field would come to around 5% of the domestic market and about 1% in the global market.(Laoyaoba, Korea Herald, YNA)

Canon is developing a lithography machine for semiconductor 3D technology. New Canon lithography machines are expected to be launched in 1H23 at the earliest. The exposure area has been expanded to approximately 4 times that of existing products, enabling the production of large semiconductors for AI use. The way 3D technology can improve performance by stacking multiple semiconductor chips so that they are closely connected.(Laoyaoba, Sohu, Nikkei, Darik.News)

3M’s semiconductor coolant plant in Belgium has been closed indefinitely under tightened local environmental regulations. The plant accounts for 80% of the global total semiconductor coolant output. The measure was taken on 8 Mar 2022 and 3M has sent an official notice to its clients. The clients include Samsung Electronics, SK Hynix, TSMC and Intel. The coolant is essential for semiconductor etching. The clients can withstand for 1-3 months with their inventories.(CN Beta, Business Korea)

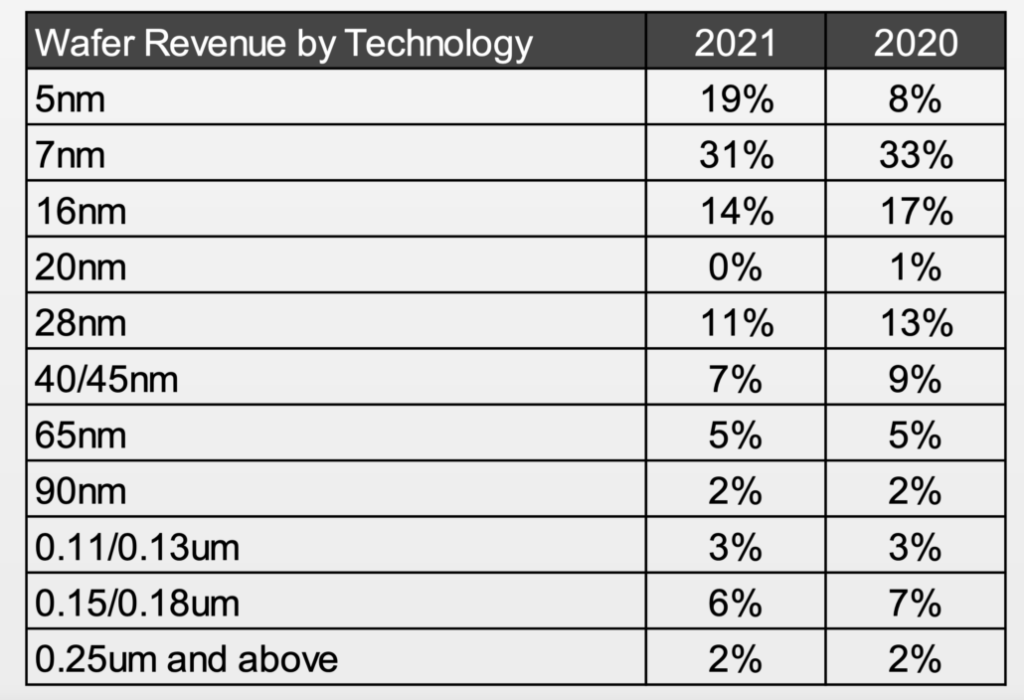

Taiwan Semiconductor Manufacturing Company (TSMC) has increased the shipments of its 5nm process technology family. This is the most advanced technology in TSMC’s portfolio, with the fab looking to move forward to 3nm manufacturing later in 2022. TSMC has increased its output of the 5nm process from an earlier 120,000 wafers per month to 150,000 wafers per month, to mark a 25% production increase. TSMC’s 3nm manufacturing process is still on target to enter production later in 2022. The variant to enter production is being referred to as N3B and initial output to range between 40,000 to 50,000 wafers per month. N3B will be followed soon by an advanced variant dubbed N3E, which is expected to enter production in 2023. (Laoyaoba, WCCFTech, Digitimes)

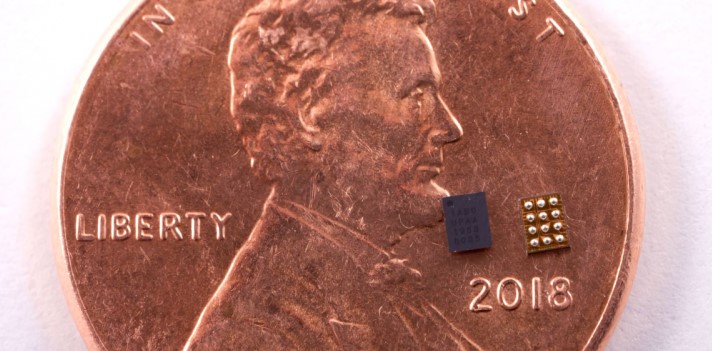

Ultra–low power AI accelerator startup Syntiant has closed a funding round of USD55M, bringing the company’s total raise to around USD100M. Syntiant has also announced that it has shipped more than 20M of its neural decision processor chips to date, making it one of the few edge AI chip startups shipping in substantial volumes today. Syntiant and Renesas have been collaborating on a “voice–controlled multimodal AI solution” since summer 2021, which combines Renesas’ RZ/V series microprocessors with Syntiant’s NDP120. This design uses Syntiant’s always–on neural decision processor to enable voice activation for a variety of vision–based AI applications, which are performed on the Renesas chip; all while keeping the standby power very low. (Laoyaoba, Globe Newswire, EE Times, VentureBeat)

Intel has announced an agreement to acquire Granulate Cloud Solutions, an Israel-based developer of real-time continuous optimization software. The acquisition of Granulate will help cloud and data center customers maximize compute workload performance and reduce infrastructure and cloud costs.(Laoyaoba, TechCrunch, Yahoo)

Samsung Electronics is pushing for “standardization of parts” for smartphones. This is a plan to overcome the instability in the global parts supply chain, due to the COVID-19 outbreak, and increase manufacturing flexibility. As parts are standardized, it is expected that there will be a drastic change in supply chain management (SCM) such as volume control by partners. Samsung Electronics ordered its smartphone partners to develop general purpose components with high compatibility. So far, Samsung has separated parts for premium smartphones and parts for mid- to low-end phones. (Laoyaoba, ET News)

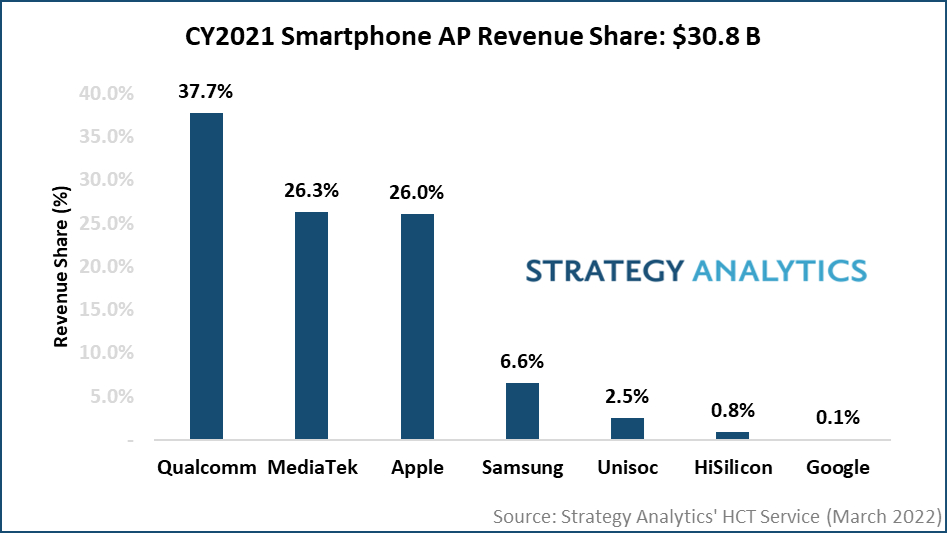

According to Strategy Analytics, the global smartphone applications processor (AP) market grew 23% to USD30.8B in 2021. Qualcomm, MediaTek, Apple, Samsung LSI and Unisoc grabbed the top-5 revenue share ranking spots in the smartphone AP market in 2021. Qualcomm maintained its smartphone AP leadership with a 38% revenue share, followed by MediaTek and Apple with each 26%. (Laoyaoba, Strategy Analytics)

The South Korean government is considering designating OLED as a national strategic technology. If designated, companies in the industry can be given sizeable tax benefits with regard to facility investment and R&D costs. The designation was proposed by the Korea Display Industry Association and the Ministry of Trade, Industry and Energy recently discussed the matter. The current number of such technologies is 34, including advanced semiconductor, vaccine and EV battery. (Laoyaoba, Business Korea)

TF Securities analyst Ming-Chi Kuo is revising his prediction about when Apple could launch a foldable iPhone. After saying in 2021 it could be as soon as 2024, the analyst expects this rumored product to be released in 2025 “at the earliest”. He has indicated that Apple does not appear to be in a hurry to enter the foldable smartphone market, and it may even take longer than that. He says that “Apple foldable product development is medium, large, and small” and the company is ‘testing foldable OLED about 9”’. According to him, the test is to “verify key technologies and may not be the final product spec”. (Twitter, Laoyaoba, MacRumors, Tom’s Guide, 9to5Mac)

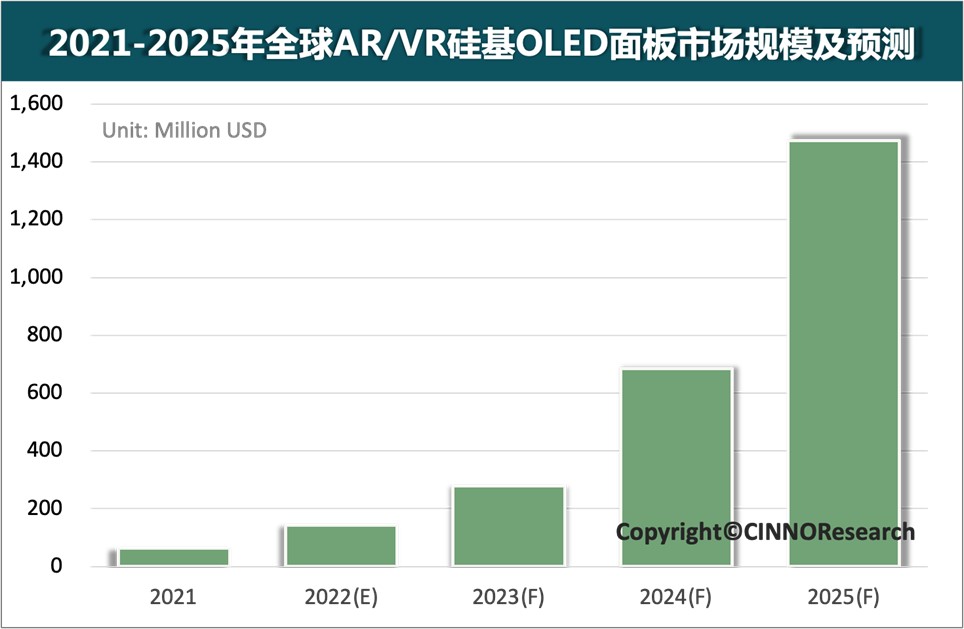

Statistics from CINNO Research show that the global AR/VR silicon-based OLED display panel market size in 2021 will be about USD64M. In the future, with the development of the AR/VR industry and the further penetration of silicon-based OLED technology, the global AR/VR silicon-based OLED display panel market is expected to grow at a CAGR of 119% by 2025. Silicon-based OLED refers to Micro OLED, OLEDoS or OLED on Silicon, which is a new type of micro-display technology, which belongs to a branch of AMOLED technology and is mainly suitable for micro-display products. The silicon-based OLED structure includes two parts: the driving backplane and the OLED device. It is an active organic light-emitting diode display device made of single crystal silicon as the active driving backplane by combining CMOS technology and OLED technology. (CINNO Research, Laoyaoba)

CSOT has announced the launch of a WQHD Low Temperature Polycrystalline Oxide (LTPO) display with strong power saving, high battery life and support for smooth and natural switching of 1~120Hz without flicker, achieving a new breakthrough in LTPO technology. The WQHD LTPO screen released by CSOT can achieve an ultra-low refresh rate of 1Hz, and at the same time supports refresh rate adaptation, which can realize switching in the ultra-wide frequency range of 1~144Hz, with more switchable frequency points. This display is also equipped with frequency conversion direct-cut technology and WQ LTPO+MLP (Micro Prism Condensing Technology) low-power combination technology. Huaxing’s FHD&WQ LTPO technology is ready to be put in place, and the production line of the future t4 project will have 15K LTPO mass production capacity.(CN Beta, ZOL, 163)

TCL CSOT has announced that its first shipment to Samsung in its Indian company based in Tirupati of Andhra Pradesh. India’s CSOT is India’s first full-process Bonding-Assembly LCD panel module factory. It can provide key components – LCD modules for local mobile phone and TV manufacturers in India. This shipment is for Samsung’s mobile phone products. The CSOT plant in India is to be constructed in two phases. The first phase is planned to invest CNY1.53B and configure 11 production lines, including 5 large-size panels and 6 small-size mobile phone panels. The planned annual output is 8M pieces of 26-55” large-size TVs. Panels and 30M 3.5~8” small size mobile phone panels. So far, India’s CSOT is ramping up its production capacity. The current monthly production capacity has reached 1.2M. It is expected that by May 2022, the monthly production capacity of small-sized display modules will reach more than 2M; the large-sized display module is expected to be put into production in May 2022, and quickly pull up the entire production capacity. (Laoyaoba, Laoyaoba, 163, EET China)

Samsung Electronics is likely to step up its outsourcing of OLED display driver ICs in 2022 and 2023, with Novatek Microelectronics and other Taiwan-based DDI suppliers being pinpointed as the largest beneficiary, according to Digitimes. Novatek has previously signed a contract with Samsung to supply OLED DDI, but considering the possibility of OLED DDI supply shortage, the latter is seeking to have more than one Taiwanese OLED DDI supplier to meet its growing demand through 2023 . Taiwan-based DDI has been signing long-term deals with foundry partners over the past year to compete for more 28nm fab capacity. (Laoyaoba, Digitimes, Digitimes)

Samsung and Western Digital have signed a memorandum of understanding (MOU) that will see the two work together to further develop new SSD technology. As part of the new MOU, both companies will collaborate to standardize and drive broad adoption of next-generation data placement, processing and fabrics (D2PF) storage technologies. However, Samsung and Western Digital will initially focus on creating an ecosystem for Zoned Storage solutions. Zoned Storage is a class of storage devices which enable both host and storage devices to cooperate in order to achieve higher storage capacities, increased throughput and lower latencies.(Laoyaoba, Samsung, Tom’s Hardware, TechRadar, Western Digital)

TF Securities analyst Ming-Chi Kuo believes that the notch and its replacement on Apple iPhone could be retired by an under-display version in a future model. He believes that under display Face ID is coming in 2026 on “iPhone 16”. A hole-punch cutout and pill-shaped hole is expected to arrive in the iPhone 14 Pro and Pro Max models due in fall 2022. Samsung Display is allegedly working on under-panel technology that could be used to hide the Face ID module in future iPhones. (Apple Insider, Twitter, CN Beta)

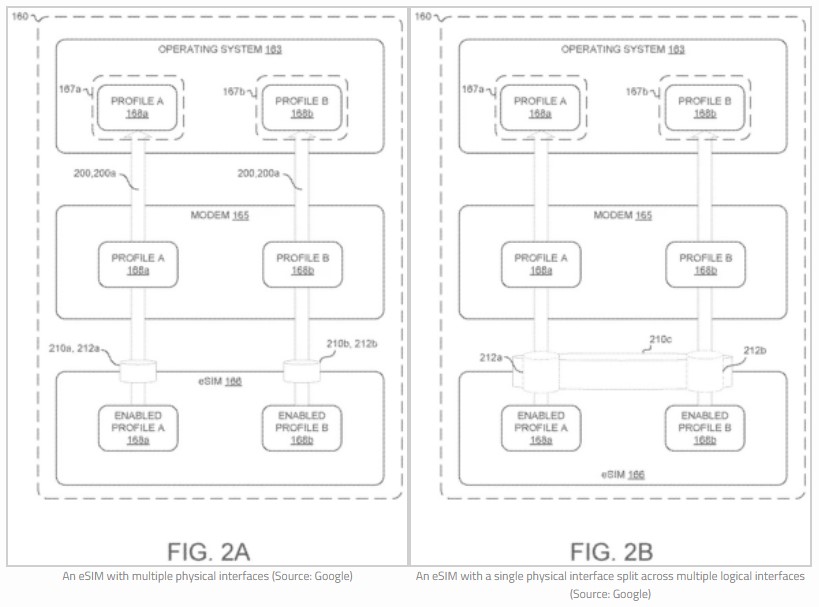

Google Android 13 may support multiple profiles on a single eSIM. Google’s solution to allow multiple enabled profiles (MEP) was referenced in the Android Open Source Project and Android Developers website, which suggests it is coming in the next big Android 13 update. The codebase for Android 13 contains an implementation of a patent filed by Google in 2020, which allows multiple SIM profiles to be used on a single embedded chip.(My Drivers, XDA-Developers, CNET, USPTO, Esper)

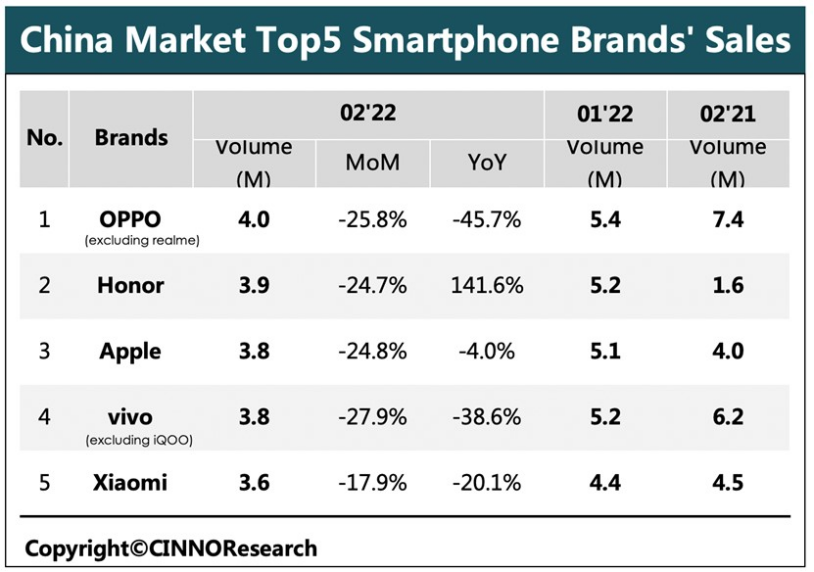

China’s shipments of smartphones fell 20.5% YoY and 24.0% MoM to 23.48M handsets in Feb 2022, according to CINNO Research. OPPO and Huawei spinoff brand Honor ranked first and second. Specifically, OPPO, Honor, Apple, vivo, and Xiaomi ranked in the top five in terms of shipment. (CINNO Research, Laoyaoba)

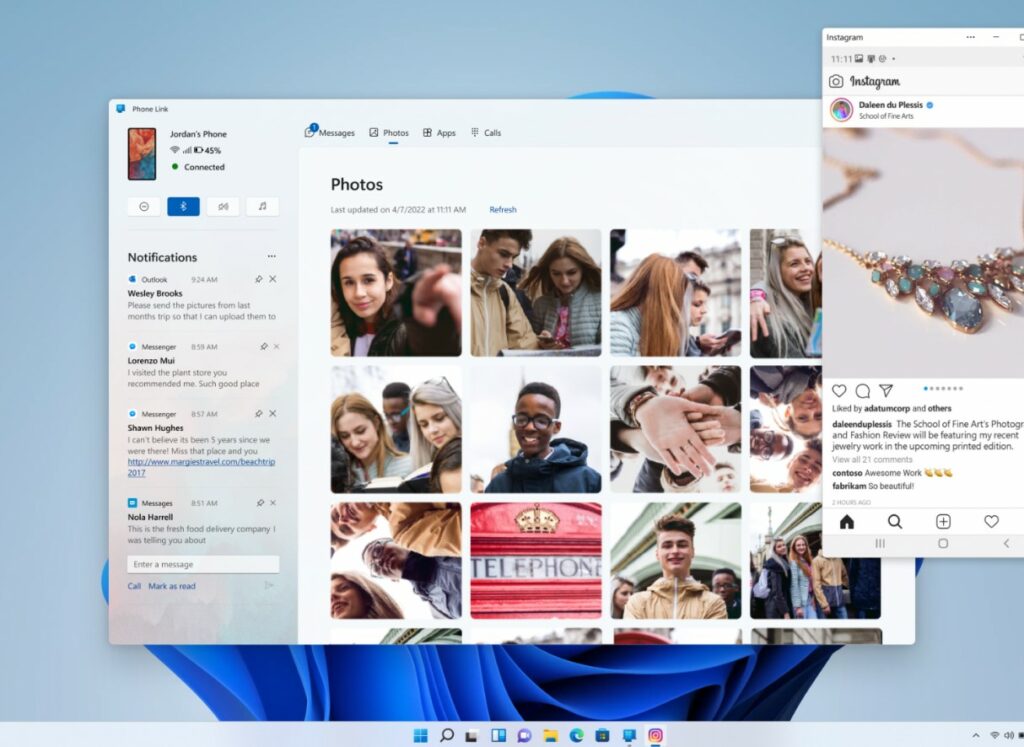

Microsoft rebrands its Your Phone app to Phone Link and updating it with a Windows 11 design. Your Phone is launched in 2019 offering to link an Android phone to Windows. Microsoft has also announced the service will be available in China, following a partnership with Honor, which will bring support for some devices of the now-independent smartphone brand.(GSM Arena, Windows, The Verge)

Microsoft is moving its Surface Duo OS, SwiftKey, Phone Link, Microsoft Launcher, and a handful of other Android teams under a new dedicated Android org called “Android Microsoft Platform and Experiences” (AMPX). With AMPX, Microsoft could provide even better functionality between Android and Windows. This division will be overseen by Corporate Vice President (CVP) Panos Panay. (My Drivers, Windows, Android Police, Android Central, GSM Arena, Windows Central)

Xiaomi continues to work with disaster prevention and mitigation institutions in developing early warning systems that could help millions of Indonesians respond adequately to earthquake threats. Xiaomi has therefore announced the launch of its Earthquake Early Warning (EEW) feature for its Indonesia-based customers. The EEW feature is a trial version for now. The EEW feature, when switched on, will provide useful notifications on seismic activity that could result in earthquakes in Indonesia. The seismic intensity and the location of the earthquake immediately it occurs will help Xiaomi smartphone users in Indonesia make an informed decision to move away and avoid such areas.(Laoyaoba, IT Home, XiaomiUI, Gizmo China)

Samsung Galaxy M33 5G (India) is launched – 6.6” 1080×2408 FHD+ v-notch 120Hz, Samsung Exynos 1280, rear quad 50MP-5MP ultrawide-2MP depth-2MP macro + front 8MP, 6+128 / 8+128GB, Android 12.0, side fingerprint, 6000mAh 25W, INR18,999 (USD250) / INR19,999 (USD263).(GSM Arena, Gadgets360)

Vietnam’s automaker VinFast has said has signed a preliminary deal to initially invest USD2B to build a factory in North Carolina to make electric buses, sport utility vehicles (SUVs) along with batteries for EVs. The unit of Vietnam’s biggest conglomerate Vingroup, has said it plans to have a total investment of USD4B in its first U.S. factory complex. Construction should begin this year as soon as the company gets necessary permits, and is expected to finish by July 2024. The plant’s initial capacity will be 150,000 units per year. (Laoyaoba, Car and Driver, Reuters, TechCrunch)

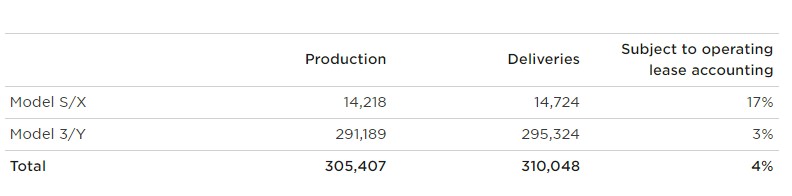

Tesla delivered 310,048 vehicles in 1Q22, despite what Tesla CEO Elon Musk says was an “exceptionally difficult quarter,” citing global supply chain issues and a brief closure at Tesla’s Shanghai factory. Tesla said the Model 3 and Y made up 295,324 of these deliveries, while 14,724 were for the Model S and X. Deliveries increased slightly from the previous quarter’s 308,600 deliveries and outpaced the 184,800 shipments Tesla made in the first quarter, representing a 68% YoY increase. On the production side of things, Tesla managed to build a total of 305,407 vehicles.(The Verge, Tesla, Laoyaoba, Engadget, CNBC, CN Beta)

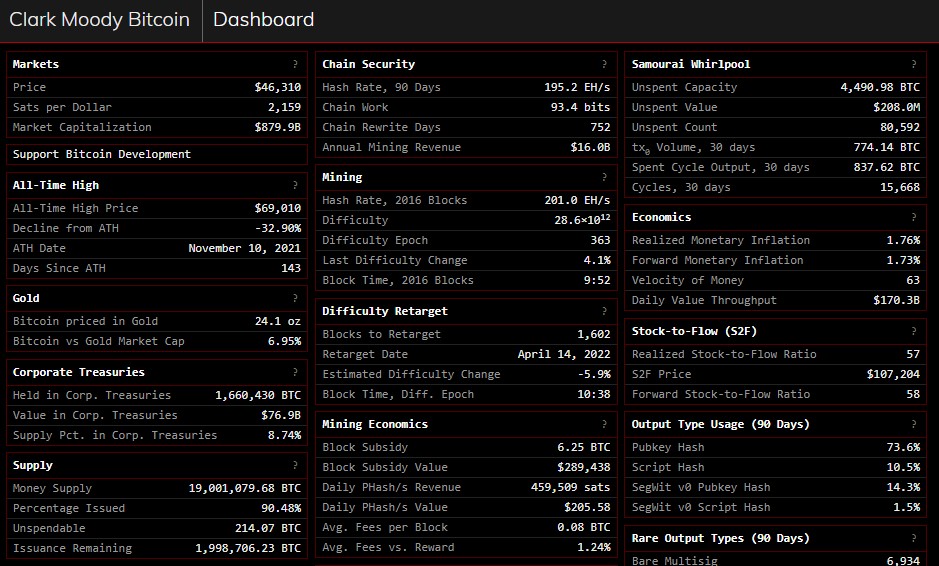

The Bitcoin (BTC) network reached a milestone on 1 Apr 2022, after records show that 19M bitcoin have been mined. The watershed moment occurred at block height 730,034 and now there is only 2M left to be mined. At block height the total amount of bitcoin in existence was 19,000,004.68 BTC. Whenever a block is found by a miner, the coin issuance increases by 6.25 bitcoins per block (USD289,656) found. A block is discovered roughly every ten minutes and the next block reward halving is expected to occur on or around 3 May 2024. After the next halving occurs, miners will get 3.125 bitcoins per block and the next halving will take place in 2028. (GizChina, Bitcoin.com, Clark Moody Bitcoin)

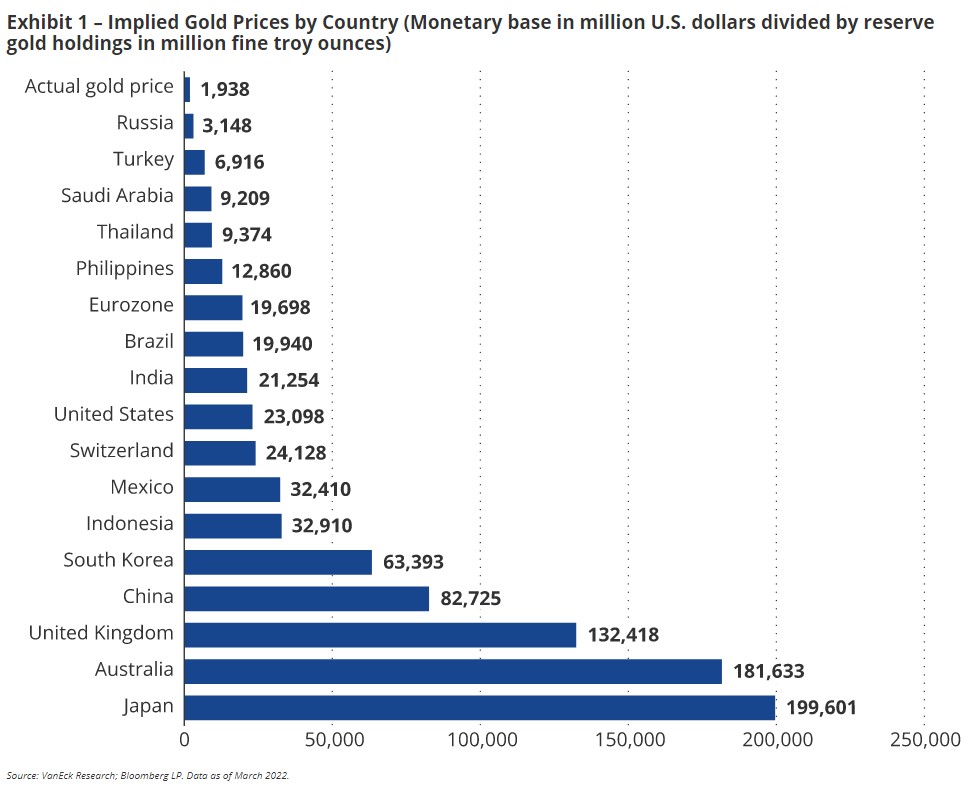

Bitcoin could reach a price of USD1.3M while gold may top USD31,000 per ounce, if the assets become the sole reserve asset across the globe, respectively. According to Van Eck Associates, as the U.S. and some other western countries sanctioned Russia by freezing its central bank’s reserves, which include the euro, US dollars, gold and China’s yuan among others, it should “reduce demand for hard currencies as reserve assets, while increasing demand for currencies that can perform the original functions of these former reserve currencies”. (CN Beta, Market Watch, Van Eck)