4-20 #Anxiety : Samsung’s 3nm GAA yield rates reportedly are still far behind target; Samsung is increasingly adopting Exynos chips for mid- to low-priced smartphones; Volvo Cars has invested in the Israeli battery developer StoreDot; etc.

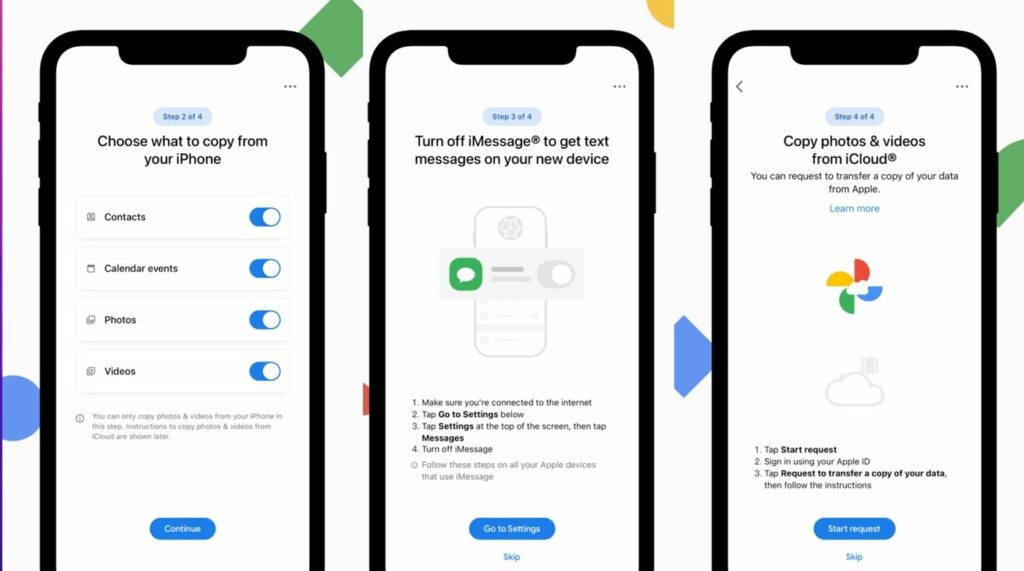

Google has released a new app for iOS called “Switch to Android”, a counterpart to Apple’s “Move to iOS” app for moving important user data from an iPhone to an Android smartphone. The Switch to Android app from Google helps you quickly and securely move your most important data types — photos, videos, contacts, and calendar events — to a brand new Android device without fussy cables.(Apple Insider, Android, The Verge, 9to5Google)

Isaiah Research believes that the continuous Covid-19 epidemic in Shanghai and Kunshan will have some impact on the production of iPhone and MacBook, and under the influence of the current situation, it is difficult for Apple to transfer production plans in large quantities to Foxconn in Shenzhen, Zhengzhou or Shanxi (production of iPhones) and the factory in Chongqing (which makes MacBooks). Eddie Han, senior analyst at Isaiah Research, has said that Apple may consider shifting orders from Pegatron to Foxconn, but due to logistical issues and difficulties in adjusting equipment, it is expected that the number may be limited, in the worst case, if the blockade lasts for 2 If Apple is unable to reschedule orders, Pegatron may cut production by 6-10M iPhones. Correspondingly, since the main production bases of OPPO, vivo and Xiaomi are not in Shanghai and Kunshan, the impact of the epidemic on these companies is expected to be limited. (Laoyaoba, Isaiah Research)

Worldwide smartphone shipments fell 11% amid unfavorable economic conditions and sluggish seasonal demand in 1Q22. Samsung led the market with a 24% share, up from 19% in 4Q21 as the vendor revamped its 2022 portfolio. Apple came second, with a solid 1Q22 thanks to the growing demand for its iPhone 13 series. Xiaomi stayed in third place due to the stellar performance of its Redmi Note series. OPPO (including OnePlus) and vivo completed the top five with 10% and 8% shares. (CN Beta, Canalys)

realme Q5i is announced in China – 6.58” 1080×2400 FHD+ u-notch 90Hz, MediaTek Dimensity 810, rear dual 13MP-2MP depth + front 8MP, 4+128 / 6+128GB, Android 12.0, side fingerprint, 5000mAh 33W, CNY1,199 (USD188) / CNY1,299 (USD204). (Gizmo China, GSM Arena)

OPPO A55s 5G is launched in China – 6.5” 720×1600 HD+ v-notch, MediaTek Dimensity 700 5G, rear tri 13MP-2MP macro-2MP depth + front 8MP, 6+128 / 8+128GB, Android 11.0, side fingerprint, 5000mAh CNY1,099 (USD172) / CNY1,199 (USD188).(GSM Arena, OPPO, Gizmo China)

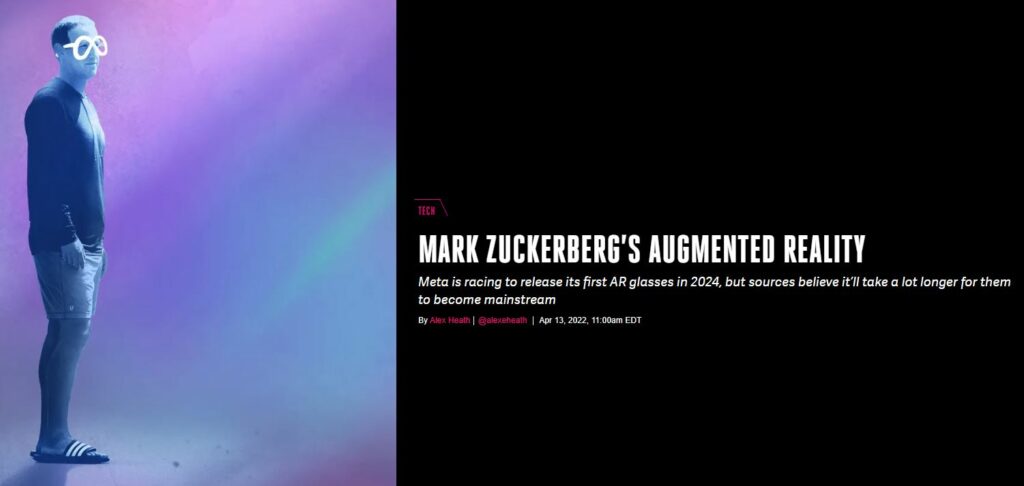

Facebook (now known Meta) CEO Mark Zuckerberg calls AR goggles a “holy grail” device that will “redefine our relationship with technology,” akin to the introduction of smartphones. Meta reportedly includes at least 4 different versions to be launched over the next 6 years. Meta’s first-generation AR glasses, dubbed Nazare, will be designed to work independently from a smartphone with the use of a wireless, phone-shaped device that offloads part of the computing required for the glasses to function. Meta intends to deliver the first-generation model of its AR glasses, aimed at early adopters and developers, by 2024. In the same year, the company also plans to release a pair of cheaper smart glasses, codenamed Hypernova, that will pair with a smartphone to show incoming messages and other notifications in a heads-up display. Looking further ahead, Meta’s AR roadmap includes a lighter, more advanced version of the Nazare glasses set to arrive in 2026, followed by a third version in 2028.(MacRumors, The Verge)

Apple is still working on a new HomePod product that combines a speaker, Apple TV functions, and a FaceTime camera, according to Bloomberg’s Mark Gurman. He “absolutely” thinks that a new HomePod is coming that will likely be “at the center of Apple’s approach” to the home. (MacRumors, Bloomberg, GSM Arena)

China’s new energy vehicle (NEV) penetration rate reached 13.4% at the end of 2021, and the number will likely surpass 15% in 2022, according to Digitimes. Despite challenges brought by the COVID-19 pandemic, rising raw material prices, and semiconductor component shortages, NEV sales in China went up in 2021, with more than 500,000 NEVs sold in Dec 2021. There are currently two main types of NEVs in China: battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Statistics from China Academy of Information and Communications (CAICT) show that the total NEV sales in China in 2021 had increased by nearly 160% on year to 3.52M units, including 2.92M units of BEVs. While the average monthly BEV sales were between 100,000-200,000 units in 1H21, the numbers rose to 448,000 units at the end of the year. Although demand for PHEVs is significantly lower than that for BEVs, average monthly PHEV sales in the country also surged from 20,000-40,000 units in 1H21 to around 80,000 units by the end of Dec 2021. (Digitimes, CN Beta)

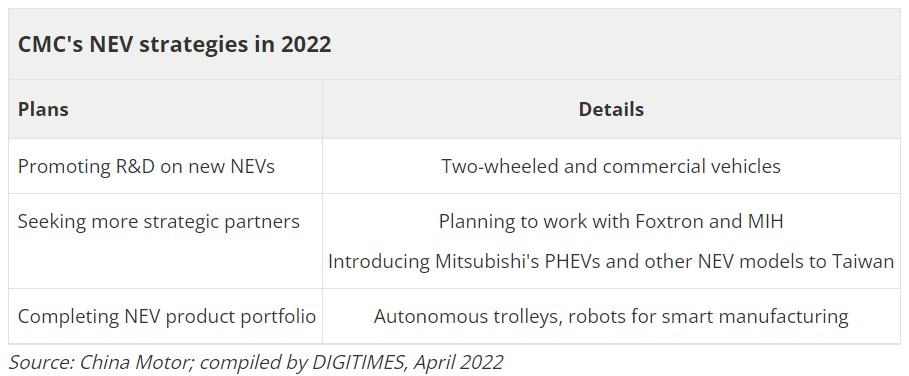

Taiwan-based car dealer China Motor (CMC) is ramping up efforts to develop new energy vehicles (NEVs) in 2022, while evaluating whether to partner with other electric vehicle (EV) developers, such as Foxtron and the MIH platform. The company VP Chien Ching-wu has indicated that CMC will continue to develop NEVs, corresponding to global trends of improving environment, social and governance (ESG) strategy and corporate average fuel economy (CAFE) standards, and achieving carbon neutrality in coming decades.(Digitimes, China Times, UDN)

Richard Yu, the CEO of Huawei BG and CEO of Smart Car solutions, is optimistic about Huawei’s chances in the automobile industry, given its past successes, albeit in a different sector. He has further added that Huawei’s aim is to be the first smartphone brand to be fully invested in the automobile market. The company has a notable goal since nobody remembers the one that comes second. Regarding the goal of Aito M5 selling 300,000 units a year, he has admitted that it is relatively difficult currently, and they did not expect that the automotive industry will lack such serious chipsets now. Previously, a chip was only CNY20-30, and now it has risen to CNY1,000-2,000 a piece, they use 8 or 9 pieces in a car, the cost is too high. Moreover, in Mar 2022, more than 3,000 Auto M5s have been delivered, and if it is expected that it may reach 5,000 units in Apr 2022, they will ensure that the sales of Aito M5 will gradually increase, and the sales will reach 10,000 and 20,000 in the later period.(Android Headlines, Gizmo China, IT Home, Sina, Jiemian)

Robinhood has agreed to buy Ziglu, a London-based fintech app that allows users to trade bitcoin and several other cryptocurrencies. The announcement comes nearly two years after Robinhood halted plans to launch in Britain. Ziglu is one of the few crypto companies that has secured approval from the country’s Financial Conduct Authority. Founded in 2018, Ziglu allows users to make payments, invest in a range of cryptocurrencies and earn interest on holdings of bitcoin and British pounds sterling. (CN Beta, Robinhood, CNBC, CoinDesk)

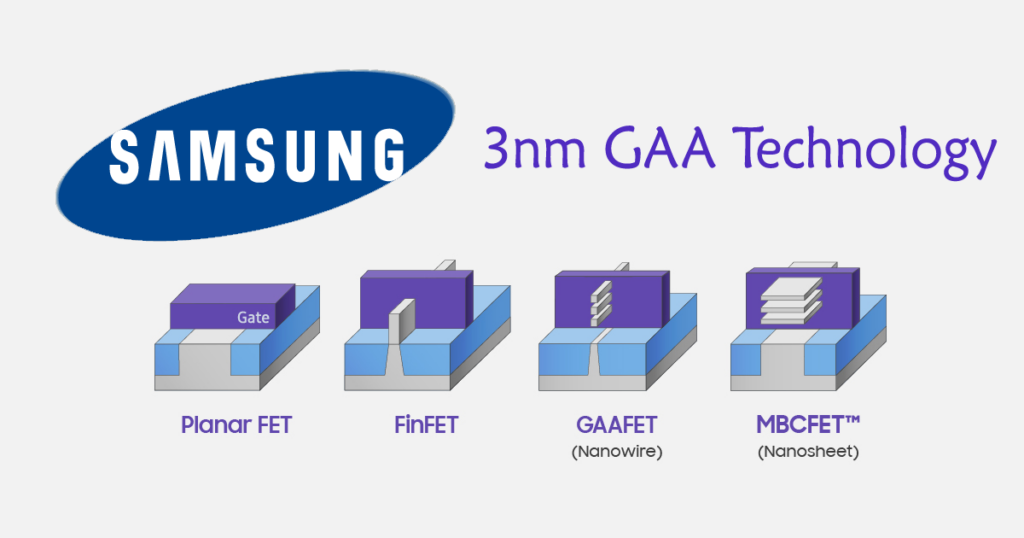

Samsung Electronics’ 3nm GAA process yield rates reportedly are still far behind the chip vendor’s target. The yield rates have fallen in 10-20%. Samsung has had better results with its 4nm process, which was used to complete Qualcomm’s Snapdragon 8 Gen 1 orders, with a yield rate of around 35%. Samsung’s second-generation 3nm process will be ready for customers in 2023, but if the yield rate does not pick up, Qualcomm will have no choice but to stick with TSMC for its next-generation Snapdragon 8 Gen 2 even if it means paying a premium to have an exclusive supplier. (CN Beta, Digitimes, WCCFTech)

Based on a report by Susquehanna, the lead time for what can be called ancillary semiconductors that are paired up with processor, SoCs and GPUs, now have a lead time of over 6 months. This is based on data from the distribution channel and as such, it is unlikely to affect large companies that have long-term contracts with their suppliers. However, smaller companies, or semiconductor manufacturers that solely rely on the distribution channel for sales of the parts, are not in a good place right now. This does not affect everything equally and many parts are also in stock with the big distributors, but sometimes at inflated prices compared to a couple of years ago. Susquehanna is pointing towards several reasons for the increase in lead times, although the big ones include the Russia’s war on Ukraine, an earthquake in Japan (on 16 Mar 2022) as well as the more recent lockdowns in several cities in the PRC which are key to the production of everything from semiconductors to finished consumer goods. At the latter 2H20, the lead time was less than 14 weeks, but has since then increased to almost 27 weeks and it looks like it’s likely to continue to increase for the time being. (Techpowerup, The Register, CN Beta)

Samsung Electronics has used the Exynos 850 application processor (AP) for the Galaxy A13 LTE smartphones for the North American market. The Galaxy A13 comes in 2 versions — long-term evolution (LTE) and fifth-generation (5G). MediaTek Dimensity 700 powers the 5G version. The Galaxy A53 and Galaxy A33 released by Samsung Electronics in Mar 2022 are powered by the Exynos 1280. It is a game-specific AP produced on a 5nm process. Samsung Electronics is increasing the proportion of the Galaxy A and Galaxy M series in its smartphone business.The company is shifting its focus from developed countries to emerging markets. It is increasingly adopting Exynos chips for mid- to low-priced smartphones.(Laoyaoba, Business Korea, SamMobile)

According to Ross Young, CEO of Display Supply Chain Consultants, the new VR headset will launch in 2023 and will use AMOLED display. He expects these AMOLED panels to have a pixel density well above 800 PPI, which is a record high for mass-produced AMOLED. He indicates that the VR display shipments to rise >50% to >15M in 2022 despite delays to 2023 at Apple and Sony. (Pocket-Lint, DSCC, Twitter)

Visionox has said that the company is optimistic about the trend of foldable smartphone. Foldable display can make device take into account both “small size” and “large display”, and are suitable for application scenarios such as office and entertainment integration. Currently, global leading phone manufacturers have very strong demand for flexible foldable display.(Laoyaoba, Sohu)

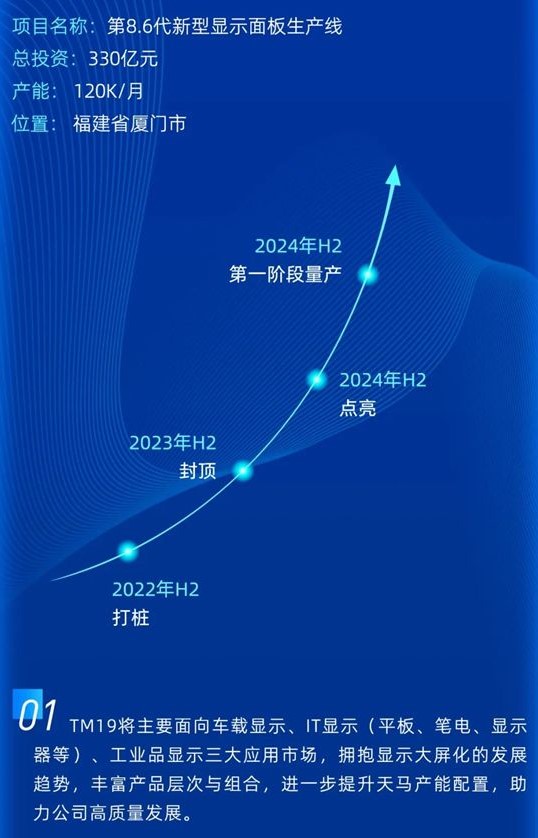

According to Tianma Microelectronics, Gen-8.6 new display panel production line project “TM19” has entered the implementation stage, with a total investment of CNY33B. According to the plan, Tianma’s Gen-8.6 new display panel production line is located in Xiamen City, Fujian Province, piling in 2H22, capping in 2H23, lighting in 2H24, and the first stage of mass production. The main production is 2250×2600 mm glass substrates, and the monthly production capacity can reach 1.2M pieces. The main technology of the project is a-Si (amorphous silicon) and IGZO (indium gallium zinc oxide) technology double-track parallel. (My Drivers, 163)

O-Film has broken through the technical barriers of high-end lenses. The 100Mp 7P optical lens has been mass-produced. Multi-performance products such as telephoto lens, macro lens and ultra-wide-angle lens have all entered the lens supply chain of domestic mainstream mobile phone manufacturers. O-Film has said that the company’s 8P lens project has been successfully developed and is currently in the trial production stage. The advantages of having more lenses are: first, the ability to gather light is strong, which can enhance the resolution and contrast of the lens; second, it can improve the glare in the dark state.(CN Beta, Sohu, iFeng)

Samsung is planning to install fab equipment on its new advanced fab P3 at its Pyeongtaek plant early in May 2022. The company is aiming to complete the construction of the fab within 2H22. In preparation, Samsung will be placing and installing equipment at the fab up to Jul 2022. This schedule is a month behind what the tech giant initially planned for. Samsung is expected to spend between at least KRW30T and almost KRW50T on P3 over the coming years. P3 is a mixed fab that will manufacture both memory and logic chips. It will manufacture 10nm DRAM made with extreme ultraviolet (EUV) process and Gen 7 176-layer V-NAND. It will also manufacture 3nm with EUV foundry for logic customers. The NAND flash line will be built first, followed by DRAM then foundry. Samsung is expected to build P4 after P3 at Pyeongtaek. It is also planning to build another foundry fab with KRW20T in the US.(The Elec)

Yangtze Memory Technology Co (YMTC) has announced the launch of UFS 3.1 universal flash memory – UC023. This is a flagship high-speed flash memory chip created by YMTC, which can be widely used in high-end flagship smartphones, tablet PCs, AR/VR and other smart terminal fields. According to reports, the UC023 adopts the newly upgraded TLC 3D flash memory particles of the chip stack 2.0 (Xtacking .0) technology, and the design and process have been further improved and optimized.(CN Beta, Sohu)

A consortium led by LG Energy Solution (LGES), the global No. 2 electric vehicle battery maker, will invest USD9B in a battery value chain in Indonesia to handle the entire process of production in the world’s largest nickel-producing country. The consortium, consisting of LG Energy, LG Chem, LX International, POSCO and China’s Zhejiang Huayou Cobalt have inked a nonbinding framework agreement to set up the value chain with a local mining company PT Aneka Tambang Tbk (Antam) and Indonesia Battery Corp. (IBC). (CN Beta, Korea Times, KED Global, Pulse News)

Samsung SDI will decide within Apr 2022 where its electric vehicle battery joint venture with automaker Stellantis will be based at. The Generation 5 batteries are made through stacking material such as the cathode, the separator, and the Anode instead of winding them as Samsung SDI has done with all previous four generations and innovating for the next. Meanwhile, LG Energy Solution is also expected to finalize the details of its joint venture with the automaker that it announced back in March that will be based in Ontario in Canada. The South Korean company said it plans to spend KRW4.8T and is aiming for a production capacity of 45GWh by 2026. LG Energy Solution and automaker are also planning to build a module line at their plant. Stellantis has earlier said it plans to spend EUR30B up to 2025 to shift its production focus on electric vehicles.(CN Beta, The Elec, Sammy Fans)

Samsung SDI has developed a prototype of a next-generation battery management system (BMS) that can accurately figure out the state of batteries and will be able to mass produce it after 2023. A BMS is literally a device that manages batteries. It maintains optimal conditions for batteries, increasing energy efficiency and extending battery lives. Specifically, it monitors voltage, current, and temperature in real time to prevent excessive charging or discharging. Samsung SDI has developed an algorithm that analyzes a battery’s status using artificial intelligence (AI). Samsung SDI says that the next-generation BMS boost battery lives by 15%, car mileage by 6%, and energy output by 10%. It also implements wireless operation and cybersecurity functions.(Laoyaoba, Business Korea)

Samsung SDI’s experience in electric vehicle (EV) battery manufacturing could soon come into play for the mobile market. The company is reportedly planning to adopt the stacking technology used for EV batteries to manufacture smartphone batteries with increased capacities. Smartphone batteries use a so-called “flat jelly roll” design. However, switching to a stacked design similar to the one used by electric vehicle batteries could lead to a 10% or higher increase in battery capacity. To put things into perspective, a smartphone that has a traditional flat jelly roll battery with a 5,000mAh capacity could benefit from a stacked 5,500mAh battery within the same volume and footprint. Samsung is reportedly planning to manufacture stacked-type smartphone batteries at its Cheonan plant in Seoul. The company is expected to invest at least KRW100B (USD85M) to equip its manufacturing lines for the task. Another pilot line is reportedly being prepared at Samsung SDI’s Tianjin plant in China. (CN Beta, SamMobile, The Elec)

Volvo Cars has invested in the Israeli battery developer StoreDot. The two companies have not disclosed the amount of the strategic investment. Previous investors in StoreDot include Daimler, Samsung, BP, VinFast and Ola Electric. Volvo says that the investment is being made through its own Tech Fund. This investment gives Volvo Cars the opportunity to develop new battery technologies in collaboration with StoreDot. StoreDot, in turn, wants to accelerate the market launch of its development through the collaboration with Volvo Cars. Volvo Cars says that series production will start in 2024 but this yearly figure was already revealed in May 2021, when StoreDot entered into a cooperation with the Chinese battery manufacturer EVE Energy.(CN Beta, Volvo Cars, Electrive)