5-29 #72hours : Qualcomm and MediaTek have both scaled back 5G chip orders for 2H22; Nokia expects 6G mobile networks to be in operation by the end 2030; Samsung has reportedly reduced its smartphone sales target for 2022 by 10%; etc.

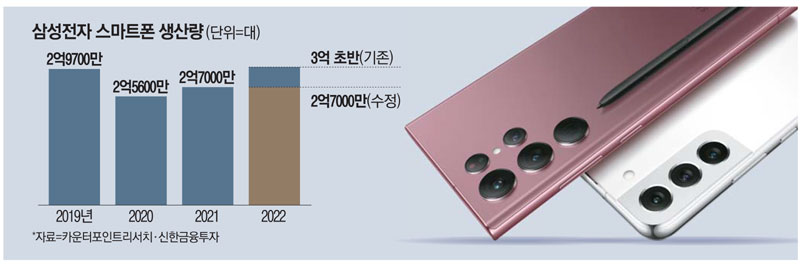

Samsung has reportedly reduced its smartphone sales target for 2022 by 10%. Samsung is now aiming to sell around 270M smartphones in 2022. It has initially set a target of 300M units. It will proportionally reduce the production of budget, mid-range, and flagship models, including foldables. Samsung’s target of foldable smartphone for 2022 is more than 14M units, which would be about 5% of the company’s total projected smartphone shipments for the year, and 1% of the global smartphone market. (Android Headlines, MK)

realme has opened its world’s first offline flagship store. It is located in Ahmedabad, India and is said to transform the tech experience of visitors. The store is currently in trial operation with doors officially opening on 1 Jun 2022. Additionally, the brand is also set to open its first offline store at Lurdy Haz shopping mall in Budapest, Hungary.(Gizmo China, realme, realme, Pandaily)

According to TF Securities analyst Ming-chi Kuo, major Chinese Android brands have cut a total of another 100M orders since his last Mar 2022 survey. His current 2022 smartphone shipment estimations for Xiaomi, OPPO, vivo, Transsion, and Honor are about 160M, 160M, 115M, 70M, and 55M units, respectively. Chinese Android brands’ order cuts represent weak demand in China, Europe, and emerging markets. Samsung also cut 2022 smartphone shipments by about 10% to 275M alongside Chinese Android’s continuing order cuts. Overall, Apple’s iPhone shipment momentum is still better than Android. (Medium, HK01, Yahoo, TechNews)

Moto E32s is launched in Europe – 6.5” 720×1600 HD+ v-notch 90Hz, MediaTek Helio G37, rear tri 16MP-2MP macro-2MP depth + front 16MP, 4+64GB, Android 11.0, side fingerprint, 5000mAh 18W, EUR149. (Phone Arena, Financial Express)

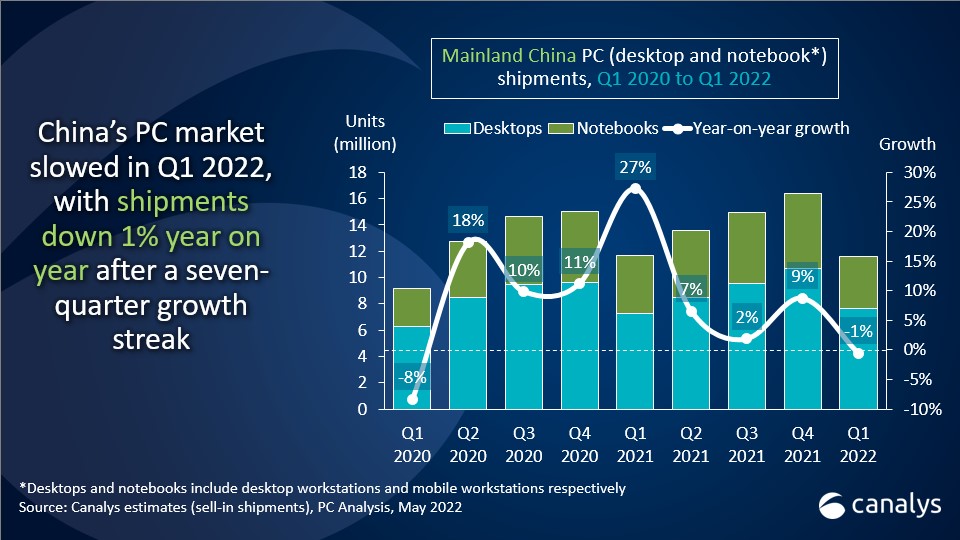

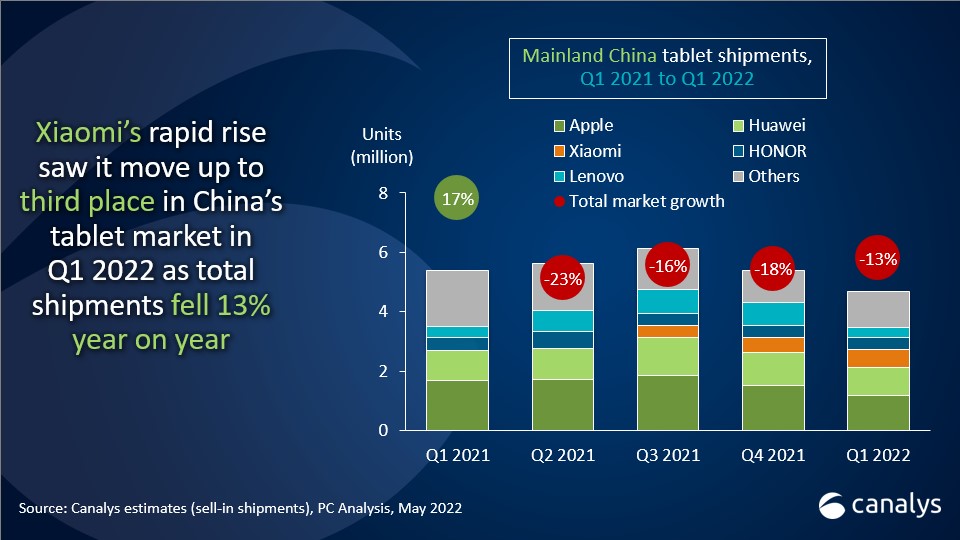

According to Canalys, China’s PC (desktop, notebook and workstation) shipments fell by 1% to 11.7M units in 1Q22, ending the growth streak of the last 7 quarters. Desktop (including desktop workstation) shipments were down by 11% annually to 3.9M units. Notebook (including mobile workstation) shipments stayed strong, withYoY growth of 6% to reach 7.7M units. China’s tablet market suffered a fourth consecutive decline in 1Q22, with shipments down 13% to 4.7M units following supply issues and weaker demand from both consumers and businesses. (Gizmo China, Canalys)

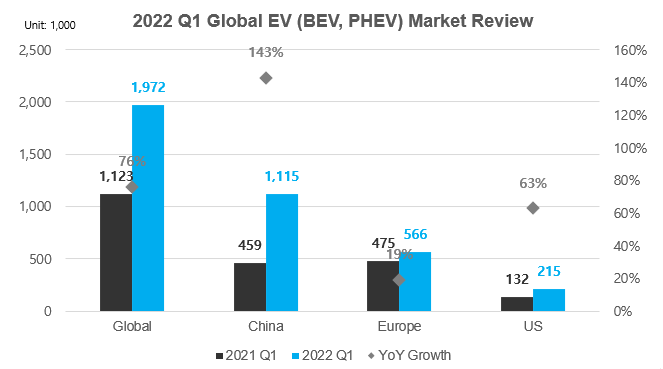

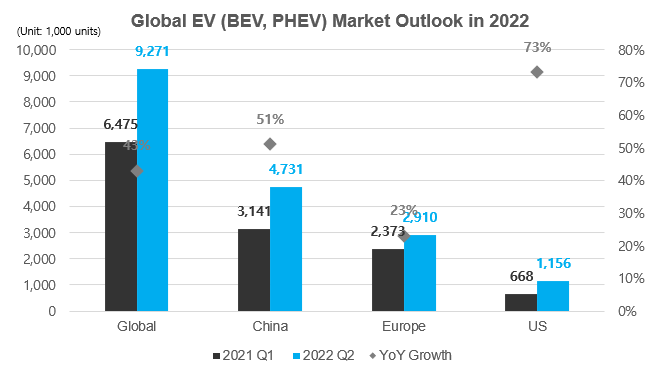

Global EV sales forecasted to rise 43%, reaching around 9.3M units in 2022, despite the Russian Invasion of Ukraine and China lockdowns. The global car market has seen a 9% decline due to the persistent supply chain issue, while the global electric vehicle (BEV, PHEV) sales has expanded by 76% year-on-year in Jan-Mar 2022. Compared to the previous quarter Oct-Dec 2021, though, the global EV sales have declined by 12%, recording approximately 1.97M units. The global EV penetration rate has slightly decreased (-0.7%p) from the previous quarter, landing at 10%. (SNE Research)

BMW reportedly plans to produce electric vehicles (EV) in Mexico at its San Luis Potosi plant. The BMW 3 Series Sedan and the iX3 electric crossover will be the two models that this plant will manufacture. Production is expected to start in 2027 and San Luis Potosi will become the first center of EV production for the automaker. The plant currently produces the BMW Series 3 and the BMW Series 2 Coupé and will begin producing the second generation of the M2 in late 2022. (CN Beta, Auto News, Car Scoops, Mexico Business, El Fianciero)

Google is in talks with the Indian government to integrate its shopping services with the country’s open e-commerce network ONDC. India soft-launched its Open Network for Digital Commerce (ONDC) in Apr 2022 as the government tries to end the dominance of U.S. companies Amazon.com and Walmart in the fast-growing e-commerce market. Google’s talks follow the success of its payments business because of the government’s initiative for financial transactions, the Unified Payments Interface (UPI). Google’s existing shopping business works solely as an aggregator of listings online and does not carry out any order fulfilment like delivery, which the likes of Amazon do. (CN Beta, Business Standard, Reuters, India Times)

Samsung’s new flagship Exynos SoC has been codenamed “Quadra”. This chipset will apparently be the successor to the Exynos 2200, which was codenamed “Pamir” that shipped with the Galaxy S22, Galaxy S22+, and Galaxy S22 Ultra. In other words, Quadra might be officially called the Exynos 2300.(Gizmo China, Twitter, Fonearena)

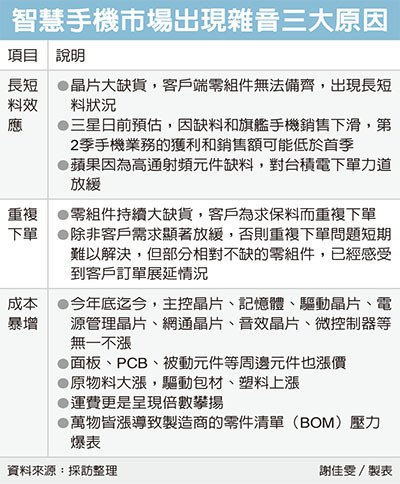

Qualcomm and MediaTek have both scaled back 5G smartphone chip orders with their manufacturing partners for 2H22, according to Digitimes. MediaTek and Qualcomm have cut 5G chip orders for 2H22. MediaTek has cut 4Q22 orders by 30–35% (mainly mid-to-low-end). SM8475 and SM8550 shipment forecasts remain unchanged, but Qualcomm has cut other high-end Snapdragon 8 series orders by about 10–15% for 2H22. Qualcomm will slash existing SM8450 and SM8475 prices by 30–40% after mass shipments of SM8550 start at the end of 2022 to clear the inventory. According to TF Securities analyst Ming-chi Kuo, MediaTek and Qualcomm’s order cuts for 4Q22 / 2H22 imply that demand may not improve until 1Q23 due to 5G chips’ longer lead time vs. general components. The market consensus on the revenue and profit of MediaTek and Qualcomm for 3Q22–1Q23 would be further revised. (Digitimes, LTN, Laoyaoba, Tencent, CTEE, Twitter, Medium)

imec has charted the path to semiconductor process technology and chip design below 1nm down to the A2 two angstrom generation. The company CEO Luc van den Hove is convinced that Moore’s Law will not stop, but there will be many approaches that will all contribute. He points to several generations of device architecture, evolving from FinFET devices to forksheet and atomic channel devices, as well as new materials and the introduction of high NA lithography systems by ASML which takes many years. The prototype NA systems being installed now will see commercial roll out in 2024. He points to the forksheet architecture developed at imec. This allows us to put then and p channel closer together with a barrier material, This will be an option to extend gate all around beyond 1nm. Then you can put the n and p channel on top of each other for further scaling and we believe we have developed the first versions of these”. Then there are new materials using tungsten or molybdenum that can provide gate lengths of a few atoms for the A10 (1nm) processes in 2028 and below to structures with four Angstrom (A4) in 2034 and two Angtroms (A2) in 2036. (Laoyaoba, EE News Europe)

Economy Minister Nadia Calvino has revealed that Spain’s government has approved a plan to spend EUR12.25B (USD13.12B) on the semiconductor and micro chip industry by 2027, including EUR9.3B to fund the building of plants. The plan will finance domestic semiconductor production capacity in leading-edge (below 5nm) and mid-range (above 5nm) semiconductor manufacturing with a EUR9.3B investment. It will fund research and development with a EUR1.1B subsidy and EUR1.3B will be allocated to chip design. It will also support Spanish companies in strategic projects developed at the European level and will create a 200M Chip Fund to finance start-ups and scale-ups in the Spanish semiconductor sector. (CN Beta, AA, Reuters, US News)

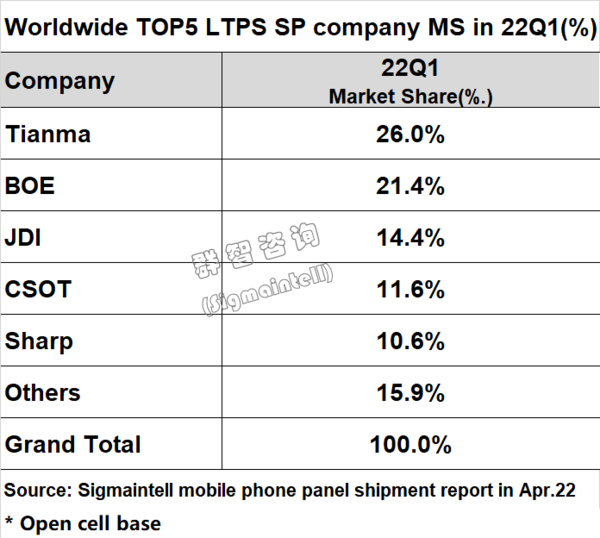

According to Sigmaintell, in the 1Q22 global LTPS LCD smartphone panel shipment ranking list, Tianma continued to rank first in the world. Tianma ranked first with a market share of 26.0%. Tianma has successfully developed TED In-Cell (single-chip touch) technology, In-Cell active pen technology, high-PPI VR (virtual reality) high-brush and fast-response technology, low blue light 100% DCI-P3 technology, mini-LED technology, etc. Industry leading display solutions. These technologies are the key to Tianma’s leadership. The second is BOE, with a market share of 21.4%. Previously, BOE released the report for the first quarter of 2022, with operating income of CNY50.476B, a slight increase of 0.40% YoY. (CN Beta, My Drivers)

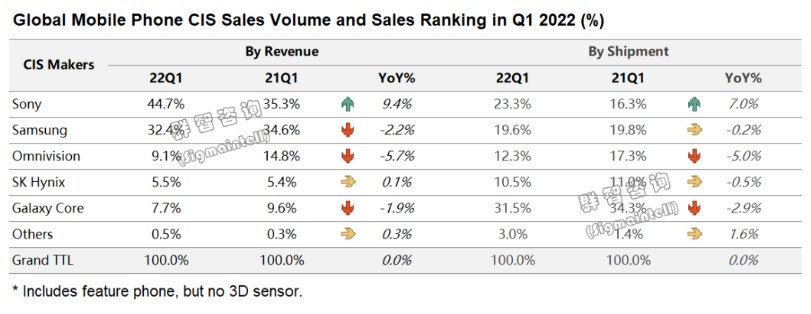

According to TF Securities analyst Ming-chi Kuo, shipments of CCM and lens for Chinese Android smartphone brands will decline by 20–30% YoY for 3Q22. The total inventory of Chinese Android brands’ top 5 CMOS image sensor (CIS) suppliers has exceeded 550M units. (Medium)

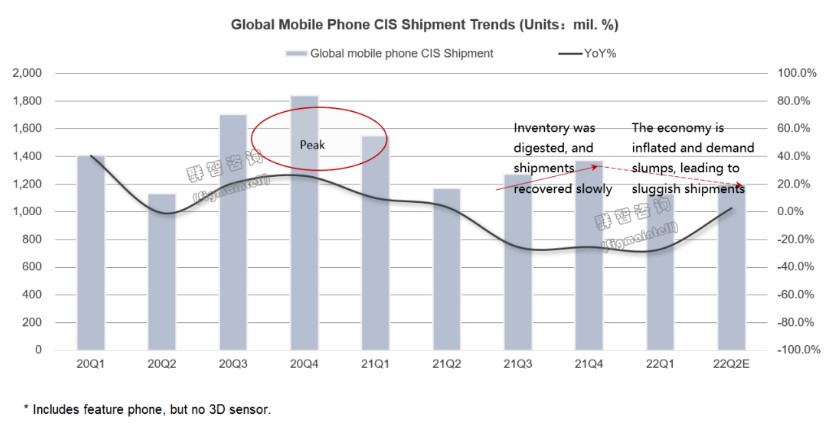

According to Sigmaintell, the global mobile phone image sensor shipments in 1Q22 were about 1.13B, down about 27.0% YoY, and the shipments in 2Q22 will not be optimistic. In early 2022, upstream wafer foundry prices rose to the highest level, and the production capacity of the mature processes of the head fabs also increased slightly. TSMC, UMC, Samsung LSI, etc. are all actively expanding the production of 40nm / 28nm and below processes, and TSMC and UM’’s new 28nm new factory plans are also on schedule, and it is expected to gradually release production capacity by 2023. Sigmaintell’s data predicts that in 2022, the global 28nm production capacity for image sensor applications will increase by about 12.1% YoY. This also means that the production capacity of high-end image sensors used in smartphones is in a steady growth state. Without the impact of emergencies, it is expected that the global supply relationship of high-end image sensors for smartphones will show a relatively balanced or slightly surplus in 2022. (Sigmaintell)

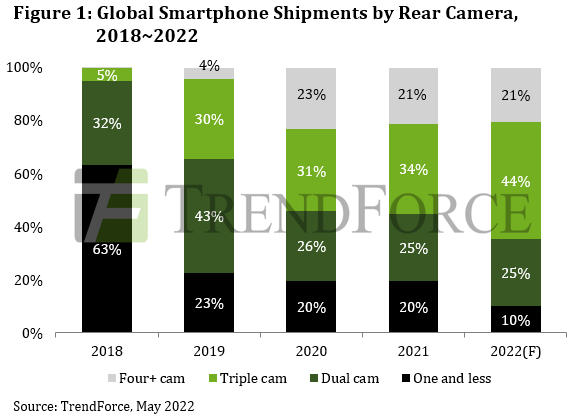

According to TrendForce, smartphone camera module shipments will increase to 5.02B units in 2022, an annual growth rate of 5%. Since the price-performance ratio of whole devices is the primary basis for consumer purchases, the cost of high-standard solutions such as the five-camera design and main cameras sporting hundreds of millions of pixels will inevitably be passed on to the manufacturer with little improvement in sales performance. Therefore, the three-camera module remains the mainstream design this year and is forecast to account for more than 40% of total shipments. Only some smartphone models will adopt a four-camera design to differentiate their specifications, while the number of products with dual-cameras or less will fall, with entry-level models being the primary candidates. (TrendForce, TrendForce)

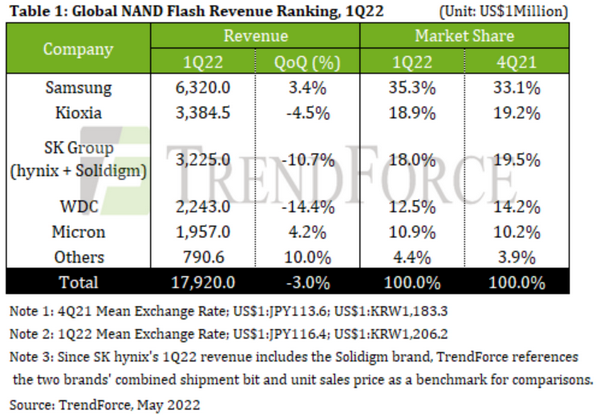

According to TrendForce, as manufacturers actively shifted production capacity to 128 layer products, the market turned to oversupply, resulting in a drop in contract prices in 1Q22, among which the decline in consumer-grade products was more pronounced. Although enterprise SSD purchase order volume has grown, demand for smart phone bits has weakened due to the Russian-Ukrainian war, the traditional off-season, and rising inflation. Client inventories have increased significantly, so it remains challenging for overall bit shipment volume to offset potential decline. In 1Q22, NAND Flash bit shipments and average selling prices fell by 0.5% and 2.3%, respectively, resulting in a 3.0% quarterly decrease in overall industry revenue to USD17.92B. (Laoyaoba, TrendForce, TrendForce)

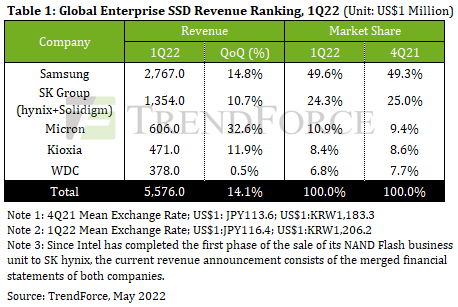

According to TrendForce research, North American data centers saw an improvement in components supply after Feb 2022, driving a recovery in purchase order volume. As Server brands returned to normal in-office work following the pandemic, the increase in capital expenditures on related information equipment has also boosted order growth. The addition of Kioxia’s raw material contamination incident led to an increase in the pricing of certain rush orders, pushing up overall Enterprise SSD revenue in 1Q22 to USD5.58B, or 14.1% growth QoQ. According to TrendForce, Samsung and SK hynix (including Solidigm) were the top two players in 1Q22. (CN Beta, TrendForce, TrendForce)

NOR flash memory contract prices will likely trend downward in 2H22, according to industry sources. Prices for low-density chips have started to drop in 2Q22. The recent slowdown in demand for mobile phones, personal computers and consumer electronics has led to an uncertain demand outlook in 2H22, and downstream equipment suppliers are facing increasing pressure to destock. Negotiations on the price of the 3Q22 NOR Lightning contract have not yet been finalized. Chip suppliers intend to lower their offers by 3%, while order cuts from branded equipment suppliers could give buyers more bargaining power. Prices of NOR flash memory chips with densities ranging from 4Mb to 32Mb are being dragged down by weak demand for smartphones, especially those launched in China. (Digitimes, Digitimes, Laoyaoba)

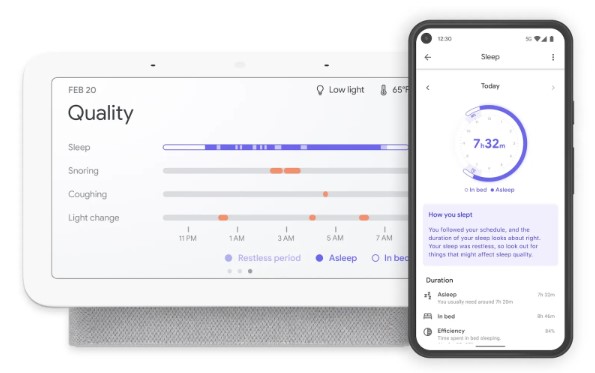

Google Health Studies hit version 2.0 to support the launch of a new digital wellbeing study. Google explains that its “Health Sensing team is actively working to bring an advanced suite of sensing capabilities and algorithms to Android devices with the goal of providing users with meaningful insight into their sleep”. This audio collection “supports this mission by providing data necessary to validate, tune, and develop such algorithms”. These “Cough and Snore algorithms” will translate into a “bedside monitoring” feature on Android devices that works in a “privacy-preserving, on-device” manner for “nocturnal cough and snore monitoring.” (9to5Google, Android Authority)

Following Samsung Group and Hyundai Motor Group’s massive investment plans, other Korean conglomerates, including SK, LG, GS, POSCO and Hyundai Heavy Industries unveiled large-scale investment plans. SK Group has said it will invest a total of KRW247T (USD194.8B) until 2026 to strengthen its capabilities in core business items such as semiconductors, batteries and bio. In order to achieve carbon neutrality of its businesses, SK Group will invest KRW67T in eco-friendly businesses such as electric vehicle (EV) batteries, battery materials, hydrogen, wind power and renewable energy. LG Group also announced it will invest KRW106T solely in Korea until 2026. Among the total investment amount, KRW43T will be invested in emerging areas such as batteries, battery materials, next-generation displays and AI. (CN Beta, China Daily, SNE Research, Korea Times, Reuters)

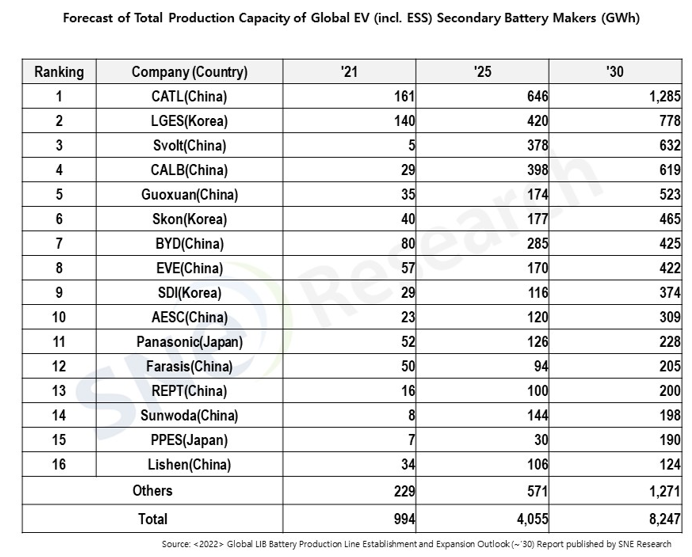

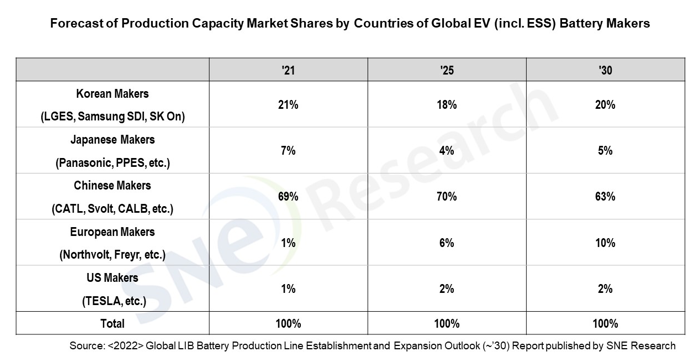

According to SNE Research, total production capacity of global EV (incl. ESS) secondary battery makers is expected to grow by 27% annually; from 994GWh in 2021 to 8,247GWh in 2030. As of 2021, CATL in China with 161GWh took the lead in the production capacity race among battery makers in the world, followed by LG Energy Solution (hereinafter, LGES) with 140GWh. SNE Research forecasts that the production capacity of CATL will reach 1,285GWh in 2030, securing its top position in the industry. (SNE Research)

CATL has said it will start supplying cylindrical cells to BMW from 2025 to power its new series of electric vehicles. CATL has signed an agreement with BMW in which it is nominated as the supplier of the cylindrical cells for the automaker. BMW will use the round cells instead of prismatic ones as it seeks to cut costs. The change will deliver a 30% drop in cost savings. CATL has been supplying BMW with batteries for a decade. CATL is looking at potential battery factory sites in the United States to supply automakers including BMW, with a goal of production beginning in 2026. BMW will launch a dedicated “Neue Klasse” (New Class) electric platform by 2025 as it seeks to challenge EV leaders, including Tesla.(Laoyaoba, BMW Blog, Inside EVs, Auto News)

Nokia CEO Pekka Lundmark expects 6G mobile networks to be in operation by the end 2030 but he does not think the smartphone will be the most “common interface” by then. He has further said that it will not be smartphones that take this new tech to the next decade. Companies like Neuralink, co-founded by Elon Musk, are already developing smart electronic devices that could be implanted into the brain. This could potentially change the way we communicate with machines and people.(Android Headlines, CNBC)