5-21 #Loosen : TSMC is reportedly in talks to build a major new fabrication facility in Singapore; BOE is yet to receive approval from Apple to manufacture OLED panels for the upcoming iPhone 14 series; China’s leading smartphone makers have allegedly told suppliers to scale back orders for the coming quarters by around 20% from previous plans; etc.

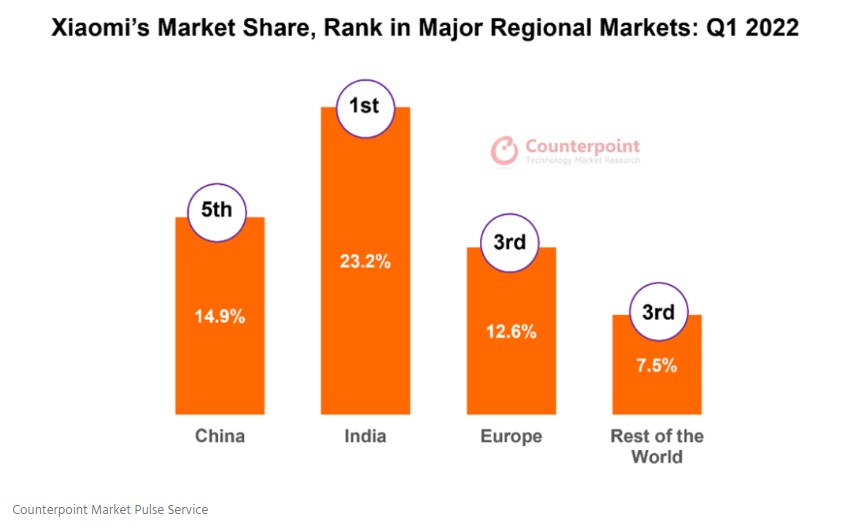

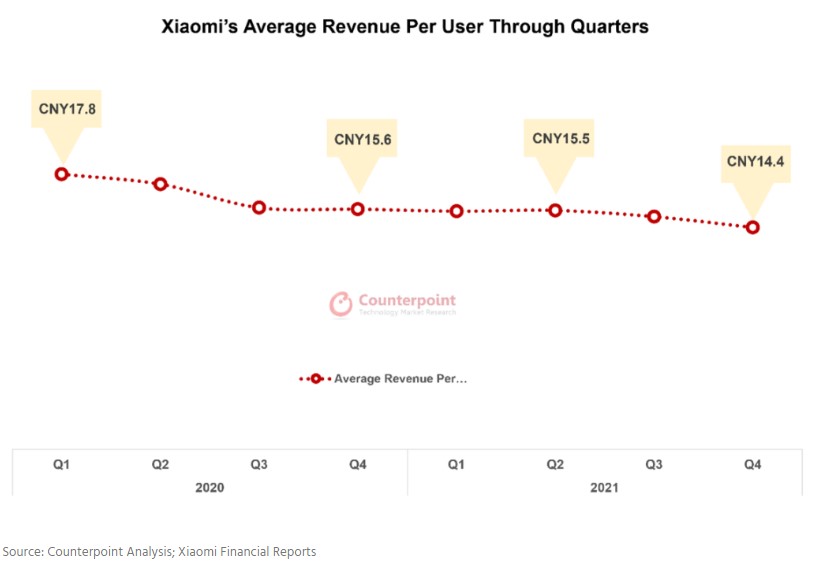

According to Counterpoint Research, Xiaomi passed a significant milestone in 1Q22. Xiaomi has crossed the 500M smartphone installed base mark early in the quarter to join Samsung and Apple in the elite club. Theoretically, Xiaomi’s large user base can (1) help the company branding develop further if products match or exceed expectations, (2) give Xiaomi more opportunities to monetize the traffic on its smartphones and (3) allow the company to effectively cross-sell other IoT products such as TWS and smartwatch. (Counterpoint Research, Gizmo China, EET China, My Drivers)

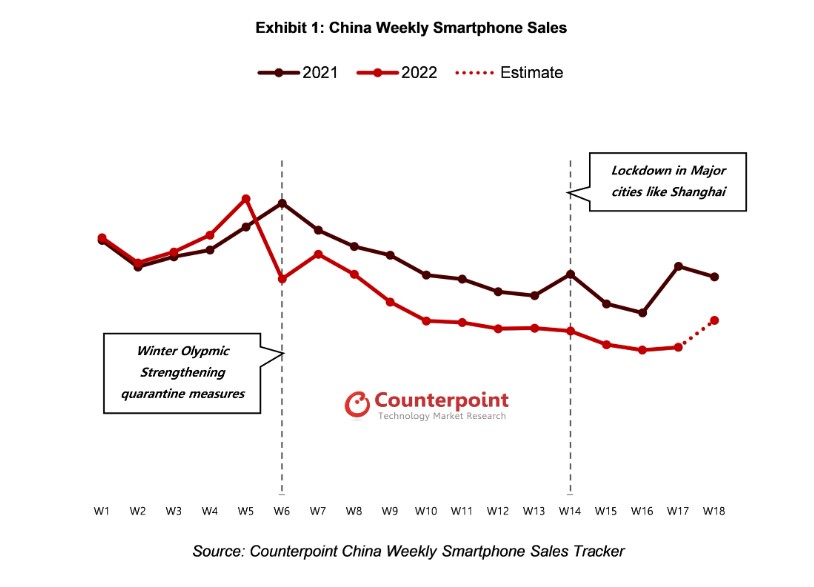

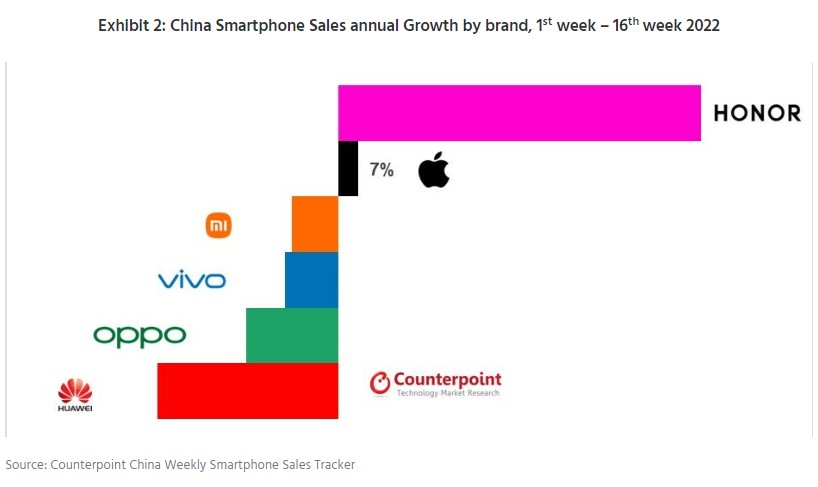

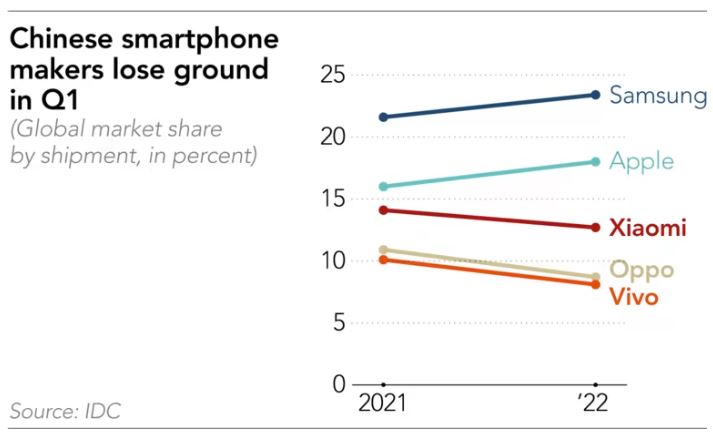

China’s smartphone sales declined for 10 consecutive weeks since the 6th week of 2022 when compared to the same period in 2021, according to Counterpoint Research. Weakened consumer sentiment caused by the Chinese government’s “dynamic zero-Covid” policy was one of the main drivers for this decline. It is now evident that consumer sentiment becomes weak every time strong COVID-19 quarantine measures are taken. Major Chinese smartphone brands, except Honor, failed to avoid the impact and their sales declined YoY. Huawei and OPPO showed more sales drop than market average for 15 weeks. Meanwhile, Xiaomi momentarily exceeded the previous year’s sales due to the launch of the Redmi K40s and Redmi K50 series, but this rebound did not last long. Apple’s sales volume increased YoY until the 10th week, but even iPhone sales started to decrease as iPhone 13 series sales declined. (Counterpoint Research)

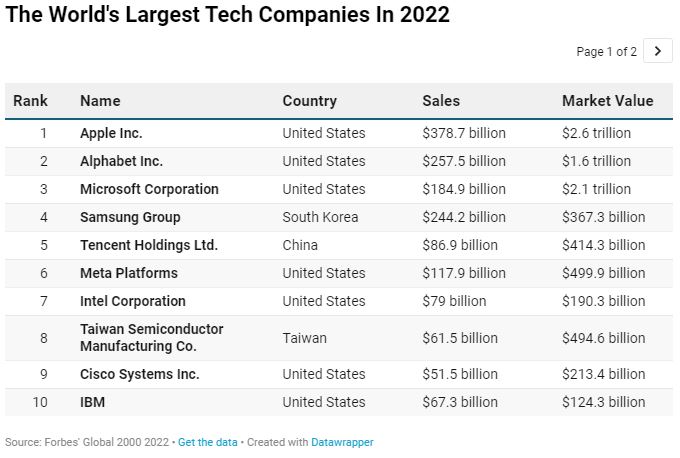

After claiming a record 177 spots on the list in 2021, the number of technology companies landing on the Global 2000, Forbes’ annual ranking of the world’s largest companies, slipped to 164 in 2022, but the overall decline did not prevent total sales from skyrocketing. The firms posted a record USD4T in combined annual revenue over the last 12 months, up from about USD3.3T in 2021—even with fewer firms. Apple heads up the technology ranks for the seventh-straight year thanks in part to record sales of USD378.7B, up nearly 29% from one year earlier. Supply-chain woes have been particularly bad for Samsung Electronics, which slipped 3 spots in the global rankings to become the world’s fourth-largest tech company, down from second in 2021—and Covid lockdowns in China (where the firm operates a semiconductor factory) have only added to the pain. Though it posted record sales of USD244B, the South Korea-based firm has endured a steady stock plunge over the past year, pushing its market value down nearly 30% to USD367.3B. (Android Headlines, Forbes, Forbes)

China’s leading smartphone makers have allegedly told suppliers to scale back orders for the coming quarters by around 20% from previous plans following monthlong COVID lockdowns that have severely disrupted supply chains and battered consumer confidence. Xiaomi has told suppliers that it will lower its full-year forecast to around 160M-180M units from its previous target of 200M. OPPO and vivo have also reduced orders for 1Q22 and the next by about 20% in an attempt to digest excessive inventories currently filling retail channels. vivo has even alerted some suppliers that it will not update specifications for some key components going into some midrange smartphone models in 2022, citing efforts to reduce costs amid inflation concerns and dwindling demand. Samsung, on the other hand, hopes to ship more than 270M units in 2022, which would be a slight growth from 2021. (Asia Nikkei, press)

According to Wedbush’s analyst Dan Ives, Apple’s iPhone demand is “better than expected” for 2Q22, and its supply chain is proving “surprisingly resilient”. Ives notes that Apple’s iPhone demand is “trending better” than guidance in the quarter so far. He also put to rest some concerns about the supply chain. As Ives notes, Apple’s supply chain is under pressure in mainland China because of strict zero-COVID measures implemented by the government. Some factories have had to suspend operations, with others operating at limited capacity or keeping employees in “closed-loop” environments to prevent the spread of the disease. (Seeking Alpha, CN Beta, iMore, Business Insider, Twitter)

Moto G71s is launched in China – 6.6” 1080×2400 FHD+ HiD OLED 120Hz, Qualcomm Snapdragon 695 5G, rear tri 50MP 1.28um OIS-8MP ultrawide-2MP macro + front 16MP, 8+128GB, Android 12.0, side fingerprint, stereo speakers, 5000mAh 33W, CNY1,699 (USD250).(GSM Arena, IT Home, Playful Droid)

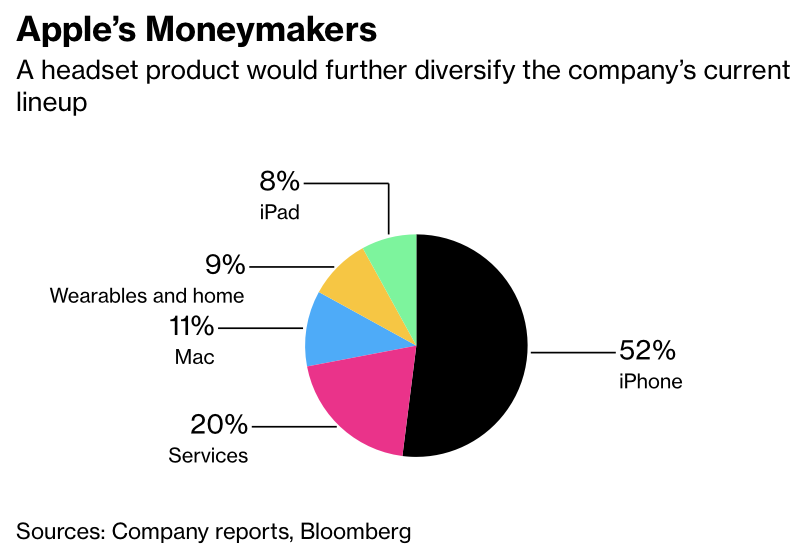

Apple has recently shown its upcoming mixed-reality headset to members of its board of directors, suggesting that the device is nearing completion and could be ready for a launch soon. In addition to work on the actual device, Apple has also reportedly ramped up development of the headset’s operating system, which could be dubbed “RealityOS”.The headset reportedly features a pair of 4K OLED displays, 15 different camera modules, and powerful silicon more akin to Apple’s M1 than its A series of chips. The headset could see an announcement as early as the end of 2022. However, it likely will not be ready for a full consumer launch until 2023.(Digital Trends, Bloomberg, Apple Insider, PED30)

Samsung has now announced the launch of a brand new Partner Early Access Program intended to help test compatibility between partner products and incoming Matter smart home standards. The newly-announced program is intended to accelerate progress in testing interoperability between devices, services, and manufacturers that support Matter. Samsung is happy to welcome Aeotec, Aqara, Eve Systems, Leedarson, Nanoleaf, Netatmo, Sengled, Wemo, WiZ and Yale into this exclusive program.(The Verge, Android Headlines, Samsung)

Uber Eats is launching two autonomous delivery pilots in Los Angeles with Serve Robotics, a robotic sidewalk delivery startup, and Motional, an autonomous vehicle technology company. The new programs are a part of a range of new products Uber is launching across its ride-hail and delivery platforms. The Motional partnership was originally announced in Dec 2021 and marks the first time Uber is partnering with an AV fleet provider, as well as the first time Motional is trying its hand at autonomous delivery. Until this point, Motional has focused on robotaxis, securing partnerships with companies like Lyft and Via. Serve Robotics is actually an Uber spinout. Aurora acquired Uber ATG, Uber’s self-driving arm, in 2020, and under the terms of the deal, Uber invested USD400M in the company. (CN Beta, TechCrunch, Fossbytes)

Nissan is considering adding a new auto plant in the U.S. to keep up with growing demand for electric vehicles, according to the company’s Chief Operating Officer Ashwani Gupta. The company would likely need a new factory by the end of the decade under its Ambition 2030 long-term plan. Nissan Motor now has two auto plants in the U.S. One in Canton, Mississippi makes the Titan pickup truck and Altima sedan, among other models. The other in Smyrna, Tennessee makes the Leaf electric car, Pathfinder sport utility vehicle and other models. In Nov 2021, Nissan said it will invest JPY2T (USD16.4B) in the next 5 years to amp up an electrified vehicle push with 23 new entries worldwide by the end of the decade while the company derives 40% of U.S. sales from pure electrics. Nissan said earlier 2022 it will invest USD500M to turn the Canton plant into a “center for EV manufacturing and technology.” Under that overhaul, Canton will produce two new EVs, one for the Nissan brand, the other for Infiniti. (CN Beta, Auto News, Asahi, AP News, Japan Today)

Cruise, the self-driving startup controlled by General Motors, is working with the automaker’s BrightDrop electric van business on a plan to develop autonomous delivery vehicles. Cruise and BrightDrop have reportedly started early-stage work that could eventually put a self-driving system into the electric vans, potentially creating a driverless package-delivery service. The nascent project could be a logical next step for GM, whose Cruise unit has mostly been focused on getting its robotaxi business running and generating revenue. (CN Beta, Bloomberg, Sina)

Samsung has reportedly decided not to manufacture its own brand of electric vehicles (EVs). The core reasons behind this decision are that it does not believe its entry into the finished EV segment will see sustainable profits, and it holds the intention to continue avoiding any possible conflicts with its top clients, amid the focus on its contract-based semiconductor foundry business. Samsung is betting more on its sustainability to boost its foundry business. Because the foundry service manufactures chips for third-party clients, keeping mutual trust is a core factor. (Android Headlines, Korea Times)

Samsung Electronics’ Device Solutions (DS) Division has allegedly started the development of an Application Processor (AP), especially for the Samsung Galaxy series smartphones. However, the new AP from Samsung isn’t expected to be available until 2025. Apart from a dedicated chip for its own smartphones, Samsung is also focusing on expanding the market share of Exynos chips and has decided to adopt its own chips on more and more smartphones coming from the brand. (GSM Arena, iNews24, Twitter, Gizmo China, Neowin)

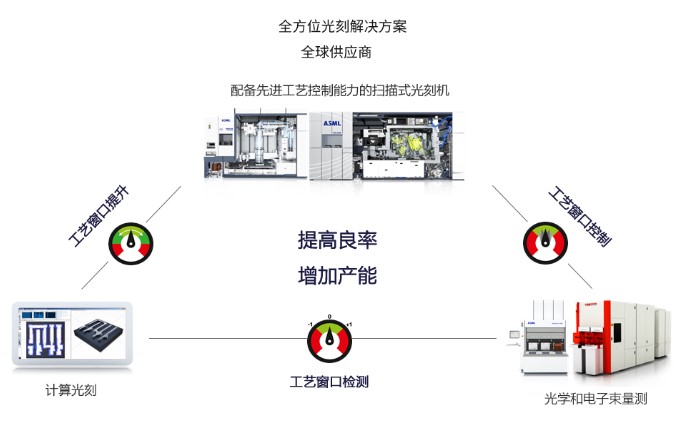

ASML China emphasizes that Moore’s Law is still in effect and in good condition over the past 15 years, and will continue to maintain momentum in the next 10 years or more. ASML has pointed out that in terms of components, current technological innovations are sufficient to advance the chip process to at least 1 nanometer node, including gate-all-around FETs (gate-all-around FETs), nanosheet FETs, forksheet FETs and complementary FETs. In addition, improvements in lithography system resolution (expected to shrink by a factor of 2 every 6 years or so) and edge placement error (EPE) as a measure of accuracy will further drive chip size reductions.(CN Beta, ASML)

ASML is developing a new type of lithography machine, worth as much as USD400M, and it is size of double-decker bus and weighs more than 200 tons. The prototype is expected to be completed in 1H23, put into use for the first time in 2025, and will be mainly shipped from 2026 to 2030. This machine should refer to High-NA EXE:5200 (0.55NA), and Intel is the first company in the world to place an order. The so-called High-NA is high numerical aperture, and nodes after 2nm have to rely on it to achieve. In fact, ASML’s EUV lithography machine is very large. The 0.33NA EUV lithography machine currently sold has more than 100,000 parts. It requires 40 shipping containers or 4 jet freighters to complete the transportation at one time. The unit price is about USD140M. (CN Beta, EE News Europe, Semi Insights)

Qualcomm has announced Wireless AR Smart Viewer Reference Design, powered by the Snapdragon XR2 Platform for extended reality (XR). The AR reference design hardware, developed by Goertek, has a 40% thinner profile and a more ergonomically balanced weight distribution for increased comfort. SeeYA provides the dual micro-OLED binocular display enabling 1920×1080 per eye and frame rates up to 90Hz and a no-motion-blur feature to deliver a seamless AR experience. Dual monochrome cameras and one RGB camera on the smart viewer enable six-degrees of freedom (6DoF) head tracking and hand tracking with gesture recognition to achieve AR precision. The device obtains <3ms latency between the smartphone and AR glass. With the FastConnect 6900 solution, the reference design offers uncompromising Wi-Fi 6 / 6E and Bluetooth connectivity.(Engadget, Qualcomm)

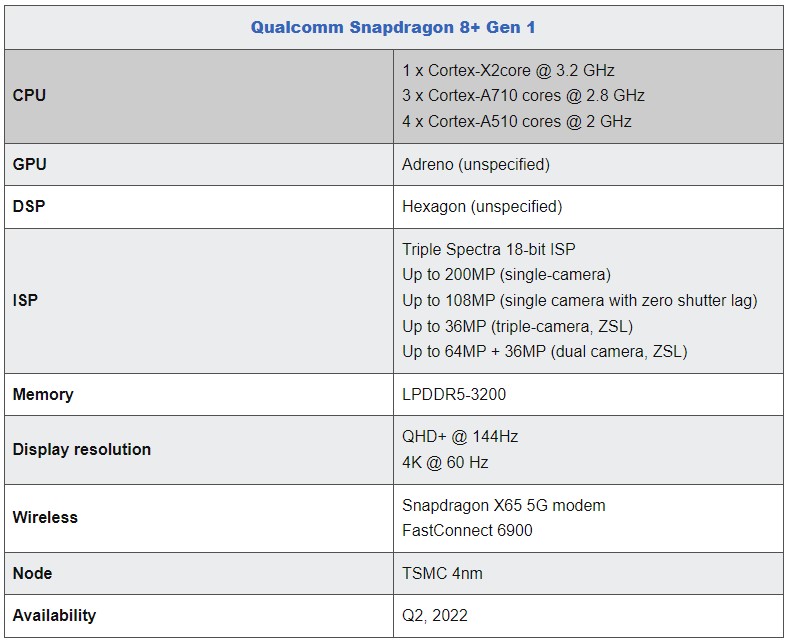

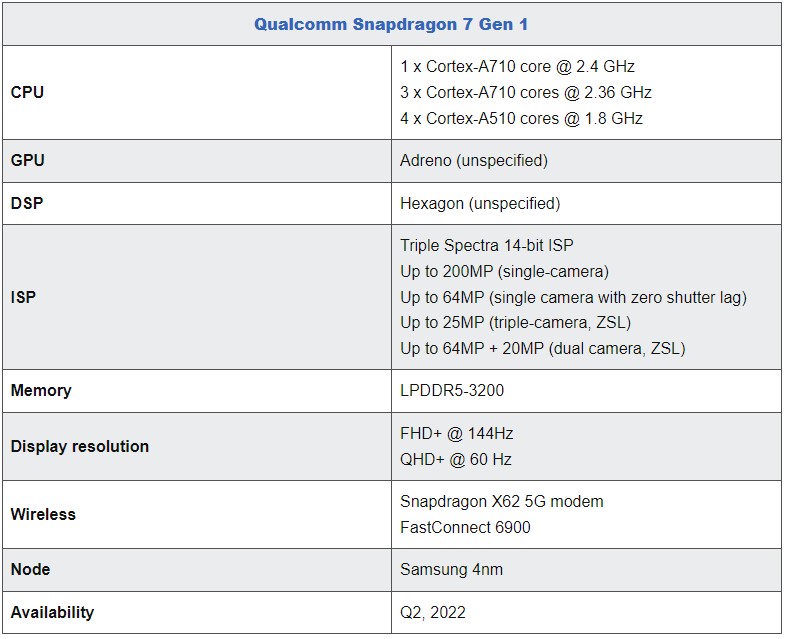

Qualcomm introduces Snapdragon 8+ Gen 1 and Snapdragon 7 Gen 1 chips for premium and mid-range devices. With Snapdragon 8+ Gen 1, the company promising up to 10% faster performance than the original Snapdragon 8 Gen 1 and up to 30% lower power consumption. The other is the Snapdragon 7 Gen 1 processor, which will begin showing up in upper mid-range devices from companies including Honor, OPPO, and Xiaomi within 2 months. The company says the new chip brings up to a 20% boost in graphics performance compared with a Snapdragon 778G 5G chip, and up to a 30% improvement in AI performance.(GSM Arena, Liliputing, Qualcomm, Qualcomm)

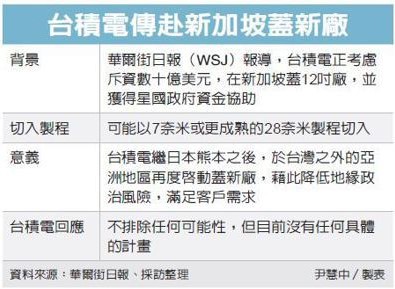

Taiwan Semiconductor Manufacturing Company (TSMC) is reportedly in talks to build a major new fabrication facility in Asia, as part of measures to address the global chip shortage. As its new USD12B plant in Arizona is delayed, TSMC is said to be having preliminary talks with Singapore’s Economic Development Board about building a new facility there. TSMC is looking to build the facility to manufacture 7nm-28nm processors. These are used in some smartphones, but are more widely seen in cars and other devices. No specific location or budget estimate is known for the potential Singapore plant, but TSMS has reportedly budged USD40B-44B for its overall capital expenditure in this financial year.(MacRumors, WSJ, Business Times, Apple Insider, Yahoo, UDN, Sina)

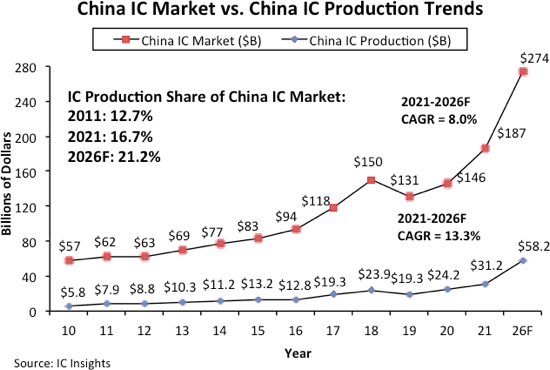

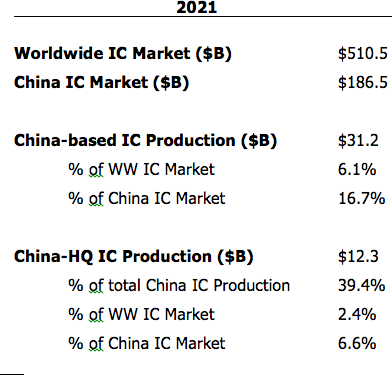

According to IC Insights, IC production in China represented 16.7% of its USD186.5B IC market in 2021, up from 12.7% 10 years earlier in 2011. Moreover, IC Insights forecasts that this share will increase by 4.5 percentage points from 2021 to 21.2% in 2026 (a 0.9 percentage point per-year gain on average). Of the USD31.2B worth of ICs manufactured in China in 2021, China-headquartered companies produced USD12.3B (39.4%), accounting for only 6.6% of the country’s USD186.5B IC market. TSMC, SK Hynix, Samsung, Intel, UMC, and other foreign companies that have IC wafer fabs located in China produced the rest. IC Insights estimates that of the USD12.3B in ICs manufactured by China-based companies, about USD2.7B was from IDMs and USD9.6B was from pure-play foundries like SMIC. (CN Beta, IC Insights)

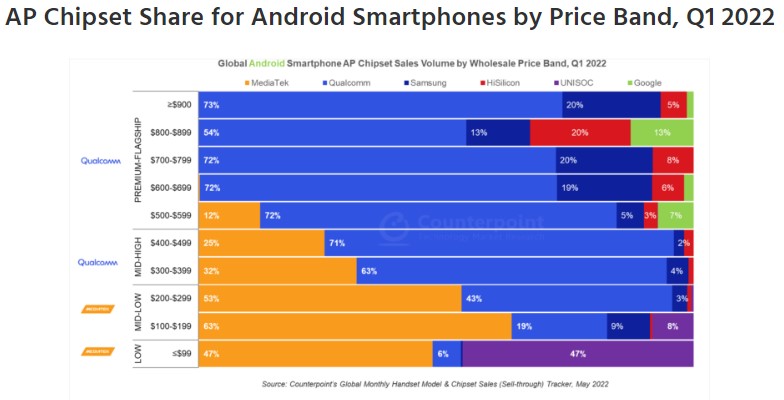

According to Counterpoint Research, MediaTek led the Android smartphone SoC market in 2021 with a 44% share, followed by Qualcomm with 35%. Qualcomm’s focus on the premium smartphone segment (>USD500) has helped it to grow revenues. Its Snapdragon 800 series and Snapdragon 700 series, notably the flagship Snapdragon 8 Gen 1 and Snapdragon 778G, are both key volume drivers. Furthermore, Qualcomm has gained a 75% share of Samsung’s Galaxy S22 series shipments. MediaTek dominates the low-mid tier wholesale price segment (USD100-299), driven by its Dimensity 700 and Dimensity 900 series. Also, the 4G SoC in the <USD199 price band is driven by the P35, G80 and G35 chipset models. MediaTek has entered the premium segment with the Dimensity 9000 series, but the sales will only start to pick up in 2Q22. (Counterpoint Research, Android Headlines)

Samsung has reportedly begun the mass production of key components for the new foldables. The company plans to start the production of the devices Jun, or latest by Jul 2022. Samsung is aiming to sell well over 10M units of the Galaxy Z Fold 4 and Galaxy Z Flip 4 combined in 2022. Samsung is expecting a similar proportion (70/30) in the shipment of the 2022 Flip and Fold-series foldables. Samsung is expected to announce the Galaxy Z Fold 4 and Flip 4 in Aug / Sept 2022. (Android Headlines, The Elec, CN Beta)

LG Display (LGD) has showcased an 8” OLED display with a resolution of 2480×2200 pixels. The display can be folded inwards and outwards so it serves as an inner screen and an outer screen, as needed. LG uses ‘a special folding structure’ that minimizes the crease. LG claims its foldable OLED display is durable enough to survive being folded 200,000 times. (Android Headlines, Tom’s Guide)

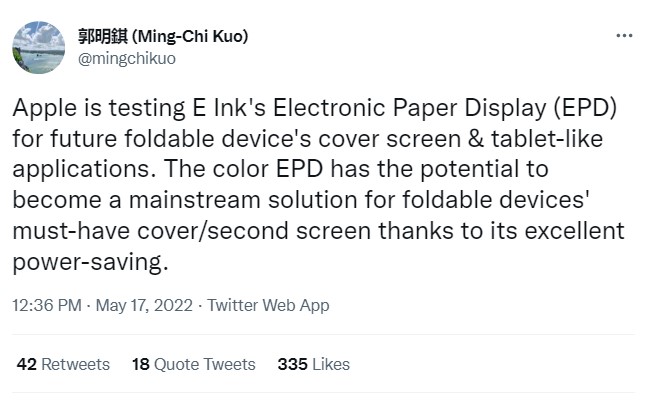

TF Securities analyst Ming-Chi Kuo has indicated that Apple is testing electronic paper display (EPD) technology for possible implementation in future foldable devices and tablet applications. The color EPD displays made by E Ink could be used for the outer-most display in a foldable device, while the larger, folded-out display would use a more advanced display technology. Apple is reportedly planning to first launch a 9” foldable that sits somewhere between an iPhone and iPad in display specifications around 2025. (Twitter, CN Beta, MacRumors)

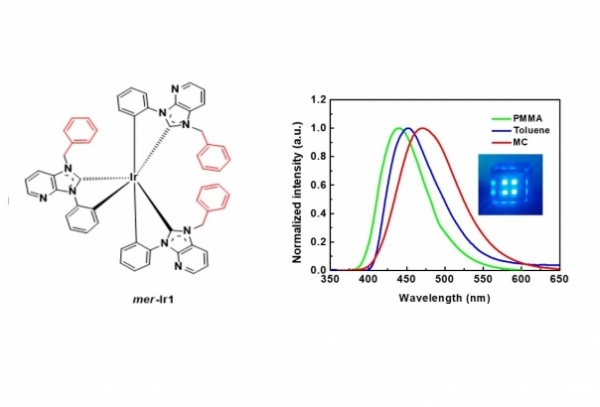

Samsung Display is researching phosphorescent blue OLED material to apply on quantum dot (QD)-OLED panels. Currently, OLED panels used in TVs and smartphones use phosphorescent OLED materials with 100% internal luminance efficiency for the red and green. However, for the blue, fluorescent materials with only around 25% luminance efficiency are used. Display makers and material companies such as UDC are researching phosphorescent OLED materials to extend the life span of OLED panels. Samsung Display’s current QD-OLED panel uses fluorescent blue OLED material and green phosphorescent OLED material as the emission layer. The layers are in what the company calls a four tandem structure, where there are three blue layers and one green layer. This is the same for its 34”, 55” and 65” panels that are used for monitors and TVs.(CN Beta, The Elec)

BOE is yet to receive approval from Apple to manufacture OLED panels for the upcoming iPhone 14 smartphones series. The company was caught having changed the circuit width of the thin film transistors on the OLED panels it made for iPhone 13 earlier 2022. This was done without Apple’s approval in a likely bid to increase the yield rate. Apple seems poised to give the order for around 30M OLED panels it intended to give BOE before the incident to Samsung Display and LG Display instead.(Apple Insider, The Elec, MacRumors)

SK hynix has started constructing a non-volatile memory manufacturing project in Northeast China’s Dalian city. The project will include a new wafer factory to produce non-volatile 3D NAND chip memory products. SK hynix closed the first phase of the transaction to acquire Intel’s NAND and solid-state drive (SSD) business at the end of 2021, taking over Intel’s SSD business and the Dalian NAND flash manufacturing facility. The new manufacturing facility will promote the competitive power of its local capacity as well as secure supply in the Chinese market, according to Chung Eun Tae, president of SK hynix in China. (My Drivers, Global Times, China Daily)

LG Chem has announced that it has developed a new plastic product for battery application that can prevent the spread of flame in batteries, delivering the longest fire-resistance performance in the world. LG Chem’s flame-retardant engineering plastic product is able to prevent the spread of flames, thanks to the company’s proprietary technology and manufacturing methods. The new advanced flame barrier product created by LG Chem is a highly functional engineering plastic product made from various composites including polyphenylene oxide (PPO) and polyamide (PA) resin. When used in battery components, the new product is resistant to flames for a longer period of time due to its superior properties. It also features excellent dimensional stability and maintains its shape under changing temperature conditions. During LG Chem’s testing, the product was able to prevent the spread of flames caused by thermal propagation for over ten minutes at 1,000°C, 10 times longer than general plastics. (CN Beta, Business Wire, Yahoo)

According the Ministry of Justice in Brazil, over 900 Procon groups have teamed up to take legal actions against Samsung and Apple for not providing a charging adapter with new smartphones. The consumer groups may file a formal lawsuit if the companies do not agree to settle the matter outside court. Procon is a Brazilian state institution responsible for guiding citizens about their consumer rights. All state capitals in the country have at least one Procon group. A Procon group in Fortaleza, the capital of the Brazilian state of Ceará, has already fined Apple and Samsung over the matter. The report says the companies received a fine of BRL26M (roughly USD5.22B). Apple has reportedly paid a fine of BRL10.5M (~USD2.11M) to the Procon of Sao Paulo. (Android Headlines, SamMobile, Telecom Paper, CN Beta, Sohu)

The Biden administration has formally started its USD45B effort to bring affordable and reliable high-speed broadband internet access to everyone in the US by 2030. The Internet for All funding is part of the USD65B earmarked for broadband in the USD1T Bipartisan Infrastructure Law. Starting today, states and other entities can apply for funding from three Internet for All programs. (Android Headlines, Engadget, Commerce.gov, Internet for All)

Canadian Prime Minister, Justin Trudeau, is nearing a final decision that place a trade ban on Huawei. Canada has “delayed the decision”, in an effort to avoid provoking or “stoking tensions” between Canada and China. The country has confirmed that ZTE is being included in the trade ban over the same cybersecurity concerns. Huawei has responded that Huawei Canada is disappointed by the Canadian government’s decision. This is an unfortunate political decision that has nothing to do with cyber security or any of the technologies in question. (Android Central, Bloomberg)